Medicaid Work Requirements in Arkansas: Experience and Perspectives of Enrollees

Introduction

Arkansas is one of five states for which CMS has approved a Section 1115 waiver to condition Medicaid eligibility on meeting work and reporting requirements and the first state to implement this type of waiver.1 This brief builds on our prior analysis of state data and a case study published in October 2018, to include perspectives of enrollees and providers about the new “Arkansas Works” waiver requirements. The findings are primarily based on four focus groups with a total of 31 Arkansas Works enrollees conducted by the Kaiser Family Foundation, working with PerryUndem Research/Communication, during November 2018. Focus groups were held in Little Rock and Monticello, Arkansas to capture both more urban and rural experiences with the new requirements. Little Rock is the state capital and the most populous city in the state. Monticello is the county seat of Drew County, located in the rural lower Delta region in the southeastern corner of the state (Figure 1).

In each location, one group consisted of enrollees ages 30 to 49 who were currently subject to the new requirements and were not identified by the state through data matching as exempt from work or reporting requirements.2 Focus group participants also were not receiving SNAP benefits (so they were not automatically exempt from the Medicaid reporting requirements). A few in the older age group had lost coverage due to failure to meet the reporting requirement, and others knew someone who had lost coverage. Most were working, although several had changed jobs or cycled in and out of work in the past year. Others were unable to work due to caring for elderly parents or physical or mental health conditions that prevented work. A couple were in substance use recovery. Some participants did not have children, while others were parents of young adult children (ranging in age from late teens to 20’s and 30’s) or the parents of minor children for whom they did not have custody. Enrollees subject to the new requirements have annual incomes up to $16,753 (138% of the federal poverty level for an individual in 2018).

The other group in each location included enrollees ages 19 to 29 who will be subject to the new requirements beginning in 2019. Many participants in the younger age group were students, and most also were working. Most were relatively healthy, although a few had chronic physical or mental health conditions. All focus group participants were contacted via phone and email, so they may be unlike many other Arkansas Works enrollees who do not have regular access to a phone and/or email. Most had had stable addresses and phone numbers for some time, although one was homeless, living out of a car, and another lived in a halfway house. Participants also had reliable transportation to get to the focus groups, which is not common among all Arkansas Works enrollees.3

To account for these differences among enrollees and provide a fuller picture of how enrollees are experiencing the new requirements, we also conducted interviews with four safety net health care and food assistance providers and a case worker in the Department of Workforce Services in November, 2018, and reviewed publicly available reports and data. Key findings center on enrollees’ awareness of the new requirements and ability to set up online accounts for monthly reporting; the effect of the new requirements on enrollees’ work and common barriers to work; enrollees’ experience with monthly reporting; impacts on particular populations, such as those with disabilities or who are homeless; and the anticipated effects of coverage losses resulting from the new requirements.

Background

CMS approved Arkansas’ waiver amendment on March 5, 2018, and the new work and reporting requirements took effect for the initial group of beneficiaries on June 1, 2018. The requirements were phased in for enrollees ages 30 to 49 from June through September, 2018, and will apply to those ages 19 to 29 beginning in January, 2019. Unless exempt, enrollees must engage in 80 hours of work or other qualifying activities each month and must report their work or exemption status using an online portal. Individuals need to report work activities or exemptions by the 5th of the following month. The Arkansas Department of Human Services (DHS) has released monthly data related to the new requirements since June, 2018. September, 2018 was the first month that enrollees could lose coverage for failure to meet the new requirements for three months. As of December 7, 2018, the state reported that nearly 17,000 people have lost Medicaid coverage as a result of the new work and reporting requirements.

Key findings from our October, 2018 case study report show that despite a robust outreach campaign conducted by the state, health plans, providers, and beneficiary advocates, many enrollees have not been successfully contacted about the new requirements. In addition, the process to set up an online account is complicated. The state is using data matching to exempt about two-thirds of enrollees from the reporting requirements. For non-exempt enrollees, reporting of exemptions or work activities requires multiple steps. Some enrollees who may qualify for an exemption but are not identified by the state data matching may fall through the cracks, and others may face barriers to work. Coverage losses could result in gaps in care as well as increases in the uninsured rate and uncompensated care costs for providers.

Key Findings

Are enrollees aware of the new requirements and if so, what is their experiencing setting up online accounts?

Informational letters and notices about the new requirements were not fully read or understood by enrollees. The state has sent multiple mailings about the new requirements; links to samples are contained in the Appendix to this report. Enrollees in the November, 2018 focus groups confirm earlier findings that despite robust outreach efforts, many were not fully aware of the specifics of the new requirements. Most enrollees did get a letter, but the large majority did not fully read the letter and/or understand the new work or reporting requirements or the consequences of failure to comply, including coverage loss for the remainder of the calendar year. Enrollees described the letters as confusing and long, and many enrollees did not get to the second page. Many said their lives are busy and complicated, and they put the letters aside without fully comprehending the information because they had to focus on more immediate and pressing needs. For example, one enrollee said that she was focused on her alcoholism recovery and getting back on her feet so the notices went unread. Others were focused on meeting basic needs like affording food and utility bills. Safety net providers observed that those with low literacy levels or limited English proficiency would have greater difficulty understanding the information, given the complicated rules and reading level required. In a few instances, individuals had moved recently within the state, and despite having reported an address change to DHS, notices and other mail were not getting delivered to the correct address.

