2017 Employer Health Benefits Survey

Abstract

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage including premiums, employee contributions, cost-sharing provisions, and employer practices. The 2017 survey included more than 2,100 interviews with non-federal public and private firms. Annual premiums for employer-sponsored family health coverage reached $18,764 this year, up 3% from last year, with workers on average paying $5,714 towards the cost of their coverage, according to the Kaiser Family Foundation/Health Research & Education Trust 2017 Employer Health Benefits Survey. The 2017 survey includes information on the use of incentives for employer wellness programs, plan cost sharing, and firm offer rates. Survey results are released in a variety of ways, including a full report with downloadable tables on a variety of topics, summary of findings, and an article published in the journal Health Affairs.

News release

- A news release announcing the publication of the 2017 Employer Health Benefits Survey is available here.

Summary of Findings

- The Summary of Findings provides an overview of the 2017 survey results and is available under the Summary of Findings.

Full report

- The complete Employer Health Benefits Survey Report includes over 200 exhibits and is available under the Report The “Report” section contains 14 separate sections. Users can view each section separately or download the section exhibits from the right side of the respective section page.

Health affairs

- The peer-reviewed journal Health Affairs has published an article with key findings from the 2017 survey: Health Benefits In 2017: Stable Coverage, Workers Faced Considerable Variation in Costs.

Web briefing

- On Tuesday, September 19, 2017, the Kaiser Family Foundation and the Health Research & Educational Trust (HRET) held a reporters-only web briefing to release the 2017 Employer Health Benefits Survey.

Interactive graphic

- This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2017.

Key exhibits-chartpack

- Over twenty overview slides from the 2017 Employer Health Benefits Survey are available as a slideshow or PDF.

Additional resources

- Standard errors for selected estimates are available in the Technical Supplement here.

- Employer Health Benefits Surveys from 1998-2016 are available here. Please note that historic survey reports have not been revised with methodological changes.

- Researchers may request a public use dataset by going to Contact Us and choosing “TOPIC: Health Costs.”

Researchers at the Kaiser Family Foundation, NORC at the University of Chicago, and Health Research & Educational Trust designed and analyzed the survey.

Summary Of Findings

Employer-sponsored insurance covers over half of the non-elderly population; approximately 151 million nonelderly people in total.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (Kaiser) and the Health Research & Educational Trust (HRET) conduct an annual survey of private and nonfederal public employers with three or more workers. This is the nineteenth Kaiser/HRET survey and reflects employer-sponsored health benefits in 2017.

HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS

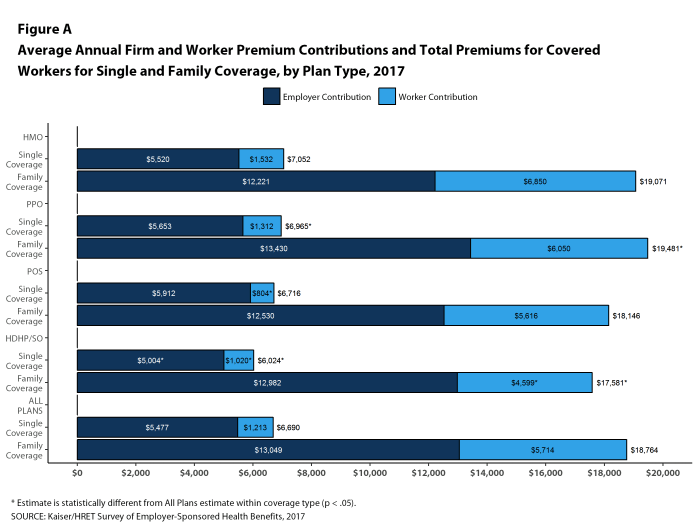

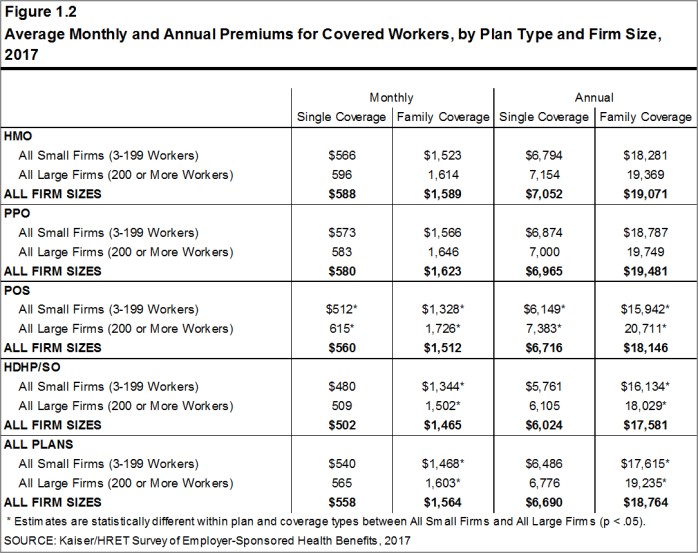

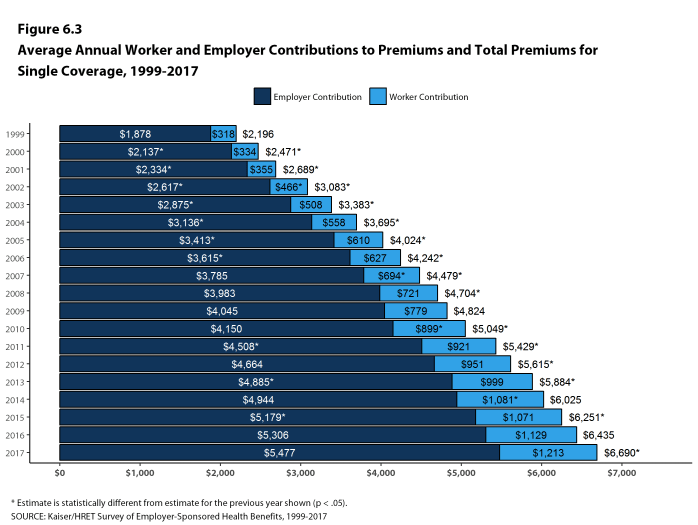

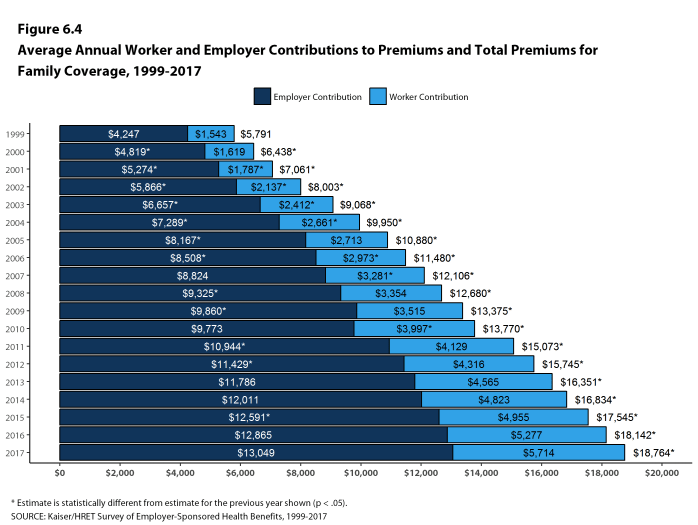

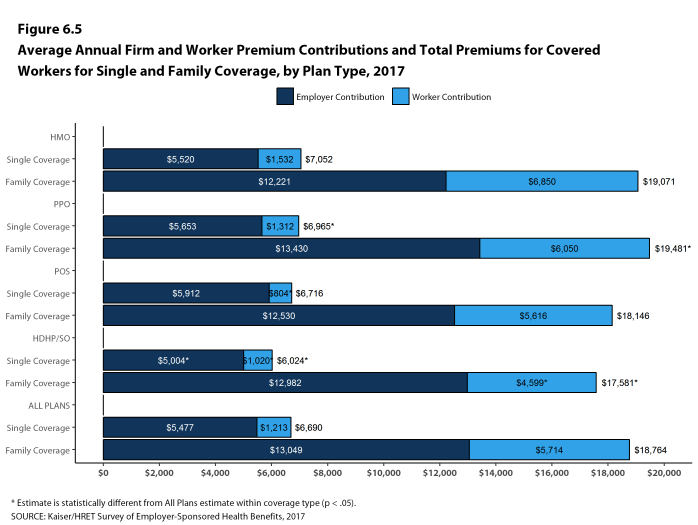

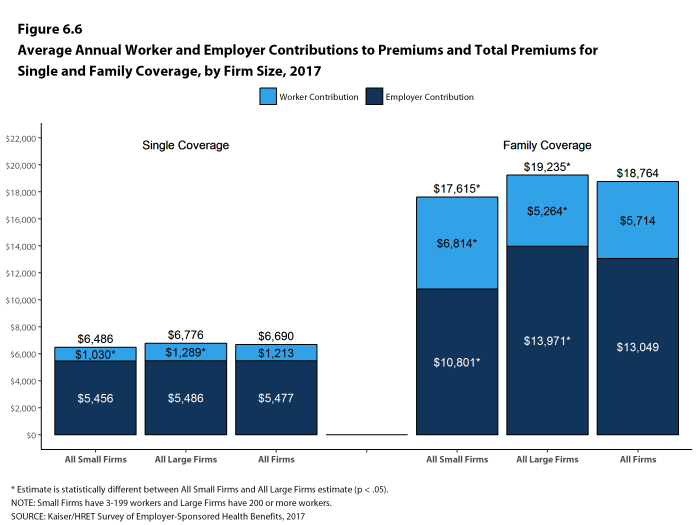

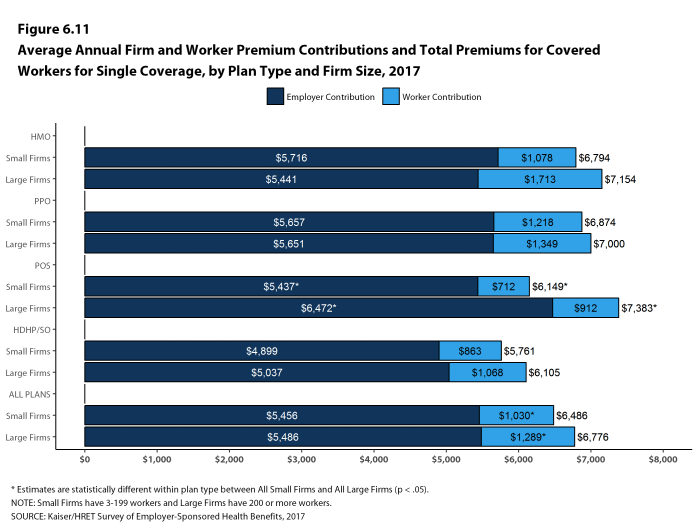

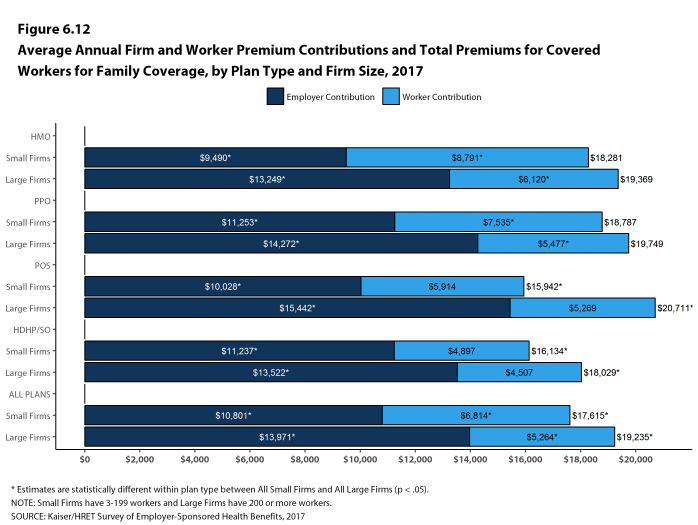

In 2017, the average annual premiums for employer-sponsored health insurance are $6,690 for single coverage and $18,764 for family coverage [Figure A]. The average single premium increased 4% and the average family premium increased 3% in 2017. Workers’ wages increased 2.3% and inflation increased 2.2% over the last year.2 The average premium for family coverage is lower for covered workers in small firms (3-199 workers) than for workers in large firms (200 or more workers) ($17,615 vs. $19,235).

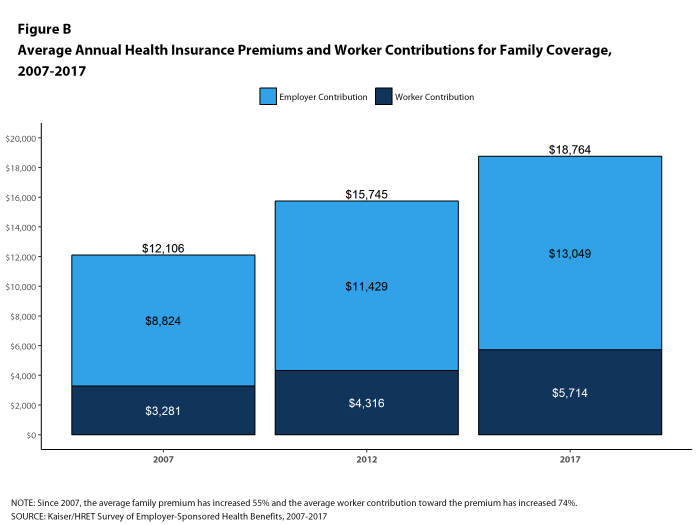

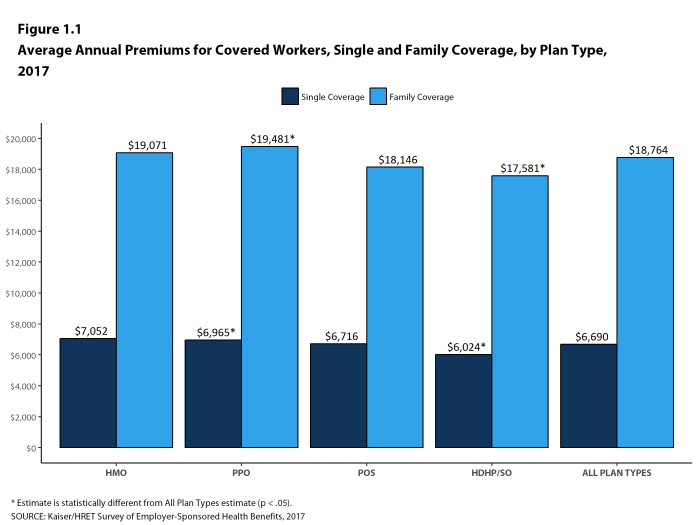

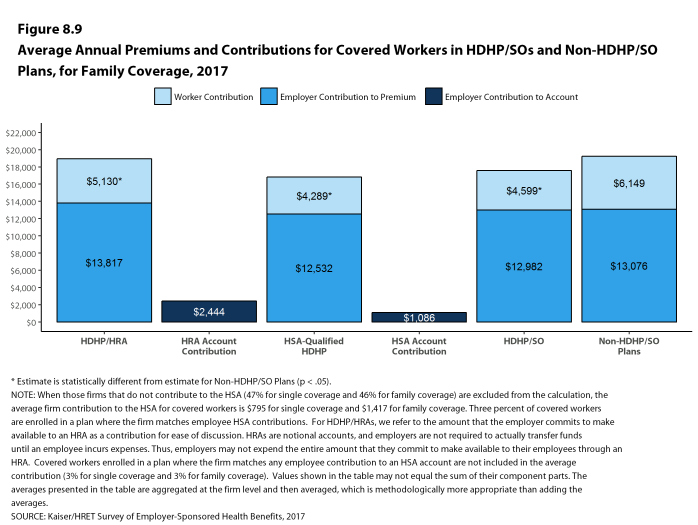

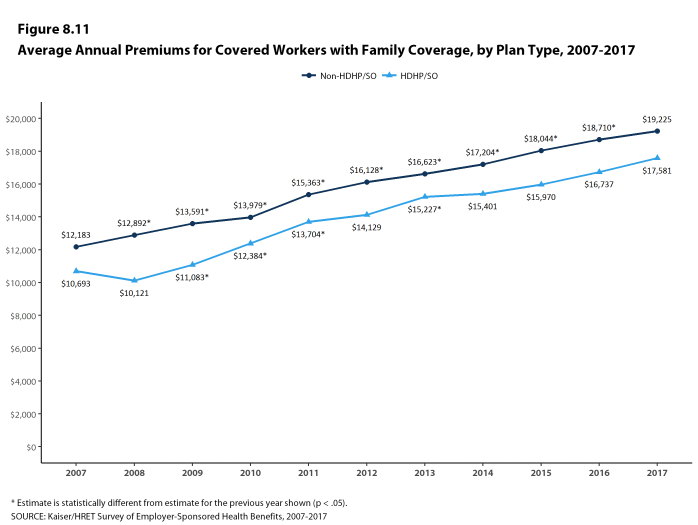

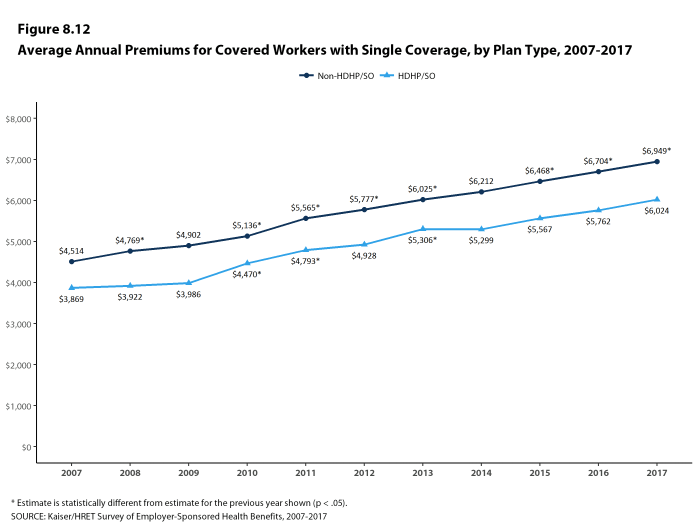

Premiums for family coverage have increased 19% since 2012 and 55% since 2007 [Figure B]. Average premiums for high-deductible health plans with a savings option (HDHP/SOs) are considerably lower than the overall average for all plan types for both single and family coverage, at $6,024 and $17,581, respectively [Figure A]. These premiums do not include any firm contributions to workers’ health savings accounts or health reimbursement arrangements.

Premiums vary significantly around the averages for both single and family coverage, reflecting differences in health care costs and compensation decisions across regions and industries. Seventeen percent of covered workers are in plans with an annual total premium for family coverage of at least $22,517 (120% or more of the average family premium), and 21% of covered workers are in plans where the family premium is less than $15,011 (less than 80% of the average family premium).

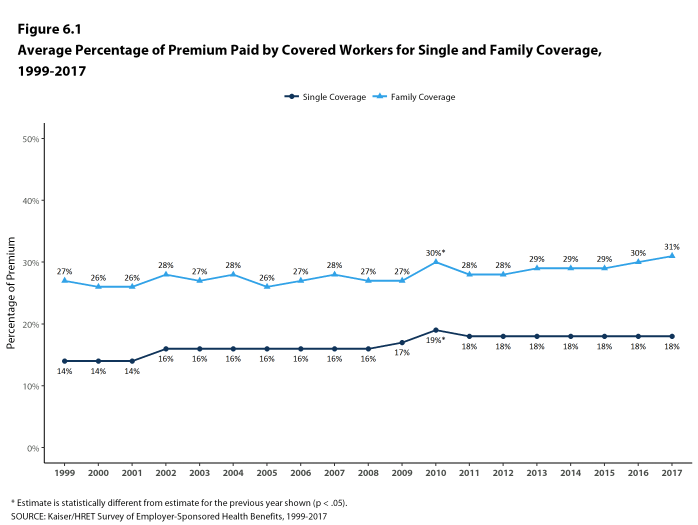

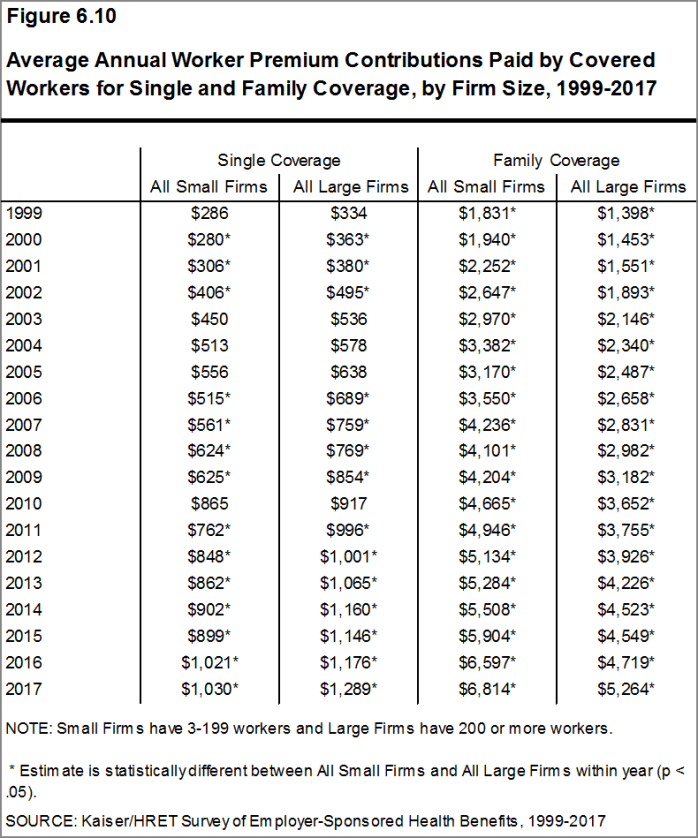

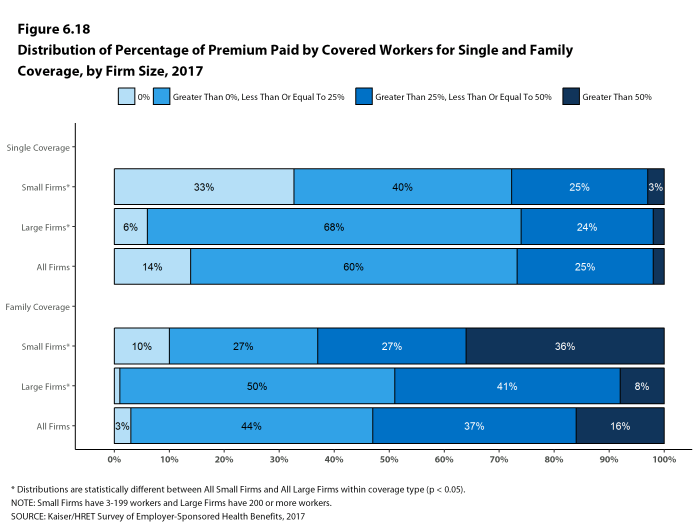

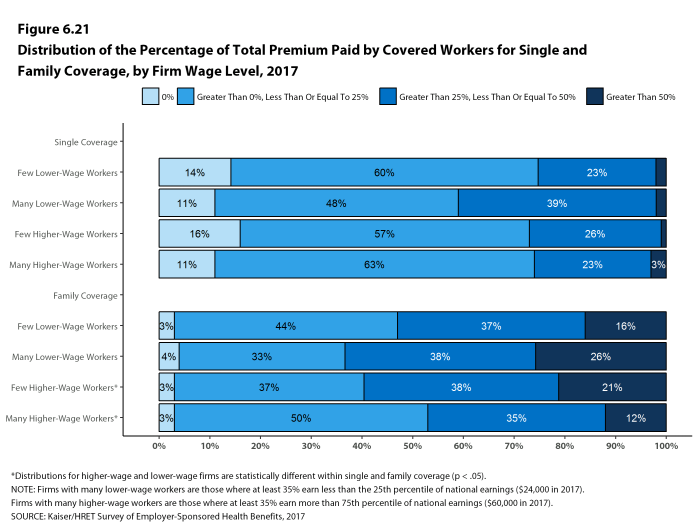

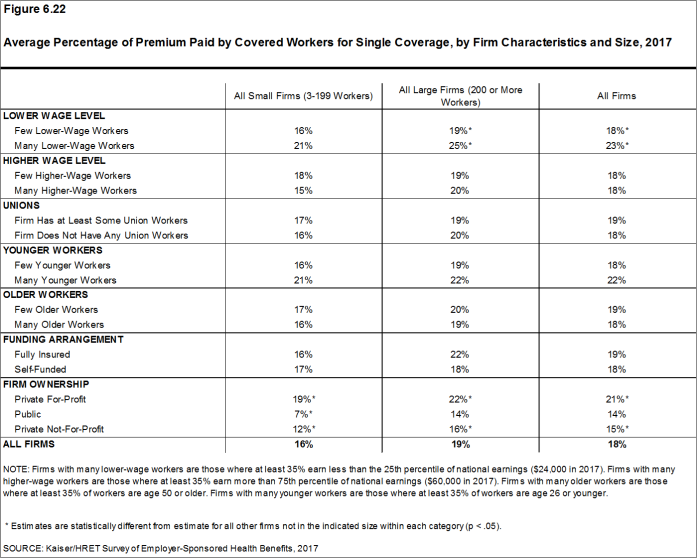

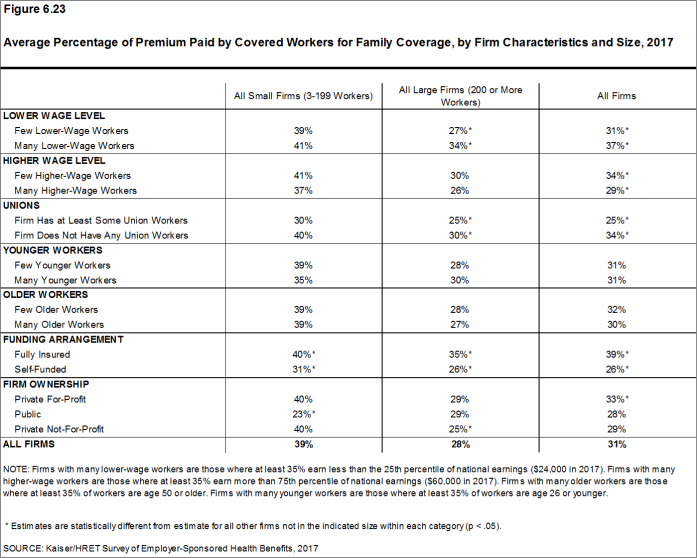

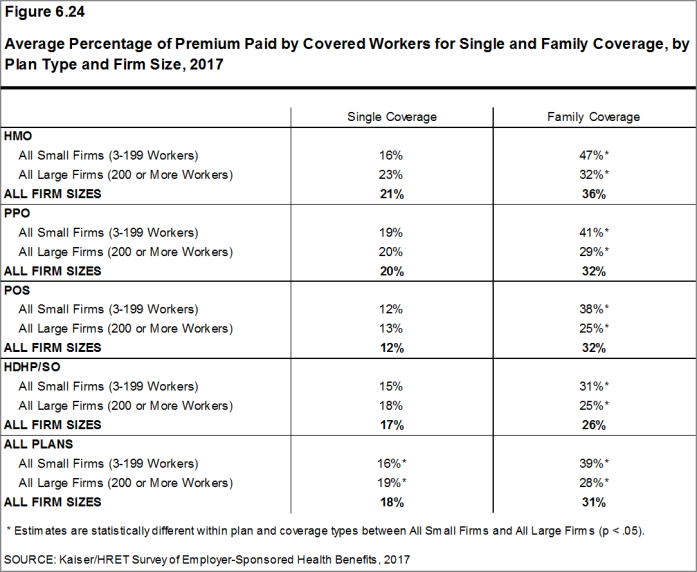

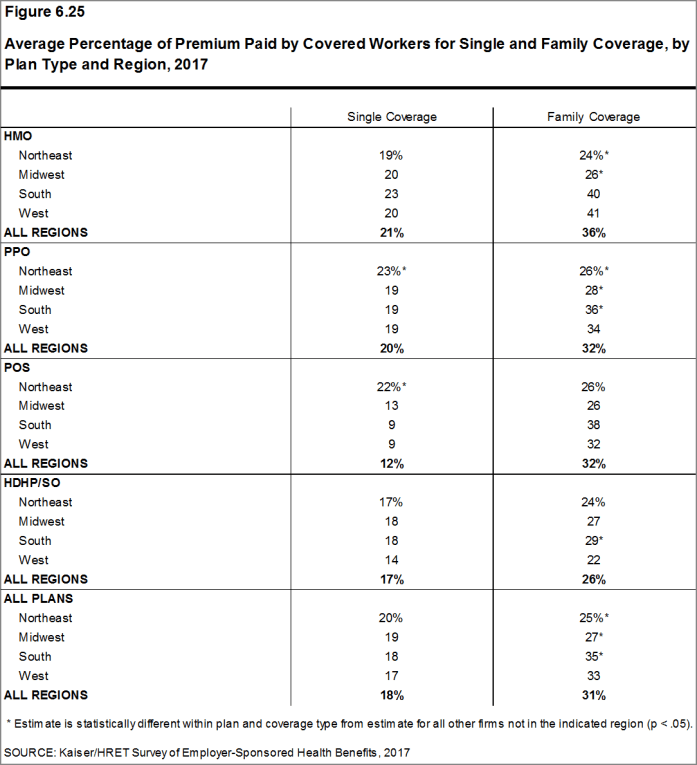

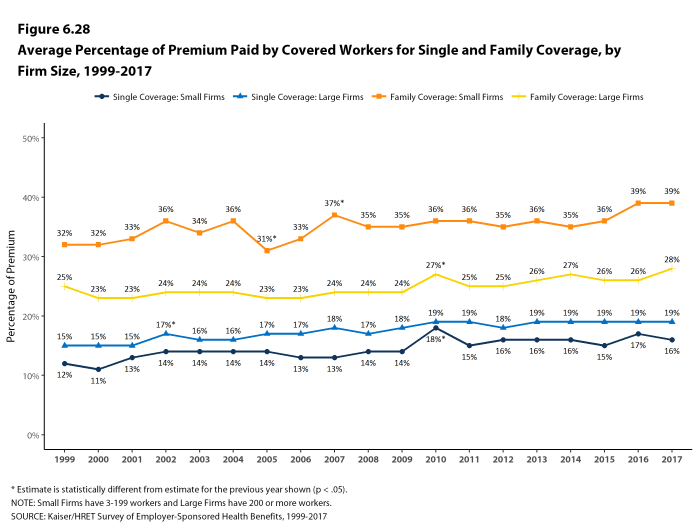

Most covered workers make a contribution toward the cost of the premium for their coverage. On average, covered workers contribute 18% of the premium for single coverage and 31% of the premium for family coverage. Workers in small firms contribute a higher average percentage of the premium for family coverage than workers in large firms (39% vs. 28%).

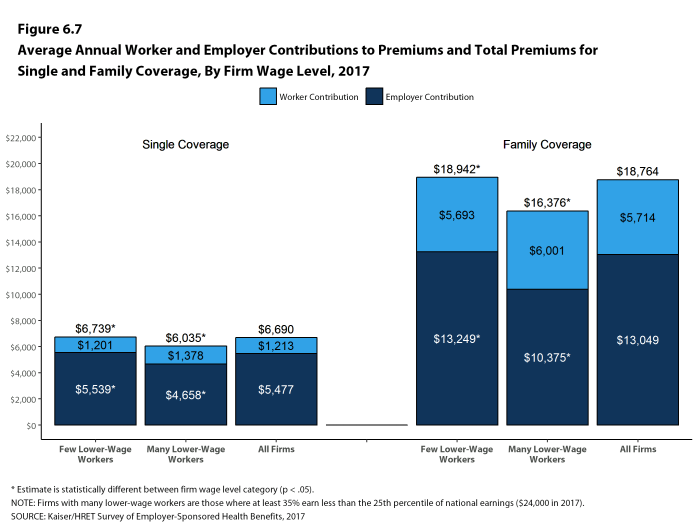

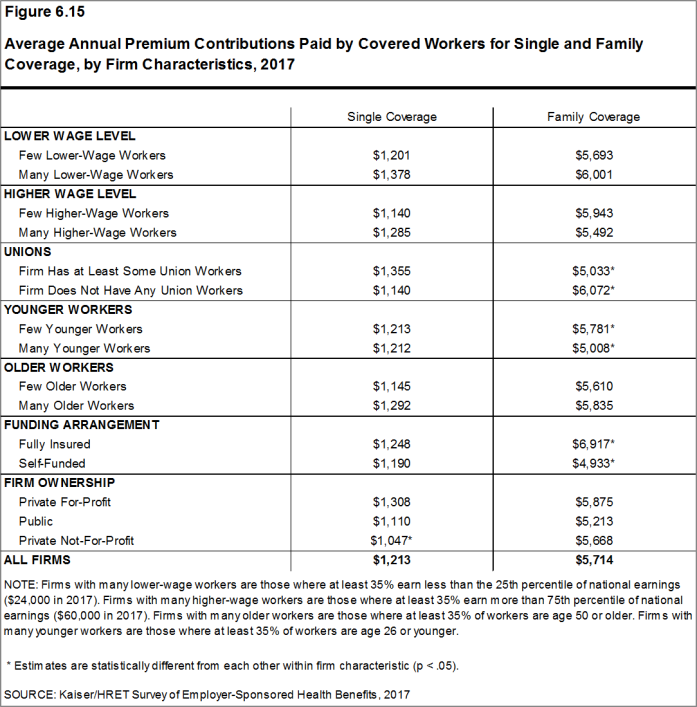

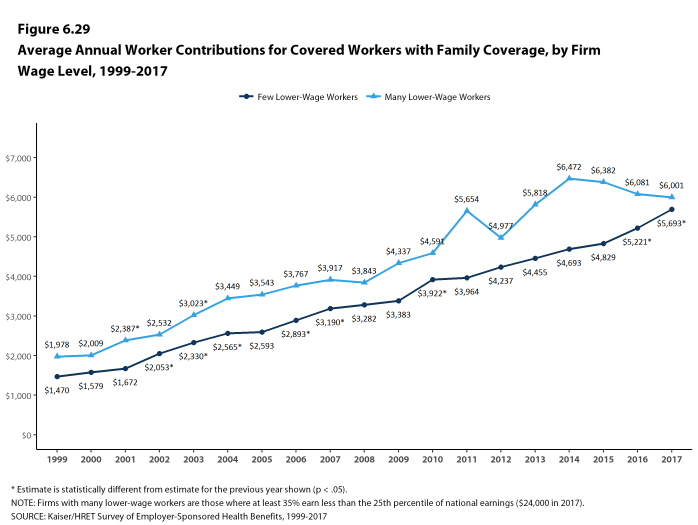

Covered workers in firms with a relatively high percentage of lower-wage workers (at least 35% of workers earn $24,000 a year or less) contribute higher percentages of the premium for single (23%) and family (37%) coverage than workers in firms with a smaller share of lower-wage workers (18% and 31%, respectively).3

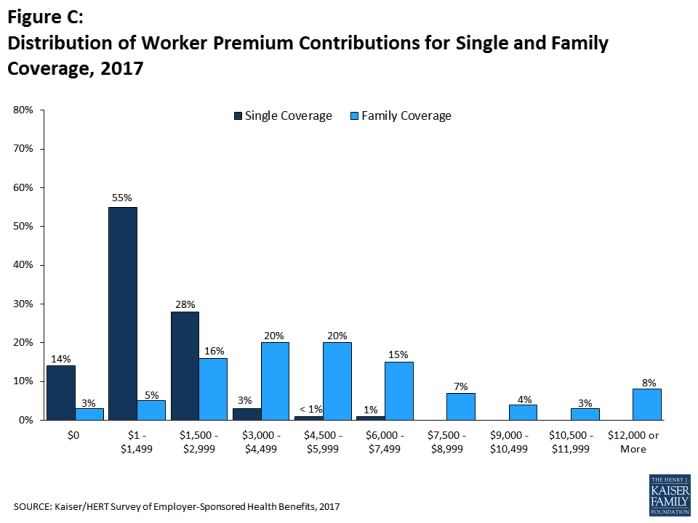

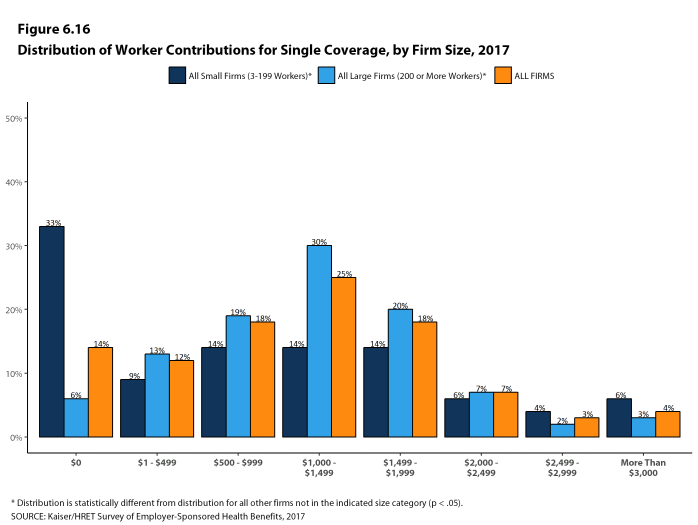

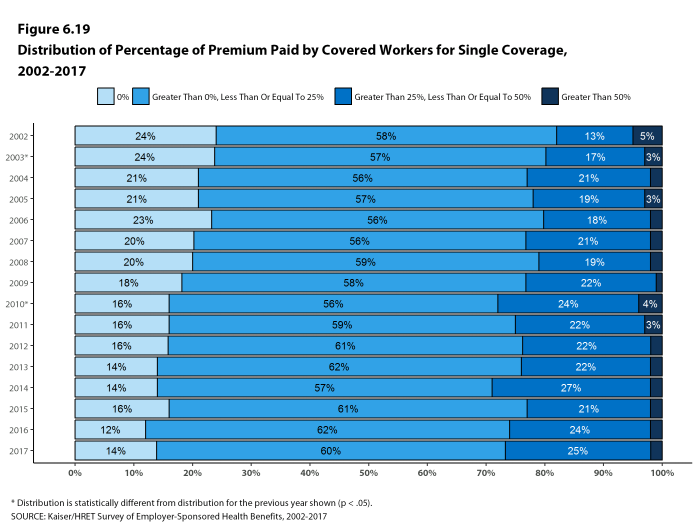

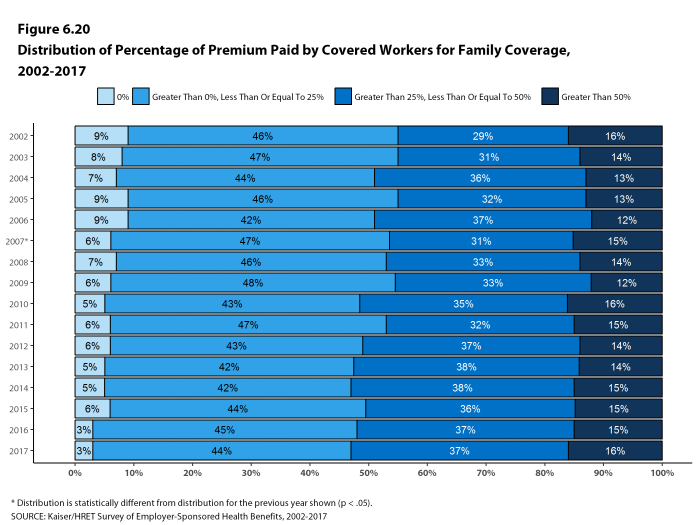

As with total premiums, the share of the premium contributed by workers varies considerably. For single coverage, 14% of covered workers are in plans that do not require them to make a contribution, 60% are in plans that require a contribution of 25% or less of the total premium, and 2% are in plans that require a contribution of more than half of the premium. For family coverage, 3% of covered workers are in plans that do not require them to make a contribution, 44% are in a plan that requires a contribution of 25% or less of the total premium, and 16% are in plans that require more than half of the premium. Covered workers in small firms are more likely than covered workers in large firms to be in a plan that requires the worker to contribute more than 50% of the total family premium (36% vs. 8%).

