2020 Employer Health Benefits Survey

Abstract

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, offer rates, wellness programs, and employer practices. The 2020 survey included 1,765 interviews with non-federal public and private firms.

Annual premiums for employer-sponsored family health coverage reached $21,342 this year, up 4% from last year, with workers on average paying $5,588 toward the cost of their coverage. The average deductible among covered workers in a plan with a general annual deductible is $1,644 for single coverage. Fifty-five percent of small firms and 99% of large firms offer health benefits to at least some of their workers, with an overall offer rate of 56%.

Survey results are released in several formats, including a full report with downloadable tables on a variety of topics, a summary of findings, and an article published in the journal Health Affairs.

NEWS RELEASE

- A news release announcing the publication of the 2020 Employer Health Benefits Survey is available.

SUMMARY OF FINDINGS

- The Summary of Findings provides an overview of the 2020 survey results and is available under the Summary of Findings.

FULL REPORT

- The complete Employer Health Benefits Survey report includes over 200 exhibits and is available under the Report. The “Report” contains 13 separate sections. Users can view each section separately or download the section exhibits from the right side of the respective section page.

HEALTH AFFAIRS

- The peer-reviewed journal Health Affairs has published an article with key findings from the 2020 survey: Health Benefits In 2020: Premiums Inch Higher, Employers Respond to Federal Policy.

INTERACTIVE GRAPHIC

- This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2020.

KEY EXHIBITS-CHARTPACK

- More than 20 overview slides from the 2020 Employer Health Benefits Survey are available as a slideshow.

2020 TABLES BY SECTION

ADDITIONAL RESOURCES

- Standard errors for selected estimates are available in the Technical Supplement here.

- Employer Health Benefits Surveys from 1998–2019 are available here. Please note that historic survey reports have not been revised with methodological changes.

- Researchers may request a public use dataset by going to Contact Us and choosing “TOPIC: Health Costs.”

Summary of Findings

Employer-sponsored insurance covers approximately 157 million people.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (KFF) conducts an annual survey of private and non-federal public employers with three or more workers. This is the twenty-second Employer Health Benefits Survey (EHBS) and reflects employer-sponsored health benefits in 2020.

The social and economic upheavals resulting from the coronavirus pandemic have certainly impacted employers, workers and employee benefits. The EHBS was fielded between January and late July, which means that a portion of the interviews were conducted before the full impact of the pandemic became apparent, and other interviews were conducted as the implications unfolded; including during the period of significant job loss that occurred during and after March. Many of the metrics we look at, such as premiums, contributions, cost sharing and plan offerings, are determined before plan year begins, so it is likely that responses for those items were largely unaffected by the pandemic. Responses for other items, such as incentives for health screenings or inclusion of coverage for telehealth visits, may have changed during the course of the pandemic: employers for example, may have suspended certain incentives to accommodate employee reluctance to visit provider offices. As such we cannot determine how the pandemic has affected employer responses. Because of the timing of the survey, we were unable to include any direct questions about how employers reacted to the pandemic.

HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS

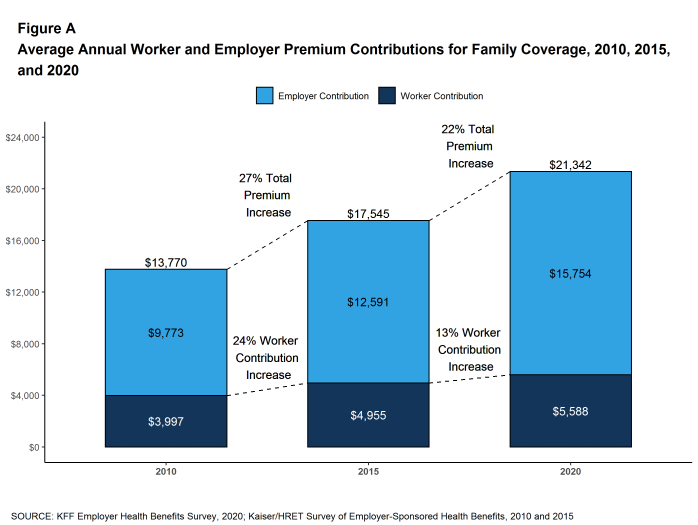

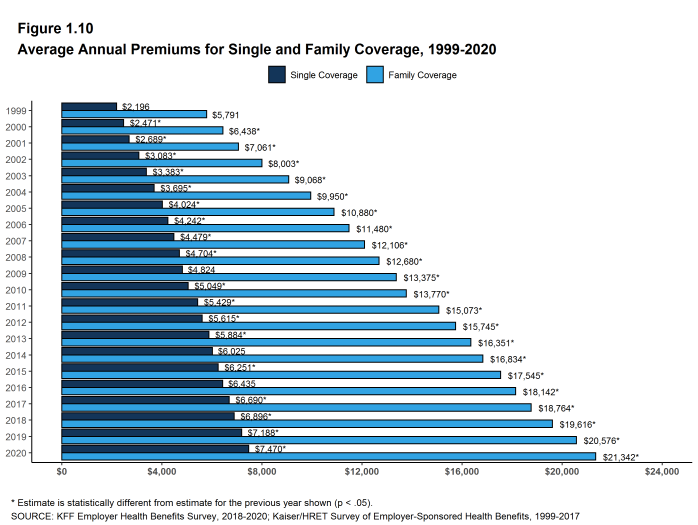

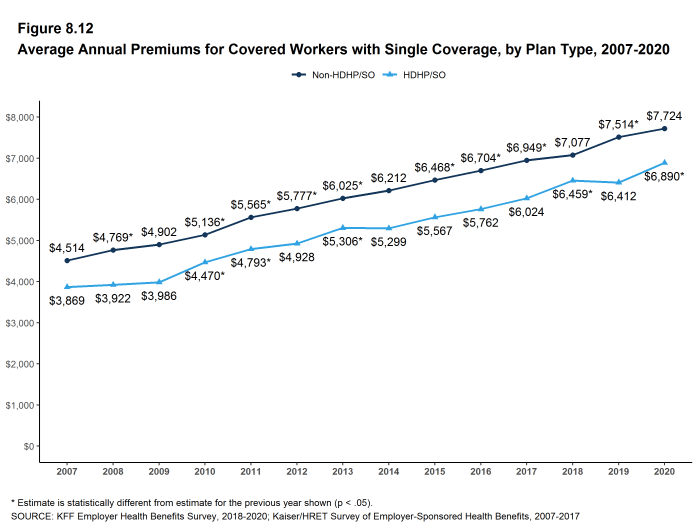

In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage [Figure A]. The average single premium increased 4% and the average family premium increased 4% over the past year. Workers’ wages increased 3.4% and inflation increased 2.1%.2

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years [Figure A].

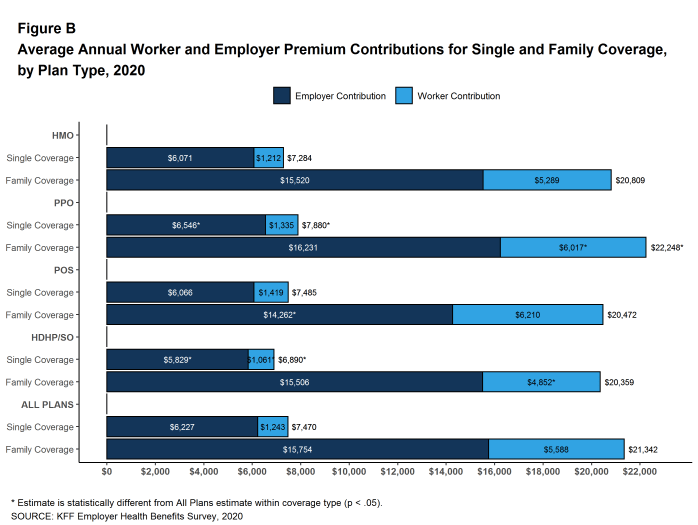

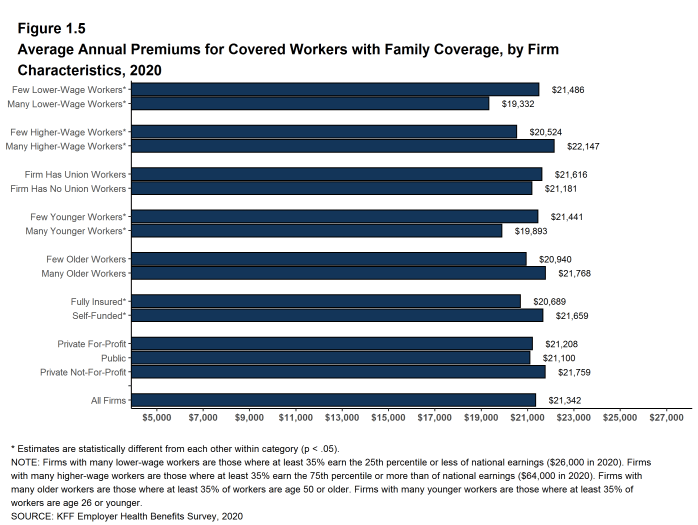

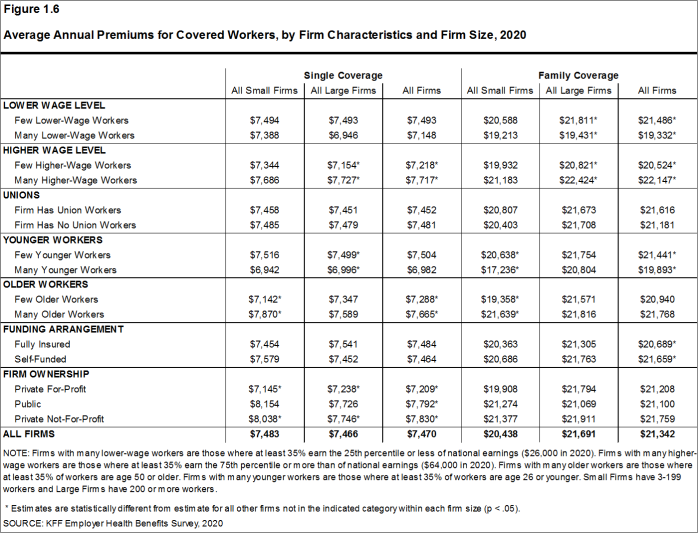

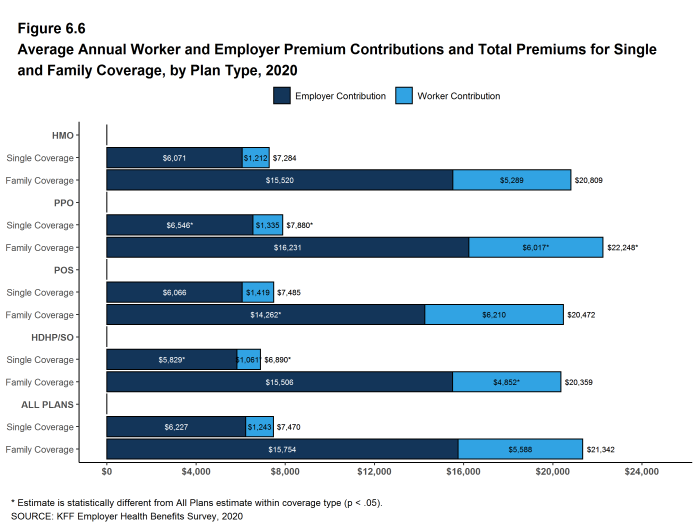

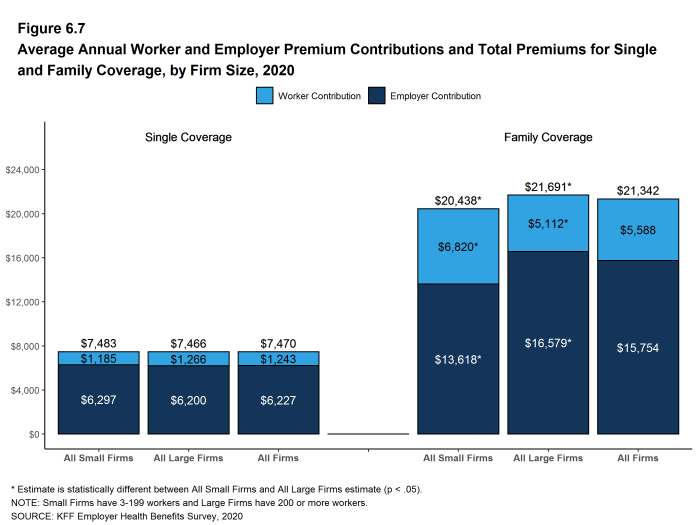

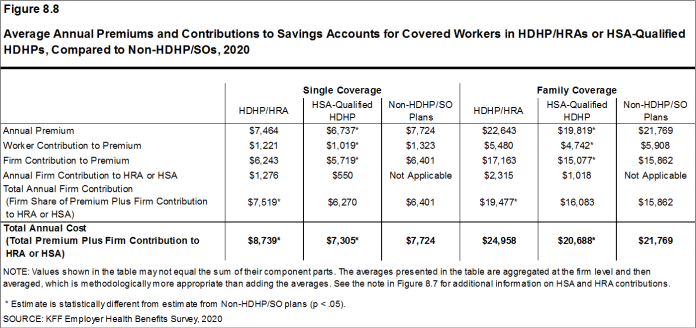

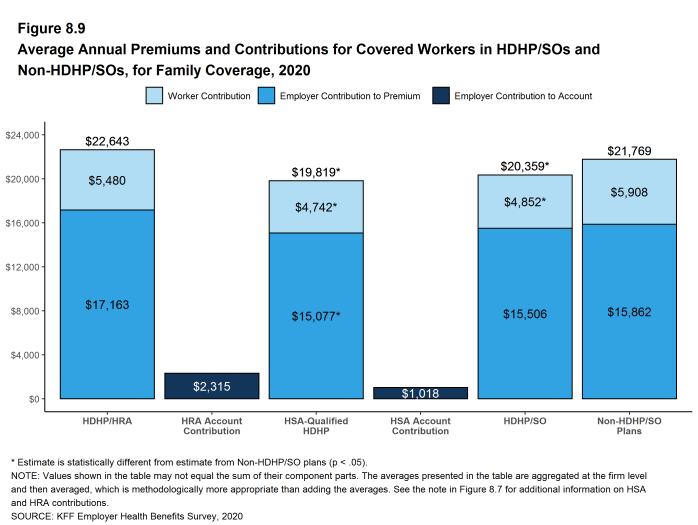

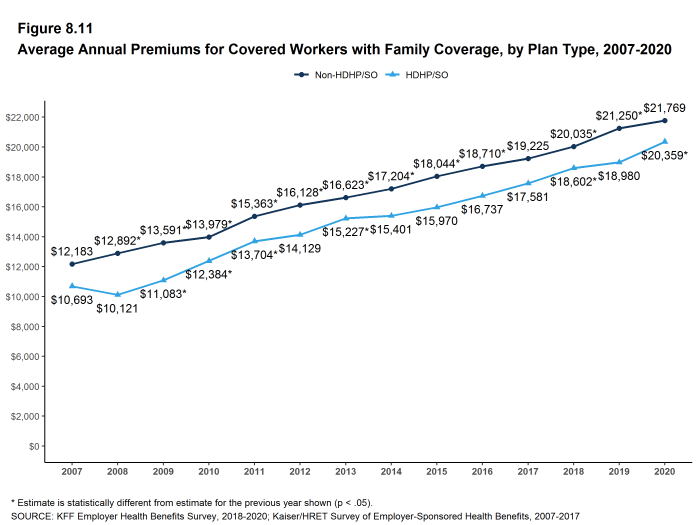

For covered workers in small firms, the average premium is similar to the average premium in large firms for single coverage ($7,483 vs. $7,466) but is lower than the average premium in large firms for family coverage ($20,438 vs. $21,691). The average premiums for covered workers in HDHP/SOs is lower for single coverage ($6,890) but similar for family coverage ($20,359) to the overall average premiums [Figure B]. Covered workers enrolled in PPOs have higher average premiums for single ($7,880) and family coverage ($22,248) than the overall average premiums. The average premium for family coverage for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of the workers earn $26,000 annually or less) is lower than the average premium for covered workers in firms with a smaller share of lower-wage workers ($19,332 vs. $21,486).

Figure A: Average Annual Worker and Employer Premium Contributions for Family Coverage, 2010, 2015, and 2020

Figure B: Average Annual Worker and Employer Premium Contributions for Single and Family Coverage, by Plan Type, 2020

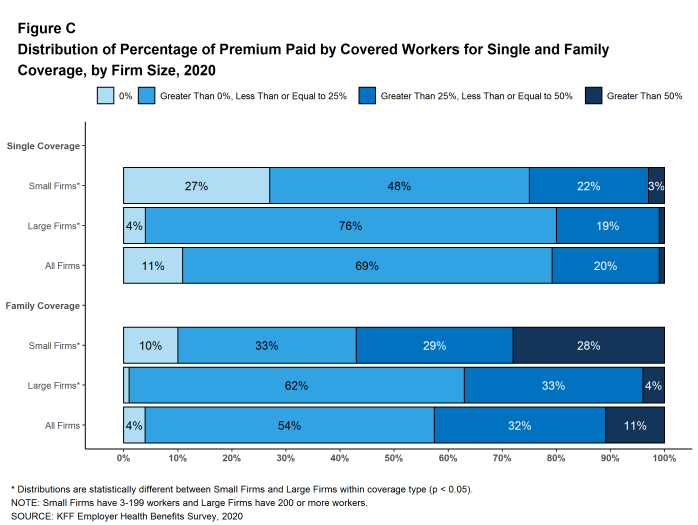

Most covered workers make a contribution toward the cost of the premium for their coverage. On average, covered workers contribute 17% of the premium for single coverage and 27% of the premium for family coverage. Compared to covered workers in large firms, covered workers in small firms on average contribute a higher percentage of the premium for family coverage (35% vs. 24%). Covered workers in firms with a relatively large share of lower-wage workers have higher average contribution rates for family coverage (38% vs. 26%) than those in firms with a smaller share of lower-wage workers.3 Covered workers at private for-profit firms on average contribute a higher percentage of the premium for both single and family coverage than covered workers at other firms for both single and family coverage.

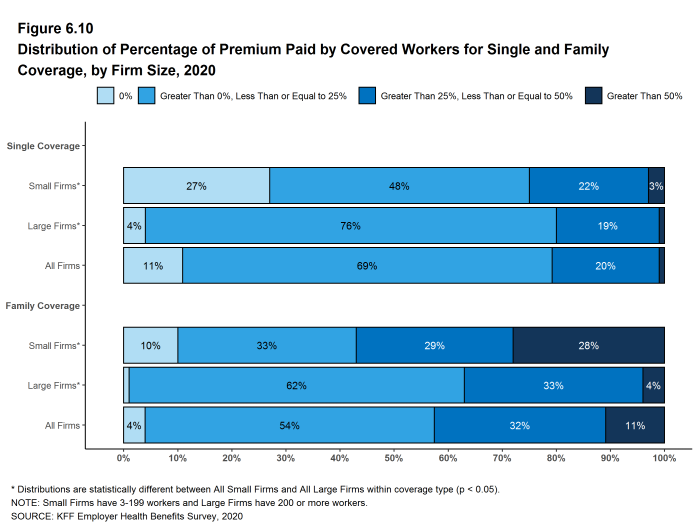

Twenty-seven percent of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. In contrast, 28% of covered workers in small firms are in a plan where they must contribute more than one-half of the premium for family coverage, compared to 4% of covered workers in large firms [Figure C].

The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, similar to the amounts last year. The average dollar contribution for family coverage has increased 13% since 2015 and 40% since 2010 [Figure A]. Average contribution amounts for covered workers in HDHP/SOs are lower than the average overall worker contribution amounts for both single and family coverage [Figure B]. Six percent of covered workers, including 17% of covered workers in small firms, are in a plan with a worker contribution of $12,000 or more for family coverage.

Figure C: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2020

PLAN ENROLLMENT

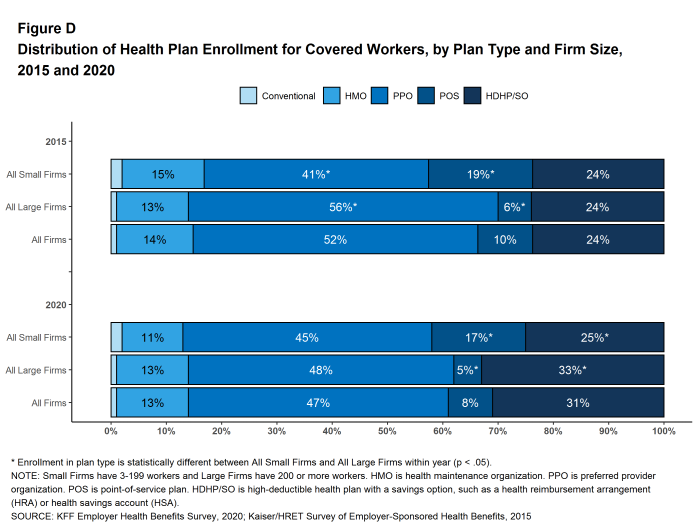

PPOs are the most common plan type, enrolling 47% of covered workers in 2020. Thirty-one percent of covered workers are enrolled in a high-deductible plan with a savings option (HDHP/SO), 13% in an HMO, 8% in a POS plan, and 1% in a conventional (also known as an indemnity) plan [Figure D]. The percentage of covered workers enrolled in HMOs is significantly lower than the percentage last year (13% vs. 19%). This percentage has risen and fallen over the last four years so it is unclear if this trend will continue.