“I only skimmed through it and picked up [that] I had to do the 80 hours a month or something and then I set it down…It didn’t say nothing about opening an account.” Little Rock AR Works enrollee

“You get this in the mail, you don’t go to the next page, but my friend told me…you got to read the next page. Because if you don’t go online to do this, you’re going to get cut off…” Monticello AR Works enrollee

Few enrollees recalled getting phone calls about the changes to AR Works. Earlier findings report that phone calls were a focus of state and health plan outreach efforts, although they had limited effectiveness. Most focus group participants did not remember getting calls, but said that if they got a call from an unknown number, they were not likely to pick up. Most enrollees in the focus groups had stable cell phone numbers, but many did not have land line phones. Other enrollees who answered a call did not take additional action; however, one participant did say that repeated phone calls from his insurer motived him to try to set up an online account, although he required help from both the health plan and his wife to do so.

“And then I got a phone call with some lady saying, did you get the letter? You’re gonna have to start logging in or you lose your insurance. And I said what does that have to do with my insurance. Well it’s a new requirement. I just said, okay, thank you, have a good day and then we got off the phone.” Little Rock AR Works enrollee

“She was from Blue Cross/Blue Shield or something…my wife was like, well you need to talk them folks because they about to cut this off… I called the lady and talked to her and she was like, you need to report… you get three strikes and then they’ll cut it off.” Monticello AR Works enrollee

While many in the focus groups had social media accounts, virtually no one got information about AR Works through Facebook or other social media. The state had conducted outreach and education sessions through social media, like Facebook Live and posted YouTube videos online. While most people in the focus groups used social media to be in touch with friends or family, not one person in any of the groups had gotten information about Arkansas Works that way. In addition, enrollees reported having limited cellular data and those in more rural areas have less access to wi-fi or the internet and greater problems with cell phone connectivity, which makes accessing information about AR Works through social media more difficult. A common comment among the Monticello participants was not having any cellular service at home, especially for those living “out in the country,” and having to come “into town” to get a signal. Another Monticello participant who did live “in town” also described sporadic cellular service. Those with wifi described the connectivity as “going in and out.” A provider noted that some of the Delta region had no cellular service, with the only option to access the internet at home being a satellite connection, which was prohibitively expensive for those with low wage jobs.

The younger enrollees who will be phased in to the new requirements beginning in January, 2019 had started to hear about the program changes, but few had complete information or fully understood what was required to comply. Most had received a letter in the mail, although a number did not get the letter because they were college students with new addresses. A few had online accounts already set up for Arkansas Works and got the information through email. In some cases, they had heard about the new requirements from their parents or from the news. However, their understanding was high-level. Similar to the older enrollees, they may have gotten a letter and skimmed the information without fully understanding the key rules necessary to maintain coverage, including the requirement to set up an online account and to report work activities monthly and periodically report and renew exemptions.

The majority of those who were aware of the requirement to set up an online account reported problems doing so and could not get assistance. Some tried to set up an account but did not have the right reference numbers or passwords. Many said that the process was complicated, and it was difficult to get in touch with someone at DHS to get help. Many participants tried to call and were on hold for very long periods of time or transferred to multiple people before getting help. A number of enrollees gave up and were left with negative perceptions about DHS. One participant who was working but disenrolled from coverage was unable to successfully report hours after experiencing multiple problems with the reference number and account passwords. Several enrollees mentioned the fact that the online portal shuts down every evening at 9 pm for maintenance as an additional barrier to reporting because the portal was not open when they were most likely available to use it. A number of people in the focus groups knew about the DHS processing or call center in Pine Bluff. Notably, one enrollee who worked as a software technician had difficulty navigating the online account set-up process and ended up losing coverage for failure to successfully report her work hours. She was unable to set up her account because the portal would not accept the reference number from her notice and unable to reach a live person on the phone for help for some time; she was finally told to fax documents to Pine Bluff, but still was disenrolled and had to navigate an appeal. Many enrollees in the focus groups who tried to complete the online account process were not confident that they set up or reported information correctly. Many recalled receiving individualized help when they first signed up for AR Works coverage because it was difficult to navigate the new online processes and systems. Providers noted that support from enrollment assistors that had existed in 2014 was no longer available but still needed to help enrollees navigate the online account setup and reporting.

