KFF Health Tracking Poll: Economic Views and Experiences of Adults Who Struggle Financially

Findings

About half of adults say they either have difficulty affording monthly bills or are just able to afford their household expenses without having money left over, according to the latest KFF Tracking Poll. These groups are much more likely than those who can afford their monthly costs with money left over to rate the national economy negatively and worry about affording everyday expenses. Worries about health care costs, however, pervade regardless of financial situation, with a majority of adults who can afford their bills with money left over saying they worry about affording unexpected medical bills or the cost of health care services. Thinking ahead to the upcoming 2024 presidential election, voters who have difficulty affording household expenses are more likely than others to say it is “very important” for presidential candidates to discuss inflation and affordability of health care on the campaign trail.

Assessments of the national economy are historically linked to presidential approval, and KFF’s latest tracking poll reflects this, with large shares of Republicans describing the economy negatively compared to fewer than half of Democrats saying the same. Yet at least three quarters of adults who report difficulty affording bills or say they can just afford their bills rate the economy negatively, suggesting that negative perceptions of the economy, at least in part, also reflect adults’ personal financial situations.

Who Struggles Affording Monthly Bills?

About one in five adults (19%) say they have difficulty affording their bills each month and about four in ten (37%) say they are just able to afford their bills each month, while a little over four in ten (44%) say they are both able to pay their bills and have some money left over.

Adults who have difficulty affording their monthly bills as well as those who are just able to pay their bills each month are younger and have lower household incomes compared to adults who say they can afford their bills each month with money left over. These groups are also disproportionately made up of Black adults, Hispanic adults, and women. The groups struggling to afford household expenses are equally made up of Democrats, independents, and Republicans, while adults who say they can afford their monthly bills with money left over are more likely to be Democrats than independents or Republicans.

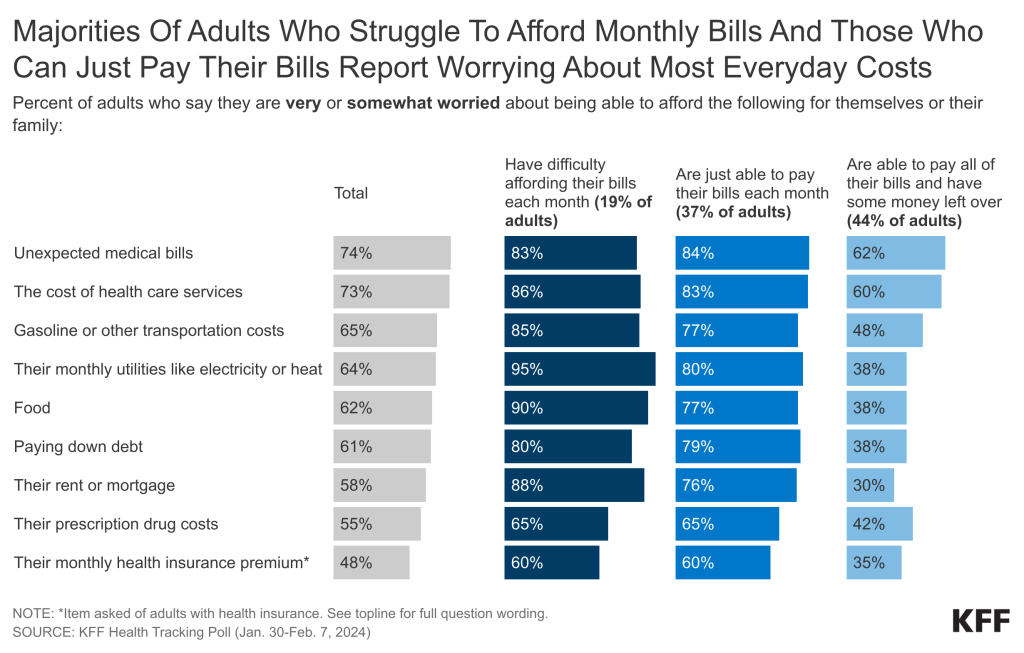

Majorities of adults who report difficulty affording their monthly bills and those who are just able to afford their bills say they are worried about affording expenses for themselves and their family, from health care costs to food and paying down debt. About nine in ten adults who have difficulty affording their monthly bills are “very” or “somewhat worried” about being able to afford their monthly utilities like electricity and heat (95%), food (90%), or their rent or mortgage (88%) for themselves or their family. Similarly large majorities of the group who can just afford their bills also say they are worried about affording monthly utilities (80%), food (77%), or their rent or mortgage (76%).