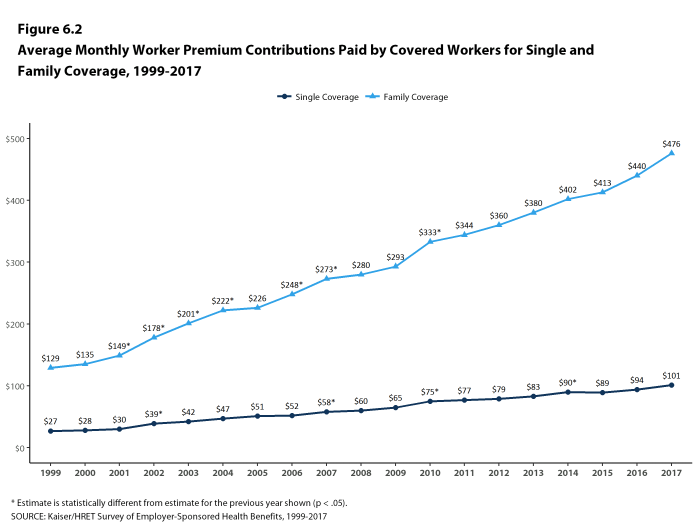

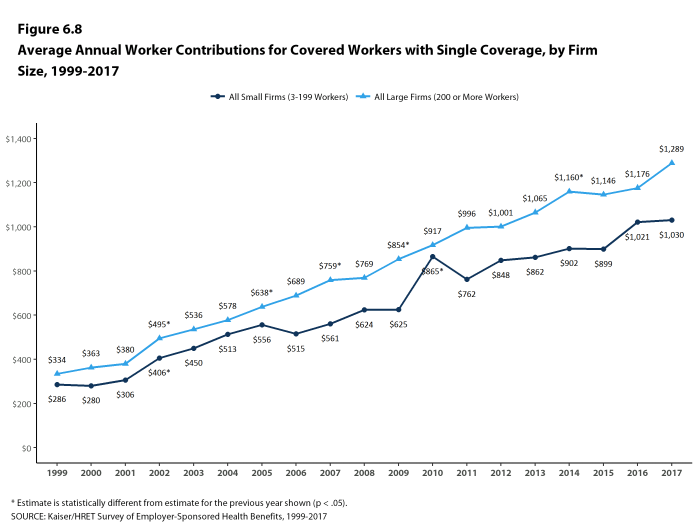

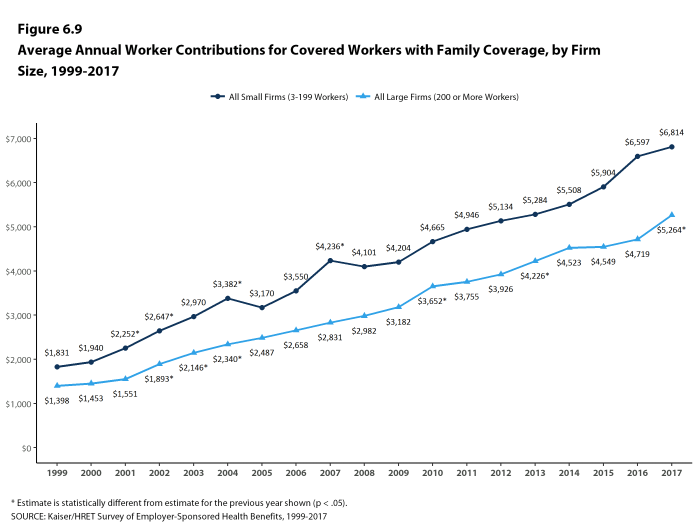

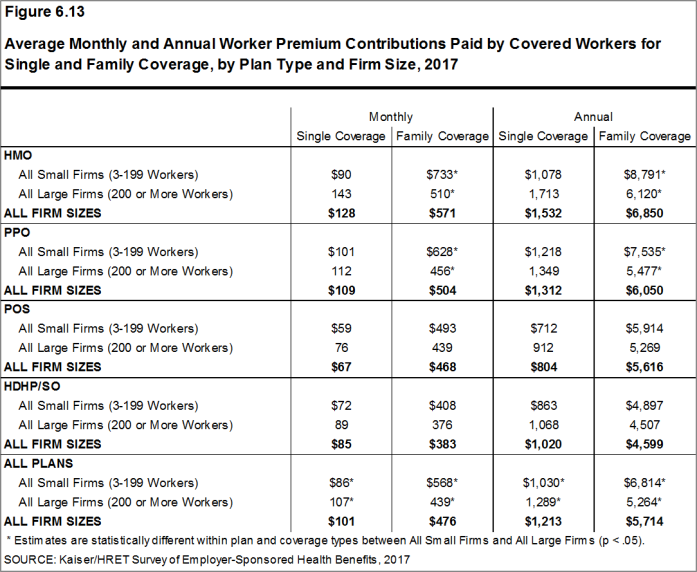

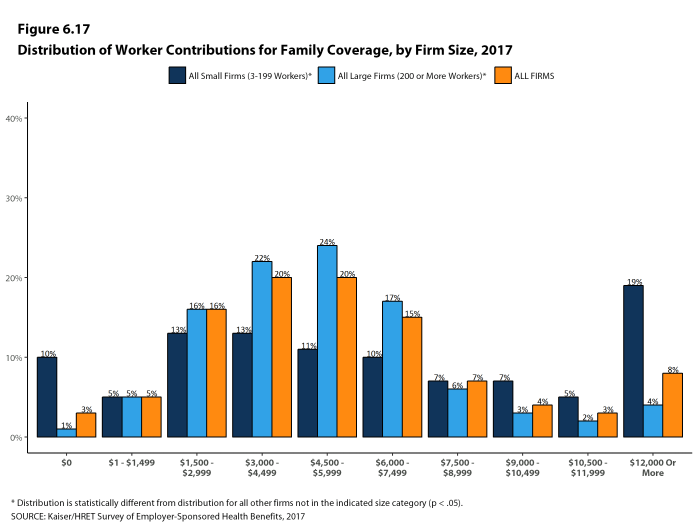

With regard to dollar amounts, the average annual premium contributions by covered workers for 2017 are $1,213 for single coverage and $5,714 for family coverage. Eight percent of covered workers contribute $12,000 or more a year for family coverage c[Figure C]. Average contribution amounts for covered workers in HDHP/SOs are lower for single and family coverage than for covered workers in other plan types [Figure A]. Covered workers’ average dollar contribution to family coverage has increased 74% since 2007 and 32% since 2012 Figure B]. Covered workers in small firms have lower average contributions for single coverage than workers in large firms ($1,030 vs. $1,289), but higher average contributions for family coverage ($6,814 vs. $5,264).

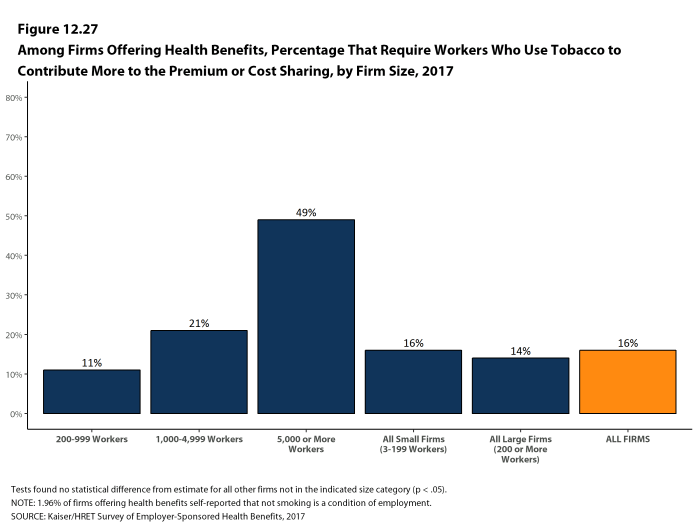

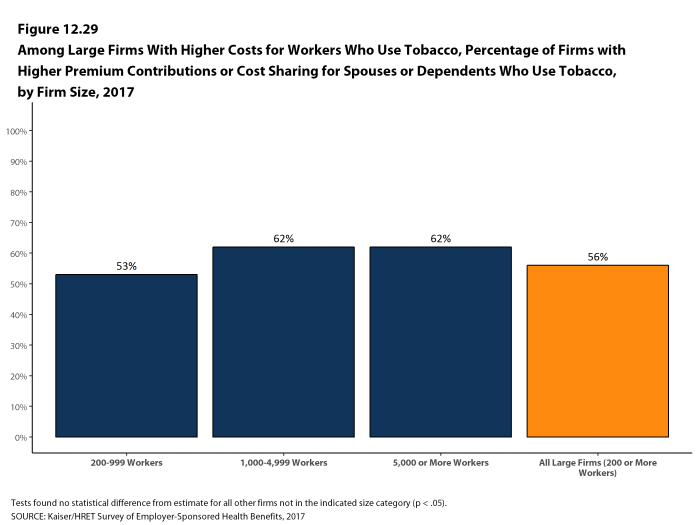

One reason for this variation in dollar amounts is the different approaches that employers use to structure employee contributions, particularly for family coverage. Of firms that offer family coverage, 45% of small firms and 15% of large firms provide the same dollar contribution for single and family coverage, which means that workers must pay the full additional premium cost to enroll family members in their plan. Forty-five percent of small firms and 75% of large firms make a higher dollar contribution for family coverage than for single coverage; 1% of small firms and 4% of large firms vary their approach with the class of the employee; and the remaining 9% of small firms and 6% of large firms take some other approach. Sixteen percent of covered workers are in a plan that requires workers who use tobacco to contribute more toward the premium.

Figure A: Average Annual Firm and Worker Premium Contributions and Total Premiums for Covered Workers for Single and Family Coverage, by Plan Type, 2017

Figure B: Average Annual Health Insurance Premiums and Worker Contributions for Family Coverage, 2007-2017

Figure C: Distribution of Worker Premium Contributions for Single and Family Coverage, 2017

PLAN ENROLLMENT

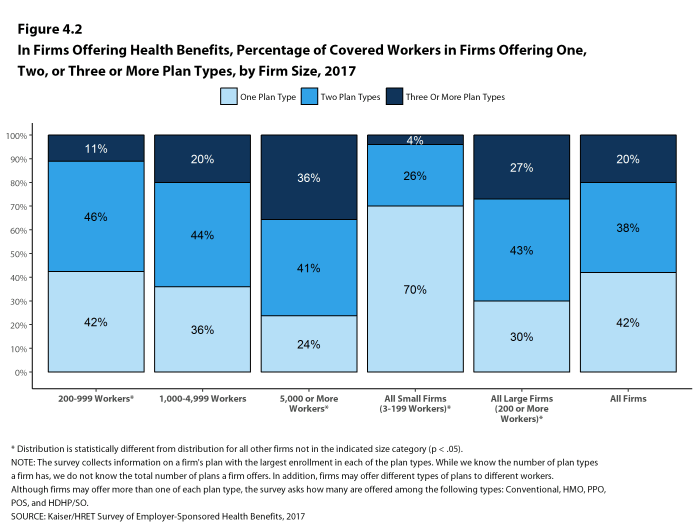

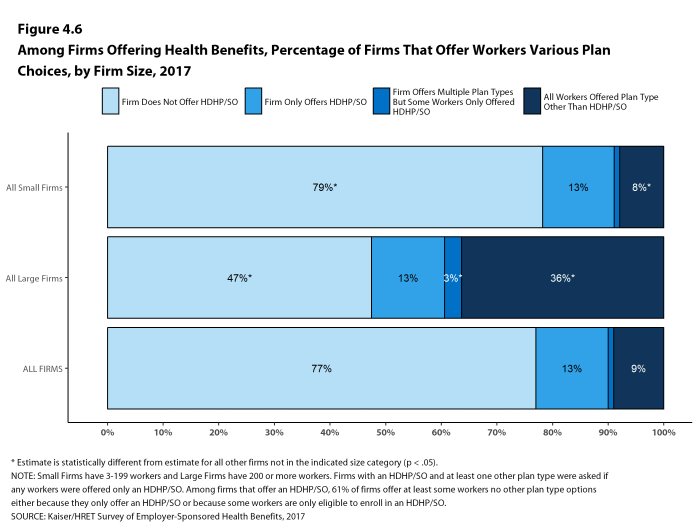

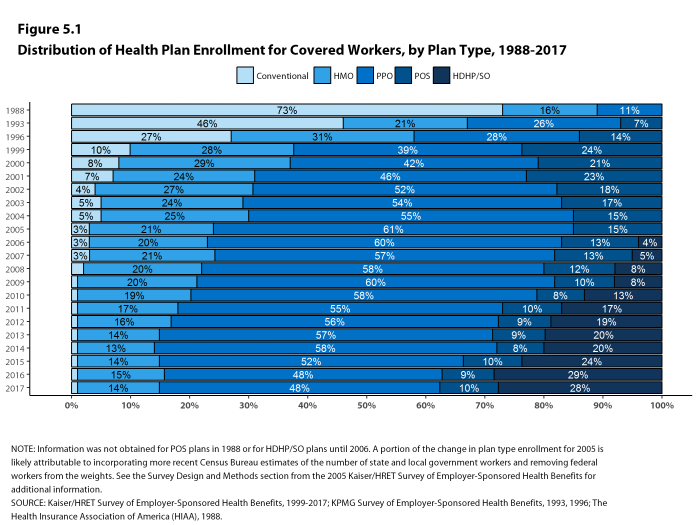

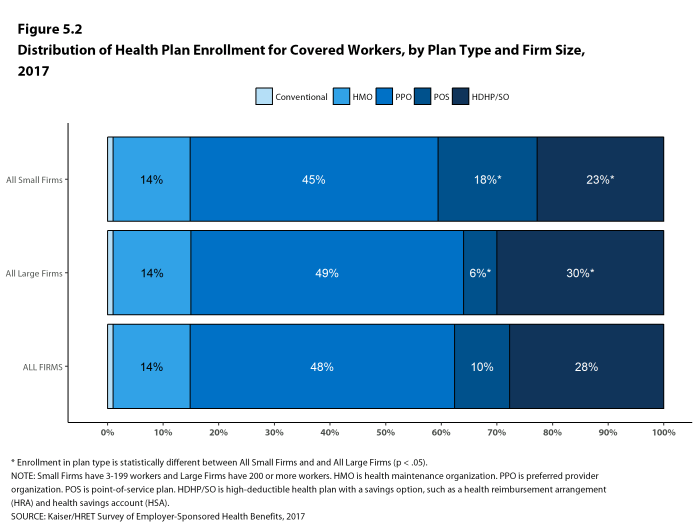

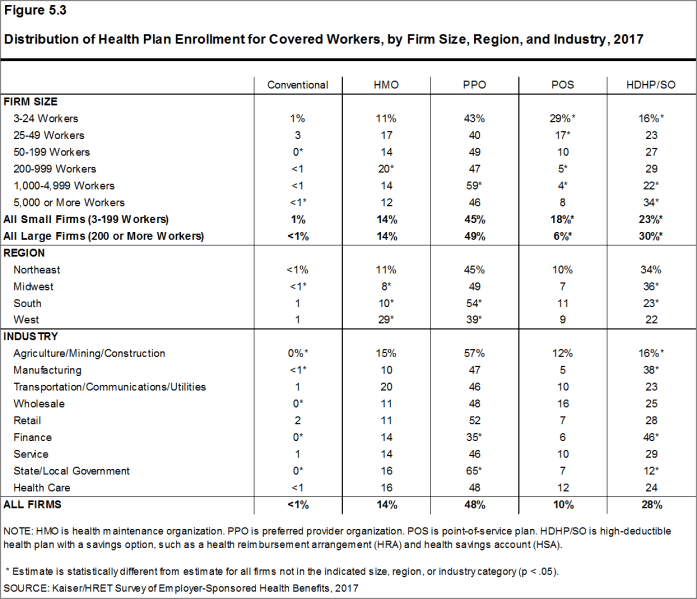

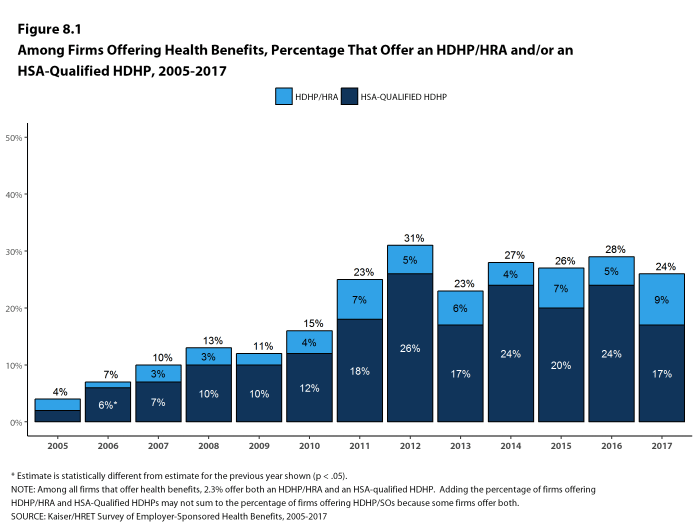

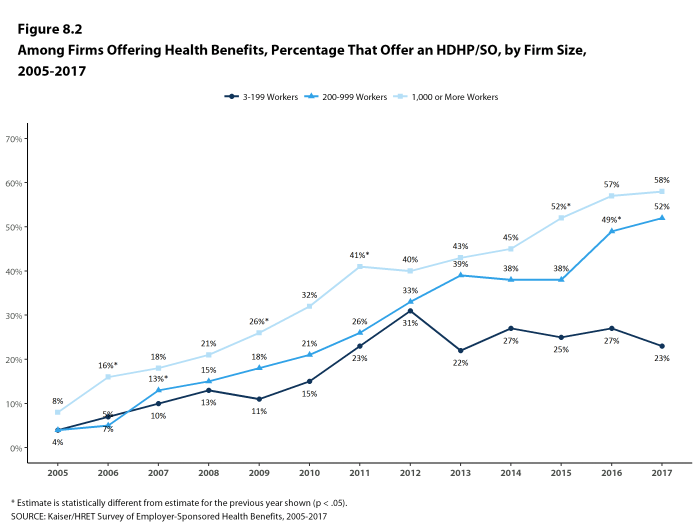

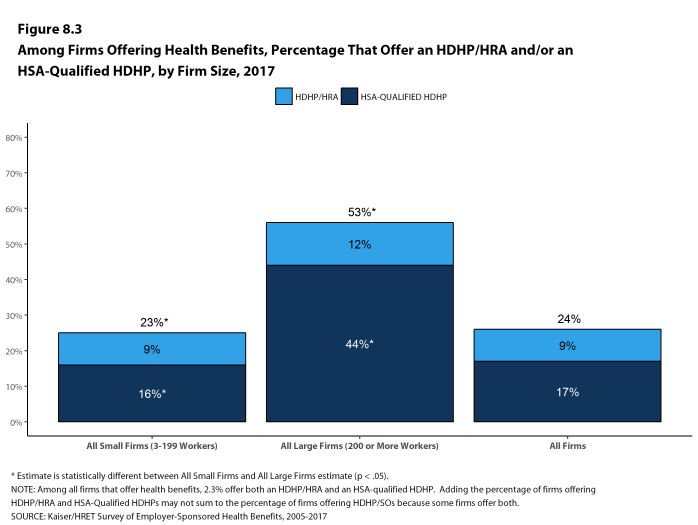

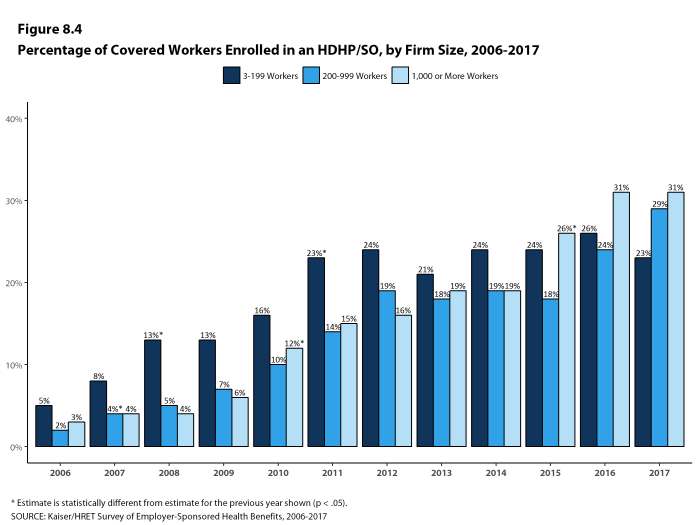

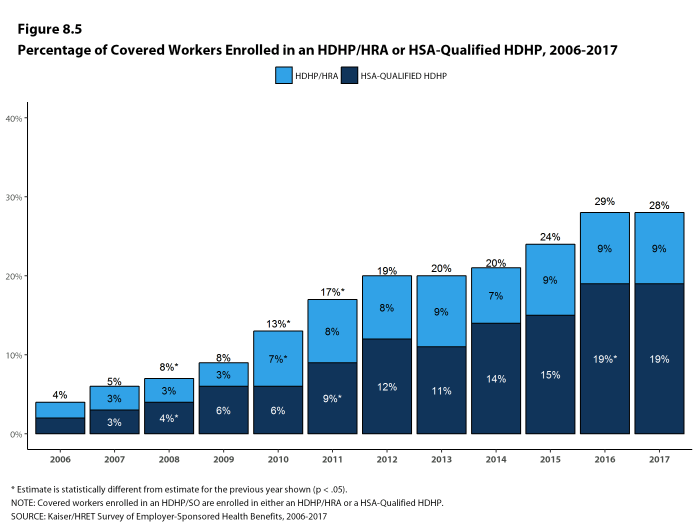

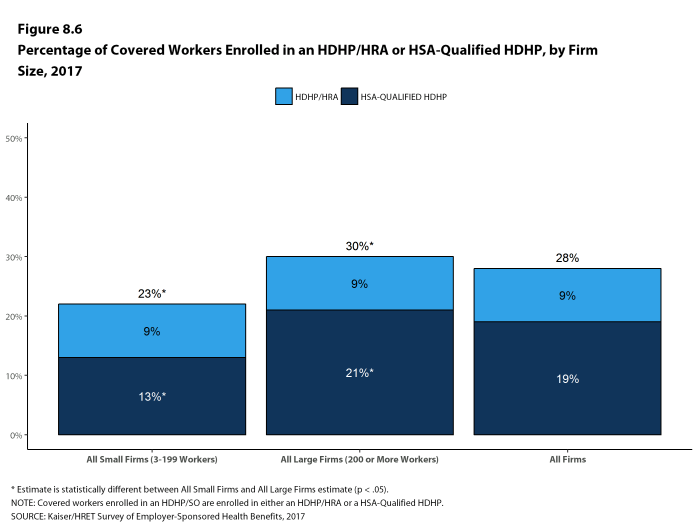

PPOs continue to be the most common plan type in 2017, enrolling 48% of covered workers. Twenty-eight percent of covered workers are enrolled in a high-deductible plan with a savings option (HDHP/SO), 14% in an HMO, 10% in a POS plan, and <1% in a conventional (also known as an indemnity) plan [Figure D]. Over the last five years, enrollment in PPOs has fallen by 8 percentage points while enrollment in HDHP/SOs has increased by 9 percentage points. Six percent of firms offering an HDHP/SO offer only an HDHP/SO to at least some of their workers.

Figure D: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2017

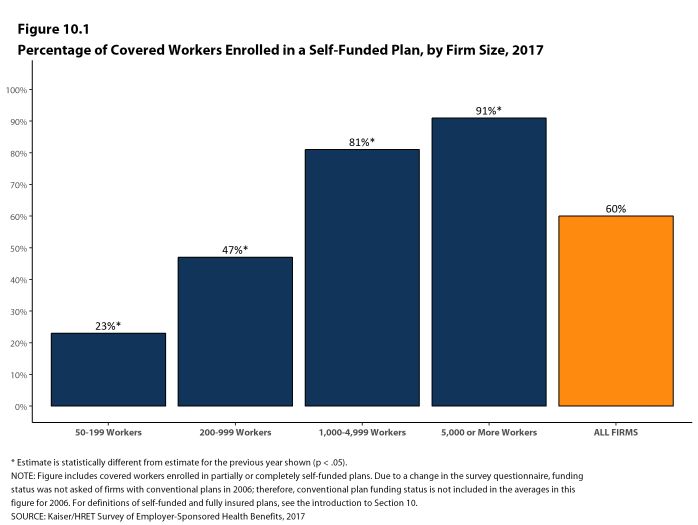

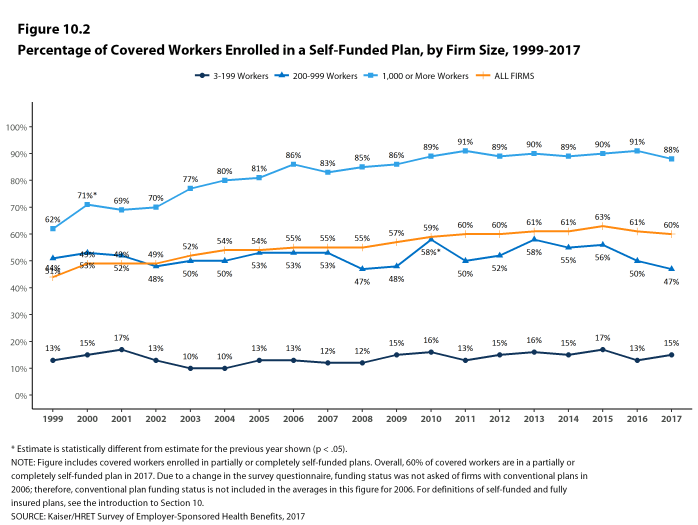

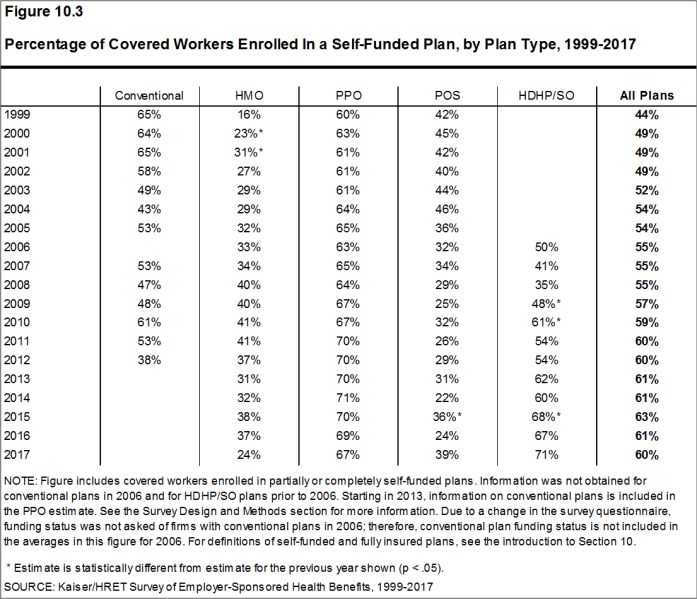

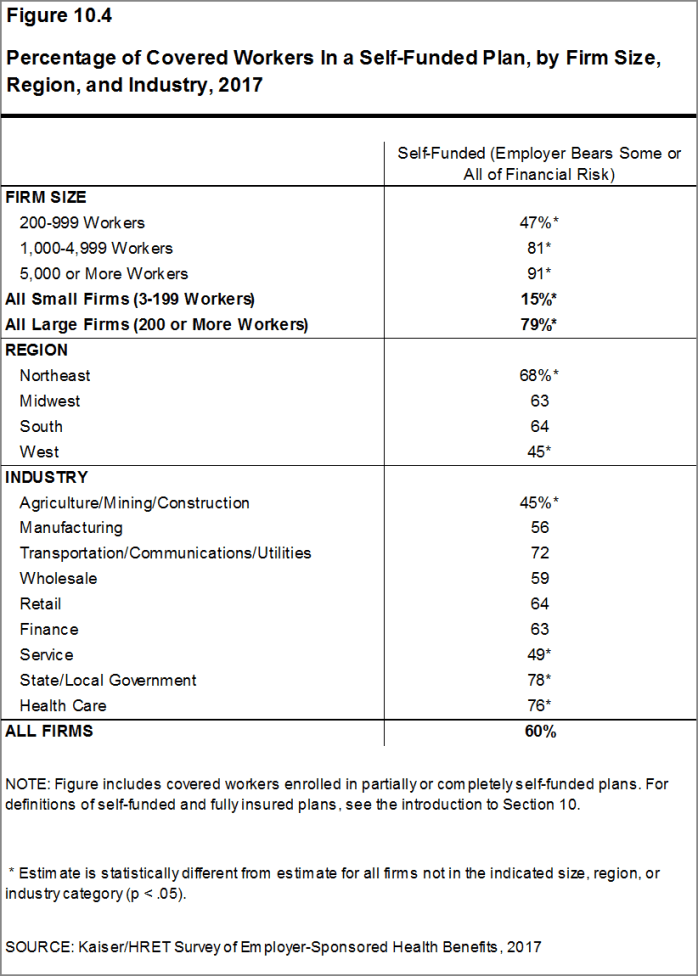

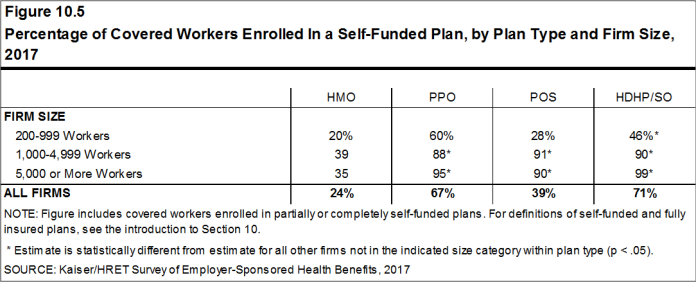

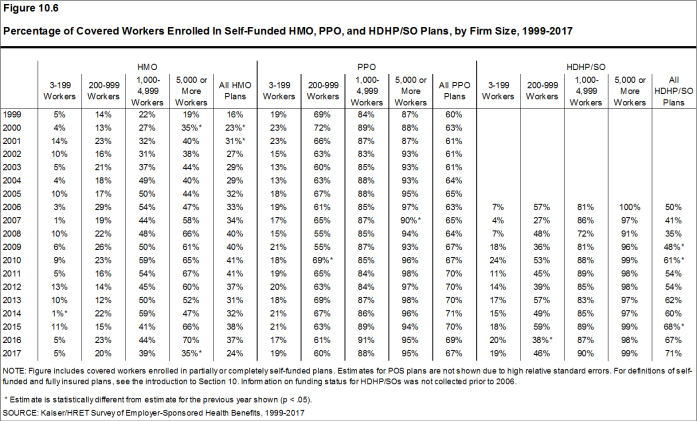

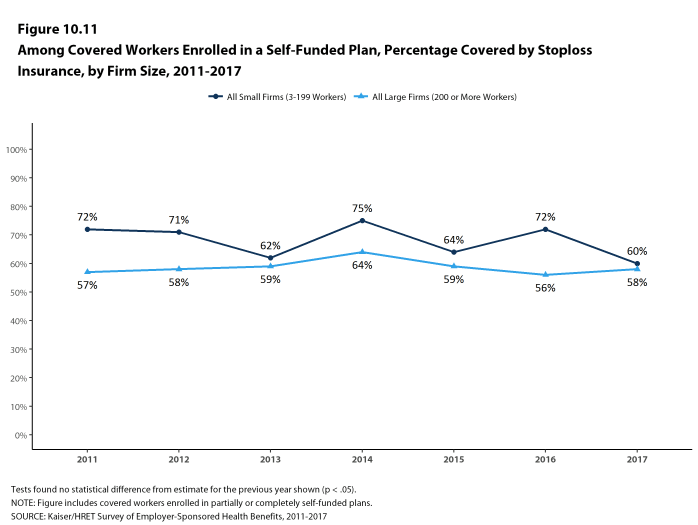

Self-Funding. Fifteen percent of covered workers in small firms and 79% in large firms are enrolled in plans that are either partially or completely self-funded, similar to last year. Although there has been discussion of more insurers offering partially self-funded plans (sometimes called level-premium plans) to smaller employers, we have not seen an increase in respondents reporting that they have self-funded plans in recent years.

