1.4 Million Lawfully Present Immigrants are Expected to Lose Health Coverage due to the 2025 Tax and Budget Law

Congressional Republicans and President Trump passed the tax and budget reconciliation bill in July 2025. The new law includes significant cuts to the Medicaid program as well as eligibility restrictions for many lawfully present immigrants, including refugees and asylees, to access Medicaid and the Children’s Health Insurance Program (CHIP), subsidized Affordable Care Act (ACA) Marketplace, and Medicare coverage. Under longstanding federal policy, undocumented immigrants already are ineligible for federally funded health coverage. This policy watch outlines the groups of lawfully present immigrants that will lose access to federally funded health coverage due to the 2025 tax and budget law and the Congressional Budget Office’s (CBO’s) estimates of the increases in the number of uninsured and federal savings and revenue changes due to these provisions.

CBO estimates that the law’s restrictions on eligibility for federally funded health coverage for lawfully present immigrants will result in about 1.4 million lawfully present immigrants becoming uninsured, reduce federal spending by about $131 billion, and increase federal revenues by $4.8 billion as of 2034. Additional lawfully present immigrants are likely to lose Marketplace coverage and become uninsured due to the anticipated expiration of the enhanced subsidies for this coverage. Moreover, under Trump administration regulatory changes, the more than 530,000 Deferred Action for Childhood Arrivals (DACA) recipients are ineligible for federally funded coverage options.

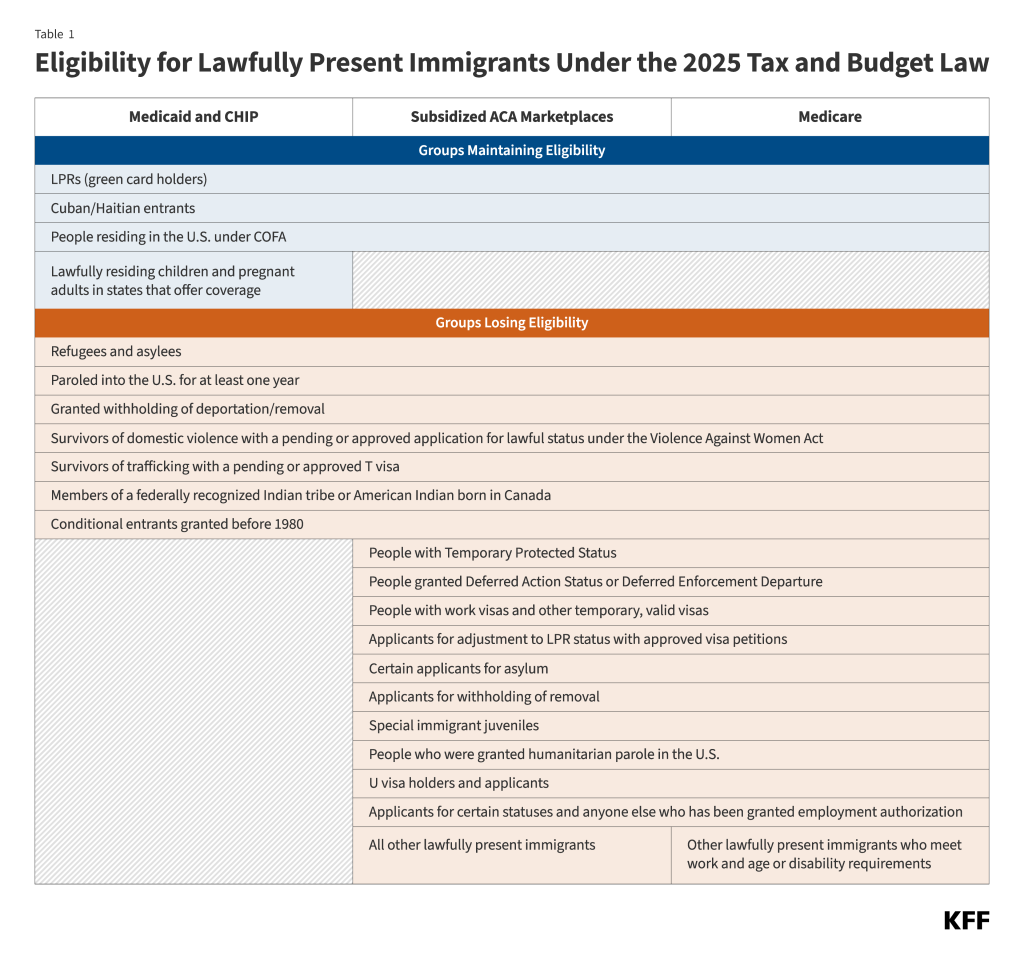

Changes in Eligibility for Lawfully Present Immigrants Under the 2025 Tax and Budget Law

