Financial Performance of Medicare Advantage, Individual, and Group Health Insurance Markets

Executive Summary

Medicare-for-All proposals have sparked discussion about the role of private health insurance in the U.S. health care system. Some of the current Medicare-for-All proposals would essentially eliminate private insurance. Others would allow private insurers to administer benefits under the new public program, similar to the role of Medicare Advantage plans today, which serve as a private-plan alternative to traditional Medicare. Another set of proposals would create a new Medicare-like public plan option, but preserve a role for private health insurance, including employer-sponsored coverage and policies sold to individuals and families in the Affordable Care Act (ACA) Marketplaces.

As context for these discussions, this brief examines and compares the financial performance of insurers in the Medicare Advantage, individual, and fully-insured group markets, using data reported by insurance companies to the National Association of Insurance Commissioners and compiled by Mark Farrah Associates. We analyze how insurers’ gross margins vary across the three markets, over time, and among insurers. Gross margins are the difference between premiums collected and medical expenses and do not account for administrative expenses. The brief also examines medical expenses as a percentage of premiums collected (simple loss ratios) across these three markets. See the Methods section for more information on calculations.

Key findings include:

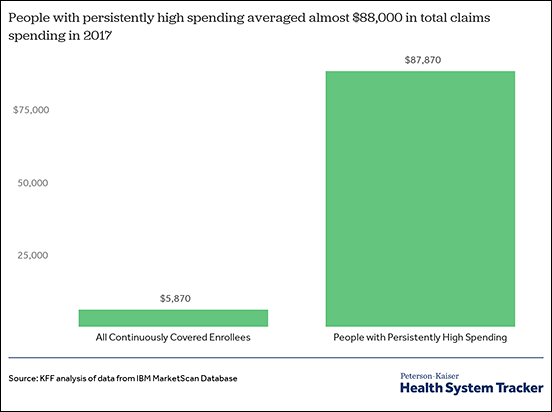

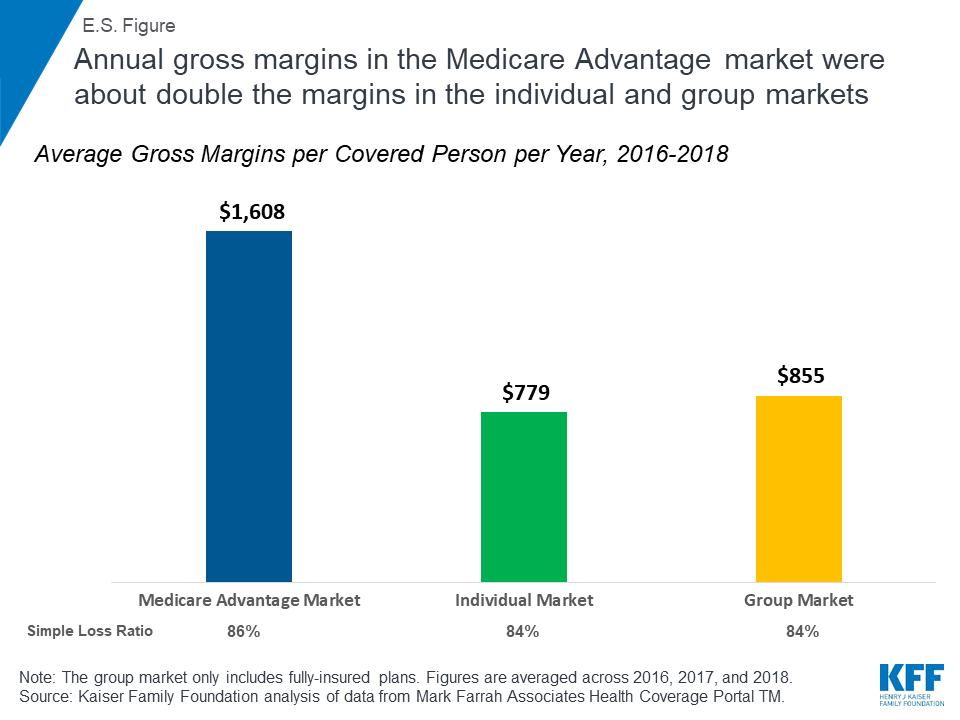

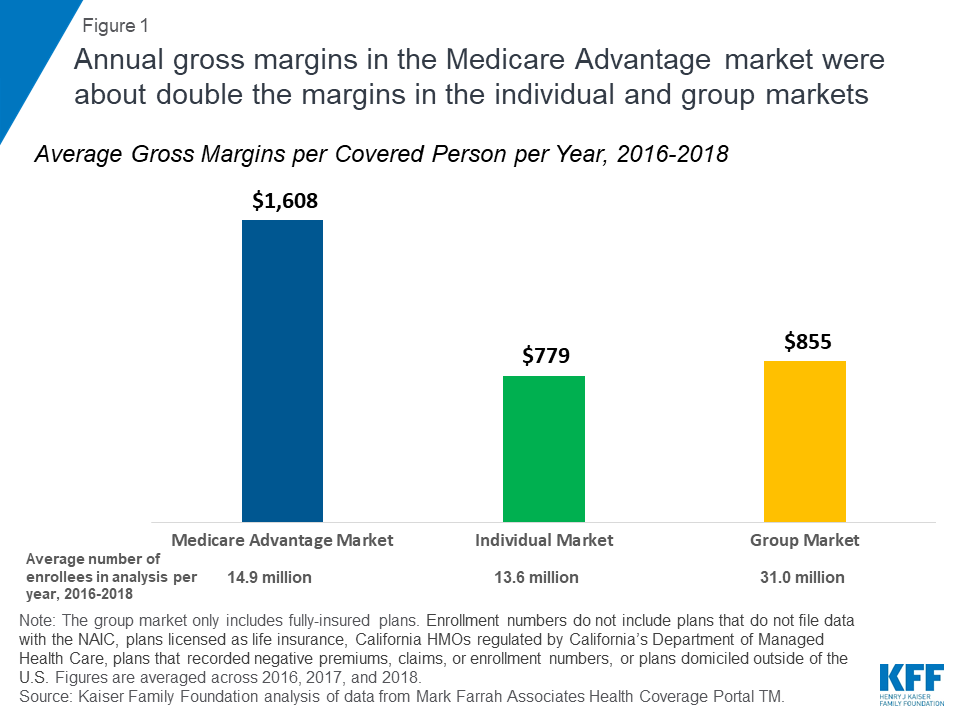

- Annual gross margins in the Medicare Advantage market averaged $1,608 per covered person between 2016 and 2018, about double the margins in the individual and group markets (E.S. Figure). Between 2016 and 2018, the individual market experienced substantial volatility, and the three-year average gross margins are not representative of any single year. In 2016, individual market insurers saw significant losses, and in 2018, margins were unusually high and plans were overpriced due to policy uncertainty.

- When aggregated across all plans in this analysis, annual gross margins sum to $23.9 billion, $10.6 billion, and $26.5 billion for the Medicare Advantage, individual, and group markets, respectively, for 2016-2018.

