Medicaid

new and noteworthy

Medicaid: What to Watch in 2026

In this brief, KFF explores how state fiscal pressures are likely to converge with the implementation of the 2025 reconciliation law to affect Medicaid coverage, financing, and access to care over the next year, especially leading up to the midterm elections.

Medicaid and work

Challenges with Implementing Work Requirements: Findings from a Survey of State Medicaid Programs

To better understand how states are preparing for Medicaid work requirements, states were asked to discuss anticipated challenges to implementing work requirements by the end of 2026, including related system changes and data matching.

understanding medicaid

5 Facts: Provider Taxes

All states except Alaska cover some state Medicaid costs with taxes on health care providers. This brief uses data from KFF’s 2024-2025 survey of Medicaid directors to describe current practices and the federal rules governing them.

5 Facts: Medicaid and Hospitals

Absorbing reductions in Medicaid spending could be challenging for hospitals, particularly for those that are financially vulnerable. This brief provides data on the reach of Medicaid across hospitals, patients, and charity care.

5 Facts: Medicaid and Rural Areas

Approximately 66 million people live in rural areas – about 20% of the U.S. population. Nearly 1 in 4 of them have Medicaid, a higher share than in urban areas (24% vs 21%).

5 Facts: Nursing Facilities

The substantial Medicaid savings in the reconciliation bill that has been passed by the House could have major implications for nearly 15,000 federally certified nursing facilities and the 1.2 million people living in them.

2025 Medicaid Home Care survey

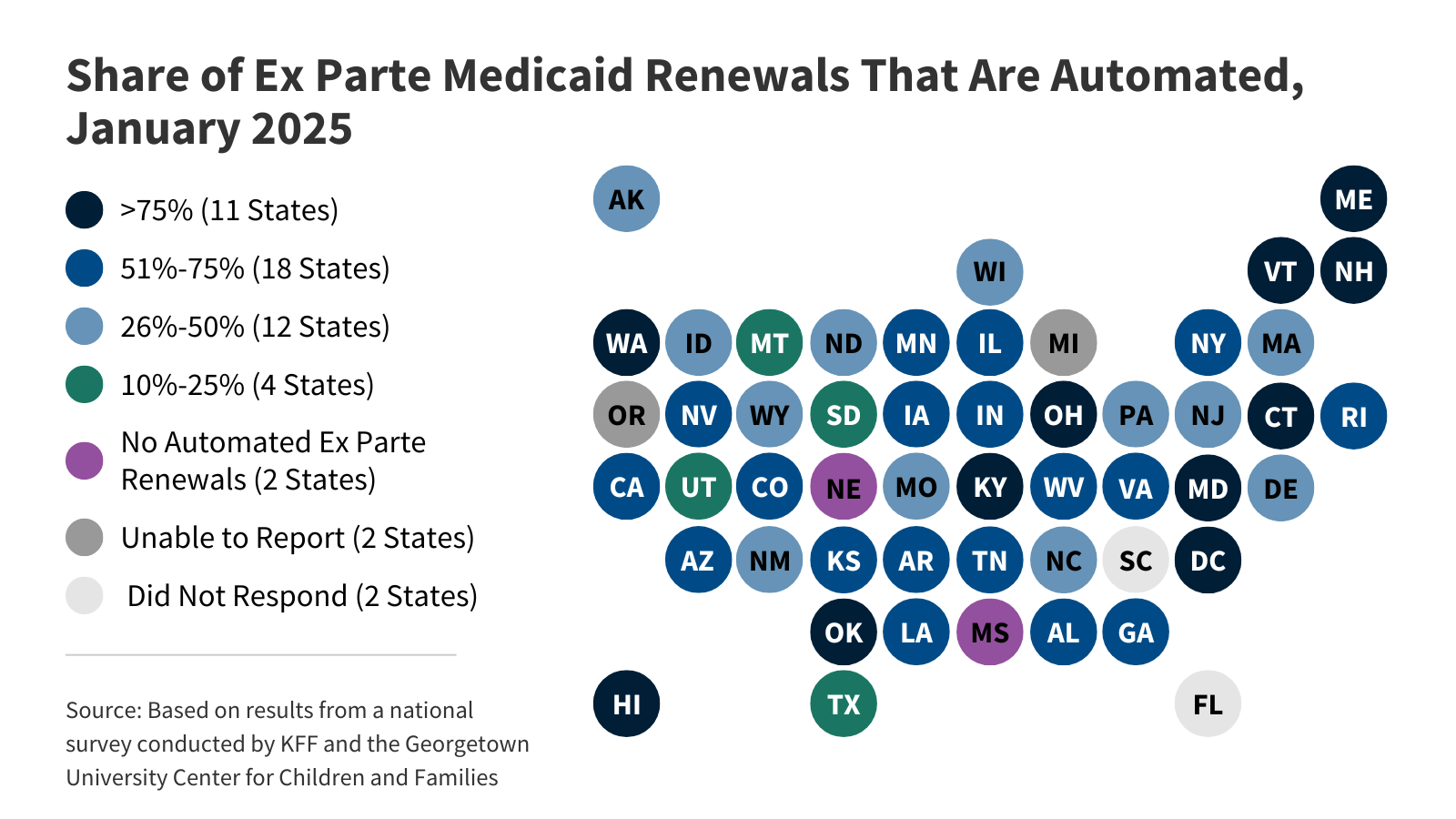

Eligibility, Enrollment, and Renewal Policies

KFF's survey findings capture state actions that seek to improve the accuracy and efficiency of Medicaid and CHIP enrollment and renewal processes, as of January 2025.