Medicaid and CHIP

Under prior law, to be eligible for Medicaid and CHIP, immigrants were required to have a “qualified” immigration status in addition to meeting other eligibility requirements such as income. Qualified immigrants, as defined by the 1996 Personal Responsibility and Work Opportunity Act and subsequent additions, include lawful permanent residents (LPRs or “green card” holders); refugees; individuals granted parole for at least one year; individuals granted asylum or related relief and certain abused spouses and their children or parents; certain victims of trafficking; Cuban and Haitian entrants; and citizens of the Freely Associated (COFA) nations of the Marshall Islands, Micronesia and Palau residing in U.S. states and territories. In addition, many had to wait five years after obtaining qualified status before they could enroll in Medicaid even if they met other eligibility requirements. States have an option to extend Medicaid and/or CHIP coverage to all children and/or pregnant individuals who are lawfully residing and waive the five-year wait for these groups, which 39 states plus D.C. had taken up as of January 2025. States also have the option in CHIP to provide prenatal care and pregnancy related benefits to targeted low-income children beginning from conception to end of pregnancy (FCEP) regardless of their parent’s immigration status, which 24 states plus D.C. had taken as of April 2025.

The 2025 tax and budget law will restrict Medicaid or CHIP eligibility to LPRs, Cuban and Haitian entrants, people residing in the U.S. under COFA, and lawfully residing children and pregnant immigrants in states that cover them under the Medicaid and/or CHIP option (Table 1). States also will still have the option to extend prenatal and pregnancy-related benefits to targeted low-income children from conception through the end of pregnancy through the FCEP option. These restrictions will eliminate eligibility for many other groups of lawfully present immigrants, including refugees and asylees without a green card, among others (Table 1). This provision will become effective October 1, 2026, and CBO estimates that it will reduce federal spending by $6.2 billion and lead to an additional 100,000 individuals becoming uninsured by 2034.

ACA Marketplaces

Under prior law, lawfully present immigrants have been eligible to enroll in ACA Marketplace coverage and receive premium subsidies and cost-sharing reductions, including individuals with Temporary Protected Status (TPS), those with Deferred Enforced Departure, and people on work visas. In general, Marketplace coverage is limited to individuals with incomes at or above 100% of the federal poverty level (FPL), since most of those with lower incomes would be eligible for Medicaid. However, some lawfully present immigrants with lower incomes remain ineligible for Medicaid (e.g., due to the five-year waiting period and eligibility limits to qualified immigrants). To address this gap, Marketplace eligibility was also extended to lawfully present immigrants with incomes under 100% FPL who do not qualify for Medicaid due to their immigration status, including those in the five-year waiting period for Medicaid coverage. In the years after the ACA was passed, DACA recipients were excluded from eligibility for the Marketplaces despite being lawfully present. Under regulations issued by the Biden Administration in May 2024, DACA recipients were made newly eligible for the Marketplaces and to receive subsidies to offset costs starting November 2024. However, this coverage was blocked in some states due to legal challenges, and on June 25, 2025, the Trump administration finalized a rule that once again made DACA recipients ineligible to purchase ACA Marketplace coverage as of August 25, 2025. Most states will terminate coverage for enrolled DACA recipients on September 30, 2025.

The law will also limit eligibility for subsidized ACA Marketplace coverage to lawfully present immigrants who are LPRs, Cuban and Haitian entrants, and people residing in the U.S. under COFA. (Table 1). A broader group of lawfully present immigrants will lose access to subsidized Marketplace coverage under this change, including refugees and asylees without green cards, people with TPS, and individuals on work visas, among others, beginning January 1, 2027. The CBO estimates that this provision will lead to an additional one million individuals becoming uninsured and reduce federal spending by $91.4 billion over the 2026 to 2035 time period. In addition, the provision is expected to increase federal revenue by $4.8 billion as of 2034. The law also eliminates access to subsidized Marketplace coverage for lawfully present immigrants earning less than 100% FPL who are not eligible for Medicaid due to immigration status, including those in the five-year waiting period for coverage, beginning January 1, 2026. During the 2025 open enrollment period, nearly 550,000 people with incomes under 100% FPL were enrolled in a Marketplace plan, who are likely primarily lawfully present immigrants who are ineligible for Medicaid due to immigration status. The CBO estimates that this provision will lead to an additional 200,000 individuals becoming uninsured and reduce federal spending by $27.3 billion over the 2026 to 2035 time period. In addition, the provision is expected to increase federal revenue by $176 million as of 2034.

Medicare

Lawfully present immigrants have been eligible for Medicare if they have the required work quarters and meet the disability or age requirements. Those without required work history could also purchase Medicare Part A after residing legally in the U.S. for five years continuously.

Under the new law, Medicare eligibility also will be limited to lawfully present immigrants who are LPRs, Cuban and Haitian entrants, and people residing in the U.S. under COFA, eliminating eligibility for refugees and asylees without a green card, people with TPS, and people with work visas, among others (Table 1). Current beneficiaries subject to the new restrictions will lose coverage no later than 18 months from the enactment of the legislation (January 4, 2027). The CBO estimates that this provision will lead to an additional 100,000 individuals losing coverage, with a federal spending reduction of $5.1 billion and a federal revenue decrease of $123 million as of 2034.