A Primer on Medicare: Key Facts About the Medicare Program and the People it Covers

Introduction

July 30, 2015 marks the 50th anniversary of the date in 1965 that President Lyndon Johnson signed the law establishing the Medicare program. Medicare is a social insurance program that helps to provide health and financial security for people ages 65 and older and younger people with permanent disabilities. Prior to 1965, roughly half of all seniors lacked medical insurance; today, virtually all seniors have health insurance under Medicare. Since Medicare’s beginning, a number of changes have been made to expand benefits, revise the way Medicare pays providers, modify beneficiary out-of-pocket costs for Medicare-covered services, improve access and coverage for low-income individuals, expand the role of private plans in providing Medicare-covered benefits, strengthen quality, and address the growth in program spending.

Today, Medicare provides health insurance coverage to more than 55 million people: 46.3 million people ages 65 and older and 9 million people with permanent disabilities under age 65.1 The program helps to pay for many vital health care services, including hospitalizations, physician visits, and prescription drugs, along with post-acute care, skilled nursing facility, home health care, hospice, and preventive services. People who are working contribute payroll taxes to Medicare and most people become eligible for Medicare when they reach age 65, regardless of income or health status.

Comprising 14 percent of the federal budget in 2014 and just over one-fifth of total personal health expenditures in 2013, Medicare spending has slowed in recent years and is expected to grow at a slower rate than private insurance on a per person basis over the next decade. At the same time, Medicare is often part of discussions about how to moderate the growth of both federal spending and health care spending in the U.S. With the challenges of providing increasingly expensive medical care to an aging population and sustaining the program for the future, Medicare is likely to remain prominent on the federal policymaking agenda in the years ahead. As policymakers consider potential changes to Medicare, the effects of such changes on total health care expenditures, Medicare spending, and beneficiaries’ access to quality care and their out-of-pocket costs will be important considerations.

Report: What Is Medicare?

Medicare was established in 1965 under Title XVIII of the Social Security Act to provide health insurance to people age 65 and older, regardless of income or medical history.

The program was expanded in 1972 to include people under age 65 with permanent disabilities receiving Social Security Disability Insurance (SSDI) payments and people with end-stage renal disease (ESRD). In 2001, Medicare eligibility expanded further to cover people with amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease).

Medicare benefits are divided into four parts:

- Part A, also known as the Hospital Insurance (HI) program, covers inpatient hospital, skilled nursing facility, some home health visits, and hospice care. Part A is funded by a tax of 2.9 percent of earnings paid by employers and workers (1.45 percent each), along with an additional 0.9 percent paid by higher-income taxpayers (wages above $200,000/individual and $250,000/couple). An estimated 55 million people are enrolled in Part A in 2015.2

- Part B, the Supplementary Medical Insurance (SMI) program, helps pay for physician, outpatient, some home health, and preventive services. Part B is funded by general revenues and beneficiary premiums. Beneficiaries who have higher annual incomes (more than $85,000/single person, $170,000/married couple) pay a higher, income-related monthly Part B premium; the Affordable Care Act (ACA) froze the income thresholds at 2010 levels from 2011 through 2019. An estimated 51 million people are enrolled in Part B in 2015.3

- Part C, also known as the Medicare Advantage program, allows beneficiaries to enroll in a private plan, such as a health maintenance organization (HMO) or preferred provider organization (PPO), as an alternative to traditional Medicare. These plans receive payments from Medicare to provide all Medicare-covered benefits, including hospital and physician services, and in most cases, prescription drug benefits. In 2014, 15.7 million beneficiaries were enrolled in Medicare Advantage plans.4

- Part D, the outpatient prescription drug benefit, was established by the Medicare Modernization Act of 2003 (MMA) and launched in 2006. The voluntary benefit is delivered through private plans that contract with Medicare: either stand-alone prescription drug plans (PDPs) or Medicare Advantage prescription drug (MA-PD) plans. Part D plan enrollees generally pay a monthly premium and cost sharing for prescriptions (varying by plan). In 2015, an estimated 42 million beneficiaries are enrolled in Part D.5

Report: Who Is Eligible For Medicare?

In 2015, Medicare provides health insurance coverage to 55 million people: 46 million people ages 65 and older and 9 million people with permanent disabilities who are under age 65.6

The four different parts of Medicare have varying eligibility requirements, as described below. In general, coverage under Medicare Part A and Part B is automatic when a Medicare-eligible individual applies for Social Security or Railroad Retirement benefits. Individuals can decline enrollment in Medicare Part B if they have other qualifying group coverage. If an individual qualifies for Medicare at age 65 but is not yet receiving Social Security or Railroad Retirement benefits, an application for Medicare is required to initiate Medicare coverage.

Most people age 65 and older are eligible for Part A, as are some people under age 65 with permanent disabilities and those with ESRD or ALS.

- Age 65 and older: People age 65 and older qualify for Medicare if they are U.S. citizens or permanent legal residents with at least five years of continuous residence. Individuals qualify without regard to their medical history or preexisting conditions, and do not need to meet an income or asset test.

- Under age 65: Adults under age 65 with permanent disabilities are eligible for Medicare after receiving Social Security Disability Income (SSDI) payments for 24 months.

- ESRD/ALS: People with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) are eligible for Medicare benefits as soon as they begin receiving SSDI payments, without having to wait an additional 24 months.

Since most people make payroll tax contributions during their working years, most people who are eligible for Part A do not need to pay premiums for covered services. However, people age 65 and older are required to pay a monthly premium to receive Part A benefits if neither they nor their spouse made payroll contributions for 40 or more quarters. Adults under age 65 who are eligible for Medicare do not need to pay premiums for Part A benefits.

People eligible for Part A are also eligible for Part B.

Medicare Part B is voluntary, but more than 90 percent of beneficiaries with Part A are also enrolled in Part B.7 For most individuals who become entitled to Part A, enrollment in Part B is automatic unless the individual declines enrollment. Individuals age 65 and older who are not entitled to premium-free Part A may enroll in Part B. With the exception of Medicare-eligible individuals who are working (or those with working spouses), who may delay enrollment in Part B if they receive employment-based coverage, those who do not sign up for Part B when they are first eligible typically pay a penalty for late enrollment in addition to the regular monthly premium for the duration of their enrollment in Part B.

People may choose to enroll in Part C, also known as Medicare Advantage, if they are entitled to Part A and enrolled in Part B.

Outside of their initial enrollment period for Medicare, beneficiaries can elect to enroll in a Medicare Advantage plan (or switch from one plan to another) on an annual basis between October 15 and December 7 of each year during the annual election period. Changes made during this period take effect on January 1 of the following year. Beneficiaries enrolled in a Medicare Advantage plan on January 1 who wish to disenroll and return to traditional Medicare have 45 days to do so (between January 1 and February 14 each year); they are not allowed to switch from one Medicare Advantage plan to another during this period.

People are eligible for Part D prescription drug coverage if they are enrolled in Part A, Part B, or both.

To get Part D benefits, beneficiaries must enroll in a stand-alone prescription drug plan (PDP) or Medicare Advantage prescription drug (MA-PD) plan. The annual election period for Part D runs from October 15 to December 7 each year. People who delay enrollment in Part D beyond their initial enrollment period and who do not have “creditable” drug coverage (at least comparable to the Part D standard benefit) during this time pay a permanent premium penalty if they choose to enroll in a Part D plan at a later time.

Report: What Are The Characteristics Of People With Medicare?

Medicare covers a population with a diverse profile in terms of demographics and health status. A majority of beneficiaries are white, female, between the ages of 65 and 84, and report their health status as good or better. While many Medicare beneficiaries enjoy good health, others have significant health needs and limitations.

While most beneficiaries (71%) are between the ages of 65 and 84, 16 percent are under age 65 and permanently disabled, while another 13 percent are ages 85 and older (Figure 1). More than half of beneficiaries (55%) are female, but women account for an even larger share of beneficiaries at older ages. More than three-quarters (77%) of beneficiaries are white, while 10 percent are black and 9 percent are Hispanic.8

In terms of health status, a majority of beneficiaries report being in good or better health, but one in four Medicare beneficiaries report (26%) being in fair or poor health (Figure 2). Close to half (45%) of beneficiaries live with four or more chronic conditions and three out of ten beneficiaries (31%) have a cognitive or mental impairment. One-third of beneficiaries (34%) have one or more limitations in activities of daily living (ADLs), such as eating or bathing, that limit their ability to function independently.

Most Medicare beneficiaries live at home; however, five percent live in a long-term care setting, such as a nursing home or assisted living facility. Women account for nearly two-thirds of beneficiaries living in long-term care settings along with a disproportionate share of beneficiaries ages 85 and older (67%) and beneficiaries who are dually eligible for Medicare and Medicaid (60%).

A larger share of beneficiaries at both ends of the age spectrum report poorer health status and having more chronic conditions and functional limitations than beneficiaries between the ages of 65 and 74.

Compared to beneficiaries over age 65, a larger share of beneficiaries under age 65 are men (53% versus 44%), racial and ethnic minorities (36% versus 21%), and are dually eligible for Medicare and Medicaid (46% versus 14%). Because people under age 65 on Medicare qualified due to having a permanent disability, they typically have relatively high rates of chronic conditions, functional limitations, and cognitive impairments. A much larger share of beneficiaries under age 65 than those ages 65 and older report that they are in fair or poor health status (56% versus 21%).

Among beneficiaries at the older end of the age spectrum, a larger share of beneficiaries ages 85 and older than those between the ages of 65 and 74 are women (67% versus 54%), white (85% versus 78%), living in long term care facilities (17% versus 2%), and dually eligible for Medicare and Medicaid (20% versus 11%). Not surprisingly, there are also differences in health status between the two groups; compared to younger seniors, a larger share of the oldest old (age 85 and older) have four or more chronic conditions (61% versus 36%), cognitive impairments (44% versus 19%), and one or more functional limitations (60% versus 20%).

Most Medicare beneficiaries have limited financial resources, including incomes and assets. A disproportionate share of beneficiaries with low incomes and assets are women, racial and ethnic minorities, and under age 65.

In 2013, half of all Medicare beneficiaries had incomes below $23,500 per person (Figure 3).9 This equates to roughly 200 percent of the federal poverty level ($11,173 for a single person and $14,095 for a married couple age 65 and older in 2013).10 Income declines with age among seniors and is lower among women than men and among blacks and Hispanics compared to whites, and higher among married beneficiaries and those with higher education levels. A larger share of beneficiaries under age 65 have relatively low incomes compared to those ages 65 and older.

Along with having relatively low incomes, many Medicare beneficiaries have relatively low levels of savings. In 2013, half of all beneficiaries reported savings less than $61,400 per person. As with income, savings levels are lower among beneficiaries who are female, racial and ethnic minorities, and those under age 65.

Future growth in the Medicare population will affect the demographic profile of beneficiaries.

Driven by the aging “Baby Boom” generation, the U.S. population ages 80 and over will nearly triple between 2010 and 2050, increasing from 11 million to 31 million people, and the number of people ages 90 and over will quadruple (from 2 million to 8 million). As an increasing number of people become eligible for Medicare and as more people live into their 80s and beyond, the demographics of the Medicare population can be expected to change, not only in terms of the age distribution, but also beneficiaries’ physical and mental capabilities, financial resources, health status, and medical needs.

Report: What Does Medicare Cover?