Health care costs are also a concern for those who struggle with bills, with more than eight in ten saying they are worried about the cost of health care services (86%) or unexpected medical bills (83%). Among those who are just able to afford their bills, about eight in ten are worried about being able to afford unexpected medical bills (84%) or health care services (83%). Fewer, but still majority shares, of both these groups report being worried about affording prescription drug costs (65% for each), and – among those with health insurance – their monthly health insurance premium (60%).

Notably, worry about health care costs pervade among a majority of adults, regardless of their financial situation. Six in ten adults who say they can afford their bills with money left over nonetheless say they are “very” or “somewhat worried” about being able to afford unexpected medical bills (62%) or the cost of health care services (60%) for themselves and their family. For this group, larger shares worry about affording health care services and unexpected medical bills than other expenses like housing, food, and utilities, perhaps reflecting anxieties associated with the uncertainty and potential high costs of a prospective medical episode.

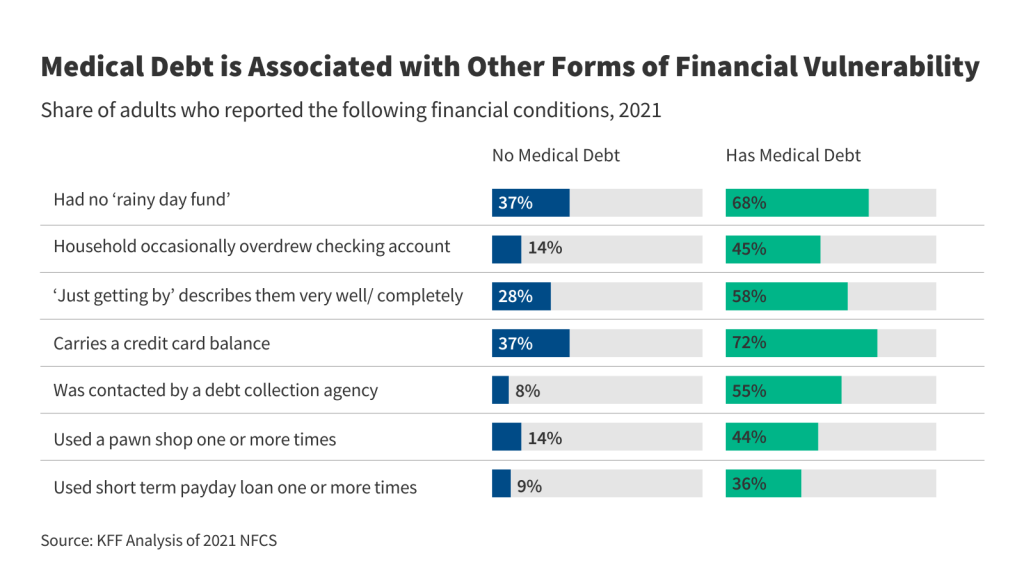

Beyond affordability worries, large shares of adults overall – including even larger shares of those who have difficulty affording bills or can just afford their bills – express worry about the prospect of medical debt, which prior KFF polling has found is held by about four in ten U.S. adults. Overall, seven in ten (70%) adults say they are “very” or “somewhat worried” a medical or dental bill will put them into debt or add to their current debt. Over eight in ten (85%) adults who struggle to afford their monthly bills say they are worried a medical or dental bill will put them in debt or add to their debt, including two-thirds (66%) of this group who say they are “very worried” about the prospect of taking on medical debt. Similar shares of the group that can just afford their bills also worry about health care debt, with 85% saying they are “very” or “somewhat worried” a medical or dental bill will lead to debt or add to their debt. Half (51%) of adults who can afford their bills with money left over report worrying that a bill will put them into health care debt or add to their debt.

How Personal Finances Impact Views of National Economy and Politics

Adults who struggle with their monthly bills are much more likely than those who are able to afford bills to rate the economy negatively, even as recent news reports have emphasized an improving national economy, although inflation rates have recently remained higher than expected. While there are notable partisan divides on the economy, with Republican voters much more likely than Democratic voters to rate the economy negatively, views on the economy also differ by financial situation. More than eight in ten adults (84%) who report difficulty affording their bills say the national economy is either “not so good” or “poor,” as do three-fourths (77%) of those who are just able to afford their monthly bills. These assessments of the national economy are at least twenty percentage points more negative than the views of adults who can afford their bills with money left over (57%).

Voters struggling to afford their monthly costs are more likely to say they want to hear the 2024 presidential candidates discuss economic issues and the future of Medicaid, suggesting that these issues may resonate even more with these voters during the presidential campaign. However, a majority of voters, regardless of financial situation, say they want to hear about cost issues. Voters who have trouble affording their monthly bills are more likely than those who can afford their bills with money left over to say it is “very important” for the 2024 presidential candidates to talk about several economic and health care related issues such as inflation (93% v. 77%), affordability of health care (89% v. 79%), prescription drug costs (76% v. 64%), the future of Medicaid (75% v. 49%) and student loan debt (44% v. 27%).