Figure D: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2015 and 2020

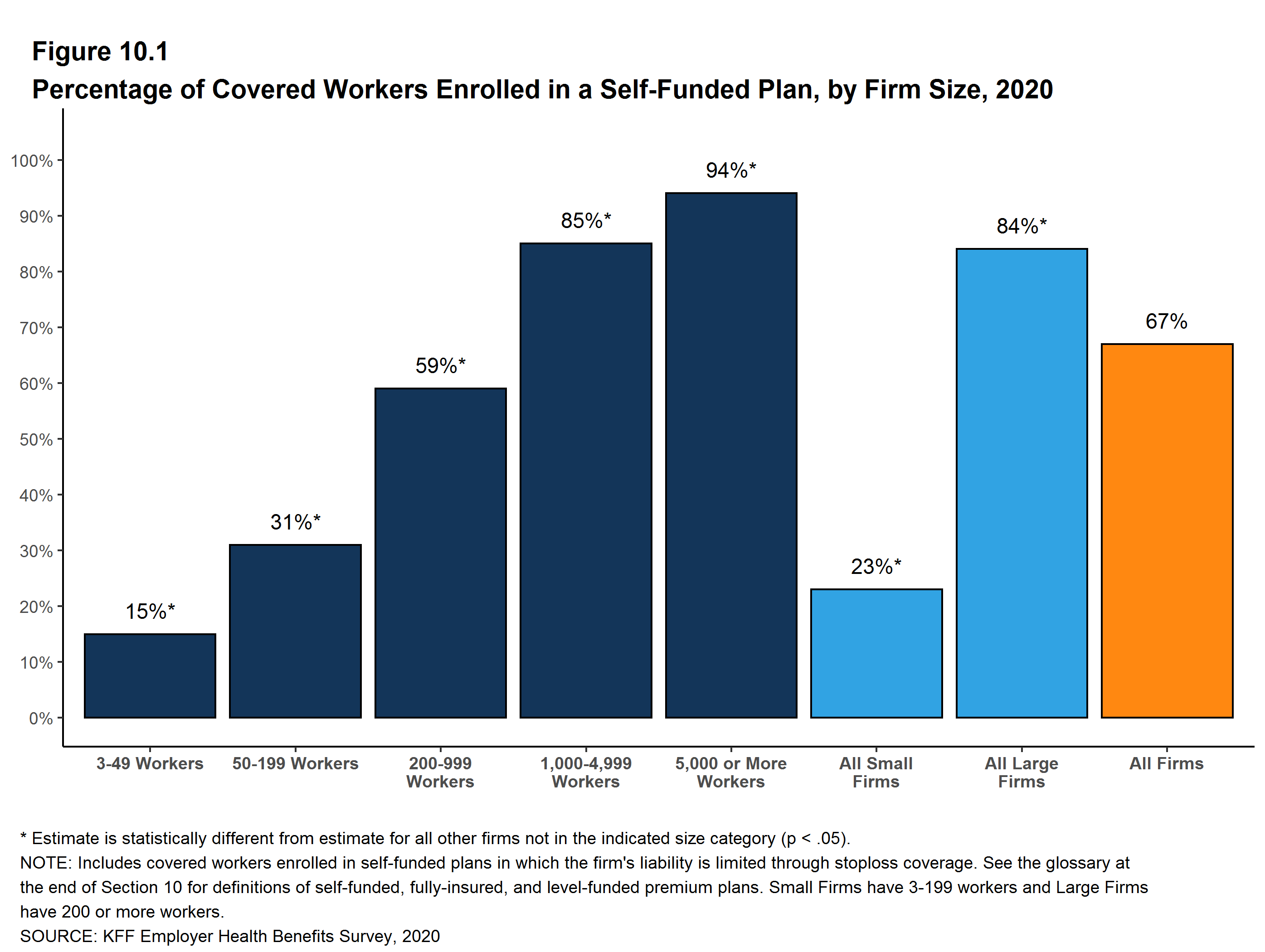

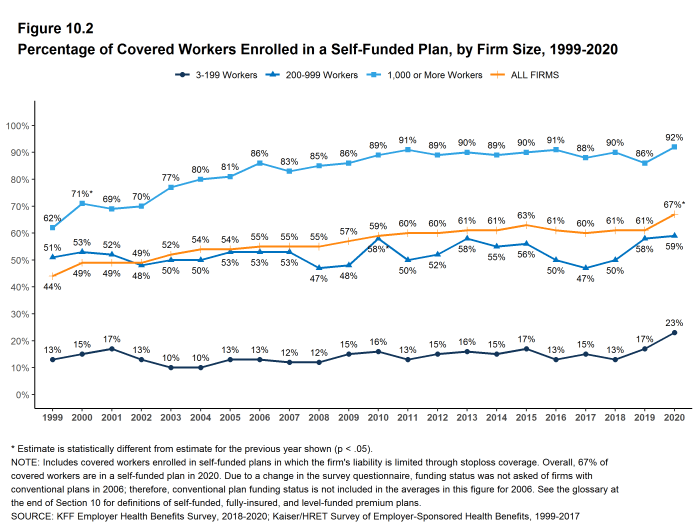

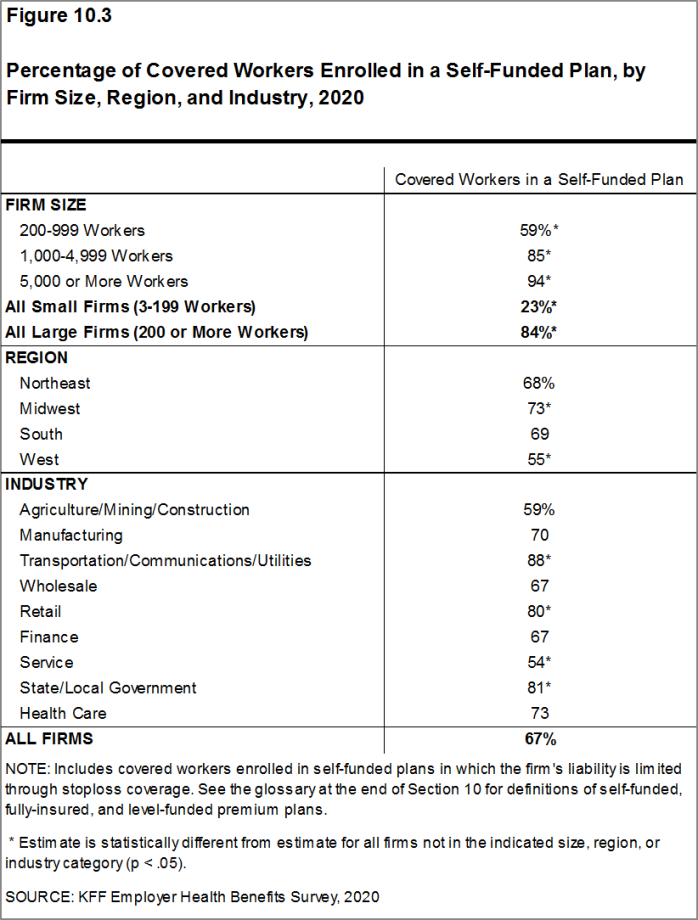

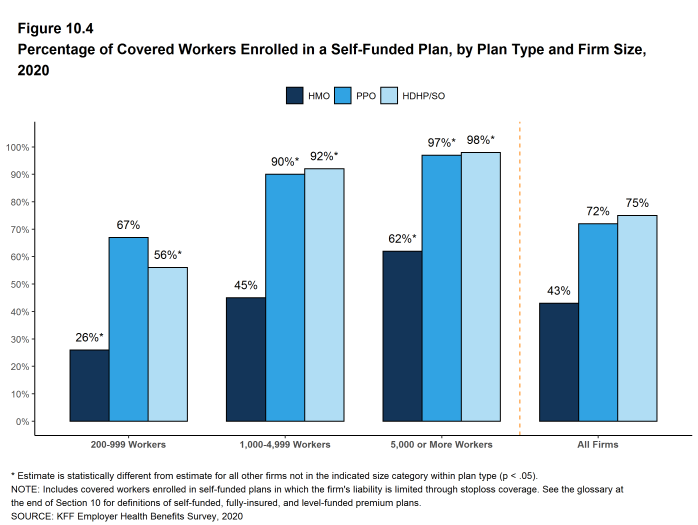

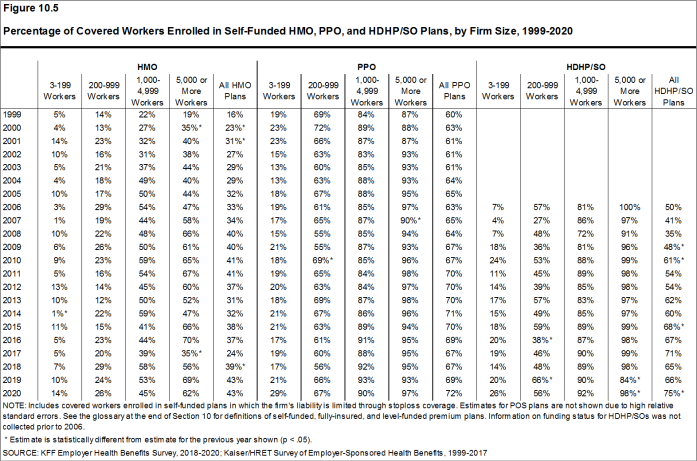

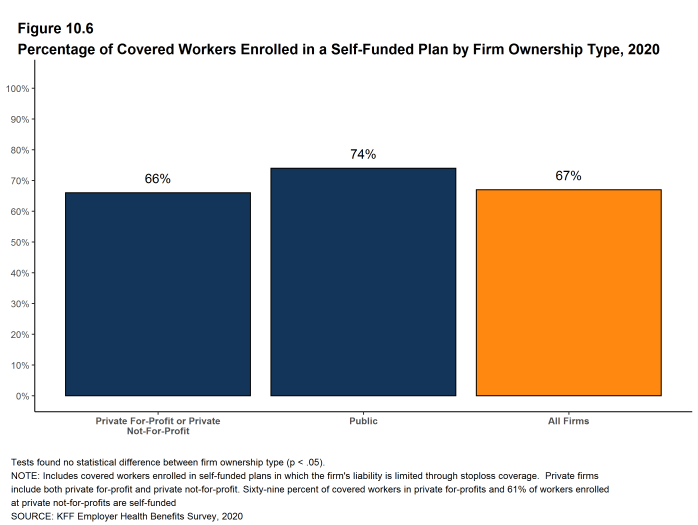

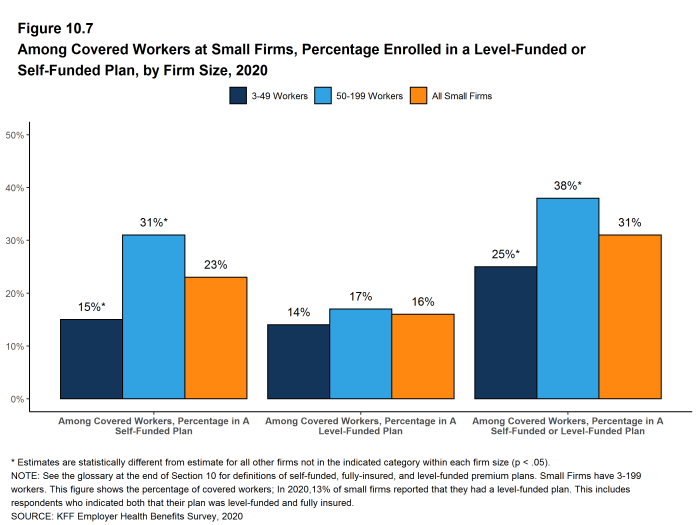

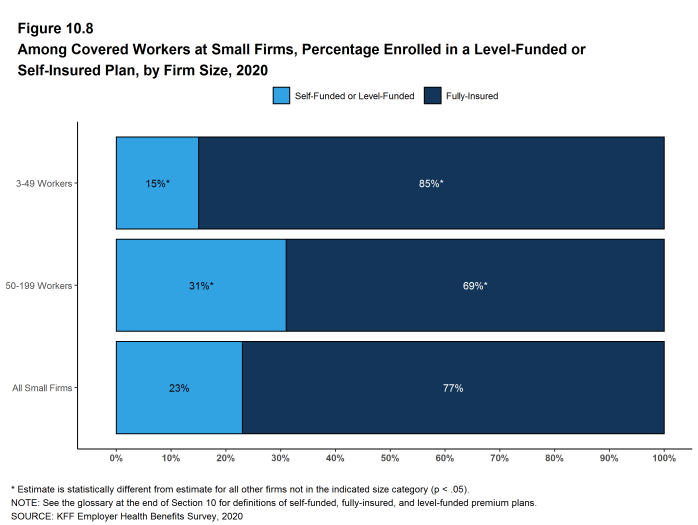

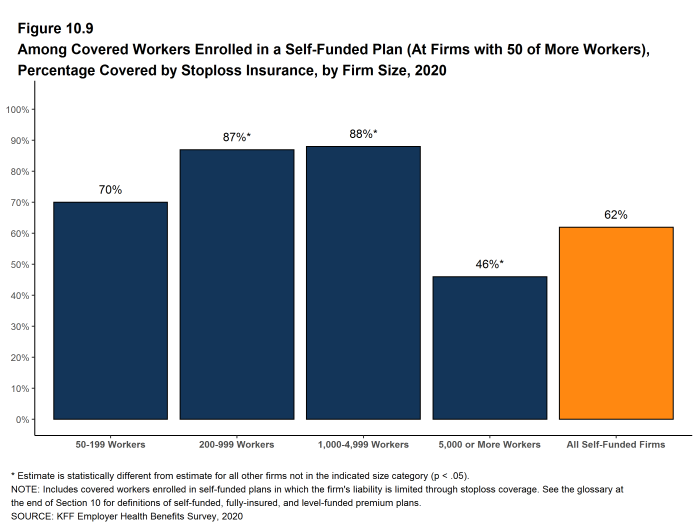

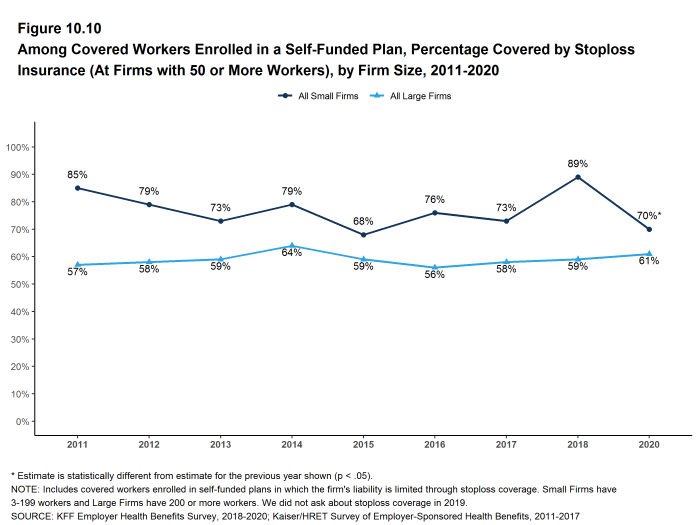

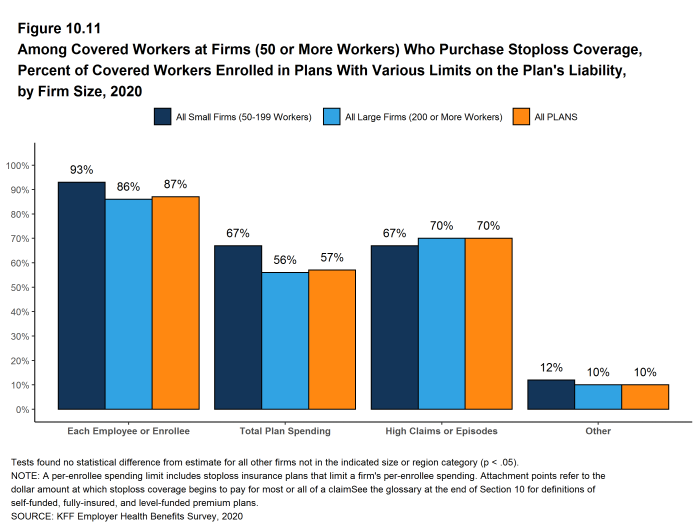

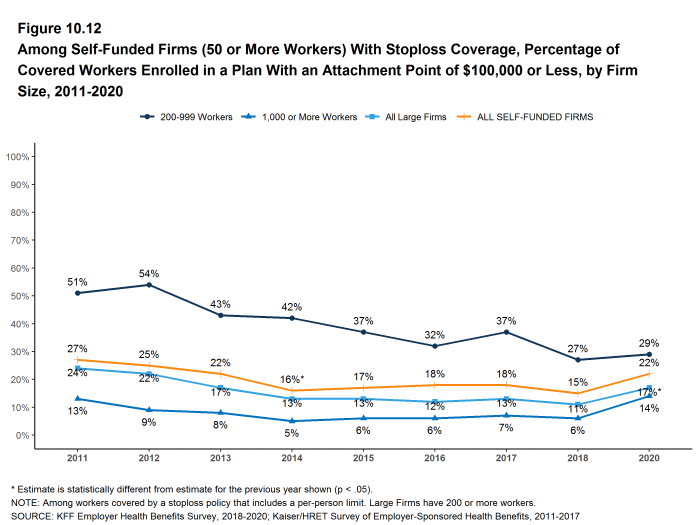

Self-Funding. Sixty-seven percent of covered workers, including 23% of covered workers in small firms and 84% in large firms, are enrolled in plans that are self-funded. The percentage of firms offering health benefits that are self funded in 2020 is higher than the percentage (61%) last year.

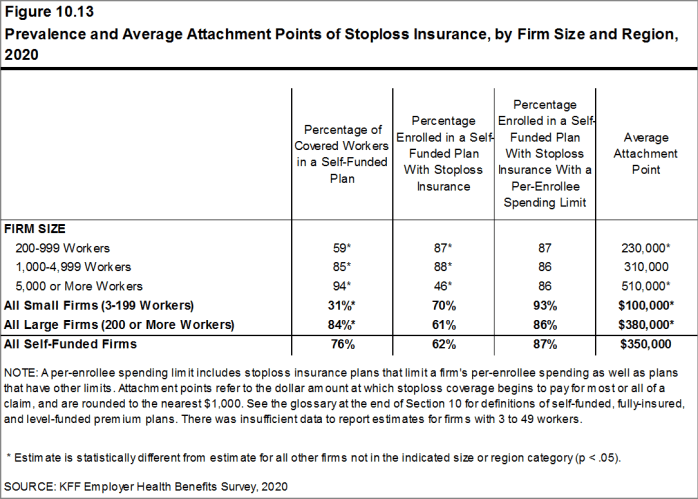

Thirteen percent of small firms report that they have a level-funded plan, similar to the percentage last year. These arrangements combine a relatively small self-funded component with stoploss insurance with low attachment points that may transfer a substantial share of the risk to insurers. These arrangements are complex and some small employers may not be entirely certain about the funding status of their plans. Among covered workers in small firms, 31% are in a plan that is either self-funded or told us that their plan was level-funded, higher than the percentage (24%) last year.

EMPLOYEE COST SHARING

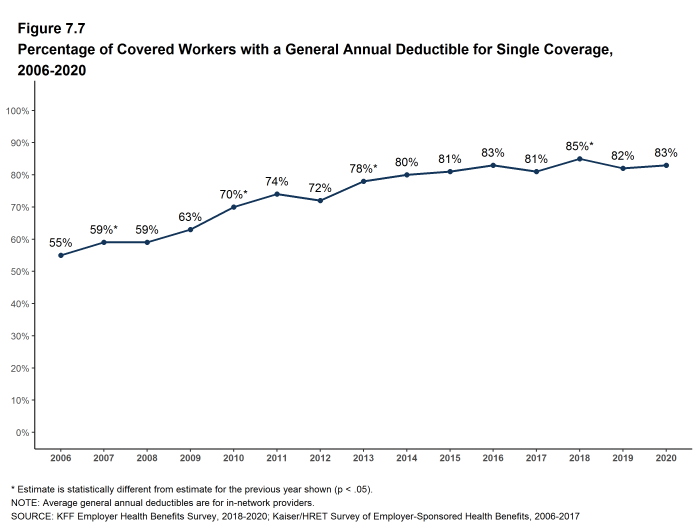

Most covered workers must pay a share of the cost when they use health care services. Eighty-three percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan.

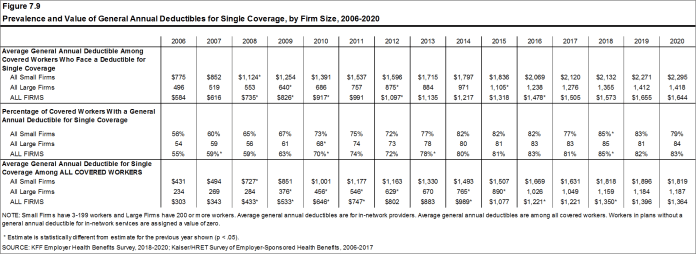

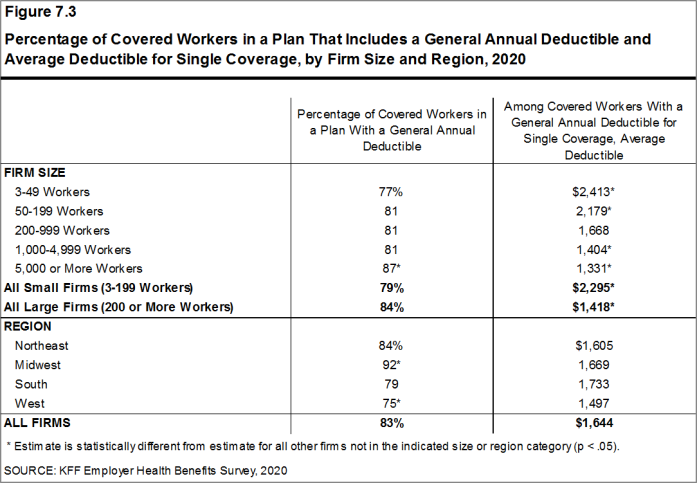

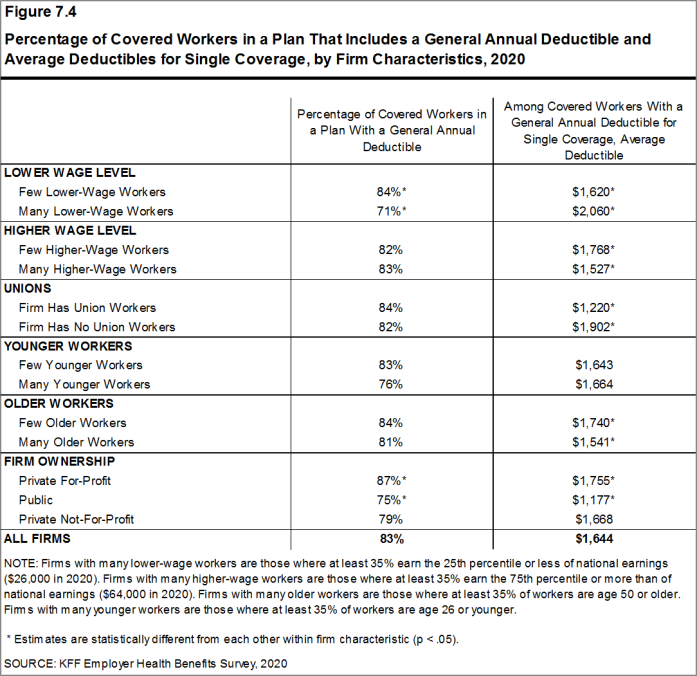

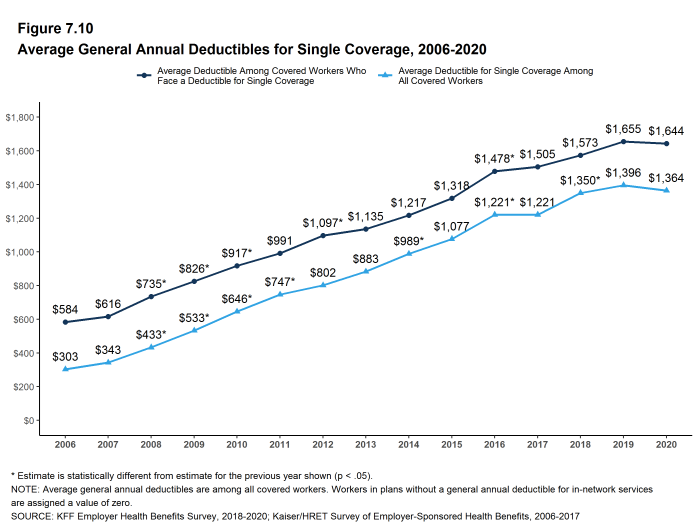

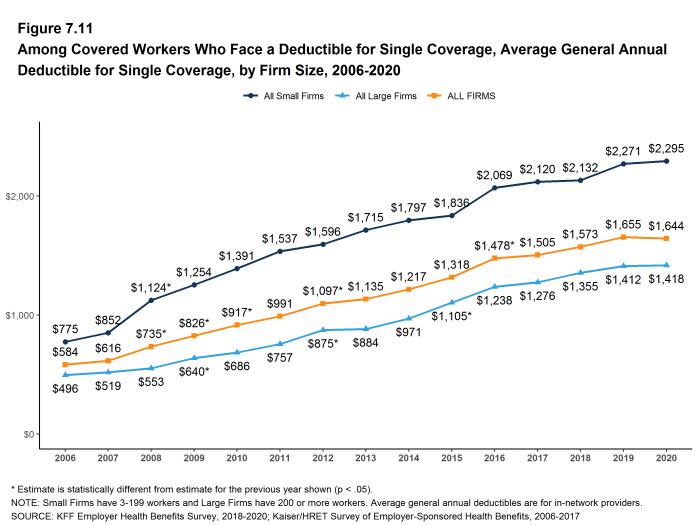

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,644, similar to the average deductible last year. The average deductible for covered workers is higher in small firms than large firms ($2,295 vs. $1,418). The average single coverage annual deductible among covered workers with a deductible has increased 25% over the last five years and 79% over the last ten years.

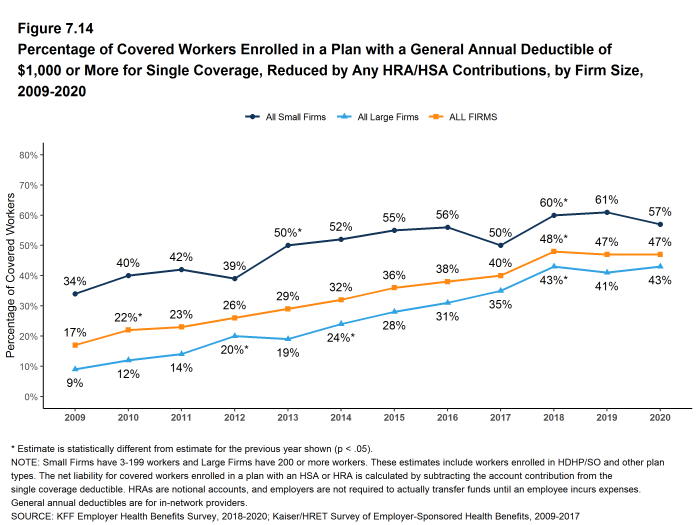

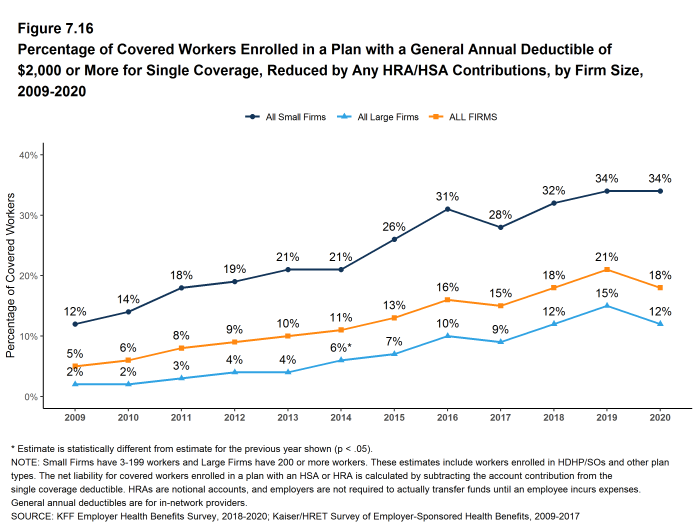

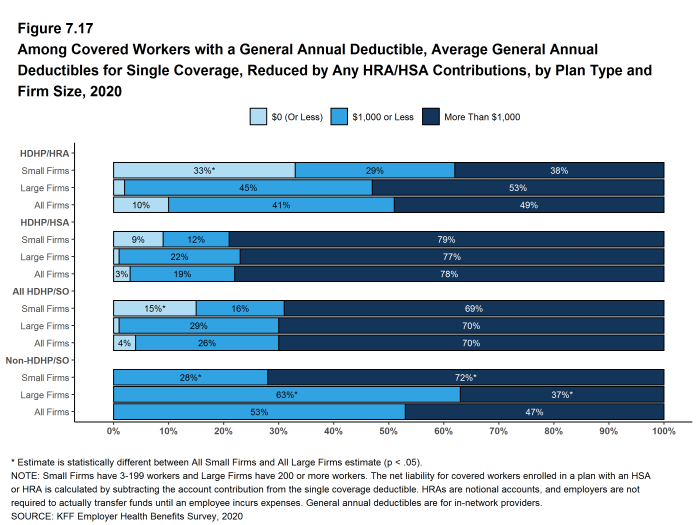

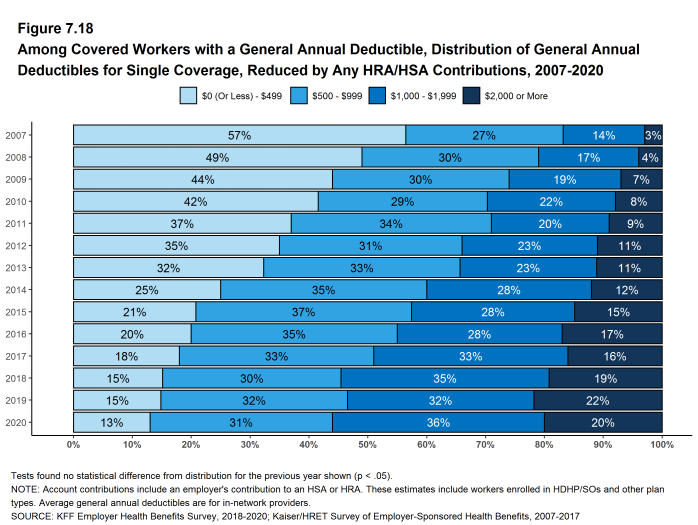

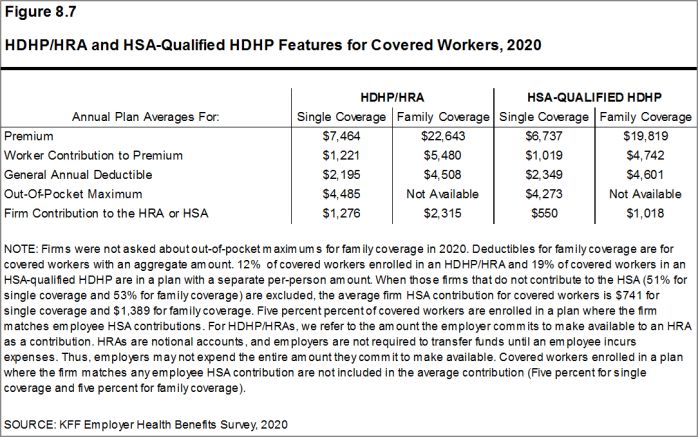

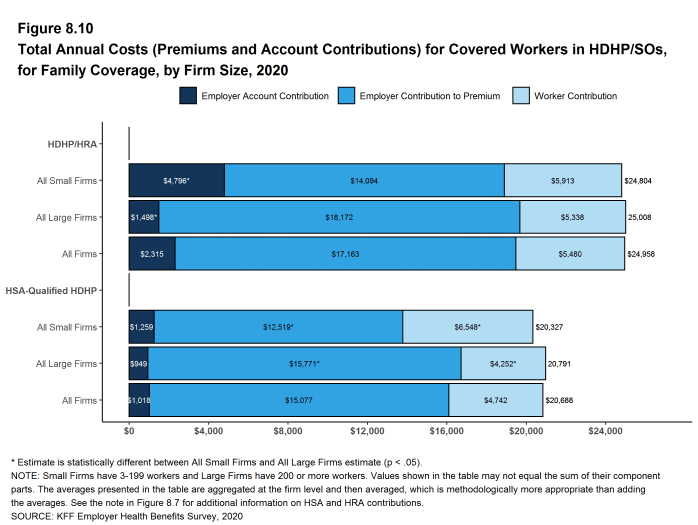

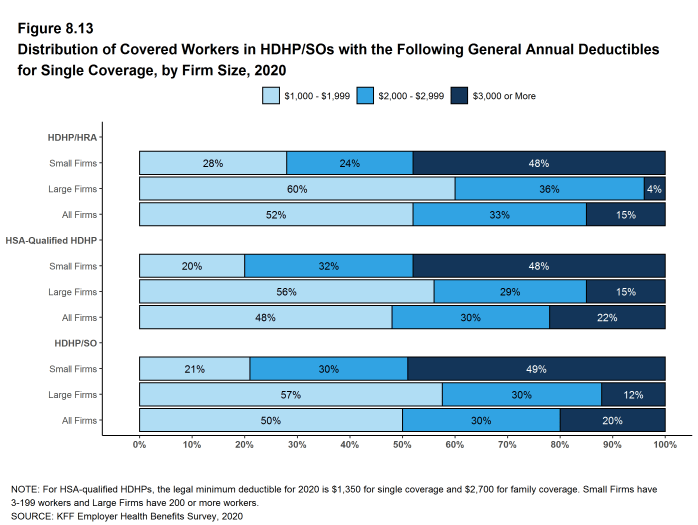

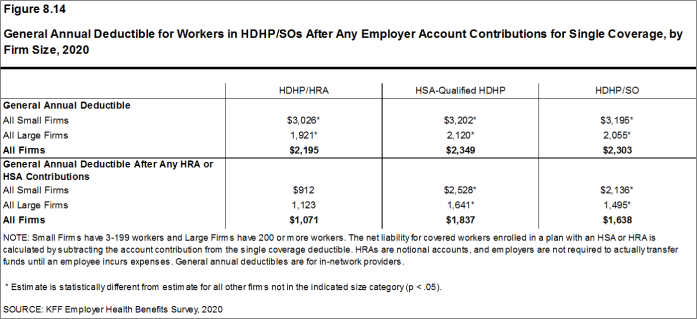

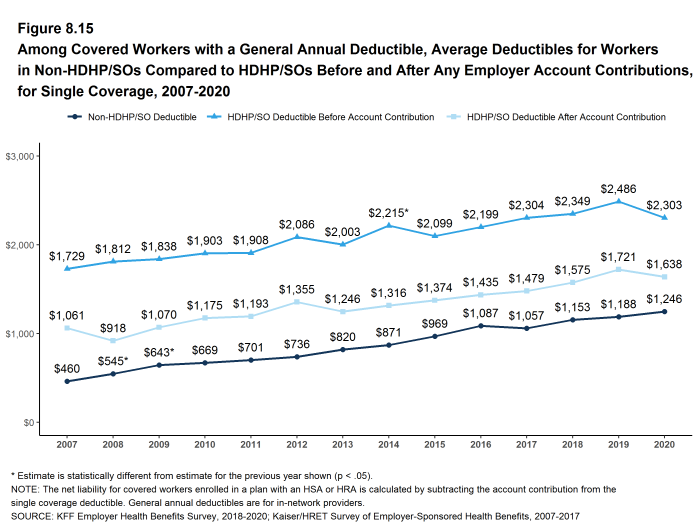

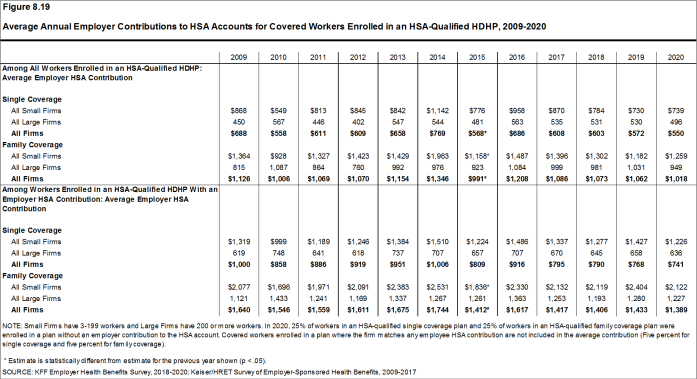

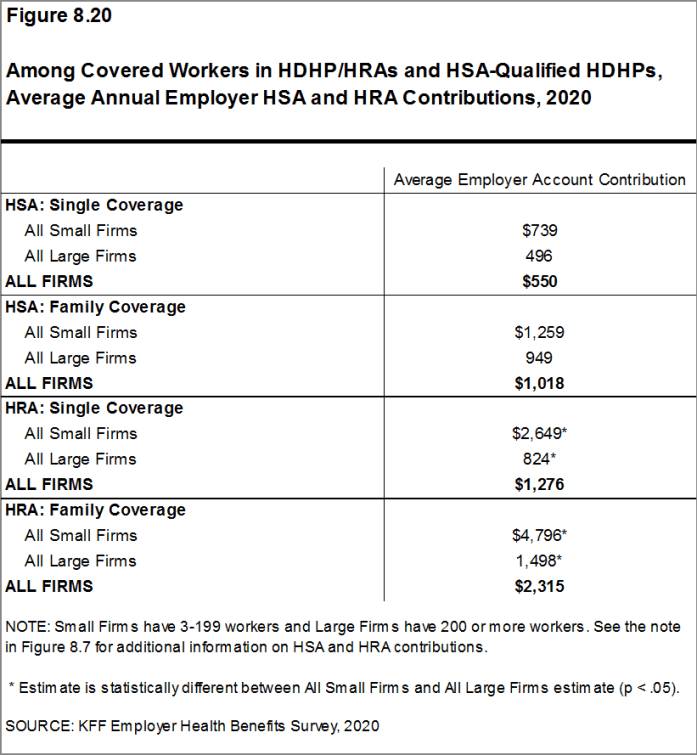

Deductibles have increased in recent years due to higher deductibles within plan types and higher enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift to enrollment in HDHP/SOs does not necessarily do so if HDHP/SO enrollees receive an offsetting account contribution from their employers. Ten percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA), and 3% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while another 41% of covered workers in an HDHP with an HRA and 19% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their actual liability to less than $1,000.

We can look at the increase in the average deductible as well as the growing share of covered workers who have a deductible together by calculating an average deductible among all covered workers (assigning a zero to those without a deductible). The 2020 value of $1,364 is 27% higher than the average general annual deductible for single coverage of $1,077 in 2015 and 111% higher than the average general annual deductible of $646 in 2010.

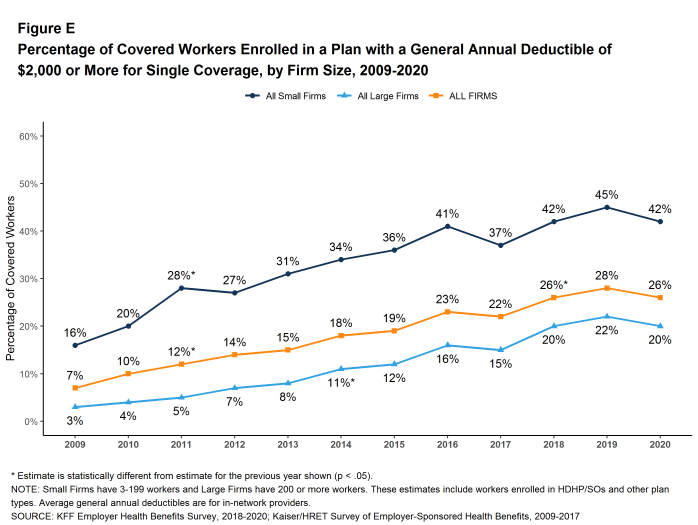

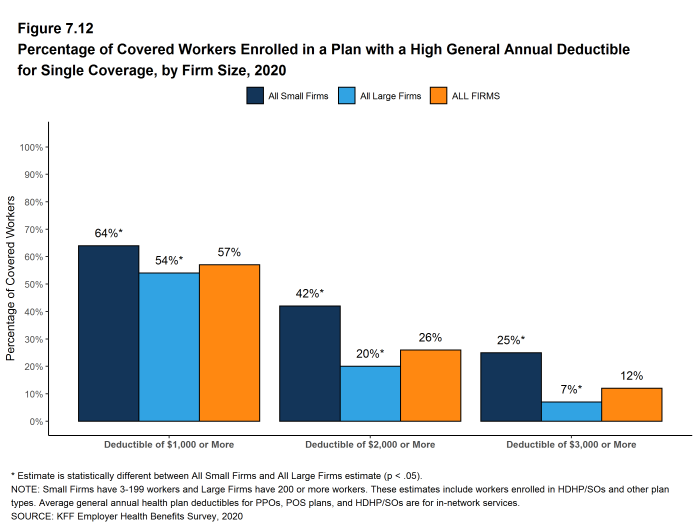

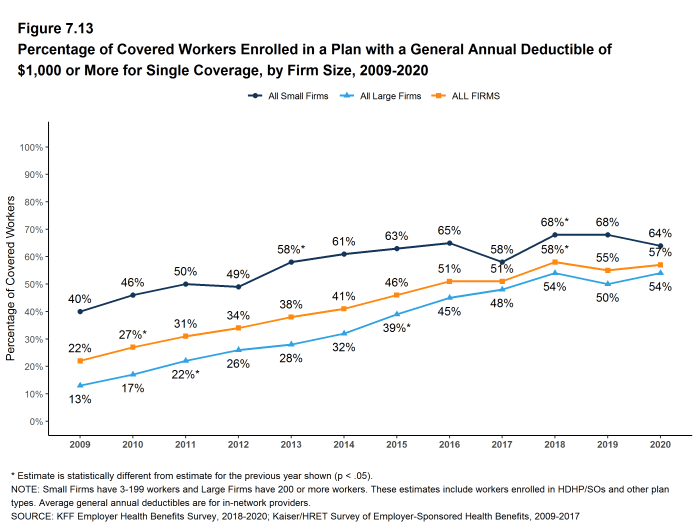

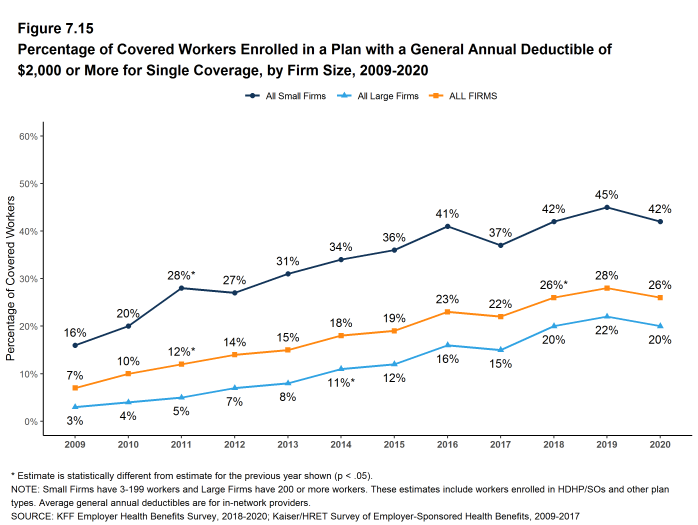

Another way to look at deductibles is the percentage of all covered workers who are in a plan with a deductible that exceeds certain thresholds. Over the past five years, the percentage of covered workers with a general annual deductible of $2,000 or more for single coverage has grown from 19% to 26% [Figure E].