Medicare provides coverage of a comprehensive set of vital medical services, including care in hospitals and other settings, physician services, diagnostic tests, preventive services, and an outpatient prescription drug benefit. (See Appendix 1: Medicare Benefits and Cost-Sharing Requirements, 2015)

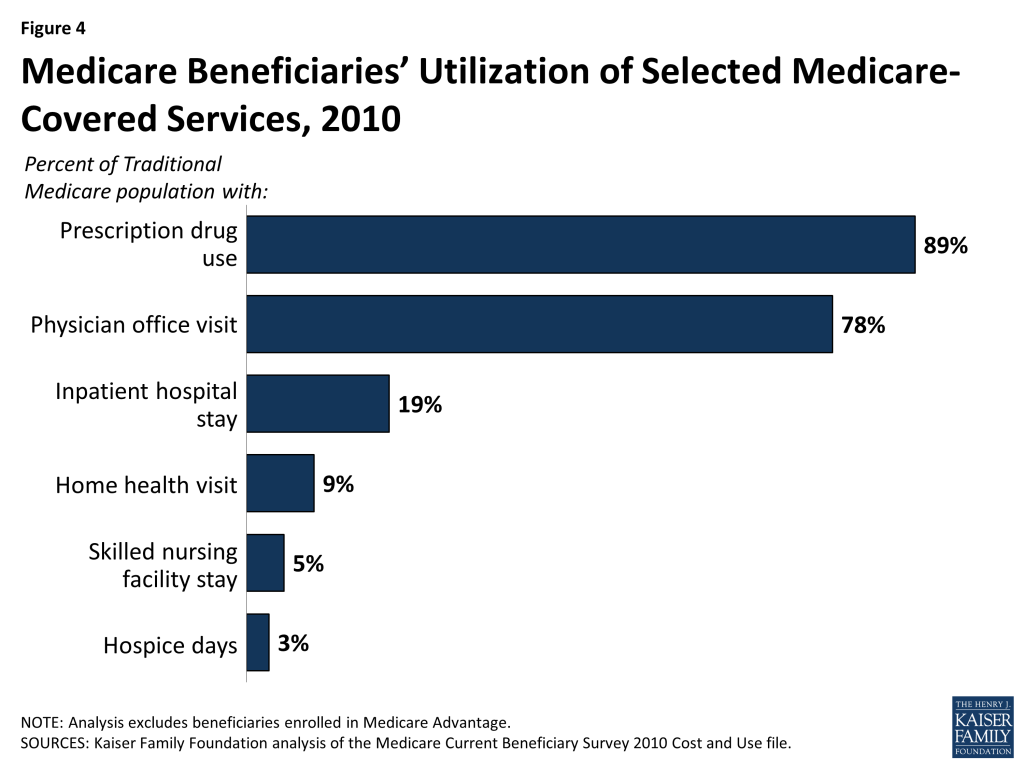

- Part A benefits include inpatient care provided in hospitals and short-term stays in skilled nursing facilities, hospice care, post-acute home health care, and pints of blood received at a hospital or skilled nursing facility. In 2010, 19 percent of beneficiaries in traditional Medicare had an inpatient hospital stay, while 9 percent used home health care services, 5 percent had a skilled nursing facility stay, and 3 percent used hospice care (Figure 4).

- Part B benefits include outpatient services such as outpatient hospital care, physician visits, and preventive services (e.g., mammography and colorectal screening). Part B benefits also include ambulance services, clinical laboratory services, durable medical equipment (such as wheelchairs and oxygen), kidney supplies and services, outpatient mental health care, and diagnostic tests (such as x-rays and magnetic resonance imaging). The ACA added a free annual comprehensive wellness visit and personalized prevention plan to the list of Medicare-covered benefits. The law also gave the Secretary of Health and Human Services (HHS) the authority to modify coverage of Medicare-covered preventive services to conform to the recommendations of the U.S. Preventive Services Task Force (USPSTF). A larger share of beneficiaries use Part B services compared to Part A services. For example, in 2010, more than three quarters (78%) of traditional Medicare beneficiaries had a physician office visit.

- Part C (Medicare Advantage) private health plans cover all benefits under Medicare Part A, Part B, and, in most cases, Part D. Medicare Advantage plans are required to provide all Medicare-covered benefits, but are permitted to vary the benefit design as long as the core benefit package (excluding the value of supplemental benefits) is actuarially equivalent to traditional Medicare. Some Medicare Advantage plans also include extra benefits, such as dental services, eyeglasses, or hearing exams. (See What is Medicare Advantage? for additional information.)

- Part D covers an outpatient prescription drug benefit through private plans. Plans are required to provide a “standard” benefit or one that is actuarially equivalent, and may offer more generous benefits. In 2010, 89 percent of traditional Medicare beneficiaries used prescription drugs. (See What is the Medicare Part D prescription drug benefit? for additional information.)

Despite the important protections provided by Medicare, there are significant gaps in Medicare’s benefit package.

Medicare does not pay for some services and supplies that are often needed by older people and younger beneficiaries with disabilities. For instance, Medicare does not pay for custodial long-term services and supports, either at home or in an institution, such as a nursing home or assisted living facility. Medicare also does not pay for routine dental care and dentures, routine vision care or eyeglasses, or hearing exams and hearing aids.

Report: How Much Do Beneficiaries Pay For Medicare Benefits?

Medicare has varying premiums, deductibles, and coinsurance amounts that can change annually to reflect changes in program costs. Taken altogether, Medicare has relatively high cost-sharing requirements for covered benefits and, unlike typical large employer plans, traditional Medicare does not place a limit on beneficiaries’ annual out-of-pocket spending. (See Appendix 1: Medicare Benefits and Cost-Sharing Requirements, 2015)

Part A:

- Most beneficiaries do not pay a monthly premium for Part A services, but are required to pay a deductible before Medicare coverage begins. In 2015, the Part A deductible for each “spell of illness” is $1,260 for an inpatient hospital stay.

- Beneficiaries are generally subject to coinsurance for Part A benefits, including extended inpatient stays in a hospital ($315 per day for days 61-90 and $630 per day for days 91-150 in 2015) or skilled nursing facility ($157.50 per day for days 21-100 in 2015). There is no coinsurance for days 1-60 of an inpatient hospital stay or days 1-20 of a skilled nursing facility stay, and there is no cost sharing for home health visits.

Part B:

- Beneficiaries enrolled in Part B are generally required to pay a monthly premium ($104.90 in 2015).

- Beneficiaries with annual incomes greater than $85,000 for a single person or $170,000 for a married couple in 2015 pay a higher, income-related monthly Part B premium, ranging from $146.90 to $335.70. The income amounts that are used to determine who pays the income-related premium and how much they will pay are fixed at their current levels through 2019. Approximately 5 percent of all Medicare beneficiaries paid the income-related Part B premium in 2014.

- Part B benefits are subject to an annual deductible ($147 in 2015), and most Part B services are subject to coinsurance of 20 percent. No coinsurance or deductible is charged for the annual wellness visit or for preventive services that are rated ‘A’ or ‘B’ by the USPSTF.

Part C (Medicare Advantage):

- Medicare Advantage plan enrollees generally pay the monthly Part B premium and many also pay an additional premium directly to their plan.

- Medicare Advantage plans are required to place a limit on beneficiaries’ out-of-pocket expenses for Medicare Part A and Part B covered services ($6,700 in 2015). This limit is not applied to beneficiaries in traditional Medicare, nor is it applied to out-of-pocket expenses for prescription drugs covered under Part D. (See What is Medicare Advantage? for additional information.)

Part D:

- In general, Part D enrollees pay a monthly premium, along with cost-sharing amounts for each brand-name and generic drug prescription; premiums and cost sharing vary by plan.

- Part D enrollees with higher incomes ($85,000 for a single person and $170,000 for a couple) pay an income-related monthly adjustment amount in addition to the monthly premium charged by their Part D plan. As with the Part B income-related premium, the income thresholds that determine who pays higher premiums for Part D coverage are fixed at current levels through 2019. (See What is the Medicare Part D prescription drug benefit? for additional information.)

Many people who are covered under traditional Medicare obtain some type of private supplemental insurance (such as Medigap or employer-sponsored retiree coverage) to help cover their Medicare cost-sharing requirements.

Supplemental insurance coverage can help beneficiaries pay their out-of-pocket costs for Medicare-covered services. Even with supplemental insurance, however, beneficiaries can face out-of-pocket expenses in the form of copayments for services including physician visits and prescription drugs as well as costs for services not covered by Medicare. Also, premiums for these policies can be costly: beneficiaries with Medigap supplemental policies generally pay higher premiums than those with employer-sponsored retiree health coverage. Moreover, while Medicaid, the Medicare Savings Programs (MSPs), and the Part D Low-Income Subsidy (LIS) program help to shield low-income beneficiaries from Medicare premiums and other out-of-pocket costs, not all low-income people on Medicare qualify for these programs. (See What types of supplemental insurance do beneficiaries have? for additional information.)

Many beneficiaries face significant out-of-pocket costs for both premiums and non-premium expenses to meet their medical and long-term care needs.

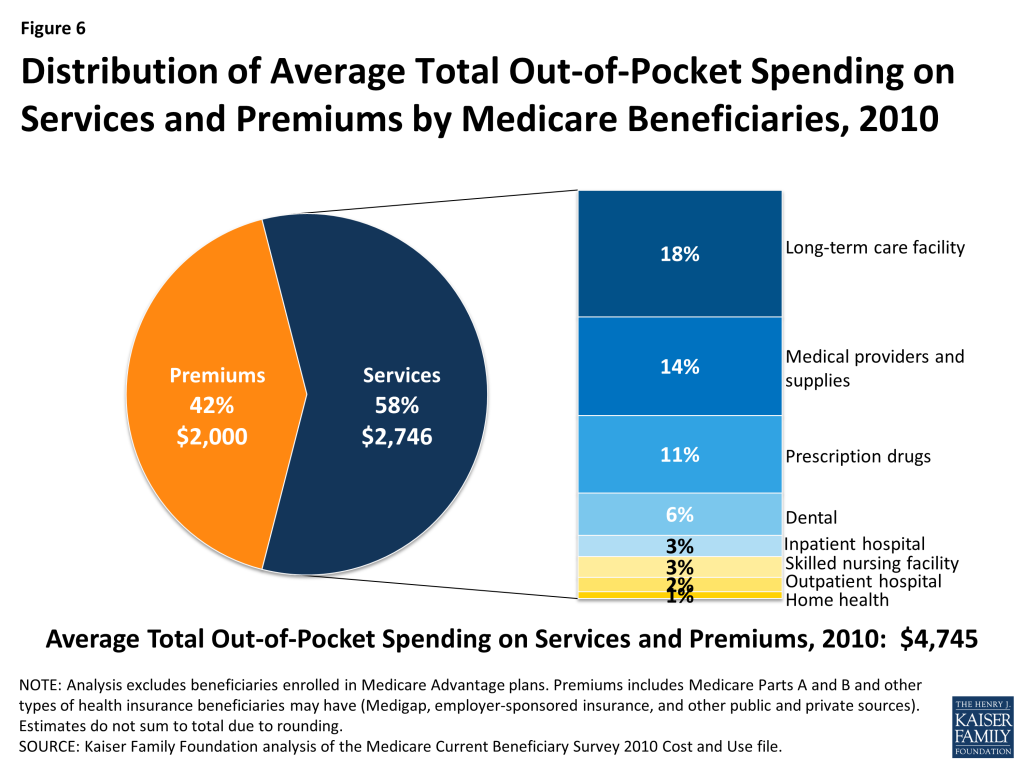

The burden of out-of-pocket spending for health care expenses is three times larger for Medicare households than non-Medicare households (Figure 5). In 2010, Medicare beneficiaries spent $4,745 out of their own pockets for health care spending, on average, including premiums for Medicare and other types of supplemental insurance and costs incurred for medical and long-term care services (Figure 6). Premiums for Medicare and supplemental insurance accounted for 42 percent of average total out-of-pocket spending among beneficiaries in traditional Medicare in 2010.

