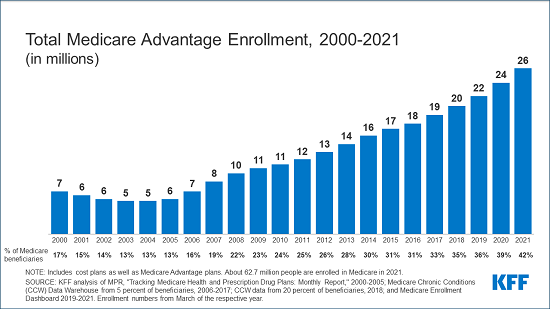

Although Their Share of the Market Varies By State, Enrollment in Medicare Advantage Plans Has More Than Doubled Over the Past Decade, with More than 4 in 10 Medicare Beneficiaries Now Enrolled in the Private Plans

Three KFF Analyses Examine the Latest Data and Trends in Medicare Advantage Enrollment, Premiums, Plan Benefits, Out-of-Pocket Limits, Cost Sharing, Star Ratings and Bonuses, and More

The private plans known as Medicare Advantage now cover more than 4 in 10 Medicare beneficiaries, reflecting a more than doubling of enrollment over the past decade even as the plans remain a far larger presence in some states than others, according to a new KFF analysis.

More than 26 million of the nation’s nearly 63 million Medicare beneficiaries are enrolled in Medicare Advantage plans in 2021. The share varies considerably by state, ranging from less than 20 percent in Vermont, Maryland, Alaska, and Wyoming, to more than 50 percent in Minnesota, Florida, and Puerto Rico, the analysis finds.

Enrollment rates also vary widely across counties, within states. In Florida, for example, it ranges from 16 percent in Monroe County (Key West) to 73 percent in Miami-Dade County. Nationally, 29 percent of Medicare beneficiaries live in a county where more than half of all Medicare beneficiaries are enrolled in Medicare Advantage plans.

The new analysis is one of three released by KFF today that examine various aspects of Medicare Advantage, a type of Medicare coverage that the Congressional Budget Office has projected will cover 51 percent of all Medicare beneficiaries by 2030.

One brief provides current information about Medicare Advantage enrollment, including the types of plans in which Medicare beneficiaries are enrolled, and how enrollment varies across geographic areas. A second analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, and prior authorization requirements. A third compares Medicare Advantage plans’ star ratings and federal spending under the quality bonus program.

Among other key findings:

• Nine in ten Medicare Advantage enrollees are in plans that include prescription drug coverage and nearly two-thirds of these enrollees (65%) pay no premium other than the monthly Medicare Part B premium ($148.50 in 2021).

• Virtually all Medicare Advantage enrollees (99%) would pay less than the traditional Medicare Part A hospital deductible of $1,484 for an inpatient stay of three or fewer days. But for a six-day stay or longer, about half (53%) would incur higher costs than beneficiaries in traditional Medicare with no supplemental coverage.

• In 2021, the weighted average out-of-pocket limit for Medicare Advantage enrollees is $5,091 for in-network services and $9,208 for in-network and out-of-network services combined. For enrollees in HMOs, the average out-of-pocket (in-network) limit is $4,566.

• Most enrollees in individual Medicare Advantage plans have access to some benefits not covered by traditional Medicare, including eye exams and/or glasses (99%), telehealth services (94%), dental care (94%), a fitness benefit (93%) and hearing aids (93%). Other benefits are offered far less frequently, such as a meal benefit (55%), transportation (37%), and in-home support services (7%), and when they are offered, tend to be offered more frequently in special needs plans.

• More than 80 percent of Medicare Advantage enrollees in 2021 are in plans that receive bonus payments from Medicare based on quality star ratings, substantially higher than the share in 2015 (55%). Spending on bonus payments to Medicare Advantage plans totals $11.6 billion in 2021, almost four times the amount in 2015.

The full analyses are available online and include:

• Medicare Advantage in 2021: Enrollment Update and Key Trends

• Medicare Advantage in 2021: Premiums, Cost Sharing, Out-of-Pocket Limits and Supplemental Benefits

• Medicare Advantage in 2021: Star Ratings and Bonuses

For more data and analyses about Medicare Advantage, visit kff.org