KFF Health Tracking Poll – October 2019: Health Care In The Democratic Debates, Congress, And The Courts

KFF Health Tracking Poll – October 2019: Health Care In The Democratic Debates, Congress, And The Courts

Findings

Key Findings:

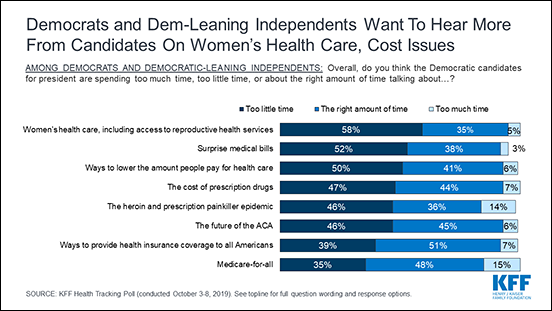

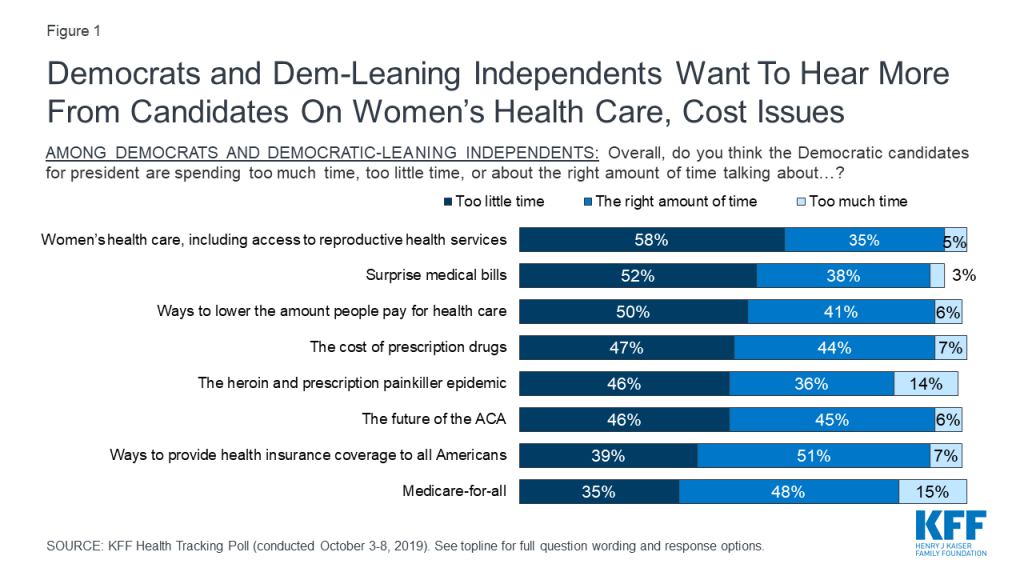

- In the lead up to the fourth round of Democratic primary debates, majorities of Democrats and Democratic-leaning independents say Democratic candidates for president are spending too little time talking about women’s health care and surprise medical bills, while most feel they are spending the right amount or too much time talking about coverage expansions and Medicare-for-all.

