KFF Health Tracking Poll: The Public’s Views of Funding Reductions to Medicaid

Findings

The latest budget reconciliation bill, named the “One Big Beautiful Bill Act” by Republicans, passed the U.S. House of Representatives in late May and will be taken up next by the Senate. The bill includes significant changes to Medicaid and the Affordable Care Act (ACA), among other health care provisions. The Congressional Budget Office estimates that the bill would decrease federal Medicaid spending by more than $700 billion and result in more than 10 million people losing Medicaid coverage.

The latest KFF Health Tracking Poll examines the views and experiences of the groups that could be most directly impacted by the impending legislation. Key takeaways include:

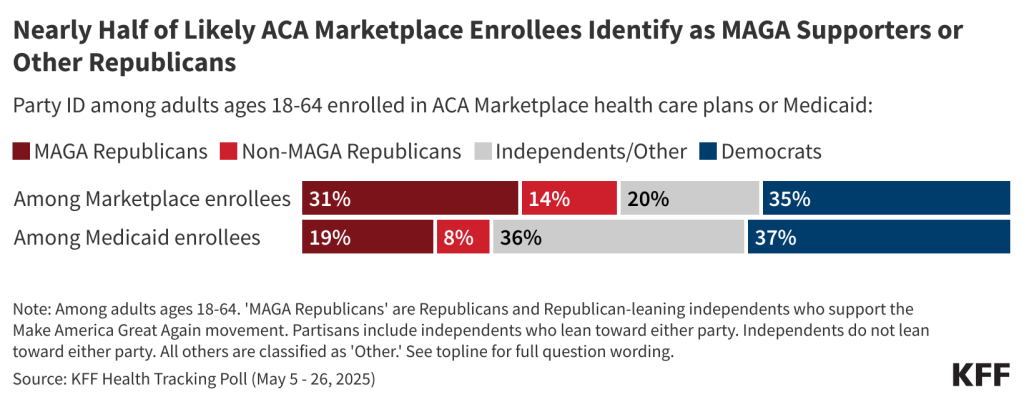

- Those who get their coverage from Medicaid and the ACA Marketplaces represent a range of political identities. More than four in ten of those who purchase marketplace coverage identify as Republican, including one-third who call themselves supporters of President Trump’s “Make America Great Again” (MAGA) movement. Among Medicaid enrollees, more than a quarter are Republican, including one in five who identify with MAGA.

- Most of the public is worried about the consequences of significant reductions in federal Medicaid spending, including among many groups that would be directly impacted by the cuts. Partisanship drives these attitudes to a certain extent, but about two-thirds or more of Republicans enrolled in Medicaid and those with lower incomes are worried that Medicaid spending reductions would hurt their families and their communities.

- The poll finds a large majority of rural residents, and particularly those with lower household incomes, worry these cuts will lead to more children and adults losing health care coverage, harm providers in their communities, and make it more difficult for themselves and their families to access or afford health care. Rural residents are divided along partisan lines on this issue, but half of rural Republicans are worried about more people becoming uninsured. Rural health care providers, which often rely heavily on Medicaid funding, may be especially vulnerable to the decreased federal spending included in the reconciliation bill.

- Views on how the Trump administration’s policies will impact the country’s health care programs are largely partisan, even among people who are enrolled in these programs. Overall, most of the public says the Trump administration’s policies will weaken Medicare and Medicaid, including most Democrats and independents, while most Republicans expect the administration’s policies to strengthen or have no impact on these programs. Among Republican Medicaid enrollees, however, views are mixed with similar shares saying the policies will strengthen, weaken, or have no impact on the program they rely on.

Medicaid and Marketplace Enrollees Represent a Wide Range of Political Identities

Millions of adults who get health insurance from Medicaid and the ACA Marketplaces across the political spectrum are at risk of losing coverage if the current version of the reconciliation bill becomes law. While most Medicaid beneficiaries under age 65 are Democrats or lean Democratic (37%), or do not lean toward either party (36%), more than one in four are Republicans or lean that way (27%), including one in five (19%) who identify as MAGA supporters, President Trump’s strongest base of support.

Republicans also make up 45% of adults who purchase their own health insurance, most of whom do so through the ACA Marketplaces, including about three in ten (31%) who identify with the MAGA movement. About one-third (35%) are Democrats or lean that way, and one in five do not identify or lean toward either political party.