Of the remaining 58 percent of average total out-of-pocket spending on services, long-term facility costs are the largest component (accounting for 18 percent of total out-of-pocket spending), followed by medical providers/supplies (14%), prescription drugs (11%), and dental care (6%).

Out-of-pocket spending varies by beneficiary characteristics, including age, sex, and health status. Not surprisingly, more extensive use of services leads to higher out-of-pocket spending.

Spending on medical and long-term care rises with age among beneficiaries ages 65 and older and is higher for women than men, especially among those ages 85 and older (Figure 7). Beneficiaries’ health status and chronic conditions also are significant drivers of out-of-pocket spending, with average out-of-pocket spending on services rising as beneficiaries’ health status declines, and rising with the number of functional impairments and chronic conditions. Out-of-pocket spending is also higher among beneficiaries who have multiple hospitalizations and post-acute care use and those who live in long-term care facilities. These differences are driven primarily by variation in average spending on medical and long-term care services, rather than by variation in premium spending.11

Analysis of ‘high out-of-pocket spenders’ finds a disproportionate share of certain groups in the top quartile and top decile of total out-of-pocket spending (including both services and premiums).

In 2010, one in four beneficiaries spent at least $5,276 out of pocket on medical and long-term care services and premiums (the top quartile), and one in ten spent at least $8,292 (the top decile). Average total out-of-pocket spending among the top quartile—$11,501 in 2010—was more than twice as much as the average among all beneficiaries ($4,745), while among the top decile, it was four times as much ($19,103). Long-term care facility costs are a major component of spending for beneficiaries in the top quartile of total out-of-pocket spending. This group of ‘high out-of-pocket spenders’ includes a disproportionate share of older women, beneficiaries living in long-term care facilities, those with Alzheimer’s disease and ESRD, and beneficiaries who were hospitalized.12

Report: What Is The Medicare Part D Prescription Drug Benefit?

Since 2006, Medicare beneficiaries have had access to an outpatient prescription drug benefit (Part D) offered through private plans: either stand-alone prescription drug plans (PDPs) or Medicare Advantage prescription drug (MA-PD) plans.

In 2015, 1,001 stand-alone prescription drug plans (PDPs) are available nationwide, fewer than in any year since the program began in 2006. Medicare beneficiaries in each region have a choice of 30 stand-alone PDPs, on average, in 2015.

Medicare Part D plans are required to offer either the standard benefit that is defined in law or an alternative benefit design that is equal in value (“actuarially equivalent”); plans can also offer enhanced benefits.

The standard benefit in 2015 has a $320 deductible and 25 percent coinsurance up to an initial coverage limit of $2,960 in total drug costs, followed by a coverage gap (Figure 8). During the gap, enrollees are responsible for a larger share of their total drug costs than in the initial coverage period. Enrollees in plans with no additional gap coverage in 2015 pay 45 percent of the total cost of brands and 65 percent of the total cost of generics in the gap until they reach the catastrophic coverage limit. Medicare will phase in additional subsidies for brands and generic drugs, ultimately reducing the beneficiary coinsurance rate in the gap to 25 percent by 2020.

After total out-of-pocket spending reaches $4,700 in 2015 (excluding premiums)—an amount equivalent to $7,062 in estimated total drug costs—enrollees pay 5 percent of the drug cost or a copayment ($2.65/generic drugs or $6.60/brand-name drugs for each prescription) for the rest of the year. The standard benefit amounts are set to change annually by the rate of change in per capita Part D spending.

In 2015, no PDPs offer the standard benefit. Most charge copayments (flat dollar amounts) instead of 25 percent coinsurance; 58 percent of plans charge a deductible (44 percent of plans charge the full $320 deductible amount, and 14 percent charge a partial deductible).13 The majority (74%) of PDPs offer no gap coverage in 2015 beyond what the ACA requires plans to offer. With all Part D enrollees now getting coverage for a share of their drug costs in the gap, the value of additional gap coverage offered by plans will become lower each year until 2020, when the gap is fully closed.

Part D plans are required to maintain a medical loss ratio (MLR) of at least 85 percent; that is, 85 percent of revenue must be used on patient care, rather than on administrative expenses or profit. Plans vary widely, however, in terms of formularies (the list of covered drugs), the placement of drugs on formulary tiers, cost-sharing requirements, and utilization management tools (such as prior authorization requirements).

Monthly Part D premiums and cost-sharing amounts vary across plans and regions, and have increased significantly on average since 2006.

In 2015, the average monthly Part D premium for PDP plans is $38.83 (weighted by 2014 enrollment). Actual monthly PDP premiums vary across plans and regions, ranging from a low of $12.60 for a plan available in New Mexico, to a high of $171.90 for a plan available in Florida. Average monthly PDP premiums, weighted by 2014 enrollment, vary widely in 2015 across regions, ranging from $27.91 per month for PDPs in the New Mexico region (one of only five regions with an average under $35) to $44.56 per month for PDPs in New Jersey and $43.84 in the Idaho/Utah region.

People with modest incomes and assets are eligible for additional assistance with Part D premiums and cost-sharing requirements.

Beneficiaries with limited income (less than 150 percent of the federal poverty level, or $17,655 for a single person; $23,895 for a married couple in 2015) and limited assets ($13,640/single person; $27,250/married couple in 2015) are eligible for the Low-Income Subsidy (LIS) program, or “extra help,” which helps pay for some or all of the Part D monthly premium and cost-sharing amounts. Around 12 million beneficiaries are currently receiving full or partial benefits under the LIS program, depending on their income and asset levels.

Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid. People determined eligible for the Low-Income Subsidy are assigned to a PDP if they do not enroll on their own.

Approximately 90 percent of all Medicare beneficiaries have “creditable” prescription drug coverage, while approximately 10 percent lack a known source of creditable drug coverage.

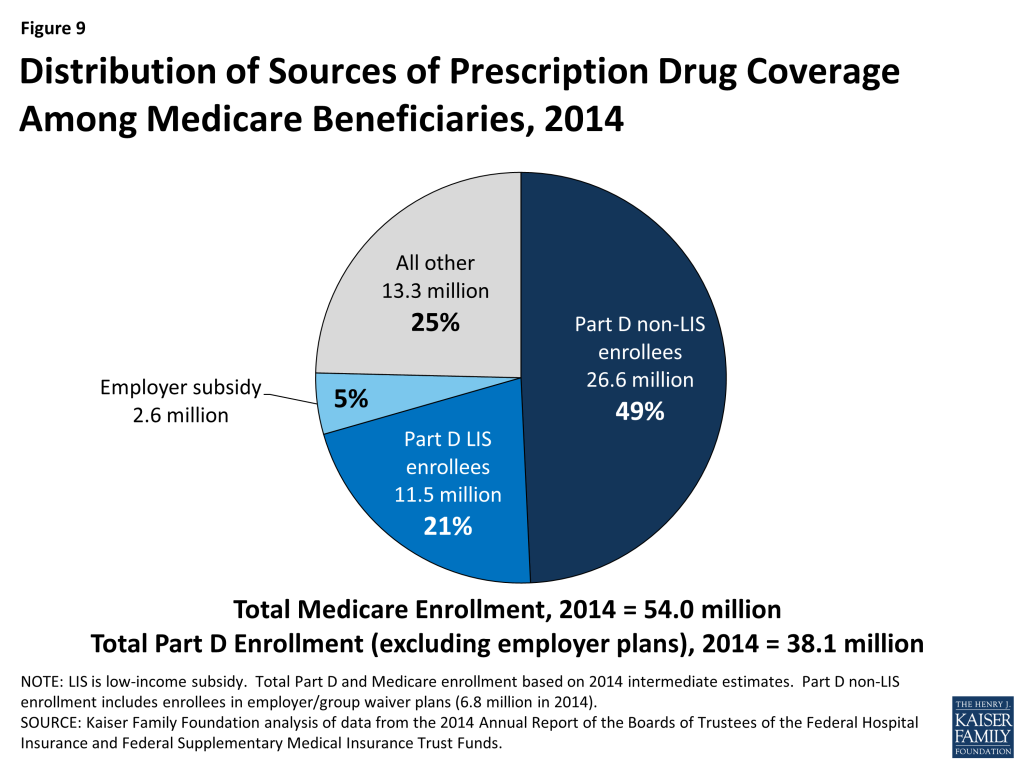

Of the 38 million beneficiaries enrolled in Part D plans, about 61 percent (23.2 million) are in PDPs; the others are enrolled in Medicare Advantage drug plans. These enrollment counts from September 2014 include 6.6 million Part D enrollees in employer-only plans. Another 2.6 million Medicare beneficiaries are estimated to be receiving prescription drug coverage from an employer or union plan in which the employer receives subsidies through the Medicare Retiree Drug Subsidy (RDS) program (equal to 28 percent of drug expenses between $310 and $6,350 per retiree in 2014) (Figure 9).14

The coverage gap, also known as the “doughnut hole,” is gradually closing by 2020 due to a provision of the ACA.

In 2015, Part D beneficiaries pay 45 percent of their brand-name drug costs, and 65 percent of their generic drug costs in the coverage gap. Medicare is gradually phasing in subsidies in the coverage gap for brand-name drugs and generic drugs, reducing the beneficiary coinsurance rate from 100 percent in 2010 to 25 percent in 2020. In addition, between 2014 and 2019, the out-of-pocket amount that qualifies an enrollee for catastrophic coverage will be reduced, further lowering out-of-pocket costs for those with relatively high prescription drug expenses. In 2020, the catastrophic coverage level will revert to what it would have been absent these reductions.

Medicare’s payments to Part D plans are determined through a competitive bidding process. Private plan sponsors bid each year to offer Part D coverage and are paid monthly capitation payments for each Medicare beneficiary who enrolls in their plan.

Medicare provides plans with a subsidy of 74.5 percent of the cost of standard coverage for all beneficiaries, which is based on annual bids submitted by plans for their expected benefit payments. Premium payments by beneficiaries cover the remaining 25.5 percent. In 2015, private plans are projected to receive average annual payments from Medicare of $548 per enrollee overall and $1,996 for Low-Income Subsidy enrollees; employers are expected to receive, on average, $604 for retirees in employer-subsidy plans.15 Plans also receive additional risk-adjusted payments for high-cost enrollees and reinsurance payments for a share of their enrollees’ costs above the catastrophic threshold. Part D plans’ potential losses or profits are limited by risk-sharing arrangements with the federal government (“risk corridors”).

Report: What Is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a program that allows beneficiaries to enroll in private health plans to receive Medicare-covered benefits.

