The independent source for health policy research, polling, and news.

County-Level Analysis Finds ACA Premiums are Falling in Many Areas of the Country, Though Changes Vary by County and Type of Plan

In Many Counties, Tax Credits Would Cover the Premiums for a Silver Plan for Low-Income Residents and for a Bronze Plan for Those with Somewhat Higher Incomes

Premiums for the Affordable Care Act Marketplace benchmark silver plan are decreasing 3.1 percent on average across the country – the fourth year in a row that benchmark premiums have fallen – though the changes vary by county, a new KFF county-by-county analysis finds.

The benchmark plan premiums are important because they are used to determine the tax credits available to people who buy their own insurance through the Marketplaces. What people would have to pay in premiums, if anything, will depend on where they live, the plan they choose, and their age and income.

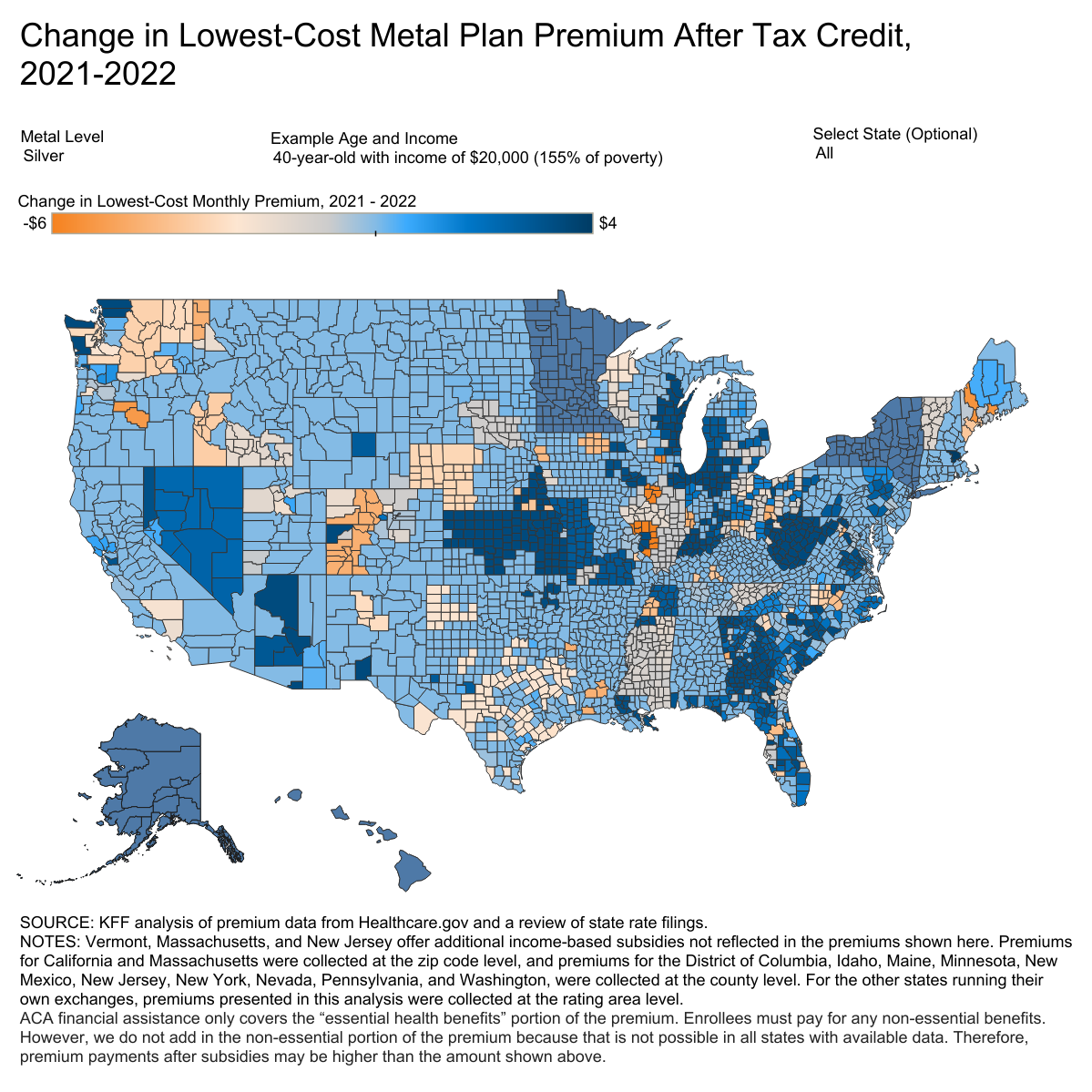

An interactive map illustrates changes in premiums after tax credits for the lowest-cost bronze, silver and gold plans by county for a 40-year-old at varying income levels. Key findings include:

• Across counties, average premiums before tax credits fell 1.8 percent for the lowest-cost silver plan and 4.1 percent for the lowest-cost gold plan. Average premiums changed little for the lowest-cost bronze plan (up 0.3%).

• Due to this year’s American Rescue Plan Act, people with incomes up to 150% are eligible ($19,320 for an individual and $39,750 for a family of 4) for a silver-level plans without a monthly premium and with additional cost-sharing subsidies to lower their deductibles and other out-of-pocket expenses. In two-thirds of counties nationwide, tax credits also would cover the full premium for the lowest-cost silver plan for a 40-year-old earning $20,000 a year (155% of the federal poverty level). These enrollees may have to pay a nominal amount for coverage in some counties because the tax credits only apply to “essential health benefits.”

• In a third of counties, tax credits would cover the full cost of the lowest-premium bronze plan for a 40-year-old earning $35,000 a year (272% of the federal poverty level). Such plans typically have high cost-sharing requirements but provide substantial protection in case of severe illness.

The analysis examines data from insurer rate filings to state regulators, state exchange websites and HealthCare.gov to assess how premiums are changing at the county level. This year’s American Rescue Plan Act temporarily made the tax credits more generous for 2021 and 2022, though they are set to expire in 2023.

The ACA open enrollment period for the federal Marketplace and most state Marketplaces began Nov. 1 and ends on Jan. 15. KFF’s updated Health Insurance Marketplace Calculator allows consumers to estimate their ACA premiums after any tax credits if they buy coverage on their own in the ACA marketplaces. Consumers also can search our collection of more than 300 Frequently Asked Questions about open enrollment, the health insurance marketplaces and the ACA. Most questions are also available in Spanish.