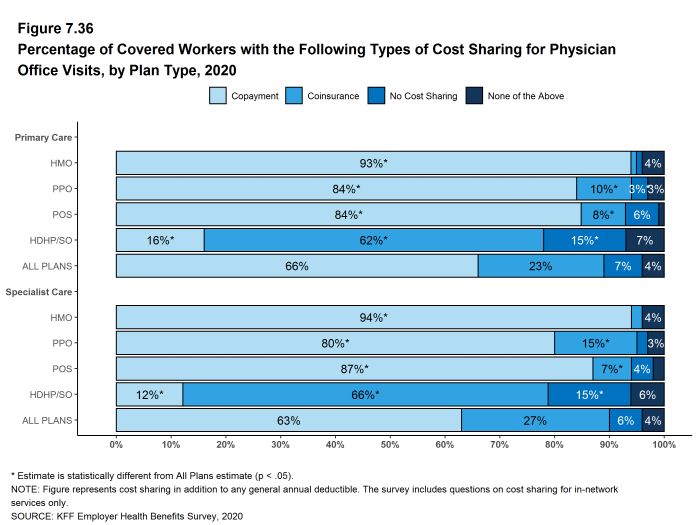

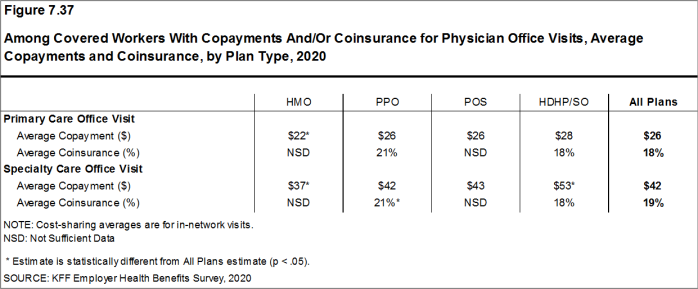

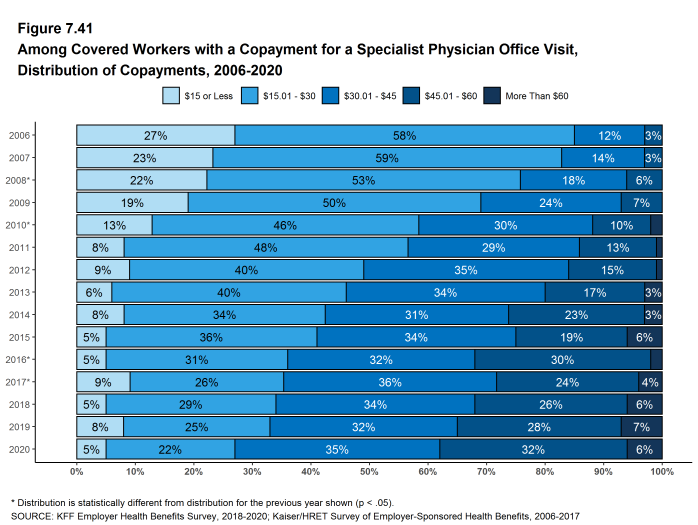

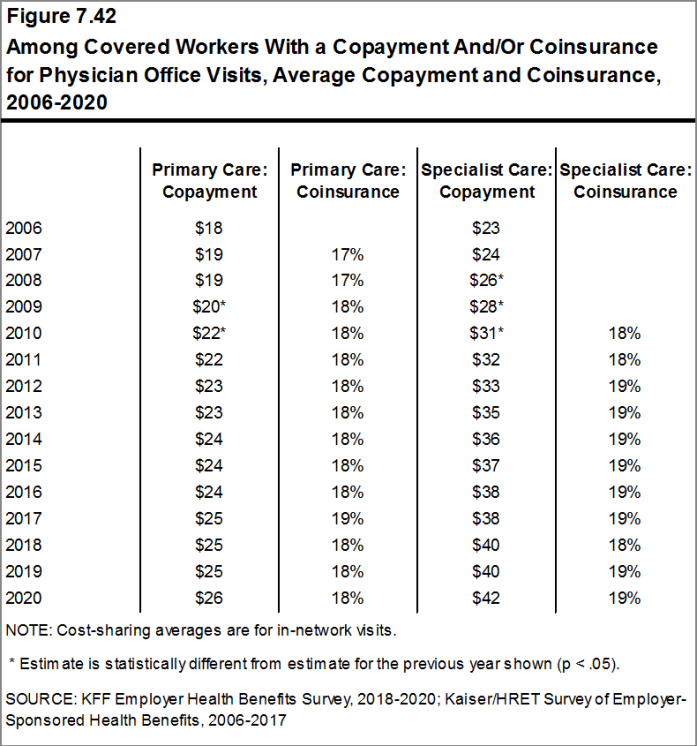

Whether or not a deductible applies, a large share of covered workers also pay a portion of the cost when they visit an in-network physician. Most covered workers face a copayment (a fixed dollar amount) when they visit a doctor, although some workers face coinsurance requirements (a percentage of the covered amount). The average copayments are $26 for primary care and $42 for specialty care. The average coinsurance rates are 18% for primary care and 19% for specialty care. These amounts are similar to those in 2019.

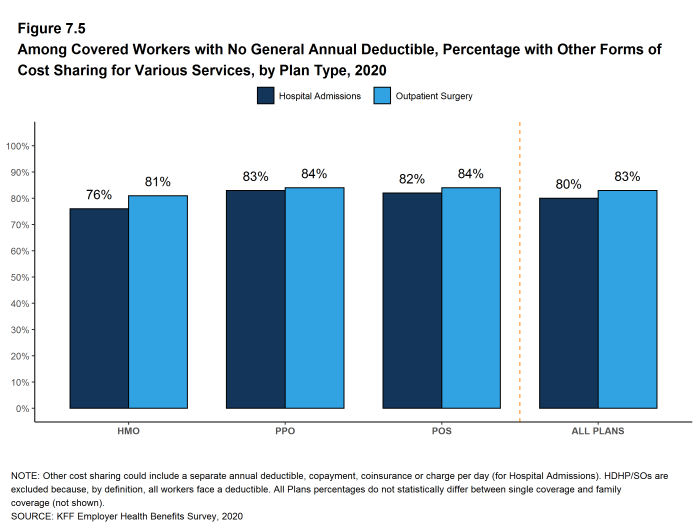

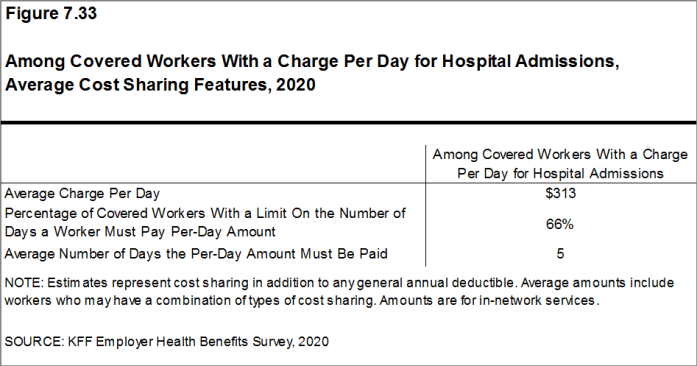

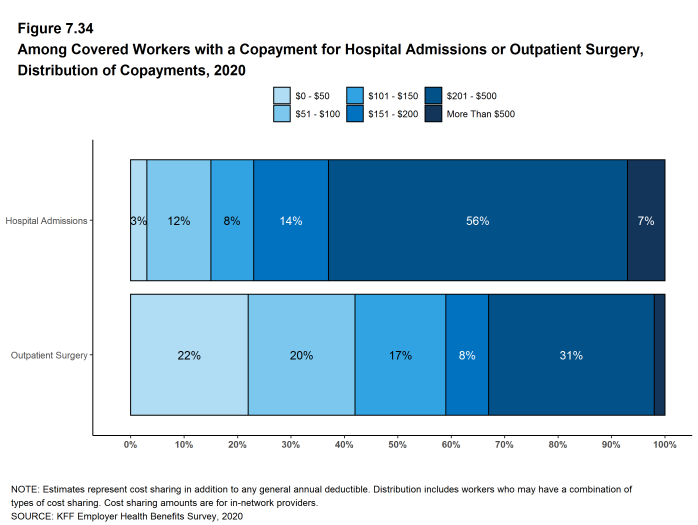

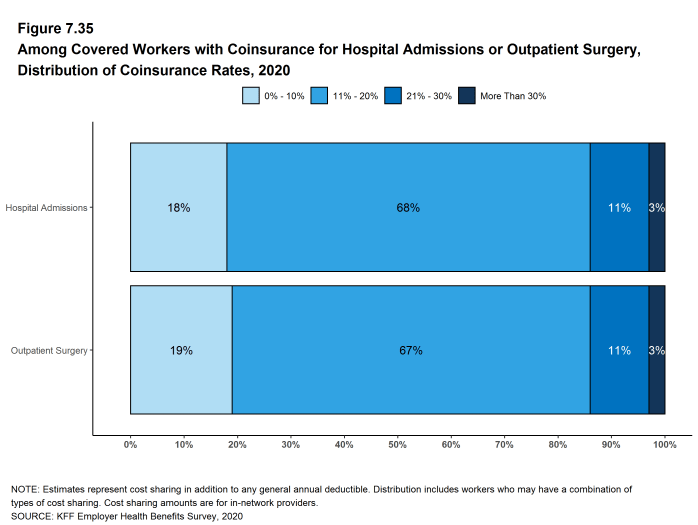

Most workers also face additional cost sharing for a hospital admission or outpatient surgery. Sixty-five percent of covered workers have coinsurance and 13% have a copayment for hospital admissions. The average coinsurance rate for a hospital admission is 20% and the average copayment is $311 per hospital admission. The cost-sharing provisions for outpatient surgery follow a similar pattern to those for hospital admissions.

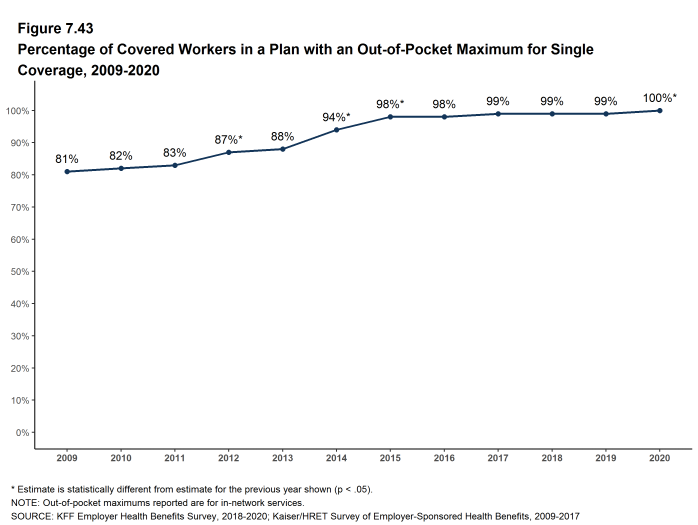

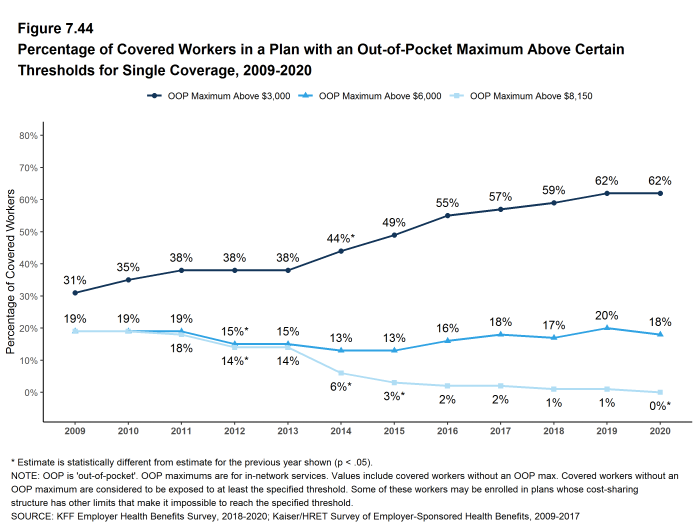

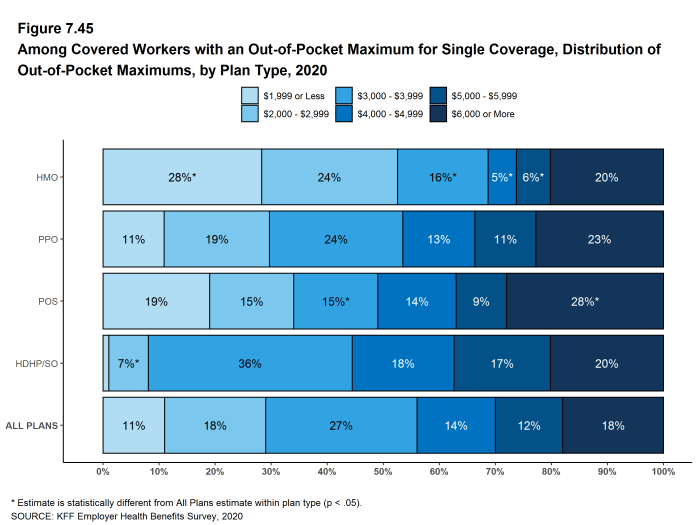

Virtually all covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, though the limits vary significantly. Among covered workers in plans with an out-of-pocket maximum for single coverage, 11% are in a plan with an out-of-pocket maximum of less than $2,000, while 18% are in a plan with an out-of-pocket maximum of $6,000 or more.

Figure E: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More for Single Coverage, by Firm Size, 2009-2020

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

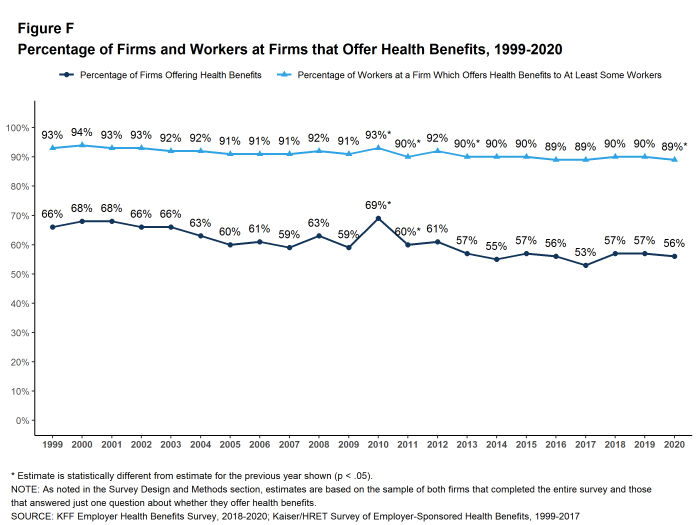

Fifty-six percent of firms offer health benefits to at least some of their workers, similar to the percentage last year [Figure F]. The likelihood of offering health benefits differs significantly by firm size; only 48% of firms with 3 to 9 workers offer coverage, while virtually all firms with 1,000 or more workers offer coverage.

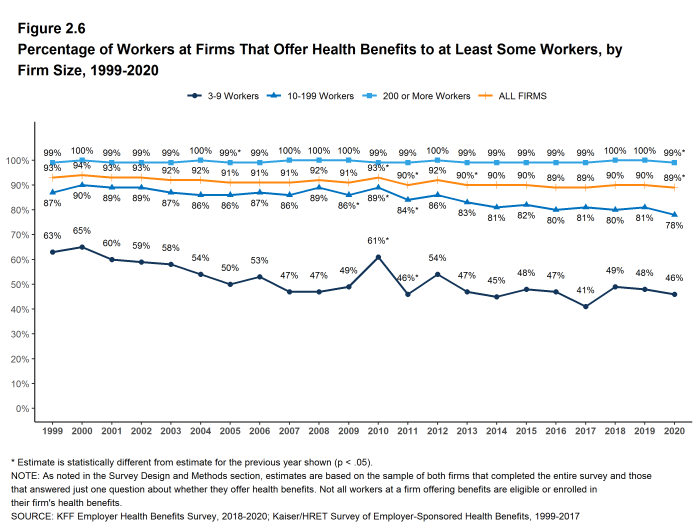

While the vast majority of firms are small, most workers work for large firms that offer coverage. In 2020, 89% of workers are employed by a firm that offers health benefits to at least some of its workers [Figure F].

Although the vast majority of workers are employed by firms that offer health benefits, many workers are not covered at their job. Some are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) and others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 82% of workers are eligible for the health benefits offered, and of those eligible, 78% take up the firm’s offer, resulting in 64% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to 2019.

Looking at workers in both firms that offer and firms that do not offer health benefits, 57% of workers are covered by health plans offered by their employer, similar to the percentage last year.

Figure F: Percentage of Firms and Workers at Firms That Offer Health Benefits, 1999-2020

HEALTH AND WELLNESS PROGRAMS

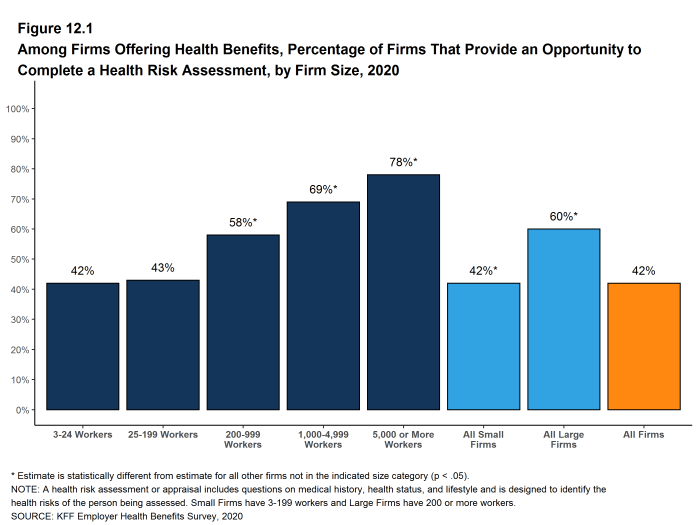

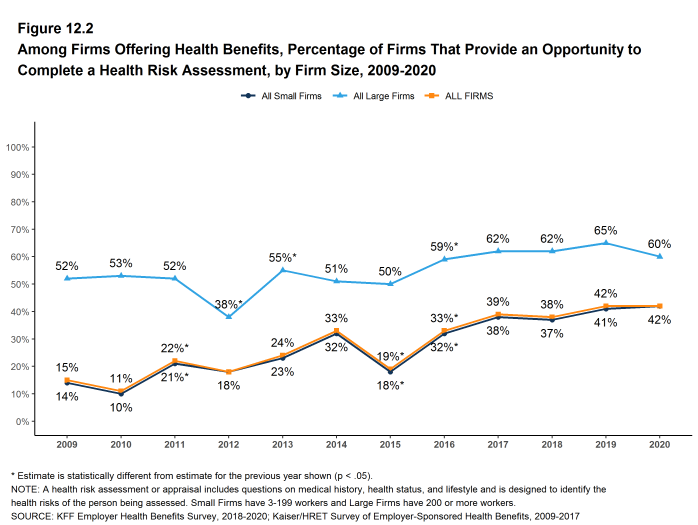

Most large firms and many small firms have programs that help workers identify health issues and manage chronic conditions, including health risk assessments, biometric screenings, and health promotion programs.

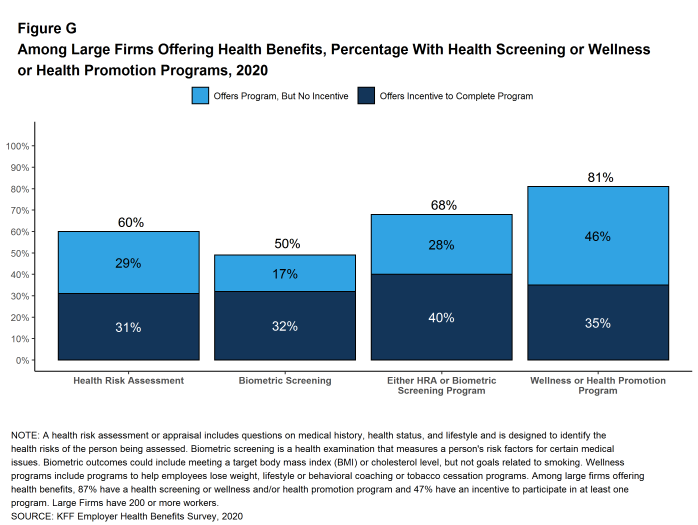

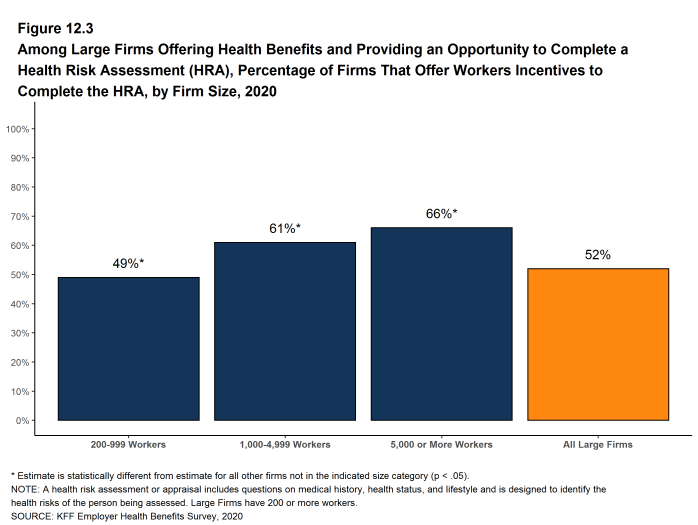

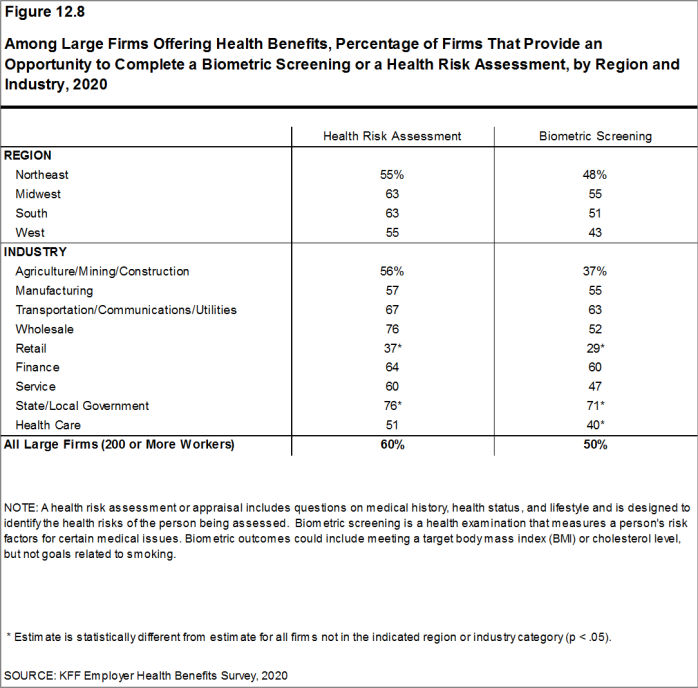

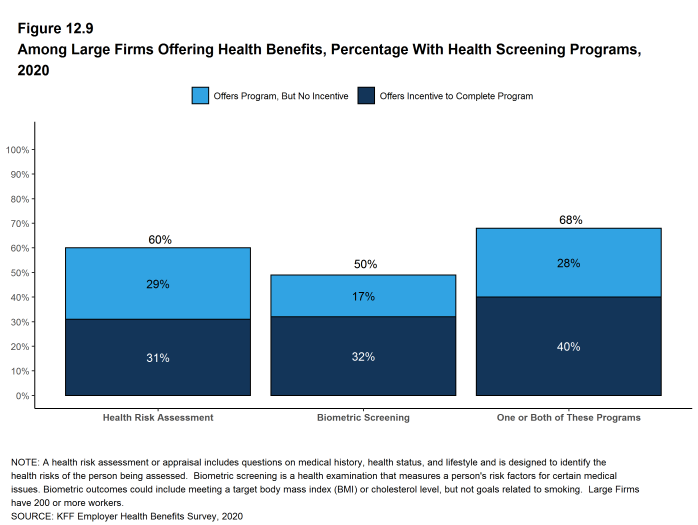

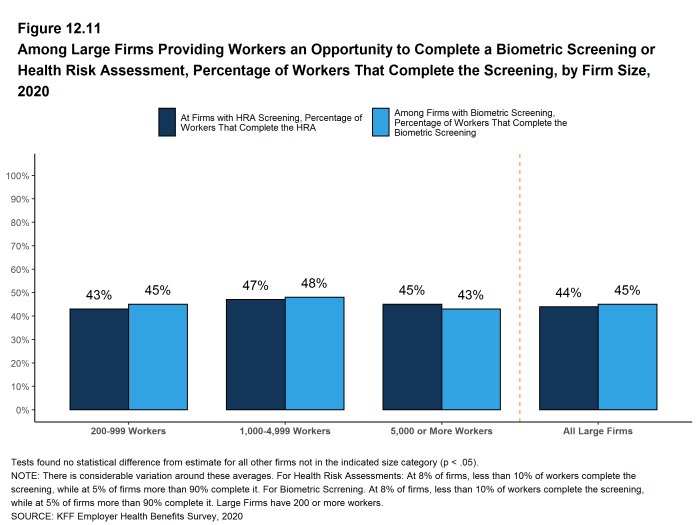

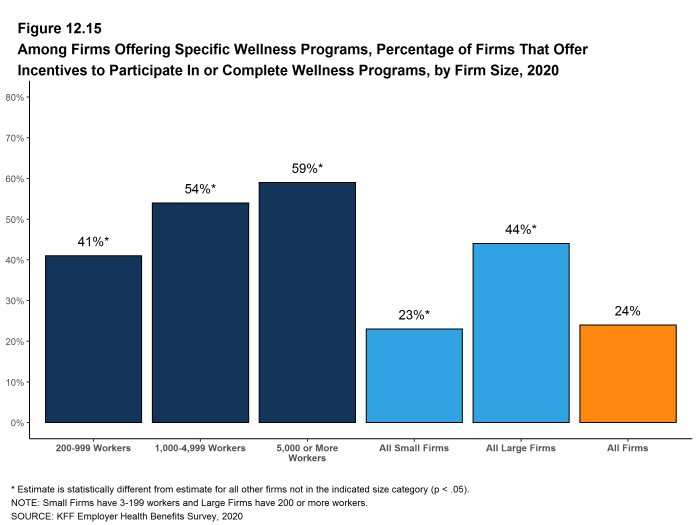

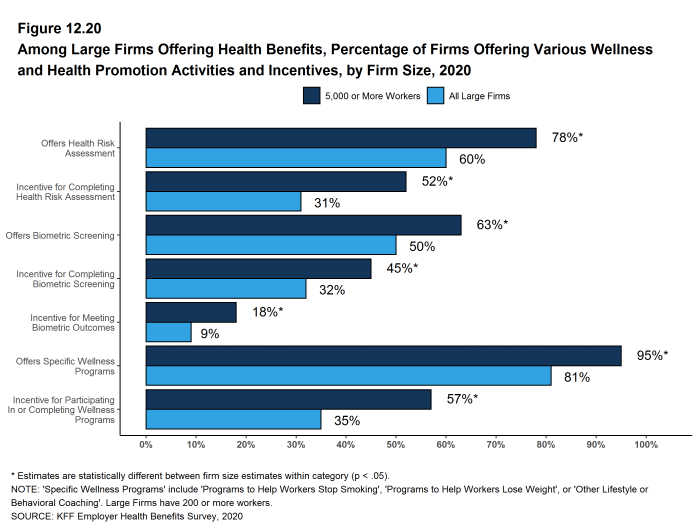

Health Risk Assessments. Among firms offering health benefits, 42% of small firms and 60% of large firms provide workers the opportunity to complete a health risk assessment [Figure G]. A health risk assessment includes questions about a person’s medical history, health status, and lifestyle. Fifty-two percent of large firms with a health risk assessment program offer an incentive to encourage workers to complete the assessment. Incentives may include: gift cards, merchandise or similar rewards; lower premium contributions or cost sharing; and financial rewards, such as cash, contributions to health-related savings accounts, or avoiding a payroll fee.

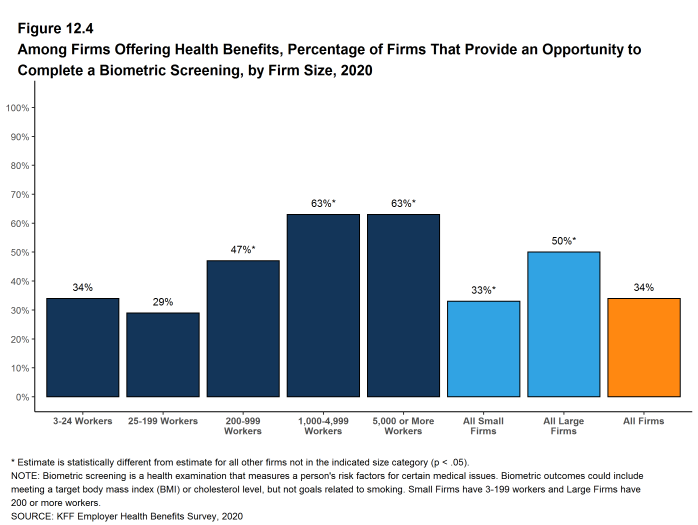

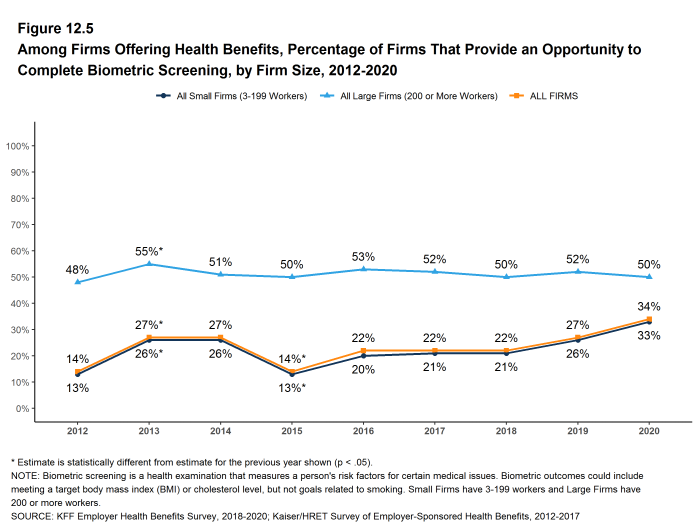

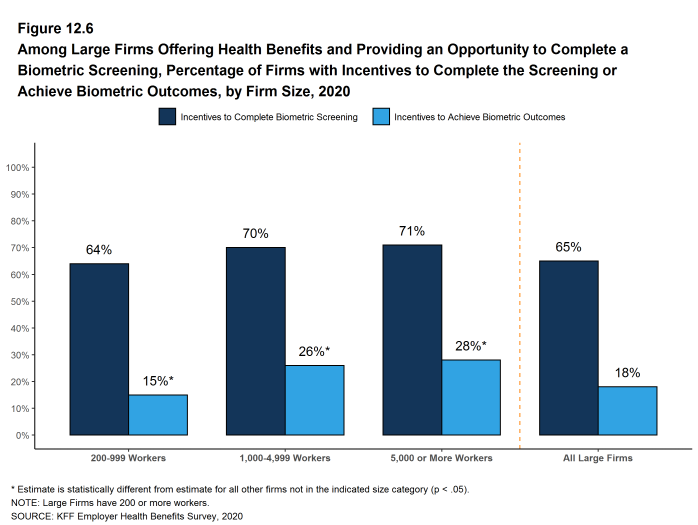

Biometric Screenings. Among firms offering health benefits, 33% of small firms and 50% of large firms provide workers the opportunity to complete a biometric screening. A biometric screening is an in-person health examination that measures a person’s risk factors, such as body mass index (BMI), cholesterol, blood pressure, stress, and nutrition. Sixty-five percent of large firms with biometric screening programs offer workers an incentive to complete the screening.

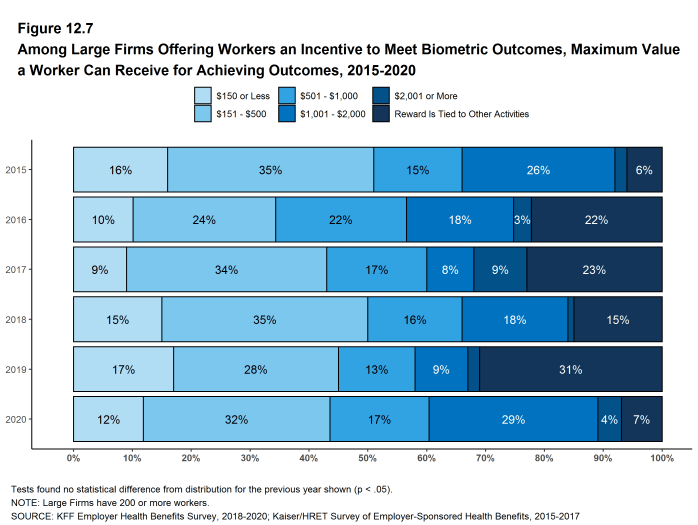

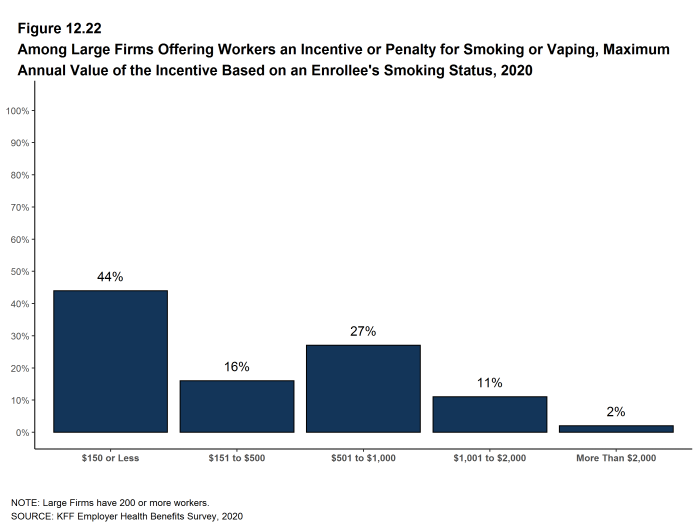

Additionally, among large firms with biometric screening programs, 18% reward or penalize workers based on achieving specified biometric outcomes (such as meeting a target BMI). The size of these incentives varies considerably: among large firms offering a reward or penalty for meeting biometric outcomes, the maximum reward is valued at $150 or less in 12% of firms and more than $1,000 in 32% of firms.

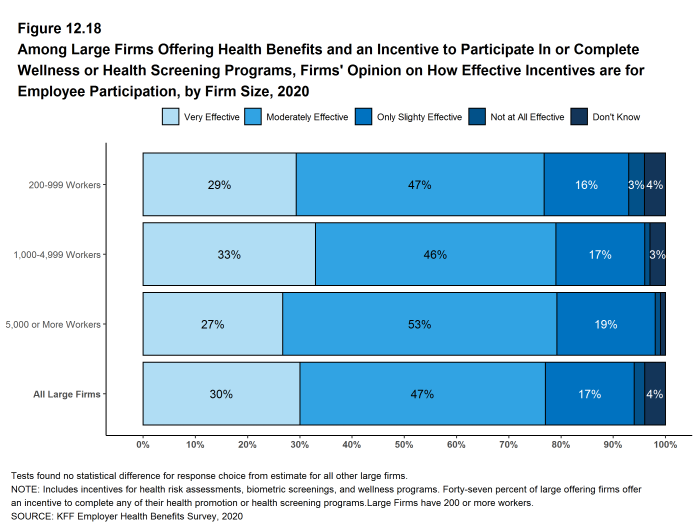

Effectiveness of Incentives. This year we asked large firms with an incentive to participate in a health promotion or health screening program, how effective they believed these incentives were at increasing employee participation. 30% believed incentives were ‘very effective’ and 47% believed they were ‘moderately effective’.