Private plans, such as health maintenance organizations (HMOs), have been an option under Medicare since the 1970s. Medicare now contracts with other types of private plans, including local preferred provider organizations (PPOs), regional PPOs, private fee-for-service (PFFS) plans, and high deductible plans linked to medical savings accounts (MSAs). In 2015, Medicare beneficiaries are able to choose from an average of 18 Medicare Advantage plans offered in their area.16

Medicare Advantage plans provide all benefits covered under traditional Medicare, and many plans offer additional benefits. The majority of plans also provide Part D prescription drug coverage.

Medicare Advantage plans receive payments from the federal government to provide all Medicare-covered benefits to enrollees. Plan sponsors are generally required to offer at least one plan with basic drug coverage. More than 8 in 10 Medicare Advantage plans (86 percent) offer drug coverage in 2015, and about four in ten plans (44 percent) offer some coverage beyond the standard benefit design in the coverage gap, mainly for generic drugs only. Plans are required to use any additional payments (known as rebates) to provide extra benefits to enrollees in the form of lower premiums, lower cost sharing, or benefits and services not covered by traditional Medicare. Examples of extra benefits include eyeglasses, hearing exams, preventive dental care, podiatry, chiropractic services, and gym memberships.

Medicare Advantage plan premiums and cost-sharing requirements vary widely, and have increased in recent years.

Medicare Advantage enrollees generally pay the monthly Part B premium and many also pay an additional premium directly to their plan. In 2015, the average premium for MA-PD plans (weighted by 2014 enrollment) is $41 per month, but varies by plan type and is lower for HMOs ($32) than for local PPOs ($70).17 Medicare Advantage plans are required to place a limit on beneficiaries’ out-of-pocket expenses for Medicare Part A and B covered services of $6,700 in 2015. In 2015, 9 percent of all Medicare Advantage plans have a limit of $3,400 or less, while almost half (48 percent) have a limit of more than $5,000.

Since 2004, the number of Medicare Advantage plan enrollees has increased.

After a decline in the number of Medicare Advantage enrollees between 1999 and 2003, the program has seen a rapid increase in enrollment in more recent years (Figure 10). The number of Medicare enrollees in private plans has almost tripled between 2003 and 2014, from 5.3 million to 15.7 million. In 2014, 64 percent of Medicare Advantage enrollees were in HMOs, 23 percent were in local PPOs, 2 percent were in PFFS plans, 8 percent were in regional PPOs, and the remainder were in other plan types.18

Enrollment in Medicare Advantage plans varies widely across states.

In 2015, less than 5 percent of beneficiaries in 2 states (Alaska and Wyoming) were enrolled in Medicare Advantage plans, while more than 30 percent of beneficiaries in 18 states (Arizona, California, Colorado, Florida, Hawaii, Idaho, Michigan, Minnesota, Nevada, New Mexico, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Tennessee, Utah, and Wisconsin) were in such plans (Figure 11).

The Affordable Care Act reduced Medicare payments to private plans and rewards plans with high-quality ratings.

Since 2006, Medicare has paid private plans under a bidding process: plans submit bids that estimate their costs per enrollee for services covered under Medicare Parts A and B. If plans bid higher than the county-level benchmark, enrollees pay the difference in the form of monthly premiums. If plans bid lower than the benchmark, the plan and Medicare split the difference between the bid and the benchmark; the plan’s share is known as a “rebate,” which must be used to provide supplemental benefits to enrollees. Medicare payments to plans are then adjusted based on enrollees’ risk profiles.

In the early-2000s, Medicare payment policy for plans changed from one that produced savings to one that focused more on expanding access to private plans and providing extra benefits to enrollees. Between 2006 and 2010, many advocates, policymakers, and researchers voiced concerns about rising “overpayments” to Medicare Advantage plans – estimated to be as much as 14 percent higher than what it would have cost to cover similar people in traditional Medicare.19 In response, the ACA reduce federal payments to Medicare Advantage plans over time, bringing them closer to the average costs of care under the traditional Medicare program. Under this payment system, plans in counties with relatively high traditional Medicare costs will be paid 95 percent of fee-for-service (FFS) costs per enrollee, while plans in counties with relatively low traditional Medicare costs will be paid 115 percent of FFS costs per enrollee. The ACA also provided bonus payments to Medicare Advantage plans based on the plan quality ratings, beginning in 2012. In addition, the ACA required Medicare Advantage plans to maintain a medical loss ratio no lower than 85 percent, restricting the share of premiums and other revenues that could be used for profits and administrative expenses.

Many questions remain to be answered about the quality of care and access to care in Medicare Advantage compared to traditional Medicare.

While many studies have examined the quality and access to care in Medicare Advantage plans, shortcomings in the available research make it hard to draw broad conclusions about the relative performance of the two coverage options.20 A systematic review found that the data used in studies that compare traditional Medicare and Medicare Advantage tend to be old and provide limited information about the experience since the ACA was passed. Despite these limitations, at least through 2009, Medicare HMOs tend to perform better than traditional Medicare in providing preventive services and using resources more conservatively. Yet, beneficiaries rate traditional Medicare more favorably than Medicare Advantage plans in terms of quality and access, particularly sicker beneficiaries. Performance also has been found to vary widely across Medicare Advantage plans even within the same type.

Report: What Types Of Supplemental Insurance Do Beneficiaries Have?

Many Medicare beneficiaries have some type of supplemental insurance coverage to help fill the gaps in Medicare’s benefit package and help with Medicare’s cost-sharing requirements.

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-sharing requirements and places no limit on beneficiaries’ out-of-pocket spending. Moreover, traditional Medicare does not pay for some services vital to older people and those with disabilities, including long-term services and supports, dental services, eyeglasses, and hearing aids.

In light of Medicare’s benefit gaps and cost-sharing requirements, most beneficiaries in traditional Medicare have some form of supplemental coverage to help cover cost-sharing expenses required for Medicare-covered services (Figure 12). Other beneficiaries—30 percent in 2014—are covered under Medicare Advantage plans. However, 14 percent of all Medicare beneficiaries had no supplemental coverage in 2010, including a disproportionate share of beneficiaries under age 65 with disabilities, the near poor (those with incomes between $10,000 and $20,000), and black beneficiaries.21

Employer and union-sponsored plans are a leading source of supplemental coverage, providing coverage to about three in ten Medicare beneficiaries.

Employer-sponsored retiree coverage is a primary source of supplemental coverage for Medicare beneficiaries, but access to retiree health benefits is on the decline. In 2014, 25 percent of large firms (those with 200 or more workers) offered retiree health benefits to active workers, a sharp decline from the two-thirds offering health benefits for retirees in 1988 (Figure 13). Employer plans often provide additional benefits, such as additional prescription drug coverage and limits on retirees’ out-of-pocket health expenses. For some Medicare beneficiaries who are working (or have working spouses), employer plans are their primary source of health insurance coverage, and Medicare is the secondary payer.

Medicare Advantage plans are another source of supplemental coverage for people on Medicare.

Enrollment in private Medicare Advantage health plans has increased in recent years, and 30 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans in 2014 (up from one-fourth in 2010). Medicare beneficiaries who enroll in private Medicare Advantage plans often receive supplemental benefits that are not covered under traditional Medicare, such as vision and dental benefits. Medicare Advantage plans are required to have a limit on beneficiaries’ out-of-pocket expenses for Medicare Part A and Part B covered services of $6,700 in 2014. (See What is Medicare Advantage? for additional information.)

Medigap policies, also called Medicare Supplement Insurance, are sold by private insurance companies and help cover Medicare’s cost-sharing requirements and fill gaps in the benefit package.

Medigap policies assist beneficiaries with their coinsurance, copayments, and deductibles for Medicare-covered services. Medigap policies help to shield beneficiaries from sudden, out-of-pocket costs resulting from an unpredictable medical event, allow beneficiaries to more accurately budget their health care expenses, and reduce the paperwork burden associated with medical claims. In 2010, about one in five Medicare beneficiaries had an individually-purchased Medicare supplement insurance policy. Currently, there are 10 standard Medigap plans (labeled Plan A-N; Plans E, H, I, and J are no longer available for sale); all Medigap policies of the same letter provide the same benefits (see Appendix 2: Standard Medigap Plan Benefits).22 Premiums vary by plan type, insurer, age of the enrollee, and state of residence.

Medicaid, the federal-state program that provides health and long-term care coverage to low-income people, is a source of supplemental coverage for nearly 10 million Medicare beneficiaries with low incomes and modest assets. These beneficiaries are known as dual eligible beneficiaries because they are eligible for both Medicare and Medicaid.

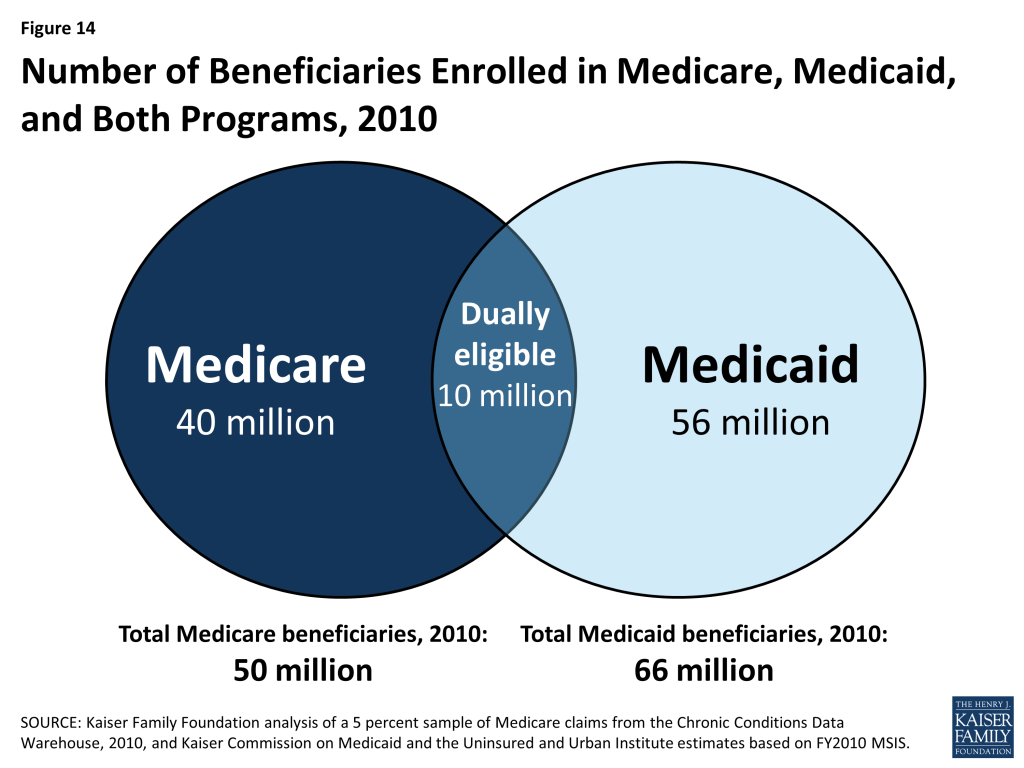

Medicaid helps to make Medicare affordable for low-income beneficiaries, given gaps in the Medicare benefit package, premiums, deductibles, and other cost-sharing requirements (see Appendix 3: Common Medicaid Eligibility Pathways and Benefits for Medicare Beneficiaries, 2014). In total, about one in five Medicare beneficiaries also had Medicaid coverage in 2010. Most dual-eligible beneficiaries qualify for full Medicaid benefits, including long-term care. These dual eligible beneficiaries also get help with Medicare’s premiums and cost-sharing requirements, and receive subsidies that help pay for drug coverage under Medicare Part D plans. (See What is the role of Medicare for dual-eligible beneficiaries? for additional information.)