Large Shares of Voters Who Are Struggling to Afford Monthly Bills Say Trump Has Done More to Address Health Care Costs

Former President Trump may be reaping the benefits of retrospective views when voters are asked which president did more in office to address health care costs, while criticism of President Biden may be largely a result of general dissatisfaction with the current state of the economy. The groups of voters who struggle to afford their bills or can just afford their bills are more likely to say former President Trump did more than President Biden to address health care costs.

Six in ten (59%) voters who report difficulty affording their bills and about half (52%) of those who can just afford their bills say former President Trump did more as president to address health care costs than President Biden, while more than half of voters (56%) who can afford their bills with money left over side with Biden.

On the question of whether each president did enough to address health care costs, one-third (34%) of voters who have difficulty affording their monthly bills say former President Trump did enough to address health care costs, compared to one in ten (11%) who say President Biden has done enough to address the cost of health care. The group of voters who have difficulty affording bills are also more likely than those who can afford their bills with money left over to say former President Trump did enough to address health care costs (34% v. 22%).

Methods

This KFF Health Tracking Poll was designed and analyzed by public opinion researchers at KFF. The survey was conducted January 30 – February 7, 2024, online and by telephone among a nationally representative sample of 1,309 U.S. adults in English (1,231) and in Spanish (78). The sample includes 1,026 adults (n=58 in Spanish) reached through the SSRS Opinion Panel either online (n=1,002) or over the phone (n=24). The SSRS Opinion Panel is a nationally representative probability-based panel where panel members are recruited randomly in one of two ways: (a) Through invitations mailed to respondents randomly sampled from an Address-Based Sample (ABS) provided by Marketing Systems Groups (MSG) through the U.S. Postal Service’s Computerized Delivery Sequence (CDS); (b) from a dual-frame random digit dial (RDD) sample provided by MSG. For the online panel component, invitations were sent to panel members by email followed by up to three reminder emails.

Another 283 (n=20 in Spanish) interviews were conducted from a random digit dial telephone sample of prepaid cell phone numbers obtained through MSG. Phone numbers used for the prepaid cell phone component were randomly generated from a cell phone sampling frame with disproportionate stratification aimed at reaching Hispanic and non-Hispanic Black respondents. Stratification was based on incidence of the race/ethnicity groups within each frame.

Respondents in the phone samples received a $15 incentive via a check received by mail, and web respondents received a $5 electronic gift card incentive (some harder-to-reach groups received a $10 electronic gift card). In order to ensure data quality, cases were removed if they failed attention check questions in the online version of the questionnaire, or if they had over 30% item non-response, or had a length less than one quarter of the mean length by mode. Based on this criterion, one case was removed.

The combined cell phone and panel samples were weighted to match the sample’s demographics to the national U.S. adult population based on parameters derived from the Census Bureau’s 2022 Current Population Survey (CPS), 2021 Volunteering and Civic Life Supplement data from the CPS, and the 2023 KFF Benchmarking survey with ABS and prepaid cell phone samples. The demographic variables included in weighting for the general population sample are sex, age, education, race/ethnicity, region, education, civic engagement, internet use, and political party identification by race/ethnicity. The sample of registered voters was weighted separately to match the U.S. registered voter population using the parameters above plus recalled vote in the 2020 presidential election by county quintiles grouped by Trump vote share. Both weights account for differences in the probability of selection for each sample type (prepaid cell phone and panel). This includes adjustment for the sample design and geographic stratification of the cell phone sample, within household probability of selection, and the design of the panel-recruitment procedure.

The margin of sampling error including the design effect for the full sample and registered voters is plus or minus 4 percentage points. Numbers of respondents and margins of sampling error for key subgroups are shown in the table below. For results based on other subgroups, the margin of sampling error may be higher. Sample sizes and margins of sampling error for other subgroups are available by request. Sampling error is only one of many potential sources of error and there may be other unmeasured error in this or any other public opinion poll. KFF public opinion and survey research is a charter member of the Transparency Initiative of the American Association for Public Opinion Research.

| Group | N (unweighted) | M.O.S.E. |

| Total | 1,309 | ± 4 percentage points |

| Financial situation | ||

| Have difficulty affording their bills each month | 279 | ± 8 percentage points |

| Are just able to afford their bills each month | 482 | ± 6 percentage points |

| Are able to pay all of their bills and have some money left over | 544 | ± 5 percentage points |