Estimated Cost of Treating the Uninsured Hospitalized with COVID-19

Issue Brief

The three COVID-19 stimulus bills that Congress has passed provide additional funding for hospitals and for free coronavirus testing for the uninsured through Medicaid. While Congress did not allocate any money specifically for COVID-19 treatment or coverage for the uninsured, President Trump has stated his intention to reimburse hospitals for treating the uninsured by tapping a new $100 billion in funding for hospitals and other health care entities included in the third stimulus, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The legislation provided little detail about how funding would be distributed, giving significant discretion to the Secretary of Health and Human Services.

To date, few specifics on the new policy for covering COVID-19 treatment costs of uninsured patients have been released, but administration officials have said that hospitals would get reimbursed at Medicare rates, which are substantially lower than prices paid by private insurers. The administration has not provided any cost estimates for this new policy, other than to say that the funding will come from the $100 billion in the CARES Act. How much of that funding will be used to pay for care for the uninsured is an important part of thinking through the implications of this policy. In this brief, we estimate a range of costs for reimbursing hospitals for treatment of COVID-19 for the uninsured and discuss some outstanding questions about the Trump administration’s new policy.

Estimating the Cost of Hospital Care for COVID-19 for People Who are Uninsured

There is still a great deal of uncertainty surrounding how the COVID-19 epidemic will evolve, including how many people will become infected and how many will become severely ill and require hospitalization. Therefore, we present a range of cost estimates for the Trump administration’s proposal to reimburse hospitals for COVID-19 treatments for uninsured patients, based on results from recent studies and models.

Our key assumptions include:

- 20% to 60% of people will ultimately become infected with the coronavirus, based on estimates from epidemiologist Marc Lipsitch at the Center for Communicable Disease Dynamics at the Harvard T.H. Chan School of Public Health.

- 15% of people who are infected will require hospitalization, similar to the assumption in a model of hospital use for COVID-19 developed by the Harvard Global Health Institute.

- We reduce the hospitalization rate by 20% to 12% to reflect the fact that the uninsured are almost entirely under age 65 and, therefore, in many cases are at lower risk for severe illness from COVID-19, based on a model recently published in the Proceedings of the National Academy of Sciences (PNAS).

- 15% of all hospitalizations will require the most intensive care, including admission into an intensive care unit and use of a ventilator. This is consistent with estimates from the Centers for Disease Control and model results from the Institute for Health Metrics and Evaluation.

- We estimate that 2% to 7% of uninsured people will require hospitalization for COVID-19, ranging from about 670,000 to slightly more than 2 million hospital admissions. This range is very similar to the results (weighted by the age distribution of the population) in the model published in the PNAS, which presents a range of hospitalization rates based on alternative assumptions about transmission of the virus and how many people isolate themselves after the onset of symptoms.

To project how much hospitals would get paid by the federal government for treating uninsured patients, we look at payments for admissions for similar conditions. For less severe hospitalizations, we use the average Medicare payment for respiratory infections and inflammations with major comorbidities or complications in 2017, which was $13,297. For more severe hospitalizations, we use the average Medicare payment for a respiratory system diagnosis with ventilator support for greater than 96 hours, which was $40,218. Each of these average payments was then increased by 20% to account for the add-on to Medicare inpatient reimbursement for patients with COVID-19 that was included in the CARES Act.1

Before accounting for the 20% add on, Medicare payments are about half of what private insurers pay on average for the same diagnoses. In the absence of this new proposed policy, many of the uninsured would typically be billed based on hospital charges, which are the undiscounted “list prices” for care and are typically much higher than even private insurance reimbursement.

Based on the above, we estimate total payments to hospitals for treating uninsured patients under the Trump administration policy would range from $13.9 billion to $41.8 billion. At the top end of the range, payments on behalf of the uninsured would consume more than 40% of the $100 billion fund Congress created to help hospitals and others respond to the COVID-19 epidemic. Given the uncertainty of our estimates of the total funding that will be needed to reimburse hospitals, and the fact that infections may come in several waves over the next year,2 it is unclear whether the new fund will be able to cover the costs of the uninsured in addition to other needs, such as the purchase of medical supplies and the construction of temporary facilities.

