Poll: People View Prior Authorization as Greatest Burden in Navigating the Health System

Many Report Impact on their Care, Finances and Well-being

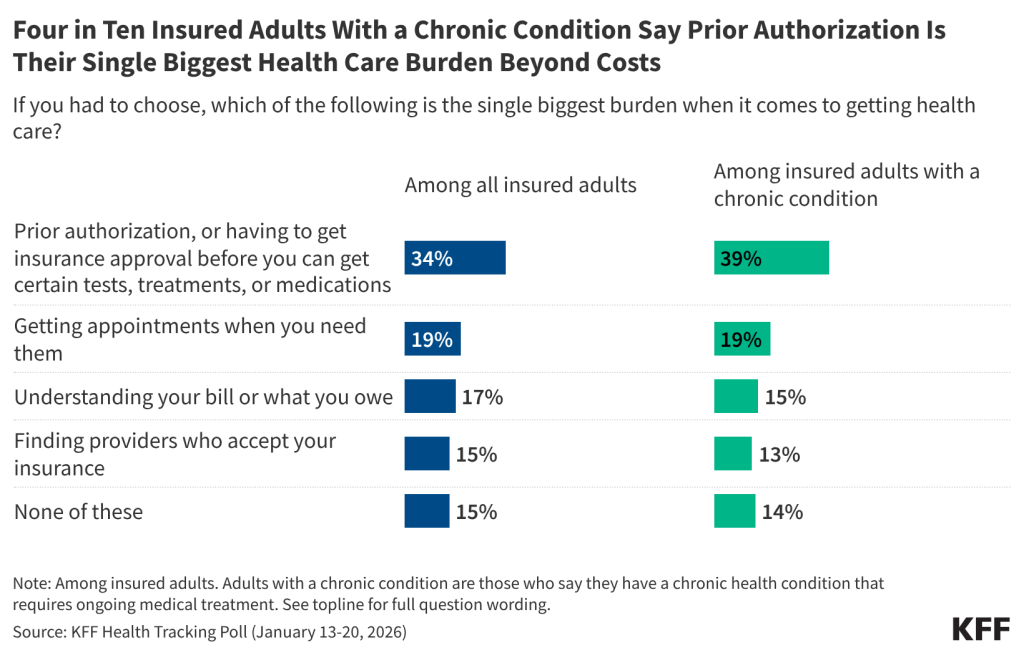

New KFF polling explores the challenges beyond costs that people with insurance face in navigating the health care system. People cite prior authorization review as their top problem by a wide margin, with a third (32%) saying prior authorization requirements are a “major burden.”

That’s more than say the same about understanding their bill or what they owe (23% say it is a major burden), getting appointments when they need them (20%), or finding providers who accept their insurance (17%).

When asked to choose which of those four factors is “the single biggest burden,” prior authorization before accessing certain tests, treatments, or medication ranks at the top (34%). Among people with a chronic condition that requires ongoing medical treatment (about half of all insured adults), 4 in 10 (39%) say prior authorization is the single biggest burden when it comes to getting care, more than twice the share who say the same about other obstacles.

“The complexity of the health system drives patients crazy, can have real consequences, and disproportionately affects people who are sick,” KFF President and CEO Drew Altman said. “Prior authorization review is the poster child for that complexity.”

Prior authorization ranks as the single biggest burden for people with employer coverage and Medicaid, as well as those who buy their own coverage (largely through the Affordable Care Act’s Marketplaces).

During the prior authorization process, some treatments or medications recommended by a provider may be delayed and, in some instances, an insurance company may end up denying medication or treatment.

About half (47%) of insured adults – and a larger share (57%) of those with chronic conditions – say their access to a certain health care service, treatment, or medication has been denied, delayed, or altered in the past two years by their health insurer.

Among those who report such denials, delays, or alterations, about a third say it had a “major negative impact” on their mental health and emotional well-being (34%) and finances (33%), and a quarter say it had a “major negative impact” on their physical health (26%). This translates to about 1 in 5 of all adults with insurance saying that their mental or physical health, or finances, have been majorly impacted.

Designed and analyzed by public opinion researchers at KFF, this survey was conducted January 13-20, 2026, online and by telephone among a nationally representative sample of 1,426 U.S. adults in English and in Spanish. The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on other subgroups, the margin of sampling error may be higher.