A Majority of the Public Worry About the Consequences of Proposed Medicaid Cuts

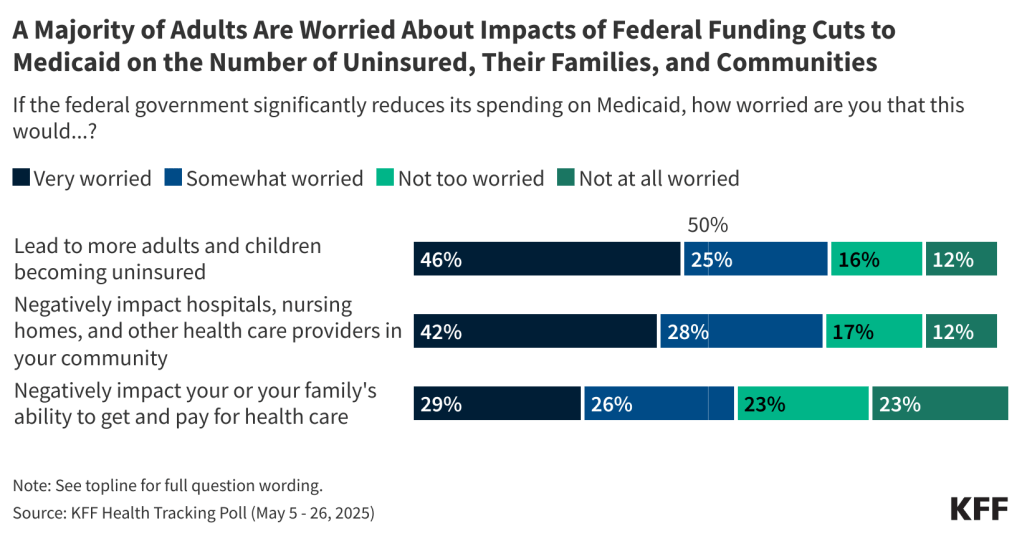

The latest KFF poll shows that most adults are worried significant reductions in federal Medicaid spending will lead to more uninsured people and will strain health care providers in their communities. About seven in ten adults (72%) are worried that a significant reduction in federal funding for Medicaid would lead to an increase in the share of uninsured children and adults in the U.S., including nearly half (46%) who are “very worried” and one in four (25%) who are “somewhat worried.”

Similarly, about seven in ten adults say they are worried that if the federal government significantly reduces its spending on Medicaid, there will be negative impacts on hospitals, nursing homes, and other health care providers in their communities (71%), including four in ten (42%) who are “very worried” and three in ten (28%) who are “somewhat worried.”

Over half (54%) of U.S. adults are worried that reductions in federal Medicaid spending would negatively impact their own or their family’s ability to get and pay for health care, including about three in ten who are “very worried” (29%) and one in four (26%) who are “somewhat worried.”

There is a strong partisan dimension to these worries, as Democrats and independents are much more likely than Republicans to worry about potential negative consequences of reductions in federal government spending on Medicaid. Large majorities of Democrats and Democratic-leaning independents (94%) and independents who do not lean toward either party (85%) say they are worried these cuts will lead to more adults and children becoming uninsured, compared to fewer than half of Republicans and Republican-leaning independents (44%). Similarly, at least eight in ten Democrats (92%) and independents (85%) are worried about funding reductions negatively impacting providers in their communities, compared to 43% of Republicans.

Democrats and independents are also more than twice as likely as Republicans to worry these cuts will negatively impact their family’s ability to get and pay for health care.

Between one in four and four in ten Republicans and Republican-leaning independents who identify as supporters of the Make America Great Again (MAGA) movement, a group that makes up about three-quarters of all Republicans and Republican-leaning independents, are worried that reducing federal spending on Medicaid would lead to negative consequences.

Funding reductions to Medicaid would likely have a disproportionate impact on women, Black and Hispanic individuals, and those with lower household incomes – all groups who are more likely to rely on Medicaid to access medical care. The poll finds these groups are also most concerned about the personal impacts of reductions in federal Medicaid spending. Larger shares of those enrolled in Medicaid (86%), Black adults (77%), those living in households earning less than $40,000 annually (73%), Hispanic adults (68%), and women (61%) are worried that their family’s ability to access and afford care would be negatively impacted by cuts to federal Medicaid spending.

Six in ten (61%) parents of children ages 18 or younger in their household say they worry about their family’s ability to access and afford care, rising to more than eight in ten (85%) single mothers.

Among Medicaid Enrollees and Lower-Income Adults, Majorities Across Partisanship Worry About Impacts of Medicaid Spending Cuts

Majorities of Medicaid enrollees and adults in lower-income households, many of whom rely on the Medicaid program or have household members who do, worry about the impacts of funding reductions on the program for their communities and families – regardless of partisanship.

A large majority of Medicaid enrollees say they are worried that spending reductions would negatively impact their own or their family’s ability to access and afford health care, including six in ten (60%) who say they are “very worried.” Large shares of Medicaid enrollees are also worried such spending reductions would hurt providers in their communities and lead to more adults and children becoming uninsured. While partisanship shapes these attitudes, among Republicans enrolled in Medicaid, three-quarters worry such funding reductions would hurt their family’s ability to get and pay for care (76%) and about two-thirds worry they would lead to an increase in the uninsured (69%) and negatively impact providers (65%).