“I went online and tried to set up an account. That was unsuccessful. So they listed this 866 number on the paper, so I tried to call and speak to somebody while I was in front of the computer, so they can walk me through it and help me set it up. And that was awful because you never could speak to nobody. And then I got through it give you all these prompts… it said you had to enter in your reference number that come on the paper and it kept saying my reference number was not my number….” Little Rock AR Works enrollee

“Tried creating the account, went through the reference number problem. Finally got a reference number. And then when I went to log back in, they said my password changed. To get your password changed, you gotta call the actual website. Once you get to the actual website, they reset your password, but presumably it’s only good for that one time. So when you try to log back in the next week to do your stuff again, you have another new password change…That’s how the website is.” Little Rock AR Works enrollee

“I got a letter in the mail telling me that I had to do this, this, this and this and this, and I if I didn’t that I would be put on probation. And if I still didn’t complete it, then I would be [dropped]. I tried to those things that they required and I couldn’t. I ran around in a circle.” Little Rock AR Works enrollee

Many do not have computers or reliable internet access, especially those in rural areas, and others are not comfortable using computers. One Monticello participant described repeatedly being unable to get her account page to load on her cell phone when she tried to report her hours; after spending an hour on the phone with DHS, she was unable to get the problem resolved and “gave up.” Many who were not comfortable with computers or with low levels of computer literacy faced more trouble. Some in more rural areas do not have reliable internet or cellular phone service which complicates the process of setting up the online account. Many use phones instead of computers to access the internet, but filling out forms, involving navigating multiple steps and screens, can be difficult on a phone. Many in the focus groups did not own a computer so need to use a computer at the library, although some had access to a work or home computer (with college students most likely to report having a computer). A number of enrollees, particularly in the older group already subject to the work requirements, were not comfortable using computers and preferred one-on-one assistance or paper to filling out forms online.

“It’s so-so, in certain parts of the house I can get good signals and other parts, um-um.” Monticello AR Works enrollee

“I don’t have a good signal so I was up in the window trying to do that on my phone.” Monticello AR Works enrollee

The younger group of enrollees who will be phased in to the new requirements starting in January 2019 were not as concerned about setting up an account and on-going reporting. In contrast to the older enrollees, many said they would feel more comfortable with online reporting and were more cautious about paper reporting. Even when informed about difficulties with account setup and getting help encountered by the 30 to 49 year old group, many in the younger group that had not yet experienced trying to set up an account or report were confident that would be able to navigate the new requirements.

“I’d just go to DHS…They have to help you…and if you walk away that’s on you. Yeah I wouldn’t leave until…You have to get it done…I have this, and you need to do this…” Little Rock AR Works enrollee

“That’s why I do everything online because there’s always a paper trail of what you’ve turned in and what you haven’t. It can’t be lost when you can just click on it.” Little Rock AR Works enrollee

What effects are the new requirements having on enrollees’ participation in work activities?

The new requirements do not appear to provide an additional incentive to work, beyond economic pressures, but are adding anxiety and stress to enrollees’ lives. Many focus group enrollees already were working or looking for work before the new requirements were in effect. No one in the groups had gotten a new job as a result of the new requirements. People are motivated to work to make ends meet. The large majority were dealing with financial pressures and struggling to pay bills such as food and utilities based on earnings from low wage jobs. One single parent of a son away at college worked full-time but regularly did not have enough food and went to a relative’s home to eat. Other participants described carefully monitoring their spending on food, watching for coupons and sales, buying less healthy food because it was more affordable, and only buying what was needed for one meal at a time. Other financial pressures included car repairs and utility shut-offs. Safety net providers described their patient population as “living paycheck to paycheck” and working multiple part-time jobs because they could not get enough hours at one job. The new requirements are not incentivizing new work or other activities in which enrollees were not already engaged, but are layering on one more thing to deal with in enrollees’ already complex lives and causing added stress because no one wants to lose their coverage.

“Let me explain something to you. Some of us are working because we have to work…I have fibromyalgia. I’m a diabetic. I be in all kinds of pain, but I gotta make ends meet to take care of my home.” Little Rock AR Works enrollee

“I try to get as many hours as I can because I got bills to pay.” Little Rock AR Works enrollee

Many enrollees are already working, but may face unstable or unpredictable work hours. Many in the focus groups did not have stable or predictable work hours primarily due to forces outside of their control. One handyman said his work depends on the weather, some enrollees who work in a hair salon noted that people can cancel appointments (although sometimes the holidays brought more work), and some enrollees had jobs where the employer set the schedule (e.g., temporary work, home health care). This lack of control and predictability can result in some months with more than 80 hours of work and some months with less. Several participants had changed jobs or cycled in and out of the workforce in the last year. For example, one individual currently employed as a software technician previously had been laid off from a prior job and out of work for about six months. Another had done food service work back and forth at different restaurants. Volunteering was not an option for people who needed to pay the bills. Some reported getting letters from DWS that they could volunteer at Good Will; however, volunteering and not getting paid was not seen as a viable option.

“Well, being a hairstylist you, you’re not guaranteed a steady paycheck… Right, say that this week Sally doesn’t want her hair done, you know, you may not make it…my husband just recently, three months, four months ago, had passed his real estate and he’s trying to do that so I’m providing for the whole family… So I wouldn’t say that I’m like starving, but there are times, like right now I’m stressed.” Monticello AR Works enrollee

“I mean you could be working, but still not making 80 hours a month.” Little Rock AR Works enrollee

“I can’t afford to volunteer for free. I have to work. I have to have some money coming in” Little Rock AR Works enrollee

More rural areas have few job opportunities. Many in the focus groups in Monticello talked about a lack of job opportunities in rural areas, particularly for low skilled workers. Many said fast food was one of the only options or you needed to know someone, or have connections, to get a good job. There were also some welding or farming jobs, but some of those jobs required some skills or involved physically demanding work that was not suitable for all enrollees. In addition, some reported that some of the farming and welding jobs were becoming more automated, so those opportunities were shrinking. The mills remaining in the area were sometimes hiring but also regularly laying off employees.