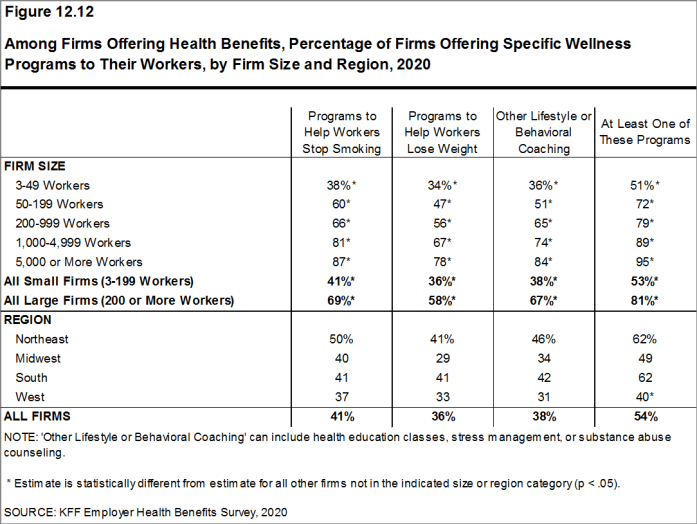

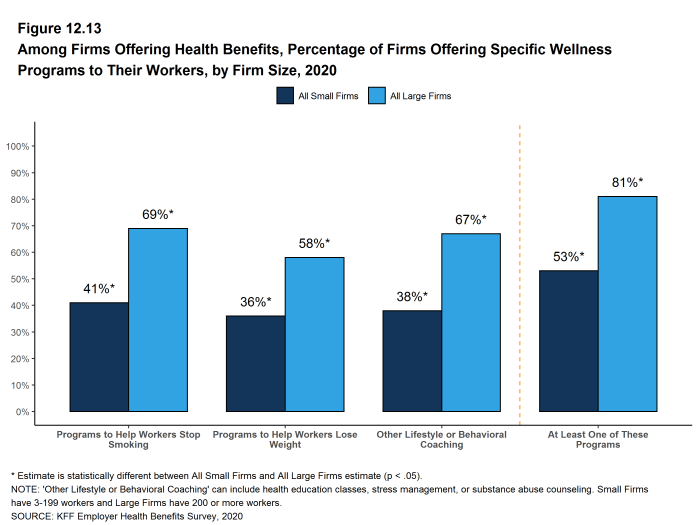

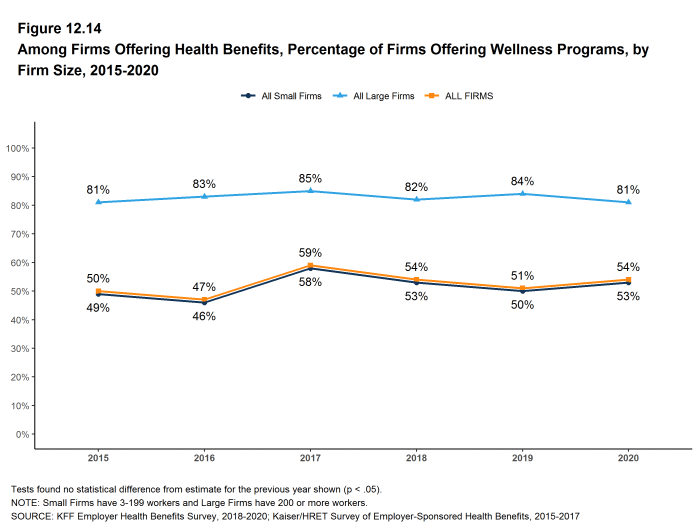

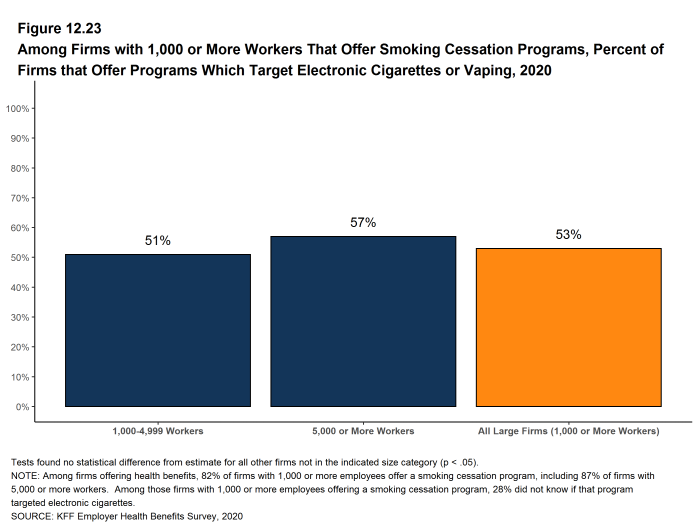

Health and Wellness Promotion Programs. Most firms offering health benefits offer programs to help workers identify and address health risks and unhealthy behaviors. Fifty-three percent of small firms and 81% of large firms offer a program in at least one of these areas: smoking cessation, weight management, and behavioral or lifestyle coaching. Among large firms offering at least one of these programs, 44% offer workers an incentive to participate in or complete the program [Figure G].

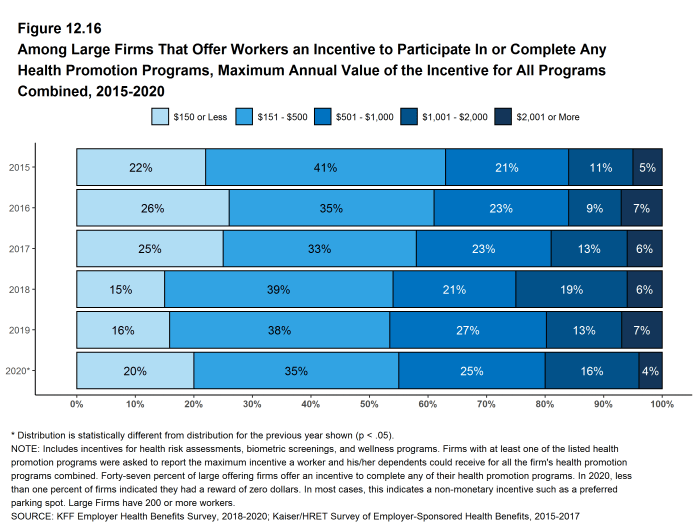

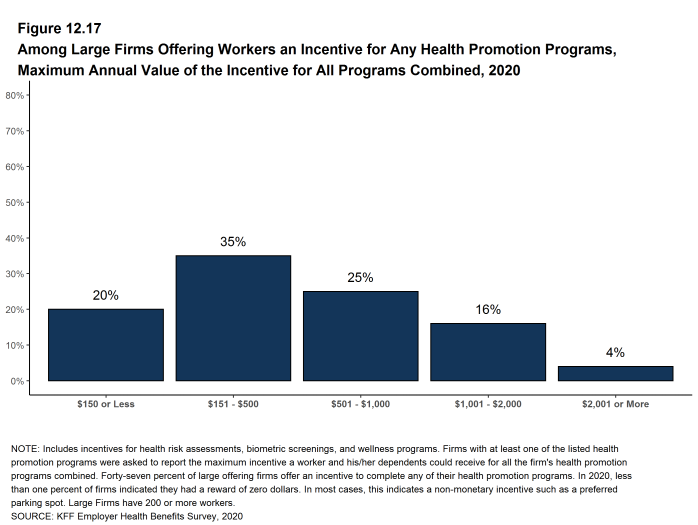

As health screenings and wellness programs have become more complex, incentives have become more sophisticated and may involve participating in or meeting goals in different programs. We asked firms that had incentives for any of these programs to estimate the maximum incentive for a worker across all of their screening and promotion programs combined. Among large firms with any type of incentive, 20% have a maximum incentive of $150 or less, while 20% have a maximum incentive of more than $1,000.

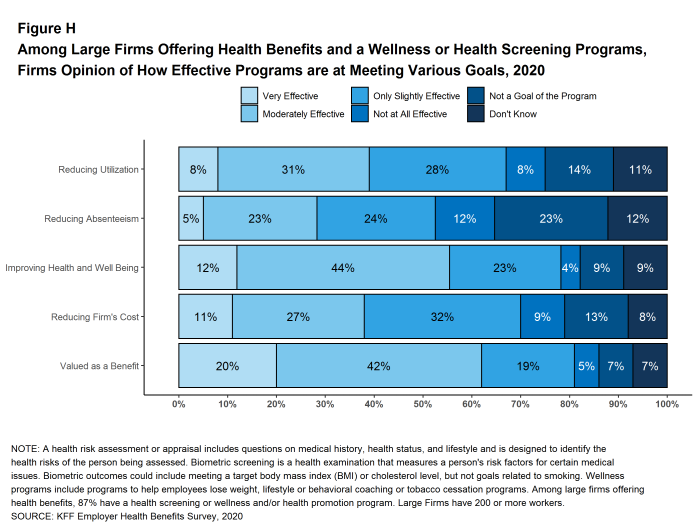

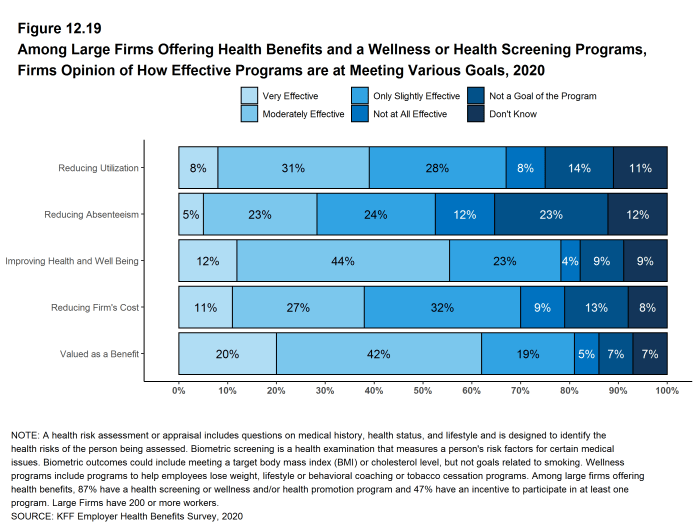

Effectiveness of Programs. Firms may have a variety of objectives for offering health screening and health promotion programs, including improving the health and wellbeing of enrollees, reducing absences from work, and reducing costs. Firms generally responded that their programs were effective to some degree in meeting certain specified objectives, although there were many who responded that they did not know [Figure H].

Figure G: Among Large Firms Offering Health Benefits, Percentage With Health Screening or Wellness or Health Promotion Programs, 2020

Figure H: Among Large Firms Offering Health Benefits and a Wellness or Health Screening Programs, Firms Opinion of How Effective Programs Are at Meeting Various Goals, 2020

SITES OF CARE

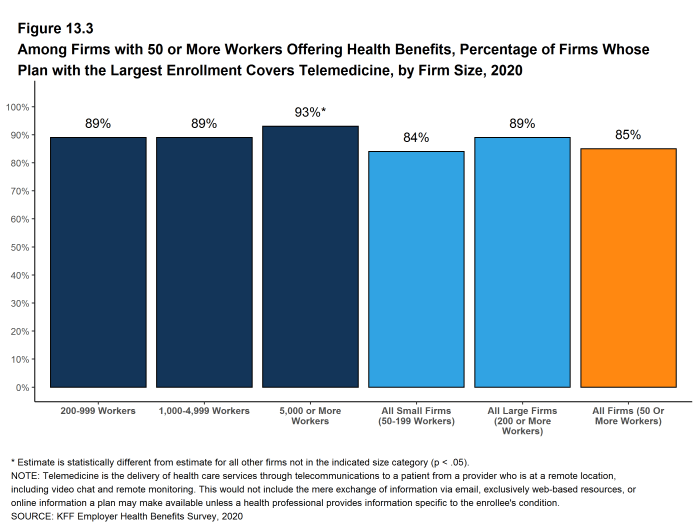

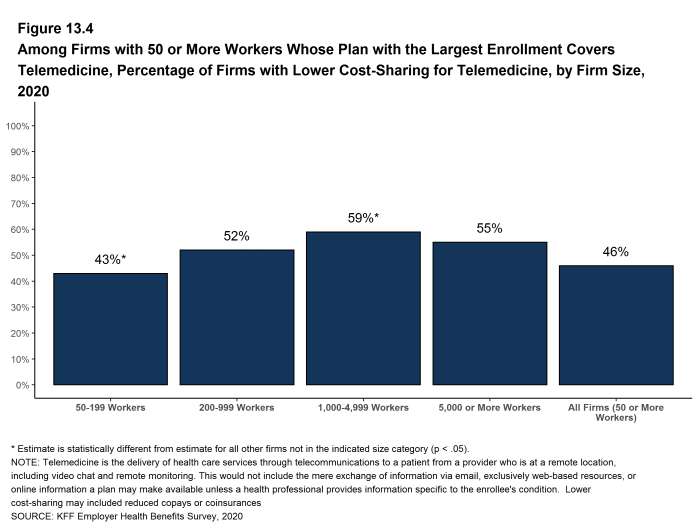

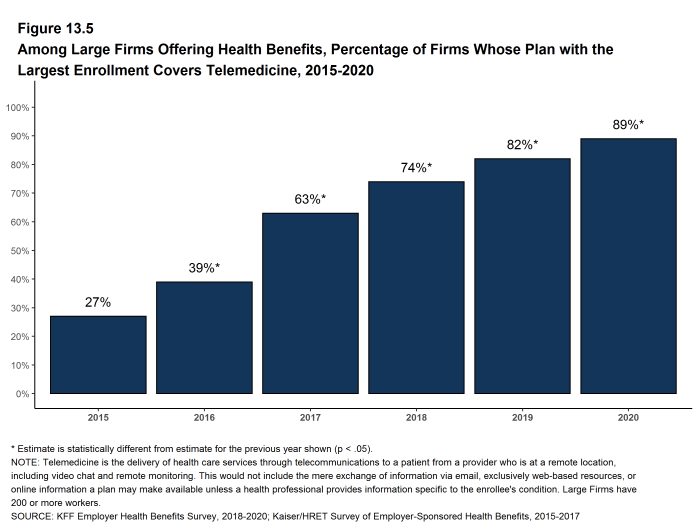

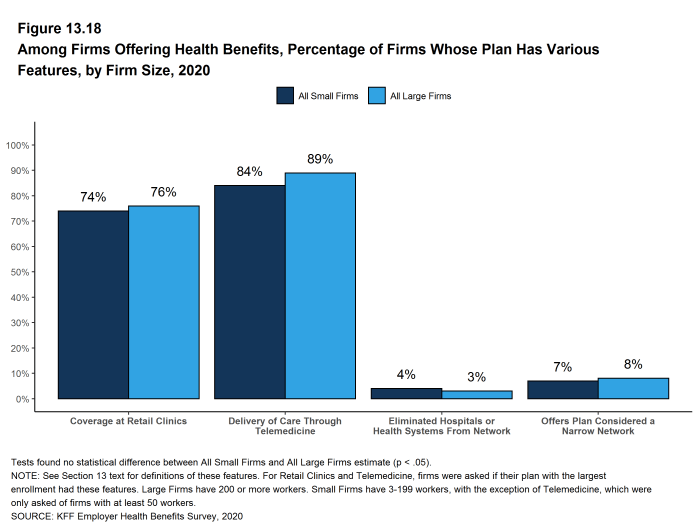

Telemedicine. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. In 2020, 85% of firms with 50 or more workers offering health benefits cover the provision of health care services through telemedicine in their largest health plan, higher than the percentage last year. Offering firms with 5,000 or more workers are more likely to cover services provided through telemedicine than smaller firms.

Over the past year, there was a significant increase in the percentage of firms, particularly smaller firms (50-199 workers), reporting that they cover some services through telemedicine. While telemedicine has grown in recent years, it is possible that some of the growth this year reflects changes in response to the coronavirus pandemic as well as to an increased awareness. It will be important to watch if this heightened focus on access to care through telemedicine continues or abates as concerns about the coronavirus recede.

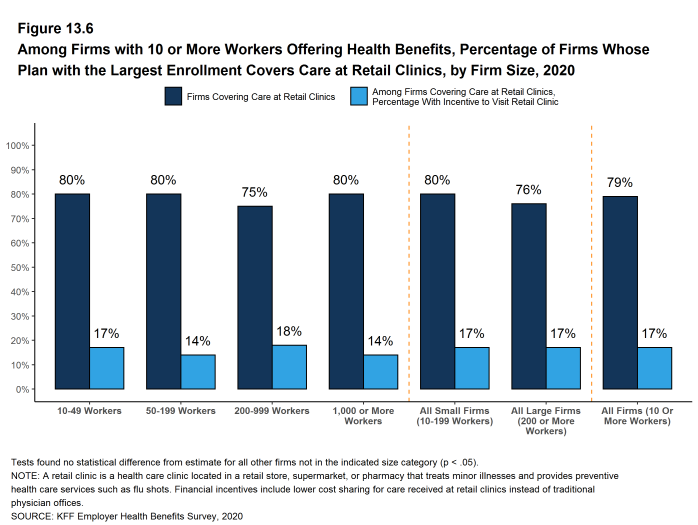

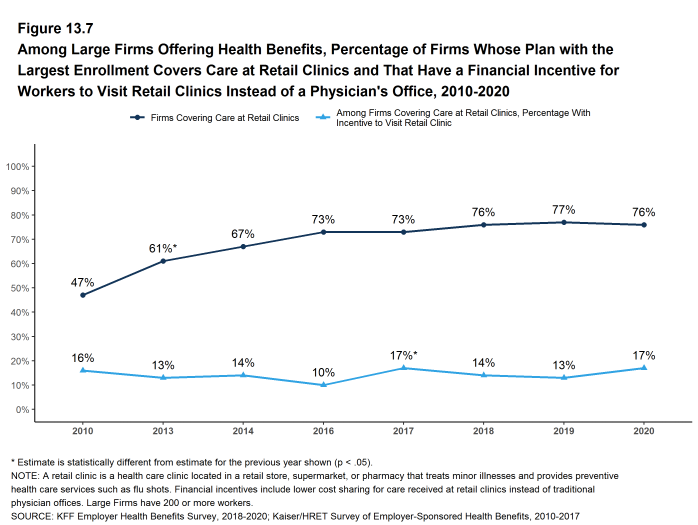

Retail Health Clinics. Seventy-six percent of large firms offering health benefits cover health care services received in retail clinics, such as those located in pharmacies, supermarkets and retail stores, in their largest health plan. These clinics are often staffed by nurse practitioners or physician assistants and treat minor illnesses and provide preventive services.

PROVIDER NETWORKS

Firms and health plans can structure their networks of providers and their cost sharing to encourage enrollees to use providers who charge lower costs and/or who provide better care. This involves assuring that there are a sufficient number of providers to assure reasonable access while also limiting the network to those that deliver good quality and cost-effective care.

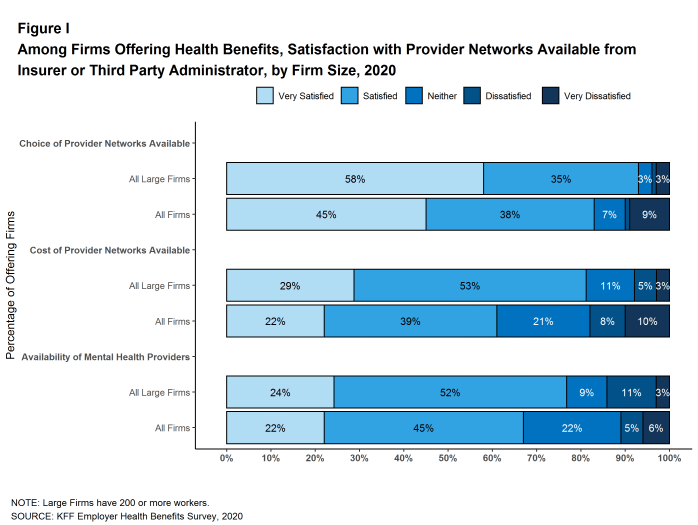

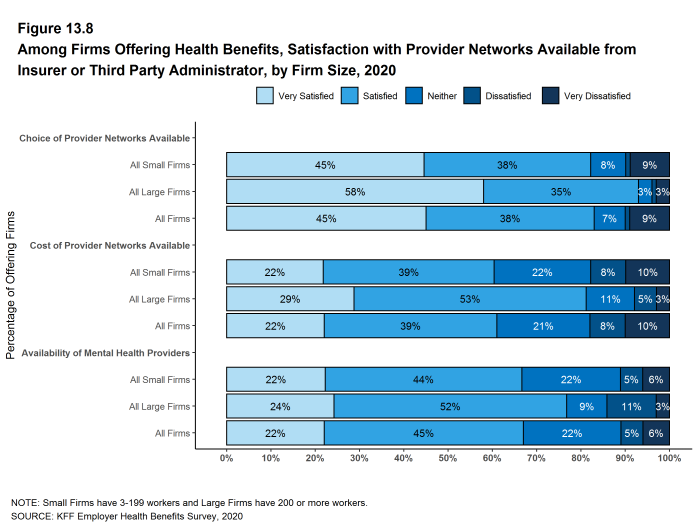

Satisfaction with Network Choices. Among employers offering health benefits, 45% of firms report being ‘very satisfied’ and 38% report being ‘satisfied’ by the choice of provider networks available to them [Figure I]. They are somewhat less satisfied with the cost of the provider networks available to them. Only 22% of these firms report being ‘very satisfied’ while 39% report being ‘satisfied’ with the cost of provider networks available. Small firms are more likely than large firms to be ‘very dissatisfied’ with the cost of the provider networks available.

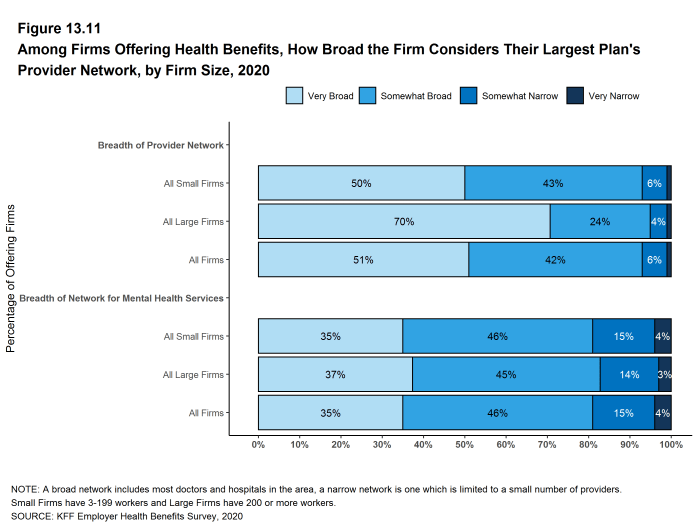

Breadth of Provider Networks. Employers offering health benefits were asked to characterize the breadth of the provider network in their plan with the largest enrollment. Fifty-one percent of firms say that the network in the plan with the largest enrollment is ‘very broad’, 42% say it is ‘somewhat broad’, and 6% say it is ‘somewhat narrow’.

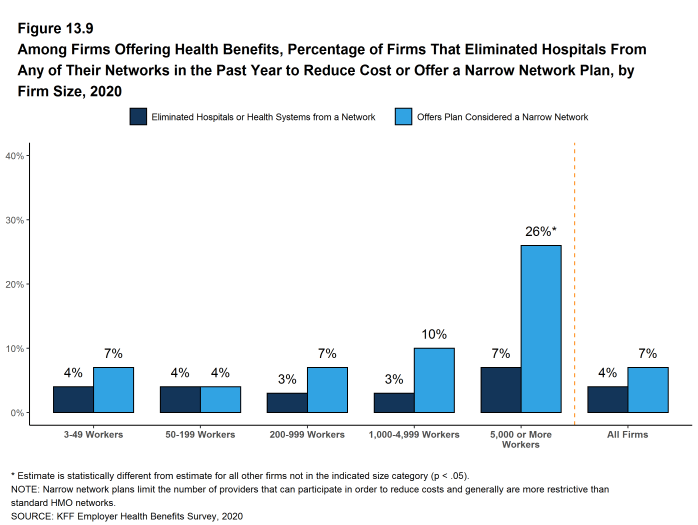

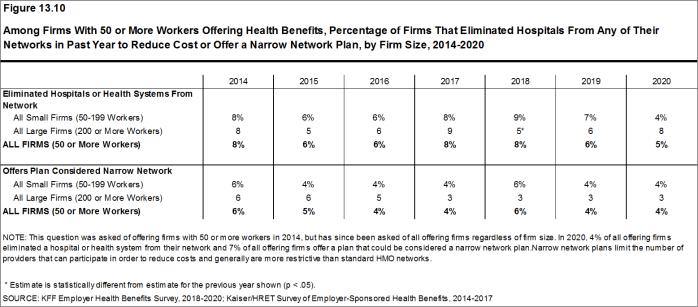

Seven percent of firms offering health benefits report that they offer at least one plan that they considered to be a narrow network plan, similar to the percentage last year. Firms with 5,000 or more workers were more likely to offer a narrow network plan than smaller firms.

Breadth of Provider Networks for Mental Health. Employers offering health benefits were also asked to characterize the breadth of the network for mental health and substance abuse providers in their plan with the largest enrollment. Thirty-five percent of firms say that the network for mental health and substance abuse in the plan with the largest enrollment is ‘very broad’, 46% say it is ‘somewhat broad’, 15% say it is ‘somewhat narrow’, and 4% say it is ‘very narrow’.

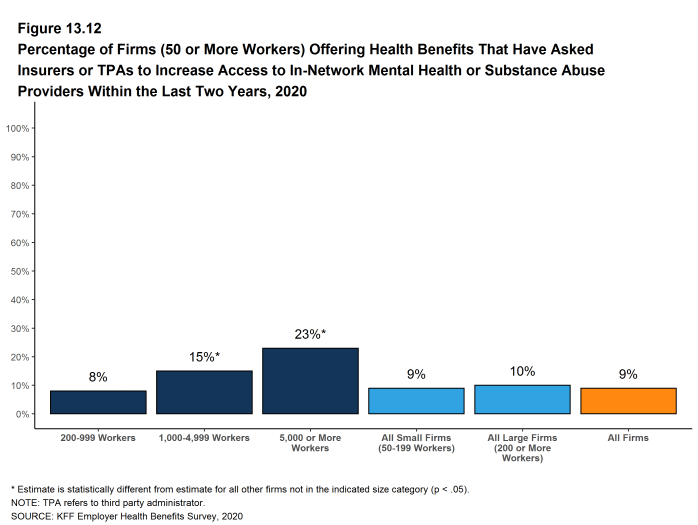

Only about one-in-five (22%) employers offering health benefits report being very satisfied with the availability of mental health providers in their provider networks. Among employers offering health benefits, 15% of employers with 1,000 to 4,999 employees and 23% of employers with 5,000 or more employees asked their insurer or third party administrator to increase access to in-network mental health and substance abuse providers.

Figure I: Among Firms Offering Health Benefits, Satisfaction With Provider Networks Available From Insurer or Third Party Administrator, by Firm Size, 2020

COST SHARING FOR PEOPLE WITH CHRONIC CONDITIONS

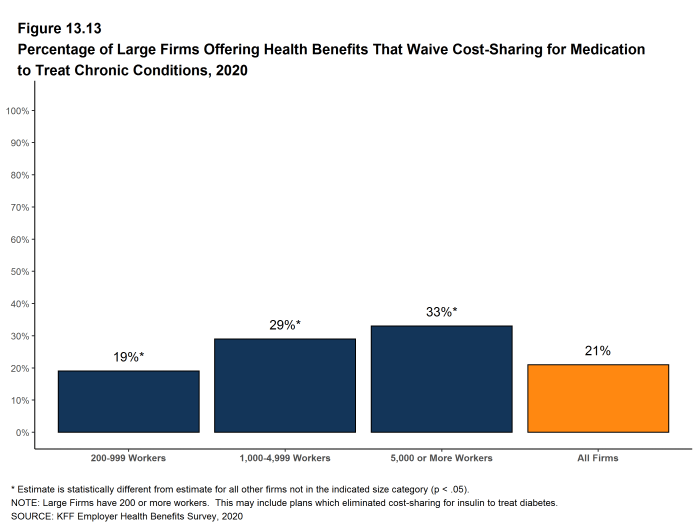

Among employers with 200 or more employees offering health benefits, 21% say that their health plan with the largest enrollment waives cost-sharing for some medications or supplies to encourage employees with chronic illnesses to follow their treatment. This likelihood increases with firm size.

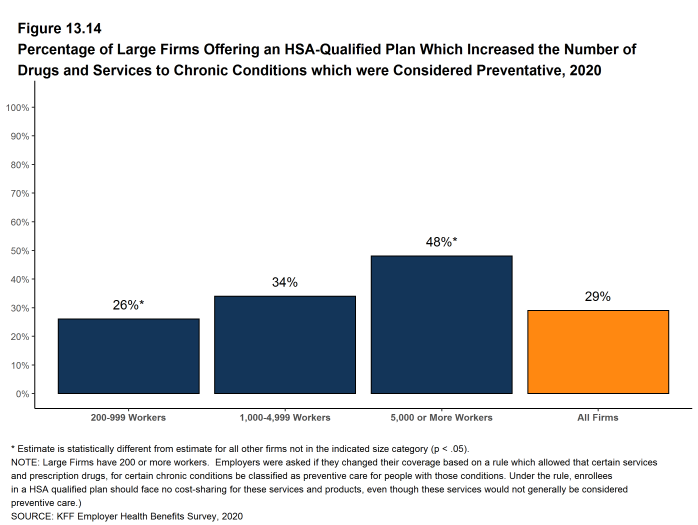

Recent changes in federal rules expanded the number and types of items and services that may be considered preventive by HSA-qualified health plans, allowing plan sponsors to pay for part or all of these services before enrollees meet the plan deductibles. Among employers with 200 or more employees offering an HSA-qualified health plan, 29% say that they changed the services or products that individuals with chronic conditions could receive without first meeting their deductibles. Firms with 5,000 or more employees (48%) are more likely to say they changed the services or products available before the deductible is met.

DISCUSSION

Looking at the metrics we usually consider, such as premiums, contributions, cost sharing, offer and coverage rates, we would conclude that the marketplace for employer-based health coverage had another stable year in 2020. Premium increases were modest and consistent with recent years, contributions and cost sharing largely did not change, nor did the shares of workers offered coverage or covered at their jobs. There is a meaningful increase in the share of workers in self-funded plans, which will be important to understand if the higher level persists. We will include additional questions in the 2021 survey to explore why employers are taking this option.

Of course the economic and social changes caused by the coronavirus pandemic have dramatically changed the employment landscape across the nation. Unprecedented job loss combined with shelter-at-home requirements and continuing delays in reopening of workplaces and schools are challenging employers and workers in many ways, including health benefits. There are questions, for example, about the continued availability of coverage for furloughed workers, the share of laid-off workers who are electing COBRA continuation coverage, and changes being made to employee assistance programs and health benefit plans to support workers with the emotional, social and financial stresses. As noted above, however, because the survey was fielded as the pandemic unfolded, we are not yet in a position to address how employers responded to the pandemic. Most of the metrics discussed above are fixed at the beginning of the plan year and may not reflect current circumstances. Some other responses may have been affected by the unfolding of the pandemic.

While we observed a relatively modest change in premiums in 2020, this does not capture the pandemic’s turbulent impacts on health care costs this year. During the spring, employers and plans saw lower health care utilization and correspondingly lower spending. With enrollees skipping some care, insurers reported lower than predicted cost through the first half of the year. As stay-at-home orders have lifted, health care utilization has again started picking up. Spending in 2021 remains uncertain as employers and insurers continue to adapt to an evolving situation. We do not know how the reduced use of care earlier this year will affect future costs and premiums: in some cases the need for care will have passed but in others the care will just have been deferred. Missed preventive and diagnostic care may also lead to worsening health and higher costs in the future. Beyond any potential pent-up demand, employer-based plans may face higher costs due to new COVID-19 tests, treatments and vaccines. Conversely, we have witnessed a dramatic economic slowdown which may lead to reduced utilization, offsetting some cost on plans.

For a year that started with historically low levels of unemployment, 2020 saw a stark increase in the unemployment rate. A less competitive job market and the economic slowdown may reduce pressure on employers to offer competitive benefit packages in the coming year. We largely reported similar average cost-sharing amounts to 2019 but some employers may be considering reducing plan generosity depending on how the economic crisis unfolds.

The challenge for the 2021 survey will be to understand how employers are responding to the pandemic and accompanying economic fallout while still maintaining the core questions and purpose of the survey. We do not know how long the pandemic will last nor what the longer term economic consequences will be, but we can ask employers about how this uncertainty affected their benefit plan decisions, what types of benefits they added and/or changed, whether they saw changes in how employees used their benefits, and whether they expect any changes to be more permanent. We also expect to ask how the disruption and uncertainty caused by the pandemic affected employer decisions about changing their plans or shopping for new vendors. The pandemic has already affected many employer benefits, and will continue to shape their decision-making as they anticipate new workplace accommodations, changes in premiums and the direct cost of the pandemic.