KFF's survey findings capture state actions that seek to improve the accuracy and efficiency of Medicaid and CHIP enrollment and renewal processes, as of January 2025.Seniors and People with Disabilities

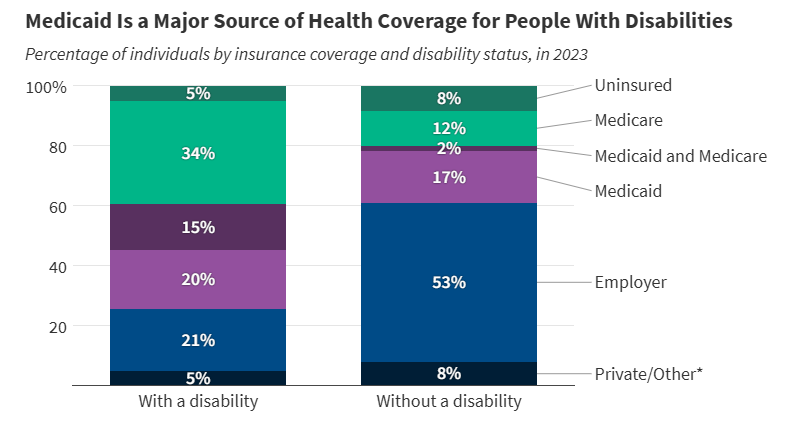

More than 1 in 3 people with disabilities (15 million) have Medicaid (35%). In comparison, only 19% of people without disabilities have Medicaid.

More than 1 in 3 people with disabilities (15 million) have Medicaid (35%). In comparison, only 19% of people without disabilities have Medicaid.Children with Special Needs

Amid debates about proposed cuts to federal Medicaid spending, this brief analyzes key characteristics of children with special health care needs and explores how Medicaid provides them with coverage.

Amid debates about proposed cuts to federal Medicaid spending, this brief analyzes key characteristics of children with special health care needs and explores how Medicaid provides them with coverage.People With Intellectual and Developmental Disabilities

