Mail Delays Could Affect Mail-Order Prescriptions for Millions of Medicare Part D and Large Employer Plan Enrollees

Data Note

In July, the new Postmaster General instituted changes in the operation of the U.S. Postal Service that could result in delays in mail delivery. More recently, the post office has suspended these changes until after the November election. Prior to the announcement that he was postponing these changes, the Postmaster General had warned states of the possibility that mail-in ballots requested close to state deadlines would not be received in time to be counted in November’s election. Changes to the Postal Service’s delivery standards have potential implications that extend beyond those for the election.

Potential mail service delays could also be a concern for people who receive prescription drugs from mail-order pharmacies. In 2019, sales of mail-order prescriptions in the U.S. totaled nearly $145 billion (excluding rebates), with residents of some states more likely than others to use mail-order pharmacies. Mail service delays could affect a relatively large number of people in the midst of the COVID-19 pandemic. Data from the first seven months of 2020 shows that use of mail order increased by up to 20% over 2019 levels in the early weeks of the pandemic as patients stocked up on prescriptions and avoided retail settings, but as of late July, mail-order use is up only slightly compared to the same period last year. Getting prescriptions through mail-order pharmacies can offer convenience and cost savings to patients. Many large group plan enrollees choose to fill prescriptions at reduced cost through the mail, while others are only able to fill scripts at a mail-order pharmacy.

To understand who may be most affected by delays in the delivery of prescription drugs, we analyzed use of mail order in Medicare Part D and large group employer plans, and identified the therapeutic classes and specific drugs with the highest volume of fills by mail-order pharmacies in each market.

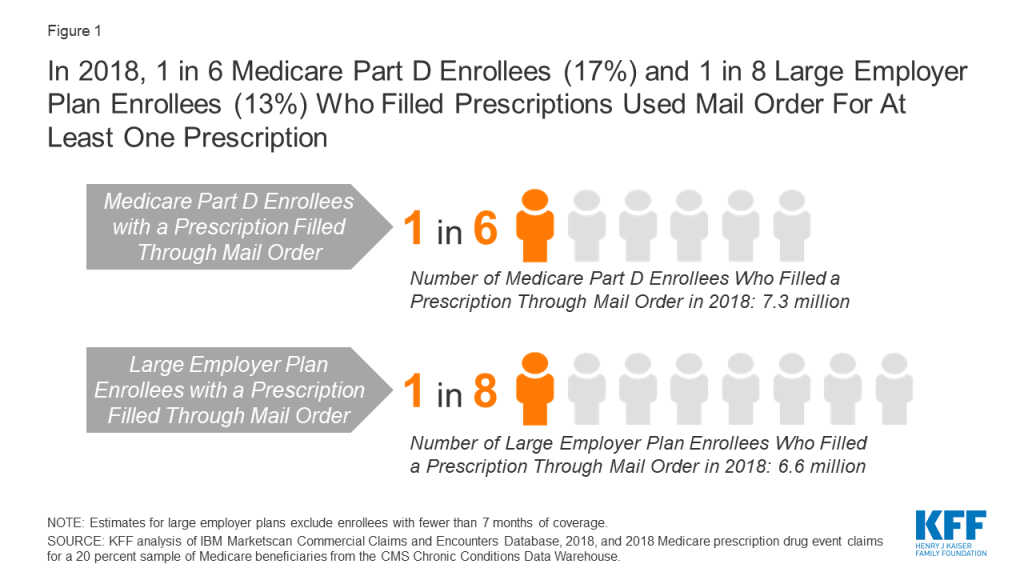

Based on 2018 data that predates the pandemic, 17% of Medicare Part D beneficiaries (7.3 million) and 13% of large employer plan enrollees (6.6 million) with prescription use had at least one prescription delivered from a mail-order pharmacy (Figure 1). Of the 157 million people who had employer coverage in 2018, 82 million were covered by an employer with 1,000 or more employees. In total, Medicare Part D beneficiaries and enrollees in large group employer plans filled 8% and 9% of prescriptions by mail order, accounting for 115 million and 58 million prescription fills respectively (Table 1). These estimates do not take into account mail-order use by people with other sources of coverage, including Medicaid, Marketplace plans, small-group enrollees, or the Veterans Administration.

Across both Medicare Part D and large group employer plans, cardiovascular agents made up five of the top 10 therapeutic classes in terms of mail-order prescription fills in 2018 (Table 1). In each population, antihyperlipidemic drugs to aid in lowering cholesterol had the largest number of prescriptions filled by a mail-order pharmacy. Among Medicare Part D beneficiaries, 14% of antihyperlipidemic drugs were filled by mail (16.5 million prescriptions), while 20% of drugs in this class were filled by mail by large employer plan enrollees (6.7 million prescriptions).