METHODOLOGY

The Kaiser Family Foundation 2020 Employer Health Benefits Survey reports findings from a telephone survey of 1,765 randomly selected non-federal public and private employers with three or more workers. Researchers at NORC at the University of Chicago and the Kaiser Family Foundation designed and analyzed the survey. Davis Research, LLC conducted the fieldwork between January and July 2020. In 2020, the overall response rate is 22%, which includes firms that offer and do not offer health benefits. Among firms participating in the past two years, the survey’s response rate is 51%. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance. Small firms have 3-199 workers. Values below 3% are not shown on graphical figures to improve the readability of those graphs. Some distributions may not sum due to rounding. For the first time since 1999, we contracted with a new data collection firm to conduct the survey. For more information on potential ‘house effects’ resulting from this change, as well as information on changes to our weighting methodology and measurements of workers’ wage and inflation see the Survey Design and Methods section.

For more information on the survey methodology, please visit the Survey Design and Methods section at http://ehbs.kff.org/.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit organization based in San Francisco, California.

- Kaiser Family Foundation. Health Insurance Coverage of the Total Population [Internet]. KFF (Kaiser Family Foundation). 2019 [cited 2020 Aug 10]. Available from: https://www.kff.org/other/state-indicator/total-population/ Coverage is based on calculations from the 2018 American Community Survey. During the winter and spring of 2020, there was a steep increase in the unemployment rate, potentially decreasing the number of people covered by employer coverage.↩︎

- Bureau of Labor Statistics. Consumer Price Index historical tables for, U.S. City Average of Annual Inflation [Internet]. Washington (DC): BLS; [cited 2020 Aug 10]. Available from: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical1967base_us_table.htm AND Bureau of Labor Statistics. Current Employment Statistics—CES (National) [Internet]. Washington (DC): BLS; [cited 2020 Aug 10]. Available from: https://www.bls.gov/ces/publications/highlights/highlights-archive.htm↩︎

- This threshold is based on the twenty-fifth percentile of workers’ earnings ($26,000 in 2020). Bureau of Labor Statistics. May 2018 National Occupational Employment and Wage Estimates: United States. Washington (DC): BLS. Available from: http://www.bls.gov/oes/current/oes_nat.htm↩︎

Cost of Health Insurance

In 2020, the average annual premiums are $7,470 for single coverage and $21,342 for family coverage. The average premium for single coverage increased by 4% since 2019 and the average premium for family coverage increased by 4%. The average family premium has increased 55% since 2010 and 22% since 2015.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: https://www.kff.org/interactive/premiums-and-worker-contributions/

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

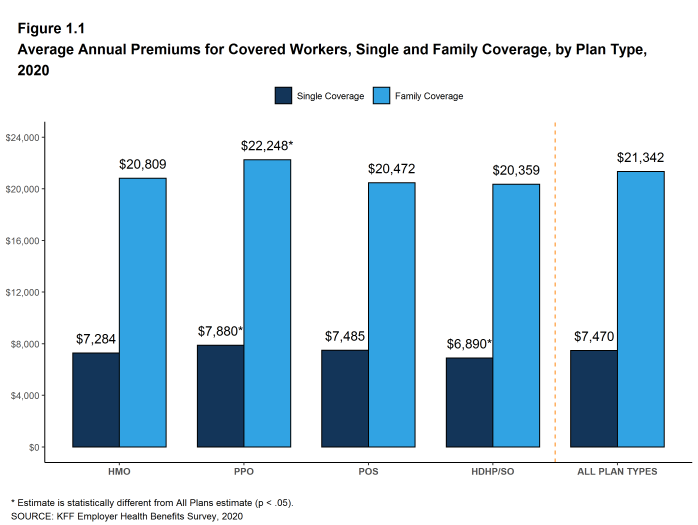

- The average premium for single coverage in 2020 is $7,470 per year. The average premium for family coverage is $21,342 per year [Figure 1.1].

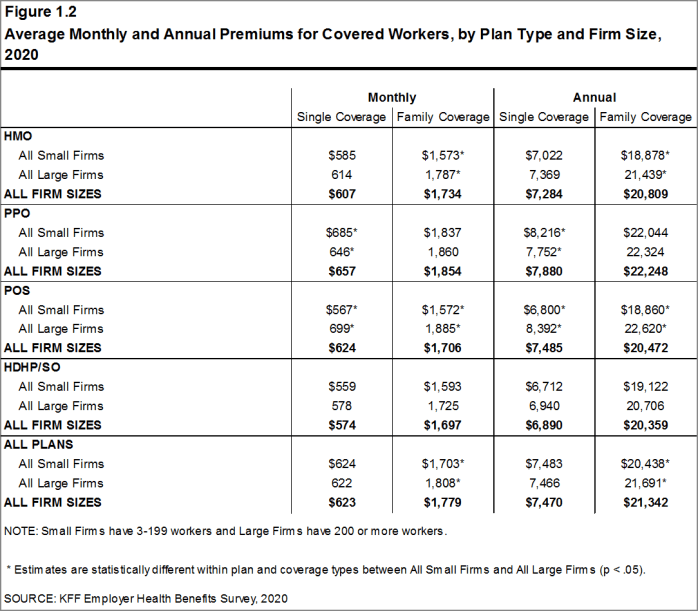

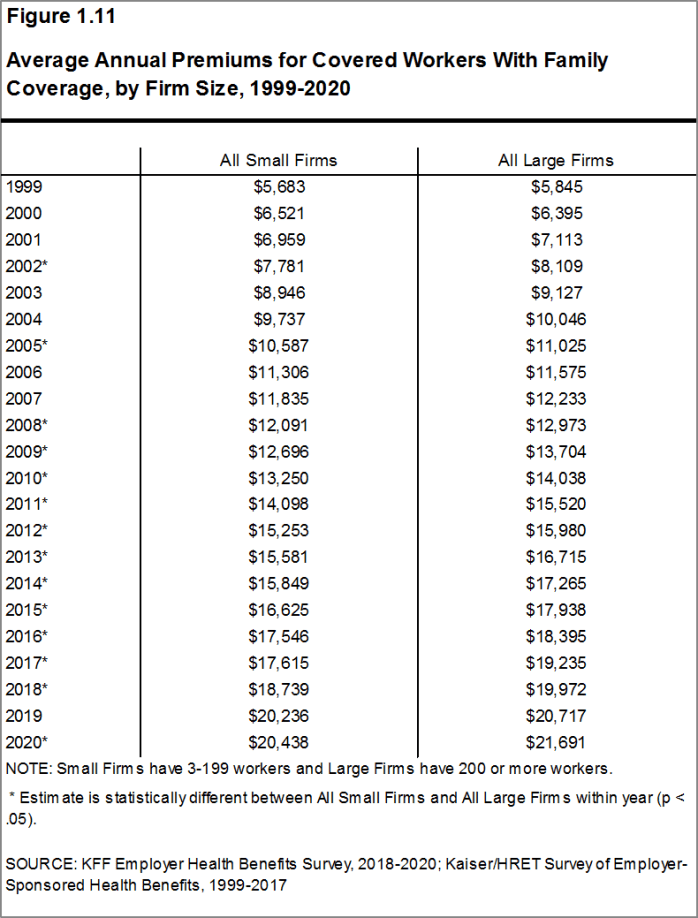

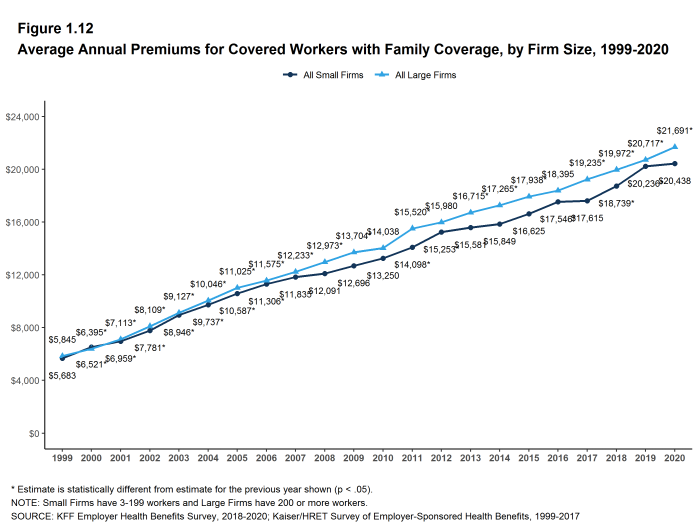

- The average annual premium for single coverage for covered workers in small firms ($7,483) is similar to the average premium for covered workers in large firms ($7,466). The average annual premium for family coverage for covered workers in small firms ($20,438) is lower than the average premium for covered workers in large firms ($21,691). [Figure 1.2].

- The average annual premiums for covered workers in HDHP/SOs is lower for single coverage ($6,890) but similar for family coverage ($20,359) to the overall average premiums. The average premiums for covered workers enrolled in PPOs are higher for single ($7,880) and family coverage ($22,248) than the overall average premiums [Figure 1.1].

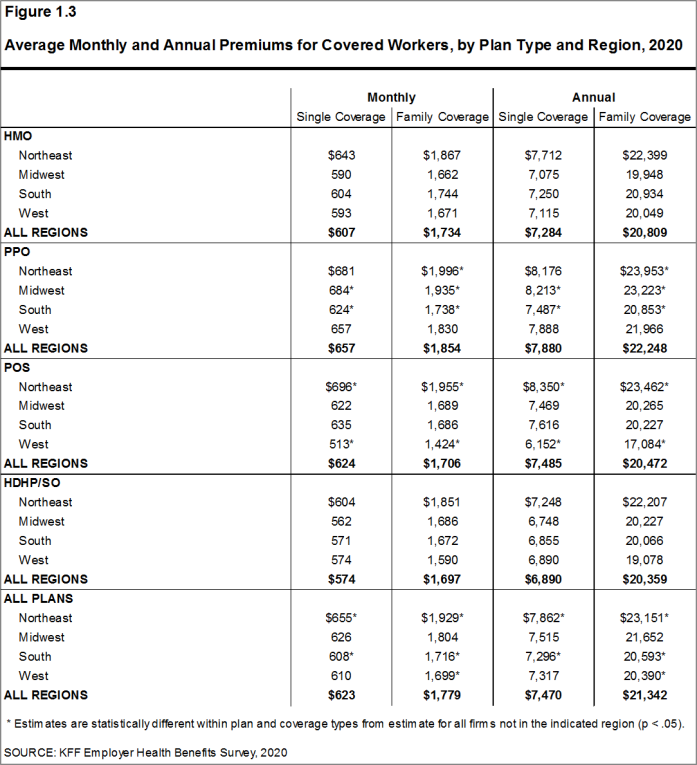

- The average premiums for covered workers with single coverage are relatively high in the Northeast and relatively low in the South. The average premiums for covered workers with family coverage are relatively high in the Northeast and relatively low in the South and West [Figure 1.3].

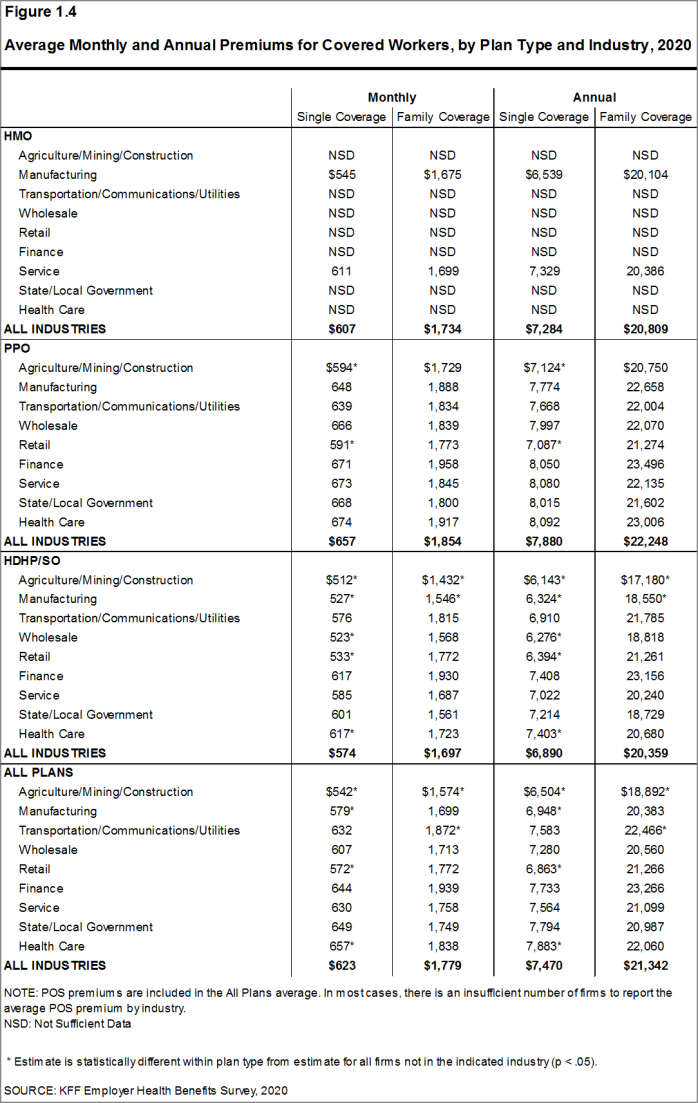

- The average premium for single coverage varies across industries. Compared to the average single premiums for covered workers in other industries, the average premiums for covered workers in the Manufacturing, Retail, and Agriculture/Mining/Construction categories are relatively low and the average premium for Health Care workers is relatively high [Figure 1.4].

- The average premium for family coverage for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of the workers earn $26,000 annually or less) is lower than the average premium for covered workers in firms with a smaller share of lower-wage workers ($19,332 vs. $21,486) [Figure 1.6].

- The average premium for single coverage for covered workers in firms with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) is higher than the average premium for covered workers in firms with a smaller share of older workers ($7,665 vs. $7,288) [Figure 1.6].

- The average premium for family coverage for covered workers in firms with a relatively large share of younger workers (where at least 35% of the workers are age 26 or younger) is lower than the average premium for covered workers in firms with a smaller share of younger workers ($19,893 vs. $21,441) [Figure 1.6].

- Covered workers at private for-profit firms have lower average annual premiums than covered workers at public firms or private not-for-profit firms for single coverage [Figure 1.6].

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2020

Figure 1.2: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2020

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2020

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2020

Figure 1.5: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2020

Figure 1.6: Average Annual Premiums for Covered Workers, by Firm Characteristics and Firm Size, 2020

PREMIUM DISTRIBUTION

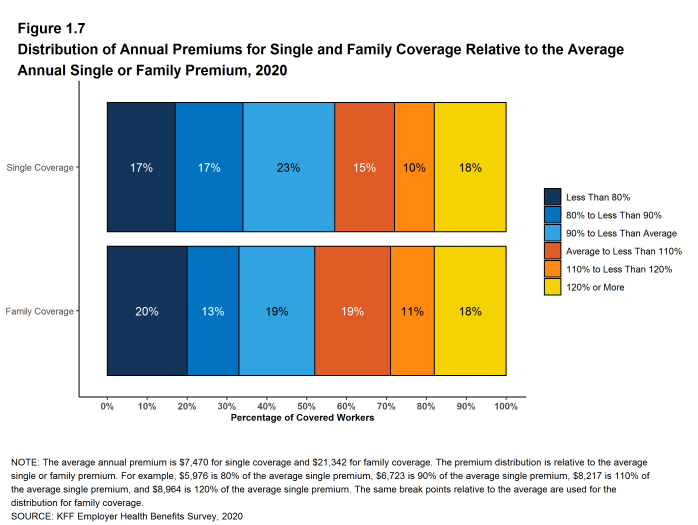

- There remains considerable variation in premiums for both single and family coverage.

- Eighteen percent of covered workers are employed in a firm with a single premium at least 20% higher than the average single premium, while 17% of covered workers are in firms with a single premium less than 80% of the average single premium [Figure 1.7].

- For family coverage, 18% of covered workers are employed in a firm with a family premium at least 20% higher than the average family premium, while 20% of covered workers are in firms with a family premium less than 80% of the average family premium [Figure 1.7].

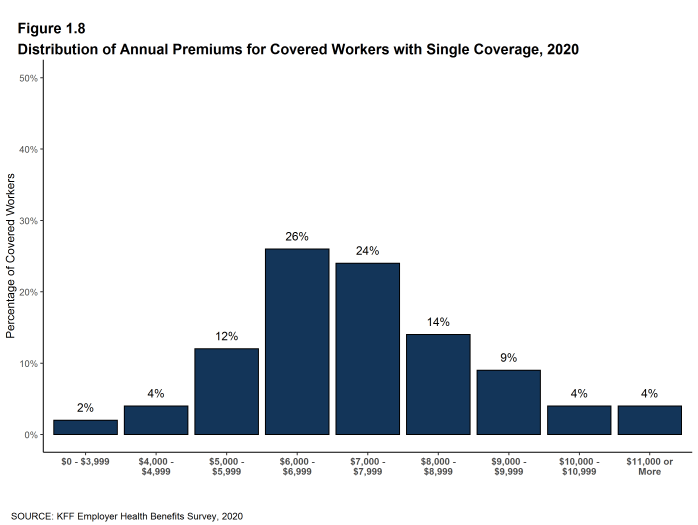

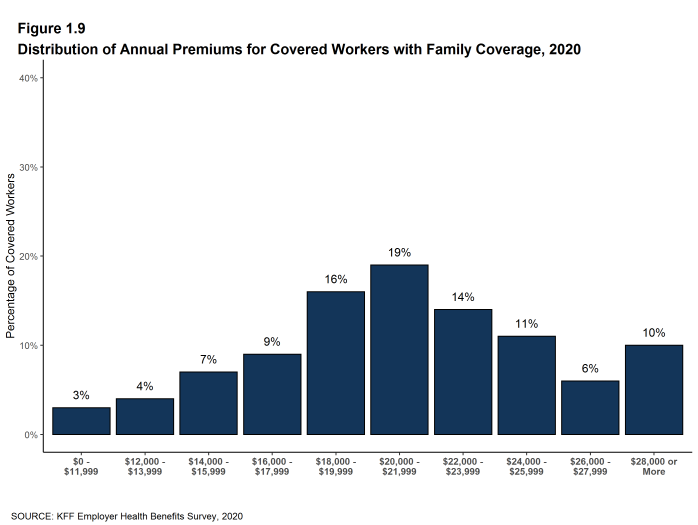

- Nine percent of covered workers are in a firm with an average annual premium of at least $10,000 for single coverage [Figure 1.8]. Ten percent of covered workers are in a firm with an average annual premium of at least $28,000 for family coverage [Figure 1.9].

Figure 1.7: Distribution of Annual Premiums for Single and Family Coverage Relative to the Average Annual Single or Family Premium, 2020

Figure 1.8: Distribution of Annual Premiums for Covered Workers With Single Coverage, 2020

Figure 1.9: Distribution of Annual Premiums for Covered Workers With Family Coverage, 2020

PREMIUM CHANGES OVER TIME

- The average premium for single coverage is 4% higher than the single premium last year, and the average premium for family coverage is 4% higher than the average family premium last year [Figure 1.10].

- The average premium for single coverage has grown 20% since 2015, similar to the growth in the average premium for family coverage (22%) over the same period [Figure 1.10].

- The average family premiums for both small and large firms have increased at similar rates since 2015 (23% for small firms and 21% for large firms). For small firms, the average family premium rose from $16,625 in 2015 to $20,438 in 2020. For large firms, the average family premium rose from $17,938 in 2015 to $21,691 in 2020 [Figures 1.11 and 1.12].

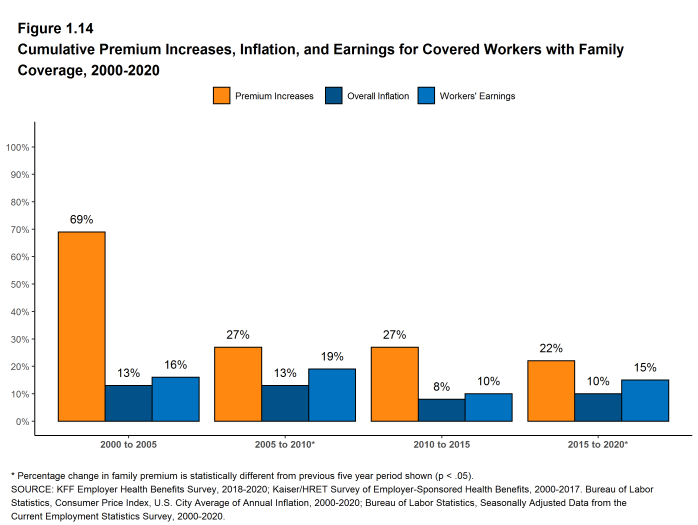

- The $21,342 average family premium in 2020 is 22% higher than the average family premium in 2015 and 55% higher than the average family premium in 2010. The 22% family premium growth in the past five years is slower than the 27% growth between 2010 and 2015 [Figure 1.14].

- The average family premiums for both small and large firms have increased at similar rates since 2010 (54% for small firms and 55% for large firms). For small firms, the average family premium rose from $13,250 in 2010 to $20,438 in 2020. For large firms, the average family premium rose from $14,038 in 2010 to $21,691 in 2020 [Figures 1.11 and 1.12].

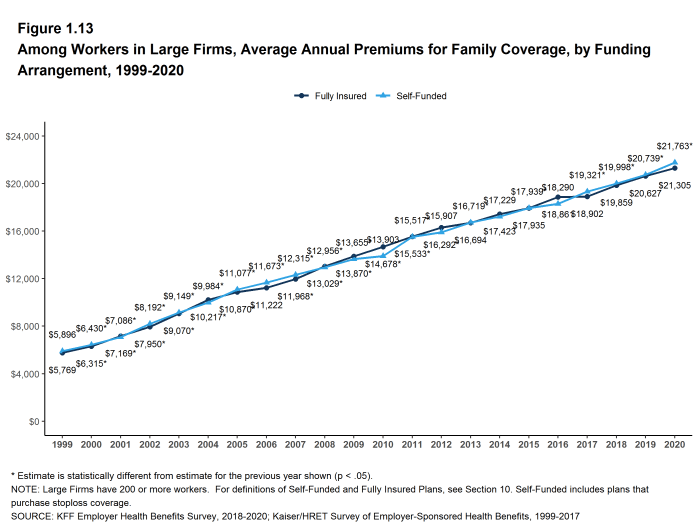

- For covered workers in large firms, over the past five years, the average family premium in firms that are fully insured has grown at a similar rate to the average family premium for covered workers in fully or partially self-funded firms (19% for fully insured plans and 21% for self-funded firms) [Figure 1.13].

- Over the last five years, the average premium for family coverage has risen 22% percent, more than inflation (10%).

Figure 1.10: Average Annual Premiums for Single and Family Coverage, 1999-2020

Figure 1.11: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2020

Figure 1.12: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2020

Figure 1.13: Among Workers in Large Firms, Average Annual Premiums for Family Coverage, by Funding Arrangement, 1999-2020

Figure 1.14: Cumulative Premium Increases, Inflation, and Earnings for Covered Workers With Family Coverage, 2000-2020

Health Benefits Offer Rates

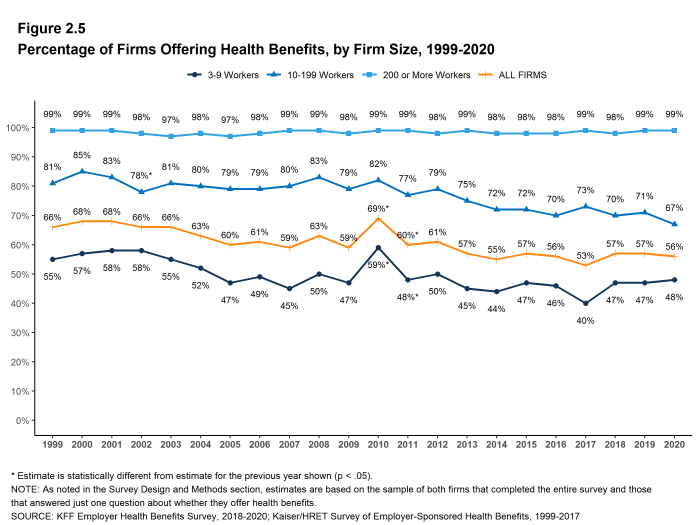

While nearly all large firms (200 or more workers) offer health benefits to at least some workers, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2020 (56%) is similar to the percentages of firms offering health benefits last year (57%) and five years ago (57%).

Firms not offering health benefits continue to cite cost as the most important reason they do not do so. Almost all firms that offer coverage offer benefits to dependents such as children and the spouses of eligible employees.

FIRM OFFER RATES

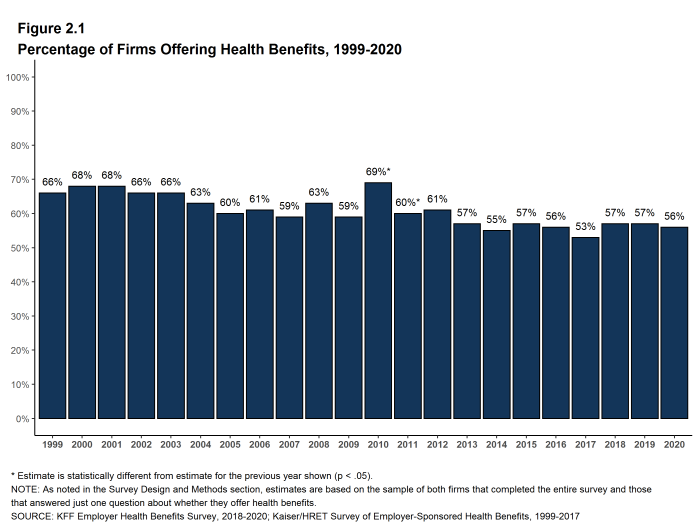

- In 2020, 56% of firms offer health benefits, similar to the percentage last year [Figure 2.1].

- The overall percentage of firms offering health benefits in 2020 is similar to the percentages offering health benefits in 2015 (57%). The percentage of offering firms in 2010 was an aberration so we are not making a 10-year comparison [Figure 2.1].

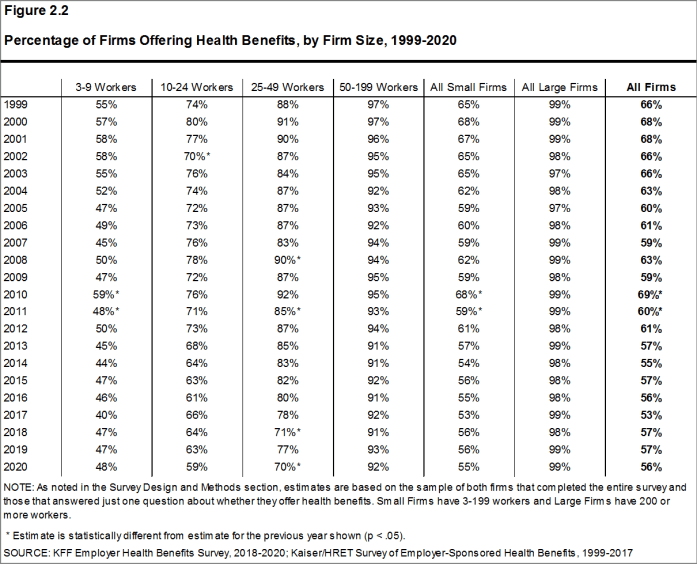

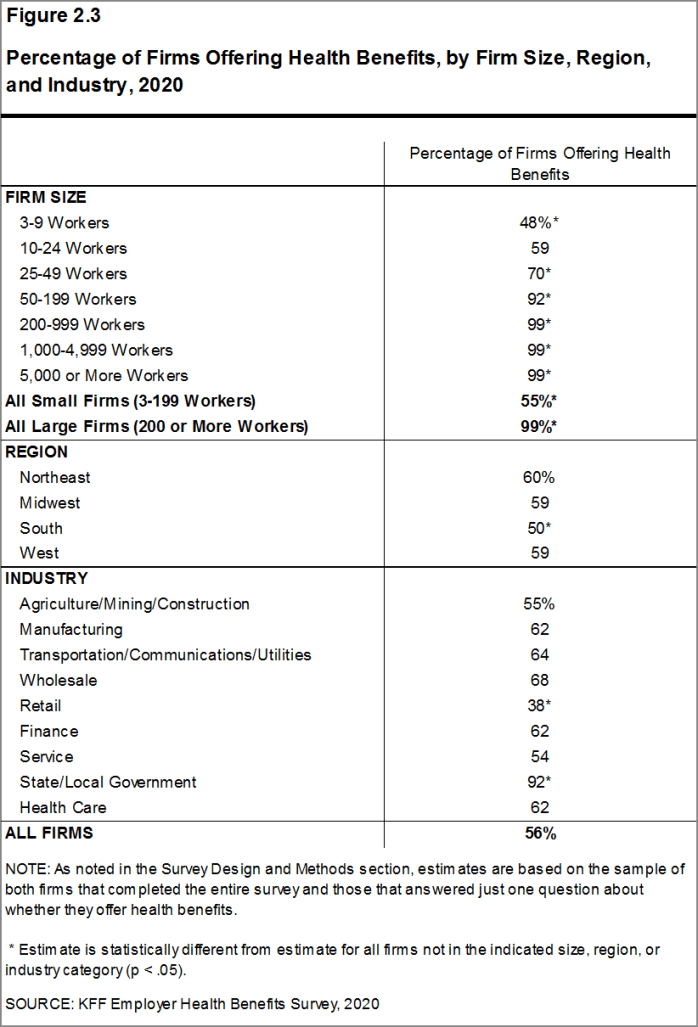

- Ninety-nine percent of large firms offer health benefits to at least some of their workers. In contrast, only 55% of small firms offer health benefits [Figure 2.2] and [Figure 2.3]. The percentages of both small and large firms offering health benefits to at least some of their workers in 2020 are similar to those last year [Figure 2.2].

- The smallest-sized firms are least likely to offer health insurance: 48% of firms with 3-9 workers offer coverage, compared to 59% of firms with 10-24 workers, 70% of firms with 25-49 workers, and 92% of firms with 50-199 workers [Figure 2.3]. Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and [Figure M.6].

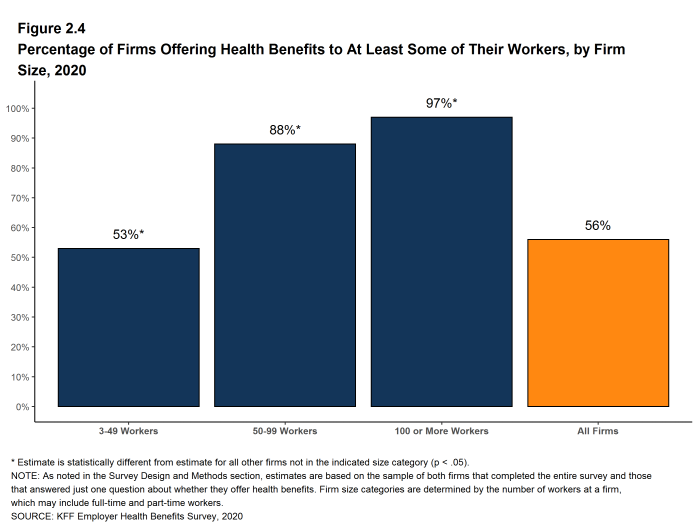

- Only 53% of firms with 3-49 workers offer health benefits to at least some of their workers, compared to 94% of firms with 50 or more workers [Figure 2.4].

- Because most workers are employed by larger firms, most workers work at a firm that offers health benefits to at least some of its employees. Eighty-nine percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.6].

Figure 2.1: Percentage of Firms Offering Health Benefits, 1999-2020

Figure 2.2: Percentage of Firms Offering Health Benefits, by Firm Size, 1999-2020

Figure 2.3: Percentage of Firms Offering Health Benefits, by Firm Size, Region, and Industry, 2020

Figure 2.4: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2020

Figure 2.5: Percentage of Firms Offering Health Benefits, by Firm Size, 1999-2020

Figure 2.6: Percentage of Workers at Firms That Offer Health Benefits to at Least Some Workers, by Firm Size, 1999-2020

PART-TIME WORKERS

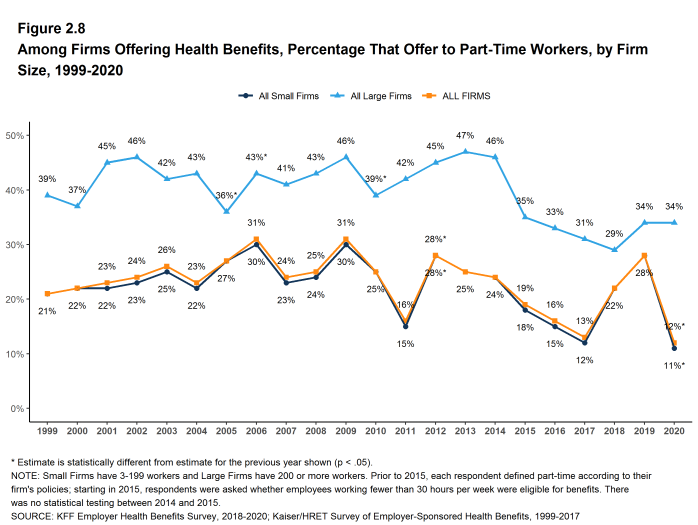

- Among firms offering health benefits, relatively few offer benefits to their part-time workers.