“You have fast food here, what else do you have? I mean you have Walmart and then fast food.” Monticello AR Works enrollee

No enrollees had contacted the Department of Workforce Services (DWS) for assistance. They mostly associated DWS with unemployment benefits, although DWS also has resources available for job search and training programs. A case worker in a Little Rock DWS office was eager and willing to help enrollees find employment, and she also was able to assist with setting up online accounts and reporting work activities. Information about DWS job services is on the last page of the initial mailing to Arkansas Works enrollees (Figure 2). Many enrollees in the focus groups already had jobs, but others were not aware of the support from DWS. Still, enrollees in more rural or remote areas may have less access to DWS offices to get help even if there wanted to seek assistance there due to lack of transportation. The closest DWS office for some enrollees in the Delta region was described as a 45 minute to 1.5 hour drive.

Figure 2: Information about DWS job services is on the last page of the initial mailing to enrollees.

Health insurance through Medicaid supports the ability to work for some enrollees who were able to control chronic conditions, while other enrollees have physical and mental health conditions that make working difficult. While many participating in the focus groups were relatively healthy, a number had medical conditions that could interfere with work including mental health issues (anxiety, depression, bi-polar disorder), substance use recovery, asthma, diabetes, recurring migraines, fibromyalgia, chronic pain, arthritis, neuropathy in the feet, narcolepsy, high blood pressure, Crohn’s disease, and ulcers; several also mentioned dental needs. None of these participants had been identified as “medically frail” and therefore exempt from work and reporting. One participant described having to leave a 20-year nursing career and take a job as a cashier due to physical limitations from chronic health conditions. Having health coverage through Arkansas Works allowed many to access critical prescription drugs that helped to control chronic conditions which enabled them to work. However, some of these conditions would make having a job that involved standing for long periods, stress or other physical demands very difficult.

“Last, two weeks ago on a Friday, see I work so hard during the week by Friday, usually I take off because I’ve had enough, you know. And it was about noon and I felt like an elephant on my chest, like a breakdown, like, it’s almost like a complete mental breakdown where I couldn’t get to the house fast enough to get my [medicine]…It [bipolar disorder] interferes with my work sometimes.” Monticello AR Works enrollee

Enrollees’ lives are complicated with a multitude of factors that could affect their ability to work such being homeless or lack of transportation. In addition to unpredictable employment hours and health issues, many enrollees have a number of other complicating life factors, such as unstable housing, transportation problems (car issue or repairs, no regular access to reliable transportation), unexpected expenses, and family caregiving responsibilities for aging parents or grandchildren. These challenges can make it difficult to obtain or maintain a job. For example, one participant caring for her elderly parents wanted to also have paid employment but was limited in the hours that she was available to work outside the home.

“I’m in a halfway house. And the thing is I pay $145 dollars a week rent. It’s like I’m stuck in a rut because I’m in a dead-end job. I don’t make no more than maybe $200 a week. Okay, a $140 of that has gotta go to rent….that’s not counting my gas costs going back and forth to work. That’s not talking about my food…I’m having to come out of pocket because now I don’t have any health insurance to cover $600 worth of medicine. My inhalers are 400 to $500.” Little Rock AR Works enrollee

“I’m limited to the number of hours…I can work. Because I’m a caregiver for my parents…I try to look for assignments after 5, but they’re kind of hard to find.” Little Rock AR Works enrollee

What effect is the monthly reporting requirement having on enrollees?

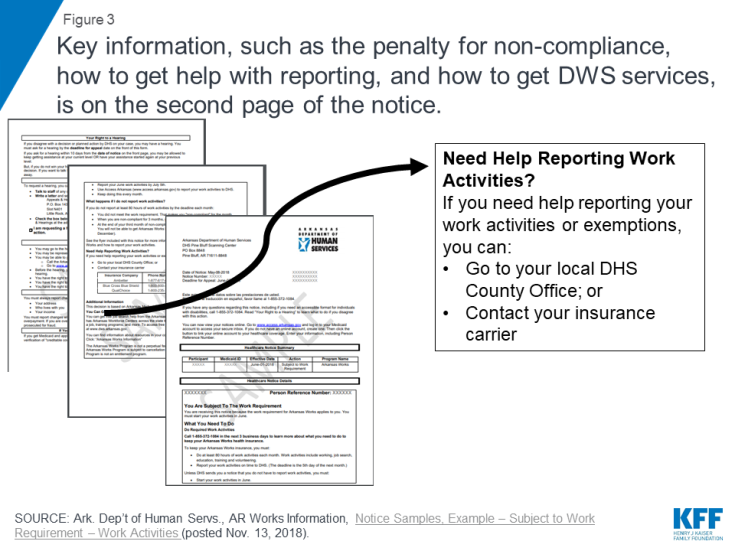

Monthly reporting is confusing and a challenge for most enrollees. Even for those who were working and had set up an account, the monthly reporting requirement seemed confusing, burdensome and hard to manage. Key information, such as the penalty for non-compliance, how to get help with reporting, and how to get DWS services, is on the second page of the notice (Figure 3). Issues mentioned above that create challenges to setting up an online account and to work, such as lack of computer or internet access, complicated and busy lives pressured by making ends meet in low wage jobs, and complex physical and mental health conditions all were factors that also contributed to challenges with satisfying an ongoing reporting requirement. Some who were trying to report encountered problems similar to those encountered during the account set-up process related to missing passwords or problems with the website. A number of enrollees commented that the system did not provide any confirmation that reporting was successful, so individuals were not confident that they reported correctly. Even the enrollees in the younger group about to be phased in to the requirements who were more comfortable using computers found the ongoing monthly reporting overwhelming and worried that it would be hard to keep track of and manage given other demands and pressures in their daily lives.