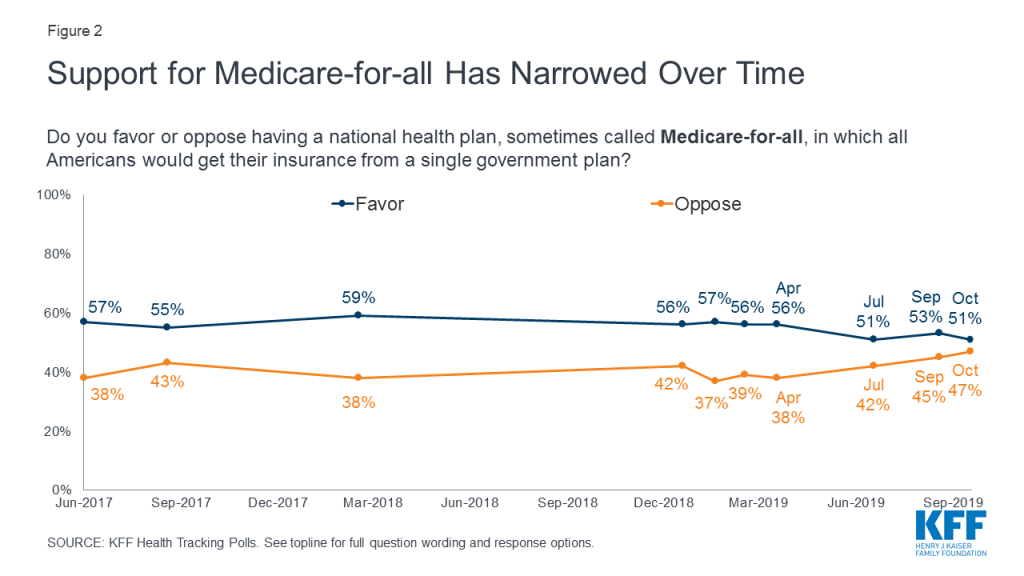

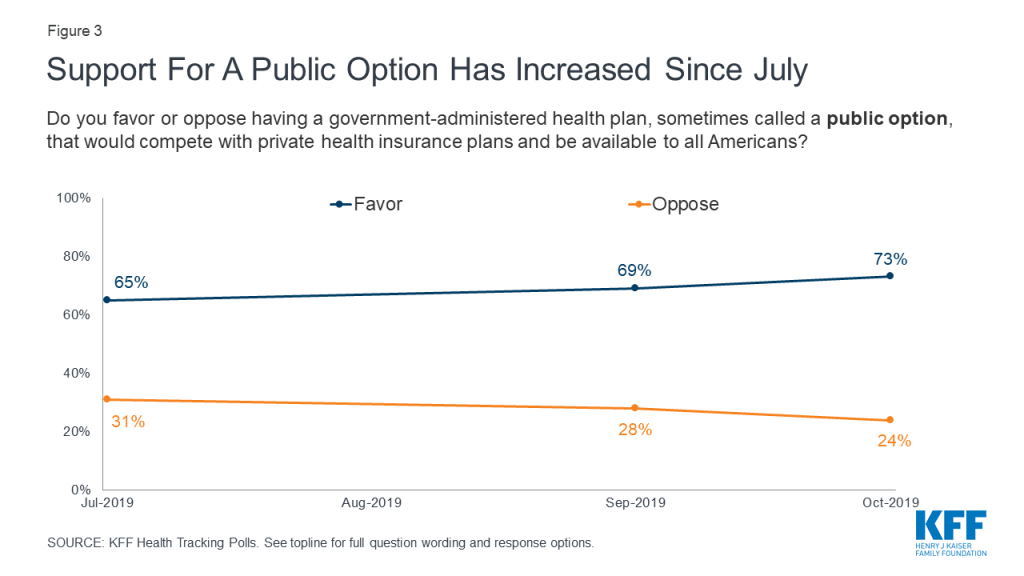

- Support for Medicare-for-all has narrowed in recent months, with 51% now saying they favor a national health plan and 47% opposed. At the same time, support for a public option has inched up since July, with 73% now saying they favor a government plan that would compete with private health care plans and 24% opposed.

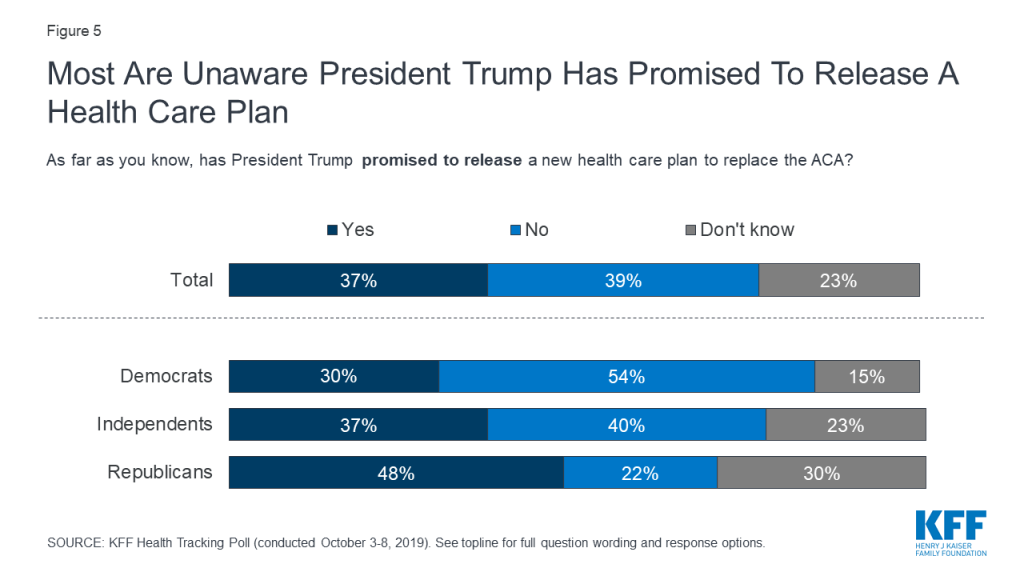

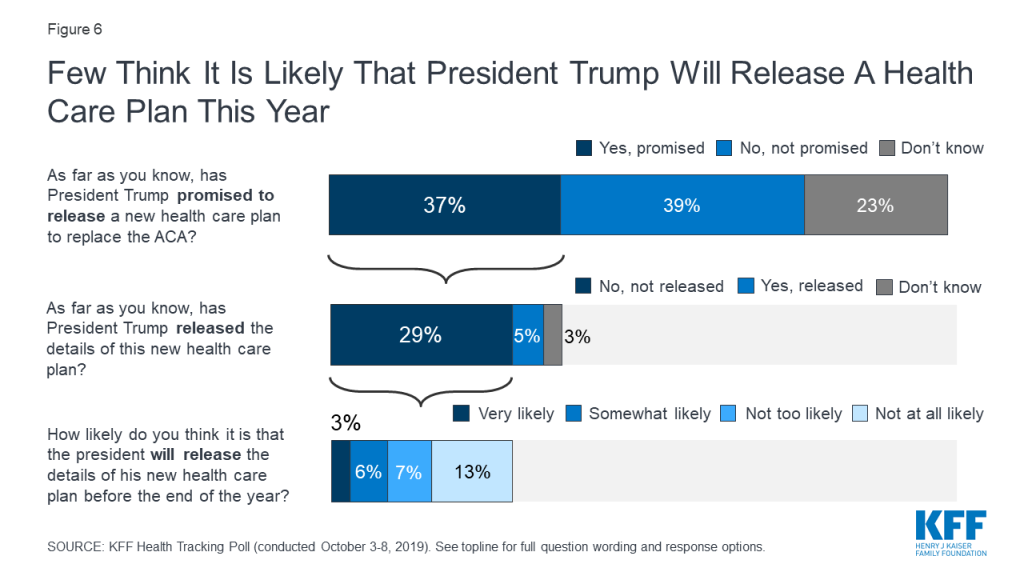

- Fewer than four in ten adults (37%) are aware that President Trump has promised to release a health care plan to replace the Affordable Care Act, while most say the president has not promised such a plan or are unsure. Most (62%) are not too confident or not at all confident that the president will be able to deliver on his promise that Americans will get better health care at a lower cost under his plan.