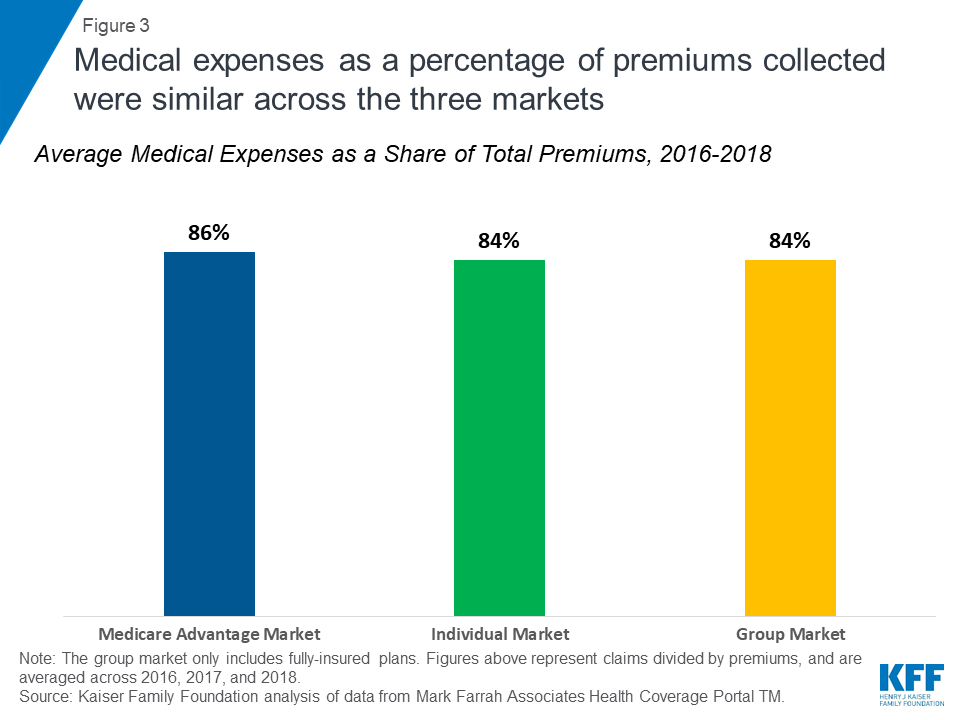

- Total medical expenses as a share of premiums collected (simple loss ratios) were similar for across the three markets between 2016 and 2018 (about 84-86%; E.S. Figure).

Each of these three health insurance markets now appear to generate high gross margins per person, particularly for insurers of Medicare Advantage plans.

Issue Brief

Background on Private Insurance Markets

The Medicare Advantage, individual (also known as non-group), and fully-insured group (employer) health insurance markets are three distinctly different markets. Each of these private insurance markets has unique features that affect the profitability for insurers, and which in turn affect coverage for eligible people. These markets are dominated by many of the same health insurers, with most of the country’s largest health insurers offering plans in all three markets.

Medicare Advantage. The Medicare Advantage market provides Medicare-covered benefits through private plans to 22 million Medicare beneficiaries in 2019, with enrollment steadily increasing over the past decade. The federal government makes risk-adjusted payments (higher payments for sicker enrollees and lower payments for healthier enrollees) to plans (averaging $11,545 per enrollee in 2019) to cover the preponderance of the cost of Medicare benefits for plan enrollees, with some plans charging enrollees an additional premium. In addition, the Medicare program pays plans more if they submit bids below the “benchmarks” set in statute or qualify for quality-related bonus payments; all of these payments are included as premiums in this analysis. In 2019, the federal payments to Medicare Advantage plans are about the same as what it would cost to cover the same people under traditional Medicare. When health risk coding differences are fully taken into account, payments to plans are 1-2% higher than traditional Medicare. Selection bias has been estimated to result in annual spending that is $1,253 lower for each Medicare Advantage enrollee compared to similar people who remain in traditional Medicare, suggesting that pegging payments to the costs of people in traditional Medicare overpays plans.

Individual Market. The individual market, which accounted for about 14 million people in 2018, includes coverage purchased by individuals and families through the Affordable Care Act’s exchanges (Marketplaces) as well as coverage purchased directly off-exchange, which includes both plans complying with the ACA’s rules and non-compliant coverage. (e.g., grandfathered policies purchased before the ACA went into effect and some short-term plans). The federal government provides subsidies for low-income people in the Marketplace and includes measures, such as risk adjustment, to help limit the financial liability of insurers. Insurers in the individual market receive premium payments from enrollees, plus any federal subsidies for people in the Marketplaces. Individual market premiums and plan availability have been considerably less stable than the Medicare Advantage and group markets.

Group Market. The fully-insured group market, the largest of the three markets (over 30 million people in 2018, excluding plans regulated by California’s Department of Managed Health Care), serves employers and their employees that are enrolled in fully-insured health plans. This market includes both small and large group plans, but excludes employer-sponsored insurance plans that are completely or partially self-funded, which account for 61% of all workers with employer-sponsored insurance.1 Plans typically receive premium payments from both employers and their employees. While both average claims and average premiums for enrollees in the group market have increased, the market has been relatively stable for insurers over the past decade.