Similarly, lower-income adults are more likely than those with higher incomes to worry about the implications of Medicaid spending cuts. Eight in ten adults in households with incomes under $40,000 say they are worried these spending reductions would lead to more children and adults becoming uninsured (80%) or that health care providers in their communities would be negatively impacted (78%). Nearly three-quarters (73%) are worried these cuts would negatively impact their own families’ ability to access and pay for care.

While Democrats and independents with lower incomes are more worried than their Republican counterparts on the implications of these funding reductions, once again the poll shows that majorities of lower-income Republicans also express worry. About six in ten Republican and Republican-leaning independents with household incomes under $40,000 say they are worried about more adults and children becoming uninsured and that the cuts would negatively impact providers in their communities. More than half of this group say they are worried that these funding reductions would negatively impact their own family’s ability to pay for health care.

In addition to being eligible for Medicaid coverage, many lower income adults in the U.S. rely on the Supplemental Nutrition Assistance Program (SNAP) to help pay for food for their families. As Congress debates reductions in both Medicaid funding and SNAP benefits for lower-income families, the latest KFF Health Tracking Poll finds about half of adults with household incomes under $40,000 report having difficulty affording necessities, and about three in ten report difficulty affording health care. About half of lower-income adults, including 49% of lower-income Democrats, 47% of lower-income Republicans, and 62% of lower-income independents, say they or a family member in their household have had problems affording food, housing, transportation, or other necessities in the past year.

Nearly three in ten lower-income adults say they have had trouble paying for health care, including three in ten lower-income Democrats (30%) and independents (30%) and one in four lower-income Republicans. With proposals from Republicans to reduce federal spending on Medicaid and SNAP, these shares could rise, placing additional strain on a population already facing significant financial challenges.

Worries About Medicaid Spending Cuts Extend to Rural Communities

Health care providers in rural communities are most at risk of experiencing the negative impacts of funding reductions from the recent tax bill, as many of these providers are dependent on funding from the Medicaid program. Overall, about seven in ten rural residents are worried that cuts would lead to more adults and children becoming uninsured (69%) or that this would negatively impact health care providers in their communities (66%). About half (52%) of rural adults say they are worried that funding reductions would impact their or their family’s ability to get or pay for care. Rural residents are split along partisan lines, with large majorities of rural Democrats worrying about each of these, compared to fewer Republicans. However, about half (52%) of rural Republicans say they are worried this would lead to more adults and children becoming uninsured.

Large majorities of rural adults in households with incomes under $40,000 also express worry about each of these consequences, including nearly nine in ten (87%) lower-income rural residents who are worried this would lead to more adults and children becoming uninsured, about eight in ten worried this would impact their local communities (78%), and three-quarters who worry about a negative impact on their own family’s ability to access and pay for care.

Most of the Public Say Medicare and Medicaid Will Be Weakened by the Trump Administration’s Policies

The reconciliation bill championed by President Trump is one way the administration’s policies may affect health care policy in the U.S. However, the direction of programs like Medicare and Medicaid are also likely to be shaped by other administration actions such as executive orders, federal appointments, and agency policies. Overall, most U.S. adults say the Trump administration’s policies will “weaken” key aspects of the U.S. health care system including Medicaid, Medicare, and health care services for veterans, while fewer say they will strengthen these programs.

About six in ten adults think the Trump administration’s policies will weaken Medicaid (59%) and Medicare (57%), more than twice the share who say the policies will strengthen each program (19% and 23%, respectively). Half of adults (49%) say the Trump administration’s policies will weaken health care services for veterans, a larger share than say the policies will strengthen care for veterans (32%).

The public is more mixed on how the Trump administration’s policies will impact private health insurance, with four in ten saying it will “weaken” it while about a quarter (27%) say it will “strengthen” it. The Republican tax bill includes changes to the Affordable Care Act (ACA) that will increase the number of uninsured people by about 8 million by 2034, estimated by the Congressional Budget Office (CBO).

Views on how the Trump administration’s policies will impact the country’s health care programs are largely partisan, with large majorities of Democrats and independents saying the policies will weaken the programs, while Republicans are more likely to say the policies will strengthen the programs – especially veterans’ health care.

Two-thirds of Republicans and Republican-leaning independents say the administration’s policies will strengthen health care services for veterans and between four in ten and half say the same about Medicare (50%), private health insurance (43%), or Medicaid (42%). Notably, one in five Republicans say the administration’s policies will weaken Medicaid (22%) and Medicare (19%), and a sizable share of Republicans say the administration’s policies will have no impact on each of these policy areas.

