The Out-of-Pocket Cost Burden for Specialty Drugs in Medicare Part D in 2019

Introduction

Medicare Part D has helped to make prescription drugs more affordable for people with Medicare, yet many beneficiaries continue to face high out-of-pocket costs for their medications. Specialty tier drugs—defined by Medicare as drugs that cost more than $670 per month in 2019—are a particular concern for Part D enrollees in this context. Part D plans are allowed to charge between 25 percent and 33 percent coinsurance for specialty tier drugs before enrollees reach the coverage gap, where they pay 25 percent for all brands, followed by 5 percent coinsurance when total out-of-pocket spending exceeds an annual threshold ($5,100 in 2019). While specialty tier drugs are taken by a relatively small share of enrollees, spending on these drugs has increased over time and now accounts for over 20 percent of total Part D spending, up from about 6 to 7 percent before 2010.

Despite Medicare’s protections, Part D enrollees with serious health problems can face thousands of dollars in annual out-of-pocket costs for specialty drugs.

This analysis draws on data from Medicare’s Plan Finder website to calculate expected annual 2019 out-of-pocket costs for 30 specialty tier drugs used to treat four health conditions—cancer, hepatitis C, multiple sclerosis, and rheumatoid arthritis. For each drug, we calculate the median annual out-of-pocket cost across all plans that cover the drug, based on coverage in stand-alone prescription drug plans (PDPs) and costs at a pharmacy in zip code 21201 (Baltimore, MD). We use one zip code to represent PDP costs nationally because most PDPs are offered on a national or near-national basis (including 24 of the 25 PDPs in the 21201 zip code), and it is common for PDPs to use the same formulary and the same specialty tier coinsurance rate in all regions. As such, our findings are broadly applicable to a majority of PDP enrollees nationwide. (See Methods for additional details.)

Key Findings

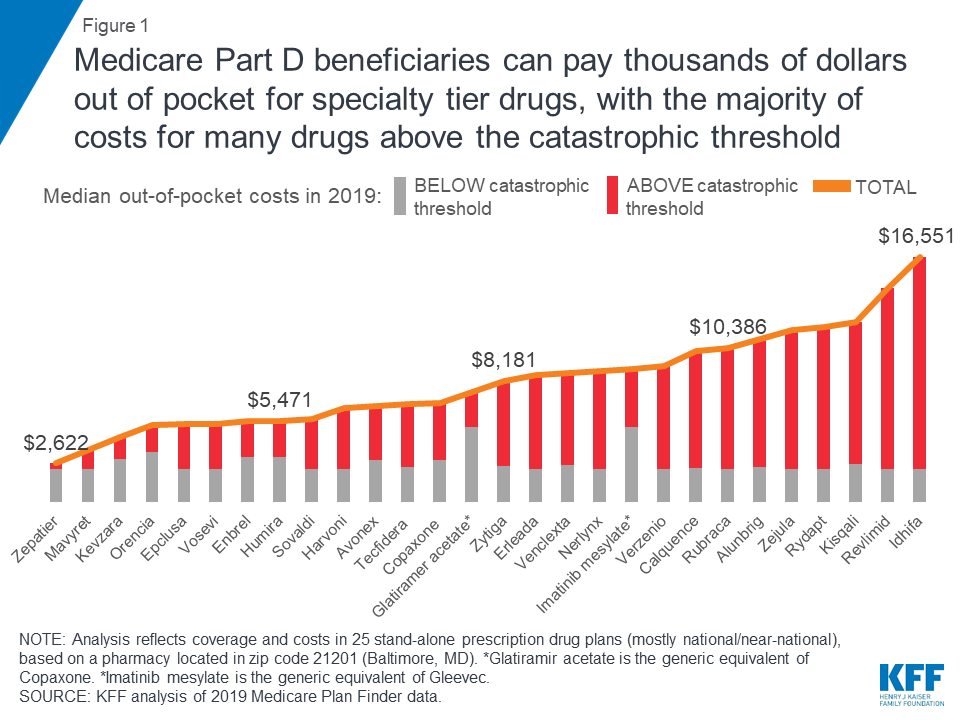

- Medicare Part D enrollees not receiving low-income subsidies can expect to pay thousands of dollars out of pocket for a single specialty tier drug in 2019 (Figure 1). Median annual out-of-pocket costs in 2019 for 28 of the 30 studied specialty tier drugs range from $2,622 for Zepatier (for hepatitis C) to $16,551 for Idhifa (for leukemia), based on a full year of use; two of the 30 drugs are not covered by any plan in our analysis in 2019.