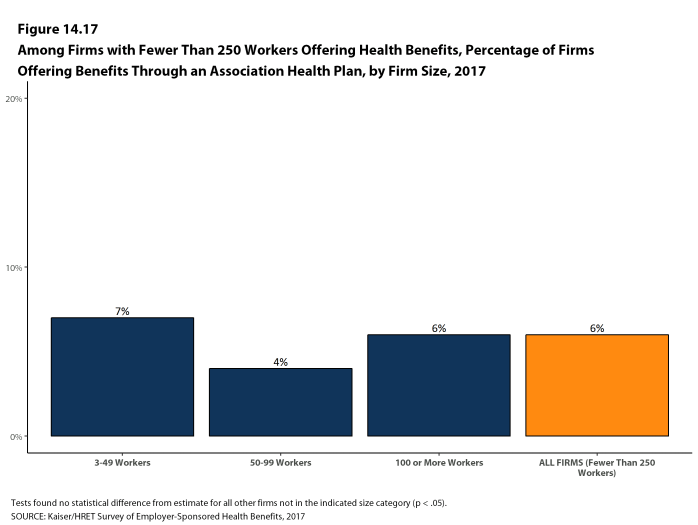

Association Health Plans. Six percent of offering firms with fewer than 250 workers offer health benefits arranged through a trade or professional association.

EMPLOYEE COST SHARING

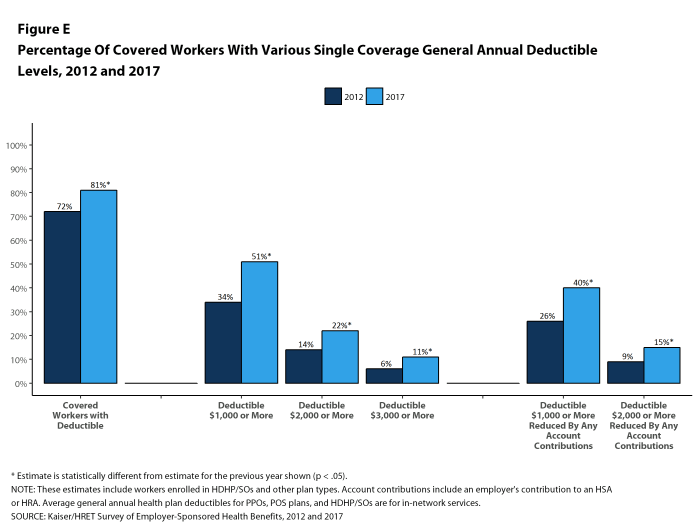

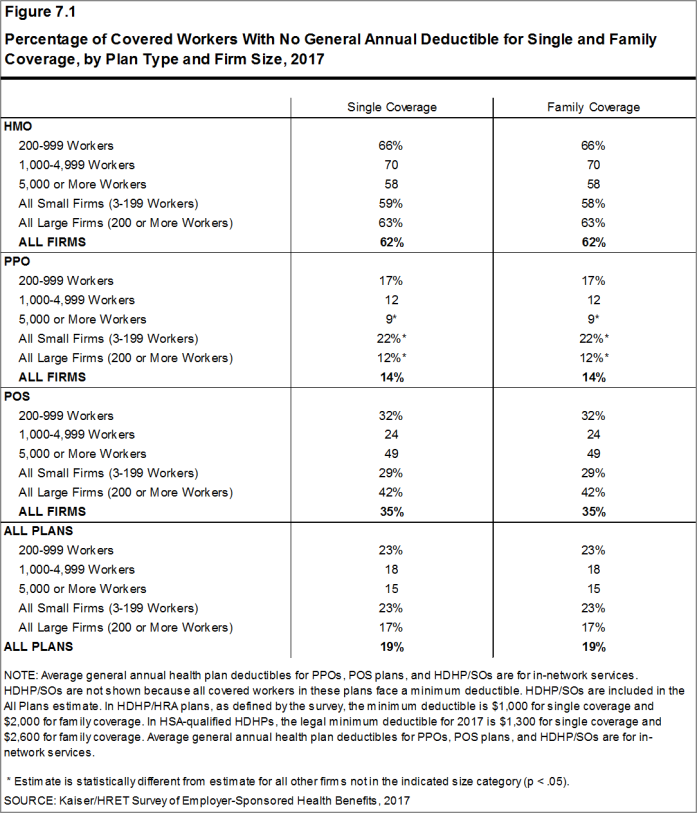

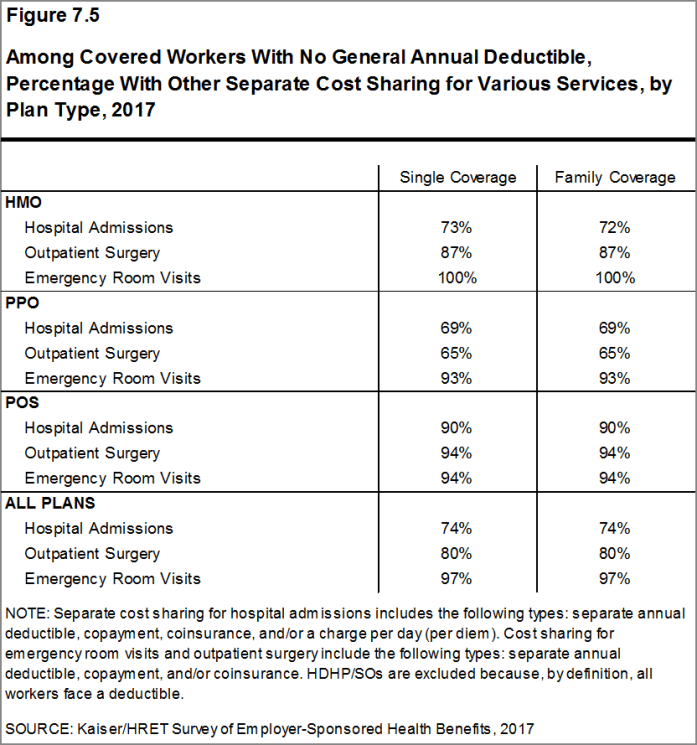

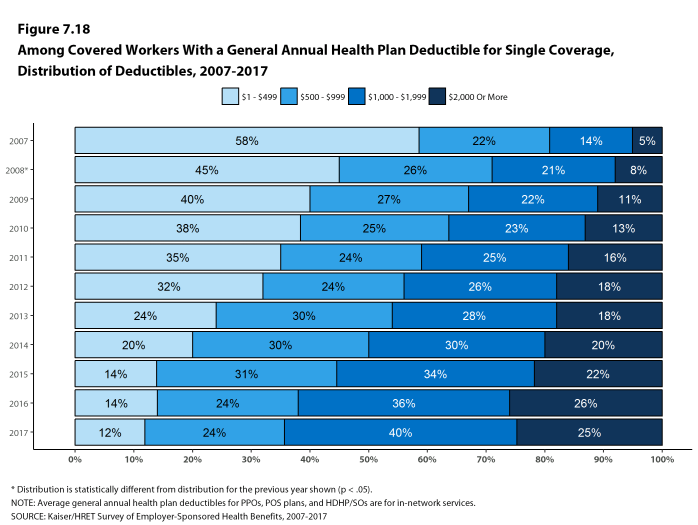

Most covered workers must pay a share of the cost when they use health care services. Eighty-one percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan [Figure E]. Even workers without a general annual deductible often face other types of cost sharing when they use services, such as copayments or coinsurance for office visits and hospitalizations.

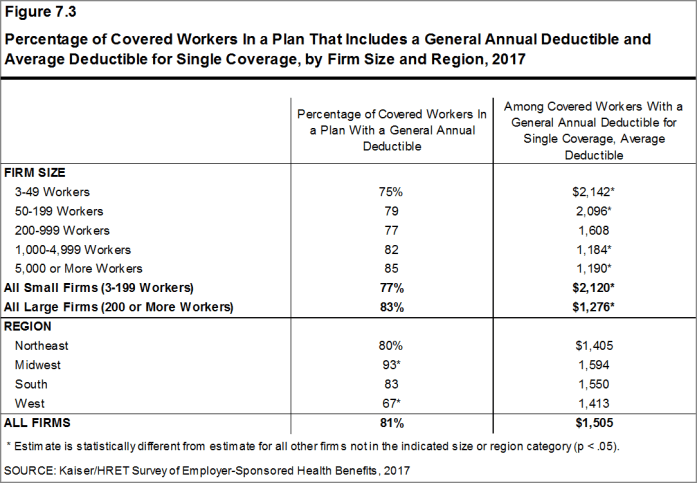

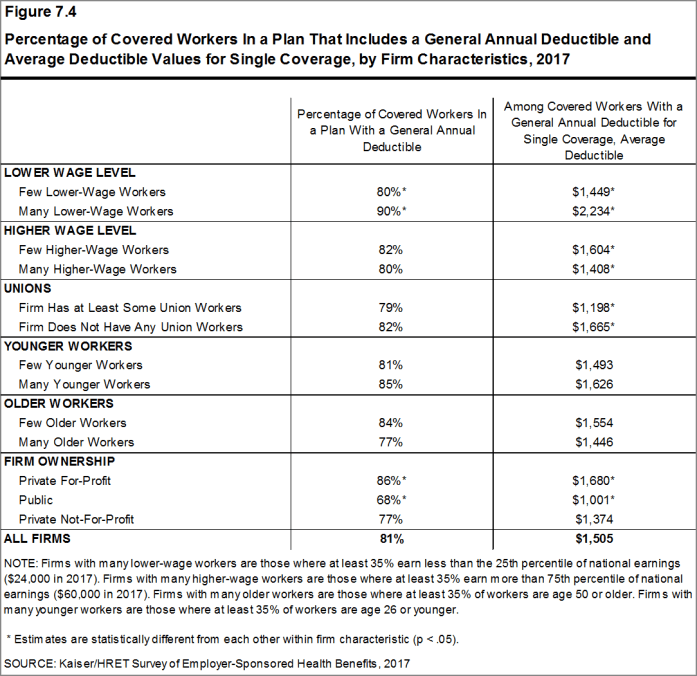

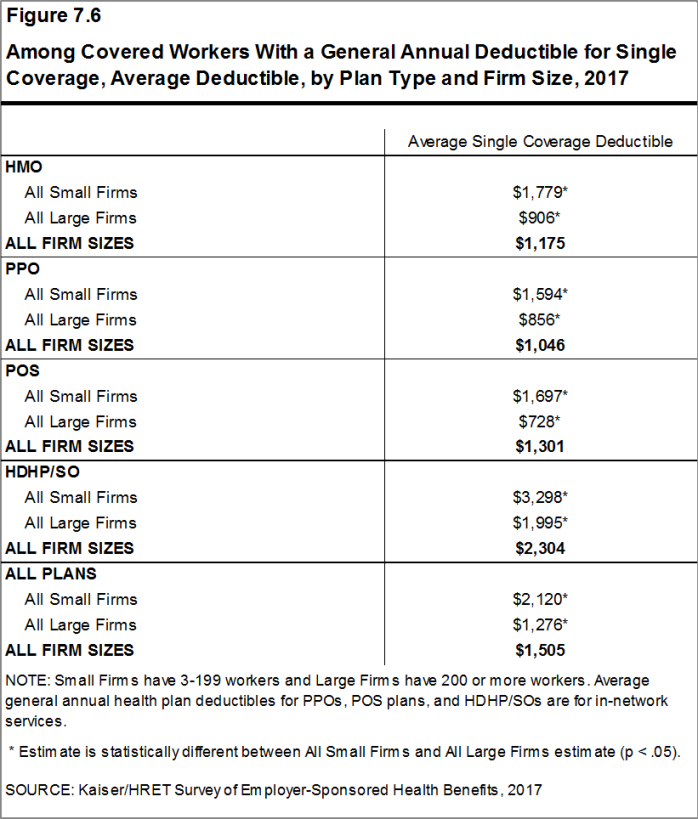

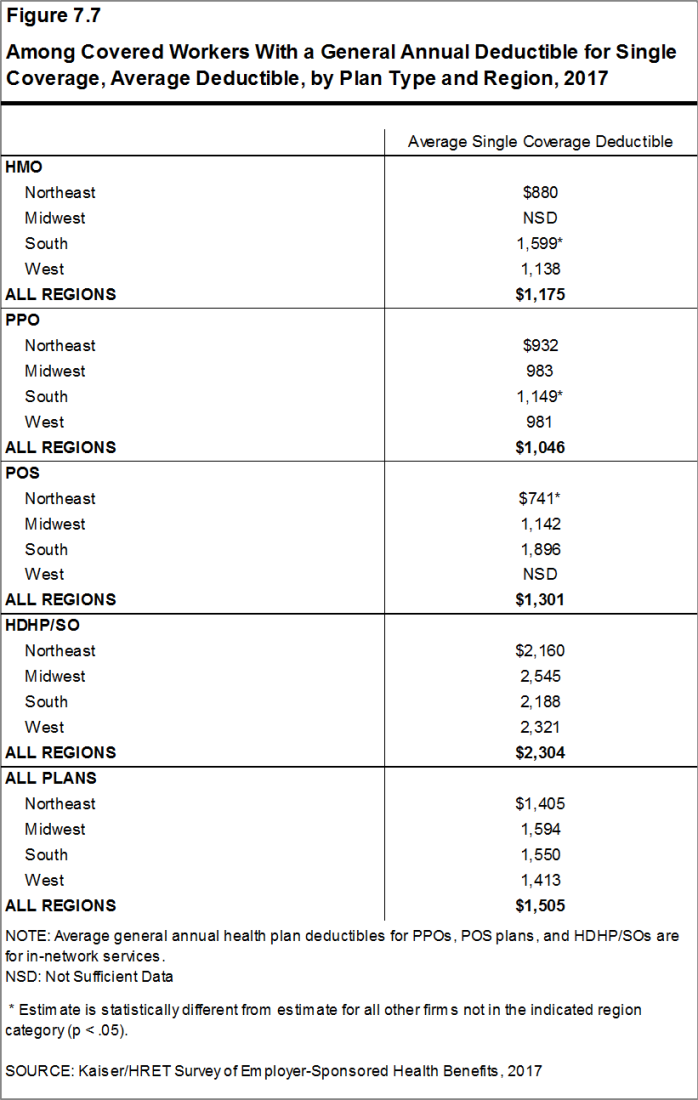

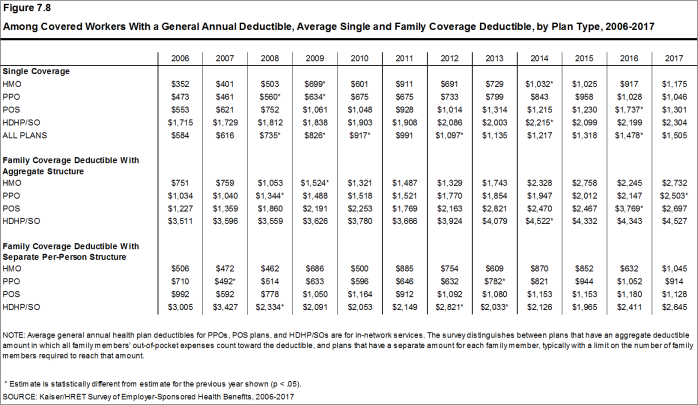

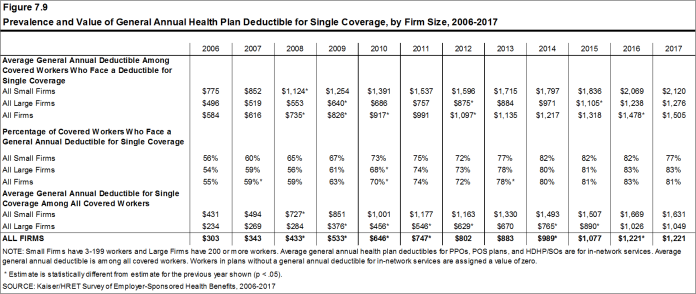

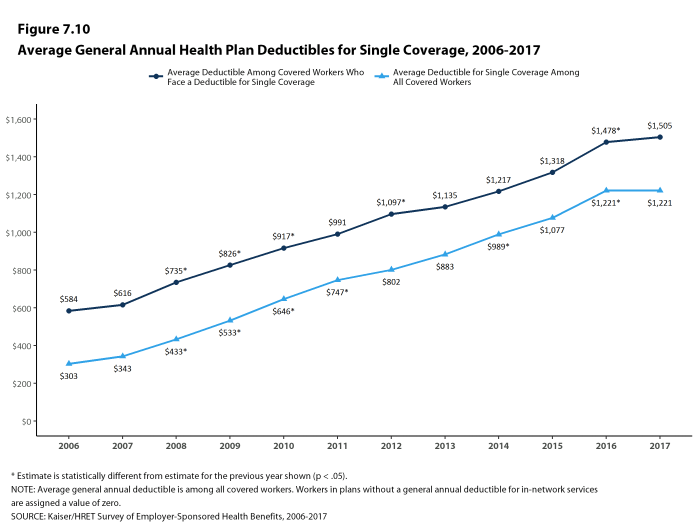

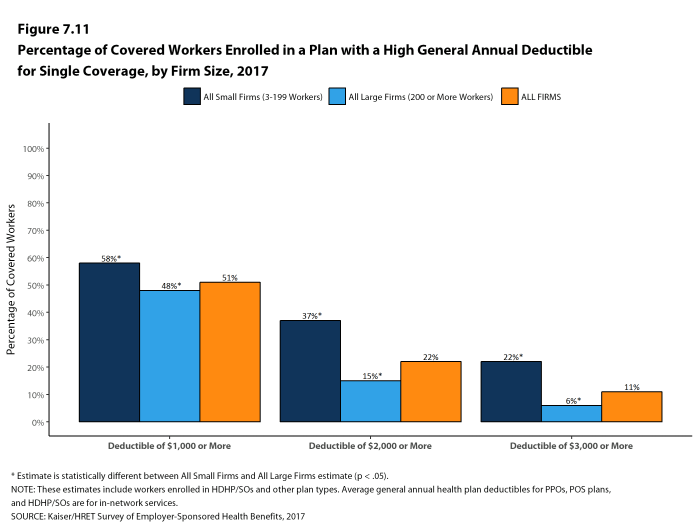

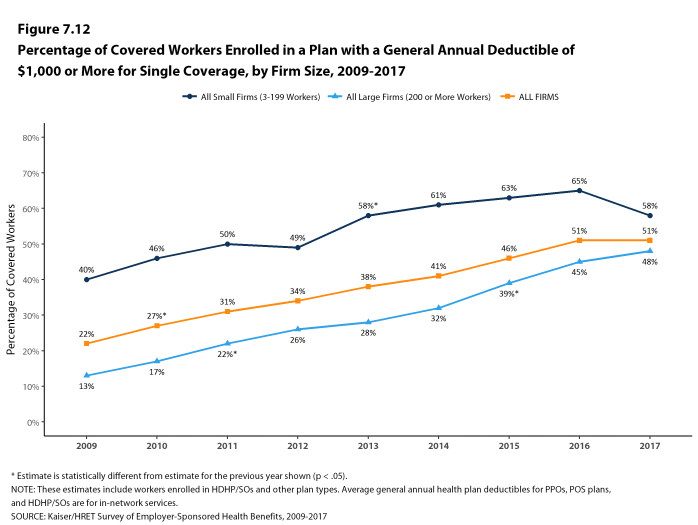

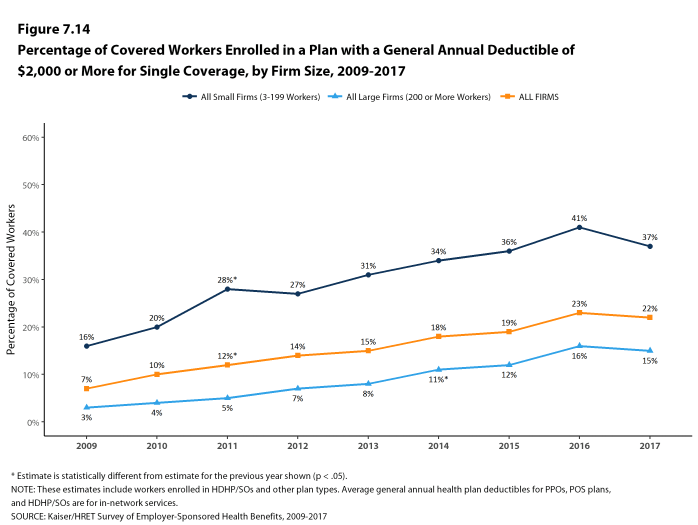

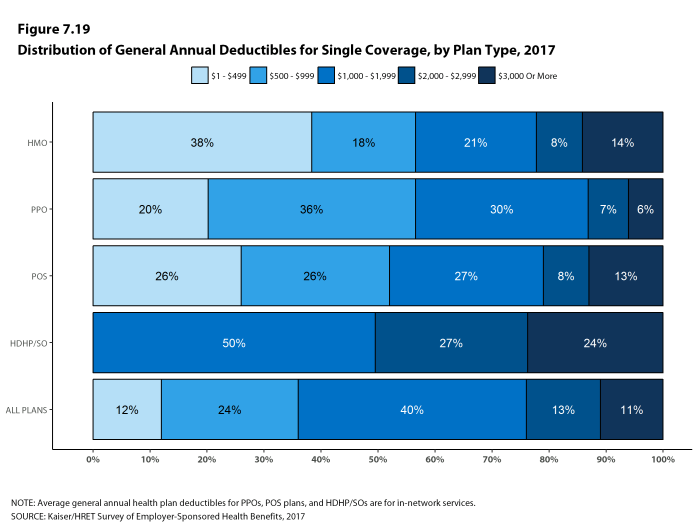

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,505, similar to the average deductible last year ($1,478). The average deductible for covered workers is higher in small firms than in large firms ($2,120 vs. $1,276). Among all covered workers, including both those with and without a deductible, the average deductible is $1,221. Fifty-eight percent of covered workers in small firms and 48% of covered workers in large firms are in a plan with a deductible of at least $1,000 for single coverage, similar to the percentages last year. Over the last five years, however, the percentage of covered workers with a general annual deductible of $1,000 or more for single coverage has grown substantially, increasing from 34% in 2012 to 51% in 2017 [Figure E]. Thirty-seven percent of covered workers in small firms are in a plan with a deductible of at least $2,000, compared to 15% for covered workers in large firms.

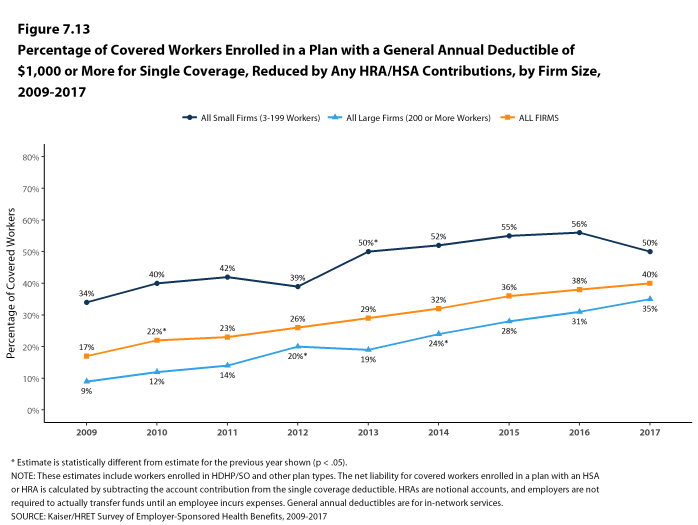

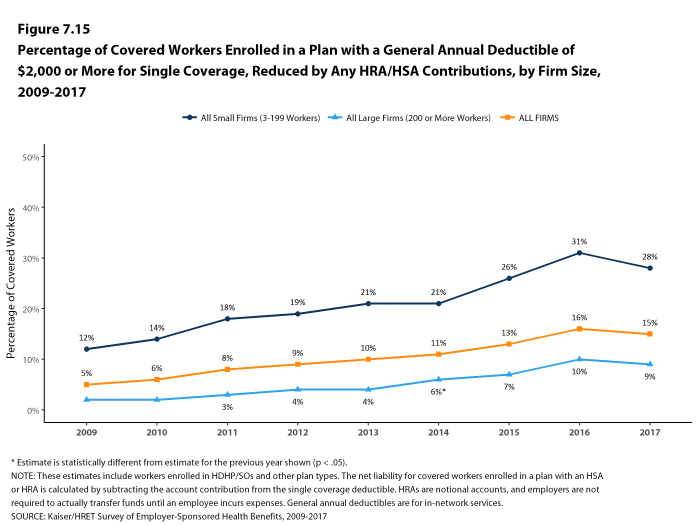

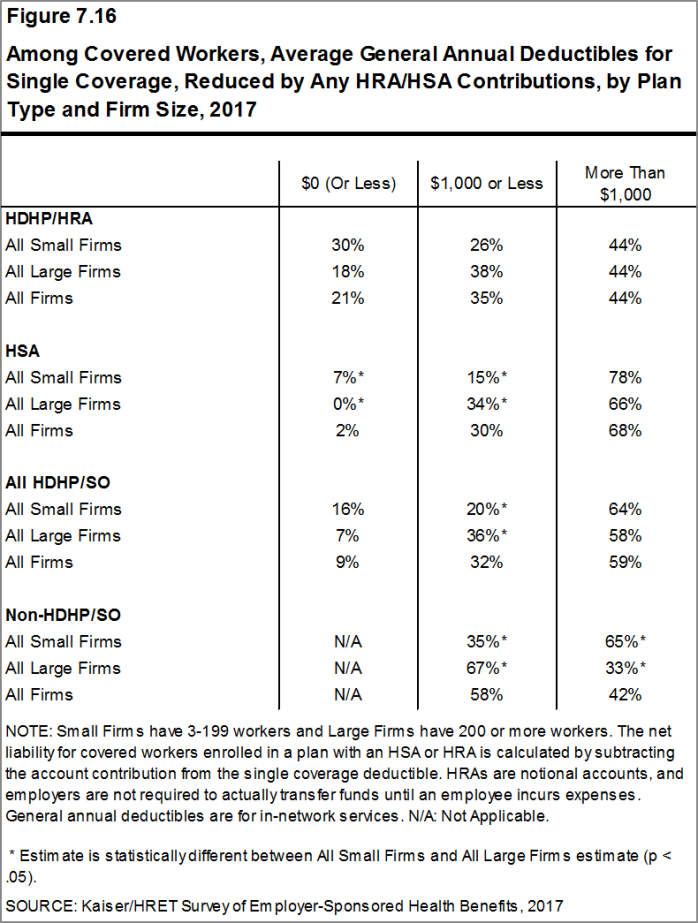

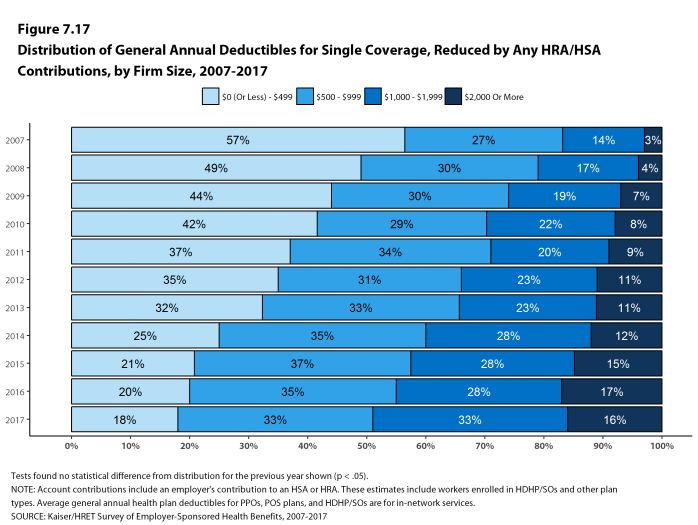

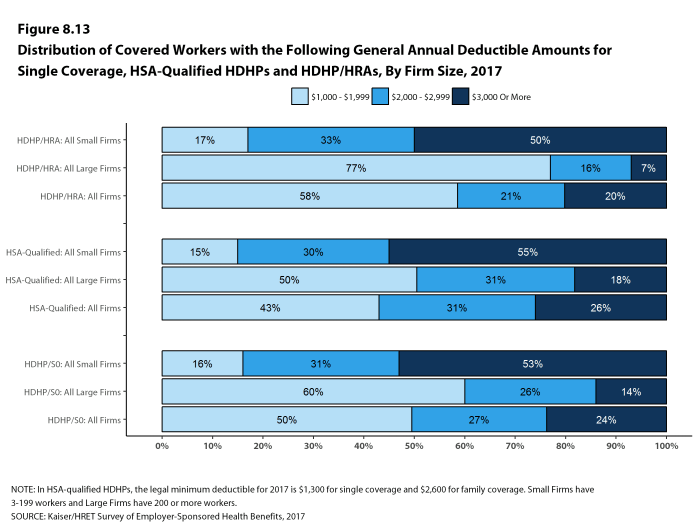

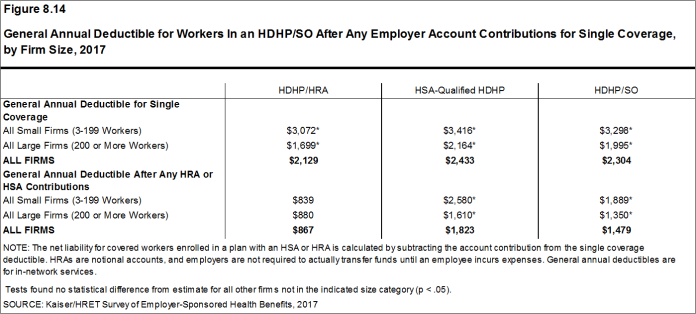

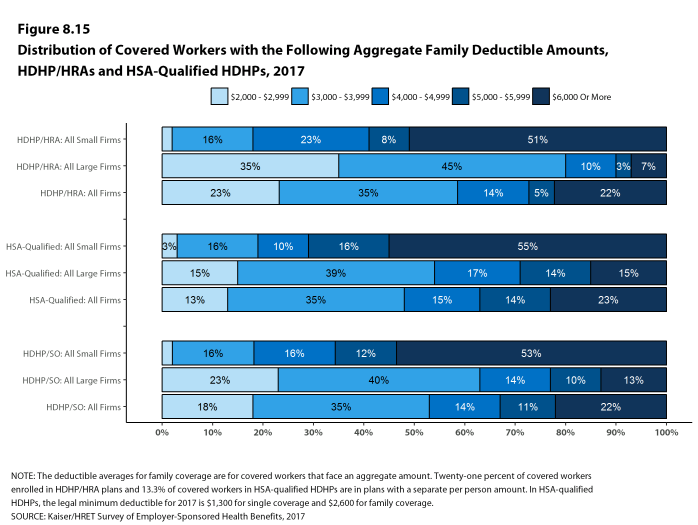

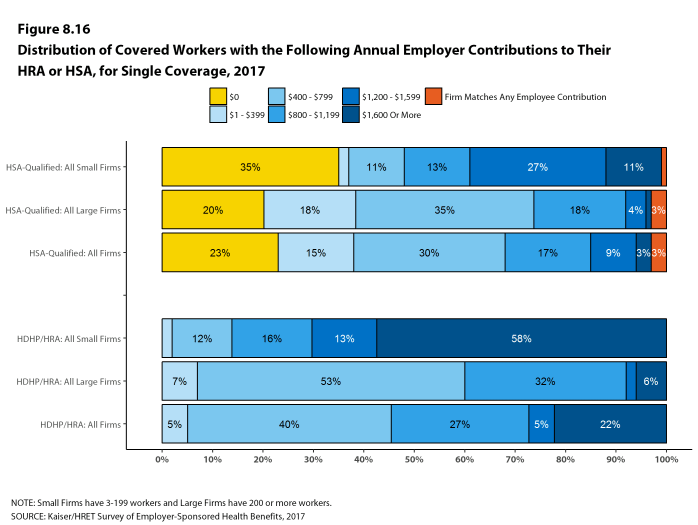

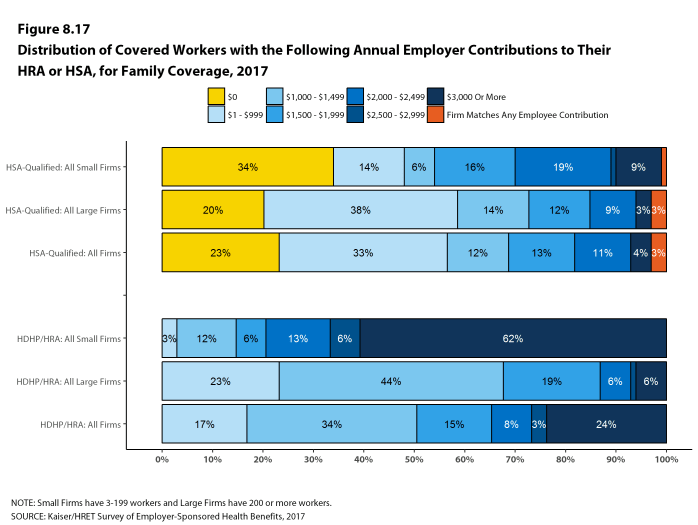

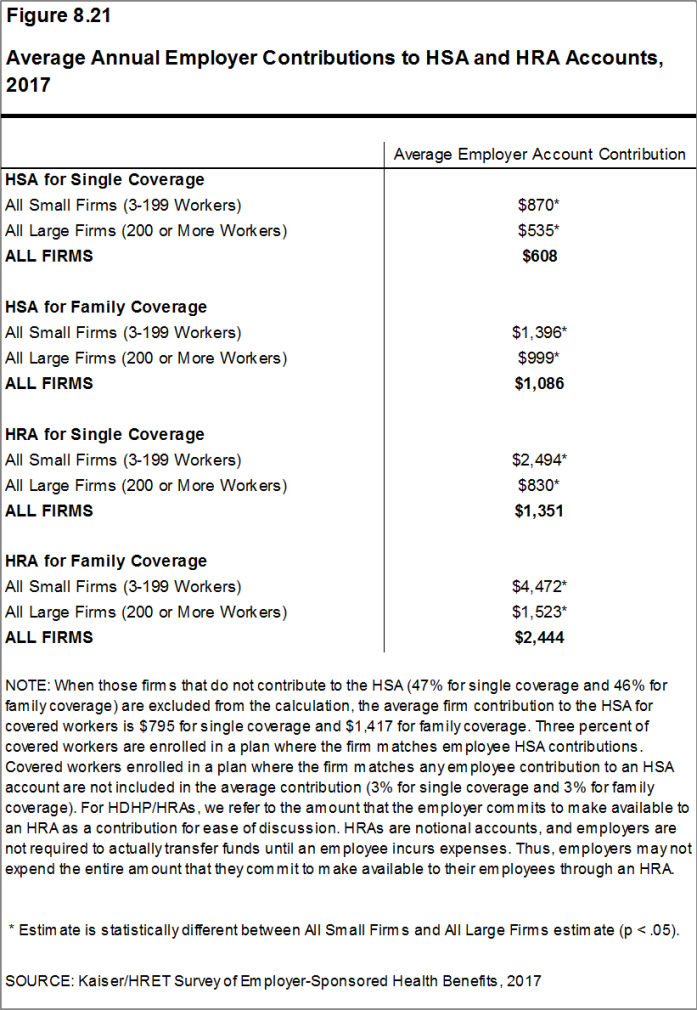

Deductibles have increased in recent years due to higher deductible amounts within plan types and to higher enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift in enrollment to HDHP/SOs does not necessarily do so because most HDHP/SO enrollees receive an account contribution from their employers. Twenty-one percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA) and 2% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while another 35% of covered workers in an HDHP with an HRA and 30% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their cost sharing to less than $1,000.