Depending on how the remaining funds are allocated, this policy could lead to larger share of the $100 billion fund going to hospitals in states with higher uninsured rates that chose to not expand Medicaid. This would leave less funding for hospitals in states with lower uninsured rates that did expand Medicaid and, in some cases, also instituted new open enrollment periods in state-based exchanges. Under the Affordable Care Act, states have the option to expand Medicaid to adults without dependent children up to 138% of poverty, with the federal government paying 90% of the cost.

Caveats and Outstanding Questions

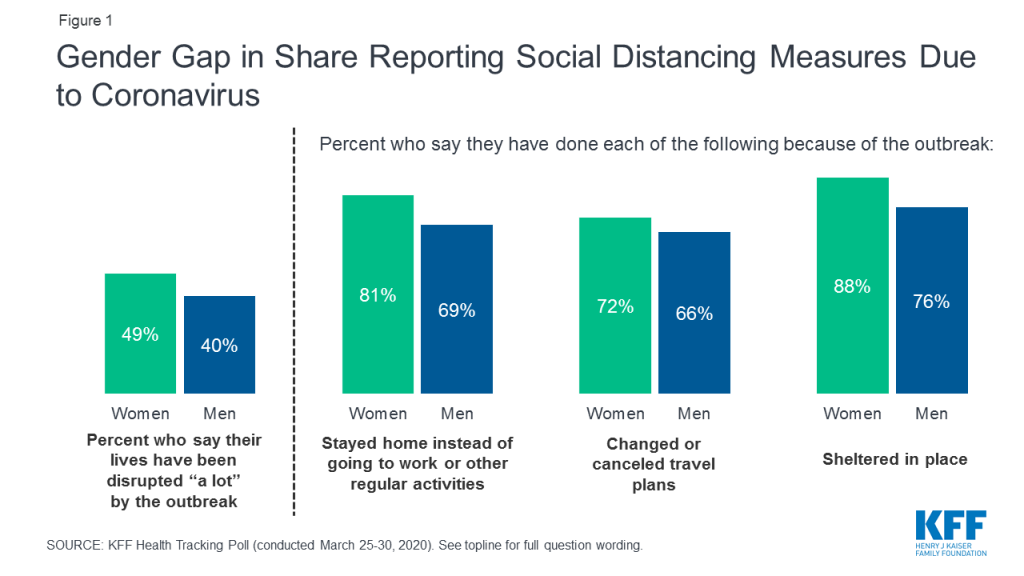

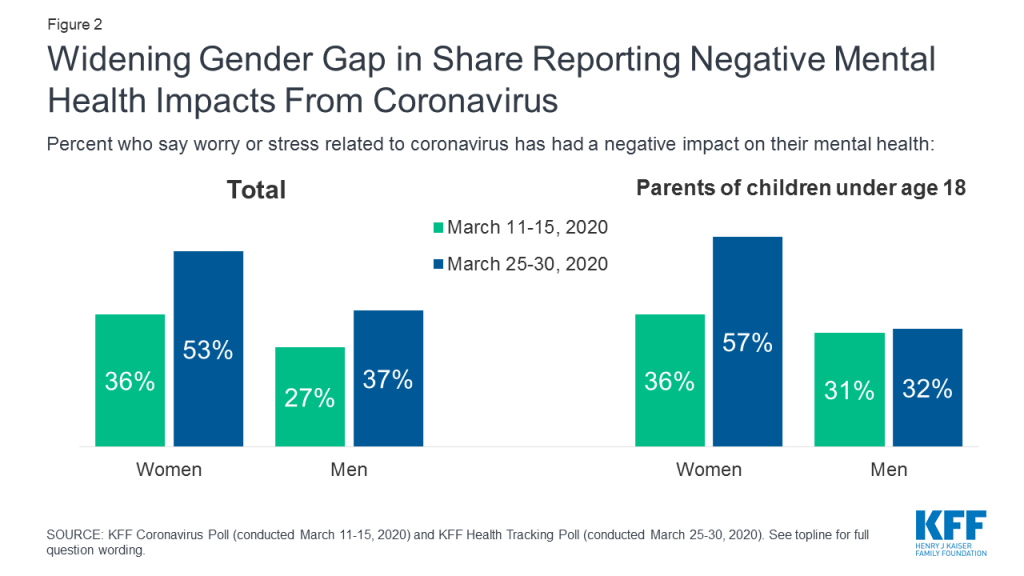

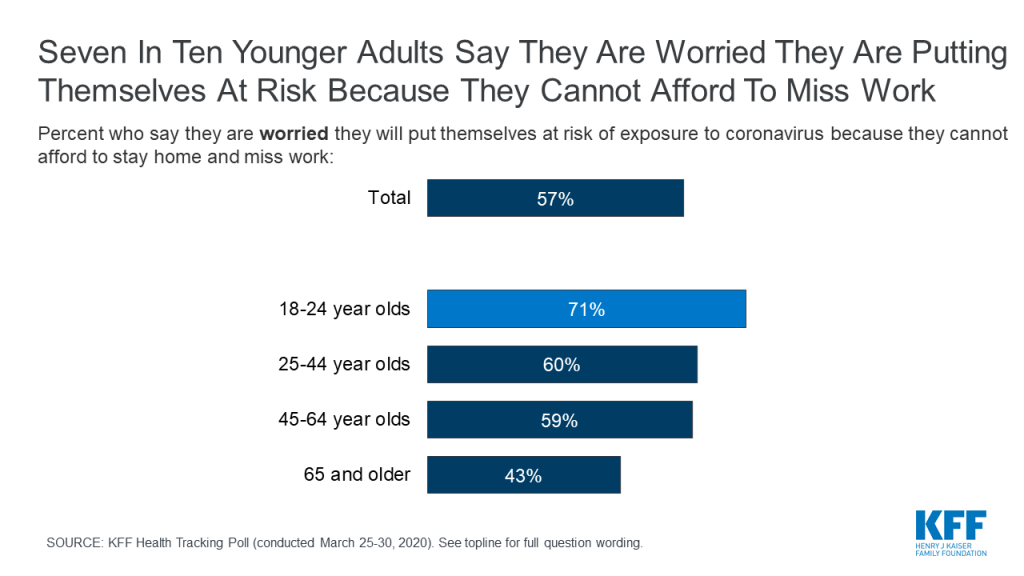

These estimates are highly uncertain, driven in particular by uncertainty surrounding how many people will become infected with the coronavirus. There is still a lot unknown about how the epidemic will evolve, which will be affected by policies like social distancing and the extent to which they are followed by the public. We will be able to refine the estimates as more data become available.

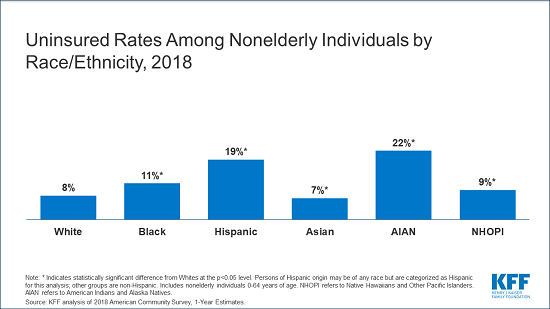

The estimates used to calculate the number of uninsured who are hospitalized are likely to be conservative, because they are based on a total of 27.9 million people uninsured from the most recent data in 2018. That number has no doubt increased, particularly with millions of people recently losing their jobs and, in many cases, their employer-provided health insurance. Many of the people who were previously uninsured, and many of those who have become recently unemployed, are eligible for Medicaid or premium subsidies under the Affordable Care Act.

Our calculations of the average cost of hospitalization also used several conservative assumptions regarding Medicare payments. The average Medicare payment data that we used was from 2017 and was not updated for inflation or for Medicare payment updates since that time. Additionally, we did not account for a likely difference in the geographic mix of COVID-19 patients as compared to those previously treated under those same Medicare codes in 2017. A geographic mix of COVID-19 patients more heavily concentrated in high wager areas such as New York would increase the total cost of reimbursing for care for the uninsured. This analysis also does not account for a temporary end to the 2% cut to Medicare that was part of sequestration and does not account for Medicare outlier payments, which provide additional reimbursement for “cases involving extraordinarily high costs.”3

While the Trump administration policy will provide relief to uninsured patients who become severely ill from COVID-19, and the hospitals that treat them, how much relief will depend on a number of implementation details that are not yet clear. For example, the administration statement refers to reimbursement of hospitals for care delivered to uninsured patients. However, hospital-based physicians typically bill patients separately for the physician service component of their care, and uninsured patients may still be responsible for those bills. Our analysis of private insurance claims shows that non-hospital charges for hospital admissions related to COVID-19 treatment are generally about 10% of the total bill and average several thousand dollars or more for patients who require a ventilator.