In addition, some low-income Medicare beneficiaries do not qualify for full Medicaid benefits, but receive help with Medicare premiums and/or some cost-sharing requirements through the Medicare Savings Programs (MSPs).23 Eligibility for this assistance is based on a beneficiary’s income and resources (the latter generally must be less than $7,160 for a single person and $10,750 for a married couple in 2014).24

Report: What Is The Role Of Medicare For Dual-eligible Beneficiaries?

Medicare and Medicaid play important but different roles for people who are eligible for both programs.

For the 10 million low-income elderly and disabled people who are covered under both the Medicare and Medicaid programs (often referred to as “dual-eligible” beneficiaries), Medicare is their primary source of health insurance (Figure 14). Medicare covers most medical services, including inpatient and outpatient care, physician services, diagnostic and preventive care and, since 2006, outpatient prescription drugs under Part D plans. Medicare does not cover routine outpatient dental care or non-skilled long-term services and supports, such as in home care or extended home and personal care in the community. Medicaid, a need-based program funded jointly by the federal and state governments, supplements Medicare by providing help with Medicare’s premiums and cost-sharing requirements, and by helping to pay for the services that are not covered by Medicare. Together, these two programs help to shield very low-income Medicare beneficiaries from potentially unaffordable out-of-pocket medical and long-term care costs.

Dual-eligible beneficiaries are disproportionately counted among both Medicare and Medicaid’s high spenders. In 2010, dual-eligible beneficiaries comprised 20 percent of Medicare beneficiaries but 34 percent of Medicare spending, and, similarly, 14 percent of the Medicaid population but 34 percent of Medicaid spending (Figure 15).25

Dual-eligible beneficiaries are poorer and have more medical needs than beneficiaries who are not dually eligible.

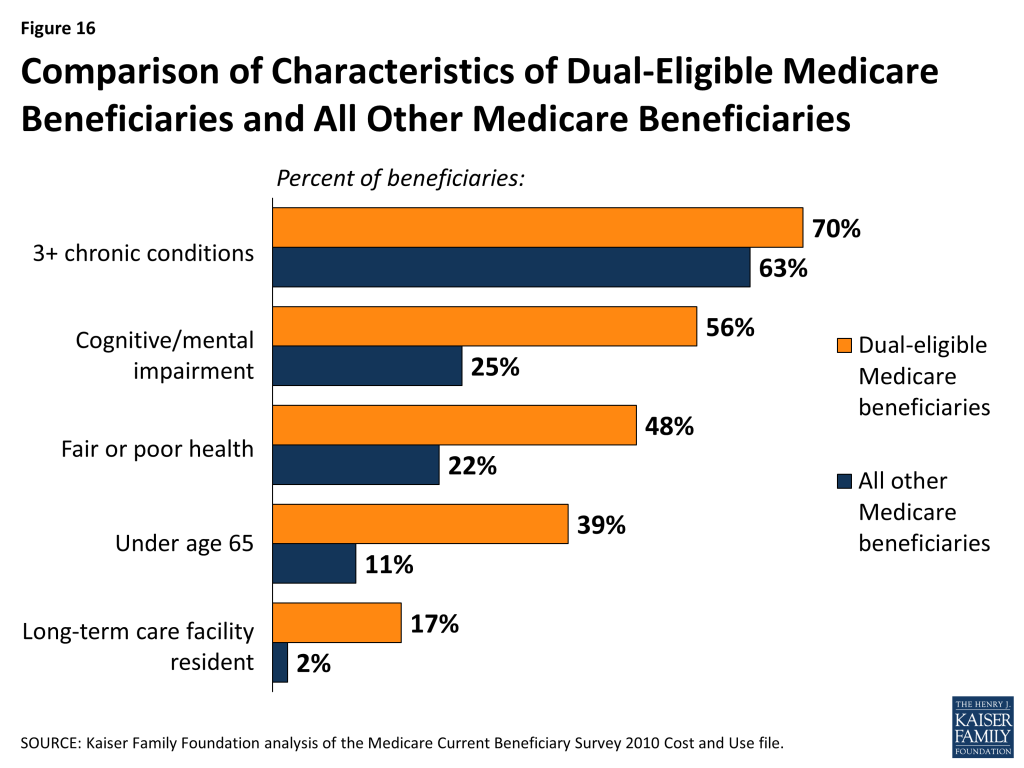

Dual-eligible Medicare beneficiaries are more likely than other Medicare beneficiaries to be frail, live with multiple chronic conditions, and have functional and cognitive impairments. Four in 10 dual-eligible beneficiaries (39%) are under age 65 and living with disabilities, compared to about one in 10 (11%) non-dual eligible beneficiaries. Nearly half (48%) of all dual-eligible beneficiaries rate their health status as fair or poor, more than double the share of non-dual eligible beneficiaries (22%). A larger share of dual-eligible beneficiaries than non-dual eligible beneficiaries have three or more chronic conditions (70% versus 63%); more than half (56%) of all dual-eligible beneficiaries have a cognitive or mental impairment, compared to one quarter (25%) of non-dual eligible beneficiaries; and more than half (55%) live with one or more functional impairments in activities of daily living (ADLs), compared to 29 percent of other Medicare beneficiaries. A substantially greater share of dual-eligible beneficiaries than other Medicare beneficiaries live in long-term care facility settings (17% versus 2%) (Figure 16).

As a result of having greater medical needs, dual-eligible beneficiaries also use more Medicare services, particularly acute care services, than other Medicare beneficiaries. Among dual-eligible beneficiaries in traditional Medicare, one-quarter (25%) had at least one hospitalization in 2010 (versus 16% of other beneficiaries) and 11 percent had two or more hospitalizations (versus 6% of other beneficiaries). Dual-eligible beneficiaries were also more likely to use the emergency room in 2010: 44 percent had at least one emergency department visit versus 24 percent of other beneficiaries.

Many, but not all, dual-eligible beneficiaries are high-need, high-cost beneficiaries.

Some dual-eligible beneficiaries, often described as “high need” or “high cost,” have extensive need for acute, post-acute, and long-term care services and supports. One quarter (25%) had Medicare spending of $20,000 or more in 2010, and another 17 percent had Medicare spending between $10,000 and $20,000 (Figure 17). Other dual-eligible beneficiaries use relatively few services and incur relatively low Medicare spending, including more than one-quarter (26%) with Medicare spending below $2,500. Three-quarters (75%) of all dual-eligible beneficiaries had no inpatient hospitalization and more than half (56%) had no emergency department visit in 2010—two of the most expensive health care services on a per capita basis.

Dual-eligible beneficiaries who are under age 65 with disabilities have different needs and lower Medicare costs, on average, than those dual-eligible beneficiaries who are age 65 and older. Specifically, a smaller share of those under age 65 have 3 or more chronic conditions compared to those age 65 and older (61% versus 77%), but a larger share have cognitive or mental impairments (65% versus 51%).26 However, a similar share of dual-eligible beneficiaries in traditional Medicare who were under age 65 compared to those age 65 or older had an inpatient stay (21% versus 28%) and a similar share had one or more emergency department visits (47% versus 42%) in 2010.27

Efforts are underway to improve the coordination of care for dual-eligible beneficiaries.

Policymakers at the federal and state levels are developing initiatives for dual-eligible beneficiaries to improve the coordination of their care and to reduce spending for both Medicare and Medicaid. Currently, the Centers for Medicare & Medicaid (CMS) has approved 13 federal-state demonstrations in 12 states (California, Colorado, Illinois, Massachusetts, Michigan, Minnesota, New York, Ohio, South Carolina, Virginia, and Washington) to improve care coordination and align financing for up to 1.5 million dual-eligible beneficiaries. Most states are pursuing capitated managed care options; two states (Colorado and Washington) are testing managed fee-for-service (FFS) models, and one state (Minnesota) will integrate administrative, but not financial, alignment. As of October 2014, 166,580 beneficiaries were enrolled in demonstrations in California, Illinois, Massachusetts, Ohio, and Virginia. CMS has also undertaken an initiative to prevent unnecessary hospitalizations of nursing home residents, two-thirds (67%) of whom are dual-eligible beneficiaries, by providing enhanced on-site services and supports.

Report: How Do Medicare Beneficiaries Fare With Respect To Access To Care?

The enactment of Medicare improved access to care for millions of elderly Americans.

Prior to the enactment of Medicare in 1965, less than half of all elderly people had insurance to help pay for hospital and other medical services.28 Many were unable to obtain health insurance either because they could not afford the premiums or because they were denied coverage based on their age or pre-existing health conditions. Medicare significantly improved access to care for elderly Americans and is now a vital source of financial and health security for nearly all Americans age 65 and older, as well as millions of people with permanent disabilities.

Beneficiaries generally enjoy broad access to physicians, hospitals, and other providers, and report relatively low rates of problems across a number of access measures. Yet, access problems are reported somewhat more frequently among certain subgroups, including younger adults with disabilities, low-income beneficiaries, and those in relatively poorer health.

- Usual source of care: The vast majority of Medicare beneficiaries (96%) report that they have a usual source of care for when they are sick or seeking medical advice.29 This key indicator of access to care is particularly important for Medicare beneficiaries because they tend to have more chronic conditions and medical needs than others. In fact, Medicare beneficiaries are more likely than younger adults with private insurance to report having a usual source of care.30

- Access to care: A relatively small share of Medicare beneficiaries (6%) report that they had trouble accessing needed medical care (Figure 18). A somewhat larger share (11%) report delaying care due to cost burdens. Certain subgroups of Medicare beneficiaries report access problems more frequently than others, particularly those who often need more health care services. For instance, Medicare beneficiaries under age 65 (most of whom qualify for Medicare because of a long-term disability) report experiencing trouble accessing care at more than four times the rate of their older counterparts (17% versus 4%). The share of Medicare beneficiaries who report that they delayed care due to cost is three times as high for people with incomes below $20,000 compared to those with income of $40,000 or more. Also, Medicare beneficiaries who report that they are in fair or poor health are considerably more likely to encounter problems getting needed care or delaying care due to cost, relative to those reporting comparatively better health.

- Physician acceptance of new Medicare patients: The majority of office-based physicians (91%) report that they accept new Medicare patients into their practice (Figure 19).31 This acceptance rate for new Medicare patients is the same as the rate for new patients with private non-capitated insurance, such as a preferred provider organization, and is higher than for new patients with private capitated insurance (72%), Medicaid (71%), or no insurance (47%). Across the country, there is some variation in acceptance rates, but in each state, the majority of physicians accept new Medicare patients (Figure 20).

- Finding a new physician: Medicare seniors are as likely to report problems finding a new physician as people aged 50 to 64 with private insurance.32 Nonetheless, for both groups of individuals, problems finding a new doctor are more frequently reported when looking for a primary care physician compared with a specialist. Among the small share of Medicare seniors (7%) who said that they looked for a new primary care physician in 2013, 28 percent reported a problem finding one—equating to about 2 percent of all seniors in Medicare.

- High physician participation rates mean predictable expenses for most Medicare patients: The vast majority of physicians and other health professionals (96%) who bill Medicare are “participating providers,” which means that they agree to accept Medicare’s fee-schedule rates and will not “balance bill” their Medicare patients (charge higher fees for Medicare-covered services). As a result, most beneficiaries encounter predictable expenses when seeing their physician. A small share of physicians (less than 4%) who bill Medicare do not have these agreements and may balance bill up to a specified maximum for Medicare covered services.