Average Gross Margins

Average gross margins, or the average amount by which premium income exceeds claims costs per enrollee in a given year, are a key measure of insurer financial performance.

Average Gross Margins. Gross margins for Medicare Advantage plans averaged $1,608 per covered person per year between 2016 and 2018 – about double the average annual gross margins for plans in the individual and group markets ($779 and $855 per member per year, respectively; Figure 1).

Average gross margins were calculated as the difference between total premiums collected and total medical expenses incurred, and were averaged across the past three years (2016 to 2018) to even out year-to-year fluctuations, particularly those in the individual market. As discussed more below, there has been significant volatility in individual market margins, due in part to underpricing in the early years of ACA implementation and more recent overcorrections amid uncertainty about ACA repeal, enforcement of the individual mandate, and in response to the Trump Administration’s decisions to cease cost-sharing subsidy payments and reduce funding for outreach. The three-year average gross margins shown in Figure 1 include a year when individual market insurers generally saw significant losses as well as a year when profits were unusually high.

Gross margins do not necessarily translate into profitability since they do not account for administrative expenses. Nonetheless, gross margins are an indicator of financial performance and signal how much insurers retain, including profits, after paying for enrollees’ covered medical expenses.

Variation in Gross Margins Over Time. In every year since 2006, average gross margins for Medicare Advantage plans have exceeded those of plans in the individual and group markets (Figure 2). Average gross margins for Medicare Advantage plans climbed between 2006 and 2009, somewhat flattened after 2009, as federal overpayments to Medicare Advantage plans took on a more prominent role in policy discussions. Average margins then dipped somewhat after 2012 as federal payments to plans were reduced as a result of the ACA. Since 2015, average gross margins for Medicare Advantage plans have been on the rise, with the average gross margin for 2018 ($1,683 per member) nearly reached its peak 2009 value of $1,692 per member. The increase in average gross margins in the past few years has primarily been due to a sharp increase in the size and number of plans receiving bonus payments for high quality ratings, with total bonus payments more than doubling between 2015 and 2018.

Figure 2: Since 2006, Medicare Advantage plans’ average gross margins have exceeded those for plans in the individual or group markets

Gross margins in the individual market have been more volatile. Gross margins fell from about $446 per member per year in 2013 to -$122 in 2015 as the ACA’s market rules and consumer protections went into effect in 2014. At the time, insurers had very little information to work with in setting their premiums and many underpriced, experiencing significant losses. By 2017, the individual market generally had begun to stabilize. However, going into 2018, insurers raised benchmark premiums by an average of 34% in response to policy changes such as the Trump Administration’s decision to cease cost-sharing subsidy payments and uncertainty over whether the ACA as a whole would remain law or whether the individual mandate would be enforced. These premium hikes, along with slow claims growth, made 2018 the most profitable year for individual market insurers since the ACA went into effect. These high 2018 individual market profits will be offset somewhat by record high Medical Loss Ratio rebates insurers are required to issue in 2019 to 2018 enrollees due to overpricing. Premiums fell slightly on average for 2019, as it became clear that some insurers had raised 2018 rates more than was necessary, and margins will likely be lower for 2019.

Average gross margins for plans in the fully-insured group market have slowly, but steadily, increased since 2006, rising 71% from $525 per member in 2006 to $897 per member in 2018.

Simple Loss Ratios

Simple loss ratios, or the percentage of premium income that insurers pay out in claims, provide further context about the financial status of each of these markets. Despite differences in gross margins, medical expenses comprised a similar share of total premiums collected (simple loss ratios) across plans in the Medicare Advantage, individual, and fully-insured group markets (Figure 3). Between 2016 and 2018, the medical expenses of Medicare Advantage enrollees averaged about 86% of the total premiums collected by Medicare Advantage plans (primarily federal payments for Medicare-covered benefits), which is similar to the individual market (84%) and fully-insured group market (84%) three-year averages.