- The Affordable Care Act (ACA) defines full-time workers as those who on average work at least 30 hours per week, and part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer most full-time employees coverage that meets minimum standards or be assessed a penalty.13

Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

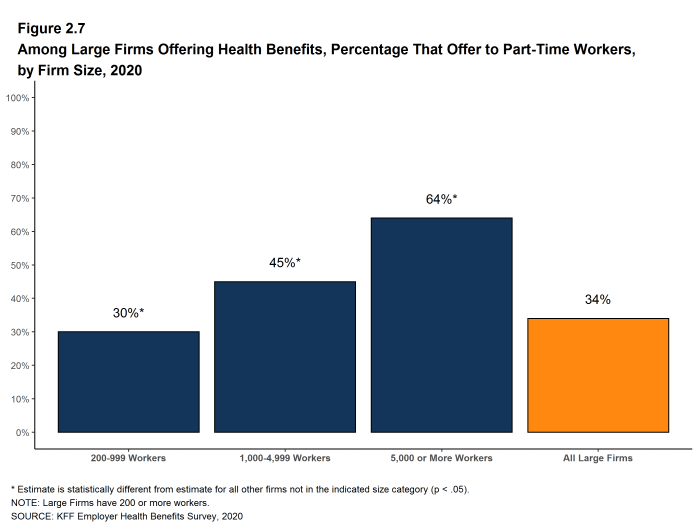

- Thirty-four percent of large firms offer health benefits in 2020 offer health benefits to part-time workers, similar to the percentage in 2019. The share of large firms offering health benefits to part-time workers increases with firm size [Figure 2.7].

Figure 2.7: Among Large Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 2020

Figure 2.8: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2020

SPOUSES AND DEPENDENTS

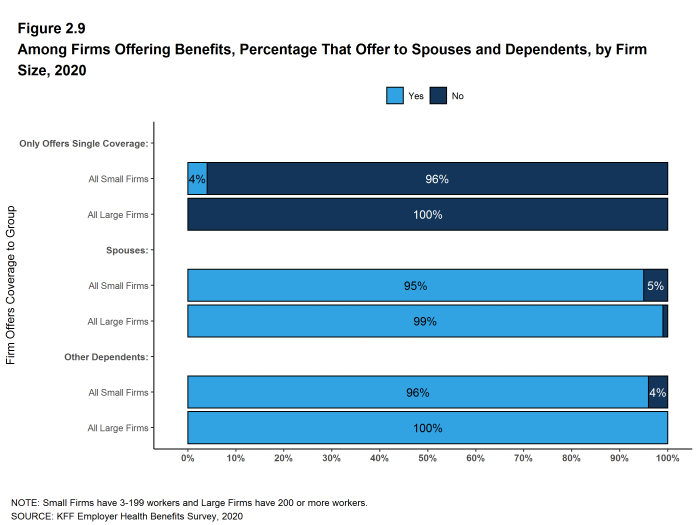

- The vast majority of firms offering health benefits offer to spouses and dependents, such as children.

- In 2020, 95% of firms offering health benefits offer coverage to spouses, similar to the percentage last year [Figure 2.9].

- Ninety-six percent of firms offering health benefits cover dependents other than spouses, such as children, similar to the percentages last year [Figure 2.9].

- Four percent of small firms offering health benefits offer only single coverage to their workers, similar to the percentage last year [Figure 2.9].

Figure 2.9: Among Firms Offering Benefits, Percentage That Offer to Spouses and Dependents, by Firm Size, 2020

SPOUSAL SURCHARGES

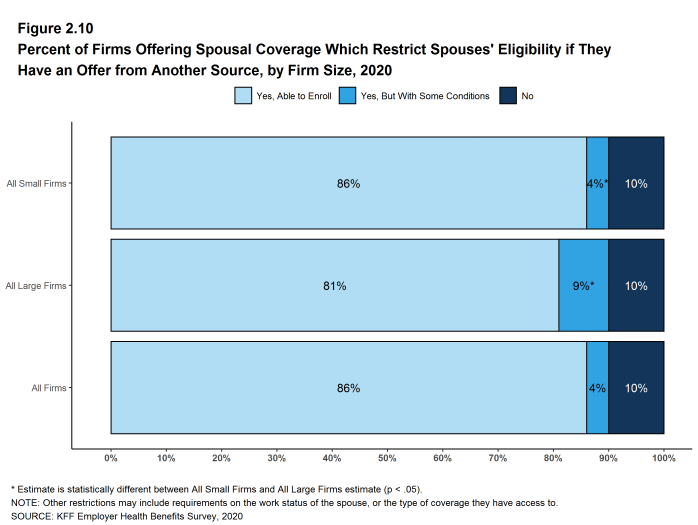

Some employers place conditions on the ability of dependent spouses to enroll in a health plan if the spouse is offered health insurance from another source, such as his or her own place of work.

- Among firms offering health benefits to spouses, 86% say that an employee’s spouse is able to enroll in the employee’s health plan even if the spouse is offered coverage from another source, 4% say the spouse can enroll subject to some conditions (for example, the type of coverage offered), and 10% say that the spouse is not eligible to enroll [Figure 2.10].

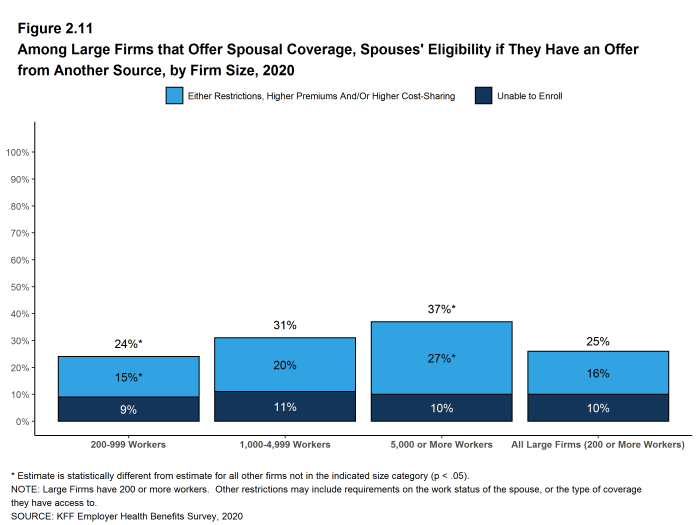

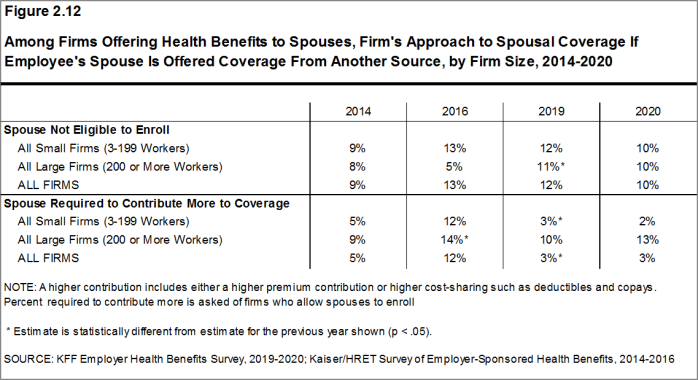

- Among large firms that say that spouses are eligible to enroll in an employee’s health plan even if the spouse has access to coverage from another source, 13% require the spouse to pay more to enroll than other spouses, such as a higher premium contribution or cost sharing [Figure 2.12].

Figure 2.10: Percent of Firms Offering Spousal Coverage Which Restrict Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2020

Figure 2.11: Among Large Firms That Offer Spousal Coverage, Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2020

Figure 2.12: Among Firms Offering Health Benefits to Spouses, Firm’s Approach to Spousal Coverage If Employee’s Spouse Is Offered Coverage From Another Source, by Firm Size, 2014-2020

FIRMS NOT OFFERING HEALTH BENEFITS

- The survey asks firms that do not offer health benefits several questions, including whether they have offered insurance or shopped for insurance in the recent past, their most important reasons for not offering coverage, and their opinion on whether their employees would prefer an increase in wages or health insurance if additional funds were available to increase their compensation. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

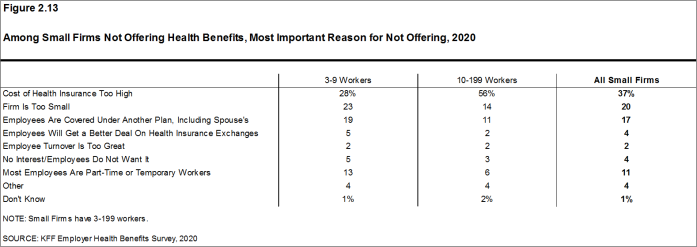

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms not offering health benefits, 37% cite high cost as “the most important reason” for not doing so. Other factors include “the firm is too small” (20%), employees are covered by another health plan (including a spouse’s plan) (17%) and “most employees are part-time or temporary workers” (11%). Few small firms indicate that they do not offer because they believe employees will get a better deal on the health insurance exchanges (4%) [Figure 2.13].

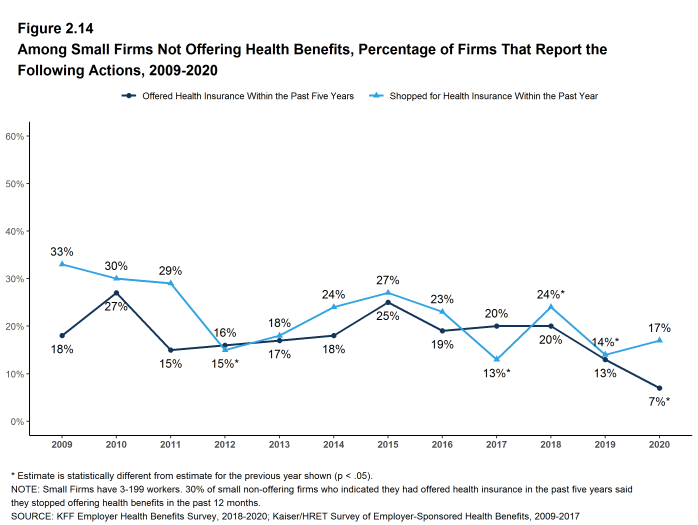

- Some small non-offering firms have either offered health insurance in the past five years or shopped for health insurance in the past year.

- Seven percent of small non-offering firms have offered health benefits in the past five years, lower than the percentage reported last year or in recent years [Figure 2.14]. We will monitor this percentage to determine if this is a single-year change or a new and different level.

- Seventeen percent of small non-offering firms have shopped for coverage in the past year, similar to the percentage last year (14%) [Figure 2.14].

- Among small non-offering firms that report they stopped offering coverage within the past five years, 30% stopped offering coverage within the past year.

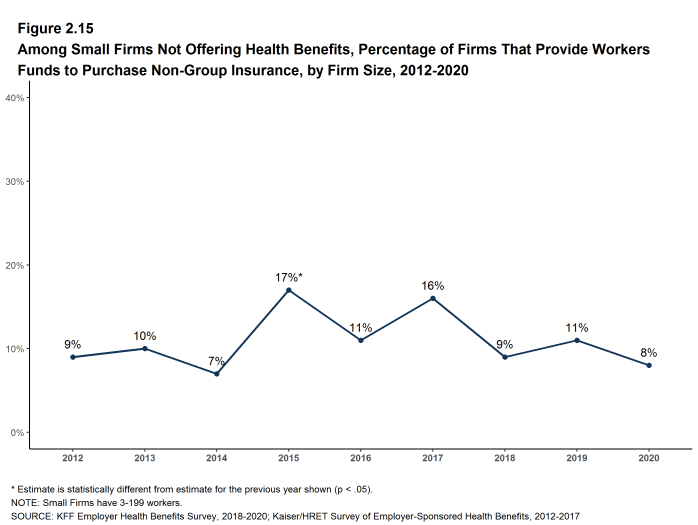

- Eight percent of small firms not offering health benefits report that they provide funds for employees to purchase insurance on their own in the individual market or through a health insurance exchange, similar to the percentage in 2019 [Figure 2.15].

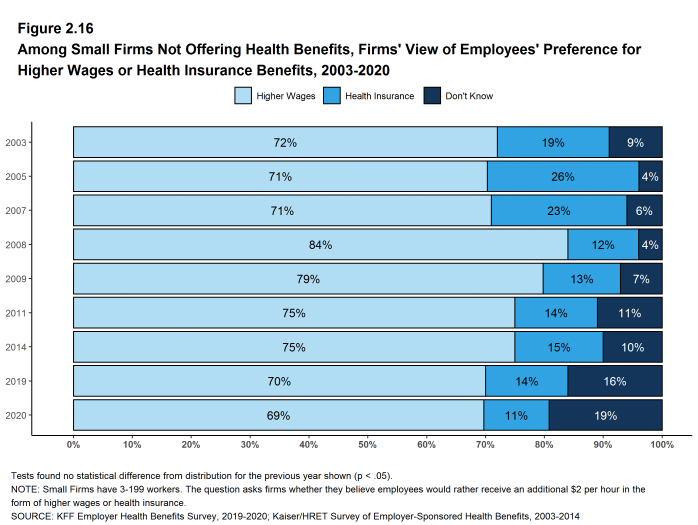

- Sixty-nine percent of small firms not offering health benefits believed that their employees would prefer a two dollar per hour increase in wages rather than health insurance. [Figure 2.16].

Figure 2.13: Among Small Firms Not Offering Health Benefits, Most Important Reason for Not Offering, 2020

Figure 2.14: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Report the Following Actions, 2009-2020

Figure 2.15: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, by Firm Size, 2012-2020

Figure 2.16: Among Small Firms Not Offering Health Benefits, Firms’ View of Employees’ Preference for Higher Wages or Health Insurance Benefits, 2003-2020

- Internal Revenue Code. 26 U.S. Code § 4980H – Shared responsibility for employers regarding health coverage. 2011. https://www.gpo.gov/fdsys/pkg/USCODE-2011-title26/pdf/USCODE-2011-title26-subtitleD-chap43-sec4980H.pdf↩︎

Employee Coverage, Eligibility, and Participation

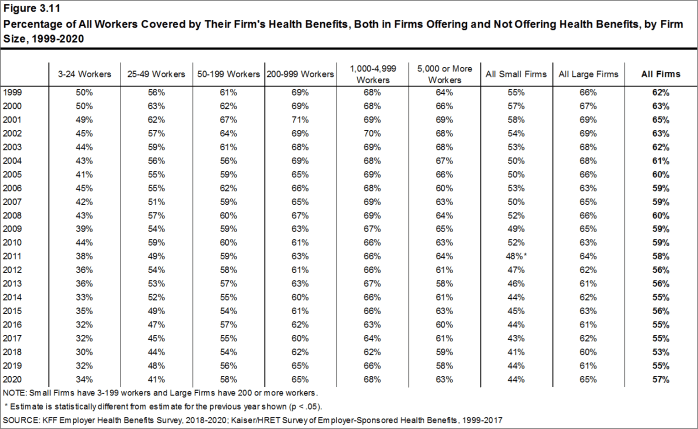

Employers are the principal source of health insurance in the United States, providing health benefits for about 157 million people.14 Most workers are offered health coverage at work, and most of the workers who are offered coverage take it. Workers may not be covered by their own employer for several reasons: their employer may not offer coverage, they may not be eligible for the benefits offered by their firm, they may elect to receive coverage through their spouse’s employer, or they may refuse coverage from their firm. In 2020, 64% of workers in firms offering health benefits are covered by their own firm, similar to the percentages last year, five years ago and ten years ago.

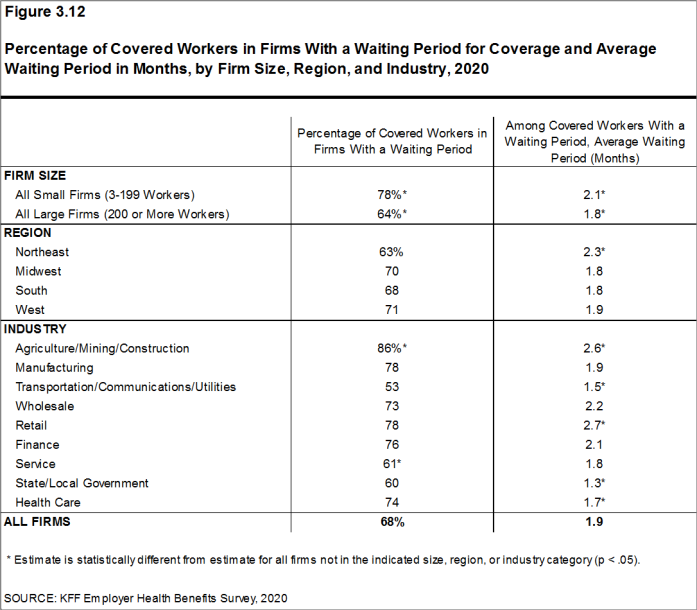

Before eligible workers may enroll in benefits at their firm, 68% of covered workers face a waiting period.

ELIGIBILITY

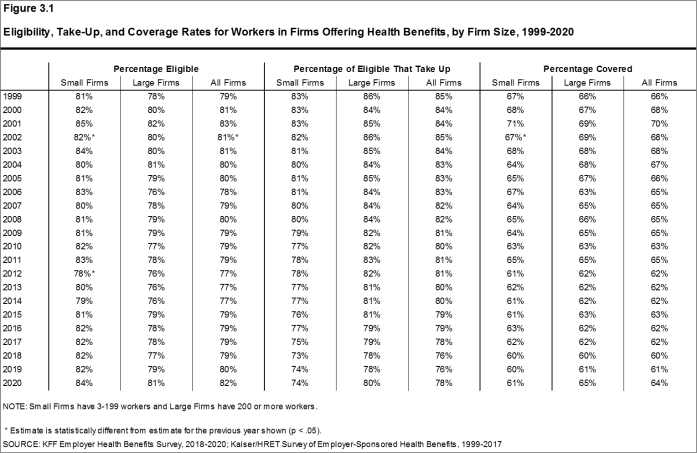

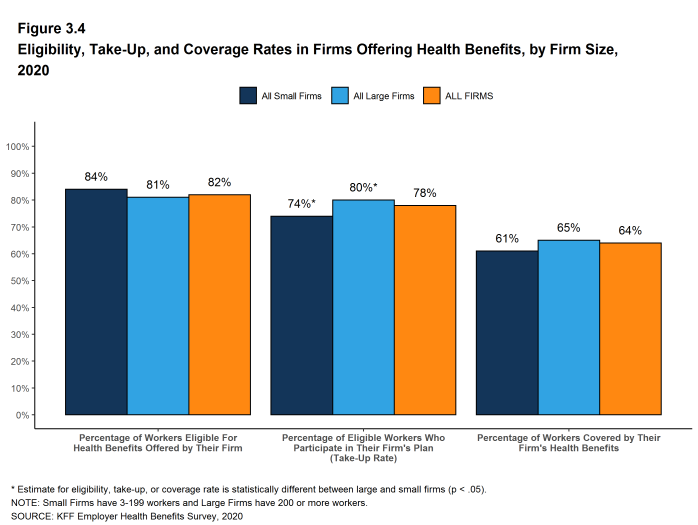

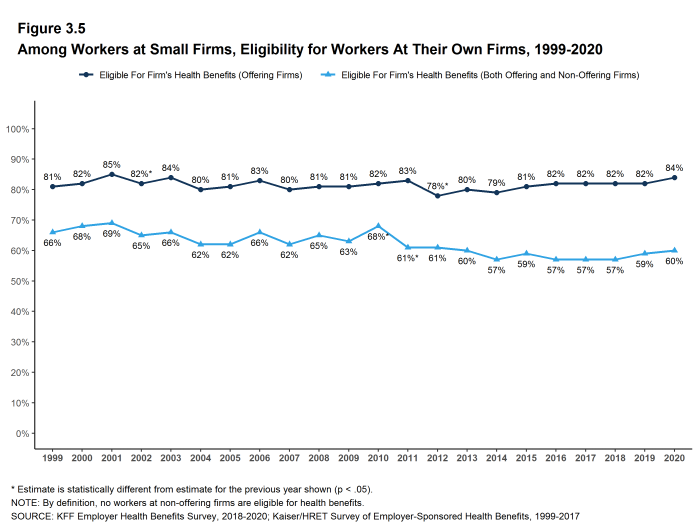

- Even in firms that offer health benefits, some workers may not be eligible to participate.15 Many firms, for example, do not offer coverage to part-time or temporary workers. Among workers in firms offering health benefits in 2020, 82% are eligible to enroll in the benefits offered by their firm, similar to the percentages last year, five years ago, and 10 years ago, for both small and large firms [Figure 3.1].

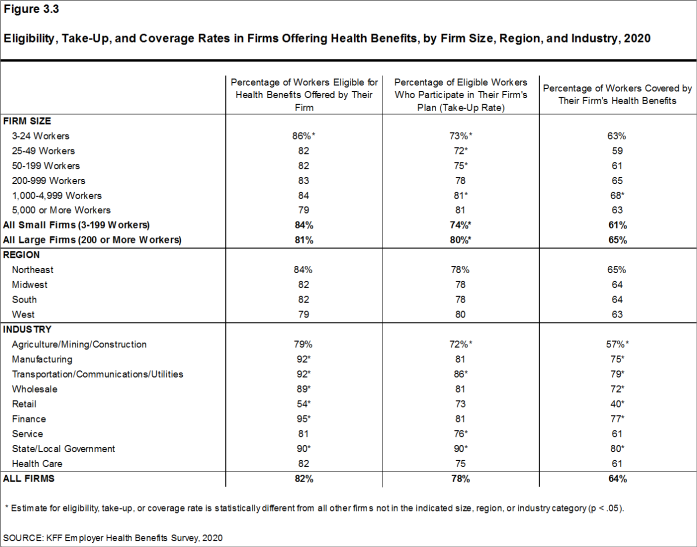

- The percentage of workers eligible to enroll in health benefits at their firm is relatively higher in firms with 3-24 workers (86%) [Figure 3.3].

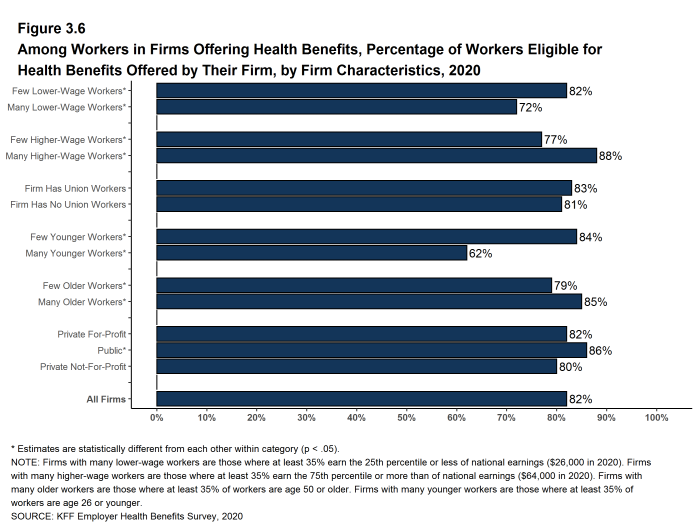

- Eligibility varies considerably by firm wage level. Workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $26,000 a year or less) have a lower average eligibility rate than workers in firms with a smaller share of lower-wage workers (72% vs. 82%) [Figure 3.6].

- Workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $64,000 or more annually) have a higher average eligibility rate than workers in firms with a smaller share of higher-wage workers (88% vs. 77%) [Figure 3.6].

- Eligibility also varies by the age of the workforce. Those in firms with a relatively small share of younger workers (where fewer than 35% of the workers are age 26 or younger) have a higher average eligibility rate than those in firms with a larger share of younger workers (84% vs. 62%) [Figure 3.6].

- Eligibility rates vary considerably for workers in different industries. The average eligibility rate remains particularly low for workers in retail firms (54%) [Figure 3.3].

Figure 3.1: Eligibility, Take-Up, and Coverage Rates for Workers in Firms Offering Health Benefits, by Firm Size, 1999-2020

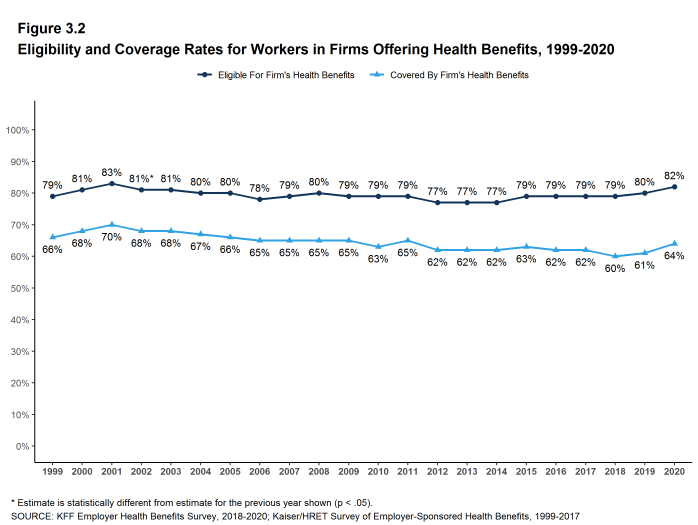

Figure 3.2: Eligibility and Coverage Rates for Workers in Firms Offering Health Benefits, 1999-2020

Figure 3.3: Eligibility, Take-Up, and Coverage Rates in Firms Offering Health Benefits, by Firm Size, Region, and Industry, 2020

Figure 3.4: Eligibility, Take-Up, and Coverage Rates in Firms Offering Health Benefits, by Firm Size, 2020

Figure 3.5: Among Workers at Small Firms, Eligibility for Workers at Their Own Firms, 1999-2020

Figure 3.6: Among Workers in Firms Offering Health Benefits, Percentage of Workers Eligible for Health Benefits Offered by Their Firm, by Firm Characteristics, 2020

TAKE-UP RATE

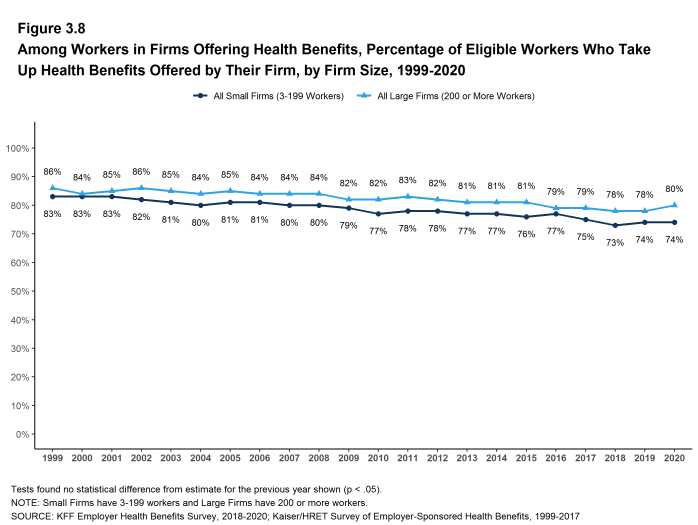

- Seventy-eight percent of eligible workers take up coverage when it is offered to them, similar to the percentage last year. The share of eligible workers taking up coverage in large firms is higher than the share in small firms [Figure 3.1].16

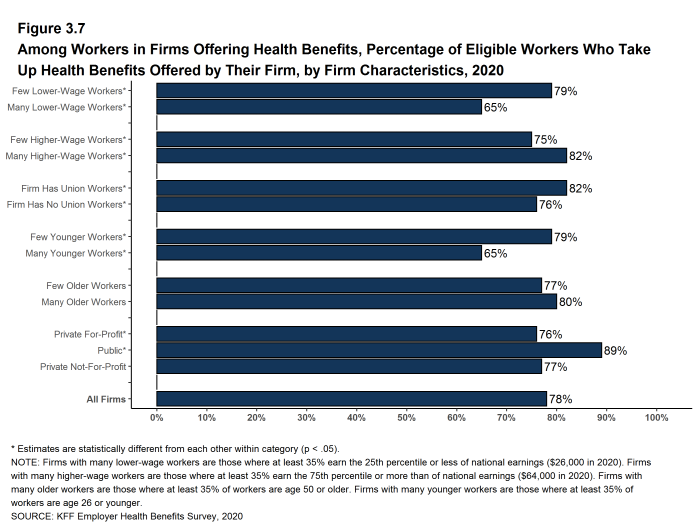

- The likelihood of a worker accepting a firm’s offer of coverage varies by firm wage level. Eligible workers in firms with a relatively large share of lower-wage workers have a lower average take up rate than eligible workers in firms with a smaller share of lower-wage workers (65% vs. 79%) [Figure 3.7].

- Eligible workers in firms with a relatively large share of higher-wage workers have a higher average take up rate than those in firms with a smaller share of higher-wage workers (82% vs. 75%) [Figure 3.7].

- The likelihood of a worker accepting a firm’s offer of coverage also varies with the age distribution of the workforce. Eligible workers in firms with a relatively large share of younger workers have a lower average take up rate than those in firms with a smaller share of younger workers (65% vs. 79%) [Figure 3.7].

- Eligible workers in private, for-profit firms have a lower average take up rate (76%) and eligible workers in public firms have a higher average take up rate (89%) than workers in other firm types [Figure 3.7].

- Eligible workers in firms with some union workers have a higher average takeup rate than those in firms with no union workers (82% vs. 76%) [Figure 3.7].

- The average percentages of eligible workers taking up benefits in offering firms also varies across industries [Figure 3.3].

- The share of eligible workers taking up benefits in offering firms (78%) is similar to the shares in 2015 (79%) and in 2010 (80%) [Figure 3.1].

Figure 3.7: Among Workers in Firms Offering Health Benefits, Percentage of Eligible Workers Who Take Up Health Benefits Offered by Their Firm, by Firm Characteristics, 2020

Figure 3.8: Among Workers in Firms Offering Health Benefits, Percentage of Eligible Workers Who Take Up Health Benefits Offered by Their Firm, by Firm Size, 1999-2020

COVERAGE

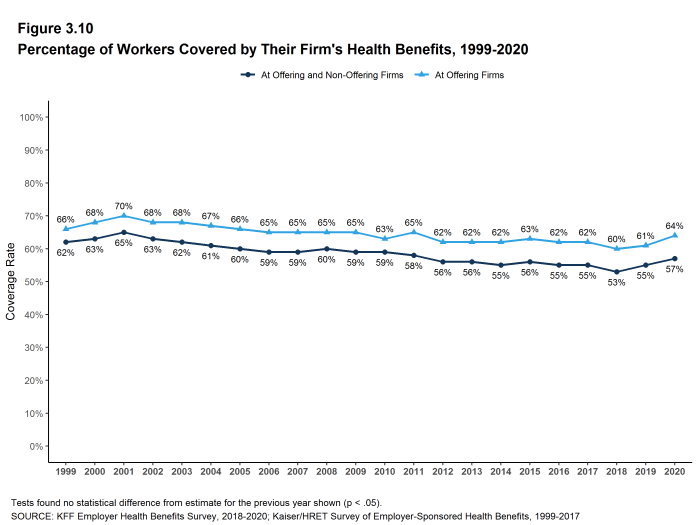

- In 2020, the percentage of workers at firms offering health benefits covered by their firm’s health plan is 64%, similar to the percentage last year [Figure 3.1] and [Figure 3.2].

- The coverage rate at firms offering health benefits is similar for small firms and large firms in 2020. These rates are similar to the rates last year for both small firms and large firms [Figure 3.1] and [Figure 3.3].

- There is significant variation by industry in the coverage rate among workers in firms offering health benefits. The average coverage rate is particularly low in the retail industry (40%) [Figure 3.3].

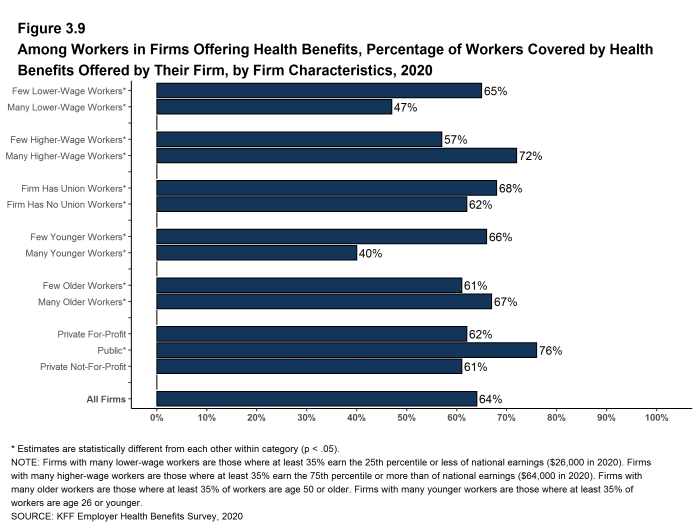

- There also is variation by firm wage levels. Among workers in firms offering health benefits, those in firms with a relatively large share of lower-wage workers are less likely to be covered by their own firm than workers in firms with a smaller share of lower-wage workers (47% vs. 65%). A similar pattern exists in firms with a relatively large share of higher-wage workers, with workers in these firms being more likely to be covered by their employer’s health benefits than those in firms with a smaller share of higher-wage workers (72% vs. 57%) [Figure 3.9].

- The age distribution of workers is also related to variation in coverage rates. Among workers in firms offering health benefits, those in firms with a relatively small share of younger workers are more likely to be covered by their own firm than those in firms with a larger share of younger workers (66% vs. 40%). Similarly, workers in offering firms with a relatively large share of older workers are more likely to be covered by their own firm than those in firms with a smaller share of older workers (67% vs. 61%) [Figure 3.9].

- Among workers in firms offering health benefits, those working in public firms are more likely than workers in other firm types to be covered by their own firm [Figure 3.9].

- Among workers in all firms, including those that offer and those that do not offer health benefits, 57% are covered by health benefits offered by their employer, similar to the percentages last year and five years ago [Figure 3.10]. The offer rate estimate for 2010 was an aberration so we are not making a coverage rate comparison to ten years ago.