- A very small share of physicians “opt out” of Medicare: Less than 1 percent of physicians has elected to “opt out” of Medicare and instead contract privately with all of their Medicare patients. These opt-out providers may charge Medicare patients any fee they choose. Psychiatrists represent a disproportionate share (42%) of these physicians, which raises concerns about access to psychiatrists for beneficiaries who cannot afford high out-of-pocket costs.

Report: How Does Medicare Pay Providers In Traditional Medicare?

Medicare relies on a number of different approaches when calculating payments to each provider for services they deliver to beneficiaries in traditional Medicare.

Current payment systems in traditional Medicare have evolved over the last several decades, but have maintained a fee-for-service payment structure for most types of providers. In many cases, private insurers have modeled their payment systems on traditional Medicare, including those used for hospitals and physicians. Building on Medicare payment reforms included in the Affordable Care Act and new approaches being tested and launched by the CMS Innovation Center, the Secretary of Health and Human Services recently announced a set of explicit targets to be met in the coming years that would tie an increasing share of traditional Medicare payments to provider performance on quality and spending.33

About two-thirds of Medicare’s benefit spending is on services delivered by providers in traditional Medicare.

Out of $597 billion in total benefit spending in 2014, Medicare paid $376 billion (63%) for benefits delivered by health care providers in traditional Medicare.34 These providers include hospitals (for both inpatient and outpatient services), physicians, skilled nursing facilities, home health agencies, inpatient rehabilitation facilities, hospice agencies, long-term care hospitals, outpatient dialysis facilities, ambulatory surgical centers, inpatient psychiatric facilities, durable medical equipment suppliers, ambulance providers, and laboratories. In general, Medicare pays each of these providers separately, using payment rates and systems that are specific to each type of provider. The remaining share of Medicare benefit payments (37%) went to private plans under Part C (the Medicare Advantage program; 26%) and Part D (the Medicare drug benefit; 11%). These private plans are responsible for paying providers or pharmacies on behalf of their Medicare enrollees. (See What is Medicare Advantage? and What is the Medicare Part D prescription drug benefit? for additional information on how Medicare pays Medicare Advantage and Part D plans.) The Budget Control Act of 2011 put in place a 2 percent across-the-board cut (known as “sequestration”) in Medicare payment to plans and providers beginning in 2013.

For most payment systems in traditional Medicare, Medicare determines a base rate for a specified unit of service, and then makes adjustments based on patients’ clinical severity, selected policies, and geographic market area differences.

Medicare uses prospective payment systems for most of its providers in traditional Medicare. In general, these systems require that Medicare pre-determine a base payment rate for a given unit of service (e.g., a hospital stay, an episode of care, a particular service). Then, based on certain variables, such as the provider’s geographic location and the complexity of the patient receiving the service, Medicare adjusts its payment for each unit of service provided (see Appendix 4: Medicare Payments to Providers). For most payment systems, Medicare updates payment rates annually to account for inflation adjustments. The main features of hospital, physician, outpatient, and skilled nursing facility payment systems (altogether accounting for almost three-quarters of spending in traditional Medicare) are described below:

- Inpatient hospitals (acute care): Medicare pays hospitals per beneficiary discharge, using the Inpatient Prospective Payment System. The base rate for each discharge corresponds to one of over 700 different categories of diagnoses—called Diagnosis Related Groups (DRGs)—that are further adjusted for patient severity. DRGs that are likely to incur more intense levels of care and/or longer lengths of stay are assigned higher payments. Medicare’s payments to hospitals also account for a portion of hospitals’ capital and operating expenses. Some hospitals receive added payments, such as teaching hospitals and hospitals with higher shares of low-income beneficiaries. Recent Medicare policies also reduce payments to some hospitals, including hospitals that have relatively higher Medicare readmission rates following previous hospitalizations for certain conditions.

- Physicians and other health professionals: Medicare reimburses physicians and other health professionals (e.g., nurse practitioners) based on a fee-schedule for over 7,000 services. Payment rates for these services are determined based on the relative, average costs of providing each to a Medicare patient, and then adjusted to account for other provider expenses, including malpractice insurance and office-based practice costs. This system, known as the Resource-Based Relative Value Update Scale (RBRVS), has been in place since 1992. Increases to Medicare’s payments include bonuses to those practicing in designated shortage areas. In general, health professionals who are not physicians but bill Medicare independently (e.g., nurse practitioners) receive a 15 percent reduction in payment.

Under current law, Medicare’s physician fee-schedule payments are subject to a formula, called the Sustainable Growth Rate (SGR) system, enacted in 1987 as a tool to control spending. For more than a decade this formula has called for cuts in physician payments, reaching as high as 24 percent. To prevent these cuts in physician payments from occurring, policymakers have overridden the SGR 17 times, as of 2014. Policymakers in both the House and the Senate agreed on a bipartisan proposal to repeal the SGR and replace it with a long-term approach for setting physician fees (H.R. 4015/S.2000), but disagreement on how the federal government would cover the cost of this proposal has so far prevented its enactment.

- Hospital outpatient departments: Medicare pays hospitals for ambulatory services provided in outpatient departments, based on the classification of each service into more than 750 categories with similar expected costs. Final determination of Medicare payments for outpatient department services is complex and incorporates both individual service payments and payments “packaged” with other services, partial hospitalization payments, as well as numerous exceptions. Hospitals may receive additional payments for certain outpatient department services, such as specified drugs and devices; unusually costly (outlier) services; and adjustments for some rural hospitals and cancer hospitals.

- Skilled Nursing Facilities (SNFs): SNFs are freestanding or hospital-based facilities that provide post-acute inpatient nursing or rehabilitation services. Medicare pays SNFs one of 66 pre-determined daily rates (categorized as Resource Utilization Groups (RUGs) for each patient, based on patients’ expected level of nursing and therapy needs. SNF payments incorporate operating and capital costs for providing care to Medicare patients, and an added daily payment from Medicare for care provided to beneficiaries with AIDS.

Report: What Is Medicare's Role In Delivery System Reform?

Delivery system reforms are new payment approaches for health care designed to change the way providers organize and deliver care.

The overarching goals of delivery system reforms in Medicare are to lower per capita spending while simultaneously fostering improved patient care. The Affordable Care Act directed CMS, primarily through a new Innovation Center, to launch a number of Medicare-wide programs and pilot projects to test new payment models across various types of providers. Evaluations of these programs are in their early stages and showing mixed results. While the overarching goals for most of these models are similar—improving care quality and lowering costs—the more specific aims within each model vary and represent a range of potential opportunities and challenges.

Current delivery system reform efforts differ from traditional Medicare’s status quo in terms of provider organization and payment approaches.

For the most part, traditional Medicare currently reimburses individual providers separately for the services they deliver to beneficiaries. This “siloed” payment approach carries inherent incentives for providers to furnish more care (or more expensive care) than may be necessary while also lacking incentives to coordinate patient care across health care settings. In contrast, new payment models that incorporate delivery system reforms typically include financial incentives that are designed to encourage collaboration and care coordination among different providers, reduce unnecessary service use, and reward providers for furnishing higher quality patient care.

The ACA included a number of delivery system reforms in Medicare.

In addition to large-scale programs implemented within Medicare, many new models are being tested as pilots and demonstration projects through the Innovation Center. Below are some examples of the types of delivery system reforms currently underway.

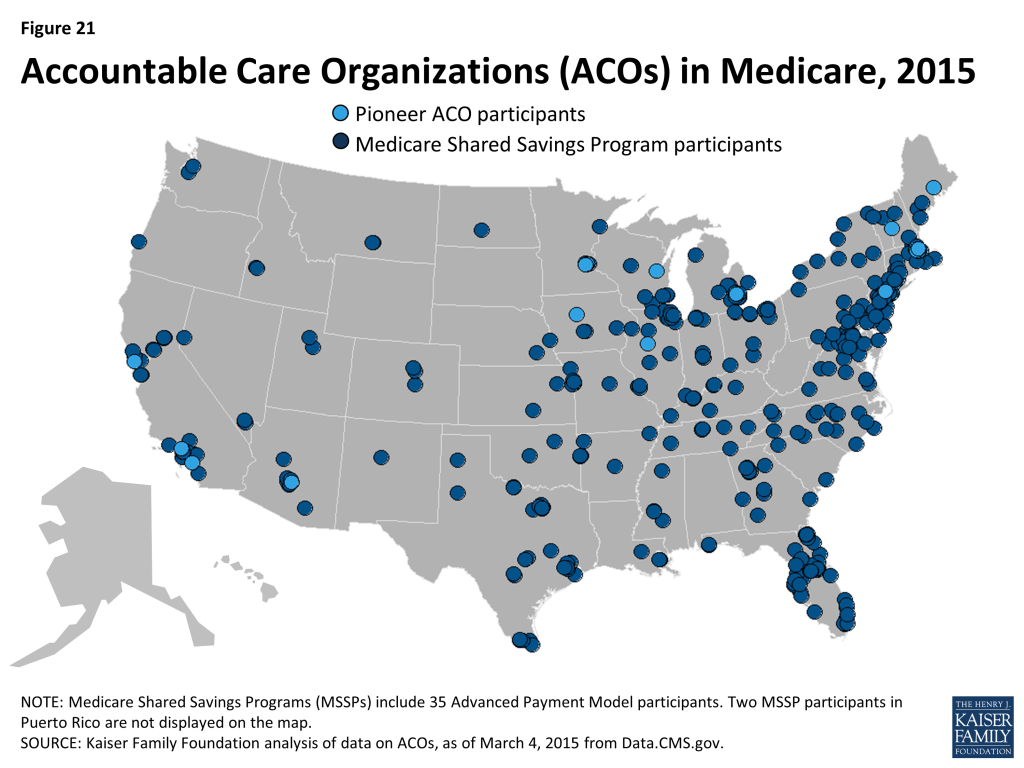

- Accountable Care Organizations (ACOs): ACOs are groups of providers (such as physician practices and hospitals) that collectively accept responsibility for the overall care of Medicare beneficiaries assigned to them, and share in financial savings if they meet aggregate spending and quality targets. In general, the ACO concept is designed to reward providers financially for working together, sharing information, and coordinating care, especially for high-risk and high-cost chronically ill patients.–Medicare has two main ACO programs: the Pioneer ACO program and the Medicare Shared Savings Program (MSSP) (Figure 21). Pioneer ACOs are generally larger entities that serve more beneficiaries and have experience with accepting financial risk for care, compared with ACOs in the MSSP. In addition to sharing in any savings, Pioneer ACOs are also required to repay Medicare a portion of any shared losses, if spending exceeds their target. In contrast, most ACOs in the MSSP do not currently take on this double-sided financial risk, but will be required to do so in future years.

- Bundled payments: Also known as episode-of-care payments, bundled payments reimburse for all services provided to a patient for a defined course of treatment, rather than paying each provider and site separately. For example, a single bundled payment for a patient undergoing knee replacement could encompass: the surgeon’s fee, the anesthesiologist charges, the hospital’s charges and those of hospital based physicians, post-surgical rehabilitation, such as physical therapy, and any medical complications that occur within a specified period of time in the episode of care. Under the bundled payment approach, the participating providers share in any savings that they generate or losses if total spending exceeds payment. The CMS Innovation center is currently managing a large-scale demonstration called the Bundled Payment for Care Improvement pilot, which is testing four bundled payment approaches for 48 different clinical conditions that started with a hospitalization.