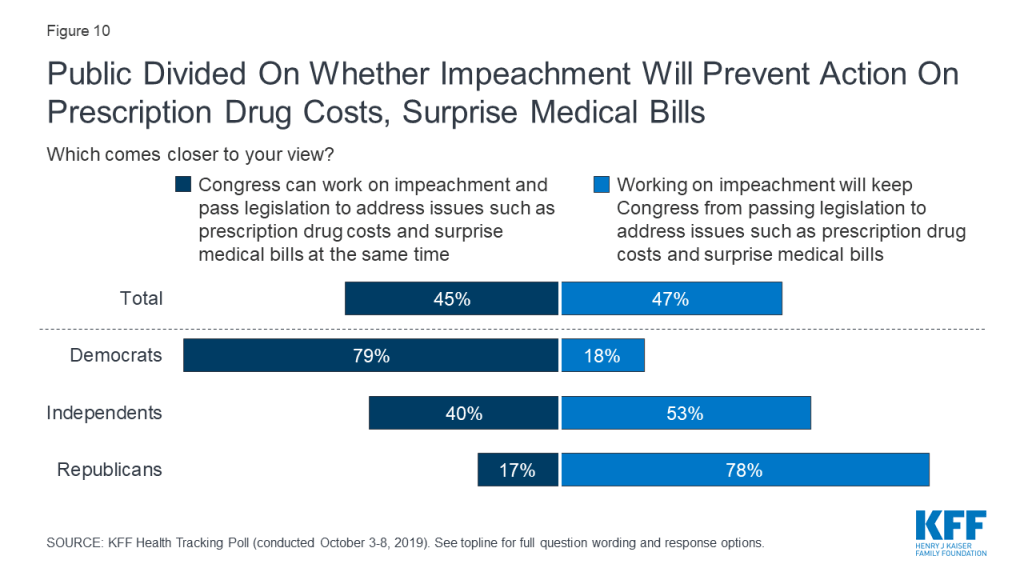

- Following House Speaker Nancy Pelosi’s announcement of a formal impeachment inquiry into President Trump, the public is divided on whether an impeachment investigation will keep Congress from addressing key health care issues (47%) or whether Congress can work on impeachment and pass legislation to address issues such as prescription drug costs and surprise medical bills at the same time (45%). Partisans diverge, but among independents, more think that working on impeachment will keep Congress from passing legislation than say Congress can work on both at the same time (53% vs. 40%).

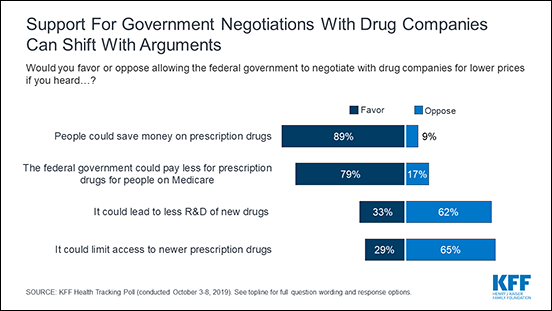

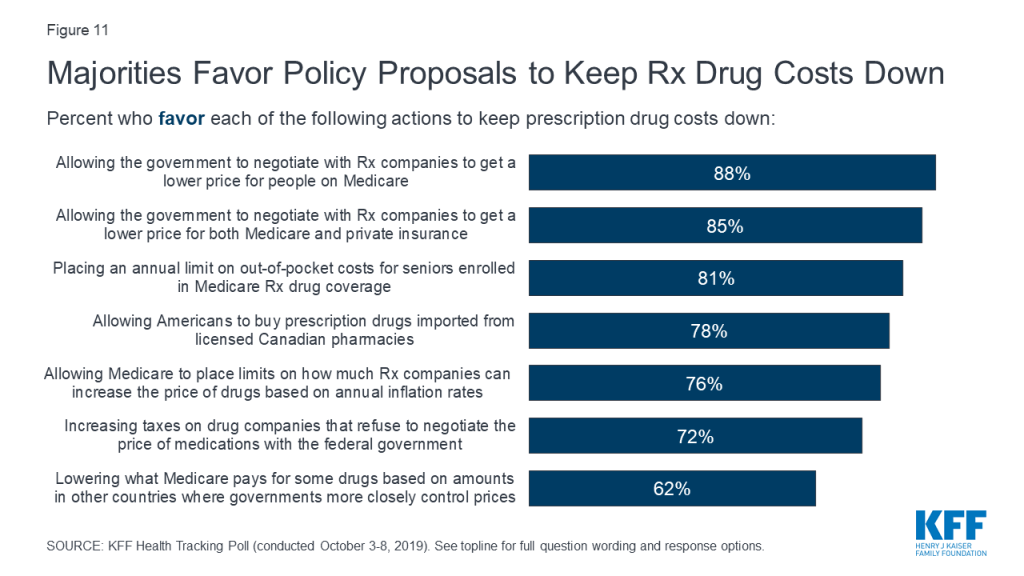

- Large majorities of the public favor various policy options aimed at lowering the cost of prescription drugs, including over eight in ten who favor allowing the federal government to negotiate with drug companies to get a lower price on medications for people with Medicare and allowing negotiations that would apply to both Medicare and private insurance. However, support can shift with arguments for and against government negotiation of drug prices.

Health Care And The 2020 Election

Democratic Presidential Primary Debates

In recent KFF Health Tracking Polls health care has consistently emerged as a top issue that Democrats and Democratic-leaning independents want to hear the 2020 Democratic presidential candidates address. This month’s tracking poll, conducted in the week prior to the fourth round of Democratic presidential debates, finds a majority of Democrats and Democratic-leaning independents say the Democratic candidates for president are spending too little time talking about women’s health care (58%) and surprise medical bills (52%) and half say the candidates are spending too little time discussing ways to lower health care costs (50%). Nearly half say candidates are spending too little time discussing the cost of prescription drugs (47%), the opioid epidemic (46%), and the future of the ACA (46%). The upcoming debates present an opportunity for Democratic candidates to address other health care issues that Democrats and Democratic-leaning independents want to hear more about as most say the candidates have spent the right amount of time or too much time talking about Medicare-for-all and ways to provide health insurance coverage to all Americans—two topics which have dominated health care discussions in the past three rounds of Democratic debates.