Figure 3.9: Among Workers in Firms Offering Health Benefits, Percentage of Workers Covered by Health Benefits Offered by Their Firm, by Firm Characteristics, 2020

Figure 3.10: Percentage of Workers Covered by Their Firm’s Health Benefits, 1999-2020

Figure 3.11: Percentage of All Workers Covered by Their Firm’s Health Benefits, Both in Firms Offering and Not Offering Health Benefits, by Firm Size, 1999-2020

WAITING PERIODS

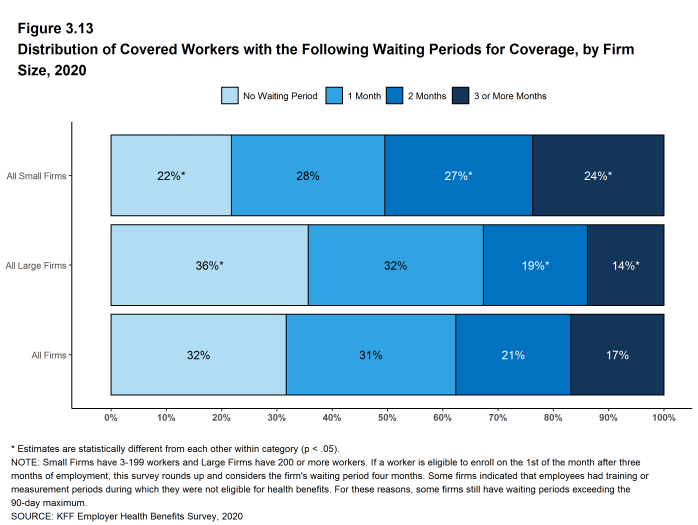

- Waiting periods are a specified length of time after beginning employment before a worker is eligible to enroll in health benefits. With some exceptions, the Affordable Care Act (ACA) requires that waiting periods cannot exceed 90 days. For example, employers are permitted to have orientation periods before the waiting period begins which, in effect, means a worker is not eligible for coverage three months after being hired. If a worker is eligible to enroll on the 1st of the month after three months of employment, this survey rounds up and considers the firm’s waiting period four months. For these reasons, some employers still have waiting periods exceeding the 90-day maximum.

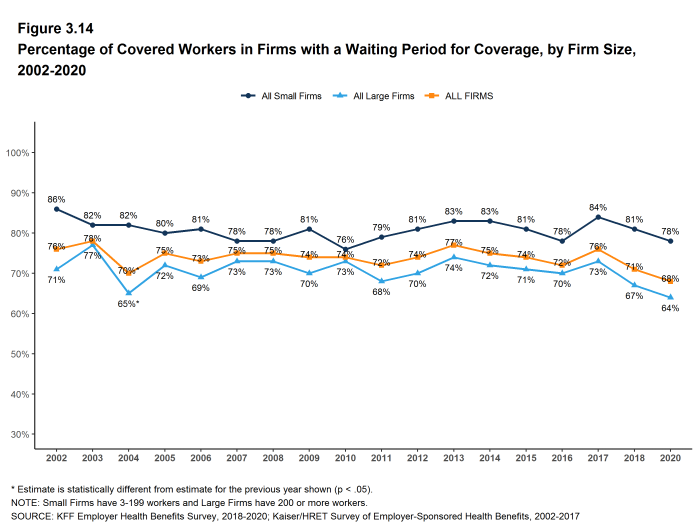

- Sixty-eight percent of covered workers face a waiting period before coverage is available, similar to two years ago [Figure 3.12]. Covered workers in small firms are more likely than those in large firms to have a waiting period (78% vs. 64%) [Figure 3.12].

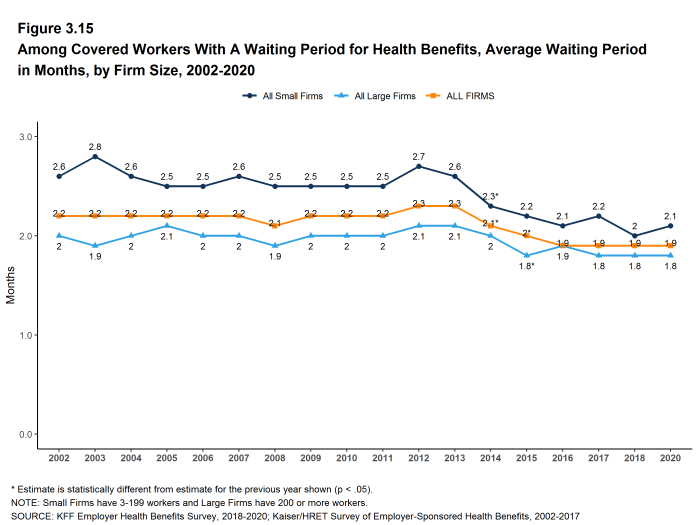

- The average waiting period among covered workers who face a waiting period is 1.9 months [Figure 3.12]. A small percentage (5%) of covered workers with a waiting period have a waiting period of more than 3 months.

- Respondents with waiting periods greater than 4 months generally indicated that employees had training, orientation, or measurement periods in which they were employees but were not eligible for health benefits. Some employers have measurement periods to determine whether variable hour employees will meet the requirements for the firm’s health benefits.

Figure 3.12: Percentage of Covered Workers in Firms With a Waiting Period for Coverage and Average Waiting Period in Months, by Firm Size, Region, and Industry, 2020

Figure 3.13: Distribution of Covered Workers With the Following Waiting Periods for Coverage, by Firm Size, 2020

Figure 3.14: Percentage of Covered Workers in Firms With a Waiting Period for Coverage, by Firm Size, 2002-2020

Figure 3.15: Among Covered Workers With a Waiting Period for Health Benefits, Average Waiting Period in Months, by Firm Size, 2002-2020

- Kaiser Family Foundation. Health Insurance Coverage of the Total Population [Internet]. KFF (Kaiser Family Foundation). 2019 [cited 2020 Aug 10]. Available from: https://www.kff.org/other/state-indicator/total-population/ Coverage is based on calculations from the 2018 American Community Survey. During the winter and spring of 2020, there was a steep increase in the unemployment rate, potentially decreasing the number of people covered by employer coverage.↩︎

- See Section 2 for part-time and temporary worker offer rates.↩︎

- In 2009, we began weighting the percentage of workers that take up coverage by the number of workers eligible for coverage. The historical take-up estimates have also been updated. See the Survey Design and Methods section for more information.↩︎

Types of Plans Offered

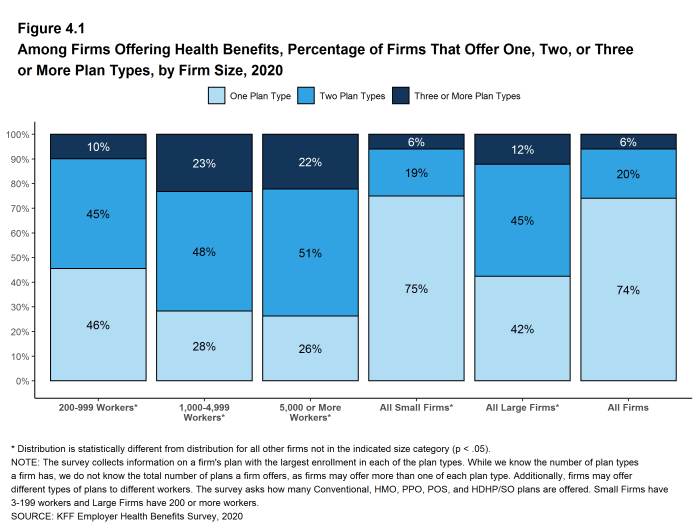

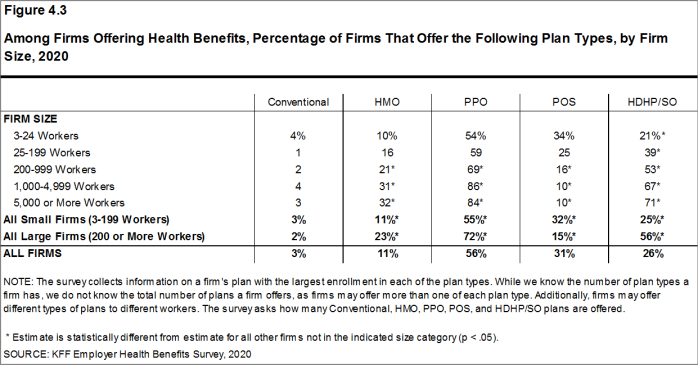

Most firms that offer health benefits offer only one type of health plan (74%). Large firms (200 or more workers) are more likely than small firms (3-199 workers) to offer more than one type of health plan. Firms are most likely to offer their workers a PPO plan and are least likely to offer a conventional plan (sometimes known as indemnity insurance).

NUMBER OF PLAN TYPES OFFERED

- In 2020, 74% of firms offering health benefits offer only one type of health plan. Large firms are more likely than small firms to offer more than one plan type (58% vs. 25%) [Figure 4.1].

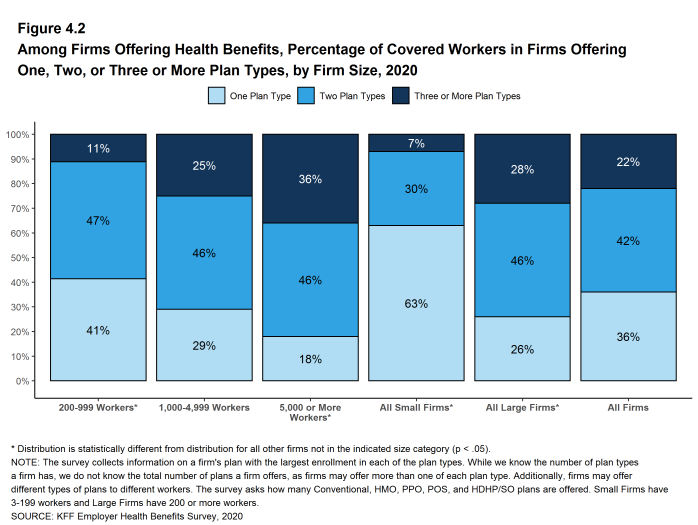

- Sixty-four percent of covered workers are employed in a firm that offers more than one type of health plan. Seventy-four percent of covered workers in large firms are employed by a firm that offers more than one plan type, compared to 37% in small firms [Figure 4.2].

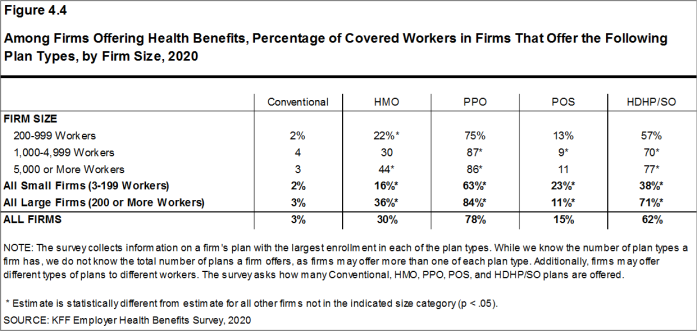

- Seventy-eight percent of covered workers in firms offering health benefits work in firms that offer one or more PPOs; 62% work in firms that offer one or more HDHP/SOs; 30% work in firms that offer one or more HMOs; 15% work in firms that offer one or more POS plans; and 3% work in firms that offer one or more conventional plans [Figure 4.4].

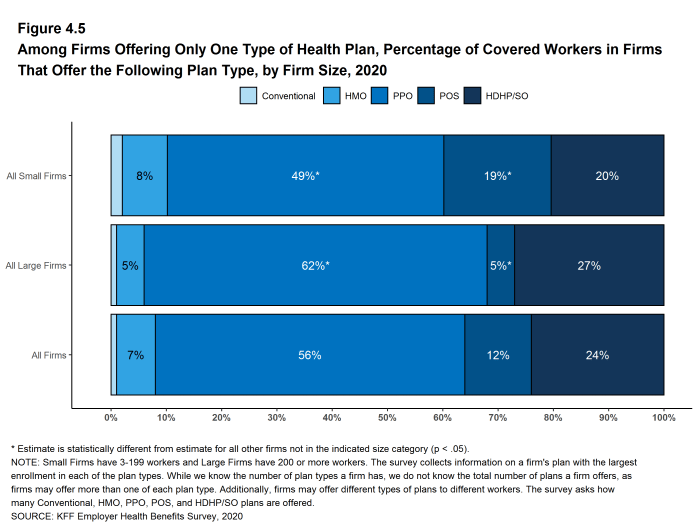

- Among covered workers in firms offering only one type of health plan, 56% are in firms that only offer one or more PPOs and 24% are in firms that only offer one or more HDHP/SOs [Figure 4.5].

Figure 4.1: Among Firms Offering Health Benefits, Percentage of Firms That Offer One, Two, or Three or More Plan Types, by Firm Size, 2020

Figure 4.2: Among Firms Offering Health Benefits, Percentage of Covered Workers in Firms Offering One, Two, or Three or More Plan Types, by Firm Size, 2020

Figure 4.3: Among Firms Offering Health Benefits, Percentage of Firms That Offer the Following Plan Types, by Firm Size, 2020

Figure 4.4: Among Firms Offering Health Benefits, Percentage of Covered Workers in Firms That Offer the Following Plan Types, by Firm Size, 2020

Figure 4.5: Among Firms Offering Only One Type of Health Plan, Percentage of Covered Workers in Firms That Offer the Following Plan Type, by Firm Size, 2020

CHOICE OF HDHP/SO PLANS

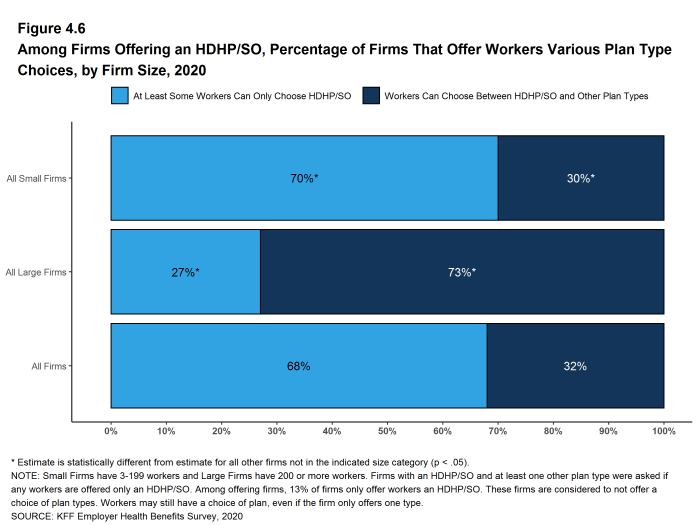

- Some firms only offer workers an HDHP/SO, or do not make other plan choices available to some workers. At 68% of firms that offer an HDHP/SO, at least some workers can only choose an HDHP/SO, while 32% of firms that offer an HDHP/SO allow workers to choose between an HDHP/SO and other plan types [Figure 4.6].

Figure 4.6: Among Firms Offering an HDHP/SO, Percentage of Firms That Offer Workers Various Plan Type Choices, by Firm Size, 2020

The survey collects information on a firm’s plan with the largest enrollment in each of the plan types. While we know the number of plan types a firm has, we do not know the total number of plans a firm offers workers. In addition, firms may offer different types of plans to different workers. For example, some workers might be offered one type of plan at one location, while workers at another location are offered a different type of plan.

Market Shares of Health Plans

PPOs are the most common plan type, covering 47% of covered workers, followed by HDHP/SOs, HMOs, POS plans, and conventional plans. The drop in the share of covered workers in PPOs in 2019 was not statistically significant.

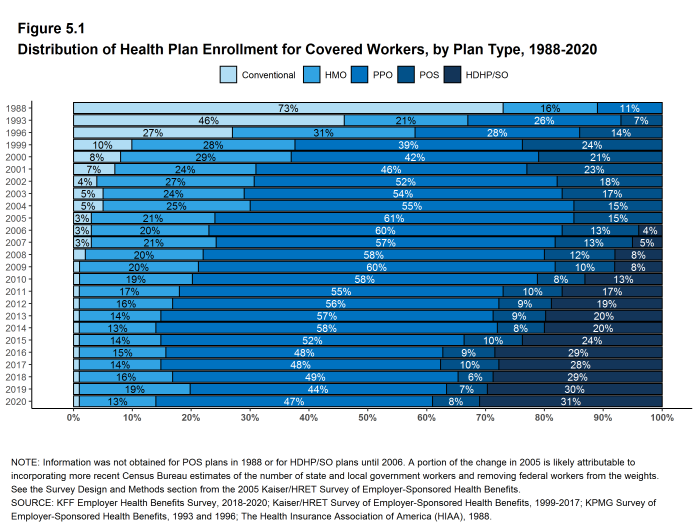

- Forty-seven percent of covered workers are enrolled in PPOs, followed by HDHP/SOs (31%), HMOs (13%), POS plans (8%), and conventional plans (1%) [Figure 5.1].

- The percentage of covered workers enrolled in HDHP/SOs is similar to last year, but has increased over the past decade. The percentage of covered workers enrolled in PPOs decreased by 11% over the past decade.

- The percentage of covered workers enrolled in HMOs (13%) is significantly lower than the percentage last year (19%) but not different from 2015 (14%). This percentage has moved over the last few years and we are unsure as to why. As noted above, we employed a new survey firm in 2020 and the change could represent a difference in interpretation of plan characteristics by new interviewers. There also may be measurement error in any of they years. We will continue to watch this topic.

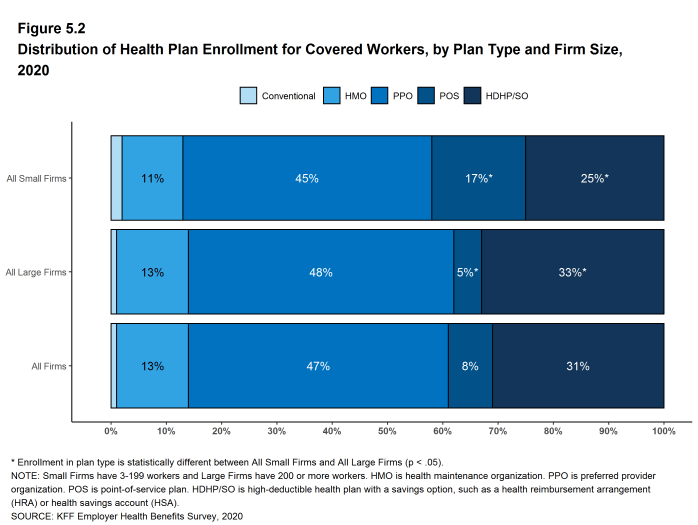

- A larger share of covered workers are enrolled in HDHP/SOs than in HMOs in small and large firms.

- Covered workers in large firms are more likely to be enrolled in HDHP/SOs than covered workers in small firms (33% vs. 25%)[Figure 5.2]. Covered workers in small firms are much more likely than covered workers in large firms to be enrolled in POS plans (17% vs. 5%) [Figure 5.2].

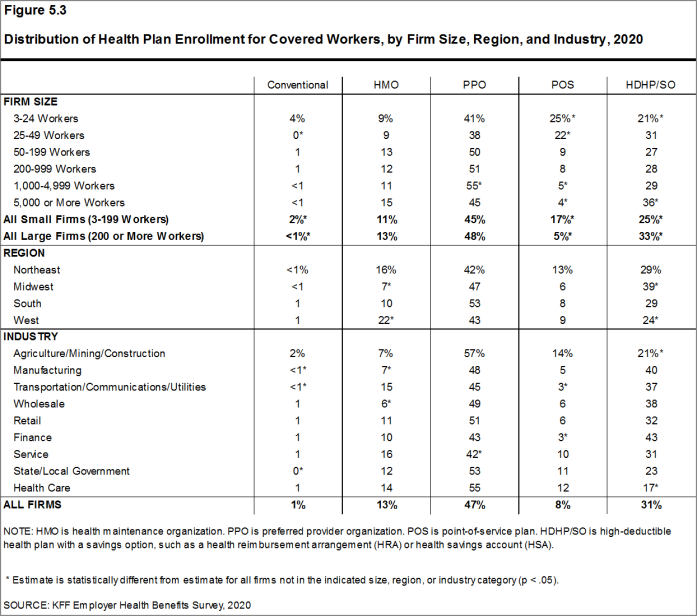

- Plan enrollment patterns also differ across regions.

- HMO enrollment is significantly higher in the West (22%), and significantly lower in the Midwest (7%) [Figure 5.3].

- Covered workers in the Midwest (39%) are more likely to be enrolled in HDHP/SOs than workers in other regions, while covered workers in the West (24%) are less likely to be enrolled in HDHP/SOs [Figure 5.3].

Figure 5.1: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type, 1988-2020

Figure 5.2: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2020

Figure 5.3: Distribution of Health Plan Enrollment for Covered Workers, by Firm Size, Region, and Industry, 2020

Worker and Employer Contributions For Premiums

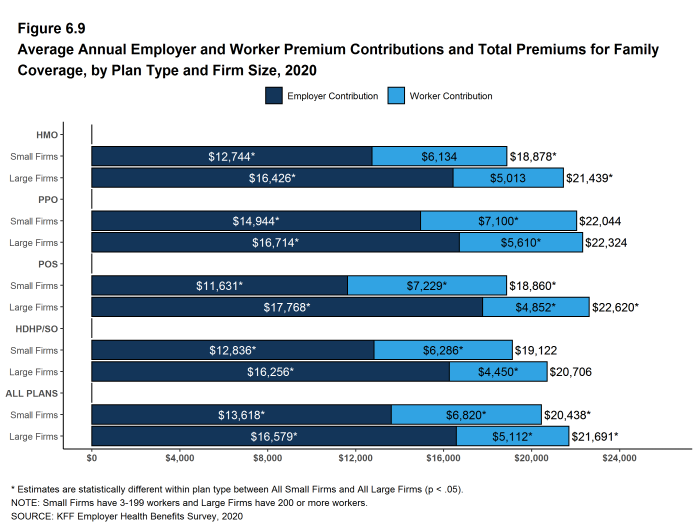

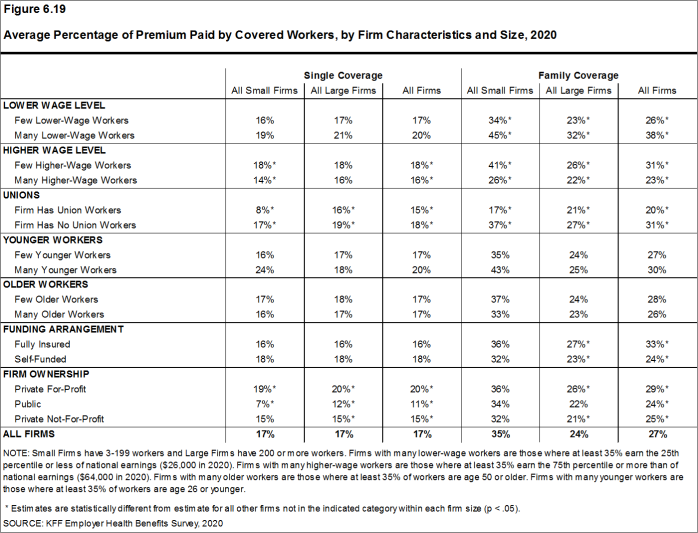

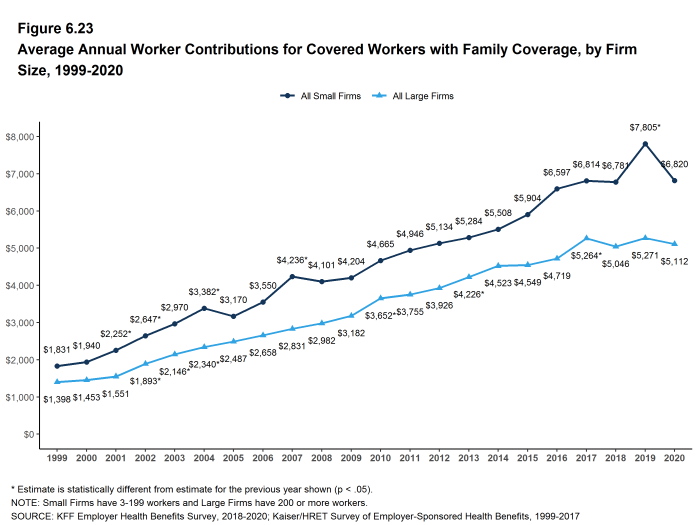

In 2020, covered workers on average contribute 17% of the premium for single coverage and 27% of the premium for family coverage.17 The average monthly worker contributions are $104 for single coverage ($1,243 annually) and $466 for family coverage ($5,588 annually). The average contribution amount for family coverage is higher for covered workers in small firms (3-199 workers) than for covered workers in large firms (200 or more workers) ($6,820 vs. $5,112).

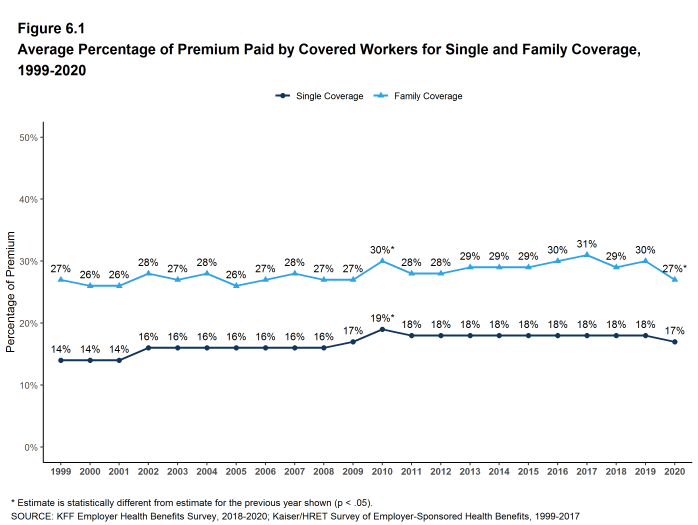

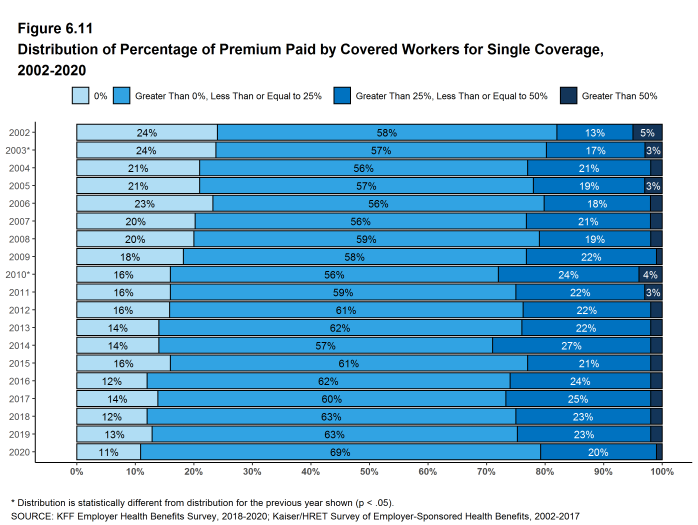

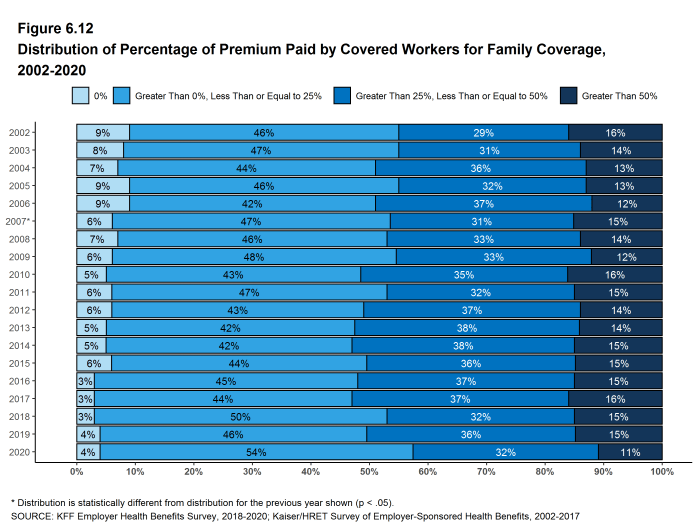

- In 2020, covered workers on average contribute 17% of the premium for single coverage and 27% of the premium for family coverage. The average percentage contributed for single coverage has remained stable in recent years. The average percentage contributed for family coverage is lower in 2020 than the percentage (30%) last year [Figure 6.1].18

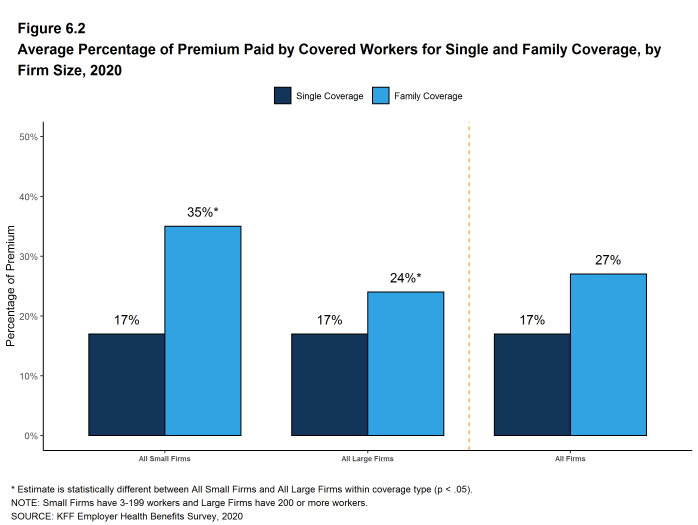

- Covered workers in small firms on average contribute a much higher percentage of the premium for family coverage (35% vs. 24%) than covered workers in large firms [Figure 6.2].

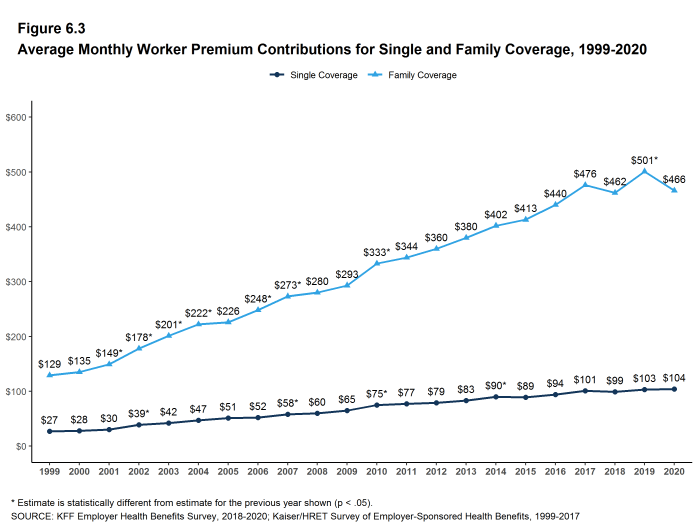

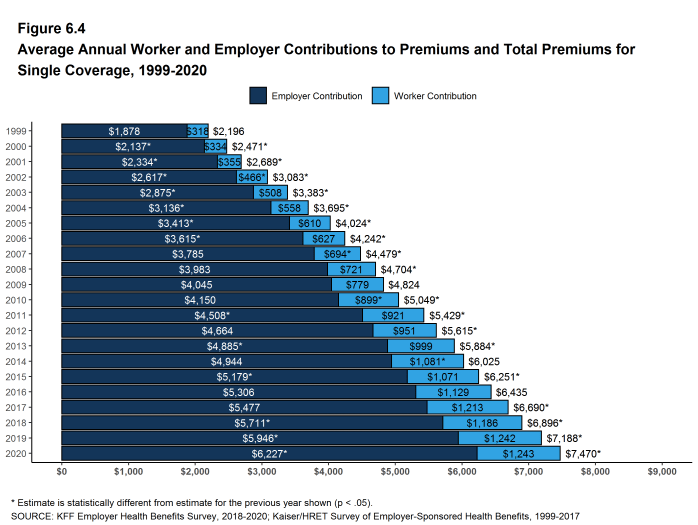

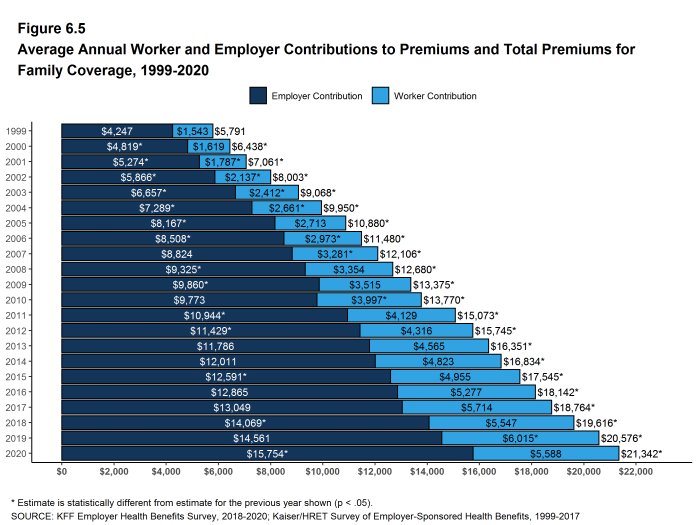

- Workers with single coverage have an average contribution of $104 per month ($1,243 annually), and workers with family coverage have an average contribution of $466 per month ($5,588 annually) toward their health insurance premiums [Figure 6.3], [Figure 6.4], and [Figure 6.5].