Medical expenses as a percentage of total premiums collected have been relatively constant since 2006, the first year for which data are available, for the plans in the Medicare Advantage and group markets. There has been quite a bit more year-to-year variation in the individual market since 2014, as the major provisions of the ACA went into effect and created uncertainty for insurers (see Appendix Table 1).

As with the gross margins, the simple loss ratios do not account for administrative expenses, and medical loss ratios as defined by the ACA are generally higher because the ACA calculation makes adjustments for taxes, fees, and quality improvement expenses. As with the analysis of gross margins, medical expenses as a percentage of premiums collected were averaged across three years (2016 to 2018) to even out year-to-year fluctuations in the individual market.

Reconciling Gross Margins and Simple Loss Ratios. Although loss ratios are similar across the three markets, gross margins are much higher for Medicare Advantage plans because both medical expenses and premiums are substantially higher for Medicare Advantage enrollees. In other words, a 5% margin, for example, in the Medicare Advantage market is a larger amount than a 5% margin in the individual or group market. People on Medicare tend to use more health care and incur higher medical expenses than people in the individual and group markets, and the federal payments (premiums) to Medicare Advantage plans are tied to the medical expenses of people in traditional Medicare. For instance, in 2018, Medicare Advantage enrollees spent an average of 1,856 days in a hospital per 1,000 enrollees, compared with averages of 304 and 294 hospital days for people in the individual and group markets, respectively (Appendix Table 2).

Variation in Performance Among Insurers Over Time

Annual gross margins varied substantially among insurers in the individual market and Medicare Advantage market, with relatively less variation among insurers in the fully-insured group market (Figure 4). In 2018, most of the Medicare Advantage market had gross margins between $1,014 (25th percentile) and $2,342 (75th percentile), and gross margins in most of the individual market varied substantially between $358 and $2,027 (25th and 75th percentiles, respectively). In contrast, gross margins in the fully-insured group market varied much less (from $501 at the 25th percentile to $1,215 at the 75th percentile in 2018).

Figure 4: Gross margins varied less across group market insurers than insurers in the individual or Medicare Advantage markets

In 2018, gross margins among insurers in the bottom quartile of the Medicare Advantage market (those with margins below $1,014) were similar to, or higher than, the average gross margin in the group market ($897). Conversely, many insurers in the top quartile of gross margins in the group market (those with margins above $1,215) had margins lower than the average in the Medicare Advantage market ($1,683) in 2018. The group market may have less variation in gross margins in part because of less uncertainty and because it has not been as subject to changes in policy. In all markets, 5-10% of insurers had negative gross margins, with medical expenses exceeding premiums, indicating that some insurers are losing money in the same markets where other insurers are making profits.

Total Gross Margins

After aggregating gross margins across all plans and enrollees in this analysis, total gross margins were highest for the fully-insured group market for all years between 2006 and 2017 (Figure 5). However, as of 2018, the Medicare Advantage market has caught up to the group market, with both markets reaching $27 billion in total gross margins in 2018. The rise in total gross margins for the Medicare Advantage market is primarily due to a steady increase in people enrolling in Medicare Advantage plans over the past decade. Total gross margins in the individual market remain significantly lower than the fully-insured group or Medicare Advantage markets, reaching $18 billion in 2018, in part because fewer people are covered in the individual market.

Figure 5: Total gross margins for Medicare Advantage plans have been rapidly nearing those for the group market

For 2016 to 2018, total gross margins averaged $23.9 billion, $10.6 billion, and $26.5 billion per year for the Medicare Advantage, individual, and group markets, respectively.2 Since this analysis excludes some plans in these markets (see Methods for more details), these aggregated margins would be larger if all plans were included.