Figure 3: Key information, such as the penalty for non-compliance, how to get help with reporting, and how to get DWS services, is on the second page of the notice.

“It’s a lot to deal with. Especially on top of your day-to-day stuff. If you got kids, you work, you know. You got a house to maintain and then it’s one more added thing; you got to remember to put this in every month.” Little Rock AR Works enrollee

“If you don’t go into their website once a month and login, and then go to your access, and all that, then you lose your coverage. But the websites so screwed up that you login and then you navigate to the next page and it logs you out.. . So I don’t know if I’m doing enough to keep my coverage.” Little Rock AR Works enrollee

“I’m not computer smart; I’m worried about it. Insurance is important but hard to keep dealing with this.” Monticello AR Works enrollee

“it’s hard. I mean I’m not getting the whole thing of why we have to do, I mean, even put in your hours. I mean it’s not something that simple I wouldn’t think, you know, if you have to do it every month.” Monticello AR Works enrollee

“Something about checking your inbox on there that I would go there and it wouldn’t load all the way. So in the, next time I went to log on, my mom was like you need to, you know, put your hours in, this is the last day. So I called trying to log back in because it wouldn’t let me even though I had stuff written down with my password. I guess she said that it was such a busy time because that was the shut off date. And it was, I was going from one person to another, call this number, call that number, but I really talked to like three different people that same day and never got anything done. So I gave up.” Monticello AR Works enrollee

Monthly reporting may not accurately capture fluctuations in income and could result in additional program churn and coverage lock-outs. Some enrollees who reported successfully had too much income that month and lost coverage. Under the Affordable Care Act (ACA), eligibility renewals for Medicaid are to occur annually, so monthly fluctuations in income do not result in enrollees churning on and off of coverage. More frequent reporting may be capturing these fluctuations and resulting in more churn on and off of coverage. Some of these issues could be exacerbated with an increase in the minimum wage in Arkansas from $8.50 to $9.25 per hour in January 2019. While increased wages are positive for low-income workers, with unpredictable hours the increase could result in uneven wages over the course of the year making them ineligible some months and eligible other months based on income. These changes and reporting could increase churn and periods of being uninsured if enrollees are subject to a coverage lock-out. In addition, some enrollees were confused because the monthly reporting could coincide with their annual eligibility renewals. Enrollees who had just submitted documentation for their renewal were confused about why they also needed to separately report to satisfy the work requirement in the same month. Additionally, documents required to renew eligibility can be submitted in person, by fax, or by mail, while work requirement reporting must be done online.