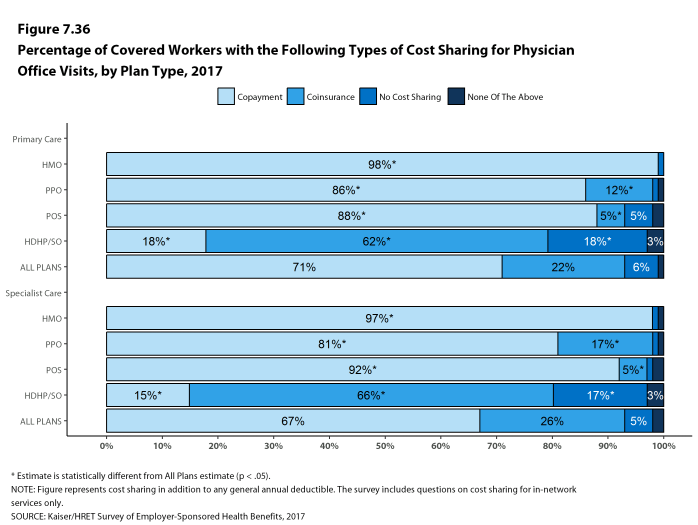

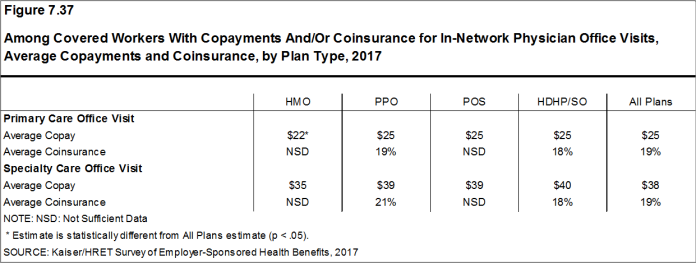

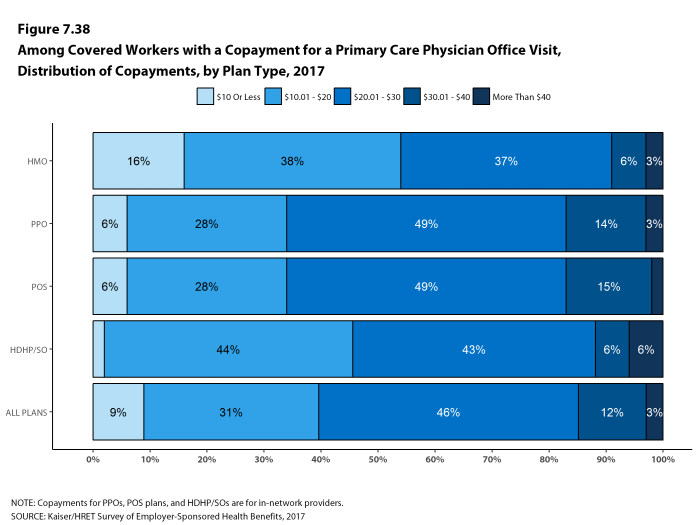

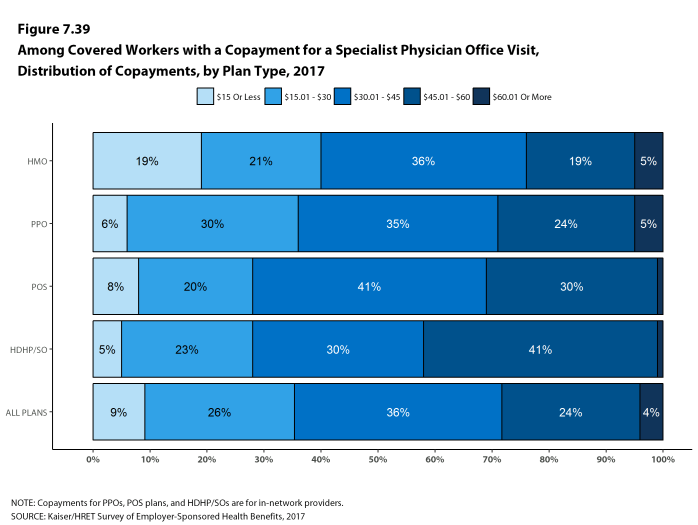

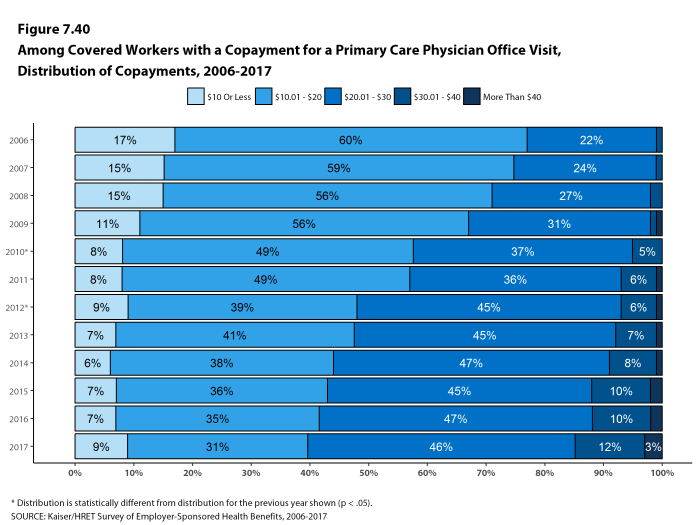

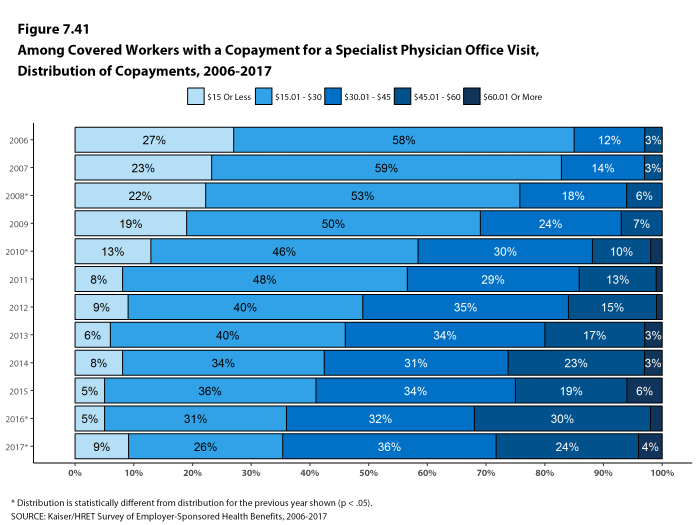

Whether they face a general annual deductible or not, a large share of covered workers also pay a portion of the cost when they visit an in-network physician. For primary care, 71% of covered workers have a copayment (a fixed dollar amount) when they visit a doctor and 22% have coinsurance (a percentage of the covered amount). For specialty care, 67% face a copayment and 26% face coinsurance. The average copayments are $25 for primary care and $38 for specialty care. The average coinsurance is 19% for primary and 19% for specialty care. These amounts are similar to those in 2016.

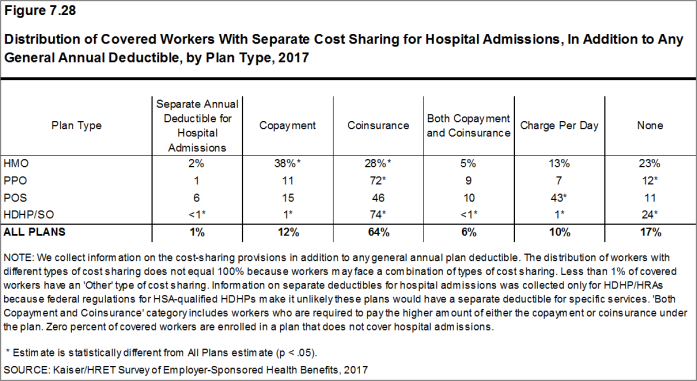

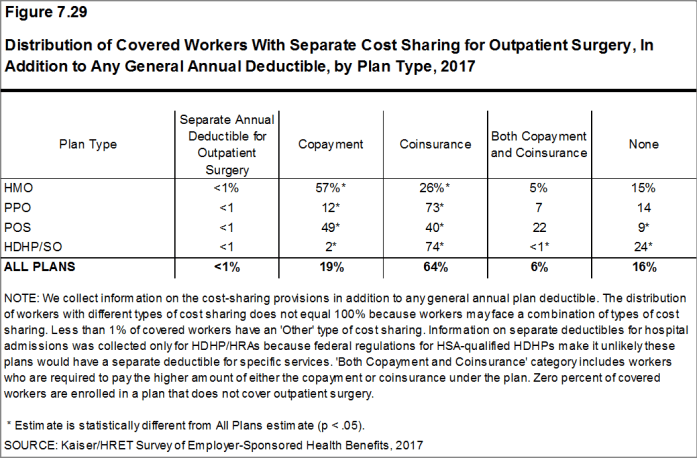

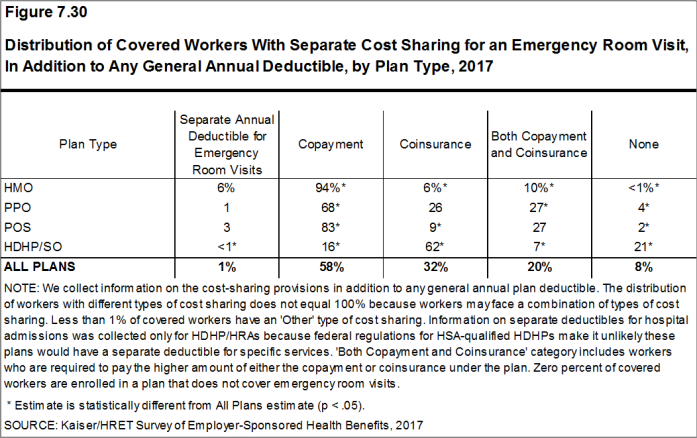

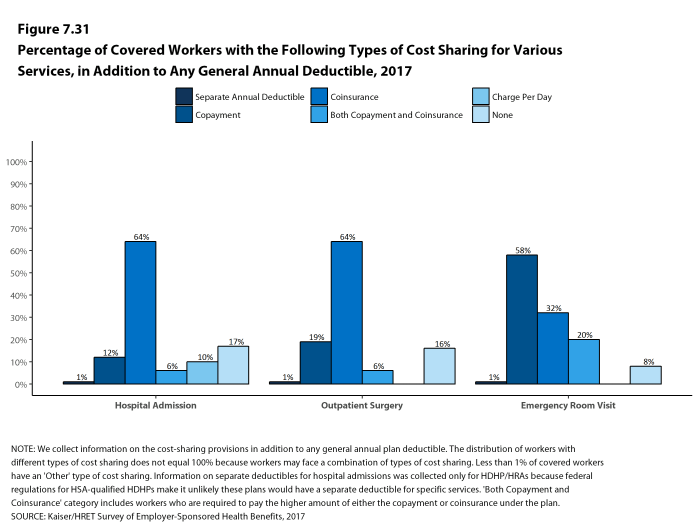

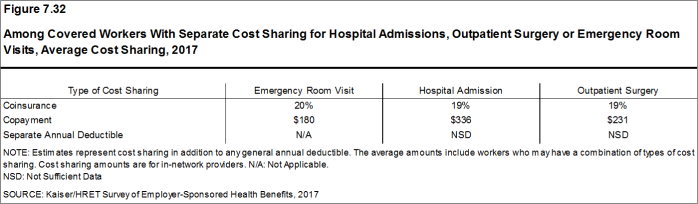

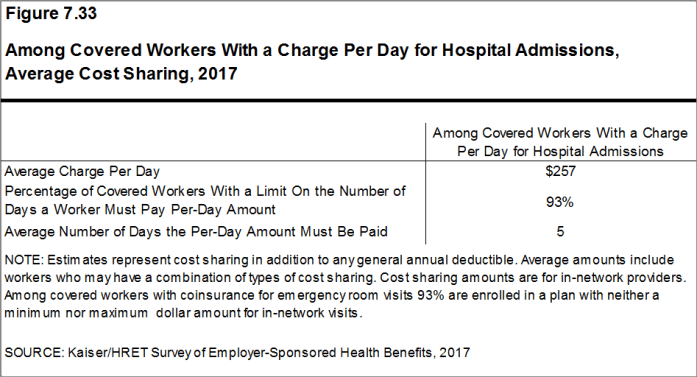

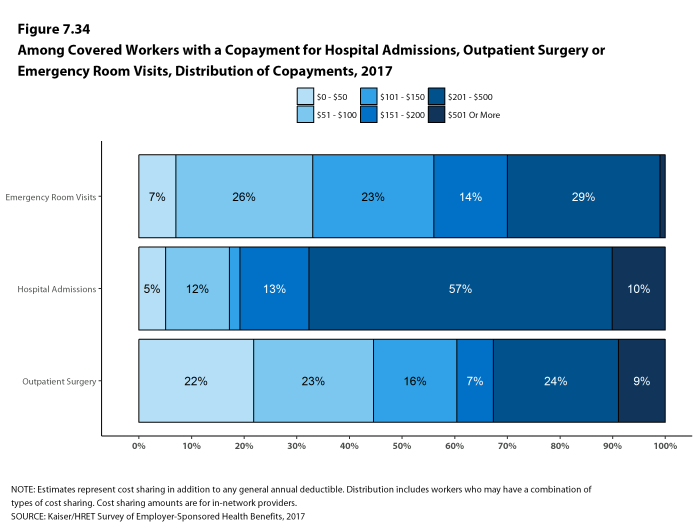

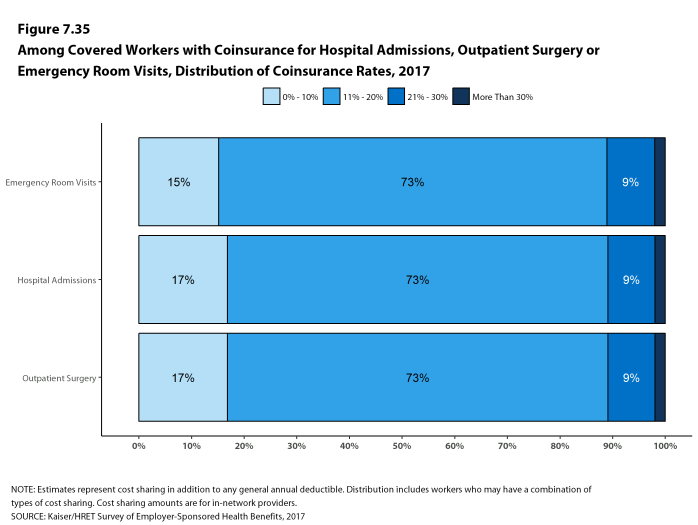

Most workers also face additional cost sharing for an emergency room visit, hospital admission, or outpatient surgery. After any general annual deductible is met, 32% of covered workers have a coinsurance and 58% have a copayment for an emergency room visit, and 64% of covered workers have a coinsurance and 12% have a copayment for hospital admissions. The average coinsurance rate for hospital admissions is 19% and the average copayment is $336 per hospital admission. The cost sharing provisions for outpatient surgery follow a similar pattern to those for hospital admissions.

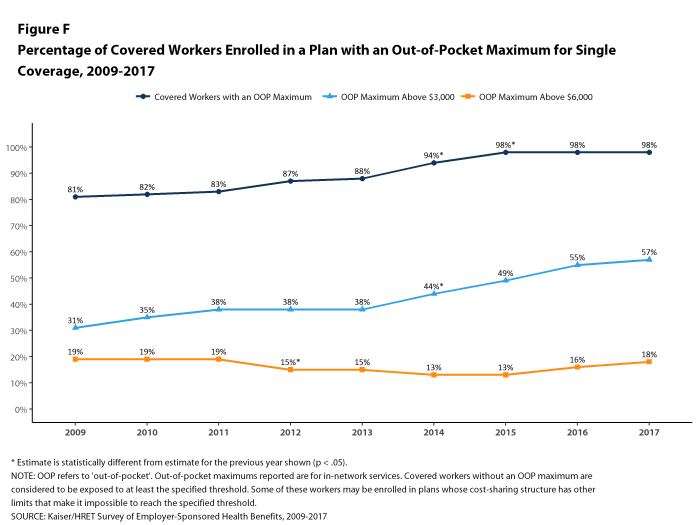

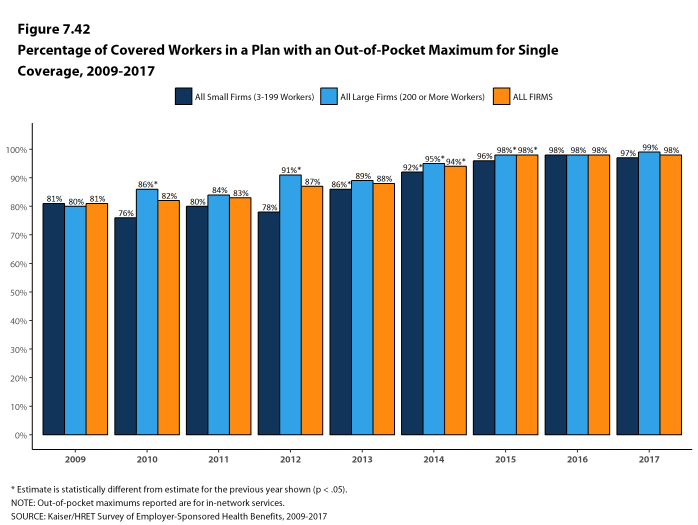

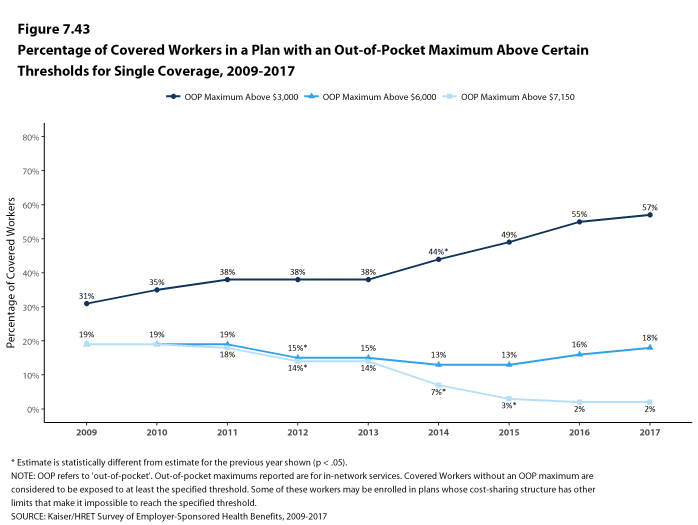

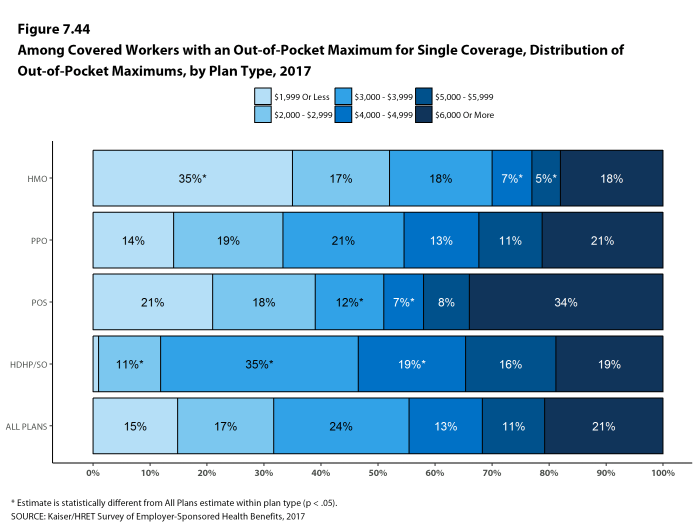

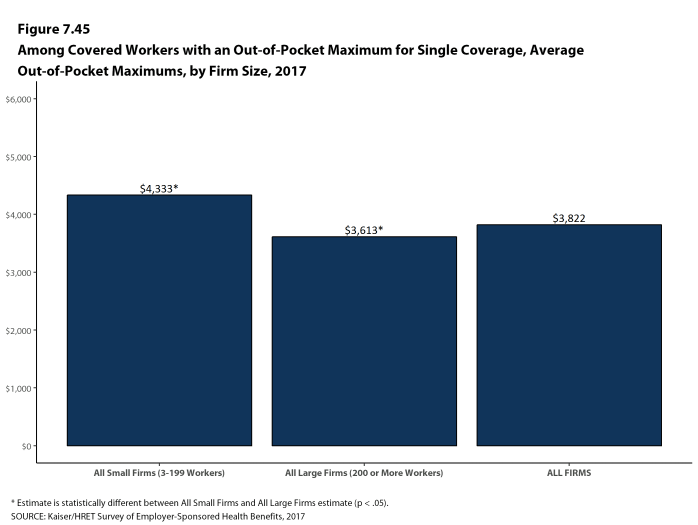

While almost all (98%) covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, there is considerable variation in the actual dollar limits [Figure F]. Fifty-seven percent of these workers are in a plan with an annual out-of-pocket maximum for single coverage of more than $3,000, while 18% are in a plan with an out-of-pocket maximum of $6,000 or more.

Figure E: Percentage of Covered Workers With Various Single Coverage General Annual Deductible Levels, 2012 and 2017

Figure F: Percentage of Covered Workers Enrolled In a Plan With an Out-Of-Pocket Maximum for Single Coverage, 2009-2017

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

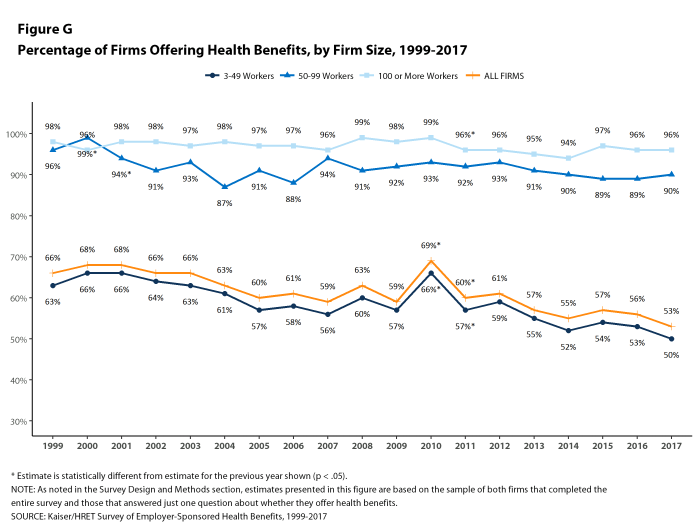

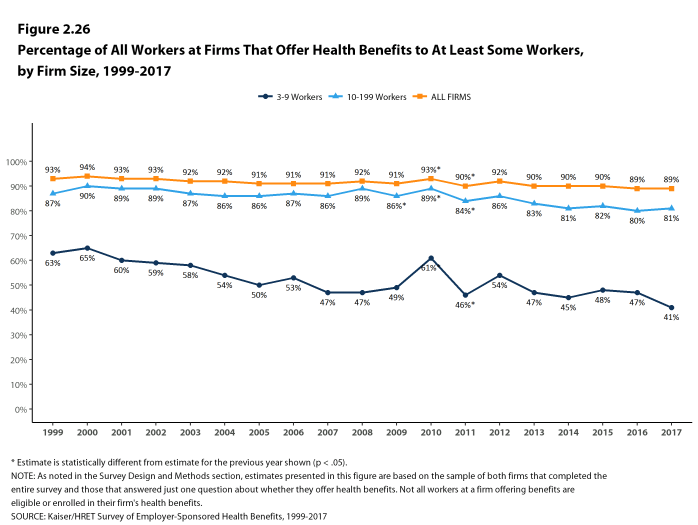

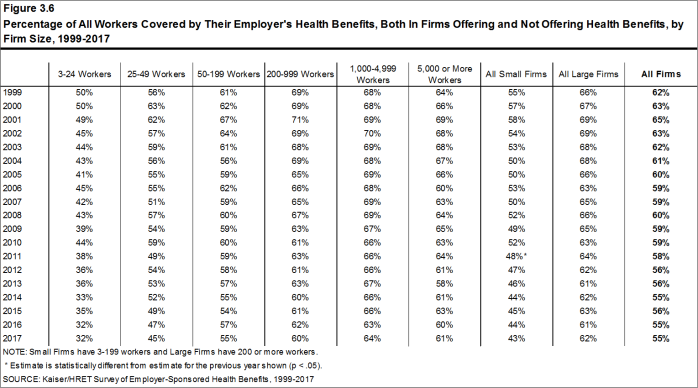

Fifty-three percent of firms offer health benefits to at least some of their workers, similar to the percentage last year [Figure G]. Eighty-nine percent of workers are in a firm that offers health benefits to at least some of its workers. Over the past decade, the percentage of workers at small firms that offer health benefits to at least some workers has decreased (78% vs 73%).

The likelihood of offering health benefits differs significantly by firm size, with only 40% of firms with 3 to 9 workers offering coverage while virtually all firms with 1,000 or more workers offer coverage.

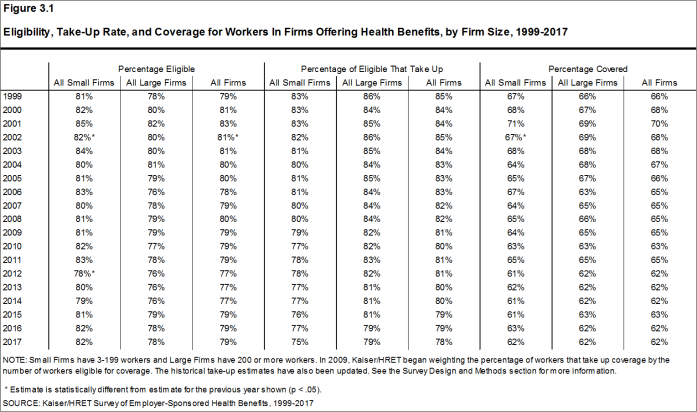

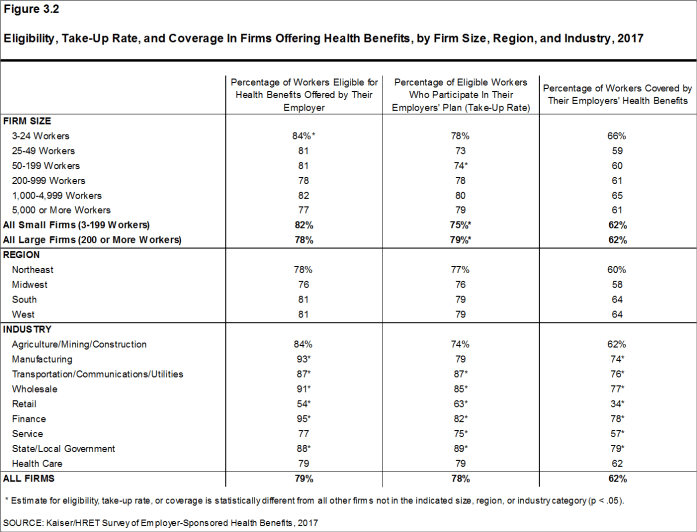

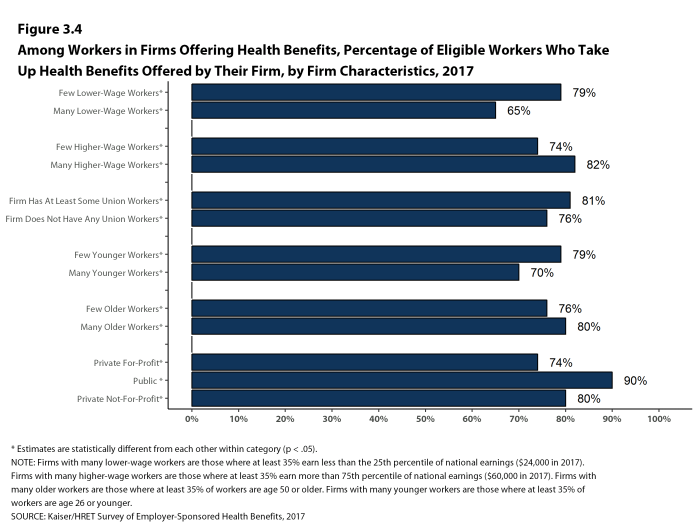

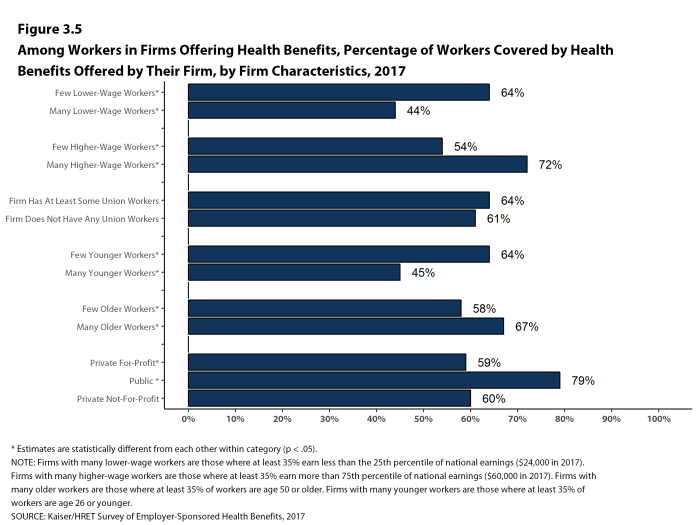

Even in firms that offer health benefits, some workers are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) and others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 79% of workers are eligible for the health benefits offered, and of those eligible, 78% take up the firm’s offer, resulting in 62% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to 2016.

Looking across workers both in firms that offer and those that do not offer health benefits, 55% of workers are covered by health plans offered by their employer.

Coverage for Family Members. Among firms offering health benefits, virtually all large firms and 94% of small firms offer coverage to spouses of eligible workers. Similarly, virtually all large firms and 92% of small firms offering health benefits offer coverage to other dependents of their eligible workers, such as children.

Figure G: Percentage of Firms Offering Health Benefits, by Firm Size, 1999-2017

RETIREE COVERAGE

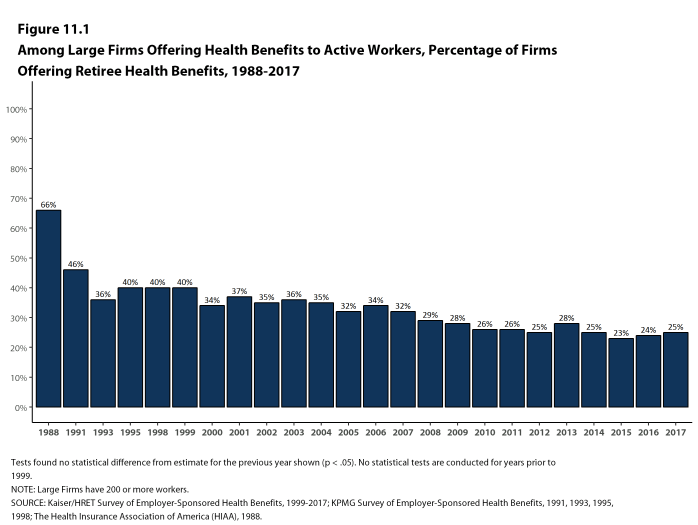

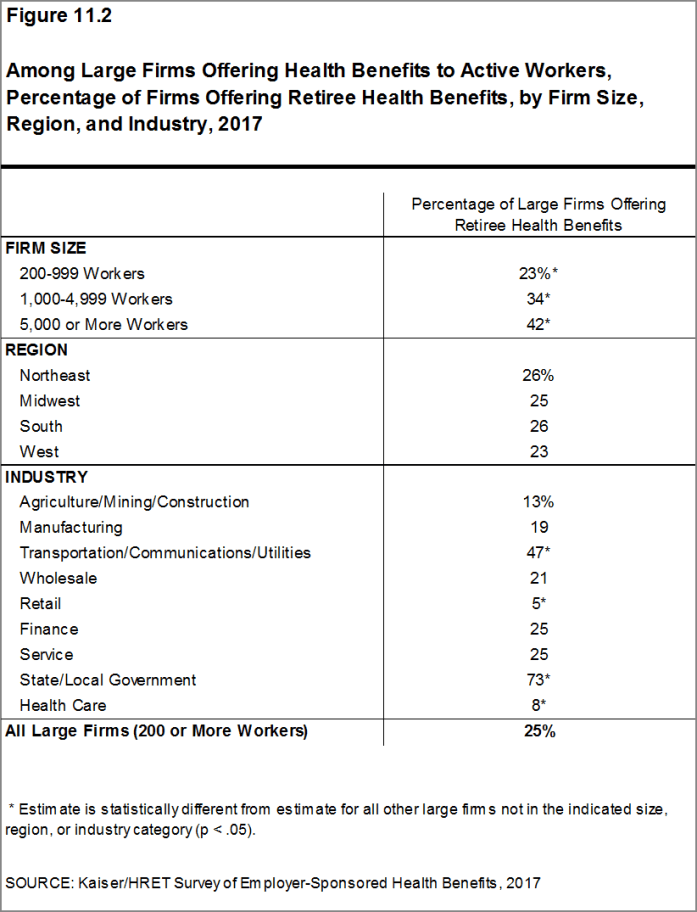

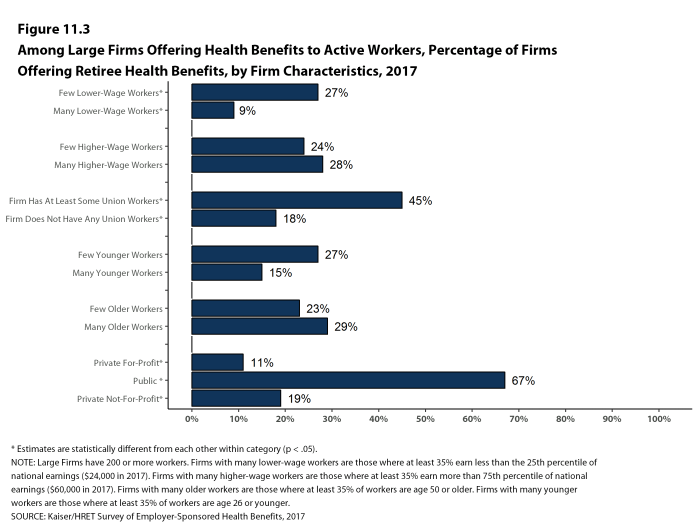

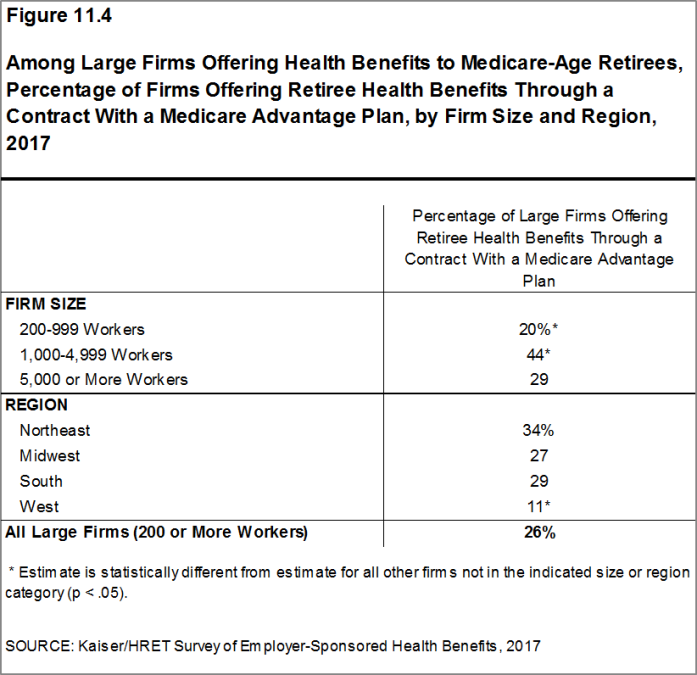

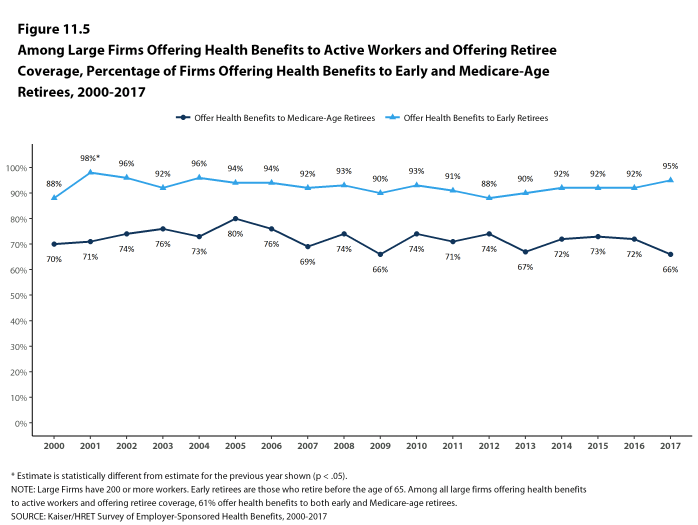

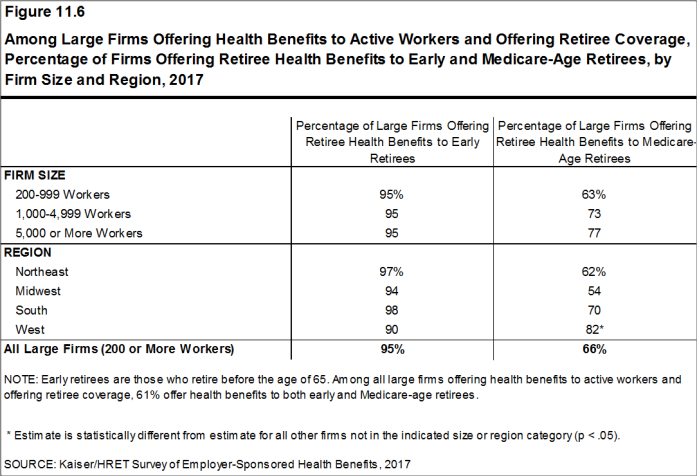

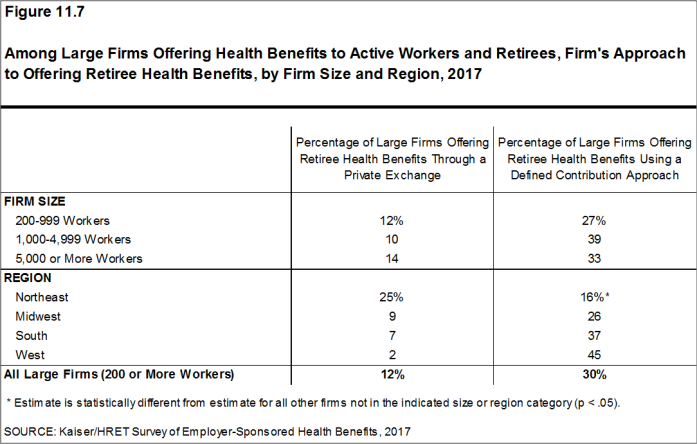

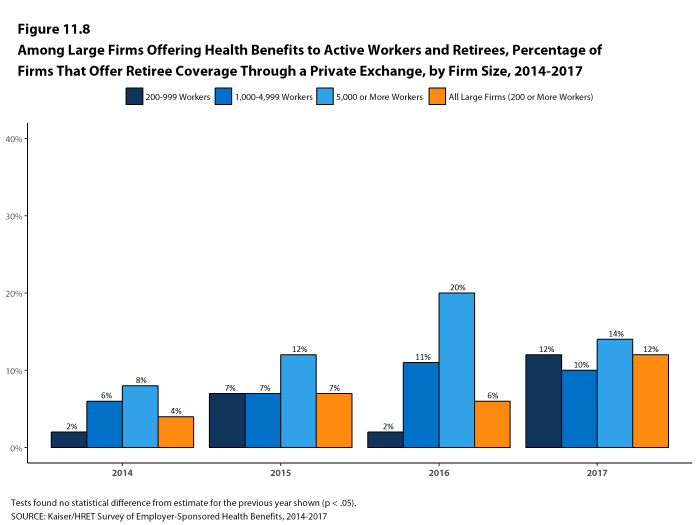

Of the large firms offering health benefits to workers in 2017, 25% also offer health benefits to retirees, similar to the percentage in 2016 (24%). Among large firms that offer retiree health benefits, 95% offer health benefits to early retirees (workers retiring before age 65) and 66% offer health benefits to Medicare-age retirees. Twenty-six percent of large firms offering retiree benefits contribute to benefits through a contract with a Medicare Advantage plan. Twelve percent of large firms offering retiree benefits offer retiree benefits through a corporate or private exchange.