Among large employer enrollees, oral contraceptives were among the top 10 therapeutic classes with prescriptions filled by mail order. In 2018, 10% percent of oral contraceptive prescriptions (2.4 million) filled by enrollees in a large group plan were filled by a mail-order pharmacy. Other classes that rank in the top 10 for mail-order prescriptions include certain diabetes medications, with 15% of prescriptions (2.5 million) for large employer enrollees and 11% of prescriptions (4.7 million) for Medicare Part D enrollees filled by mail order in 2018, and antidepressants, with 10% of prescriptions (5.7 million) for large employer enrollees and 7% of prescriptions (6.5 million) for Medicare Part D enrollees filled by mail order in 2018.

The top 10 drugs by volume of prescriptions filled by mail order in 2018 were the same for Medicare Part D and large employer plans, though the rankings vary slightly, and include several medications to treat high cholesterol and hypertension (Table 2). Among Medicare Part D enrollees, atorvastatin, which is used to treat high cholesterol, had the highest volume of mail-order fills (6.6 million, or 13% of all prescriptions for this product in 2018); among enrollees in large employer plans, levothyroxine sodium, which treats hypothyroidism, had the highest volume of mail-order fills (3.1 million, 16%).

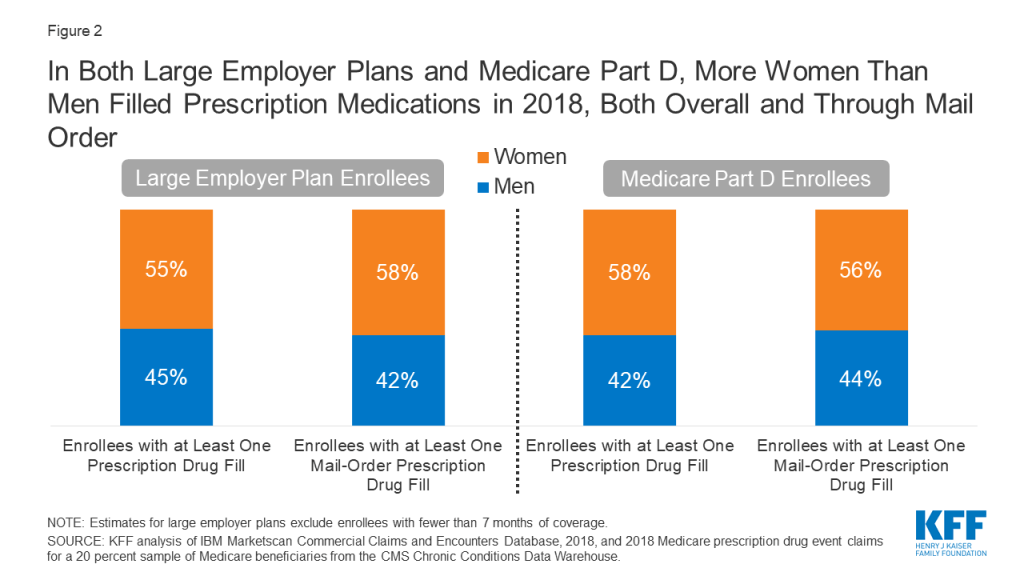

More women than men in both large employer plans and Medicare Part D filled prescription drugs and received at least one mail-order prescription drug in 2018 (Figure 2). Stratifying by age among individuals in large employer plans, among reproductive age individuals (ages 15 to 43) in large employer plans, a higher share of women than men had at least one mail-order prescription drug claim (11% for women in this age group versus 7% for men), which is partially driven by mail-order use for contraception. There were no differences by gender in the percentage of those who have at least one mail-order prescription among children ages 0-14 or individuals ages 44 to 64 (3% and 22% respectively).

Drugs used to treat chronic conditions, including hypothyroidism, high cholesterol, hypertension, and type 2 diabetes, are among the prescriptions most commonly filled by mail order for Medicare Part D enrollees and large employer plan enrollees, whether measured by therapeutic class or product. Therefore, delays in delivery due to changes to the operations of the U.S. Postal Service could lead to negative health consequences if it compromises patients’ ability to adhere to their medication regimens.