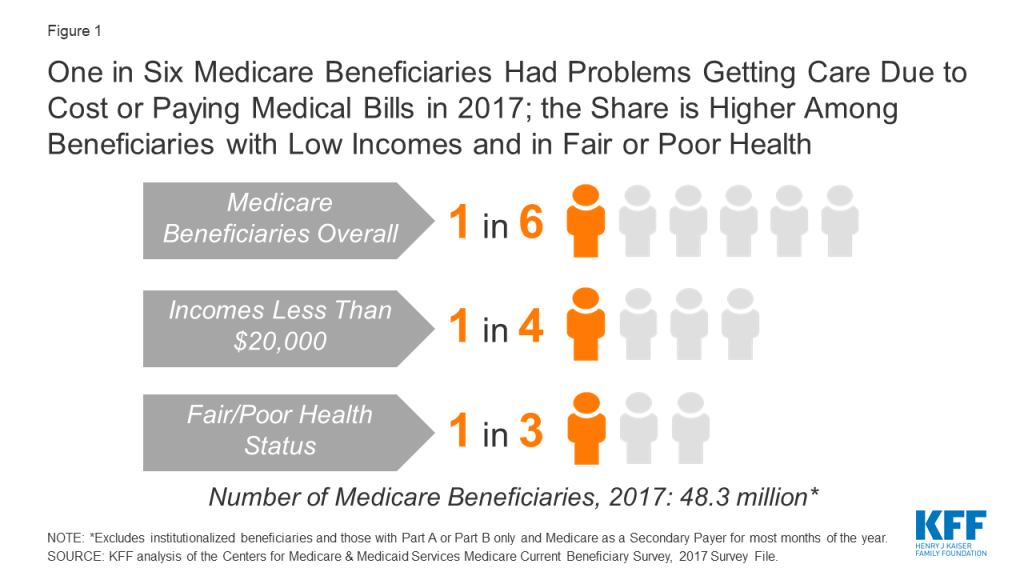

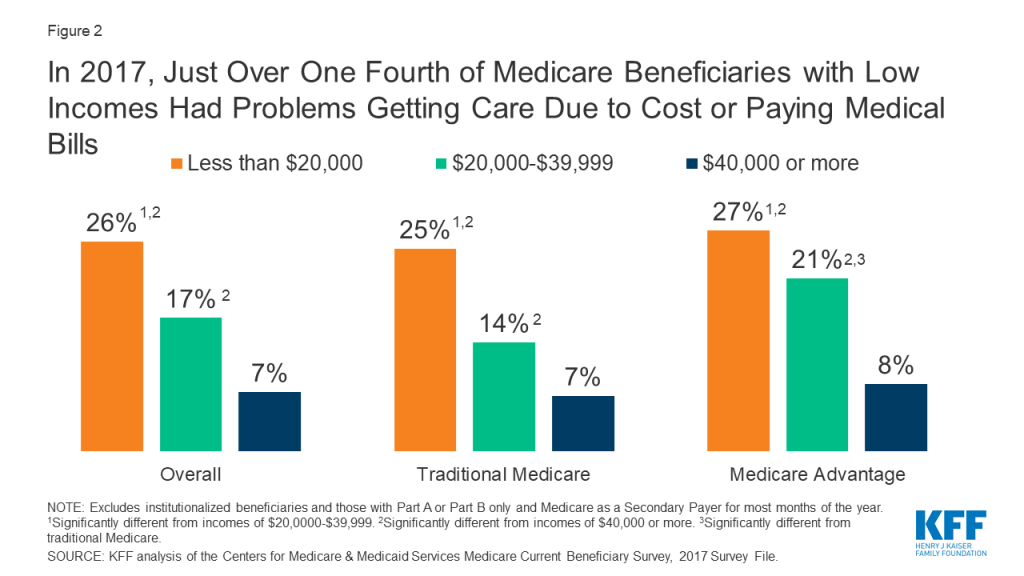

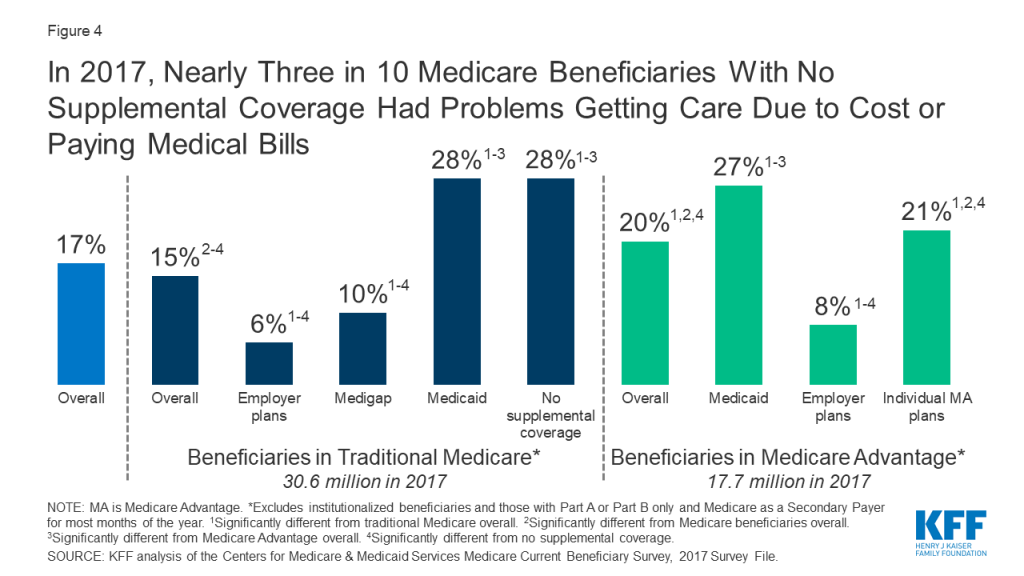

Our analysis does not take into account the likelihood that patients could also face substantial medical bills for outpatient care outside of hospitals, or the fact that this policy could encourage the uninsured to seek care in hospitals instead of lower-cost settings where the federal government will not be reimbursing for their care. The uninsured will also not be covered for needed follow-up care if that care is not provided in a hospital. In addition, the administration has not specified whether it will cover treatment costs for patients who seek care for symptoms that are typical of COVID-19 but ultimately test negative for the coronavirus. Additionally, it is unclear if the uninsured will still be required to pay cost sharing for their hospital care, although Secretary Azar stated that hospitals receiving these funds will not be permitted to balance bill patients for the difference between Medicare reimbursement and the hospital’s charges.4 There have been no changes to cost sharing in traditional Medicare, but most Medicare Advantage plans have said they will waive cost sharing for COVID-19 treatment,5 and all Medicare patients are protected against balance