Support For Medicare-for-all Narrows, While Support For Public Option Grows

Support for a national health plan, or Medicare-for-all, appears to have narrowed somewhat in recent months. This month’s poll finds about half the public (51%) favors a national Medicare-for-all plan while 47% are opposed. This is the narrowest gap between those who favor and oppose such a plan measured in KFF polls since 2017, and represents a 5-percentage point drop in the share in favor and an 8-percentage point increase in the share opposed since April.

By contrast, support for a so-called “public option” plan in which a government-administered plan would compete with private health insurance appears to be inching up. Since July, there has been an 8-percentage point increase in the share in favor of such a plan, from 65% to 73%.

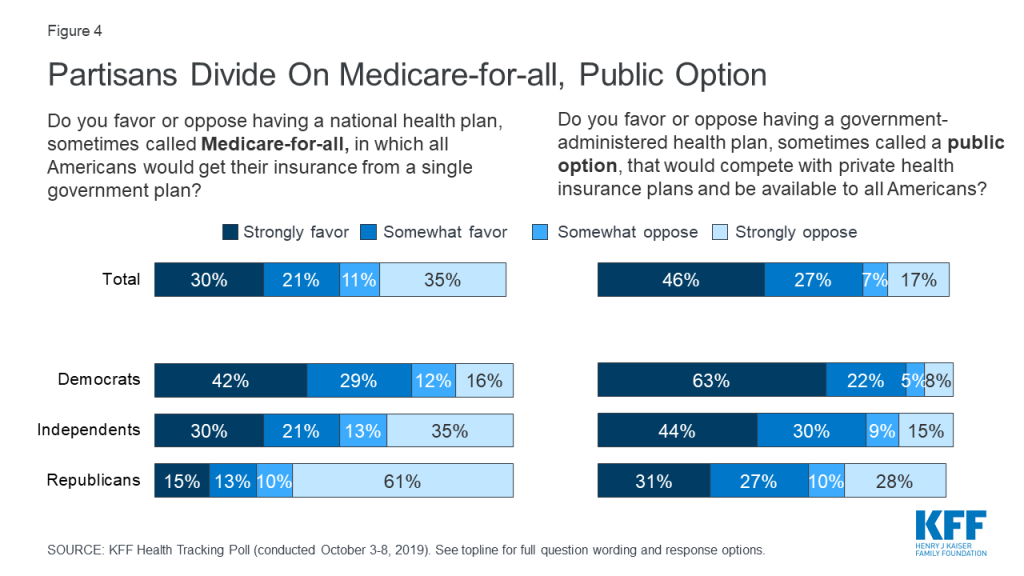

Large majorities of Democrats continue to favor both Medicare-for-all (71%) and a public option (85%). While a Medicare-for-all proposal is less popular among independents (50%) and Republicans (28%), majorities in both groups favor a public option that would compete with private health insurance plans (73% of independents and 58% of Republicans).

President Trump’s Health Care Plan

In March, President Trump stated that the Republican Party will become “the party of health care.”1 In April, he indicated that a Republican health care plan was forthcoming and that a vote would be planned following the 2020 election.2 Fewer than four in ten adults (37%) are aware that President Trump has promised to release a health care plan to replace the Affordable Care Act, while most say he has not promised to release a plan (39%) or they are unsure (23%). Notably, Republicans are more likely than Democrats and independents to know that President Trump has promised to release a health care plan to replace the ACA.

About three in ten (29%) know that President Trump has promised to release a health care plan and that he has not yet released the details of his plan. Moreover, only 9% of adults think it is very or somewhat likely that Trump will release the details of his promised health care plan to replace the ACA by the end of the year.

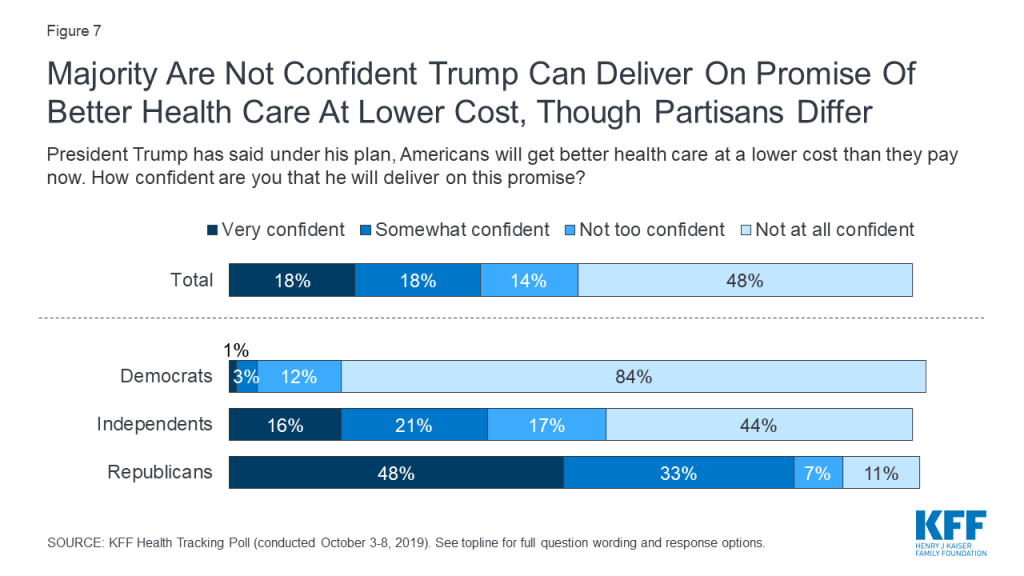

President Trump has stated that under his health care plan, Americans will get better health care at a lower cost than they currently pay3 . About three in ten adults are very or somewhat confident the President will deliver on his promise while a majority (62%) say they are not too confident or not at all confident. While most Republicans are either very confident (48%) or somewhat confident (33%) that President Trump will be able to deliver on his promise, majorities of Democrats and independents say they are not confident that the President will be able to deliver on this.