Discussion

This analysis suggests insurers are profitable in each of the three markets. There is a particular focus in policy debates right now on Medicare Advantage plans. Several Medicare-for-All and other health reform proposals would allow private insurers to administer benefits under a new Medicare-like public option, which could be lucrative and attractive for health insurers, depending on how payments to plans are set. Based on the history of Medicare Advantage plans, setting payments to private plans at the appropriate rate remains a challenge, given competing goals of broadening plan choice and fiscal accountability. With a new public program or option, policymakers are likely to face similar challenges, depending on their goals and priorities.

Methods

We analyzed insurer-reported financial data from Health Coverage Portal TM, a market database maintained by Mark Farrah Associates, which includes information from the National Association of Insurance Commissioners (NAIC). The dataset analyzed in this report does not include NAIC plans licensed as life insurance or California HMOs regulated by California’s Department of Managed Health Care. We excluded plans that filed negative enrollment, premiums, or claims and corrected for plans that did not file “member months” in the annual statement but did file current year membership. The group market in this analysis only includes fully insured plans.3 Premiums to Medicare Advantage plans do not include payments for Medicare Part D benefits.

Gross margins were calculated by subtracting the sum of total incurred claims from the sum of unadjusted health premiums earned and dividing by the total number of members in each market. Premiums for Medicare Advantage plans primarily consist of federal payments made to plans for Medicare-covered benefits, and also include any additional amounts plans may choose to charge their enrollees. Premiums for the individual market were not adjusted to account for rebates required to be remitted to enrollees. To calculate medical expenses as a percentage of premiums (or simple medical loss ratios), we divided the market-wide sum of total incurred claims by the sum of all unadjusted health premiums earned. Medical loss ratios in this analysis are simple loss ratios and do not adjust for quality improvement expenses, taxes, or risk program payments.

Appendix

| Table 1: Average Medical Expenses as a Share of Total Premiums, 2016–2018 | |||

| Year | Medicare Advantage Market | Individual Market | Fully-Insured Group Market |

| 2006 | 87% | 76% | 83% |

| 2007 | 86% | 82% | 85% |

| 2008 | 86% | 83% | 86% |

| 2009 | 85% | 84% | 87% |

| 2010 | 86% | 82% | 84% |

| 2011 | 86% | 85% | 85% |

| 2012 | 85% | 86% | 85% |

| 2013 | 87% | 87% | 85% |

| 2014 | 87% | 98% | 83% |

| 2015 | 88% | 102% | 84% |

| 2016 | 86% | 96% | 84% |

| 2017 | 86% | 83% | 83% |

| 2018 | 86% | 75% | 83% |

| Table 2: Average Annual Hospital Patient Days per 1,000 Enrollees, 2006–2018 | |||

| Year | Medicare Advantage Market | Individual Market | Fully-Insured Group Market |

| 2006 | 2,090 | 200 | 286 |

| 2007 | 2,122 | 233 | 301 |

| 2008 | 2,104 | 226 | 287 |

| 2009 | 1,943 | 276 | 320 |

| 2010 | 1,938 | 257 | 296 |

| 2011 | 1,980 | 247 | 307 |

| 2012 | 1,885 | 256 | 307 |

| 2013 | 1,987 | 258 | 310 |

| 2014 | 2,113 | 289 | 475 |

| 2015 | 2,006 | 316 | 284 |

| 2016 | 1,894 | 308 | 298 |

| 2017 | 1,933 | 314 | 301 |

| 2018 | 1,856 | 304 | 294 |

Endnotes

- As of 2016, states must define small group as 1-100 employees (and large groups as having 101 or more employees). Prior to 2016, however, states were allowed to continue to define small groups as having a maximum of 50 employees. ↩︎

- These figures are extrapolated based on enrollment in the plans included in this analysis, which do not represent the full enrollment of the private insurance market. Enrollment figures do not include plans that do not file data with the NAIC, plans licensed as life insurance, California HMOs regulated by Californiau2019s Department of Managed Health Care, plans that recorded negative premiums, claims, or enrollment numbers, or plans domiciled outside of the U.S. ↩︎

- 61% of workers with employer-sponsored insurance are enrolled in a plan that is completely or partially self-funded. This analysis only includes fully-insured group plans. ↩︎