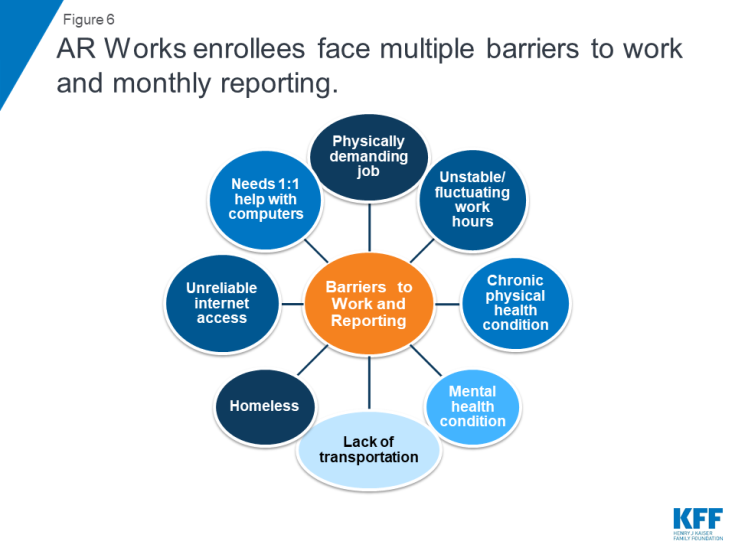

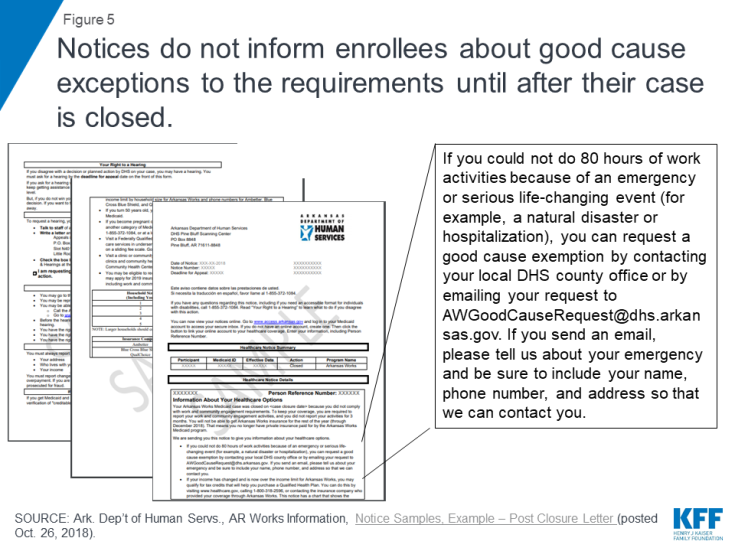

It was difficult for enrollees to understand the exemption rules and process. There was a lot of confusion about exemptions from the work and reporting rules (Figure 4). Some individuals thought their letter said they were exempt, but often the reason or the timeframe for the exemption was not stated or not clear. There was also confusion about whether an enrollee was exempt from the work requirement, or separately, from the reporting requirement. One noted that her letter said she had to work but on the same page then said she was exempt (Figure 4). Despite general confusion, one participant had obtained a family caregiving exemption and another had a short-term incapacity exemption due to a work injury. Navigating the exemption process was time-consuming and stressful for enrollees who already were experiencing stress from their family and health circumstances leading to the need for an exemption. Additionally, the notices do not tell enrollees about the good cause exception process (which is available for extenuating circumstances that interfere with an enrollee’s ability to work or report in a month) until after their case is closed for failure to comply with the requirements (Figure 5).

Figure 5: Notices do not inform enrollees about good cause exceptions to the requirements until after their case is closed.

For example, some knew about the exemptions for caregivers but were unclear if they still needed to report their work or exemption status. Many in the group of enrollees that will be phased in to the requirements in 2109 were in college, and there was a lot of confusion about if and how much time in school could qualify as an exemption and if individuals still had to report work hours as well (many students in the focus groups also were working part-time jobs). Some students did not understand that school was a qualifying activity. Others worried about their ability to keep their coverage over winter and summer breaks when they would return home and not have access to the job they worked during the semester or a comparable job (those who were in school elsewhere in the state but returned to rural areas to be with their families during break commented on the different job opportunities available to them in the two places). One enrollee with significant mental health issues in intensive outpatient treatment after a suicide attempt thought that her provider had sent a letter requesting an exemption as she is not able to work but was unsure if the state was recognizing her as exempt, based on the letter she received about the new requirements, which was causing additional stress. Some enrollees were confused about the appeals process. One enrollee had sent a letter to Pine Bluff but was unsure if the appeal was received or under consideration.

“My mom said I need to go online and do this and do that… I was on the phone with a lady trying to, she said I needed to do something with my hours….Well I was on the phone with the lady for like an hour, then she sent me to someone else, then she sent me to someone else. So it just…I just gave up from trying to report my hours worked.” Monticello AR Works enrollee

“My therapist had sent in a letter to Arkansas saying that I could not work for the next year… at the end of last year I tried to commit suicide and because I was misdiagnosed and I was on the wrong medicines. And at the beginning of the year I was diagnosed with bi-polar one that was uncontrolled and PTSD that was uncontrolled.” Monticello AR Works enrollee

What effect are the new requirements having on individuals with more complex needs?

Providers reported that patients who are homeless and those who have more serious physical or mental health disabilities may be more likely to be unaware of program changes and are more likely to have problems setting up an online account, working or complying with monthly reporting. The individuals who were able to participate in the focus groups do not accurately represent all AR Works enrollees because they were more likely to have phones or email to be contacted and more likely to have access to reliable transportation to participate in the groups. Providers also see a different set of enrollees who may have less stable addresses and phone numbers, have more complicated life circumstances exacerbated by homelessness and extreme poverty, and have more complex physical and mental health needs who would be harder to reach through mail, phone or social media about changes to the program.

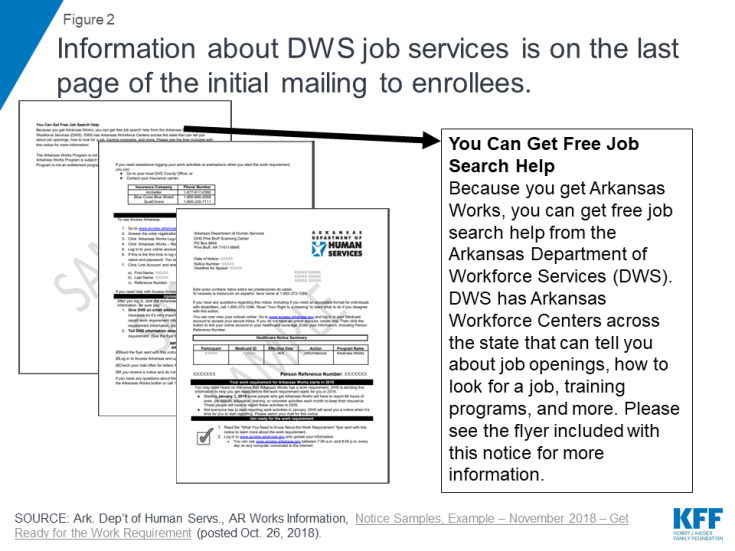

An interview with the director of a food assistance program noted that communicating program changes through social media was “totally disconnected” from how the Arkansas Works enrollees she encounters would ever get information. If aware of the new requirements, these same enrollees are likely to face barriers in setting up an account, obtaining employment or complying with monthly reporting. The food assistance program director noted that many enrollees who are homeless are “in survival mode” just trying to navigate satisfying their basic needs for each day. They are focused on getting food and finding a place to sleep, and setting up an online account (and maintaining monthly reporting) are not really possible given other more basic and immediate needs. Figure 6 illustrates the array of barriers to work and monthly reporting requirements experienced by enrollees both in the focus groups and those whose experiences were relayed by safety net providers, with most enrollees experiencing multiple barriers.