Tables

| Table 1: Top 10 Therapeutic Classes Filled by Mail Order in Medicare Part D and Large Employer Plans,by Volume of Prescriptions, 2018 | ||||

| Therapeutic class | Therapeutic group | Number of prescriptions filled by mail order | Number of enrollees with mail-order prescription | Among all prescriptions filled within therapeutic class, share filled by mail order |

| Medicare Part D | ||||

| TOTAL, all classes | 114,888,200 | 7,293,635 | 7.8% | |

| Antihyperlipidemic Drugs, NEC | Cardiovascular Agents | 16,517,565 | 4,449,520 | 14.1% |

| Cardiac, Beta Blockers | Cardiovascular Agents | 8,923,545 | 2,552,120 | 11.6% |

| Cardiac, ACE Inhibitors | Cardiovascular Agents | 6,934,975 | 1,974,120 | 12.8% |

| Psychotherapeutics, Antidepressants | Central Nervous System | 6,534,395 | 1,659,345 | 6.9% |

| Cardiac, Calcium Channel | Cardiovascular Agents | 6,453,380 | 1,873,325 | 11.3% |

| Cardiac Drugs, NEC | Cardiovascular Agents | 6,021,195 | 1,717,620 | 13.2% |

| Thyroit/Antithyroid, Thyroid/Hormones | Hormones & Synthetic Substitutes | 5,803,410 | 1,561,605 | 12.4% |

| Gastrointestinal Drug Misc, NEC | Gastrointestinal Drugs | 5,642,420 | 1,700,580 | 9.7% |

| Antidiabetic Agents, Misc | Hormones & Synthetic Substitutes | 4,693,630 | 1,280,355 | 10.8% |

| Misc Therapeutic Agents, NEC* | Misc Therapeutic Agents | 2,984,960 | 741,870 | 11.7% |

| Large Employer Plans | ||||

| TOTAL, all classes | 58,076,511 | 6,552,568 | 9.1% | |

| Antihyperlipidemic Drugs, NEC | Cardiovascular Agents | 6,743,934 | 1,807,415 | 20.1% |

| Psychotherapeutics, Antidepressants | Central Nervous System | 5,723,719 | 1,466,376 | 10.3% |

| Thyroid/Antithyroid, Thyroid Hormones | Hormones & Synthetic Substitutes | 3,409,575 | 897,768 | 15.9% |

| Cardiac, ACE Inhibitors | Cardiovascular Agents | 3,185,892 | 922,549 | 15.6% |

| Cardiac, Beta Blockers | Cardiovascular Agents | 2,680,792 | 780,268 | 15.5% |

| Cardiac Drugs. NEC | Cardiovascular Agents | 2,574,019 | 747,708 | 16.1% |

| Antidiabetic Agents, Misc | Hormones & Synthetic Substitutes | 2,512,233 | 665,014 | 15.0% |

| Contraceptive, Oral Comb, NEC | Hormones & Synthetic Substitutes | 2,411,000 | 683,445 | 10.3% |

| Gastrointestinal Drugs Misc, NEC | Gastrointestinal Drugs | 2,335,366 | 711,485 | 13.1% |

| Cardiac, Calcium Channel | Cardiovascular Agents | 2,043,871 | 604,578 | 14.5% |

| NOTE: NEC is not elsewhere classified. Estimates for large employer plans exclude enrollees with fewer than 7 months of coverage. *Less than 1% of prescriptions in the “Misc Therapeutic Agents, NEC” class are categorized in the “Respiratory Tract Agents” therapeutic group.SOURCE: KFF analysis of IBM Marketscan Commercial Claims and Encounters Database, 2018, and 2018 Medicare prescription drug event claims for a 20 percent sample of Medicare beneficiaries from the CMS Chronic Conditions Data Warehouse. | ||||

| Table 2: Top 10 Drug Products Filled by Mail Order in Medicare Part D and Large Employer Plans, by Volume of Prescriptions, 2018 | |||||

| Drug product | Number of prescriptions filled by mail order | Number of enrollees with mail-order prescription | Among all prescriptions filled for drug product, share filled by mail order | Indication | Common brand names |

| Medicare Part D | |||||

| Atorvastatin calcium | 6,636,765 | 1,967,555 | 13.0% | high cholesterol | Lipitor |

| Levothyroxine sodium | 5,698,630 | 1,548,500 | 12.5% | hypothyroidism | Levothroid, Levoxyl, Synthroid, Unithroid |

| Amlodipine besylate | 4,581,675 | 1,350,760 | 11.2% | hypertension | Katerzia, Norvasc |

| Lisinopril | 4,353,865 | 1,265,540 | 11.7% | hypertension | Prinivil, Zestril |