Democrats, on the other hand, overwhelmingly say the Trump administration’s policies will weaken each of these health insurance programs. Nine in ten Democrats say Medicaid (91%) and Medicare (90%) will be weakened by the administration’s policies. About eight in ten (84%) Democrats say health care services for veterans will be weakened by the policies, and two-thirds (66%) say the same about private health insurance. One in six Democrats say the administration’s policies will strengthen (17%) or have no impact (17%) on private health insurance.

Partisanship is also a strong predictor of these views among people who have health insurance through these programs. While most Democrats and independents with Medicaid coverage say the Trump administration’s policies will weaken Medicaid (84% and 73% respectively), Republicans and Republican-leaning Medicaid enrollees are split on the issue. While about one-third of Republican Medicaid enrollees say the administration’s policies will strengthen Medicaid (35%), a similar share (34%) say they will weaken it.

Adults ages 65 and older with Medicare coverage are sharply divided along partisan lines in their expectations for how the Trump administration’s policies will impact their health care coverage. Nine in ten (94%) Democrats and Democratic-leaning independents with Medicare say the administration’s policies will “weaken” the program, while two-thirds (67%) of Republican and Republican-leaning Medicare enrollees say the program will be “strengthened.” One in four (24%) Republican Medicare enrollees say the program will not be impacted by the Trump administration’s policies, while few (5%) Democratic Medicare enrollees agree.

Methodology

This KFF Health Tracking Poll was designed and analyzed by public opinion researchers at KFF. The survey was conducted May 5 – 26, 2025, online and by telephone among a nationally representative sample of 2,539 U.S. adults in English (2,444) and Spanish (95).

The sample includes 2,028 adults who were reached through an address-based sample (ABS) and completed the survey online (1,802) or over the phone (226). An additional 511 respondents were reached through a random digit dial telephone (RDD) sample of prepaid (pay-as-you-go) cell phone numbers. Among this prepaid cell phone component, 260 were invited to the web survey via short message service (SMS) while another 251 were interviewed by phone (CATI). Marketing Systems Groups (MSG) provided both the ABS and RDD sample. All fieldwork was managed by SSRS of Glen Mills, PA; sampling design and weighting was done in collaboration with KFF.

Both ABS and RDD samples were stratified to increase the likelihood of reaching certain populations. Both the ABS and RDD sample frames included disproportionate stratification aimed at reaching Hispanic and non-Hispanic Black respondents. The ABS was also stratified based on model-based prediction of household-members’ party identification (Republican, Democratic, or independent).

Respondents received a $15 incentive for their participation, with interviews completed by phone receiving a mailed check and web respondents receiving a $15 electronic gift card incentive. The online questionnaire included two questions designed to establish that respondents were paying attention and cases were monitored for data quality including item non-response, mean length, and straight lining. Cases were removed from the data if they failed two or more of these quality checks. Based on this criterion, four cases were removed.

The combined ABS and cell phone samples were weighted to match the sample’s demographics to the national U.S. adult population using data from three sources: the Census Bureau’s 2024 Current Population Survey (CPS), the 2021 Census Planning Database, and the 2023 National Public Opinion Reference Survey (NPORS) data. The demographic variables used for weighting include gender by age, gender by education, age by education, race/ethnicity by education, education, race, census region, population density, and frequency of internet usage. The weights also take into account differences in the probability of selection for each sample type (ABS and prepaid cell phone). This includes adjustment for the sample design and geographic stratification of the samples, and within household probability of selection.

The margin of sampling error including the design effect for the full sample is plus or minus 3 percentage points. Numbers of respondents and margins of sampling error for key subgroups are shown in the table below. For results based on other subgroups, the margin of sampling error may be higher. Sample sizes and margins of sampling error for other subgroups are available by request. Sampling error is only one of many potential sources of error and there may be other unmeasured error in this or any other public opinion poll. The Medicaid and health care costs module included in this survey was designed, analyzed, and paid for by KFF. The demographic questions included in this study were developed and funded jointly by CNN and KFF as part of an unrelated project, with each organization having independent editorial control over its portion of the survey. KFF Public Opinion and Survey Research is a charter member of the Transparency Initiative of the American Association for Public Opinion Research.

| Group | N (unweighted) | M.O.S.E. |

| Total | 2,539 | ± 3 percentage points |

| Party ID | ||

| Democrats and Democratic-leaning independents | 1,102 | ± 4 percentage points |

| Pure independents | 388 | ± 7 percentage points |

| Total Republicans and Republican-leaning independents | 886 | ± 4 percentage points |

| MAGA Republicans and Republican-leaning independents | 625 | ± 5 percentage points |

| Health Insurance Coverage | ||

| Adults enrolled in Medicaid, ages 18–64 | 454 | ± 6 percentage points |

| Adults who have purchased their own health coverage, ages 18–64 | 247 | ± 9 percentage points |

| Adults enrolled in Medicare, ages 65 and older | 411 | ± 7 percentage points |