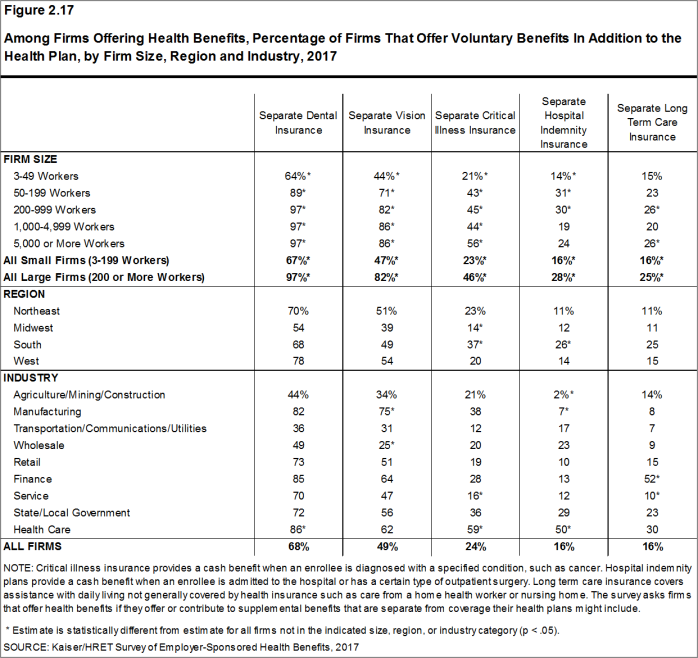

SUPPLEMENTAL AND VOLUNTARY BENEFITS

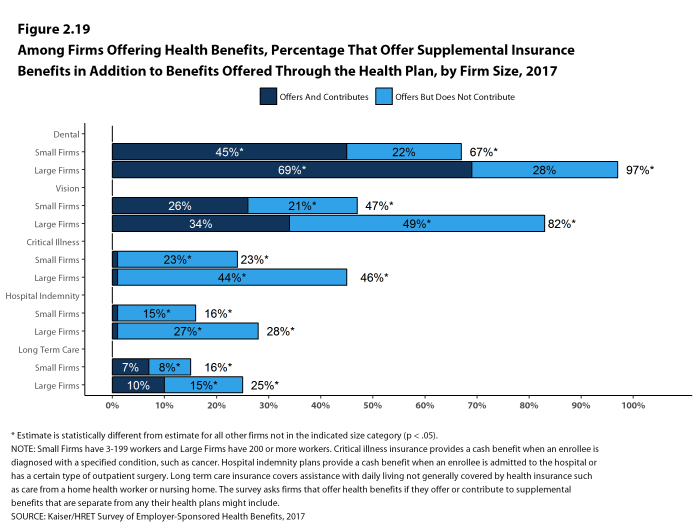

Firms offering health benefits also offer a variety of supplemental and other health benefits to their workers. Among firms offering health benefits, 67% of small firms and 97% of large firms offer dental benefits to their workers; 47% of small firms and 82% of large firms offer vision benefits; 23% of small firms and 46% of large firms offer critical illness insurance; 16% of small firms and 28% of large firms offer hospital indemnity insurance; and 16% of small firms and 25% of large firms offer long-term care insurance. Among all firms offering these supplemental benefits, firms are more likely to make a contribution toward dental coverage (67%) or vision coverage (54%) than for critical illness insurance (3%) or hospital indemnity insurance (5%).

WELLNESS, HEALTH RISK ASSESSMENTS AND BIOMETRIC SCREENINGS

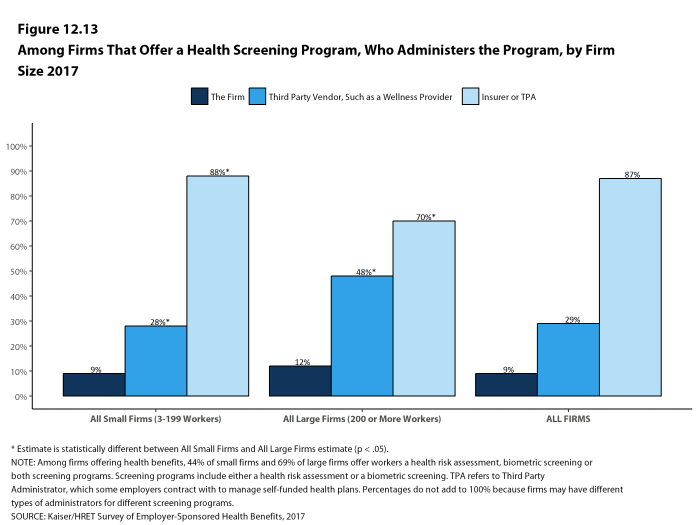

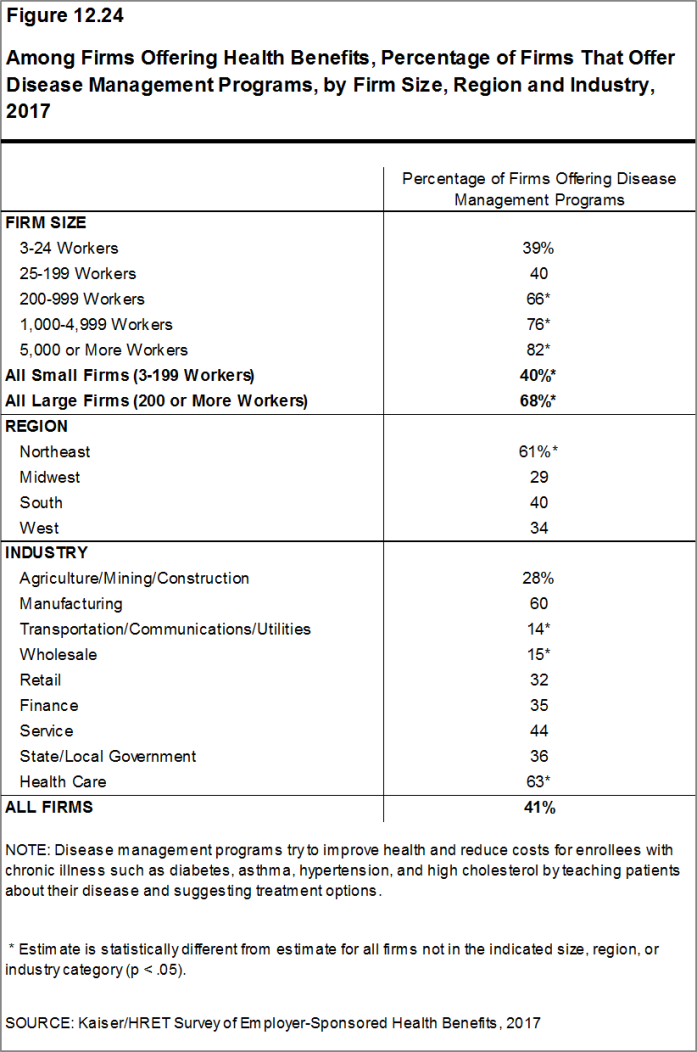

A large share of firms have programs that encourage workers to identify health issues and to take steps to improve their health. Many firms offer health screening programs including health risk assessments, which are questionnaires asking workers about lifestyle, stress or physical health, and in-person examinations such as biometric screenings. Many firms also use incentives to encourage workers to complete assessments, participate in wellness programs, or meet biometric outcomes. As we have seen in previous years, there is considerable uncertainty among small firms on some questions, particularly those related to incentives, so findings are reported only for large firms in some instances.

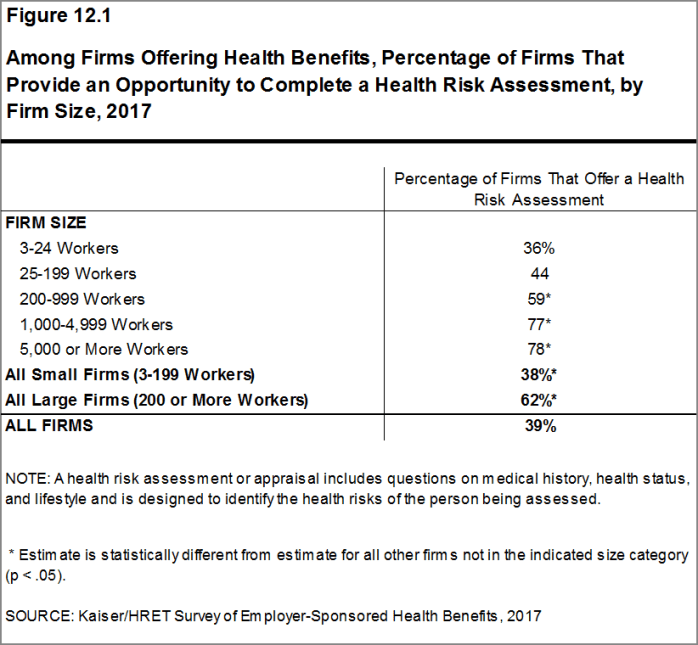

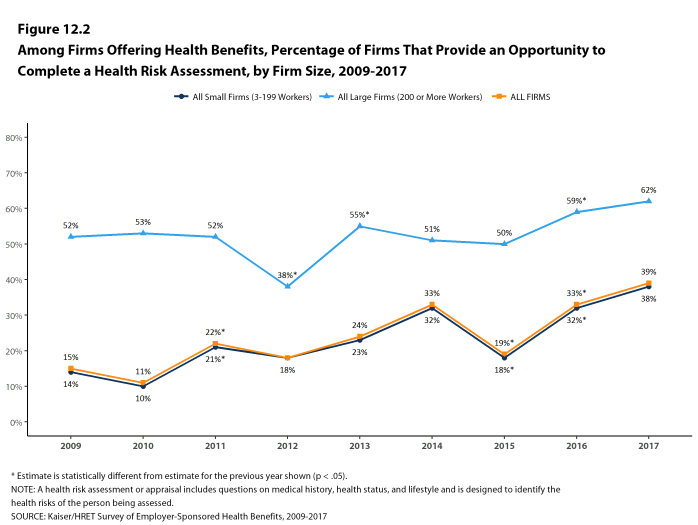

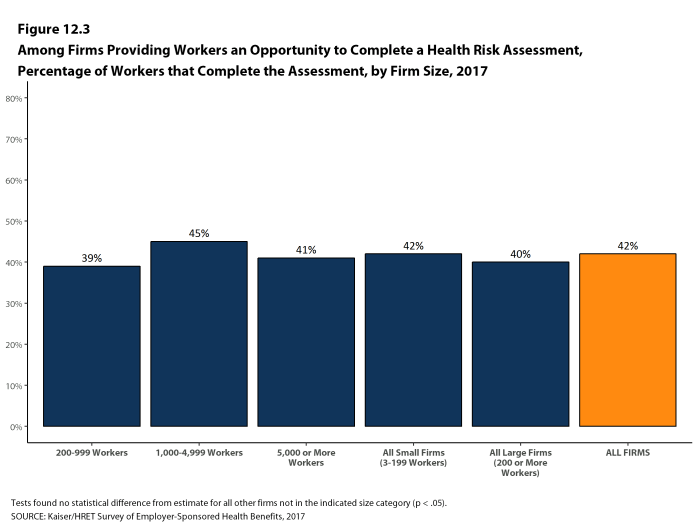

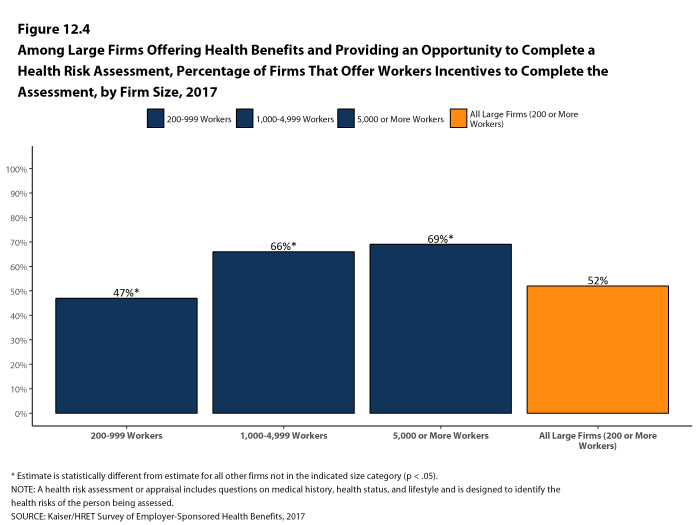

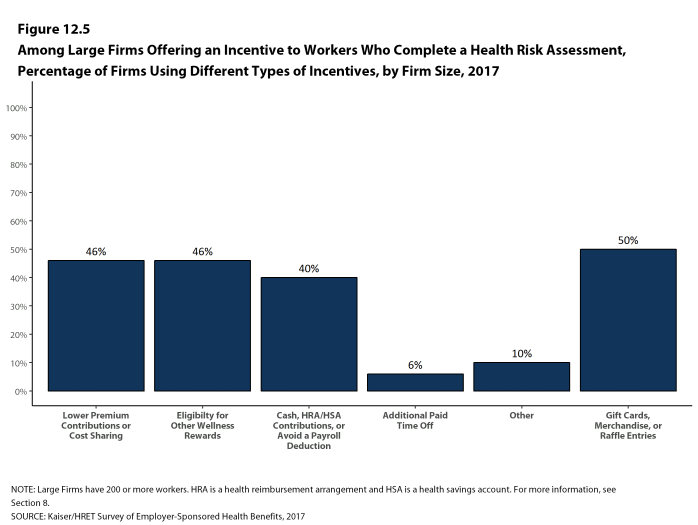

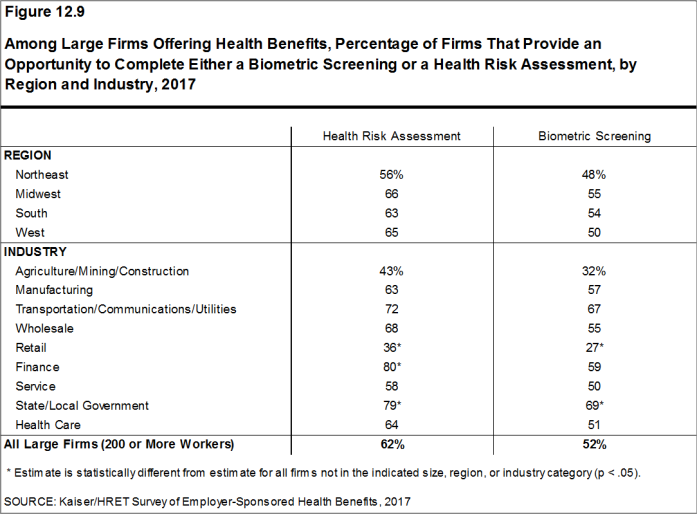

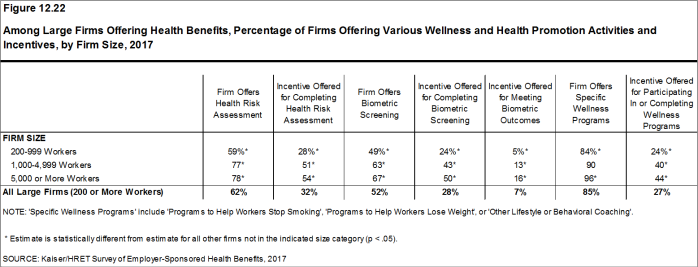

Health Risk Assessments. Among firms offering health benefits, 38% of small firms and 62% of large firms provide workers an opportunity to complete a health risk assessment. A health risk assessment includes questions about a person’s medical history, health status, and lifestyle. Fifty-two percent of large firms with a health risk assessment program offer an incentive to encourage workers to complete the assessment. Among large firms with an incentive, the incentives include: gift cards, merchandise or similar incentives (50% of firms); requiring a completed health risk assessment to be eligible for other wellness incentives (46% of firms); lower premium contributions or cost sharing (46% of firms); and financial rewards such as cash, contributions to health-related savings accounts, or avoiding a payroll fee (40% of firms).

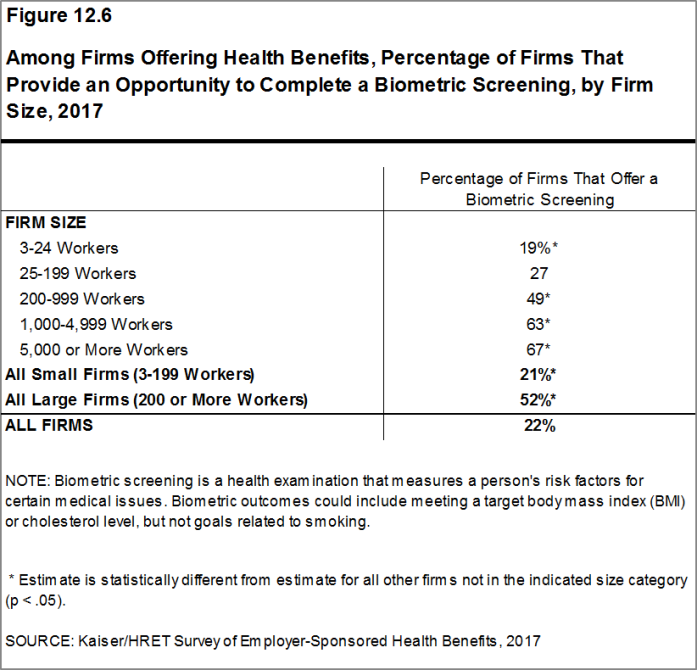

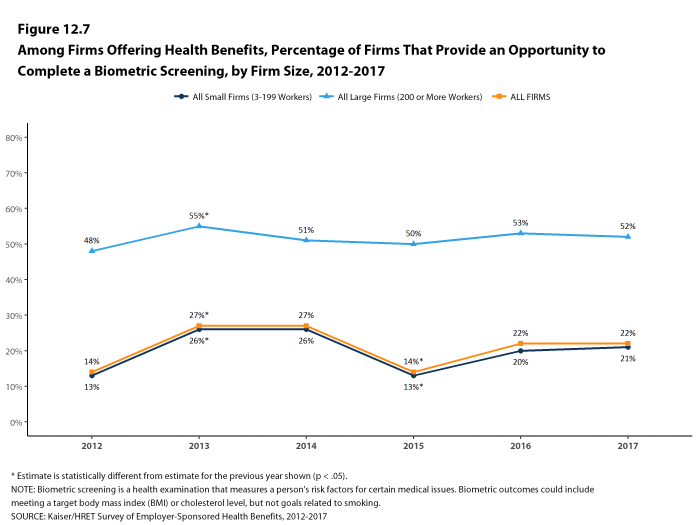

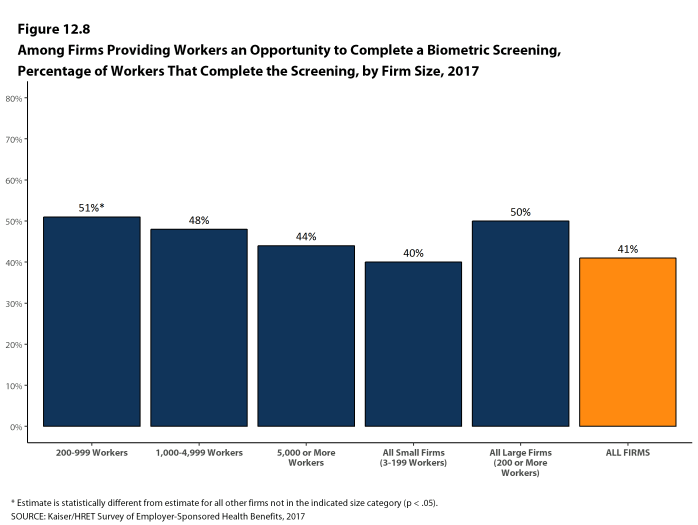

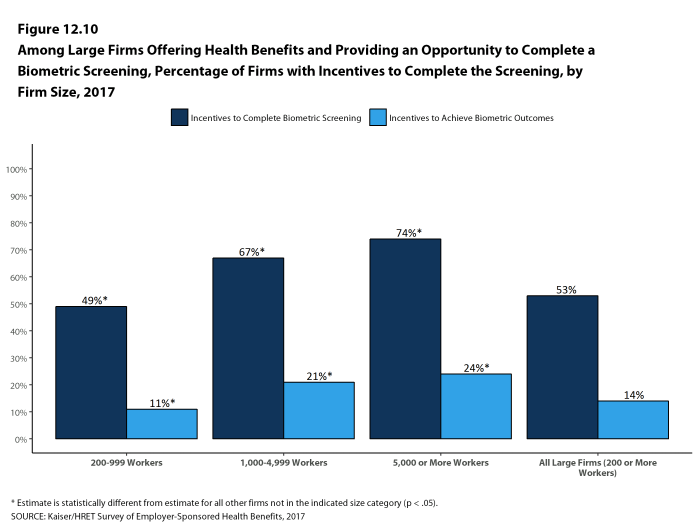

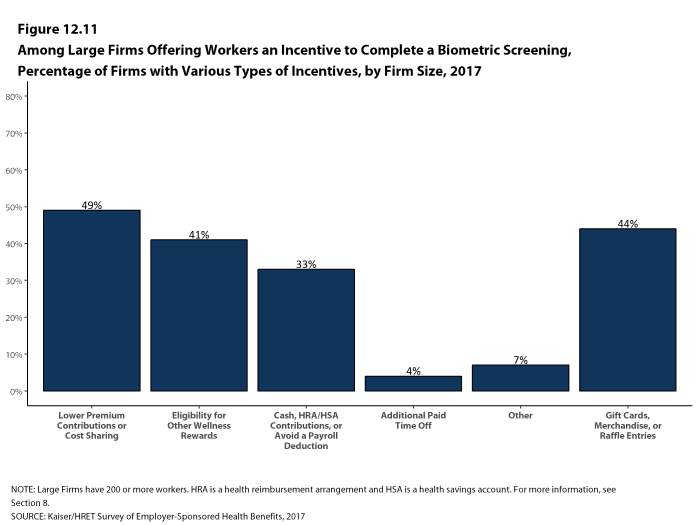

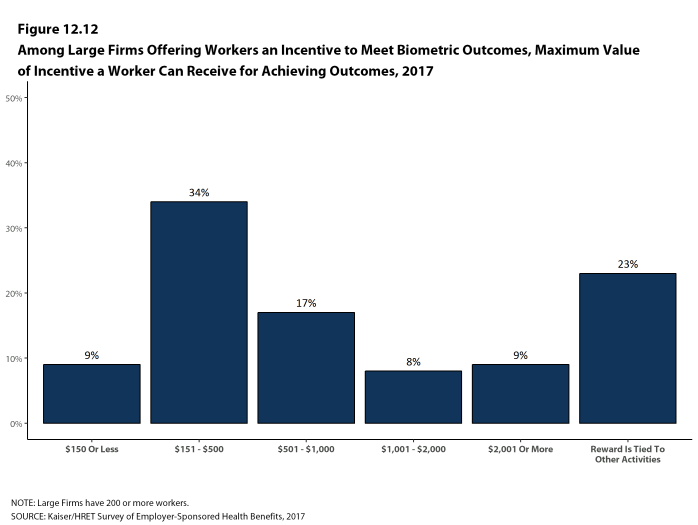

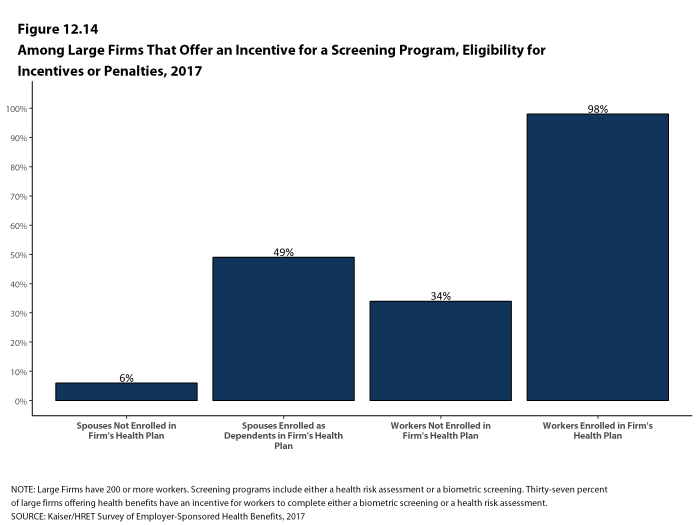

Biometric Screenings. Twenty-one percent of small firms and 52% of large firms offering health benefits offer workers the opportunity to complete a biometric screening. A biometric screening is a health examination that measures a person’s risk factors such as body weight, cholesterol, blood pressure, stress, and nutrition. Fifty-three percent of large firms with biometric screening programs offer workers an incentive to complete the screening. Among large firms with an incentive, the incentives include: lower premium contributions or cost sharing (49% of firms); gift cards, merchandise or similar incentives (44% of firms); requiring a completed biometric screening to be eligible for other wellness incentives (41% of firms); and financial rewards such as cash, contributions to health-related savings accounts, or avoiding a payroll fee (33% of firms). In addition, 14% of large firms with a biometric screening program have incentives tied to whether workers met specified biometric outcomes, such as a targeted body mass index (BMI) or cholesterol level.

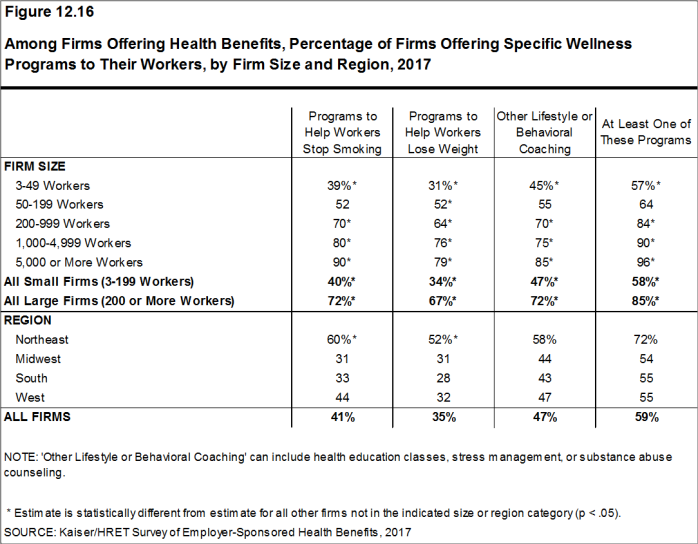

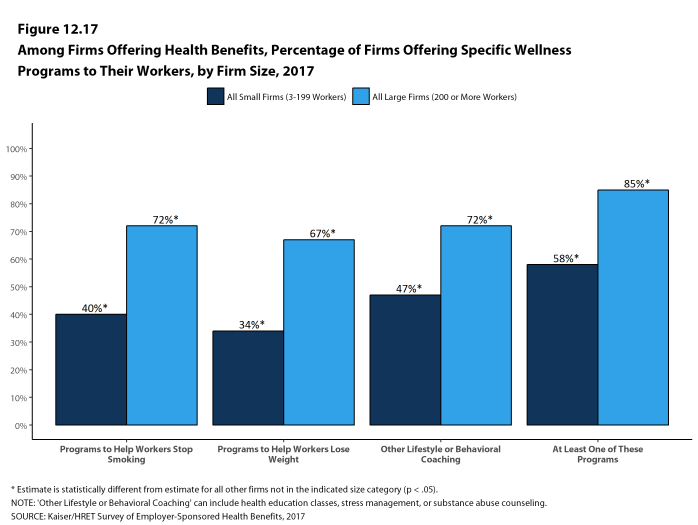

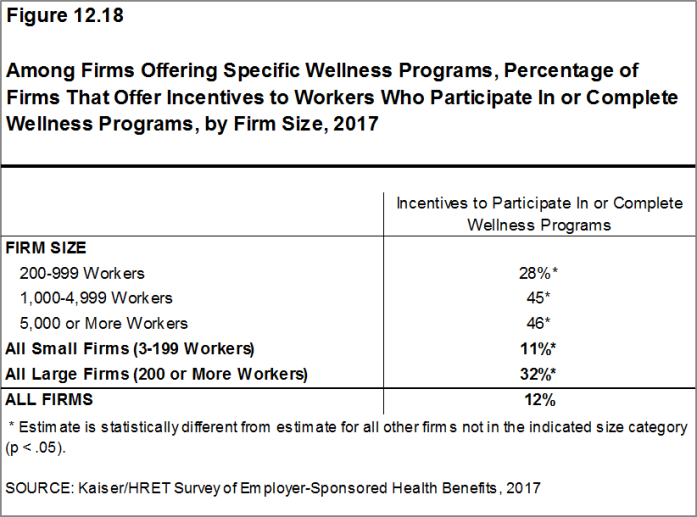

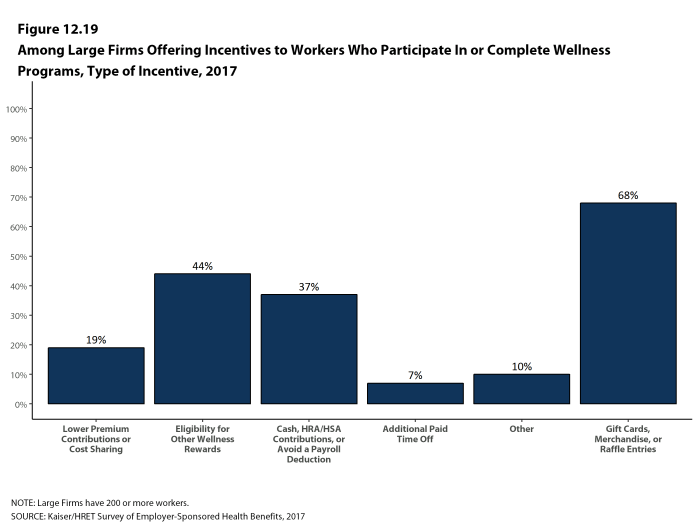

Health and Wellness Promotion Programs. Many firms offer programs to help workers identify health risks and unhealthy behaviors and improve their lifestyles. Fifty-eight percent of small firms and 85% of large firms offer a program in at least one of these areas: smoking cessation; weight management; behavioral or lifestyle coaching. Thirty-two percent of large firms with one of these health and wellness programs offer workers an incentive to participate in or complete the program. Among large firms with an incentive for completing wellness programs, incentives include: gift cards, merchandise or similar incentives (68% of firms); requiring completion of activities to be eligible for other wellness incentives (44% of firms); financial rewards such as cash, contributions to health-related savings accounts, or avoiding a payroll fee (37% of firms); and lower premium contributions or cost sharing (19% of firms).

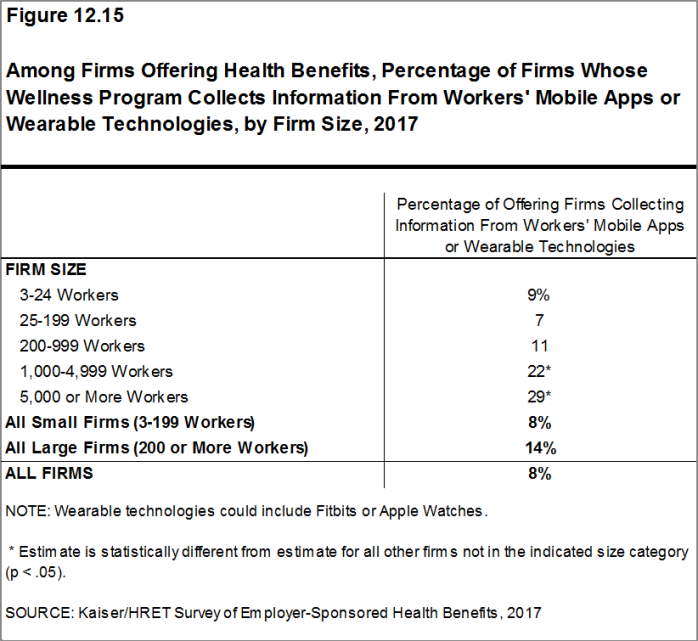

Eight percent of small firms and 14% of large firms report collecting health information from workers through wearable devices such as a Fitbit or Apple Watch.

