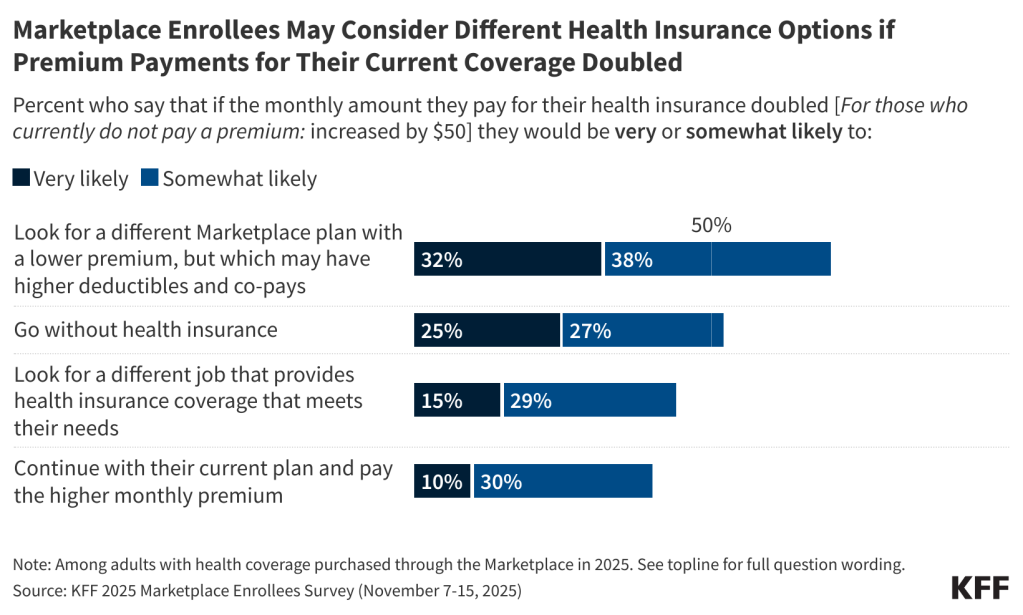

Poll: 1 in 3 ACA Marketplace Enrollees Say They Would “Very Likely” Shop for a Cheaper Plan If Their Premium Payments Doubled; 1 in 4 Say They “Very Likely” Would Go Without Insurance

As Enhanced Credits Expire, Nearly All Enrollees Expect to Make Coverage Decisions This Year

More than half of Marketplace enrollees (54%) say they expect that the cost of their health insurance coverage for next year will “increase a lot more than usual.” An additional one in four (26%) expect it to increase a “little more than usual,” while smaller shares expect their insurance costs to “increase about the same as usual” (12%) or “not increase at all” (8%).

If their overall health care expenses, including co-pays, deductibles, and premiums, increased by $1,000 next year, about half of Marketplace enrollees say it would have a “major impact” on their decision to vote in the 2026 midterm elections (54%) or on which party’s candidate they will support (52%).

People with Marketplace insurance are more likely to say that either President Trump (37%) or Congressional Republicans (33%) would deserve most of the blame if their health care costs increased by $1,000 next year than they are to say Congressional Democrats (29%).

Democrats would overwhelmingly blame Republicans in Congress (46%) or President Trump (49%). Most Republicans (65%) would blame Congressional Democrats, though about a third say they would blame either Republicans in Congress (20%) or President Trump (14%). Among independents, more than four in 10 (44%) would blame the President, a third (32%) would blame Congressional Republicans, and about one in four (23%) would blame Congressional Democrats.

Other findings include:

- Overall, about four in 10 Marketplace enrollees (39%) are Republicans or Republican-leaning independents, including about one in four (24%) who identify with President Trump’s Make America Great Again (MAGA) movement. Just over four in 10 enrollees (45%) identify as Democrats or Democratic-leaning independents, while 17% don’t identify or lean toward either party.

- Even with the current levels of financial assistance, many Marketplace enrollees say it is already difficult to afford their deductibles and other out-of-pocket costs for medical care (61%) and to afford the cost of health insurance each month (51%). More enrollees say their out-of-pocket medical costs are difficult to afford than say the same about other household expenses, such as their rent or mortgage, food and groceries, utilities, and gasoline or transportation costs.

- Large majorities of Marketplace enrollees, regardless of partisanship, say that having health insurance is “very important” for their peace of mind (78%), their ability to get needed health care (77%), and their financial well-being (69%). Enrollees between the ages of 50 and 64 are more likely than younger enrollees to say health insurance is very important for each of these three reasons.

- A large majority (84%) of enrollees say that Congress should extend the enhanced tax credits, while one in six (16%) think they should let the tax credits expire. Of them, nearly all Democrats (95%), about eight in 10 independents (84%), and about seven in 10 Republicans (72%) and MAGA supporters (72%) favor extending the expiring tax credits.

Designed and analyzed by public opinion researchers at KFF, the 2025 Marketplace Enrollees Survey was conducted November 7-15, 2025, online and by telephone, in English and in Spanish, among a nationally representative sample of 1,350 U.S. adults ages 18-64 who purchase coverage on the ACA Marketplaces. The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on other subgroups, the margin of sampling error may be higher.