- Part D enrollees taking high-cost specialty tier drugs can incur significant costs in the catastrophic phase. For the 28 studied specialty tier drugs covered by some or all plans in our analysis, the share of out-of-pocket costs that an enrollee would incur in the catastrophic phase in 2019 ranges from 13 percent for Zepatier to 86 percent for Idhifa, based on a full year of utilization. More than half (61 percent) of expected annual out-of-pocket costs for these 28 drugs in 2019 would occur in the catastrophic phase, on average, which translates to $5,444 in out-of-pocket costs in the catastrophic phase alone.

- Not all specialty tier drugs are covered by all Medicare Part D plans, unless they are in one of the six protected classes (such as cancer drugs). For the 14 specialty drugs in our analysis that are not covered by some or all plans in 2019, the median total annual cost when not covered ranges from $26,209 for Zepatier to $145,769 for Gleevec—amounts that far exceed the limits of affordability for the vast majority of Medicare beneficiaries.

- In 2019, annual out-of-pocket costs are 12 percent higher than in 2016, on average, for 8 of the 10 specialty tier drugs analyzed in both 2016 and 2019 and covered by plans in both years. For these specialty tier drugs, median annual out-of-pocket cost increases range from $224 for Copaxone, a multiple sclerosis drug, to $2,923 for Revlimid, a cancer drug. For two of the 10 drugs—Harvoni and Sovaldi, both used to treat hepatitis C—annual out-of-pocket costs are somewhat lower in 2019 than in 2016, possibly due to the entrance of competitor products since the end of 2015 and other factors related to changes in the benefit design and the limited duration of treatment that translate to a reduction in out-of-pocket costs for these drugs.

- With the now-complete closure of the Part D coverage gap for brand-name drugs, enrollees can expect to face lower annual out-of-pocket costs for selected specialty tier drugs below the catastrophic threshold in 2019 compared to 2016, but higher costs above—driven by an increase in underlying total costs between 2016 and 2019. For example, for Humira, for rheumatoid arthritis, median out-of-pocket costs below the catastrophic threshold decreased by $99 between 2016 and 2019 (from $3,155 to $3,057), while costs above the catastrophic threshold increased by $705 over these years (from $1,709 to $2,414)—and in total, expected annual out-of-pocket costs for Humira are $606 (12%) higher in 2019 than in 2016.

Findings

Medicare Part D enrollees without low income subsidies can expect to pay thousands of dollars out of pocket for a single specialty tier drug in 2019. For many specialty tier drugs, the majority of these costs will occur in the catastrophic phase of the benefit.

Part D enrollees can face thousands of dollars in annual out-of-pocket costs if they take expensive drugs, despite having catastrophic coverage. Expected annual out-of-pocket costs in 2019 average $8,109 across the 28 specialty tier drugs covered by some or all plans in this analysis. For 28 of the 30 studied specialty drugs used to treat four health conditions—cancer, hepatitis C, multiple sclerosis (MS), and rheumatoid arthritis (RA)—expected annual out-of-pocket costs for a single drug in 2019 range from $2,622 for Zepatier, a treatment for hepatitis C, to $16,551 for Idhifa, a leukemia drug. Two of the 30 drugs are not covered by any plan in our analysis. (See Tables 1 and 2 for drug-specific cost and coverage information.)