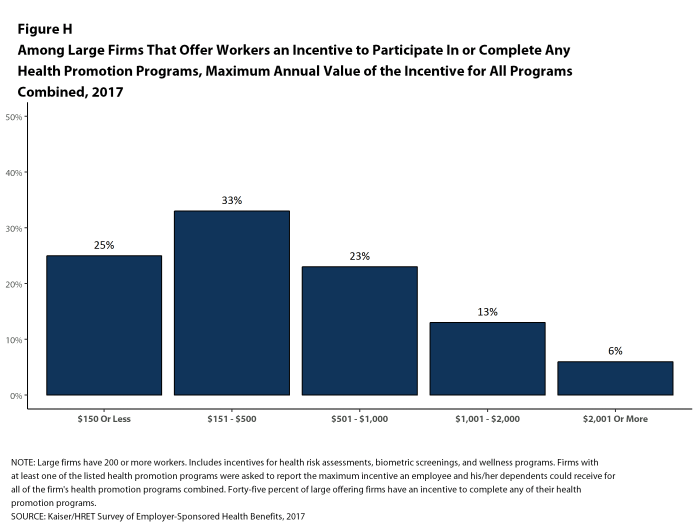

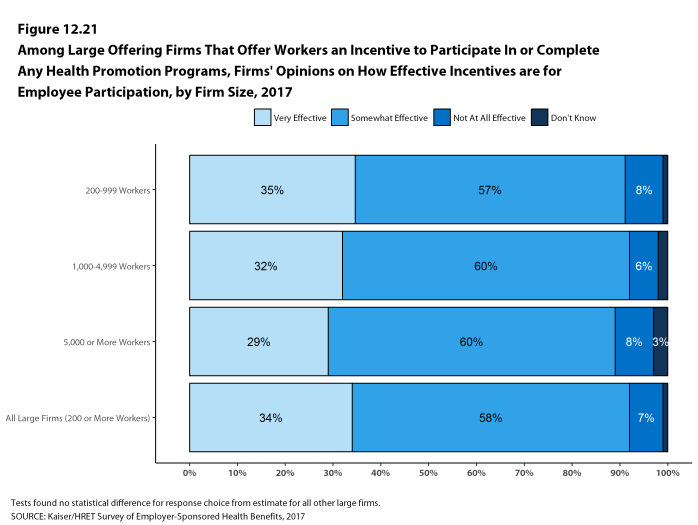

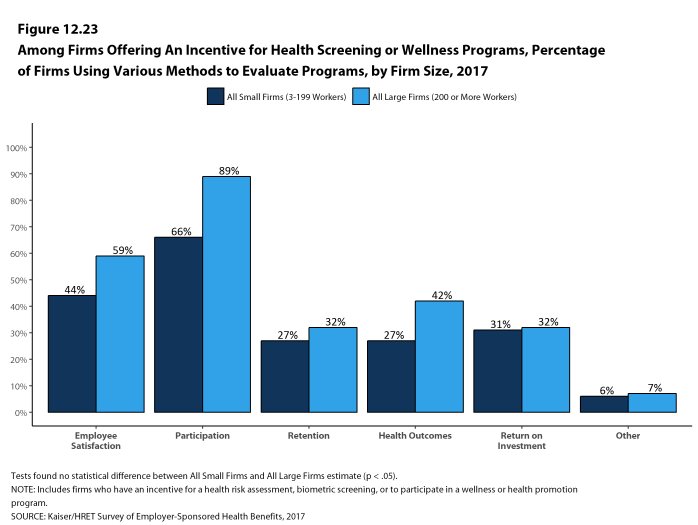

As risk assessments and wellness programs have become more complex, incentives and rewards have become more sophisticated and may involve participating in or meeting goals in different programs (e.g., completing an assessment and participating in a health promotion activity). To better understand the combined incentives or penalties facing program participants, we asked large firms that had any incentives for health risk assessments, biometric screenings, or the specified health and wellness promotion programs what the maximum incentive was for a worker for all of their programs combined. Among large firms with any type of incentive, 25% have a maximum incentive of 150 or less; 33% have a maximum incentive between $151 and $500; 23% have a maximum incentive between $501 and $1,000; 13% have a maximum incentive between $1,001 and $2,000; and 6% have a maximum incentive of more than $2,000 [Figure H].

Figure H: Among Large Firms That Offer Workers an Incentive to Participate In or Complete Any Health Promotion Programs, Maximum Annual Value of the Incentive for All Programs Combined, 2017

SITES OF CARE

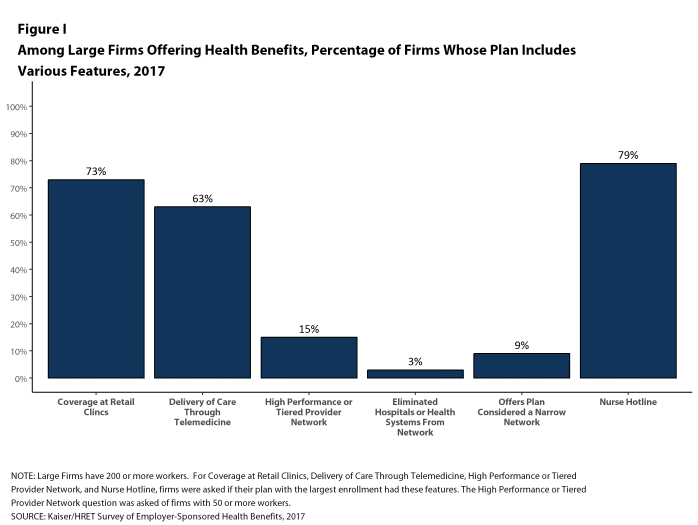

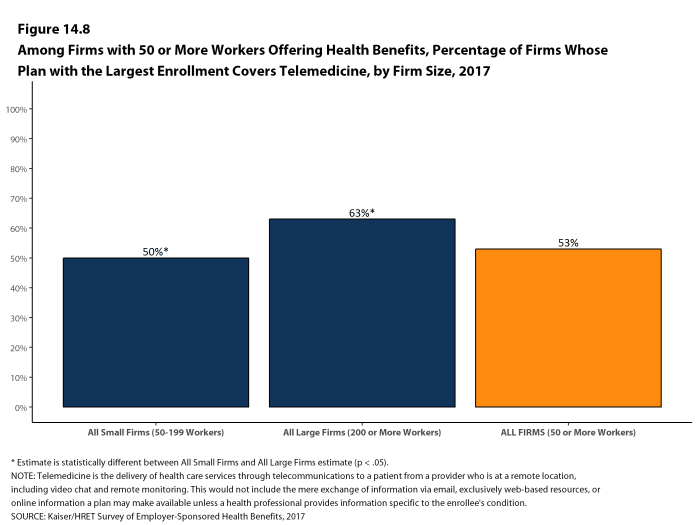

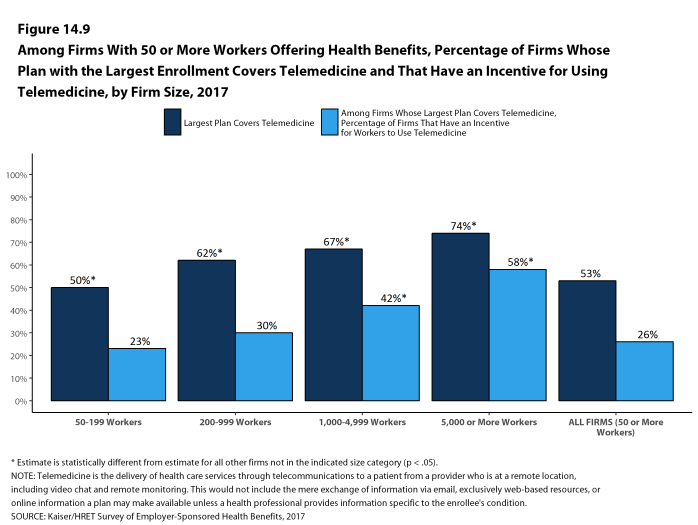

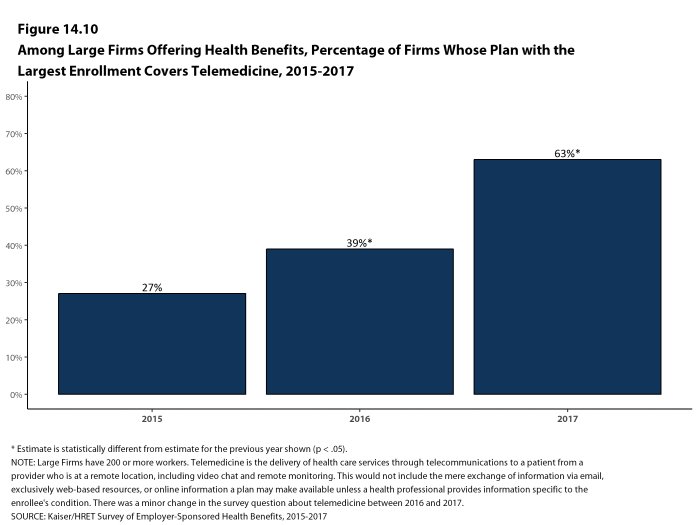

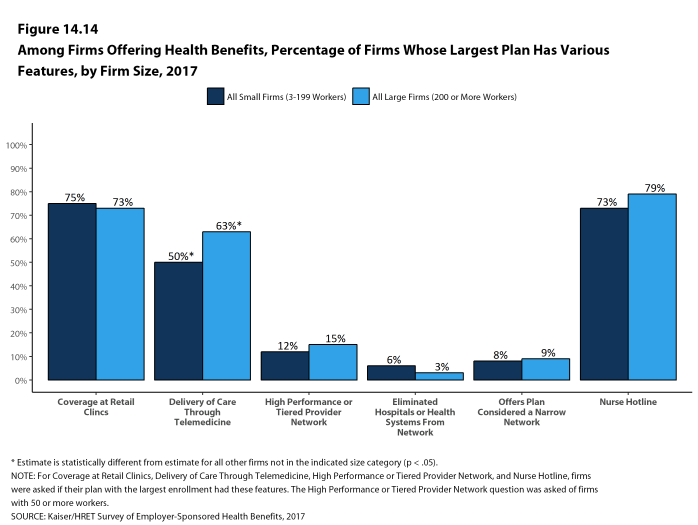

Telemedicine. Sixty-three percent of large firms that offer health benefits cover the provision of health care services through telecommunication in their largest health plan [Figure I]. Among these firms, 33% reported that workers have a financial incentive to receive services through telemedicine instead of visiting a physician’s office.

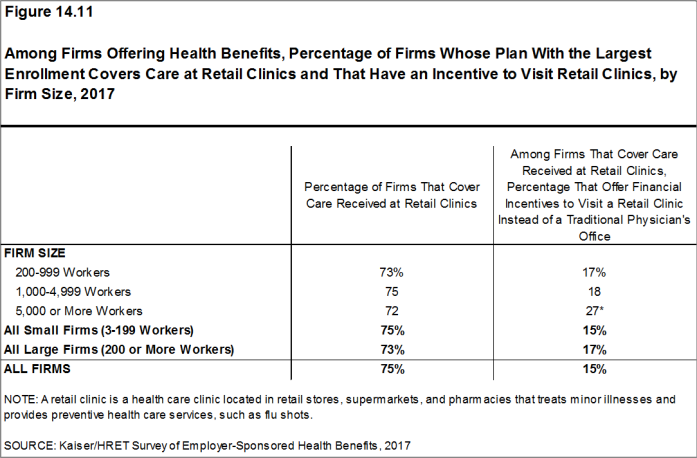

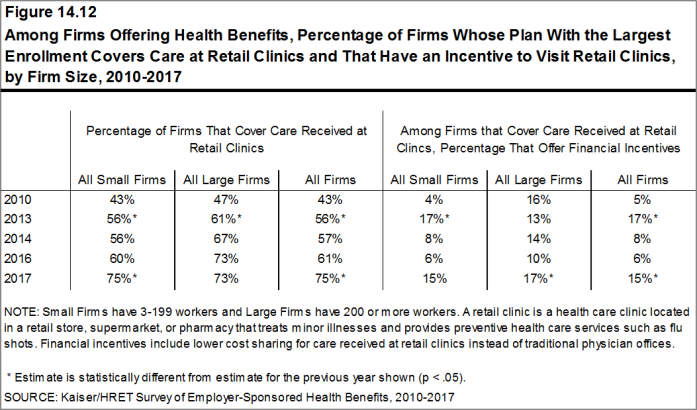

Retail Health Clinics. Seventy-three percent of large firms cover services offering health benefits provided in retail health clinics, such as those found in pharmacies and supermarkets, in their largest health plan [Figure I]. Among these firms, 17% reported that workers have a financial incentive to receive services in a retail clinic instead of visiting a traditional physician’s office.

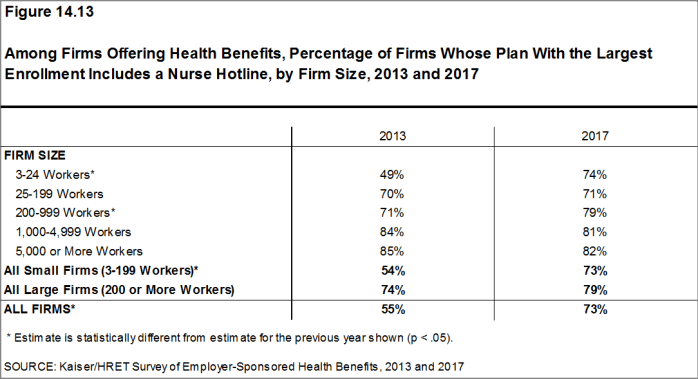

Nurse Hotline. Seventy-nine percent of large firms offering health benefits have a nurse hotline as part of their largest health plan [Figure I].

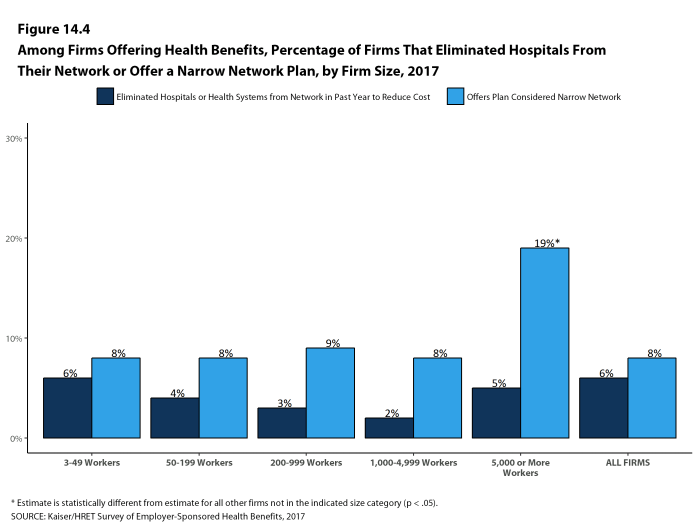

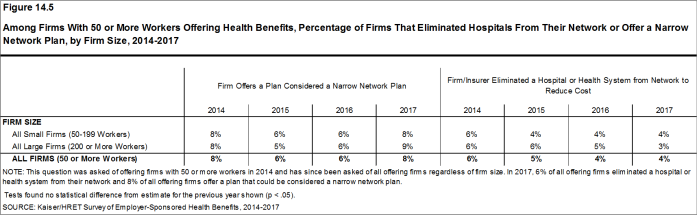

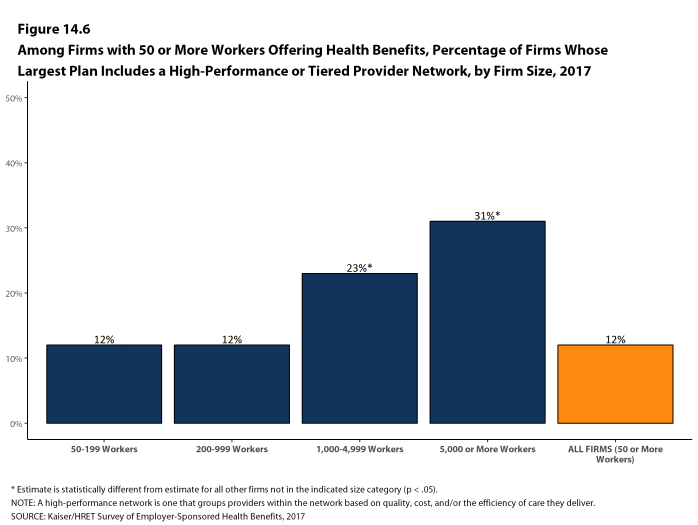

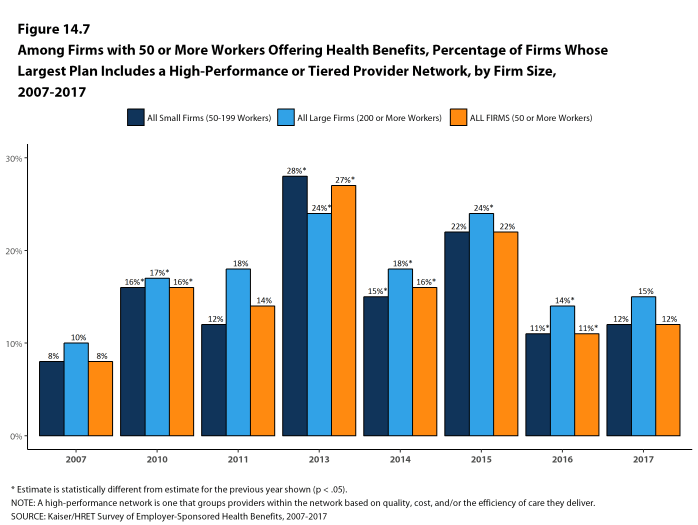

PROVIDER NETWORKS

High Performance or Tiered Networks. Fifteen percent of large firms offering health benefits have high performance or tiered networks in their largest health plan, similar to the percentage reported last year [Figure I]. These programs identify providers that are more efficient and generally provide financial or other incentives for enrollees to use the selected providers.

Narrow Networks. Nine percent of large firms offering health benefits offer a health plan that they consider to have a narrow network (i.e., a network they would consider more restrictive than a standard HMO network), similar to the percentage reported last year [Figure I].

Eliminated Hospitals or Health Systems. Only 3% of large firms report that they or their health plan eliminated a hospital or health system in the past year in order to reduce the costs of their plan, similar to the percentage reported last year [Figure I].

Figure I: Among Large Firms Offering Health Benefits, Percentage of Firms Whose Plan Includes Various Features, 2017

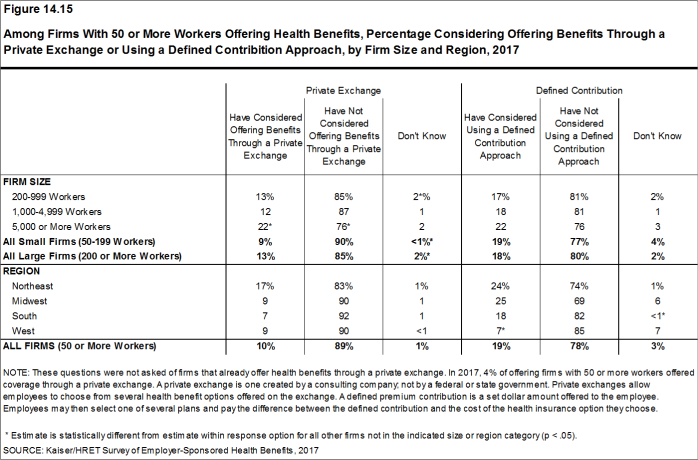

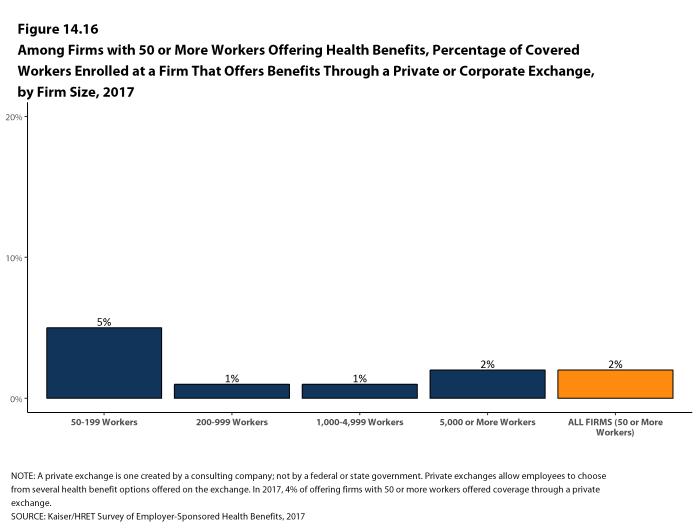

Private Exchanges. Four percent of firms offering health benefits with at least 50 workers offer health benefits through a private exchange. Among firms offering health benefits that do not currently offer through a private exchange, 10% with at least 50 workers, including 22% with at least 5,000 workers, say they have considered offering coverage through a private exchange.

CONCLUSION

The market for employer-sponsored health benefits continues along with no big changes in 2017. Premium increases are modest and there is no appreciable change in cost sharing or enrollment by type of plan. Employers continue to invest in health promotion and wellness approaches, including building incentives around programs that collect information about employee health and lifestyles.

Despite continuing economic improvement, with lower rates of unemployment, and the ACA employer mandate, there are no signs that the long-term declines in the offer and coverage rates are reversing. Even with modest premium growth, offer rates for small firms remain much lower than those for large firms, and the percentage of workers covered at work remains at 62%.

We continue to see significant variation around the average premiums and contribution amounts, particularly for small businesses. A meaningful share of covered workers in small firms must pay a substantial share of the cost of family coverage, raising the question of whether this is a viable source of coverage for the dependents of these workers.

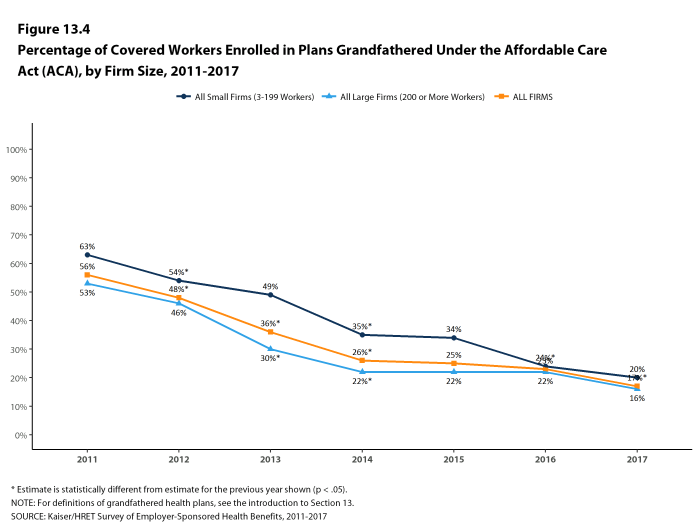

The debate about the future of the ACA has focused on the provisions that extended coverage in the non-group market and Medicaid, with the provisions affecting employer-sponsored coverage receiving relatively little attention. Employers generally appear to have adapted to ACA provisions without significant disruption, including the employer requirement to offer coverage or pay a penalty, the provisions requiring preventive care be covered without cost sharing, and that non-grandfathered plans have an out-of-pocket limit on cost sharing. Even if repeal and replace efforts ultimately succeed, the impacts on the group market will likely be relatively small: for example, some employers may reduce offers of coverage to some of their lower-paid employees or may reduce the number of preventive services available without cost sharing; but the larger metrics measuring costs and coverage are unlikely to change in any significant way.

One policy that could affect the market over the next couple of years is the high-cost plan tax, also known as the Cadillac tax. In previous surveys, employers reported increasing cost sharing and making other changes in anticipation of the high-cost plan tax taking effect in 2018. With the effective date of the tax delayed until 2020 (and with the apparent widespread Congressional support for further delay), the pressure for employers with more expensive plans to take actions to reduce their cost seems to have abated. This could change abruptly, however, if the tax is not further delayed in the near future.

METHODOLOGY

The Kaiser Family Foundation/Health Research & Educational Trust 2017 Annual Employer Health Benefits Survey (Kaiser/HRET) reports findings from a telephone survey of 2,137 randomly selected non-federal public and private employers with three or more workers. Researchers at the Health Research & Educational Trust, NORC at the University of Chicago, and the Kaiser Family Foundation designed and analyzed the survey. National Research, LLC conducted the fieldwork between January and June 2017. In 2017, the overall response rate is 33%, which includes firms that offer and do not offer health benefits. Among firms that offer health benefits, the survey’s response rate is also 33%. To improve estimates for small firms, the 2017 survey had a significantly larger sample than previous years; the increased sample size lead to both more firms completing the survey and a lower response rate than in years past. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance.

For more information on the survey methodology, please visit the Methodology section at http://ehbs.kff.org/.

The Kaiser Family Foundation, a leader in health policy analysis, health journalism and communication, is dedicated to filling the need for trusted, independent information on the major health issues facing our nation and its people. The Foundation is a non-profit private operating foundation based in Menlo Park, California.

The Health Research & Educational Trust (HRET) Founded in 1944, the Health Research & Educational Trust (HRET) is the not-for-profit research and education affiliate of the American Hospital Association (AHA). HRET’s mission is to transform health care through research and education. HRET’s applied research seeks to create new knowledge, tools and assistance in improving the delivery of health care by providers and practitioners within the communities they serve.

- Kaiser Commission on Medicaid and the Uninsured. The uninsured: A primer — Key facts about health insurance and the uninsured in the era of health reform: Supplemental Tables [Internet]. Washington (DC): The Commission; 2016 Nov [cited 2017 Aug 1]. https://files.kff.org/attachment/Supplemental-Tables-The-Uninsured-A%20Primer-Key-Facts-about-Health-Insurance-and-the-Unisured-in-America-in-the-Era-of-Health-Reform. See Table 1: 271.3 million nonelderly people, 55.8% of whom are covered by employer-sponsored insurance.↩

- Kaiser/HRET surveys use the April-to-April time period, as do the sources in this and the following note. The inflation numbers are not seasonally adjusted. Bureau of Labor Statistics. Consumer Price Index – All Urban Consumers: Department of Labor; 2017. [cited 2017 July 21] https://data.bls.gov/timeseries/CUUR0000SA0?output_view=pct_1mth. Wage data are from the Bureau of Labor Statistics and based on the change in total average hourly earnings of production and nonsupervisory employees. Employment, hours, and earnings from the Current Employment Statistics survey: Department of Labor; 2017 [cited 2017 July 21]. http://data.bls.gov/timeseries/CES0500000008↩

- This threshold is based on the twenty-fifth percentile of workers’ earnings as reported by the Bureau of Labor Statistics, using data for 2016. Bureau of Labor Statistics. May 2016 national occupational employment and wage estimates: United States [Internet]. Washington (DC): BLS; [last modified 2017 Mar 310; cited 2017 Aug 15]. Available from: http://www.bls.gov/oes/current/oes_nat.htm↩

Survey Design And Methods

The Kaiser Family Foundation and the Health Research & Educational Trust (Kaiser/HRET) conduct this annual survey of employer-sponsored health benefits. HRET, a nonprofit research organization, is an affiliate of the American Hospital Association. The Kaiser Family Foundation designs, analyzes, and conducts this survey in partnership with HRET, and also funds the study. Kaiser contracts with researchers at NORC at the University of Chicago (NORC) to work with the Kaiser and HRET researchers in conducting the study. Kaiser/HRET retained National Research, LLC (NR), a Washington, D.C.-based survey research firm, to conduct telephone interviews with human resource and benefits managers using the Kaiser/HRET survey instrument. From January to June 2017, NR completed full interviews with 2,137 firms.

SURVEY TOPICS

The survey includes questions on the cost of health insurance, health benefit offer rates, coverage, eligibility, enrollment patterns, premium contributions,4 employee cost sharing, prescription drug benefits, retiree health benefits, and wellness benefits.

Kaiser/HRET asks each participating firm as many as 400 questions about its largest health maintenance organization (HMO), preferred provider organization (PPO), point-of-service (POS) plan, and high-deductible health plan with a savings option (HDHP/SO).5 We treat exclusive provider organizations (EPOs) and HMOs as one plan type and report the information under the banner of “HMO”; if an employer sponsors both an HMO and an EPO, they are asked about the attributes of the plan with the larger enrollment. Similarly, starting in 2013, plan information for conventional (or indemnity) plans was collected within the PPO battery. Less than one percent of firms that completed the PPO section had more enrollment in a conventional plan than in a PPO plan. Firms with 50 or more workers were asked: “Does your firm offer health benefits for current employees through a private or corporate exchange?” Employers were still asked for plan information about their HMO, PPO, POS and HDHP/SO plan regardless of whether they purchased health benefits through a private exchange or not.

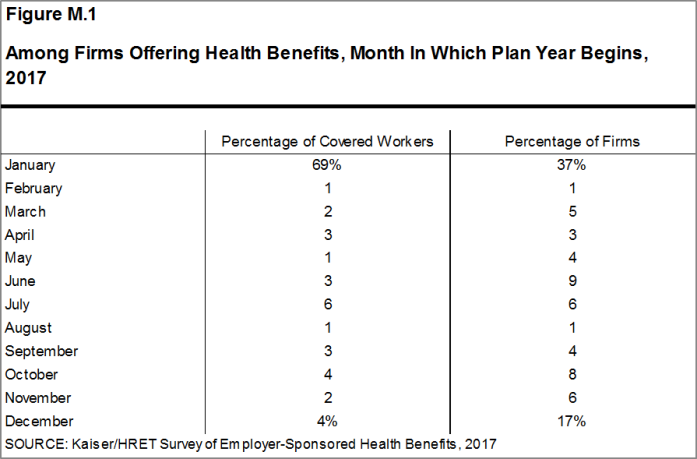

Firms are asked about the attributes of their current plans during the interview. While the survey’s fielding period begins in January, many respondents may have a plan whose 2017 plan year has not yet begun [Figure M.1]. In some cases, plans may report the attributes of their 2016 plans and some plan attributes (such as HSA deductible limits) may not meet the calendar year regulatory requirements.

Figure M.1: Among Firms Offering Health Benefits, Month In Which Plan Year Begins, 2017

RESPONSE RATE

After determining the required sample from U.S. Census Bureau data, Kaiser/HRET drew its sample from a Survey Sampling Incorporated list (based on an original Dun and Bradstreet list) of the nation’s private employers and from the Census Bureau’s Census of Governments list of public employers with three or more workers. To increase precision, Kaiser/HRET stratified the sample by ten industry categories and six size categories. Kaiser/HRET attempted to repeat interviews with prior years’ survey respondents (with at least ten employees) who participated in either the 2015 or the 2016 survey, or both. Firms with 3-9 employees are not included in the panel to minimize the impact of panel effects on the offer rate statistic. As a result, 1,427 of the 2,137 firms that completed the full survey also participated in either the 2015 or 2016 surveys, or both.6 The overall response rate is 33%.7 Response rates are calculated using a CASRO method, which accounts for firms that are determined to be ineligible in its calculation. Beginning in 2012, the calculation of the response rates was adjusted to be slightly more conservative than previous years.

While the Kaiser/HRET survey similar to other employer and household surveys has seen a general decrease in response rates over time, the decrease between the 2016 and 2017 response rates is not solely explained by this trend. In order to improve statistical power among sub-groups, including small firms and those with a high share of low income workers, the size of the sample was expanded from 5,732 in 2016 to 7,895 in 2017. As a result, the 2017 survey includes 204 more completes than the 2016 survey. While this generally increases the precision of estimates (for example, a reduction in the standard error for the offer rate from 2.2% to 1.8%), it has the effect of reducing the response rate. In 2017, non-panel firms had a response rate of 17%, compared to 62% for firms that had participated in one of the last two years.

To increase response rates, firms with 3-9 employees were offered an incentive for participating in the survey. A third of these firms were sent a $5 Starbucks gift card in the advance letter, a third were offered an incentive of $50 in cash or as a donation to a charity of their choice after completing the full survey, and a third of firms were offered no incentive at all. Our analysis does not show significant differences in responses to key variables among these incentive groups.

The vast majority of questions are asked only of firms that offer health benefits. A total of 1,832 of the 2,137 responding firms indicated they offered health benefits. The response rate for firms that offer health benefits is also 33%.

We asked one question of all firms in the study with which we made phone contact but where the firm declined to participate. The question was “Does your company offer a health insurance program as a benefit to any of your employees?”. A total of 3,938 firms responded to this question (including 2,137 who responded to the full survey and 1,801 who responded to this one question). These responses are included in our estimates of the percentage of firms offering health benefits.8 The response rate for this question is 61%.

Beginning in 2014, we collected whether firms with a non-final disposition code (such as a firm that requested a callback at a later time or date) offered health benefits. By doing so we attempt to mitigate any potential non-response bias of firms either offering or not offering health benefits on the overall offer rate statistic. In 2017, 640 of the 1,801 firm responses that solely answered the offer question were obtained through this pathway.

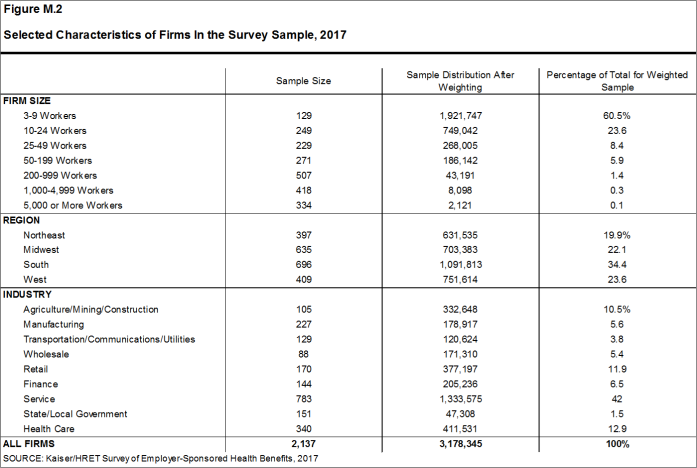

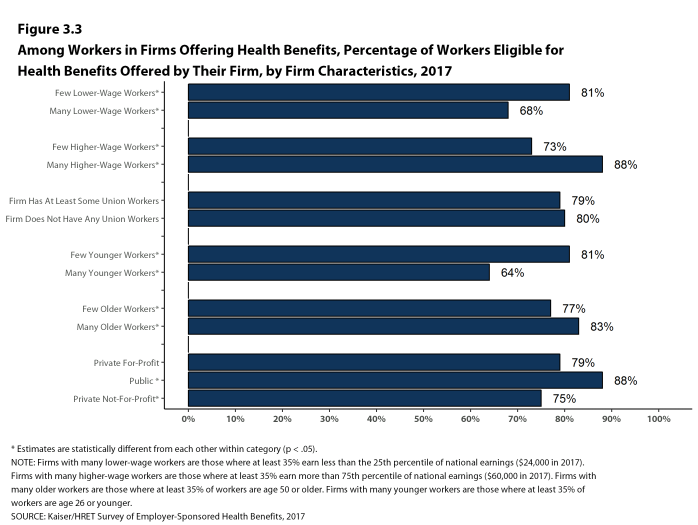

FIRM SIZE CATEGORIES AND KEY DEFINITIONS

Throughout the report, figures categorize data by size of firm, region, and industry. Unless otherwise specified, firm size definitions are as follows: small firms: 3 to 199 workers; and large firms: 200 or more workers. Figure M.2 shows selected characteristics of the survey sample. A firm’s primary industry classification is determined from Survey Sampling International’s (SSI) designation on the sampling frame and is based on the U.S. Census Bureau’s North American Industry Classification System (NAICS). A firm’s ownership category and other firm characteristics used in figures such as 3.3 and 6.22 are based on respondents’ answers. While there is considerable overlap in firms in the “State/Local Government” industry category and those in the “public” ownership category, they are not identical. For example, public school districts are included in the service industry even though they are publicly owned.