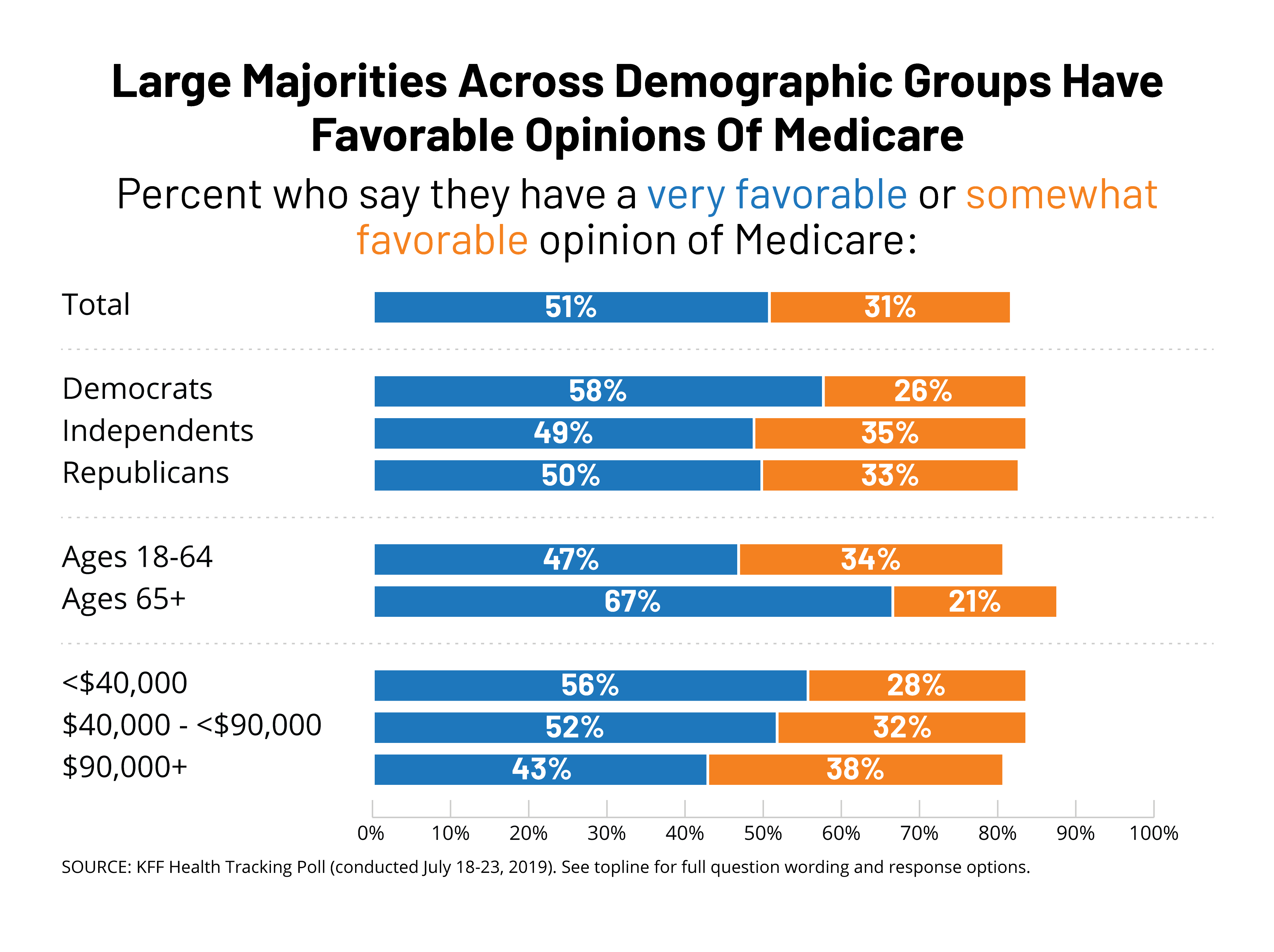

Public More Likely To Trust Democratic Party On Health Care

When it comes to health care, the public continues to give the Democratic Party the edge over the Republican Party. Larger shares say they trust the Democrats than the Republicans when it comes to handling health care (44% vs. 29%), lowering the cost of prescription drugs (49% vs. 30%), determining the future of Medicare (47% vs. 35%), and making sure seniors on Medicare are able to get the health care they need (51% vs. 32%). Unsurprisingly, majorities of partisans trust their own party to do a better job on each of these issues. While independents are more likely to trust the Democratic Party than the Republican Party, nearly one third (32%) say they trust neither party when it comes to handling health care.