Part D enrollees taking high-cost specialty tier drugs often incur significant costs in the catastrophic coverage phase of the benefit because the catastrophic threshold is not an absolute limit on out-of-pocket spending. For the 28 specialty tier drugs in our analysis covered by some or all plans, the share of annual out-of-pocket costs that would be incurred in the catastrophic phase in 2019 ranges from 13 percent for Zepatier to 86 percent for Idhifa; for 19 of these drugs, enrollees can expect to pay more than half of their annual out-of-pocket cost in the catastrophic phase. On average across these 28 specialty drugs, 61 percent of annual out-of-pocket costs occur above the catastrophic threshold in 2019, which translates to $5,444 in out-of-pocket costs in the catastrophic phase alone.

out-of-pocket Costs for SELECtED specialty tier drugs in 2019, by Condition

Cancer

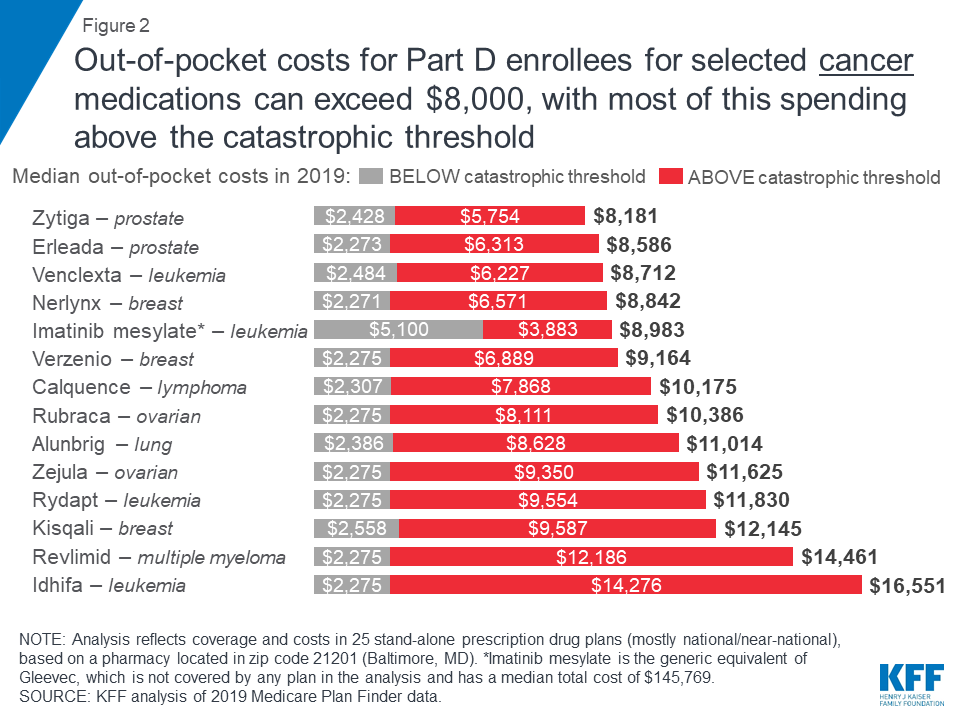

Medicare Part D enrollees without low-income subsidies who take any of the specialty tier drugs in our analysis for various types of cancer would pay more out of pocket for these medications in 2019 than enrollees who take any of the specialty drugs for the other health conditions in this analysis. Fourteen of the 15 studied specialty tier cancer drugs are covered by all plans, and the median annual out-of-pocket cost for each of these drugs exceeds $8,000. One of the 15 cancer drugs, Gleevec, is not covered by any plan in our analysis in 2019, but the generic equivalent, imatinib mesylate, is covered by all plans, which is sufficient to meet the formulary coverage requirement that plans cover all or substantially all drugs in six so-called “protected” classes, including cancer drugs.

Expected annual out-of-pocket costs in 2019 for the 14 covered specialty tier cancer drugs range from $8,181 for Zytiga (for prostate cancer) to $16,551 for Idhifa (for leukemia) (Figure 2). Part D enrollees taking any of the brand-name cancer drugs in our analysis for the full year would pay at least 70 percent of their total annual out-of-pocket costs above the catastrophic threshold in 2019. For example, 84 percent of an enrollee’s out-of-pocket costs for Revlimid, a drug to treat multiple myeloma, would occur in the catastrophic phase, which translates to $12,186 in costs for this drug in the catastrophic phase alone in 2019. For imatinib mesylate, the generic equivalent for Gleevec, the share of costs above the catastrophic coverage threshold is lower (43%) because enrollees taking this drug do not receive a manufacturer discount in the coverage gap and therefore would incur higher out-of-pocket costs below the catastrophic coverage threshold.