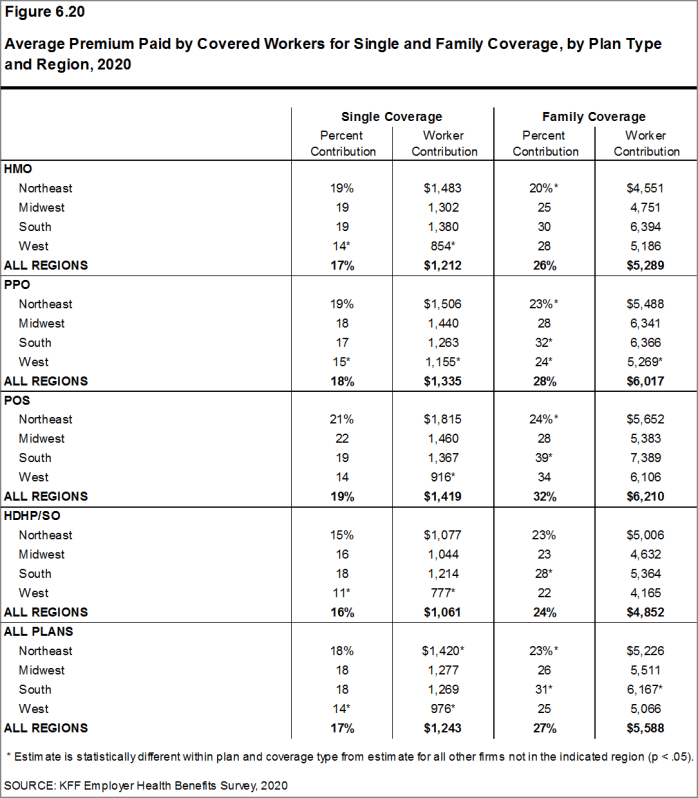

- The average worker contributions in HDHP/SOs are lower than the overall average worker contribution for single coverage ($1,061 vs. $1,243) and family coverage ($4,852 vs. $5,588). The average worker contributions in PPOs are higher than the overall average worker contribution for family coverage ($6,017 vs. $5,588) [Figure 6.6].

- Worker contributions also differ by firm size.

- Covered workers in small firms on average contribute significantly more annually for family coverage than covered workers in large firms ($6,820 vs. $5,112). The average contributions amounts for covered workers in small and large firms are similar for single coverage [Figure 6.7].

Figure 6.1: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2020

Figure 6.2: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2020

Figure 6.3: Average Monthly Worker Premium Contributions for Single and Family Coverage, 1999-2020

Figure 6.4: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2020

Figure 6.5: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2020

Figure 6.6: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Plan Type, 2020

Figure 6.7: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Firm Size, 2020

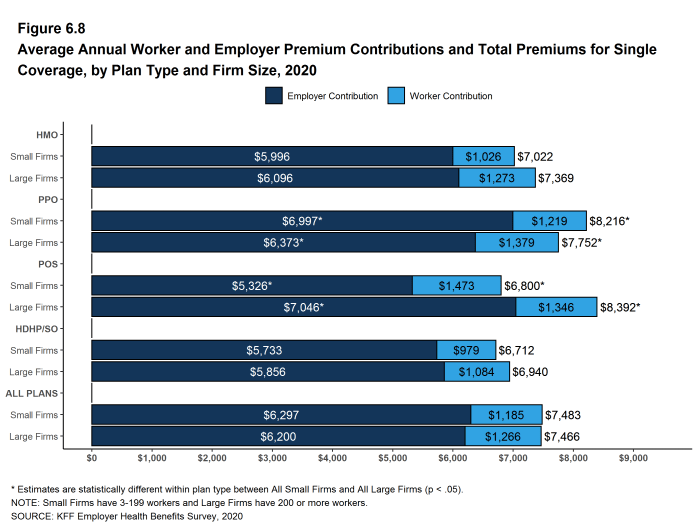

Figure 6.8: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single Coverage, by Plan Type and Firm Size, 2020

Figure 6.9: Average Annual Employer and Worker Premium Contributions and Total Premiums for Family Coverage, by Plan Type and Firm Size, 2020

DISTRIBUTIONS OF WORKER CONTRIBUTIONS TO THE PREMIUM

- About nine-tenths of covered workers are in a plan where the employer contributes at least half of the premium for both single and family coverage.

- Eleven percent of covered workers are in a plan where the employer pays the entire premium for single coverage, while only 4% of covered workers are in a plan where the employer pays the entire premium for family coverage [Figure 6.10].

- Covered workers in small firms are much more likely than covered workers in large firms to be in a plan where the employer pays the entire premium.

- Twenty-seven percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 4% of covered workers in large firms [Figure 6.10].

- For family coverage, 10% of covered workers in small firms have an employer that pays the full premium, compared to 1% of covered workers in large firms [Figure 6.10].

- Eleven percent of covered workers are in a plan with a worker contribution of more than half of the premium for family coverage [Figure 6.10].

- Twenty-eight percent of covered workers in small firms work in a firm where the worker contribution for family coverage is more than 50% of the premium, a much higher percentage than the 4% of covered workers in large firms [Figure 6.10].

- Small shares of covered workers in small firms (3%) and large firms (1%) must pay more than 50% of the premium for single coverage [Figure 6.10].

- There is substantial variation among workers in both small and large firms in the dollar amounts they must contribute.

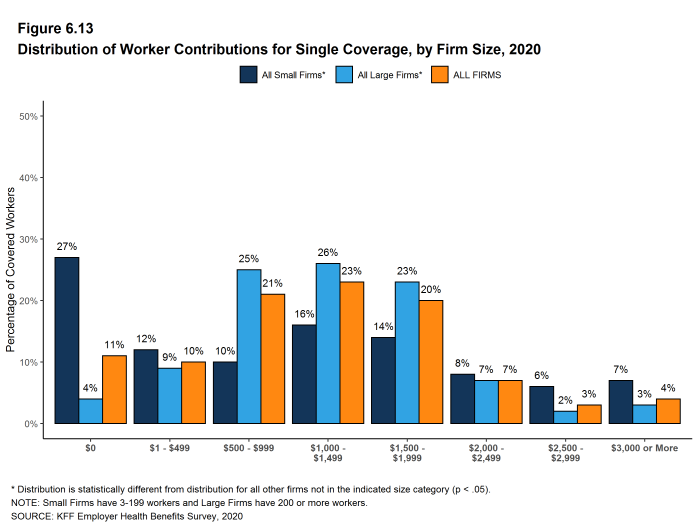

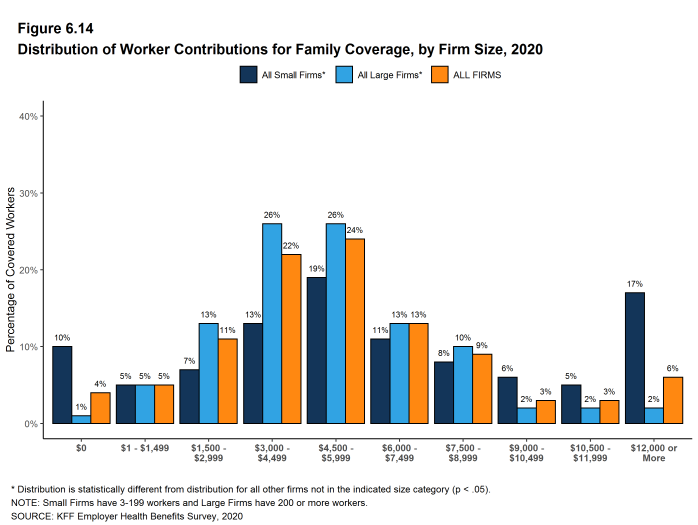

- Among covered workers in small firms, 39% have a contribution for single coverage of less than $500, while 21% have a contribution of $2,000 or more. For family coverage, 15% have a contribution of less than $1,500, while 22% have a contribution of $10,500 or more [Figure 6.13] and [Figure 6.14].

- Among covered workers in large firms, 13% have a contribution for single coverage of less than $500, while 12% have a contribution of $2,000 or more. For family coverage, 6% have a contribution of less than $1,500, while only 4% have a contribution of $10,500 or more [Figure 6.13] and [Figure 6.14].

Figure 6.10: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2020

Figure 6.11: Distribution of Percentage of Premium Paid by Covered Workers for Single Coverage, 2002-2020

Figure 6.12: Distribution of Percentage of Premium Paid by Covered Workers for Family Coverage, 2002-2020

Figure 6.13: Distribution of Worker Contributions for Single Coverage, by Firm Size, 2020

Figure 6.14: Distribution of Worker Contributions for Family Coverage, by Firm Size, 2020

DIFFERENCES BY FIRM CHARACTERISTICS

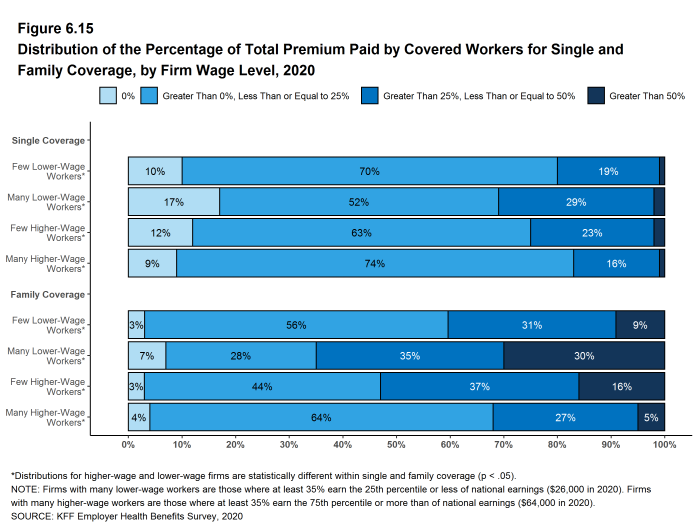

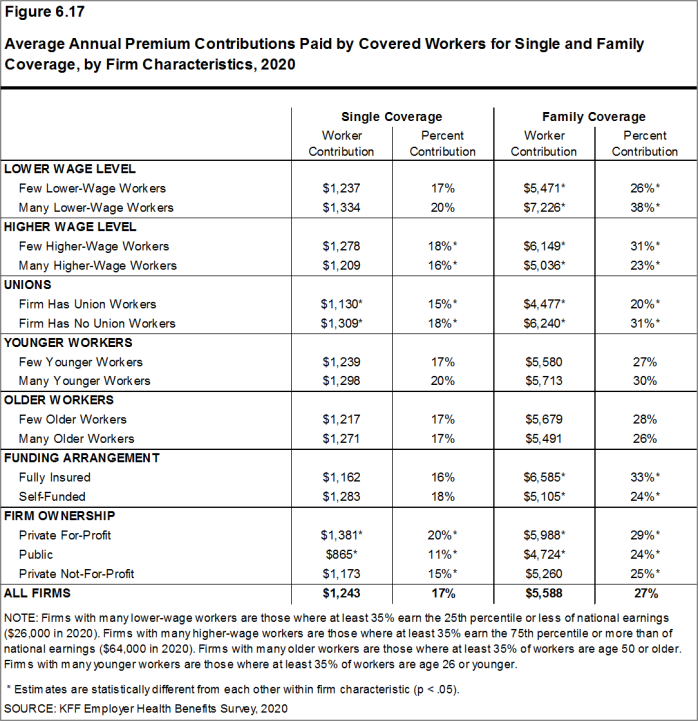

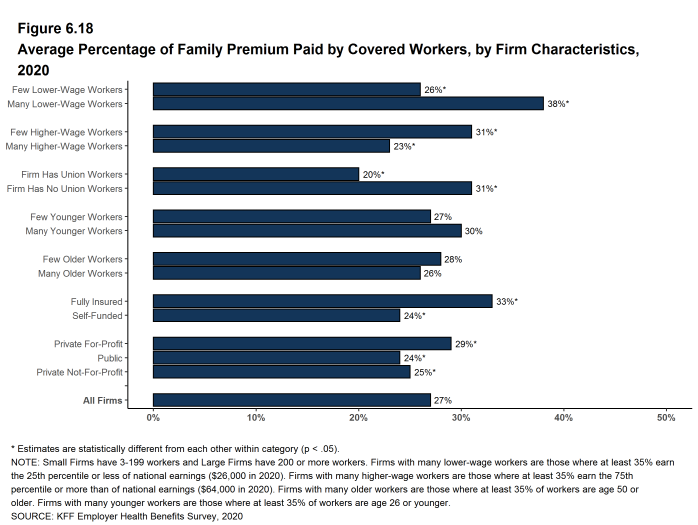

- The percentage of the premium paid by covered workers also varies by firm characteristics.

- Covered workers in private, for-profit firms have relatively high premium contributions for single ($1,381) and family ($5,988) coverage. Covered workers in public firms have relatively low premium contributions for single ($865) and family ($4,724) coverage [Figure 6.17] .

- Covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $26,000 a year or less) have a higher average contribution rate for family coverage (38% vs. 26%) than those in firms with a smaller share of lower-wage workers [Figure 6.17].

- Covered workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $64,000 or more annually) have lower average contribution rates for single coverage (16% vs. 18%) and for family coverage (23% vs. 31%) than those in firms with a smaller share of higher-wage workers [Figure 6.17].

- Covered workers in firms that have at least some union workers have lower average contribution rates for single coverage (15% vs. 18%) for family coverage (20% vs. 31%) than those in firms without any union workers [Figure 6.17].

- Covered workers in firms that are partially or completely self-funded on average have a lower average contribution rate for family coverage than workers in firms that are fully-insured (24% vs. 33%) [Figure 6.17].19

Figure 6.15: Distribution of the Percentage of Total Premium Paid by Covered Workers for Single and Family Coverage, by Firm Wage Level, 2020

Figure 6.16: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Wage Level, 2020

Figure 6.17: Average Annual Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Characteristics, 2020

Figure 6.18: Average Percentage of Family Premium Paid by Covered Workers, by Firm Characteristics, 2020

Figure 6.19: Average Percentage of Premium Paid by Covered Workers, by Firm Characteristics and Size, 2020

DIFFERENCES BY REGION AND INDUSTRY

- The average worker contribution rate for single coverage is lower in the West (14%) than in other regions [Figure 6.20].

- The average worker contribution rate for family coverage is lower in the Northeast (23%) and higher in the South (31%) than in other regions [Figure 6.20].

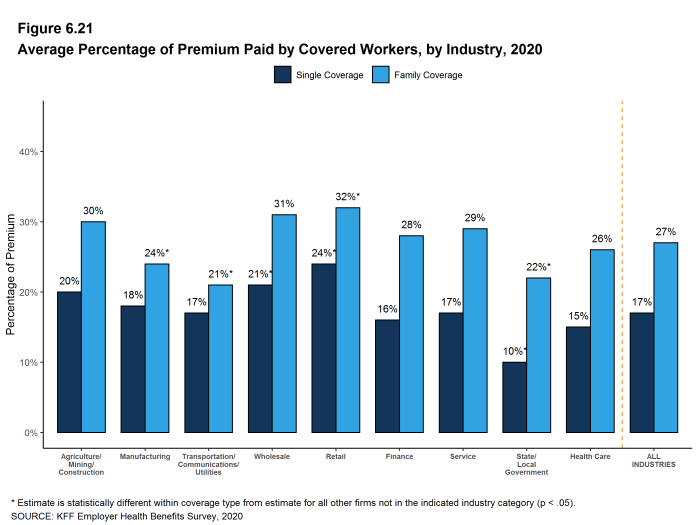

- There is considerable variation in average worker contribution rates across industries for both single and family coverage [Figure 6.21].

Figure 6.20: Average Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2020

Figure 6.21: Average Percentage of Premium Paid by Covered Workers, by Industry, 2020

CHANGES OVER TIME

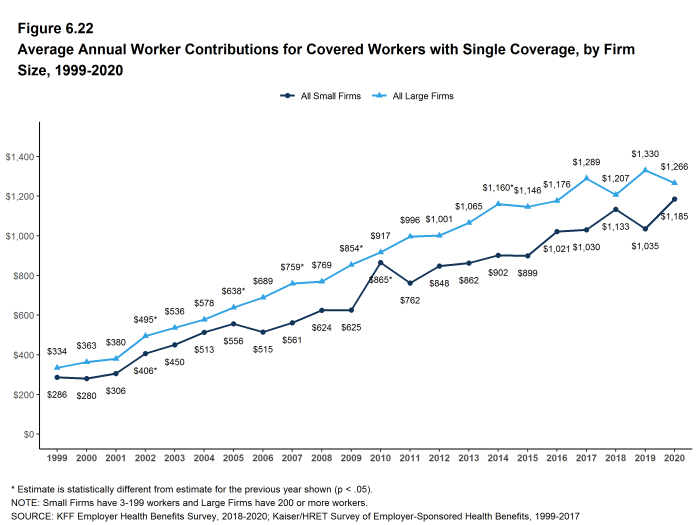

- The average worker contribution for single coverage ($1,243 in 2020) is similar to the amount last year. The average worker contribution for family coverage ($5,588 in 2020) appears lower than the average contribution for family coverage last year ($6,015), but the difference is not statistically significant [Figure 6.4] and [Figure 6.5].

- The average worker contributions for single and family coverage have increased over the last five years (16% and 13%, respectively) and over the last 10 years (38% and 40%, respectively).

Figure 6.22: Average Annual Worker Contributions for Covered Workers With Single Coverage, by Firm Size, 1999-2020

Figure 6.23: Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Size, 1999-2020

/bookdown/figures/Figure-6-24.png

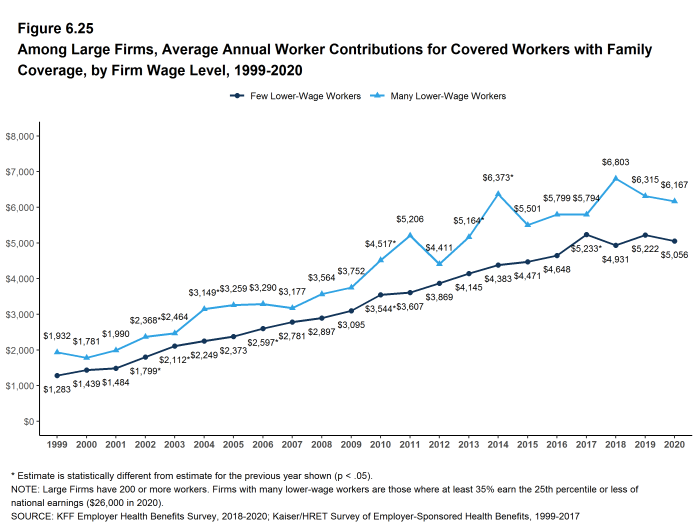

Figure 6.25: Among Large Firms, Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Wage Level, 1999-2020

- Estimates for premiums, worker contributions to premiums, and employer contributions to premiums presented in Section 6 do not include contributions made by the employer to Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs). See Section 8 for estimates of employer contributions to HSAs and HRAs.↩︎

- The average percentage contribution is calculated as a weighted average of all a firm’s plan types and may not necessarily equal the average worker contribution divided by the average premium.↩︎

- For definitions of self-funded and fully-insured plans, see the introduction to Section 10.↩︎

Employee Cost Sharing

In addition to any required premium contributions, most covered workers must pay a share of the cost for the medical services they use. The most common forms of cost sharing are: deductibles (an amount that must be paid before most services are covered by the plan), copayments (fixed dollar amounts), and coinsurance (a percentage of the charge for services). Sometimes cost sharing forms are mixed, such as assessing coinsurance for a service up to a maximum amount, or assessing coinsurance or copayment for a service, whichever is higher. The type and level of cost sharing often vary by the type of plan in which the worker is enrolled. Cost sharing may also vary by the type of service, such as office visits, hospitalizations, or prescription drugs.

The cost-sharing amounts reported here are for covered workers using in-network services. Plan enrollees receiving services from providers that do not participate in plan networks often face higher cost sharing and may be responsible for charges that exceed the plan’s allowable amounts. The framework of this survey does not allow us to capture all of the complex cost-sharing requirements in modern plans, particularly for ancillary services (such as durable medical equipment or physical therapy) or cost-sharing arrangements that vary across different settings (such as tiered networks). Therefore, we do not collect information on all plan provisions and limits that affect enrollee out-of-pocket liability.

GENERAL ANNUAL DEDUCTIBLES FOR WORKERS IN PLANS WITH DEDUCTIBLES

- We consider a general annual deductible to be an amount that must be paid by enrollees before most services are covered by their health plan. Non-grandfathered health plans are required to cover some services, such as preventive care, without cost sharing. Some plans require enrollees to meet a service-specific deductible, such as for prescription drugs or hospital admissions, in lieu of or in addition to a general annual deductible. As discussed below, some plans with a general annual deductible for most services exclude specified classes of care from the deductible, such as prescriptions or physician office visits.

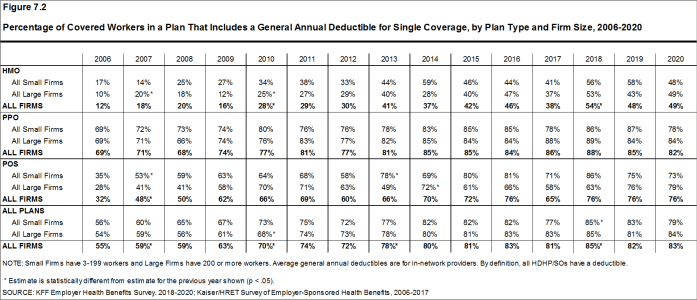

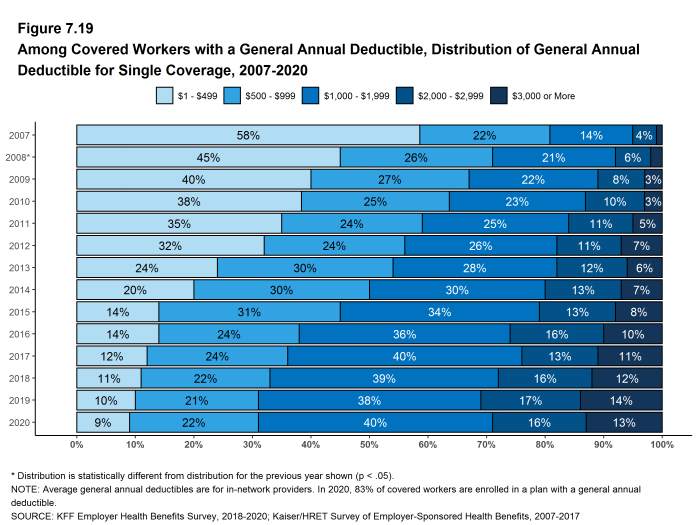

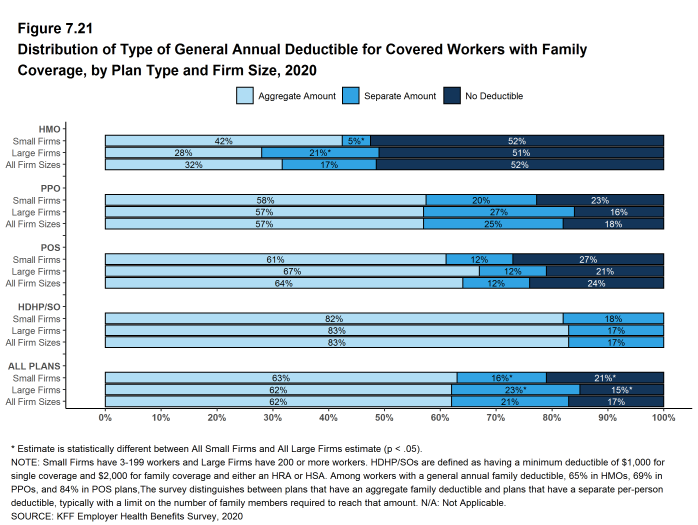

- In 2020, 83% of covered workers are enrolled in a plan with a general annual deductible for single coverage, similar to the percentage last year (82%) and much higher than the percentage ten years ago (70%) [Figure 7.2].

- The percentages of covered workers enrolled in a plan with a general annual deductible for single coverage are similar for small firms (3-199 workers) (79%) and large firms (200 or more workers) (84%) [Figure 7.2].

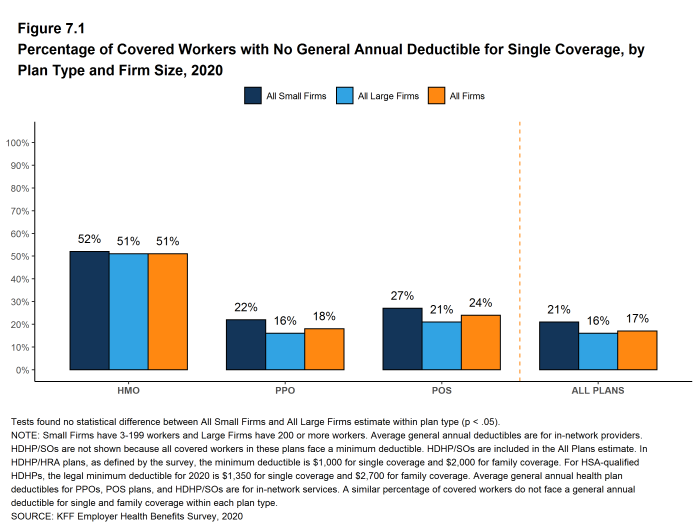

- The likelihood of being in a plan with a general annual deductible varies by plan type. Fifty-one percent of covered workers in HMOs do not have a general annual deductible for single coverage, compared to 24% of workers in POS plans and 18% of workers in PPOs [Figure 7.1].

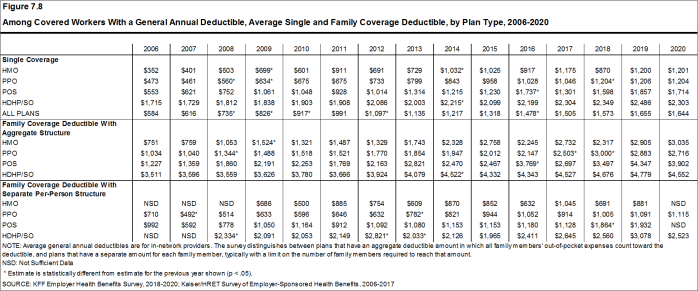

- For covered workers in a plan with a general annual deductible, the average annual deductible for single coverage is $1,644, similar to the average deductible ($1,655) last year [Figure 7.3] and [Figure 7.8].

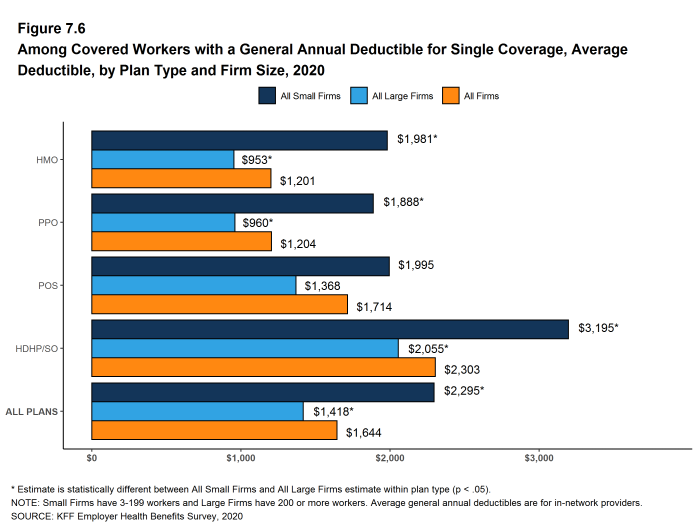

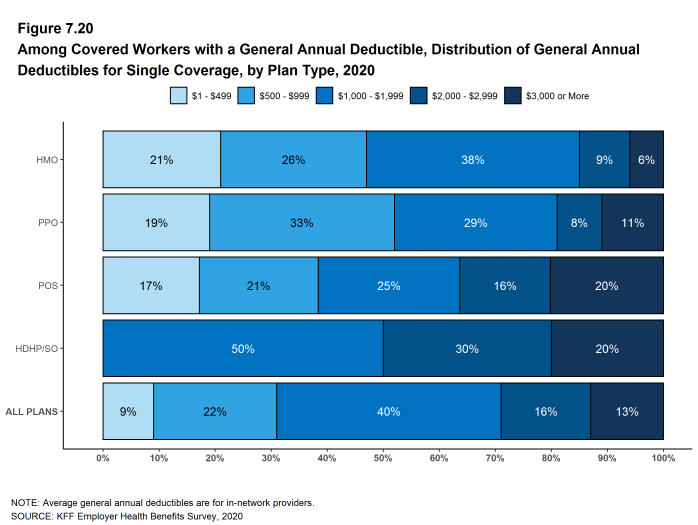

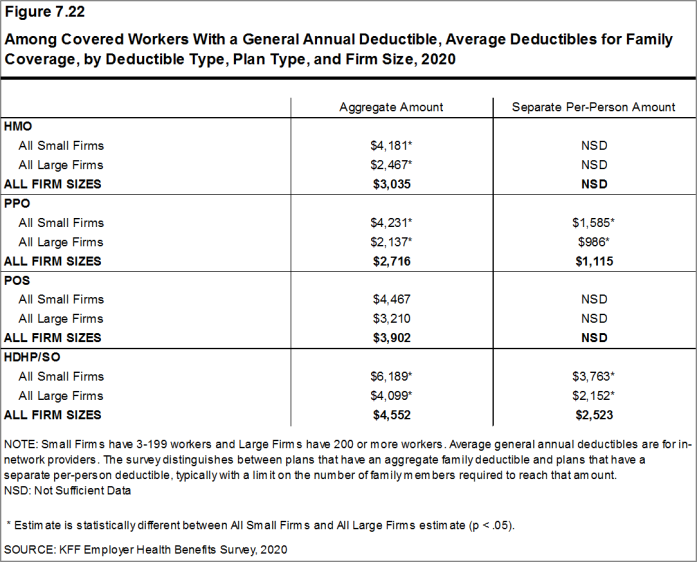

- For covered workers in plans with a general annual deductible, the average deductibles for single coverage are $1,201 in HMOs, $1,204 in PPOs, $1,714 in POS plans, and $2,303 in HDHP/SOs [Figure 7.6].

- The average deductibles for single coverage are higher for most plan types for covered workers in small firms than for covered workers in large firms. For covered workers in PPOs, the most common plan type, the average deductible for single coverage in small firms is considerably higher than the average deductible in large firms ($1,888 vs. $960) [Figure 7.6]. Overall, for covered workers in plans with a general annual deductible, the average deductible for single coverage in small firms ($2,295) is higher than the average deductible in large firms ($1,418) [Figure 7.3].

- The average general annual deductible for single coverage for covered workers in plans with a general annual deductible has increased 25% over the past five years, from $1,318 in 2015 to $1,644 in 2020 [Figure 7.8].

Figure 7.1: Percentage of Covered Workers With No General Annual Deductible for Single Coverage, by Plan Type and Firm Size, 2020

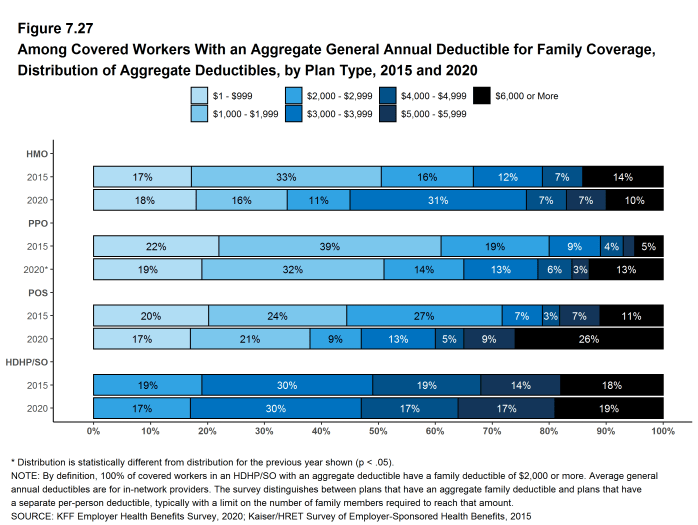

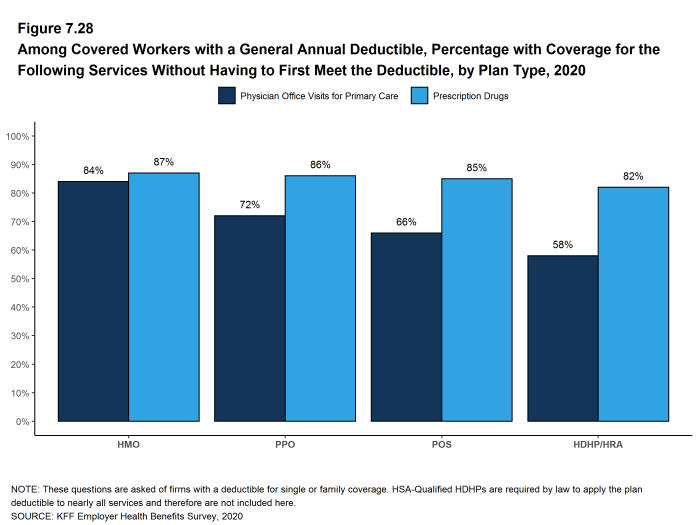

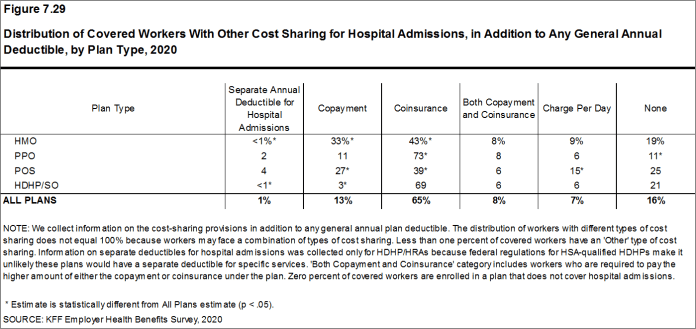

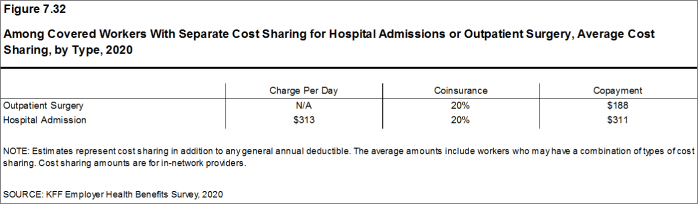

Figure 7.2: Percentage of Covered Workers in a Plan That Includes a General Annual Deductible for Single Coverage, by Plan Type and Firm Size, 2006-2020