Plaintiffs in the lawsuit challenging Arkansas’ waiver report challenges similar to the focus group participants and may also represent enrollees with more challenging circumstances compared to focus group participants. Nine individual Medicaid enrollees have filed a federal lawsuit, Gresham v. Azar, challenging HHS’s approval of the work and reporting requirements in Arkansas’ Section 1115 Medicaid waiver.4 The lawsuit is in the same court, before the same judge, as Stewart v. Azar, the case that set aside HHS’s original approval of Kentucky’s Medicaid waiver, including a work requirement and other provisions restricting eligibility and benefits.5 The Arkansas case should be ready for a hearing or a decision by the judge by mid-January, 2019, when the parties’ legal briefs are filed.6 Declarations filed by the Arkansas plaintiffs indicate that they experience multiple barriers to meeting the work and reporting requirements, including chronic physical and mental health conditions, fluctuating work hours, lack of transportation, lack of internet access, unfamiliarity with computers, and homelessness.7

Some providers felt like they were not included in implementation discussions for the new requirements and felt like they were not able to assist patients with navigating the new requirements. Some safety net providers felt like they did not have all of the information that would enable them to help their patients. For example, they were not aware of which of their patients were subject to the reporting requirements and also did not have access to information about which patients had one, two or three strikes for non-compliance. If they had more information, they would be in a better position to do outreach to specific patients at risk of losing coverage and assist with reporting. Providers were eager and willing to help their patients retain coverage if they knew who to target.

What are the effects of coverage losses due to failure to satisfy the new requirements?

Enrollees value having health insurance coverage, and loss of coverage would negatively affect their ability to work. AR Works has enabled enrollees to gain access to needed health care services and medications. No enrollee said that coverage was unimportant nor that they would willingly give up coverage. Most enrollees in the 30 to 49 age group first got insurance when Arkansas implemented Medicaid expansion in 2014, and remembered what it was like to be uninsured. Enrollees described having health insurance as bringing them peace of mind and comfort as well as protecting them from additional financial pressures and making it possible to manage their health. Health coverage has enabled focus group enrollees to work by covering medications needed to manage mental health, asthma, gastrointestinal, and other chronic health conditions. Without medication and regular follow-up care, these conditions could worsen and interfere with enrollees’ ability to work or the ability to look for work and also could result in emergency room visits or hospitalizations.

“The month that I didn’t take it [medication for narcolepsy], I was knocked out every day. Like while we’re talking, I’d probably be sleep right now…I couldn’t work.” Little Rock AR Works enrollee

“I have a mental illness, I’m bipolar…they can’t get my medicine right, little more manic, little excited…I try to think I’m okay without it and then just, you know…without this insurance I would be in a lot of trouble. I think there was one time, it would have been like $400 a month [for prescriptions] if I didn’t have insurance. And there’s no way possible.” Monticello AR Works enrollee

Employer-sponsored health coverage is not available or affordable to working enrollees. While many enrollees were in jobs that did not have benefits such as health coverage, a few enrollees had jobs that offered health coverage but said it was prohibitively expensive and not an option for coverage if an enrollee lost AR Works. Without Arkansas Works, these enrollees would be uninsured despite working. For example, the software technician who lost coverage after encountering problems with the online portal said that the insurance offered by her employer was not affordable.

Without AR Works, many worry about medical debt and would be forced to use the emergency room to access needed care. Some enrollees had been uninsured prior to obtaining AR Works coverage and had accrued medical debt from using the emergency room to access care. While medical debt was a concern, many felt like going to the emergency room would be the only viable option to get needed care without insurance. A number of enrollees said they would go without care or try their best to not get sick if they became uninsured.

“Once you rely on something to be there and it’s not then, it is a life changing situation. So you be trying to prevent anything from happening, I keep Germex with me. For real. Disinfectant in my car, Kleenex, don’t sneeze on me, get away from me.” Monticello AR Works enrollee

Loss of AR Works with the up to nine month coverage lock-out for failure to meet the new requirements could negatively affect enrollee health status and increase stress and anxiety. Many in the focus groups were not aware that they could be locked out of coverage for the remainder of the calendar year for failure to meet work or reporting requirements for three months. Many thought that rule would penalize those who get sick or injured and cannot work, just when they need the coverage most. There was concern about unforeseen events happening that could get in the way of work or reporting, leading to coverage loss. Those who had lost coverage also were not aware that they needed to reapply to obtain coverage again in January. People worried about not being able to get needed care because they could not afford it if they were uninsured. One enrollee who was working but had been hospitalized for asthma worried that without coverage he would not be able to get medications and would wind up back in the hospital. For one enrollee with severe mental health issues, who was not identified as medically frail, a loss in coverage could have catastrophic or fatal consequences if she were unable to access regular therapy and medications. Some worried that if their health worsened without coverage that would have ripple effects for family members who relied on them to provide caregiving and to work and provide financially. Providers worried that loss of coverage would interfere with medication adherence and continuity in treatment. One health center observed that it was too early to determine the full impact of coverage losses to date as most patients had three month supplies of their maintenance medications and had follow-up appointments for chronic conditions quarterly. Another provider worried that enrollees are giving up because they don’t know where to start with navigating the complex new rules.