| Simvastatin | 3,776,125 | 1,089,485 | 16.1% | high cholesterol | Zocor |

| Metformin HCL | 3,696,385 | 1,104,535 | 12.2% | type 2 diabetes | Glucophage |

| Omeprazole | 3,264,810 | 1,004,740 | 11.3% | acid reflux, ulcers, heart burn | Prilosec |

| Losartan potassium | 3,120,395 | 949,995 | 12.6% | hypertension | Cozaar |

| Metoprolol succinate | 2,992,240 | 880,120 | 12.8% | hypertension, angina, heart failure | Kapspargo Sprinkle, Toprol XL |

| Hydrochlorothiazide | 2,288,360 | 690,805 | 13.4% | hypertension | Microzide |

| Large Employer Plans | |||||

| Levothyroxine sodium | 3,072,413 | 837,581 | 16.3% | hypothyroidism | Levothroid, Levoxyl, Synthroid, Unithroid |

| Atorvastatin calcium | 2,858,703 | 864,833 | 18.9% | high cholesterol | Lipitor |

| Lisinopril | 2,067,537 | 608,625 | 15.2% | hypertension | Prinivil, Zestril |

| Metformin HCL | 1,762,022 | 544,089 | 15.5% | type 2 diabetes | Glucophage |

| Amlodipine besylate | 1,349,224 | 407,717 | 13.6% | hypertension | Katerzia, Norvasc |

| Simvastatin | 1,196,826 | 348,014 | 23.1% | high cholesterol | Zocor |

| Losartan potassium | 1,117,641 | 348,870 | 15.3% | hypertension | Cozaar |

| Omeprazole | 1,077,168 | 339,343 | 13.4% | acid reflux, ulcers, heart burn | Prilosec |

| Metoprolol succinate | 965,373 | 281,249 | 16.2% | hypertension, angina, heart failure | Kapspargo Sprinkle, Toprol XL |

| Hydrochlorothiazide | 939,555 | 287,646 | 14.6% | hypertension | Microzide |

| NOTE: Estimates for large employer plans exclude enrollees with fewer than 7 months of coverage. Includes all prescriptions for products containing the specified generic name. Does not reflect combination products that include the active ingredient. Each of the top 10 drugs are available generically. The “common brand names” field is provided as an example of branded versions, though these do not account for all of the mail-order fills for any of these top 10 drug products.SOURCE: KFF analysis of IBM Marketscan Commercial Claims and Encounters Database, 2018, and 2018 Medicare prescription drug event claims for a 20 percent sample of Medicare beneficiaries from the CMS Chronic Conditions Data Warehouse. | |||||

Methods

For the analysis of large employer plans, we analyzed a sample of medical claims obtained from the 2018 IBM Health Analytics MarketScan Commercial Claims and Encounters Database, which contains claims information provided by large employer plans. We only included claims for people under the age of 65, as people over the age of 65 are typically on Medicare. This analysis used claims for almost 18 million people representing about 22% of the 82 million people in the large group market in 2018. Seventy percent of larger group enrollees who were enrolled for more than six months had at least one prescription drug claim in the year. Weights were applied to match counts in the Current Population Survey for enrollees at firms of 1,000 or more workers by sex, age and state. Weights were trimmed at eight times the interquartile range.

For the analysis of Medicare Part D, we used the 2018 Medicare Part D prescription drug event (PDE) claims data from the Centers for Medicare & Medicaid Services (CMS) Chronic Conditions Data Warehouse (CCW) for a 20 percent sample of Medicare beneficiaries. The analysis was limited to enrollees who filled a prescription in 2018, which equaled 42.9 million enrollees out of 46.1 million total (93.1%).

For both datasets, MarketScan’s Red Book was used to classify drugs by generic id and the therapeutic/pharmacologic category of the drug product. Drug spending paid for by someone other than an enrollee’s insurer, drugs administered in an inpatient setting, or not classified under the controlled substance act were excluded. Each prescription drug claim was counted as a single prescription regardless of the quantity or strength of that prescription. Drugs were grouped by the generic drug name, which may include multiple brands, but treats combination products separately.

To identify prescriptions filled by a mail-order pharmacy, we used the field indicating the type of pharmacy that filled the prescription. It is not possible to determine the method by which the prescription was subsequently mailed, and thus the totals here reflect prescriptions delivered via the U.S. Postal Service, as well as those delivered by other services, such as FedEx or UPS. In the Part D claims, specialty pharmacy claims are reported separately from mail-order pharmacy claims, although in some cases, specialty pharmacies may ship directly to patients; our analysis does not count these prescriptions as mail order because we are unable to identify them as such.