Three-Quarters of Public Say Congress Should Extend the Enhanced ACA Tax Credits Set to Expire Next Year, Despite Budget Concerns

New KFF polling finds more than three-quarters of the public say they want Congress to extend the ACA enhanced premium tax credits set to expire at the end of this year. If the credits do expire and the average premium more than doubles, 7 in 10 of those who purchase their own insurance say they wouldn’t be able to afford premiums.

employer health benefits

Annual Family Premiums for Employer Coverage Rise 6% in 2025, Nearing $27,000; Workers Contribute $6,850 Toward Premiums

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, worker contributions, cost-sharing provisions, offer rates, and more. This year’s report also looks at how employers are approaching coverage of GLP-1 drugs for weight loss, including their concerns about utilization and cost. Read the news release →

Beyond the Data: The Semi-Sad Prospects for Controlling Employer Health Care Costs

In a new column, President and CEO Dr. Drew Altman discusses the obstacles employers face trying to control their health care costs, and the reasons why they’ve never been meaningful supporters of government cost-containment efforts. He predicts that premium increases expected next year could lead to a new wave of higher deductibles and other forms of cost sharing for the 155 million Americans who rely on employer coverage.

-

About 17 Million More People Could be Uninsured due to the Big Beautiful Bill and other Policy Changes

In total, due to the One Big Beautiful Bill Act and other policy changes, the number of people without health insurance is expected to increase by about 17 million. If all of this comes to pass, it would represent the biggest roll back of health insurance coverage ever due to federal policy changes. … more

-

Policy Uncertainty is Creating Challenges for ACA Marketplace Insurers

Until Congress passes the reconciliation bill, Marketplace insurers will face uncertainty regarding the regulatory landscape and may find it difficult to set premiums for 2026. … more

-

CMS Marketplace Rule’s Sunset Provisions Could Help Congress Find Budget Reconciliation Savings

A CMS rule, once finalized, is generally intended to exist permanently or until it is repealed…. This temporary implementation may preserve the potential for the reconciliation bill to generate official savings through changes to ACA marketplaces in later years (2027–2034) if enacted. … more

Medicare Open Enrollment

Medicare Open Enrollment FAQs

Explore frequently asked questions related to Medicare Open Enrollment, including Medicare Advantage, Part D, Medigap, and more.

New and Noteworthy

States Are Forming

‘Health Alliances.’ Can They Make a Difference for Public Health Policy?

States have begun to form “health alliances” as a counter to federal public health recommendations and policies under the Trump Administration. This Policy Watch describes the goals of these alliances, and discusses what effects they may have for U.S. public health policy.

Medicaid, Children’s Health: 5 Issues to Watch Amid Federal Changes

Major federal changes to Medicaid and other health-related policies could impact children’s health in the coming years. This issue brief explores the latest data on Medicaid and children’s health and highlights five key issues to watch as those federal changes are implemented.

Latest News

-

As Sports Betting Explodes, States Try To Set Limits To Stop Gambling Addiction

-

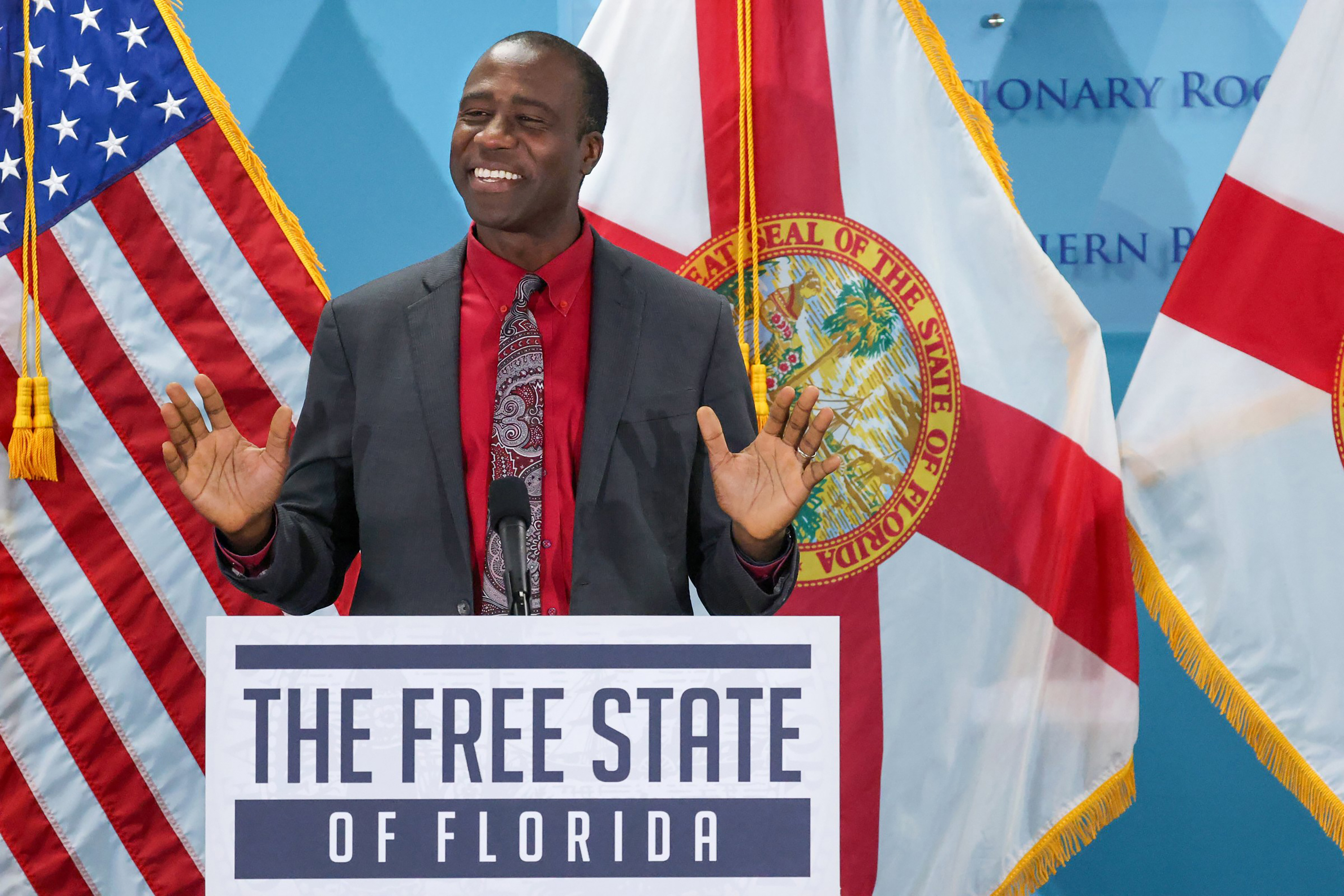

Doctors Muffled as Florida Moves To End Decades of Childhood Vaccination Mandates

-

Listen: Amid Shutdown Stalemate, Families Brace for SNAP Cuts and Paycheck Limbo

-

GOP Talking Point Holds ACA Is Haunted by ‘Phantom’ Enrollees, but the Devil’s in the Data

Subscribe to KFF Emails

Choose which emails are best for you.

Sign up here

Cynthia Cox

Cynthia Cox  Jared Ortaliza

Jared Ortaliza  Emma Wager

Emma Wager