Figure M.2: Selected Characteristics of Firms In the Survey Sample, 2017

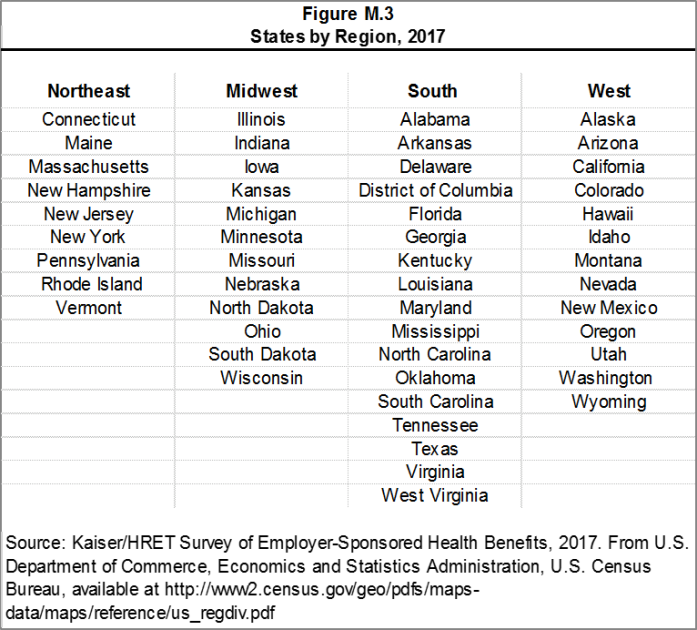

Figure M.3 presents the breakdown of states into regions and is based on the U.S Census Bureau’s categorizations. State-level data are not reported both because the sample size is insufficient in many states and we only collect information on a firm’s primary location rather than where all workers may actually be employed. Some mid- and large-size employers have employees in more than one state, so the location of the headquarters may not match the location of the plan for which we collected premium information.

Figure M.3: States by Region, 2017

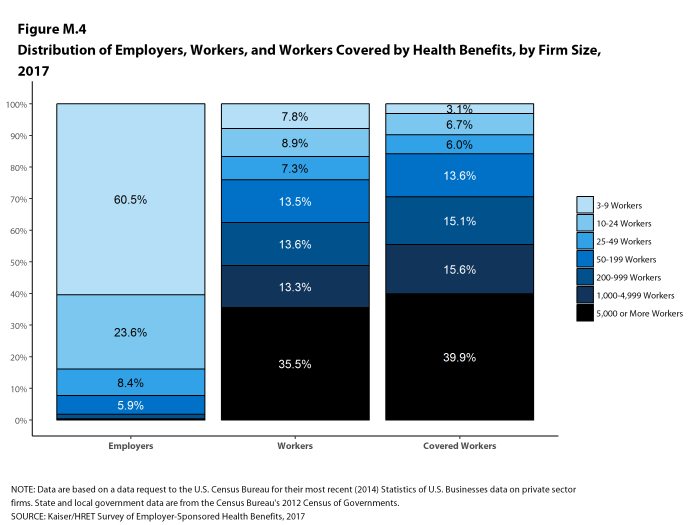

Figure M.4 displays the distribution of the nation’s firms, workers, and covered workers (employees receiving coverage from their employer). Among the three million firms nationally, approximately 60.5% employ 3 to 9 workers; such firms employ 7.8% of workers, and 3.1% of workers covered by health insurance. In contrast, less than one percent of firms employ 5,000 or more workers; these firms employ 35.5% of workers and 39.9% of covered workers. Therefore, the smallest firms dominate any statistics weighted by the number of employers. For this reason, most statistics about firms are broken out by size categories. In contrast, firms with 1,000 or more workers are the most influential employer group in calculating statistics regarding covered workers, since they employ the largest percentage of the nation’s workforce.

Figure M.4: Distribution of Employers, Workers, and Workers Covered by Health Benefits, by Firm Size, 2017

Throughout this report, we use the term “in-network” to refer to services received from a preferred provider. Family coverage is defined as health coverage for a family of four.

The survey asks firms what percentage of their employees earn less than a specified amount in order to identify the portion of a firm’s workforce that has relatively low wages. This year, the income threshold is $24,000 per year for lower-wage workers and $60,000 for higher-wage workers. These thresholds are based on the 25th and 75th percentile of workers’ earnings as reported by the Bureau of Labor Statistics using data from the Occupational Employment Statistics (OES) (2016).9 The cutoffs were inflation-adjusted and rounded to the nearest thousand. Prior to 2013, wage cutoffs were calculated using the now-eliminated National Compensation Survey.

ROUNDING AND IMPUTATION

Some figures in the report do not sum to totals due to rounding. In a few cases, numbers from distribution figures may not add to the numbers referenced in the text due to rounding. Although overall totals and totals for size and industry are statistically valid, some breakdowns may not be available due to limited sample sizes or a high relative standard error. Where the unweighted sample size is fewer than 30 observations, figures include the notation “NSD” (Not Sufficient Data). Estimates with high relative standard errors are reviewed and in some cases not published. Many breakouts by subsets may have a large standard error, meaning that even large differences are not statistically different. Statistics among small firms and those weighted by the number of firms tend to have more variability.

To control for item nonresponse bias, Kaiser/HRET imputes values that are missing for most variables in the survey. On average, 5% of observations are imputed. All variables are imputed following a hotdeck approach. The hotdeck approach replaces missing information with observed values from a firm similar in size and industry to the firm for which data are missing. In 2017, there were eleven variables where the imputation rate exceeded 20%; most of these cases were for individual plan level statistics. When aggregate variables were constructed for all of the plans, the imputation rate was usually much lower. There are a few variables that Kaiser/HRET has decided not to impute; these are typically variables where “don’t know” is considered a valid response option (for example, the percentage of workers respondents believe are covered by Medicaid). Some variables are imputed based on their relationship to each other. For example, if a firm provided a worker contribution for family coverage but no premium information, a ratio between the family premium and family contribution was imputed and then the family premium was calculated. In addition, there are several variables in which missing data are calculated based on respondents’ answers to other questions (for example, employer contributions to premiums are calculated from the respondent’s premium and the worker contribution to premiums).

Since 2014, we estimate separate single and family coverage premiums for firms that provide premium amounts as the average cost for all covered workers, instead of differentiating between single and family coverage. This method more accurately accounts for the portion that each type of coverage contributes to the total cost for the one percent of covered workers who are enrolled at firms affected by this adjustment.

SAMPLE DESIGN

We determined the sample requirements based on the universe of firms obtained from the U.S. Census Bureau. Prior to the 2010 survey, the sample requirements were based on the total counts provided by Survey Sampling Incorporated (SSI) (which obtains data from Dun and Bradstreet). Since 2010, we define Education as a separate sampling category for the purposes of sampling, rather than as a subgroup of the Service category. In the past, Education firms were a disproportionately large share of Service firms. Education is controlled for during post-stratification, and adjusting the sampling frame to also control for Education allows for a more accurate representation of both the Education and Service industries.

In past years, both private and government firms were sampled from the Dun and Bradstreet database. Beginning in 2009, Government firms were sampled from the 2007 Census of Governments. This change was made to eliminate the overlap of state agencies that were frequently sampled from the Dun and Bradstreet database. The sample of private firms is screened for firms that are related to state/local governments, and if these firms are identified in the Census of Governments, they are reclassified as government firms and a private firm is randomly drawn to replace the reclassified firm. The federal government is not included in the sample frame.

Finally, the data used to determine the 2017 Employer Health Benefits Survey sample frame include the U.S. Census’ 2013 Statistics of U.S. Businesses and the 2012 Census of Governments. At the time of the sample design (December 2016), these data represented the most current information on the number of public and private firms nationwide with three or more workers. As in the past, the post-stratification is based on the most up-to-date Census data available (the 2014 update to the Census of U.S. Businesses was purchased during the survey fielding period).

WEIGHTING AND STATISTICAL SIGNIFICANCE

Because Kaiser/HRET selects firms randomly, it is possible through the use of statistical weights to extrapolate the results to national (as well as firm size, regional, and industry) averages. These weights allow us to present findings based on the number of workers covered by health plans, the number of total workers, and the number of firms. In general, findings in dollar amounts (such as premiums, worker contributions, and cost sharing) are weighted by covered workers. Other estimates, such as the offer rate, are weighted by firms. Specific weights were created to analyze the HDHP/SO plans that are offered with a Health Reimbursement Arrangement (HRA) or that are Health Savings Account (HSA)-qualified. These weights represent the proportion of employees enrolled in each of these arrangements.

Calculation of the weights follows a common approach. We trimmed the weights in order to reduce the influence of weight outliers. First, we grouped firms into size and offer categories of observations. Within each strata, we identified the median and the interquartile range of the weights and calculated the trimming cut point as the median plus six times the interquartile range (M + [6 * IQR]). Weight values larger than this cut point are trimmed to the cut point. In all instances, very few weight values were trimmed. Finally, we calibrated the weights to U.S. Census Bureau’s 2014 Statistics of U.S. Businesses for firms in the private sector, and the 2012 Census of Governments as the basis for calibration / post-stratification for public sector firms. Historic employer-weighted statistics were updated in 2011.

In 2017, weights were not adjusted using the nonresponse adjustment process described in previous years’ methods. As in past years, Kaiser/HRET conducted a small follow-up survey of those firms with 3-49 workers that refused to participate in the full survey. Based on the results of a McNemar test, we were not able to verify that the results of the follow-up survey were comparable to the results from the original survey. In 2010 and 2015, the results of the McNemar test were also significant and we did not conduct a nonresponse adjustment.

Between 2006 and 2012, only limited information was collected on conventional plans. Starting in 2013, information on conventional plans is collected under the PPO section and therefore, the covered worker weight is representative of all plan types for which the survey collects information.

The survey collects information on physician office visits for each plan type. Different plan types at the same firm may have different cost-sharing structures (e.g., copayments or coinsurance). Because the composite variables (using data from across all plan types) are reflective of only those plans with that provision, separate weights for the relevant variables were created in order to account for the fact that not all covered workers have such provisions. As discussed below, changes in the 2017 survey have reduced the number of variable-specific weights used.

To account for design effects, the statistical computing package R and the library package “survey” were used to calculate standard errors.10,11 All statistical tests are performed at the .05 confidence level, unless otherwise noted. For figures with multiple years, statistical tests are conducted for each year against the previous year shown, unless otherwise noted. No statistical tests are conducted for years prior to 1999.

Statistical tests for a given subgroup (firms with 25-49 workers, for instance) are tested against all other firm sizes not included in that subgroup (all firm sizes NOT including firms with 25-49 workers, in this example). Tests are done similarly for region and industry; for example, Northeast is compared to all firms NOT in the Northeast (an aggregate of firms in the Midwest, South, and West). However, statistical tests for estimates compared across plan types (for example, average premiums in PPOs) are tested against the “All Plans” estimate. In some cases, we also test plan-specific estimates against similar estimates for other plan types (for example, single and family premiums for HDHP/SOs against single and family premiums for HMO, PPO, and POS plans); these are noted specifically in the text. The two types of statistical tests performed are the t-test and the Wald test. The small number of observations for some variables resulted in large variability around the point estimates. These observations sometimes carry large weights, primarily for small firms. The reader should be cautioned that these influential weights may result in large movements in point estimates from year to year; however, these movements are often not statistically significant. Standard Errors for most key statistics are available in a technical supplement available at http://www.kff.org/ehbs.

2017 SURVEY

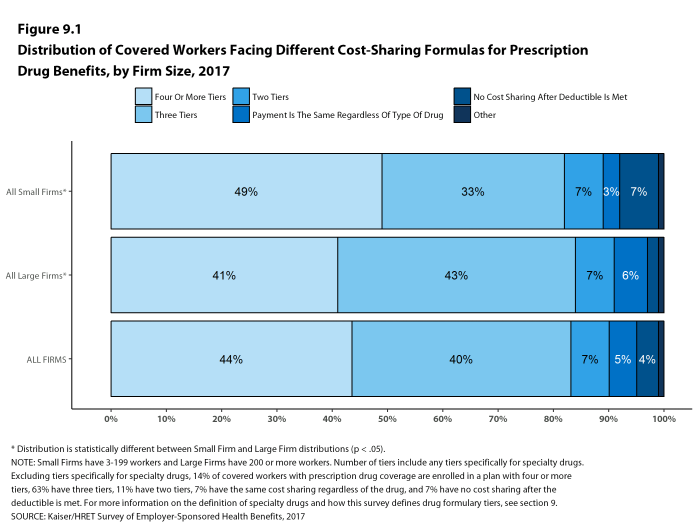

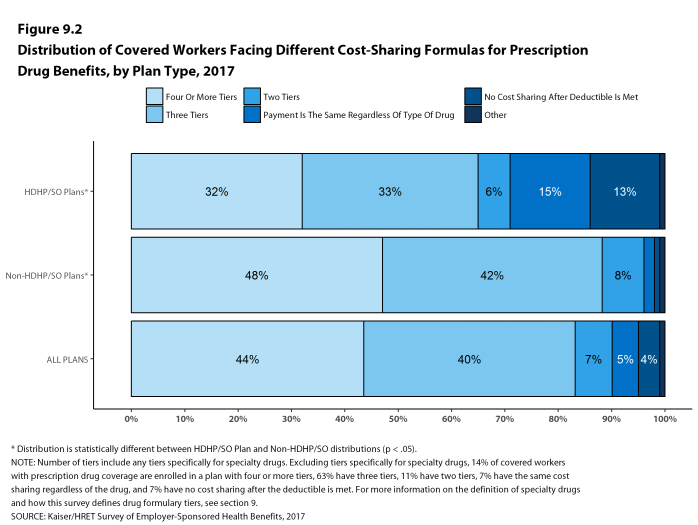

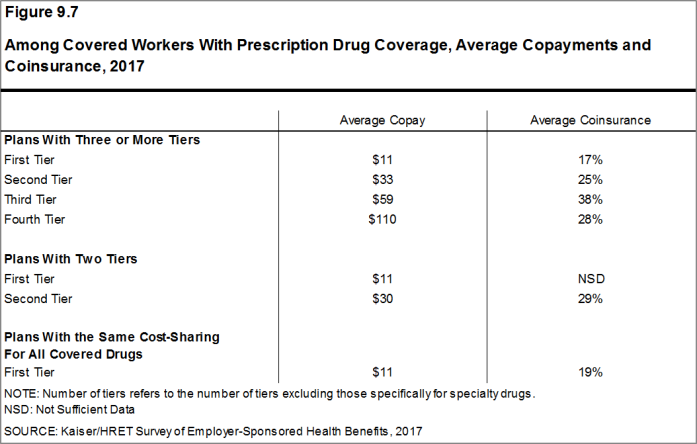

In 2017, we continued to make revisions to how the survey asks employers about their prescription drug coverage. In most cases, information reported in Prescription Drug Benefits (Section 9) is not comparable with previous years’ findings. Over time, plans have developed more complex benefit designs. In order to better capture information on specialty drugs, we elected to ask about these drugs separately from the cost sharing on other tiers. We modified the question about the number of tiers a firm’s cost-sharing structure has to ask specifically about tiers that do not exclusively cover specialty drugs. Average copayment and coinsurance values are still reported among workers with three or more tiers, two tiers, or the same cost sharing regardless of drug class, but none of these tiers includes cost sharing for tiers that exclusively cover specialty drugs. Forty-five percent of firms with drug coverage cover specialty drugs but do not have a tier that only covers this class of drugs. In these cases, cost sharing among specialty drugs is still captured with the plan’s other drug classes.

Figures 9.1 and 9.2 report the distribution of cost-sharing structures including any tiers for specialty drugs. This analysis adds the number of tiers the firm reported by any tiers they may have for specialty drugs. Therefore, a firm with two tiers and a tier exclusively for specialty drugs is considered a three tier plan in this analysis, but a two tier plan when reporting average cost sharing values. Even if a firm has multiple specialty-only tiers, we collect information on only one.

Similar to 2016, we no longer require that a firm’s cost-sharing tiers be sequential, meaning that the second tier copayment was higher than the first tier, the third tier was higher than the second, and the fourth was higher than the third. As drug formularies have become more intricate, many firms have minimum and maximum amounts attached to their copayments and coinsurance, leading us to believe it was no longer appropriate to assume that a firm’s cost sharing followed this sequential logic.

To reduce the length of survey, in several areas, including stoploss coverage for self-funded firms and cost sharing for hospital admissions, outpatient surgery, and emergency room visits, we revised the questionnaire to ask respondents about the attributes of their largest health plan rather than each plan type they may offer. This expands on the method we used for prescription drug coverage in 2016. Therefore, for these topics, aggregate variables represent the attributes of the firm’s largest plan type, and are not a weighted average of all of the firms plan types. In previous surveys, if a firm had two plan types, one with a copayment and one with a coinsurance for hospital admissions, the covered worker weight was allotted proportionally toward the average copayment and coinsurance based on the number of covered workers with either feature. With of this change, comparison among plans types is now a comparison of firms where any given plan type is the largest. The change only affects firms that have multiple plan types (58% of covered workers). After reviewing the responses and comparing them to prior years where we asked about each plan type, we find that the information we are receiving is similar to responses from previous years. For this reason, we will continue to report our results for these questions weighted by the number of covered workers in responding firms.

Starting in 2017, respondents were allowed to volunteer that their plans did not cover outpatient surgery or hospital admissions. Less than 1% of respondents indicated that their plan did not include coverage for these services. Cost sharing for hospital admissions, outpatient surgery and emergency room visits was imputed by drawing a firm similar in size and industry within the same plan type.

In 2017, HSA-qualified health plans are not allowed to have separate per-person deductibles below the minimum family deductible ($2,600 in 2017). Some firms reported per-person deductibles below this limit; in these cases, firms were re-contacted, and in some instances, respondents confirmed these responses. We elected not to edit these deductibles to the legal minimum.

Beginning in 2017, values below 3% are not shown on graphical figures to improve the readability of those graphs. The underlying data for all estimates presented in graphs is available at http://www.kff.org/ehbs.

Annual inflation estimates are usually calculated from April to April. The 12 month percentage change for May to May was 2%.12

HISTORICAL DATA

Data in this report focus primarily on findings from surveys jointly authored by the Kaiser Family Foundation and the Health Research & Educational Trust, which have been conducted since 1999. Prior to 1999, the survey was conducted by the Health Insurance Association of America (HIAA) and KPMG using a similar survey instrument, but data are not available for all the intervening years. Following the survey’s introduction in 1987, the HIAA conducted the survey through 1990, but some data are not available for analysis. KPMG conducted the survey from 1991-1998. However, in 1991, 1992, 1994, and 1997, only larger firms were sampled. In 1993, 1995, 1996, and 1998, KPMG interviewed both large and small firms. In 1998, KPMG divested itself of its Compensation and Benefits Practice, and part of that divestiture included donating the annual survey of health benefits to HRET.

This report uses historical data from the 1993, 1996, and 1998 KPMG Surveys of Employer-Sponsored Health Benefits and the 1999-2016 Kaiser/HRET Survey of Employer-Sponsored Health Benefits. For a longer-term perspective, we also use the 1988 survey of the nation’s employers conducted by the HIAA, on which the KPMG and Kaiser/HRET surveys are based. The survey designs for the three surveys are similar.

Published: September 19th, 2017. Last Updated: 2017-09-14

- HDHP/SO premium estimates do not include contributions made by the employer to Health Savings Accounts or Health Reimbursement Arrangements.↩

- HDHP/SO includes high-deductible health plans with a deductible of at least $1,000 for single coverage and $2,000 for family coverage and that offer either a Health Reimbursement Arrangement (HRA) or a Health Savings Account (HSA). Although HRAs can be offered along with a health plan that is not an HDHP, the survey collected information only on HRAs that are offered along with HDHPs. For specific definitions of HDHPs, HRAs, and HSAs, see the introduction to Section 8.↩

- In total, 139 firms participated in 2015, 274 firms participated in 2016, and 1,014 firms participated in both 2015 and 2016.↩

- Response rate estimates are calculated by dividing the number of completes over the number of refusals and the fraction of the firms with unknown eligibility to participate estimated to be eligible. Firms determined to be ineligible to complete the survey are not included in the response rate calculation.↩

- Estimates presented in Figures 2.1, 2.2, 2.3, 2.4, 2.5, and 2.26 are based on the sample of both firms that completed the entire survey and those that answered just one question about whether they offer health benefits.↩

- General information on the OES can be found at http://www.bls.gov/oes/oes_emp.htm#scope. A comparison between the OES and the NCS is available at https://www.bls.gov/opub/mlr/2013/article/lettau-zamora.htm↩

- Analysis of the 2011 survey data using both R and SUDAAN (the statistical package used prior to 2012) produced the same estimates and standard errors.↩

- A supplement with standard errors for select estimates can be found online at Technical Supplement: Standard Error Tables for Selected Estimates, http://ehbs.kff.org↩

- Bureau of Labor Statistics, Consumer Price Index, U.S. City Average of Annual Inflation (April to April), 2000-2017; [cited 2017 July 21] http://data.bls.gov/timeseries/CUUR0000SA0?output_view=pct_1mth↩

Section One: Cost Of Health Insurance

The average annual premiums in 2017 are $6,690 for single coverage and $18,764 for family coverage. The average premium for single coverage increased by 4% since 2016 and the average premium for family coverage increased by 3%. The average family premium has increased 55% since 2007 and 19% since 2012. The average family premium for covered workers in small firms (3-199 workers) ($17,615) is significantly lower than average family premiums for workers in large firms (200 or more workers) ($19,235).

PREMIUM COSTS FOR SINGLE AND FAMILY COVERAGE

- The average premium for single coverage in 2017 is $6,690 per year. The average premium for family coverage is $18,764 per year [Figure 1.1].

- The average annual premium for family coverage for covered workers in small firms ($17,615) is lower than the average premium for covered workers in large firms ($19,235) [Figure 1.2].

- The average annual premiums for covered workers in HDHP/SOs are lower for single coverage ($6,024) and family coverage ($17,581) than overall average premiums. The average premiums for covered workers enrolled in PPO plans are higher for single ($6,965) and family coverage ($19,481) than the overall plan average [Figure 1.1].

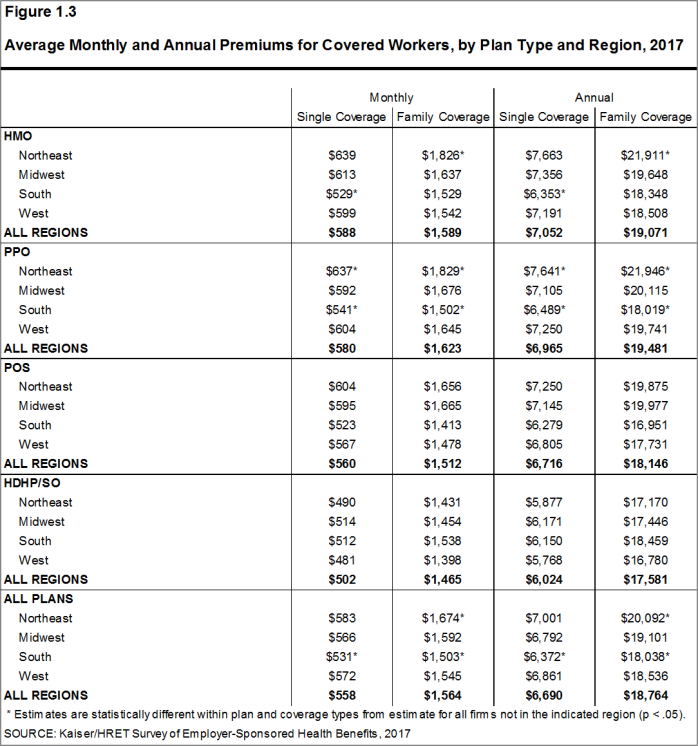

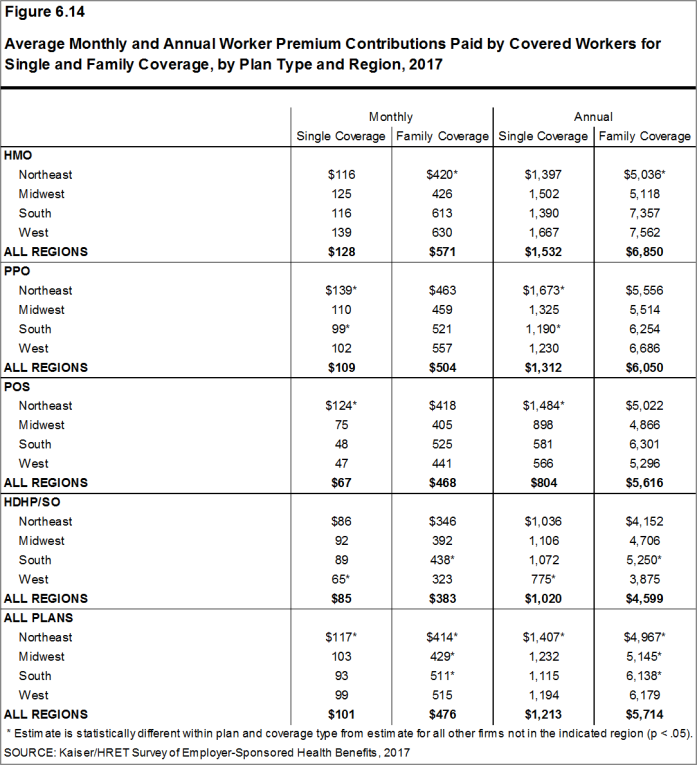

- The average premiums for covered workers are lower in the South ($6,372 for single coverage and $18,038 for family coverage) than the average premiums for covered workers in all other regions. The average premium for family coverage for covered workers in the Northeast ($20,092) is higher than the average family premium for covered workers in all other regions [Figure 1.3].

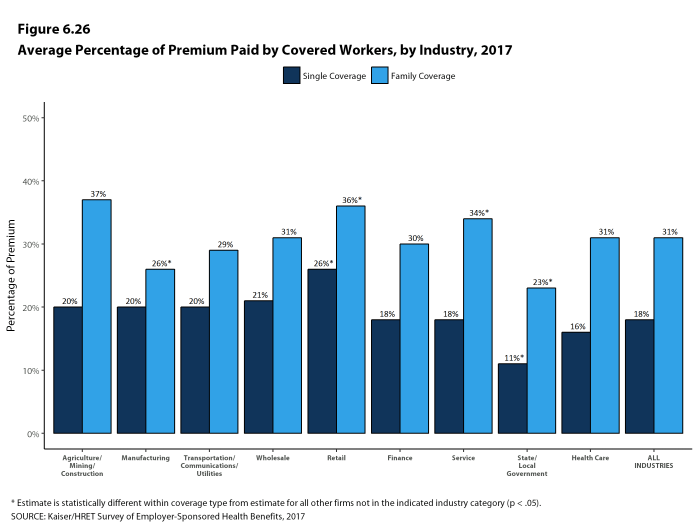

- The average premiums for covered workers vary across industries, with those in the retail industry being particularly low ($5,716 for single coverage and $16,920 for family coverage) [Figure 1.4].

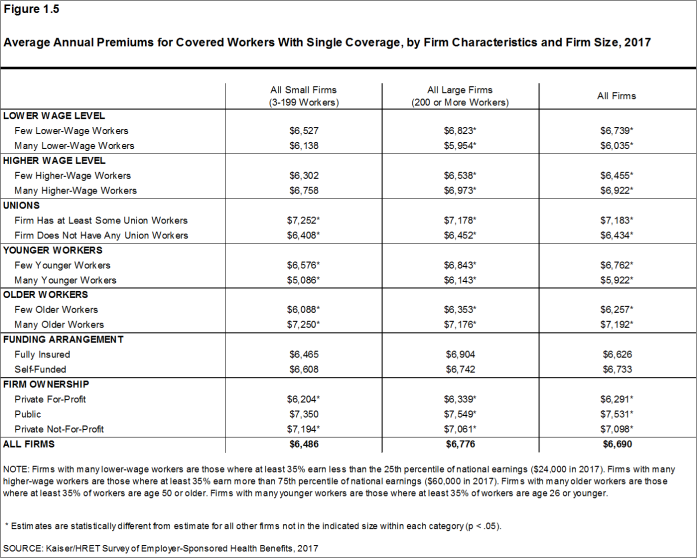

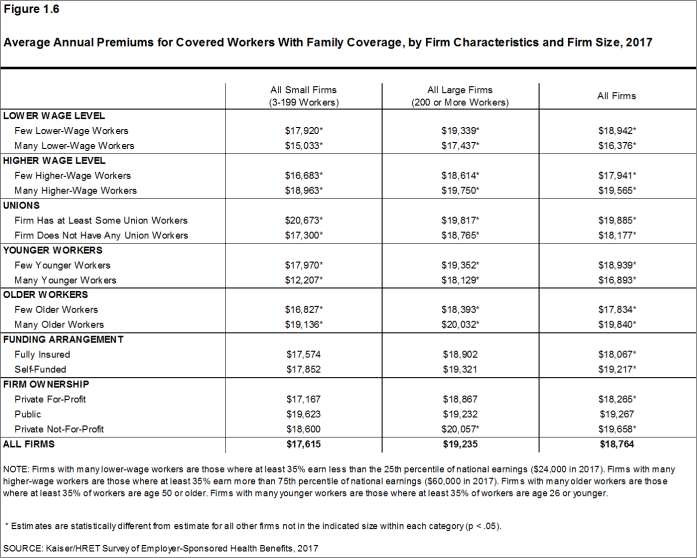

- The average premiums for covered workers in firms with a relatively large share of younger workers (where at least 35% of the workers are age 26 or younger) are lower than the average premiums for covered workers in firms with a smaller share of younger workers ($5,922 vs. $6,762 for single coverage and $16,893 vs. $18,939 for family coverage) [Figures 1.5 and 1.6].

- Premiums also vary by firm wage level. The average premiums for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $24,000 a year or less) are less than the average premiums at firms with a smaller share of lower-wage workers ($6,035 vs. $6,739 for single coverage and $16,376 vs. $18,942 for family coverage) [Figures 1.5 and 1.6].

- The average premiums for covered workers in firms with at least some union workers are higher than the average premiums for covered workers in firms without union workers ($7,183 vs. $6,434 for single coverage and $19,885 vs. $18,177 for family coverage) [Figures 1.5 and 1.6].

- There is also variation in premiums by type of firm ownership. For both single and family coverage, covered workers at private for-profit firms have lower average annual premiums than covered workers at public firms or private not-for-profit firms [Figures 1.5 and 1.6].

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2017

Figure 1.2: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2017

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2017

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2017

Figure 1.5: Average Annual Premiums for Covered Workers With Single Coverage, by Firm Characteristics and Firm Size, 2017

Figure 1.6: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics and Firm Size, 2017

PREMIUM DISTRIBUTION

- There is considerable variation in premiums for both single and family coverage.

- Twenty percent of covered workers are employed in a firm with a single premium at least 20% higher than the average single premium, while 21% of covered workers are in firms with a single premium less than 80% of the average single premium [Figures 1.7].

- For family coverage, 17% of covered workers are employed in a firm with a family premium at least 20% higher than the average family premium, while 21% of covered workers are in firms with a family premium less than 80% of the average family premium [Figure 1.7].

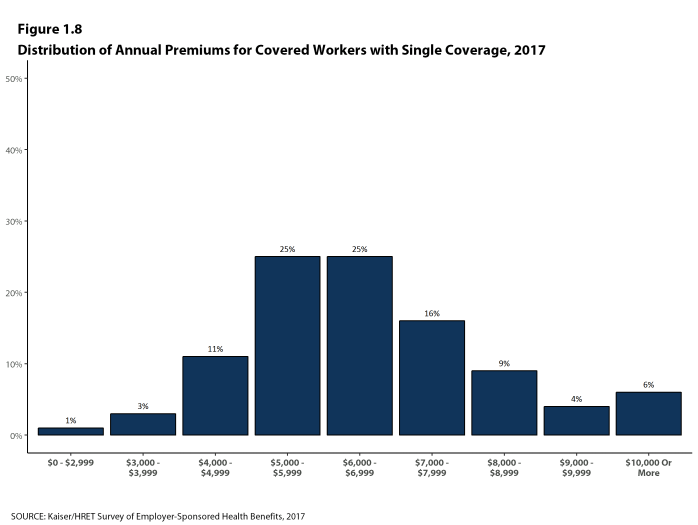

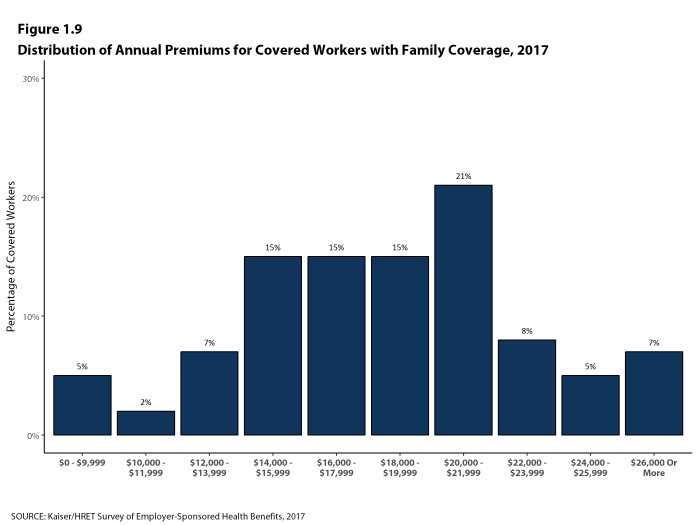

- Six percent of covered workers are in a firm with a premium of at least $10,000 a year for single coverage [Figure 1.8]. Seven percent of covered workers are in a firm with a premium of at least $26,000 a year for family coverage [Figure 1.9].

Figure 1.7: Distribution of Annual Premiums for Single and Family Coverage Relative to the Average Annual Single or Family Premium, 2017

Figure 1.8: Distribution of Annual Premiums for Covered Workers With Single Coverage, 2017

Figure 1.9: Distribution of Annual Premiums for Covered Workers With Family Coverage, 2017

PREMIUM CHANGES OVER TIME

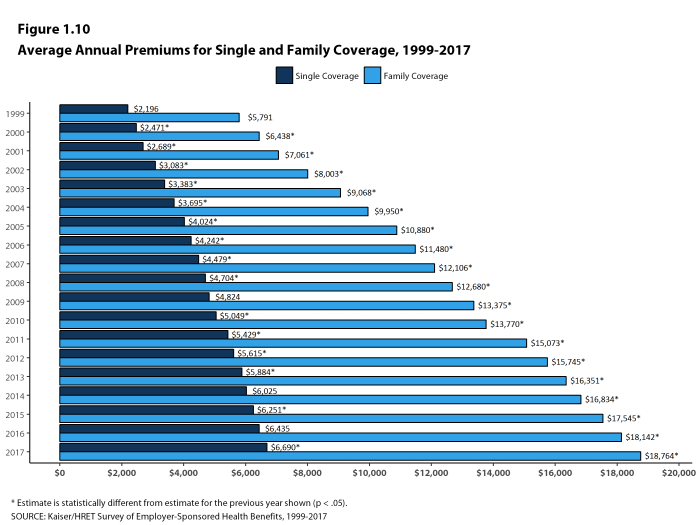

- The average premium for single coverage is 4% higher than the single premium last year and the average premium for family coverage is 3% higher than the average family premium last year [Figure 1.10].

- The average premiums for single and family coverage have grown at the same rate (19%) since 2012.