billing. Privately insured patients are not protected from balance billing by providers or hospitals and they have no federal protection against cost sharing, although some insurers have said they will waive cost sharing for their fully insured plans.6 Medicaid patients, in contrast, have no cost sharing for COVID-19 treatment. Ultimately, while this policy will help uninsured patients and discourage them from delaying care if they develop COVID-19, it is not a substitution for comprehensive health insurance.

This work was supported in part by Arnold Ventures. We value our funders. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

Endnotes

- CARES Act Sec. 3710. ↩︎

- B. Resnick, “How does the coronavirus outbreak end?,” Vox, March 7, 2020. ↩︎

- 77 Fed. Reg. 27870, 28142 (May 11, 2012); 42 CFR § 412.80. ↩︎

- U.S. Office of the Press Secretary, Press briefing by President Trump and staff, April 3, 2020. Available at: https://www.whitehouse.gov/briefings-statements/remarks-president-trump-vice-president-pence-members-coronavirus-task-force-press-briefing-18/ ↩︎

- P. Minemyer, “UnitedHealthcare, Anthem to waive cost-sharing for COVID-19 treatment,” FierceHealthcare, Apr 1, 2020 ↩︎

- D. Bunis, “Health Insurers Waive COVID-19 Out-of-Pocket Treatment Costs,” AARP, April 3, 2020. ↩︎