- Medical homes: The medical home, also called an “advanced primary care practice,” is a team-based approach to care that focuses on providing and coordinating all of a patient’s ongoing care from within a primary care medical practice. Medical home models commonly receive a monthly payment for each patient, which is intended to offset the costs of activities that occur outside of face-to-face physician visits (e.g., phone call or email follow-up with other specialists, electronic health record activities, after-hours access to clinical staff). The CMS Innovation Center is currently testing medical home models within Medicare through several programs, including the Comprehensive Primary Care Initiative, the Multi-Payer Advance Primary Care Practice program, and a medical home model within over 400 Federally Qualified Health Centers.

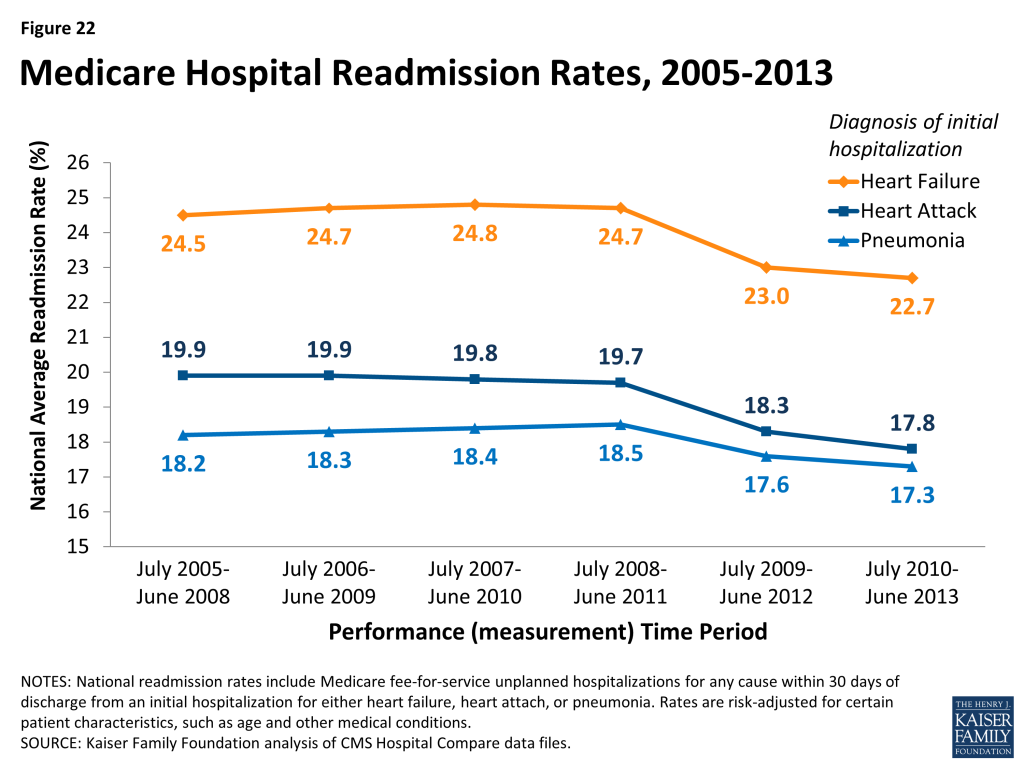

- Hospital readmission reduction initiatives: Efforts to decrease the number of patient readmissions to hospitals carries benefits to both Medicare patients as well as the Medicare program. Reducing preventable readmissions could indicate that Medicare beneficiaries are receiving better care both during and after the initial hospitalization, and may translate to lower spending in Medicare. Incentives to decrease the number of preventable hospital readmissions among Medicare patients is part of many delivery system reforms in Medicare. For example, the Hospital Readmission Reduction Program financially penalizes hospitals that have relatively higher rates of Medicare readmissions following initial hospitalizations for certain conditions (heart attack, pneumonia, hip replacement). On the whole, CMS has reported declines in national readmission rates among Medicare beneficiaries, starting in 2012 and continuing into 2013 (Figure 22).

Report: How Much Does Medicare Spend, And How Does Current Spending Compare To Past Trends And The Future Outlook?

Spending on Medicare accounted for 14 percent of total federal spending in 2014.

Federal spending for fiscal year 2014 totaled $3.5 trillion, with net spending on Medicare (that is, Medicare spending minus income from premiums and other offsetting receipts) comprising 14 percent of the total (Figure 23). Of the three main entitlement programs—Social Security, Medicare, and Medicaid—Medicare is second largest in terms of the share of federal spending on each program. Social Security is largest, at 24 percent of federal spending in 2014. Spending on Medicaid (along with spending on the Children’s Health Insurance Program and Exchange subsidies) represented 9 percent of federal spending in 2014.

Medicare benefit payments totaled $597 billion in 2014.

Medicare benefit payments totaled $597 billion in 2014; roughly one-fourth was for hospital inpatient services, 12 percent for physician services, and 11 percent for the Part D drug benefit (Figure 24). Just over one-fourth of benefit spending (26%) was for Medicare Advantage private health plans covering all Part A and B benefits; in 2014, 30 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans.

Medicare spending is concentrated among a small share of beneficiaries.

A small share of Medicare beneficiaries accounts for a majority of Medicare spending. Ten percent of beneficiaries in traditional Medicare accounted for nearly 60 percent of Medicare spending in 2010 (Figure 25). At the other end of the spectrum, 30 percent of beneficiaries in traditional Medicare had total spending of less than $1,000, accounting for just 1 percent of total expenditures. Twelve percent of beneficiaries incurred no Medicare expenditures at all.

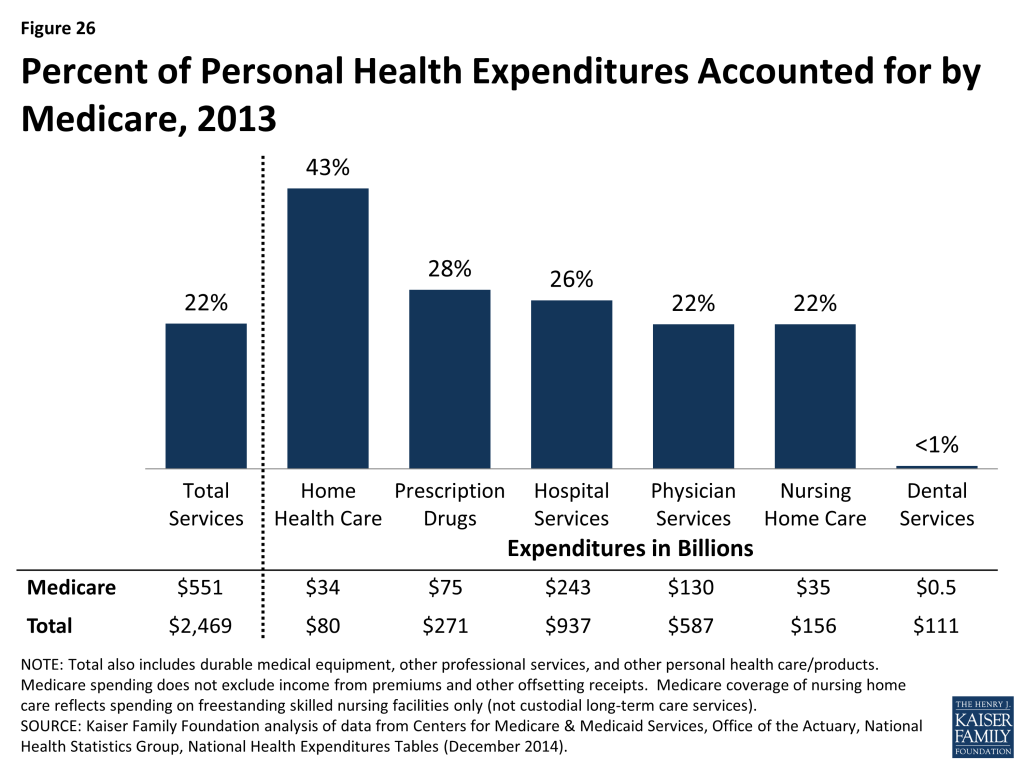

Medicare spending accounted for one-fifth of the $2.5 trillion in personal health care expenditures in the U.S in 2013.

Medicare’s share of national personal health care expenditures varies by type of service, reflecting benefits covered and services used by the Medicare population. For example, in 2013, Medicare accounted for 43 percent of home health care spending and 26 percent of all hospital spending, but less than 1 percent of dental care spending (because traditional Medicare does not cover dental services) (Figure 26). Medicare accounted for 28 percent of total national prescription drug spending in 2013—a significant increase from 2 percent in 2005, the year before the Part D drug benefit went into effect.

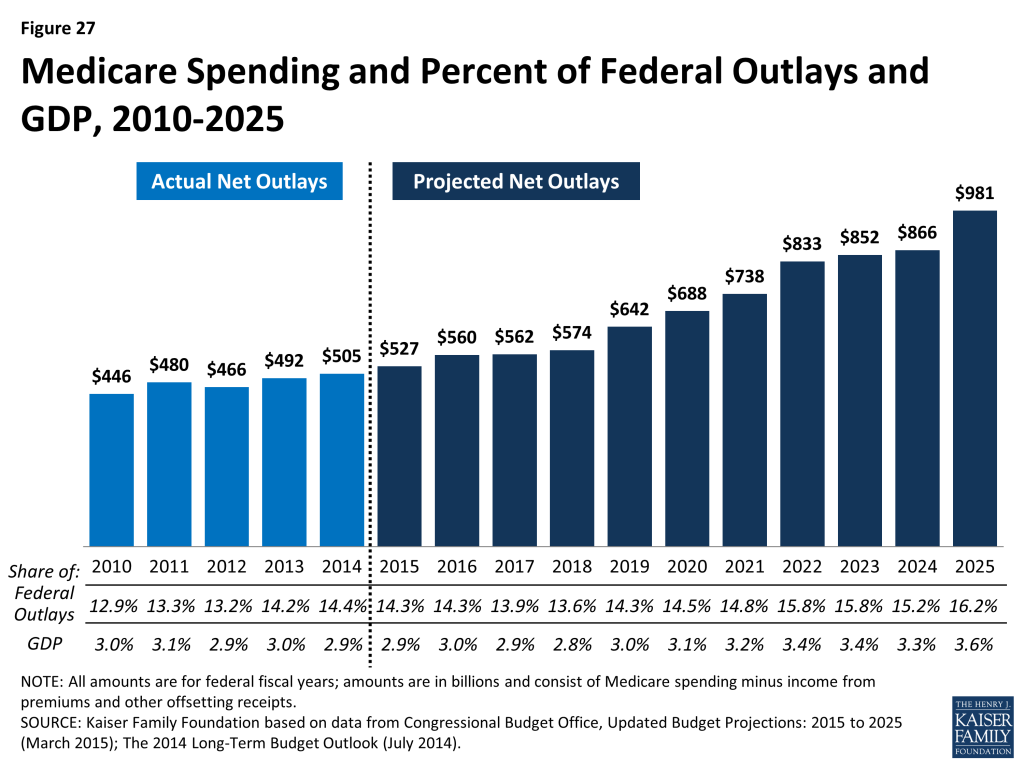

Medicare spending is projected to nearly double from $527 billion in 2015 to $981 billion in 2025, according to CBO.

