The New ACA Repeal and Replace: Health Savings Accounts

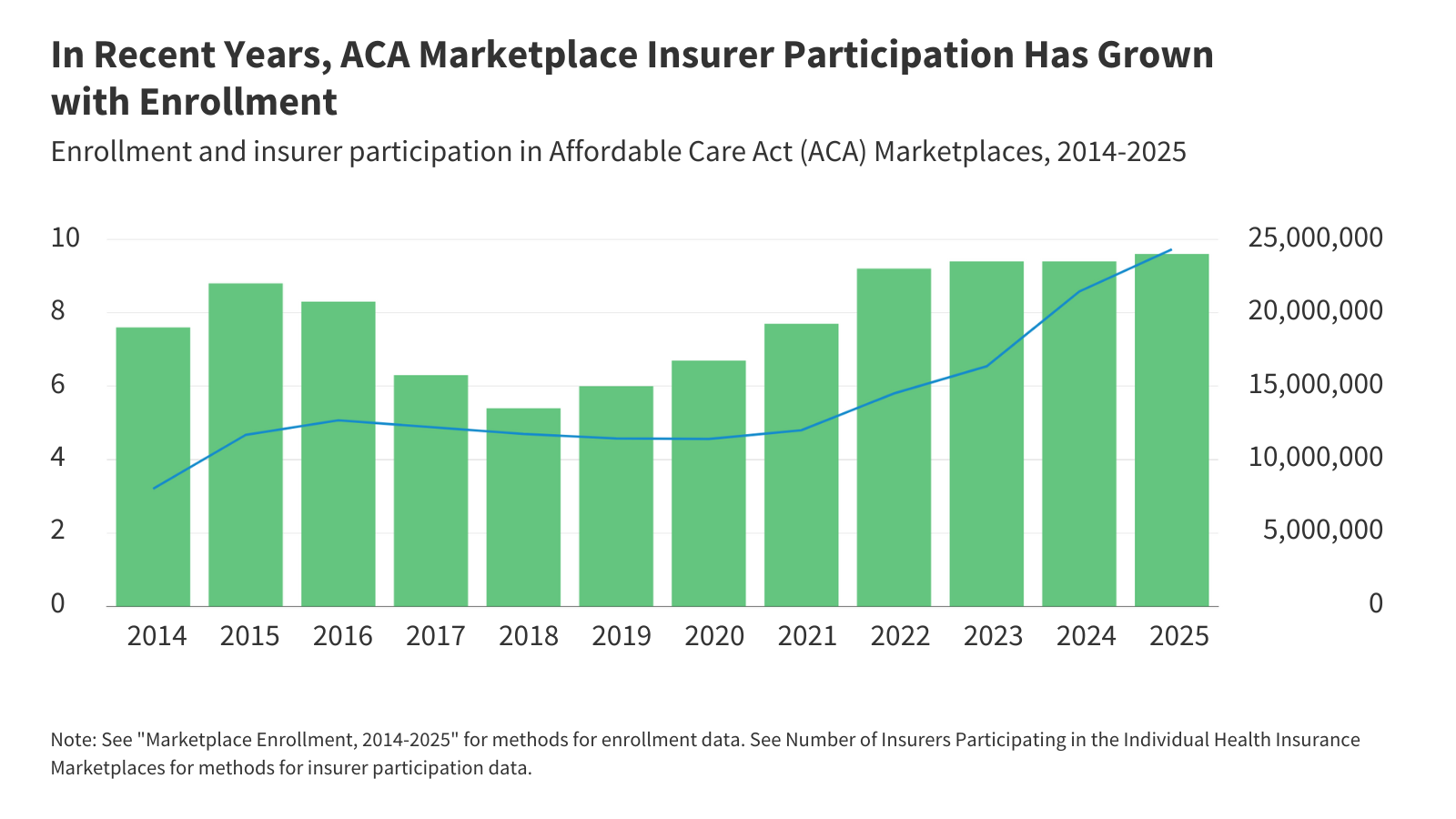

Proposals from some Republicans in Congress would effectively repeal some or all of the ACA premium tax credits and replace them with contributions to Health Savings Accounts (HSAs) or something similar.

Larry Levitt

Larry Levitt