Hepatitis C

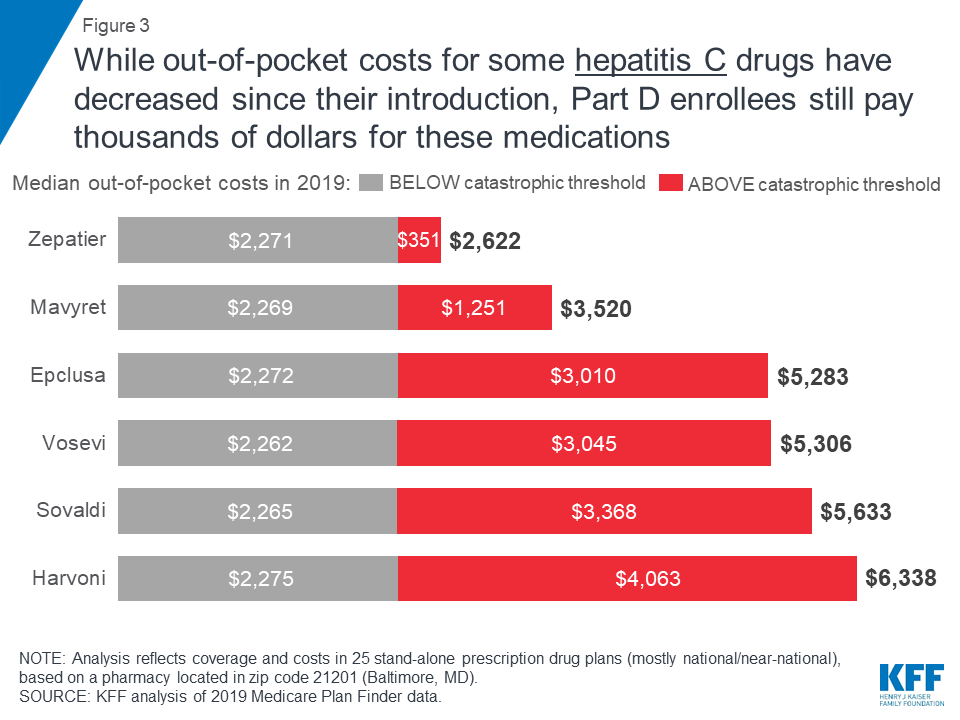

Out-of-pocket spending for breakthrough therapies used to treat and cure hepatitis C represents a significant burden for Part D enrollees who do not receive low-income subsidies, even though costs for some of these drugs have fallen over time as new competitor products have come to market.

Expected annual out-of-pocket costs in 2019 for six of the seven hepatitis C drugs in our analysis range from $2,622 for Zepatier to $6,338 for Harvoni (Figure 3). (A previously published version of this brief reported lower costs for Harvoni, based on the default quantity in the Medicare Plan Finder (28 pills/year), which is lower than the recommended quantity (84 pills/year). The estimates in this report have been updated to reflect the recommended quantity, resulting in higher costs for Harvoni. See Methods for additional details.) One of the seven drugs, Viekira Pak, is not covered by any of the plans in our analysis. For four hepatitis C drugs in our analysis (Epclusa, Vosevi, Sovaldi, and Harvoni), Part D enrollees can expect to pay more than half of their total out-of-pocket costs in the catastrophic phase in 2019, based on a full year of use. For example, 60 percent of an enrollee’s out-of-pocket costs for Sovaldi would occur in the catastrophic phase, which translates to $3,368 in costs for this drug in the catastrophic phase alone in 2019.