Looking ahead, net Medicare outlays (that is, Medicare spending minus income from premiums and other offsetting receipts) are projected to increase nearly two-fold from $527 billion in 2015 to $981 billion in 2025—an average annual growth rate of 6.4 percent in the aggregate—due to growth in the Medicare population and increases in health care costs (Figure 27). These estimates do not take into account additional spending that is likely to occur to avoid reductions in physician fees scheduled under current law. The growth in health spending, which affects all payers, is influenced by increasing volume and use of services, new technologies, and higher prices.

Despite annual growth in outlays, net Medicare spending is projected to be a modestly larger share of the federal budget and the nation’s economy in the coming decade. Medicare’s share of the federal budget is projected to rise from 14.3 percent in 2015 to 16.2 percent in 2025, while Medicare spending as a share of GDP is projected to be 2.9 percent in 2015 and 3.6 percent in 2025.

In the short term, Medicare spending per person is expected to grow more slowly than it has in the past, more slowly compared to private health insurance spending growth, and in line with growth in the economy.

On a per capita basis, Medicare spending is projected to grow at a slower rate between 2014 and 2023 than it did between 2000 and 2013 (3.7 percent vs. 5.5 percent) (Figure 28). Medicare spending also is projected to grow more slowly than private health insurance spending on a per capita basis in the coming years (4.7 percent), and roughly in line with growth in GDP per capita (3.5 percent). The Congressional Budget Office has attributed Medicare’s slow per person growth rate in the short term to a larger share of younger beneficiaries as the baby boom generation ages onto Medicare; constraints on Medicare payment rates to plans, physicians, and other types of providers; and the overall slowdown in Medicare spending across different types of services, beneficiaries, and geographic areas.

Over the longer term, both CBO and the Medicare Actuaries expect Medicare spending to begin to rise more rapidly due to a number of factors.

Medicare’s long-term spending trends are driven by the aging of the population, an increase in service use associated with greater severity of illness, and faster growth in health care costs than growth in the economy on a per capita basis. According to CBO’s most recent long-term projections, net Medicare spending will grow from 3.0 percent of GDP in 2014 to 3.8 percent of GDP in 2030, 4.7 percent in 2040, and 5.5 percent in 2050.35 Through 2039, CBO projects that the aging of the population will account for a larger share of spending growth on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage) than either “excess” health care spending growth or expansion of Medicaid and Marketplace subsidies.

Report: How Is Medicare Financed And What Are Medicare's Future Financing Challenges?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries. Other sources include taxes on Social Security benefits, payments from states, and interest.

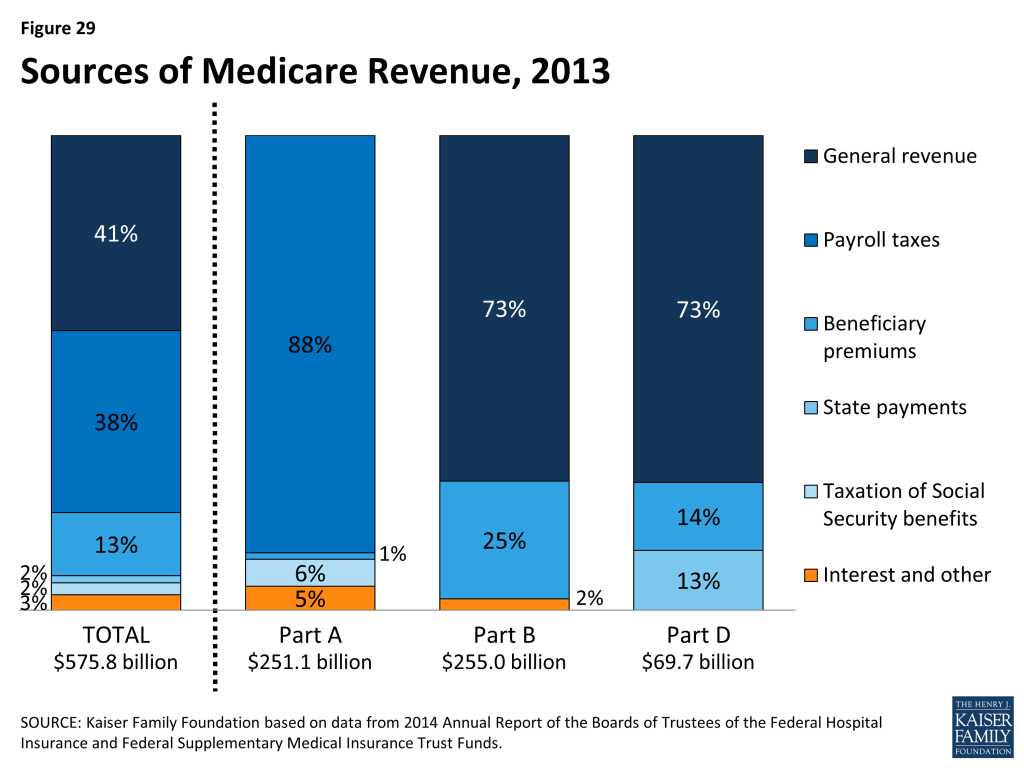

Medicare is funded as follows (Figure 29):

- Part A, the Hospital Insurance (HI) trust fund, is financed primarily through a dedicated payroll tax of 2.9 percent of earnings paid by employers and their employees (1.45 percent each). In 2013 (the most recent year for which actual data are available), these taxes accounted for 88 percent of the $251 billion in revenue to the Part A Trust Fund. In 2013, the Medicare HI payroll tax increased by 0.9 percentage points (from 1.45 percent to 2.35 percent) for higher-income taxpayers (more than $200,000/single person and $250,000/married couple), with additional revenues deposited into the HI trust fund.

- Part B, the Supplementary Medical Insurance (SMI) trust fund, is financed through a combination of general revenues, premiums paid by beneficiaries, and interest and other sources. Premiums are automatically set to cover 25 percent of spending in the aggregate, while general revenues subsidize 73 percent. Higher-income beneficiaries pay a larger share of spending, ranging from 35 percent to 80 percent of Part B costs. Part B revenues totaled $255 billion in 2013.

- Part D is financed through general revenues, beneficiary premiums, and state payments for dual-eligible beneficiaries (who received drug coverage under Medicaid prior to 2006). The monthly premium paid by enrollees is set to cover 25.5 percent of the cost of standard drug coverage, and Medicare subsidizes the remaining 74.5 percent. Similar to Part B, higher-income beneficiaries pay a larger share of the cost of standard drug coverage. In 2013, Part D revenue totaled $70 billion, 73 percent of which was from general revenues, 14 percent from premiums, and 13 percent from state payments.

- The Medicare Advantage program (Part C) is not separately financed. Medicare Advantage plans such as HMOs and PPOs cover all Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans typically pay monthly premiums for additional benefits covered by their plan in addition to the Part B premium.

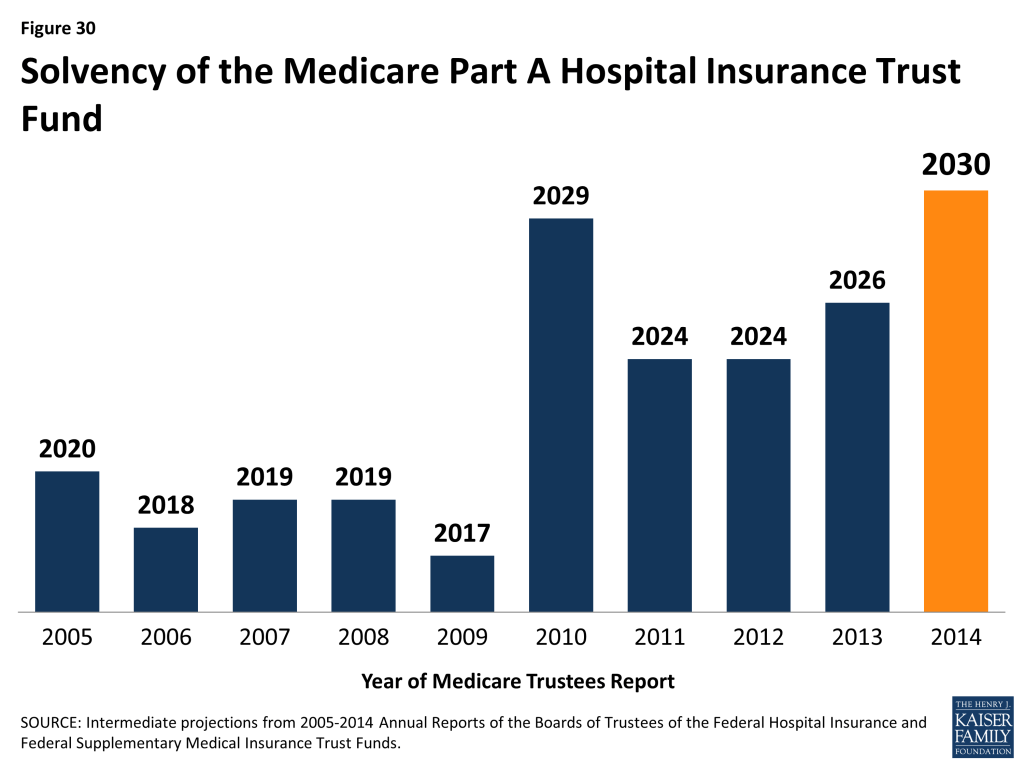

The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is a common way of measuring Medicare’s financial status. In 2014, the Medicare Trustees projected that the Part A trust fund will be depleted in 2030.

Medicare solvency is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases. When spending exceeds income and the assets are fully depleted, Medicare will not have sufficient funds to pay all Part A benefits.

Each year, the Medicare Trustees provide an estimate of the year when the asset level is projected to be fully depleted. Because of slower growth in Medicare spending in recent years, the solvency of the trust fund has been extended. In 2014, the Trustees projected that the Part A trust fund will be depleted in 2030, four years later than was projected in the 2013 report and six years later than was projected in the 2012 report (Figure 30).

Part A Trust Fund solvency is affected by growth in the economy, which affects revenue from payroll tax contributions, health care spending trends, and demographic trends: an increasing number of beneficiaries, especially between 2010 and 2030 when the baby boom generation reaches Medicare eligibility age, and a declining ratio of workers per beneficiary making payroll tax contributions.

Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. However, future increases in spending under Part B and Part D will require increases in general revenue funding and higher premiums paid by beneficiaries.

In addition to the solvency of the Part A trust fund, Medicare’s financial condition can be measured in other ways.

For example, the Independent Payment Advisory Board (IPAB), a 15-member board which was authorized by the ACA, is required to recommend Medicare spending reductions to Congress if projected spending growth exceeds specified target levels. IPAB is required to propose spending reductions if the 5-year average growth rate in Medicare per capita spending is projected to exceed the per capita target growth rate, based on inflation (2015-2019) or growth in the economy (2020 and beyond). The ACA required the IPAB process to begin in 2013, but CBO has estimated that spending reductions will not be triggered for several years because Medicare spending growth is expected to be below the target growth rate during the next decade. As yet, no members of the board have been nominated or appointed.

Looking to the future, Medicare is expected to face financing challenges due to the aging of the U.S. population, increasing health care costs, and the declining ratio of workers to beneficiaries.