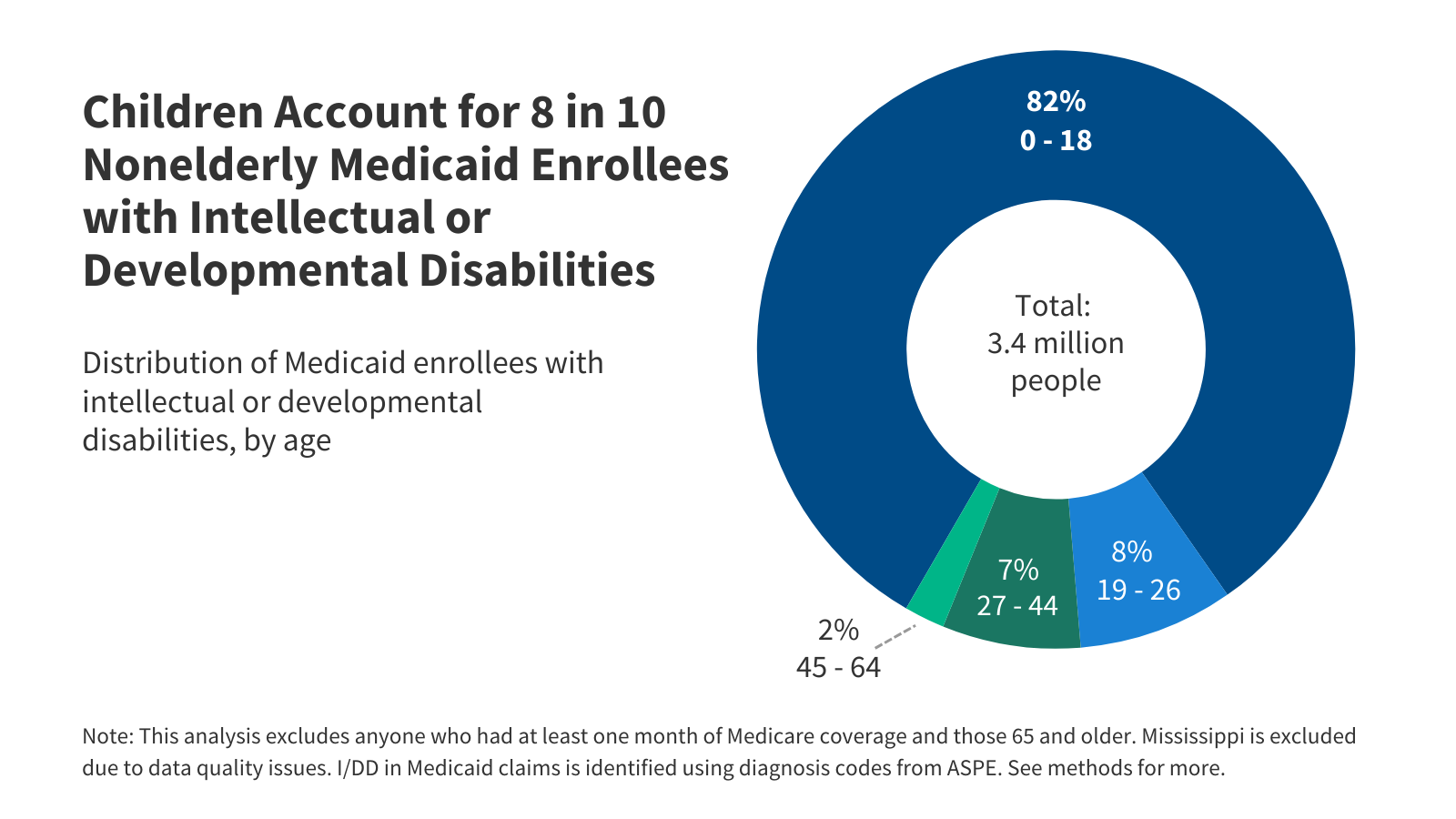

Among the estimated 8 million people with intellectual and developmental disabilities (I/DD), over three million have Medicaid coverage.

Among the estimated 8 million people with intellectual and developmental disabilities (I/DD), over three million have Medicaid coverage.Adults with Chronic Conditions

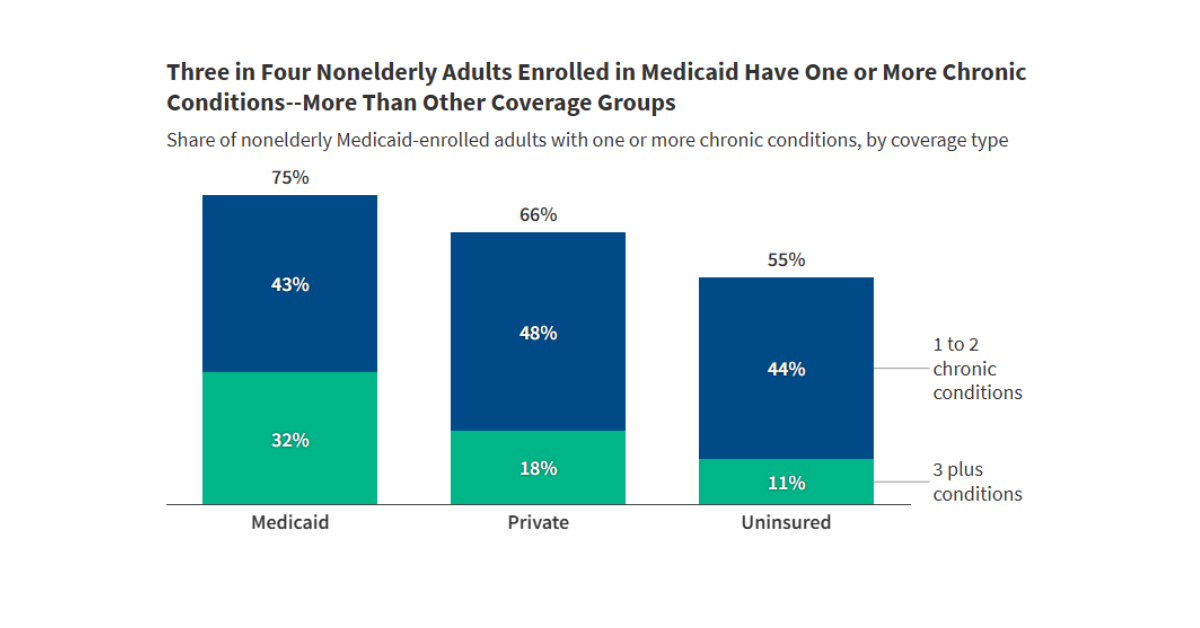

Among working age adults enrolled in Medicaid, approximately three quarters have one or more chronic conditions, and nearly one-third have three or more.

Among working age adults enrolled in Medicaid, approximately three quarters have one or more chronic conditions, and nearly one-third have three or more.

Latest News

-

Even Patients Are Shocked by the Prices Their Insurers Will Pay — And It Costs All of Us

-

Medicaid Is Paying for More Dental Care. GOP Cuts Threaten To Reverse the Trend.

-

Families Defend Disability Services Amid Medicaid Cuts

-

ICE, ALS, Addiction Medicine, and Robotic Ultrasounds: Journalists Sound Off on All That and More

Subscribe to KFF Emails

Choose which emails are best for you.

Sign up here