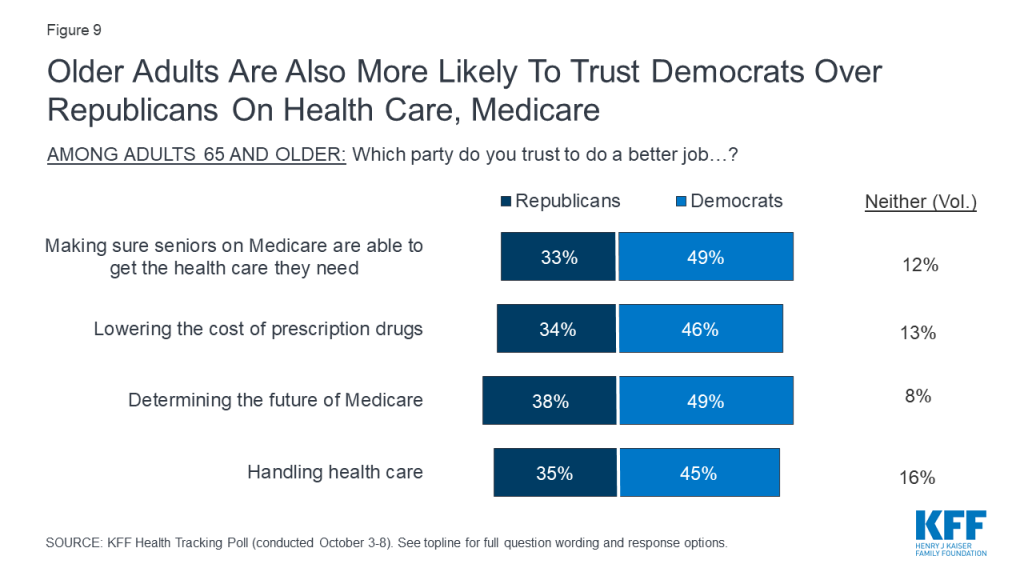

Despite President Trump’s health care speech in Florida earlier this month telling older adults that Democrats would harm their health care4 , those ages 65 and older are more likely to trust the Democratic Party than the Republican Party to do a better job handling health care (45% vs. 35%), making sure seniors are able to get the health care they need (49% vs. 33%), and lowering the cost of prescription drugs (46% vs. 34%).

Health Care And The Congress: Impeachment And Lowering Prescription Drug Prices

Public Divided On Whether Impeachment Will Prevent Congressional Action On Prescription Drugs, Surprise Bills

On September 24th, House Speaker Nancy Pelosi announced the House would begin a formal impeachment inquiry into President Trump. The public is divided on whether the recently launched impeachment investigation will keep Congress from addressing key health care issues. Forty-five percent of adults say Congress can work on impeachment and pass legislation to address issues such as prescription drug costs and surprise medical bills at the same time, while a similar proportion (47%) say impeachment will keep Congress from passing legislation to address these issues.

There are stark partisan differences, with nearly eight in ten Republicans (78%) saying impeachment will keep Congress from addressing health care issues while a similar share of Democrats (79%) say Congress can both work on impeachment and pass legislation at the same time. Independents are more likely to say that impeachment will keep Congress from passing legislation than to say they can do both (53% vs. 40%).

Majorities Support Various Approaches To Lowering Drug Costs, But Support Is Malleable

KFF’s September Health Tracking Poll found that lowering prescription drug costs remain a priority for the public, with majorities across parties saying this was an important issue for Congress to address. This issue has been a focus of lawmakers, with hearings held in both the House and Senate, proposals put forward by the Trump administration, and most recently a prescription drug policy proposal unveiled by House Speaker Nancy Pelosi. About eight in ten Americans (78%) say the cost of prescription drugs is unreasonable and majorities favor most of policy options aimed at lowering the cost of prescription drugs included in this month’s survey.

Nearly nine in ten Americans favor allowing the federal government to negotiate with drug companies to get a lower price on medications for people on Medicare (88%). A similar proportion favor allowing the federal government to negotiate prices with drug companies that would apply to both Medicare and private insurance (85%). Both of these policy proposals are supported by large majorities of Democrats, independents, and Republicans. Moreover, seven in ten adults (72%) favor increasing taxes on drug companies that refuse to negotiate with the federal government, including majorities of Democrats (79%), independents (71%), and Republicans (69%).

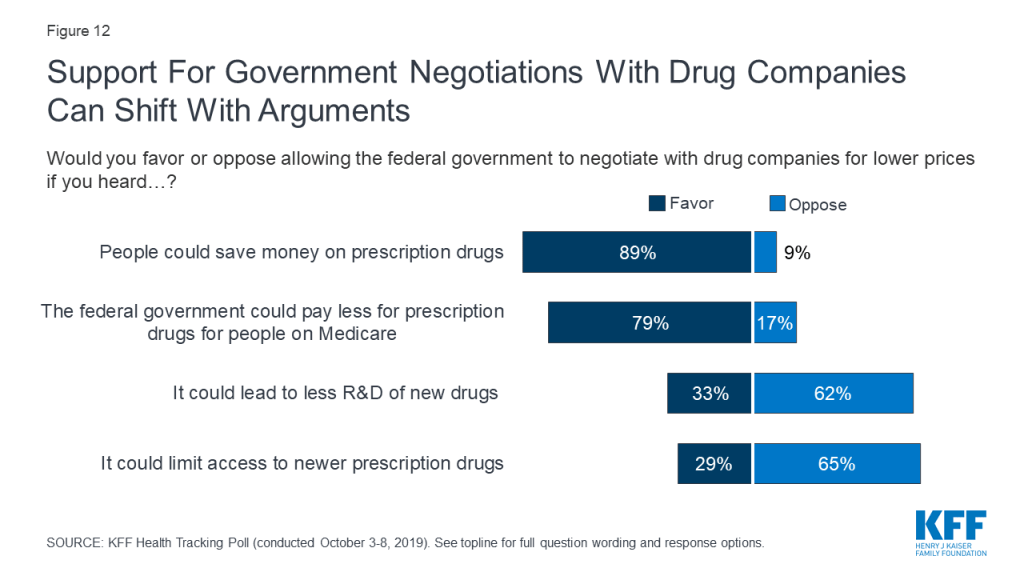

While allowing the federal government to negotiate prices with prescription drug companies is a popular policy proposal, attitudes can shift after hearing potential arguments that have been made both in favor and against the proposal. Support for government negotiations is 89% after hearing the argument that this could help people save money on their prescription drugs. In contrast, opposition is as high as two-thirds after hearing the argument that allowing government negotiation could limit access to new prescription drugs. It is important to note that these arguments do not include specific details about different approaches and constraints that could be imposed on potential negotiations, details of which may influence the public’s attitudes.