Providers interviewed for the report noted that they could face increases in uncompensated care costs if patients lost Arkansas Works coverage and became uninsured. Community health centers noted that they serve patients with and without coverage, so patients would still come to get care, but the health centers would not be able to access Medicaid reimbursement for those who lose coverage. One clinic director noted that uncompensated care costs would be higher than they were prior to the Medicaid expansion because once individuals got coverage, they sought care and may have been newly diagnosed with chronic conditions that need ongoing treatment, whereas prior to the ACA, undiagnosed conditions were not getting regularly treated. The director of a free clinic serving the uninsured in Little Rock noted that they were seeing a steady increase in patients looking for care after seeing drastic declines in their patients, who had obtained coverage after the implementation of the Medicaid expansion. They were also seeing an increase in call volume from individuals worried about losing coverage. This clinic had changed its focus to serving undocumented immigrants after Medicaid expansion provided coverage to many of its former patients. However, five months after implementation of the work and reporting requirements, the clinic was receiving calls from, and reopening closed medical record files for, former patients who had lost coverage and needed health care and was recruiting providers to offer an additional weekly medical clinic as a result of increased patient calls. Providers were also concerned that they would need to hire new staff and redirect resources to helping patients navigate the complexity of the new requirements which would mean cutbacks in other areas without any new revenue to support staff.

I think the lockout’s crazy…It’s scary…what if something happens in that period.” Little Rock AR Works enrollee

“You know, for me having a little mental illness, if I were to be locked out of there, you know, when I get some of these bills what I would have had to pay? There’s no way like seeing some of these doctors that I could ever afford. And if I was locked out for 12 months and you have a little mental illness and you need, you know what I mean? I mean you would find a way I guess, but I think being locked out…That’s something you got to be worried about, you know.” Monticello AR Works enrollee

“That’s why I feel like that’s not right, because if someone gets like terminal or they’re really sick and need assistance you’re like that’s really messed up. What are they supposed to do just stay sick? What if they die like in that time period?” Monticello AR Works enrollee

“You feel like people that work and that decide these things are like human beings and would understand kind of your situation…So if I just got into an accident and my paperwork isn’t fully filed yet or whatever the case may be, I would expect for it to be kind of like an understanding thing.” Little Rock AR Works enrollee

CONCLUSION

This brief builds on our analysis of state data that shows that as of December 2018, nearly 17,000 individuals have lost Medicaid coverage due to the new work and reporting requirements and a case study published in October 2018, to include perspectives of enrollees and providers about the new “Arkansas Works” waiver requirements. The large majority of enrollees in our four focus groups were confused about the new requirements. Many found it difficult to navigate the process to set up an online account and keep up with regular reporting of work or exemptions. Enrollees who were able to work were already working or looking for a job so many did not feel like the new work requirements were an additional incentive to work, but instead were adding anxiety and stress to enrollees’ lives. Enrollees value coverage, and health insurance through Medicaid supported the ability to work for some enrollees who were able to control chronic physical and mental conditions with prescription drugs or treatment. Loss of coverage would impede their ability to work.

While these focus groups provide an initial look at enrollee experience with the new requirements, it will be important to understand more about the group of enrollees who lost coverage: whether individuals understand the new requirements, how to use the online portal and whether there are computer or internet access issues; how many have other health insurance coverage and how many are uninsured; how many are newly working, and in what types of jobs and whether those jobs come with health insurance; how many might have been eligible for an exemption but did not apply; whether some subject to disenrollment will be found to have good cause for not meeting the requirements; how many of those disenrolled will reapply for and regain coverage in January; and whether they will again lose coverage for failing to meet the work and reporting requirements in 2019. It will also be important to continue to understand the implications of coverage loss for enrollees as well as providers and how coverage loss affects an individual’s ability to work.

On December 12, 2018, the state issued a press release indicating that beginning on December 19 enrollees would be able to report work activity by phone with DHS and that DHS will be launching an advertising campaign to provide additional outreach to enrollees as the younger group of enrollees is phased in. DHS also plans to work with higher education institutions to inform students that school hours count toward meeting the requirement. While new reporting options may assist some enrollees, research shows that any additional reporting or administrative burdens create barriers to eligible people retaining coverage. Looking forward, it will be important to watch the development and outcome of litigation moving forward challenging HHS’s approval of the new requirements in Arkansas, if individuals who lost coverage re-enroll when they are eligible to do so in January, the experience with the younger group of enrollees who seem more confident about their ability to navigate online reporting, and the details of the final waiver evaluation plan.