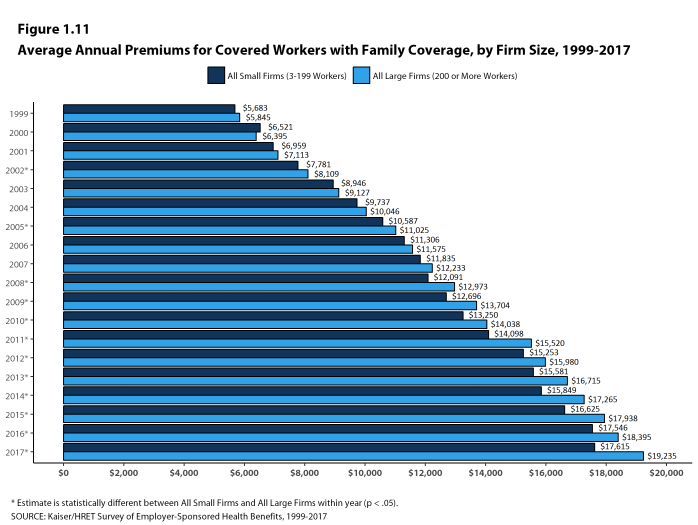

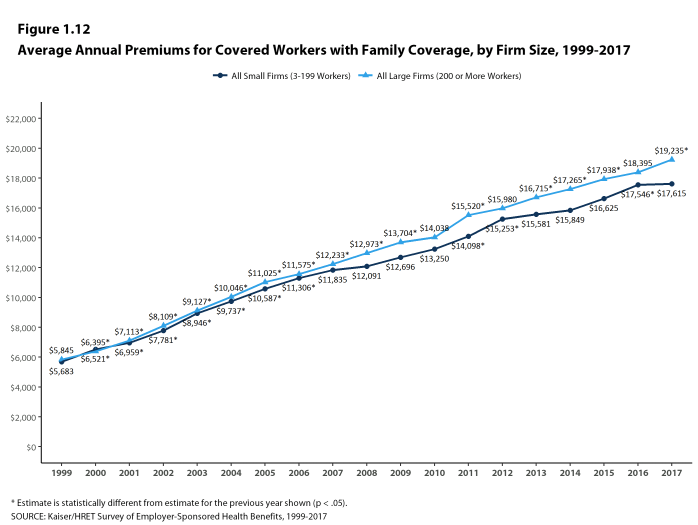

- The average family premiums for both small and large firms have increased at similar rates since 2012 (15% for small firms and 20% for large firms). For small firms, the average family premium rose from $15,253 in 2012 to $17,615 in 2017. For large firms, the average family premium rose from $15,980 in 2012 to $19,235 in 2017 [Figures 1.11 and 1.12].

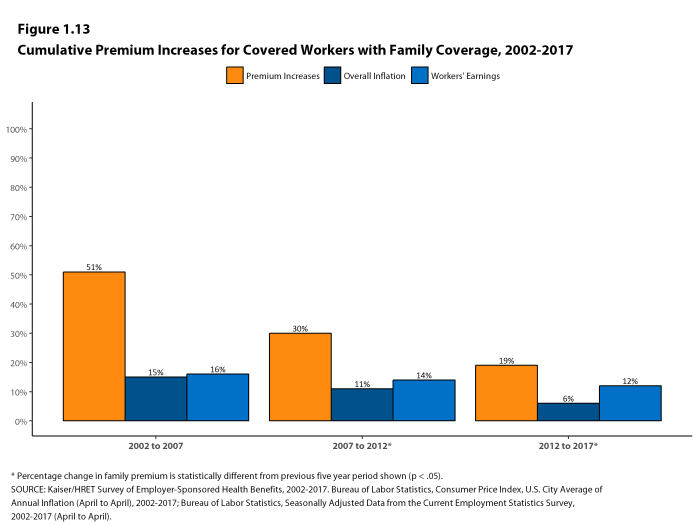

- The $18,764 average family premium in 2017 is 19% higher than the average family premium in 2012 and 55% higher than the average family premium in 2007 [Figure 1.10] . The 19% family premium growth in the last five years is smaller than the 30% growth between 2007 and 2012, or the 51% premium growth between 2002 and 2007 [Figure 1.13].

- The average family premiums for both small and large firms have increased at similar rates since 2007 (49% for small firms and 57% for large firms). For small firms, the average family premium rose from $11,835 in 2007 to $17,615 in 2017. For large firms, the average family premium rose from $12,233 in 2007 to $19,235 in 2017 [Figures 1.11 and 1.12].

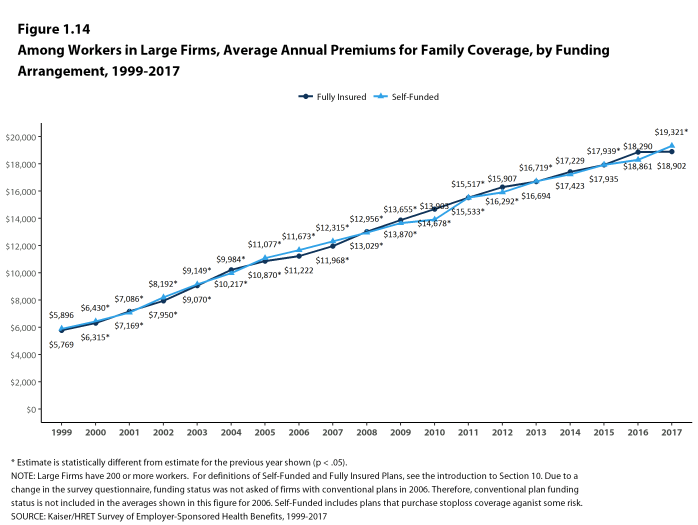

- For covered workers in large firms, over the last five years, the average family premium in firms that are fully insured has grown at a similar rate to the average family premium for covered workers in fully or partially self-funded firms (16% for fully insured plans and 21% for self-funded firms) [Figure 1.14].

Figure 1.10: Average Annual Premiums for Single and Family Coverage, 1999-2017

Figure 1.11: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2017

Figure 1.12: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2017

Figure 1.13: Cumulative Premium Increases for Covered Workers With Family Coverage, 2002-2017

Figure 1.14: Among Workers In Large Firms, Average Annual Premiums for Family Coverage, by Funding Arrangement, 1999-2017

Section Two: Health Benefits Offer Rates

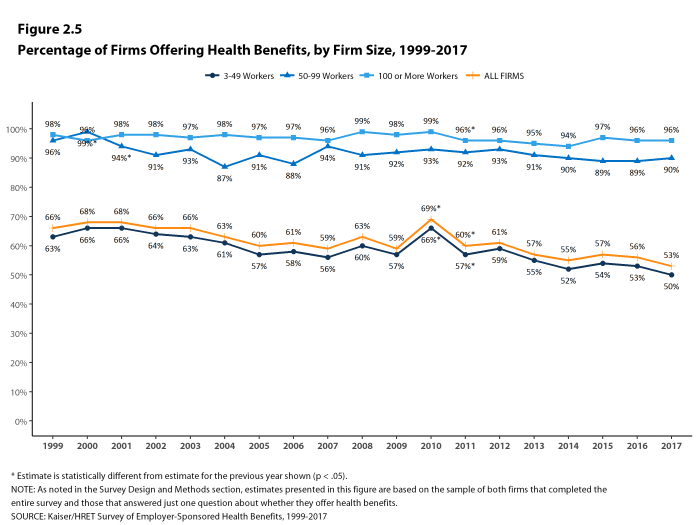

While nearly all large firms (200 or more workers) offer health benefits to at least some employees, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2017 (53%) is similar to the percentage of firms offering health benefits last year (56%), but lower than the percentages of firms offering health benefits in 2007 (59%) and 2012 (61%). As we reported last year, there has been a long-term decline in the offer and coverage rates for employer-provided coverage, particularly among smaller firms.13

Firms not offering health benefits continue to cite cost as the most important reason they do not do so. Almost all firms that offer coverage offer to dependents such as children and the spouses of eligible employees.

FIRM OFFER RATES

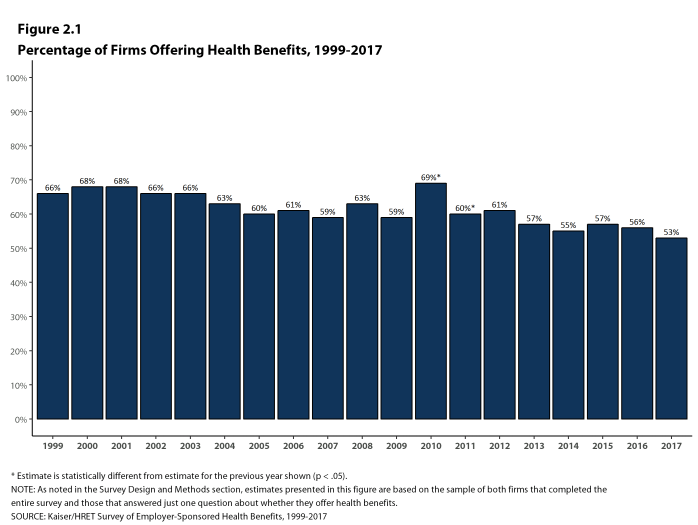

- In 2017, 53% of firms offer health benefits, similar to the 56% who reported doing so in 2016 [Figure 2.1].

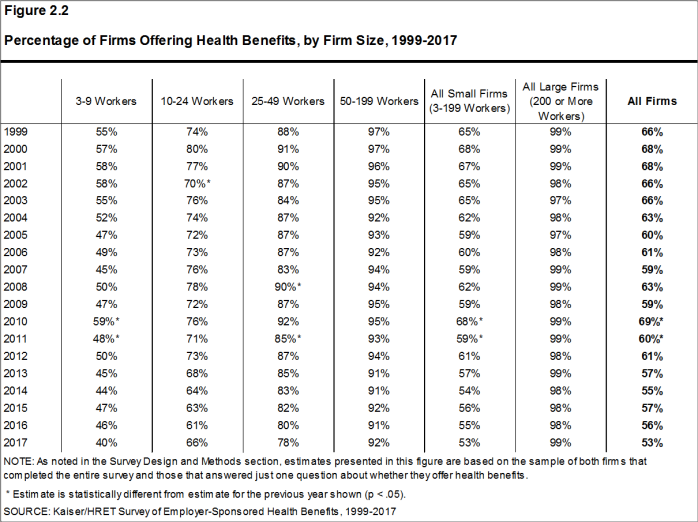

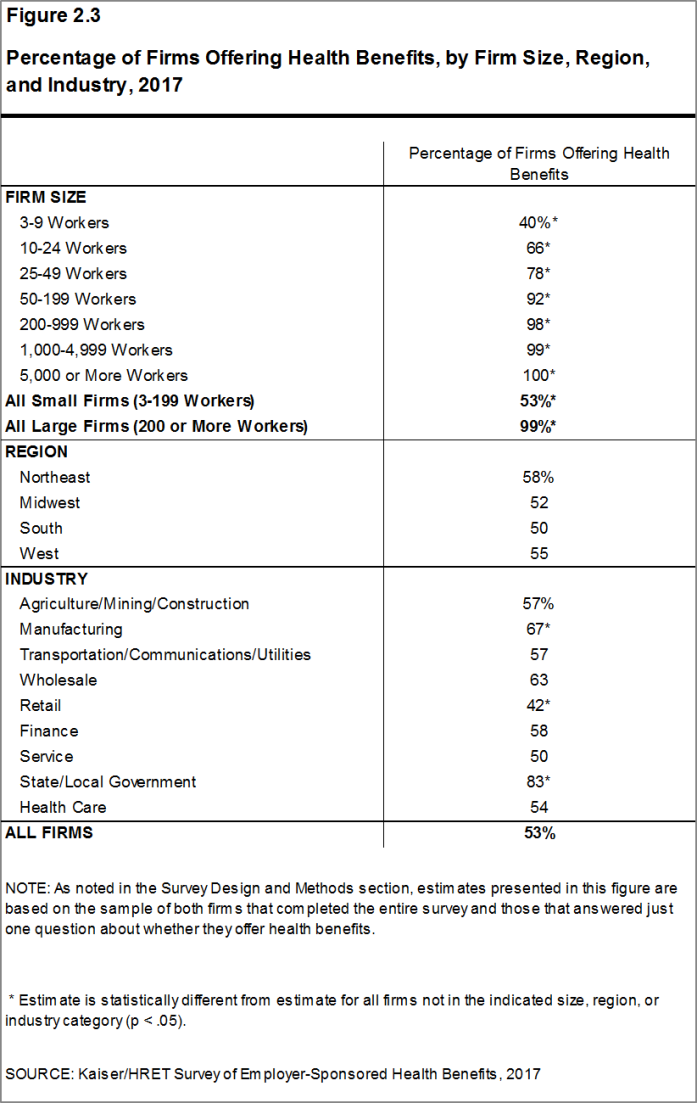

- Ninety-nine percent of large firms offer health benefits to at least some of their workers. In contrast, only 53% of small firms offer health benefits in 2017 [Figures 2.2 and 2.3]. The percentages of both small and large firms offering health benefits to at least some of their workers are similar to those of last year [Figure 2.2].

- The overall percentage of firms offering coverage in 2017 is less than the percentage offering coverage in 2012 (61%) and 2007 (59%) [Figure 2.1]. As we reported last year, there has been a long-term decline in the offer and coverage rates for employer-provided coverage, particularly among smaller firms.

- Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and Figure M.4.14

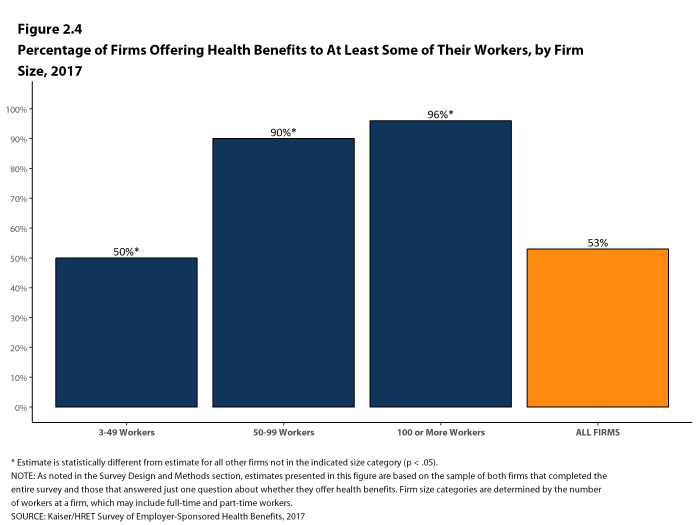

- Ninety-six percent of firms with 100 or more workers offer health benefits to at least some of their workers in 2017. Ninety percent of firms with 50-99 workers offer benefits to at least some workers [Figure 2.4].

- Eighty-nine percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.26].

- Offer rates vary across different types of firms.

- Smaller firms are less likely to offer health insurance: 40% of firms with 3-9 workers offer coverage, compared to 78% of firms with 25-49 workers, and 92% of firms with 50-199 workers [Figure 2.3].

- Offer rates throughout different firm size categories in 2017 remain similar to those reported in 2016 [Figure 2.2].

Figure 2.1: Percentage of Firms Offering Health Benefits, 1999-2017

Figure 2.2: Percentage of Firms Offering Health Benefits, by Firm Size, 1999-2017

Figure 2.3: Percentage of Firms Offering Health Benefits, by Firm Size, Region, and Industry, 2017

Figure 2.4: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2017

Figure 2.5: Percentage of Firms Offering Health Benefits, by Firm Size, 1999-2017

PART-TIME AND TEMPORARY WORKERS

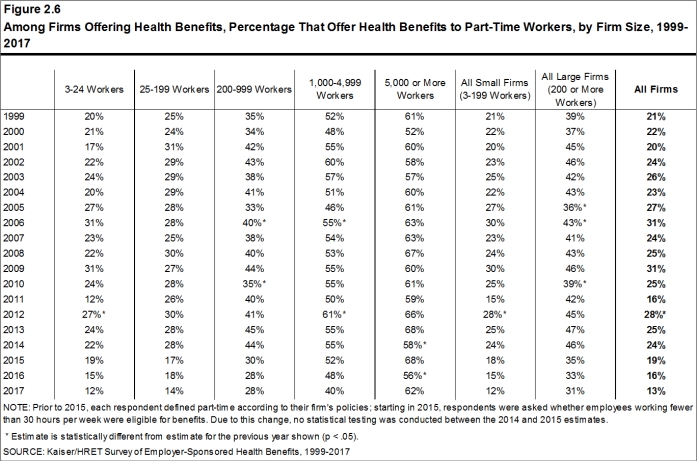

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

- The ACA defines full-time workers as those who on average work at least 30 hours per week, and part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer full-time employees coverage that meets minimum standards or be assessed a penalty.15 Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

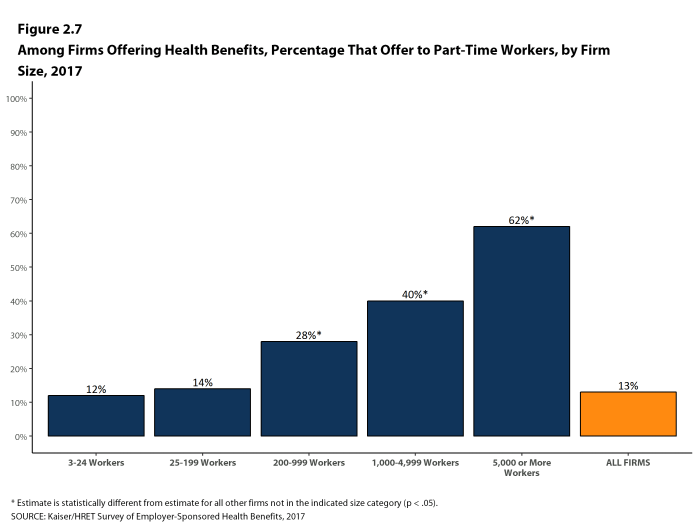

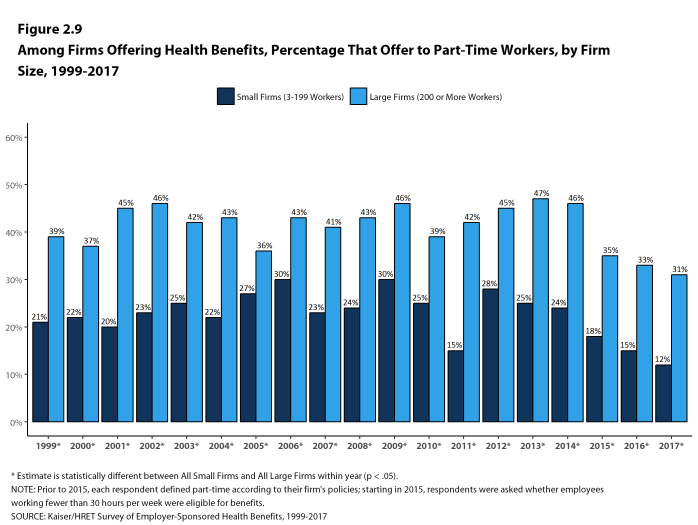

- In 2017, 13% of all firms that offer health benefits offer them to part-time workers [Figure 2.7]. Large firms are more likely to offer health benefits to part-time workers than small firms (31% vs. 12%) [Figure 2.9].

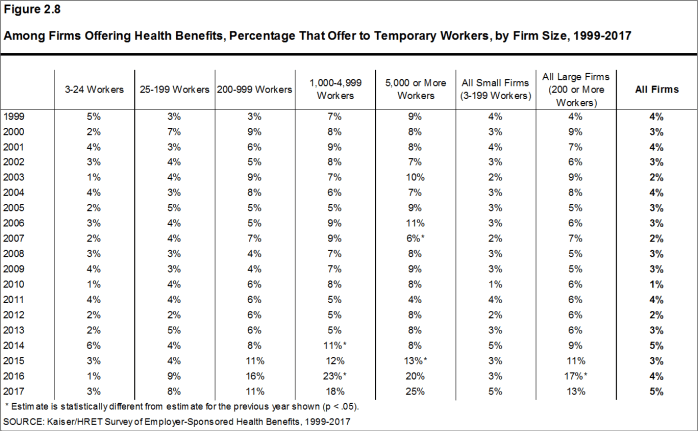

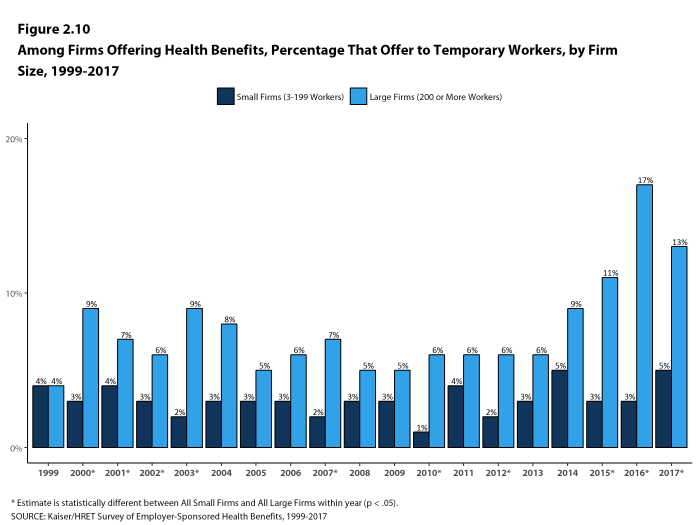

- A small percentage (5%) of firms offering health benefits offer them to temporary workers [Figure 2.8]. Among firms offering health benefits, large firms are more likely than small firms to offer benefits to temporary workers (13% vs. 5%) [Figure 2.10]. The percentage of large firms offering health benefits to temporary workers is not statistically different from the 17% reported in 2016 [Figure 2.8].

Figure 2.6: Among Firms Offering Health Benefits, Percentage That Offer Health Benefits to Part-Time Workers, by Firm Size, 1999-2017

Figure 2.7: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 2017

Figure 2.8: Among Firms Offering Health Benefits, Percentage That Offer to Temporary Workers, by Firm Size, 1999-2017

Figure 2.9: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2017

Figure 2.10: Among Firms Offering Health Benefits, Percentage That Offer to Temporary Workers, by Firm Size, 1999-2017

SPOUSES, DEPENDENTS AND DOMESTIC PARTNER BENEFITS

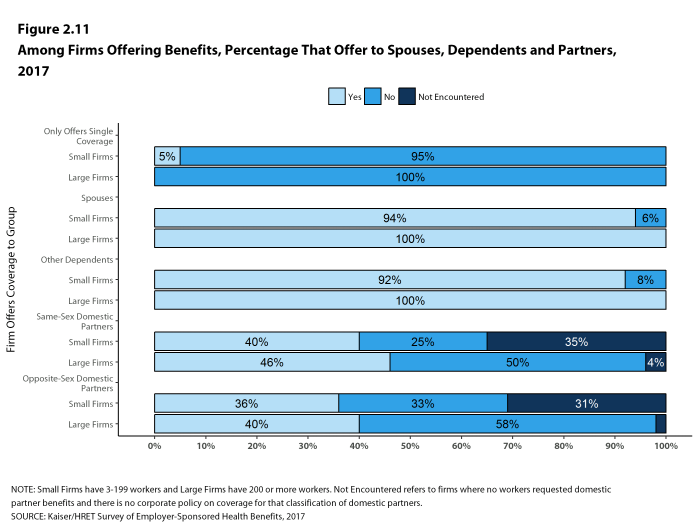

- The majority of firms offering health benefits offer to spouses and dependents, such as children. In 2017, 94% of small firms and 100% of large firms offering health benefits offer coverage to spouses, similar to last year. Ninety-two percent of small firms and 100% of large firms offering health benefits cover other dependents, such as children, similar to last year. Five percent of small firms offering health benefits offer only single coverage to employees [Figure 2.11].

- Employers were also asked whether same-sex or opposite-sex domestic partners were allowed to enroll in the firm’s coverage. While definitions may vary, employers often define domestic partners as an unmarried couple who has lived together for a specified period of time. Firms may define domestic partners separately from any legal requirements a state may have, and also, employers may have a different policy in different parts of the country or for different workers.

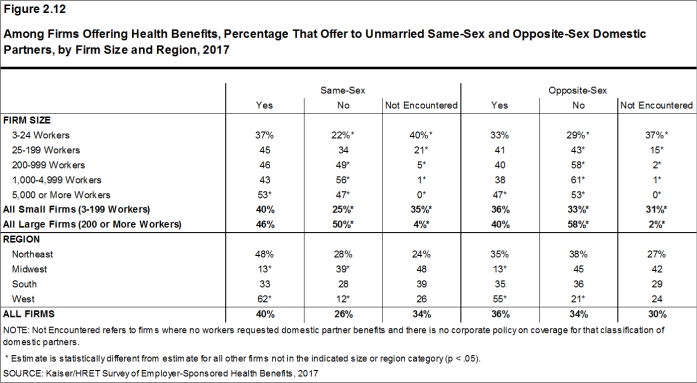

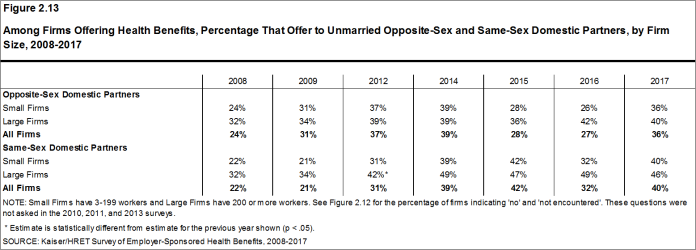

- In 2017, 36% of firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 27% who did so in 2016. Forty percent of firms offering health benefits offer coverage to same-sex domestic partners, similar to the 32% who did so last year [Figure 2.13].

- When firms are asked if they offer health benefits to opposite or same-sex domestic partners, many report that they have not encountered this issue. At some small firms, the firm may not have formal human resource policies on domestic partners simply because none of the firm’s workers have asked to cover a domestic partner. Regarding health benefits for opposite-sex domestic partners, 30% of firms report in 2017 that they have not encountered this request or that the question was not applicable [Figure 2.12]. The vast majority of firms in the United States are small businesses [Figure M.1]. Therefore, statistics about the percentage of firms that offer domestic partner benefits are largely determined by small businesses. More small firms (31%) than large firms (2%) indicate that they have not encountered this request or that the question was not applicable [Figure 2.12]. Regarding health benefits for same-sex domestic partners, 34% of firms report that they have not encountered the request or that the question was not applicable. More small firms (35%) than large firms (4%) report that they have not encountered the issue of offering benefits to same-sex domestic partners [Figure 2.12].

- Among large firms not offering health benefits to same-sex domestic partners, 3% stopped offering them within the last 12 months.

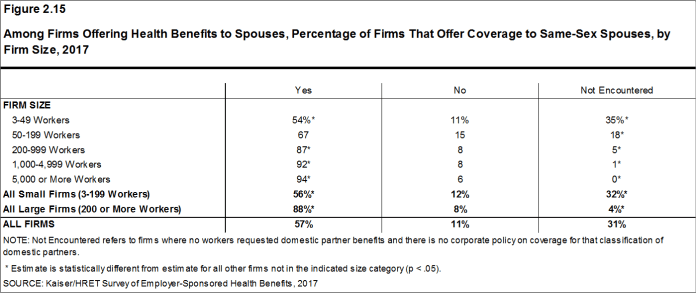

- Over half (57%) of firms that offer health benefits to spouses also offer coverage to same-sex spouses, with large firms more likely than small firms to offer coverage to same-sex spouses (88% vs. 56%). Small firms are more likely than large firms to report that this request has not been encountered (32% vs. 4%) [Figure 2.15].

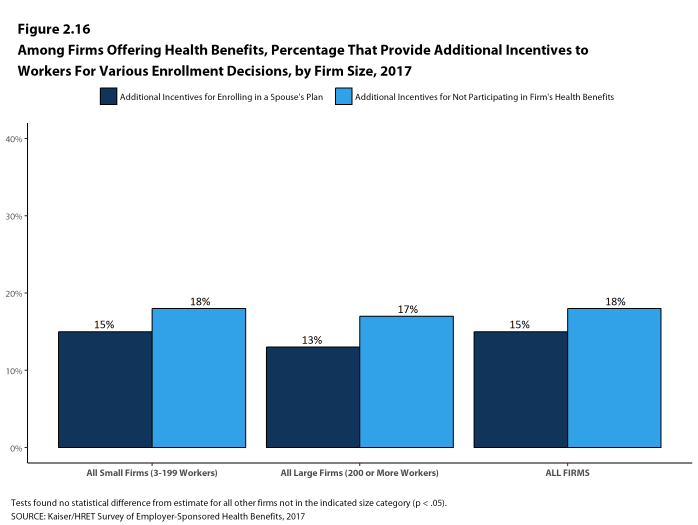

- Among all firms that offer health benefits, 15% report providing additional compensation or benefits to employees if they enroll in a spouse’s plan, and 18% provide additional compensation or benefits to employees if they do not participate in the firm’s health benefits [Figure 2.16].

Figure 2.11: Among Firms Offering Benefits, Percentage That Offer to Spouses, Dependents and Partners, 2017

Figure 2.12: Among Firms Offering Health Benefits, Percentage That Offer to Unmarried Same-Sex and Opposite-Sex Domestic Partners, by Firm Size and Region, 2017

Figure 2.13: Among Firms Offering Health Benefits, Percentage That Offer to Unmarried Opposite-Sex and Same-Sex Domestic Partners, by Firm Size, 2008-2017

Figure 2.14: Among Firms Not Offering Domestic Partner Benefits, Percentage of Firms That Stopped Offering Those Benefits In the Last 12 Months, by Firm Size, 2017

Figure 2.15: Among Firms Offering Health Benefits to Spouses, Percentage of Firms That Offer Coverage to Same-Sex Spouses, by Firm Size, 2017

Figure 2.16: Among Firms Offering Health Benefits, Percentage That Provide Additional Incentives to Workers for Various Enrollment Decisions, by Firm Size, 2017

SUPPLEMENTAL AND VOLUNTARY BENEFITS

- Firms offering health benefits also offer a variety of supplemental and other health benefits to their workers. Large firms are more likely than small firms to offer these benefits [Figure 2.17]. Among firms offering health benefits:

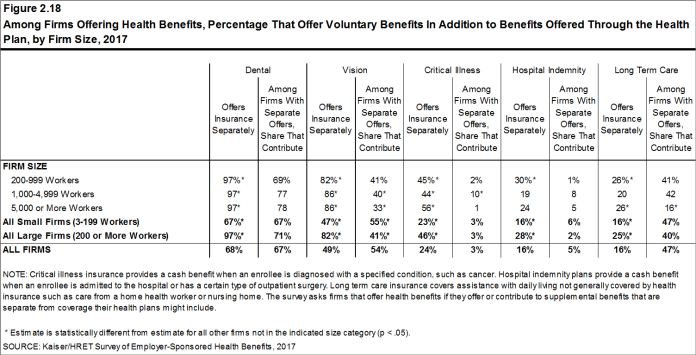

- Sixty-seven percent of small firms and 97% of large firms offer dental benefits to their employees. Of firms offering these benefits, 67% make a contribution toward the cost of the coverage [Figure 2.18].

- Forty-seven percent of small firms and 82% of large firms offer vision benefits to their employees. Of firms offering these benefits, 54% make a contribution toward the cost of the coverage [Figure 2.18].

- Critical illness insurance provides a cash benefit when an enrollee is diagnosed with a specified condition, such as cancer. Twenty-three percent of small firms and 46% of large firms offer critical illness insurance to their employees. Of firms offering these benefits, 3% make a contribution toward the cost of the coverage [Figure 2.18].

- Hospital indemnity plans, sometimes known as hospital cash plans, provide a cash benefit when an enrollee is admitted to the hospital or has a certain type of outpatient surgery. Sixteen percent of small firms and 28% of large firms offer hospital indemnity insurance to their employees. Of firms offering these benefits, 5% make a contribution toward the cost of the coverage [Figure 2.18].

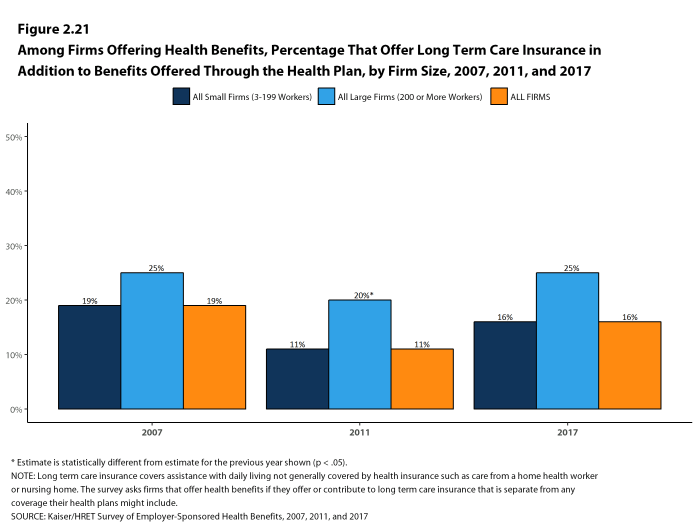

- Long-term care insurance covers assistance with daily living not generally covered by health insurance such as care from a home health worker or nursing home. Sixteen percent of small firms and 25% of large firms offer long-term care insurance to their employees, similar to the percentages in 2011. Of firms offering these benefits, 47% make a contribution toward the cost of the coverage [Figure 2.18].

Figure 2.17: Among Firms Offering Health Benefits, Percentage of Firms That Offer Voluntary Benefits In Addition to the Health Plan, by Firm Size, Region and Industry, 2017

Figure 2.18: Among Firms Offering Health Benefits, Percentage That Offer Voluntary Benefits In Addition to Benefits Offered Through the Health Plan, by Firm Size, 2017

Figure 2.19: Among Firms Offering Health Benefits, Percentage That Offer Supplemental Insurance Benefits In Addition to Benefits Offered Through the Health Plan, by Firm Size, 2017

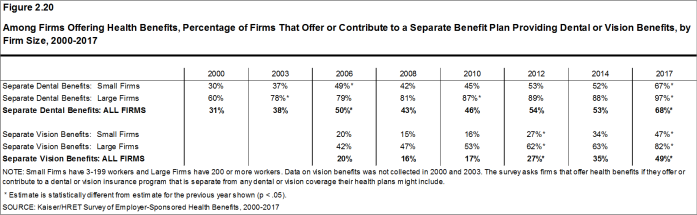

Figure 2.20: Among Firms Offering Health Benefits, Percentage of Firms That Offer or Contribute to a Separate Benefit Plan Providing Dental or Vision Benefits, by Firm Size, 2000-2017

Figure 2.21: Among Firms Offering Health Benefits, Percentage That Offer Long Term Care Insurance In Addition to Benefits Offered Through the Health Plan, by Firm Size, 2007, 2011, and 2017

FIRMS NOT OFFERING HEALTH BENEFITS

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering coverage. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

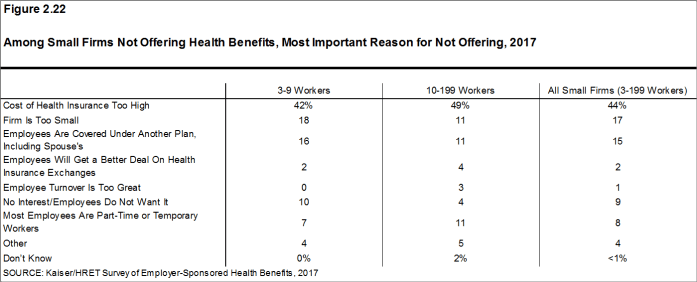

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms not offering health benefits, 44% cite high cost as “the most important reason” for not doing so, followed by “the firm is too small” (17%) [Figure 2.22]. Relatively few small firms indicate that they do not offer because they believe that employees will get a better deal on the health insurance exchanges (2%).

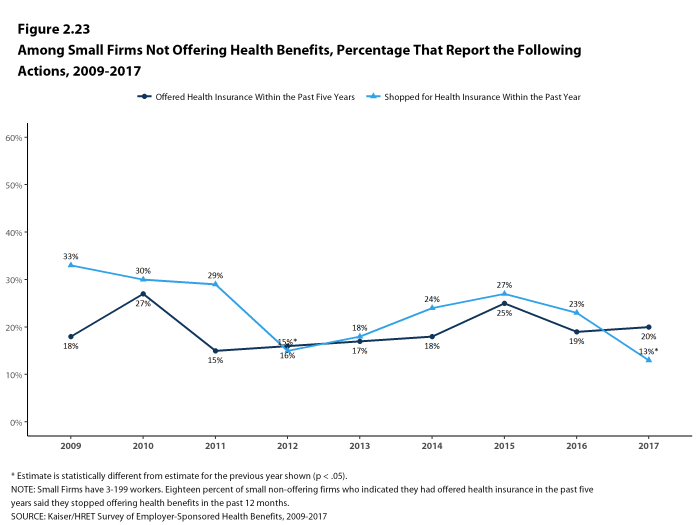

- Many small non-offering firms have either offered health insurance in the past five years, or have shopped for health insurance in the past year. Twenty percent of small non-offering firms have offered health benefits in the past five years, and 13% have shopped for coverage in the past year [Figure 2.23]. The 20% of small non-offering firms that have offered coverage in the past five years is similar to the 19% reported last year.

- Among small non-offering firms that report they stopped offering coverage within the last five years, 18% stopped offering coverage within the last year.