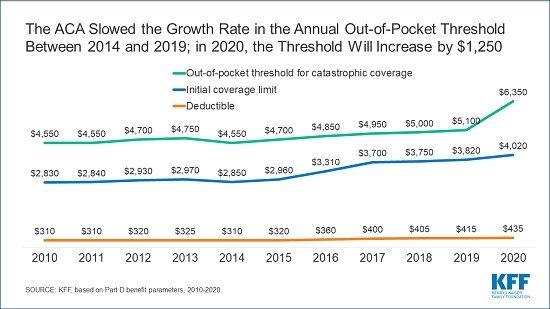

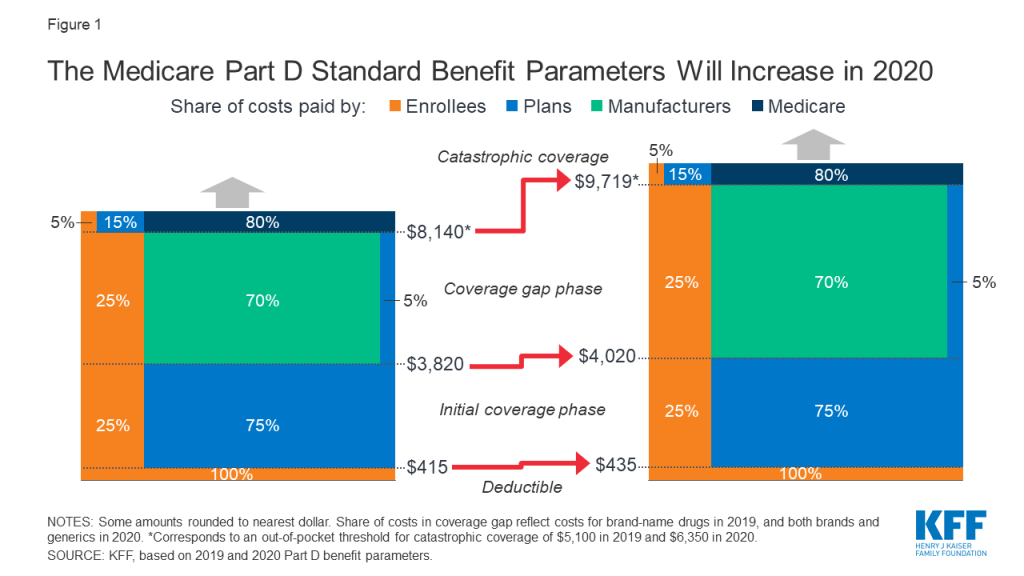

Other proposals aimed at lowering prescription drug costs are also popular among the public. At least three in four favor allowing Medicare to place limits on how much drug companies can increase the price of drugs every year based on annual inflation rates (76%), allowing Americans to buy drugs imported from licensed Canadian pharmacies (78%), and placing an annual limit on out-of-pocket costs for seniors enrolled in Medicare prescription drug coverage (81%). About six in ten (62%) favor lowering what Medicare pays based on amounts paid in other countries where governments more closely control prices. Notably, majorities of Democrats, Republicans and independents favor each of these proposals.

The ACA And The Courts

In December 2018, a federal district court judge in Texas issued a ruling siding with Republican state attorneys general that declared the Affordable Care Act invalid since Congress zeroed out the penalty for not having health insurance. In March 2019, the Trump administration filed a brief stating that the administration supports the federal judge’s ruling that all of the ACA is invalid. The Trump administration had previously stated that as part of the lawsuit known as Texas v. United States, it will no longer defend the ACA’s protections for people with pre-existing medical conditions.

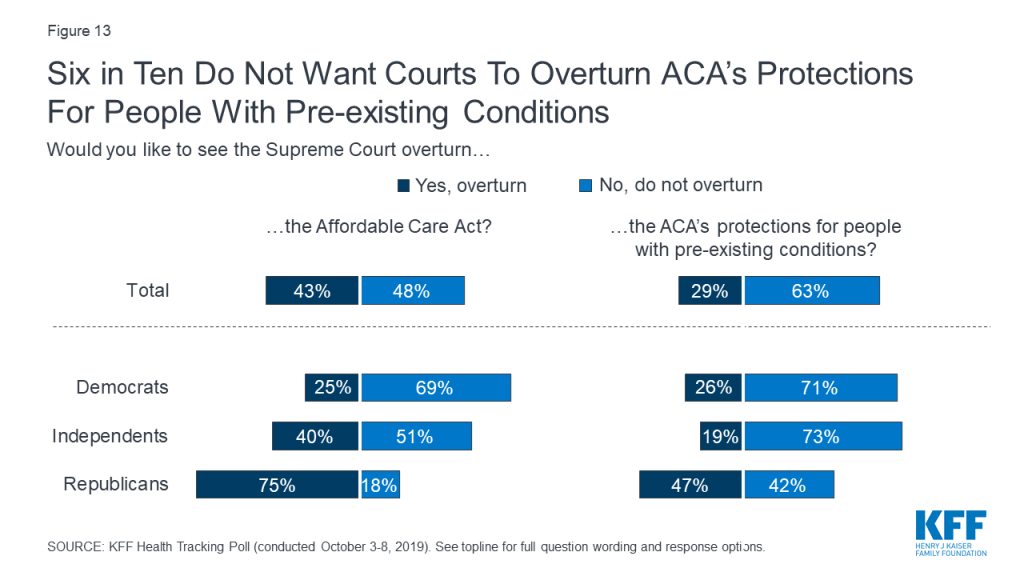

Overall, 63% of the public do not want to see the Supreme Court overturn the ACA’s pre-existing condition protections; yet the public is more divided on whether they want the Court to overturn the entire law (43% would like to see it overturned and 48% would not). While about seven in ten Democrats and about half of independents do not want to see the 2010 health care law overturned, three in four Republicans say they would like to see the courts overturn the law. However, fewer than half of Republicans (47%) want to see the ACA’s protections for people with pre-existing conditions overturned.

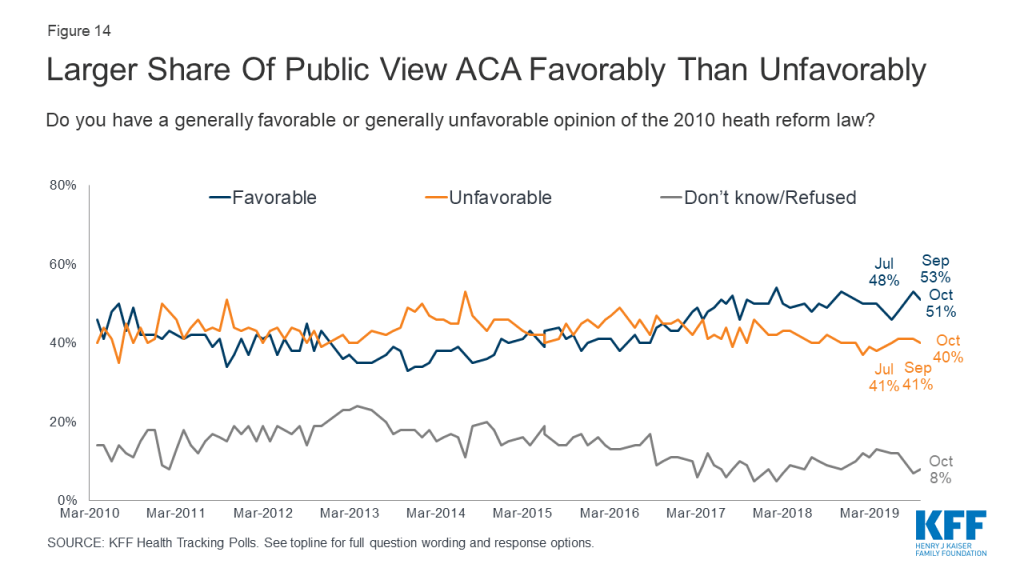

Overall opinions of the Affordable Care Act have remained relatively unchanged for the past two years since the Republican efforts to repeal the law. Half of the public (51%) this month hold favorable opinions of the ACA while four in ten hold a negative opinion of the law. The public still holds largely partisan views of the ACA as eight in ten Democrats (81%) have a favorable view of the ACA compared to half of independents (51%) and about one-sixth of Republicans (15%).

Methodology

This KFF Health Tracking Poll was designed and analyzed by public opinion researchers at the Kaiser Family Foundation (KFF). The survey was conducted October 3rd – 8th 2019, among a nationally representative random digit dial telephone sample of 1,205 adults ages 18 and older, living in the United States, including Alaska and Hawaii (note: persons without a telephone could not be included in the random selection process). The sample included 290 respondents reached by calling back respondents that had previously completed an interview on the KFF Tracking poll at least nine months ago. Computer-assisted telephone interviews conducted by landline (300) and cell phone (905, including 623 who had no landline telephone) were carried out in English and Spanish by SSRS of Glen Mills, PA. To efficiently obtain a sample of lower-income and non-White respondents, the sample also included an oversample of prepaid (pay-as-you-go) telephone numbers (25% of the cell phone sample consisted of prepaid numbers) as well as a subsample of respondents who had previously completed Spanish language interviews on the SSRS Omnibus poll (n=10). Both the random digit dial landline and cell phone samples were provided by Marketing Systems Group (MSG). For the landline sample, respondents were selected by asking for the youngest adult male or female currently at home based on a random rotation. If no one of that gender was available, interviewers asked to speak with the youngest adult of the opposite gender. For the cell phone sample, interviews were conducted with the adult who answered the phone. KFF paid for all costs associated with the survey.

The combined landline and cell phone sample was weighted to balance the sample demographics to match estimates for the national population using data from the Census Bureau’s 2017 American Community Survey (ACS) on sex, age, education, race, Hispanic origin, and region along with data from the 2010 Census on population density. The sample was also weighted to match current patterns of telephone use using data from the July-December 2018 National Health Interview Survey. The weight takes into account the fact that respondents with both a landline and cell phone have a higher probability of selection in the combined sample and also adjusts for the household size for the landline sample, and design modifications, namely, the oversampling of prepaid cell phones and likelihood of non-response for the re-contacted sample. All statistical tests of significance account for the effect of weighting.

The margin of sampling error including the design effect for the full sample is plus or minus 3 percentage points. Numbers of respondents and margins of sampling error for key subgroups are shown in the table below. For results based on other subgroups, the margin of sampling error may be higher. Sample sizes and margins of sampling error for other subgroups are available by request. Note that sampling error is only one of many potential sources of error in this or any other public opinion poll. Kaiser Family Foundation public opinion and survey research is a charter member of the Transparency Initiative of the American Association for Public Opinion Research.

| Group | N (unweighted) | M.O.S.E. |

| Total | 1,205 | ±3 percentage points |

| Party Identification | ||

| Democrats | 355 | ±6 percentage points |

| Republicans | 301 | ±7 percentage points |

| Independents | 447 | ±6 percentage points |

| Democrats/Democratic-leaning independents/Independents with no leaning | 659 | ±5 percentage points |

| Democrats and Democratic-leaning independents | 564 | ±5 percentage points |

Endnotes

- Sanger-Katz, M. (2019, October). Trump Is Being Vague About What He Wants to Replace Obamacare. But There Are Clues. The New York Times. https://www.nytimes.com/2019/04/05/upshot/trump-replacing-obamacare-insurance.html ↩︎

- Sanger-Katz, M. (2019, October). Trump Is Being Vague About What He Wants to Replace Obamacare. But There Are Clues. The New York Times. https://www.nytimes.com/2019/04/05/upshot/trump-replacing-obamacare-insurance.html ↩︎

- Transcript: ABC News’ George Stephanopoulos’ exclusive interview with President Trump. (2019, June). ABC News https://abcnews.go.com/Politics/transcript-abc-news-george-stephanopoulos-exclusive-interview-president/story?id=63749144 ↩︎

- Olorunnipa, T., Goldstein, A. (2019, October). Trump attacks Democrats’ health care plans and pledges to protect Medicare during political speech to Florida retirees. The Washington Post. https://www.washingtonpost.com/health/trump-to-expand-private-sector-version-of-medicare/2019/10/03/cd7b15aa-e562-11e9-b403-f738899982d2_story.html ↩︎