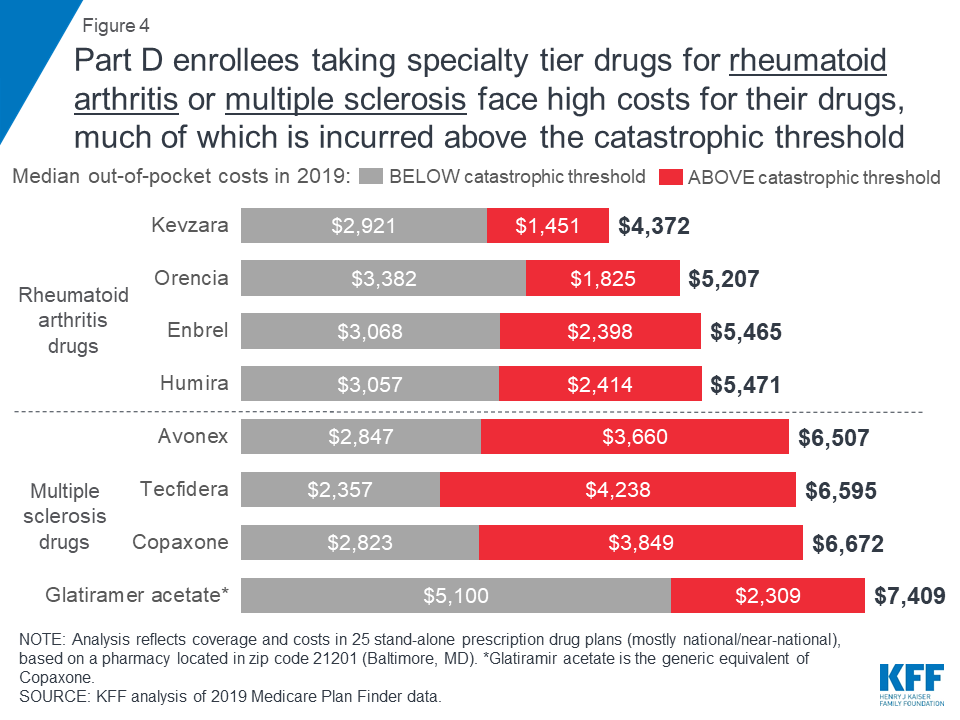

Multiple Sclerosis

Expected annual out-of-pocket costs in 2019 for the four specialty tier drugs in our analysis used to treat multiple sclerosis range from $6,507 for Avonex to $7,409 for glatiramer acetate (the generic equivalent of Copaxone) (Figure 4). An enrollee taking any of the three brand-name MS drugs in our analysis (Avonex, Copaxone, and Tecfidera) can expect to pay more than half of their total annual out-of-pocket costs in the catastrophic phase.

Expected annual out-of-pocket costs for glatiramer acetate are actually higher than costs for the brand Copaxone in 2019—and higher than out-of-pocket costs for the other branded MS drugs—while the share of out-of-pocket costs above the catastrophic threshold is lower. This is because enrollees who take the brand Copaxone would reach the catastrophic phase sooner than those who take the generic equivalent, because they receive a 70 percent manufacturer discount on the brand, which counts towards the annual out-of-pocket spending amount that triggers catastrophic coverage. This discount is not offered to those who use generic drugs, so more of their annual spending would occur below the catastrophic coverage threshold, where they face a higher coinsurance rate in the coverage gap (37%) than those who take brands (25%).

Rheumatoid Arthritis

For Part D enrollees taking any of the four specialty tier drugs in our analysis for rheumatoid arthritis, expected annual out-of-pocket costs in 2019 range from $4,372 for Kevzara to $5,471 for Humira (Figure 4). At least one-third of total annual out-of-pocket costs for each of these drugs would be incurred by Part D enrollees after their spending exceeds the catastrophic threshold. For example, Part D enrollees taking either Humira or Enbrel would pay 44 percent of their total annual out-of-pocket costs above the catastrophic threshold in 2019, based on a full year of use, which translates to costs of $2,414 for Humira and $2,398 for Enbrel in the catastrophic phase alone.

Medicare Part D coverage of specialty tier drugs varies across plans, which has implications for enrollees’ access and costs.

Part D plans must adhere to specific formulary guidelines laid out by Medicare, such as covering a minimum of two drugs in each therapeutic class and covering all or substantially all drugs in six protected classes, but plans can omit drugs from their formularies for a variety of reasons. Having flexibility in formulary design means that plan sponsors may be able to leverage steeper rebates or discounts from a drug manufacturer by excluding a competitor’s product from its formulary or placing the competitor’s drug on a non-preferred tier. Part D enrollees may benefit from negotiated rebates if lower overall plan costs translates to lower plan premiums. But Part D enrollees who are prescribed a drug that is not covered by their plan would either have to pay the total cost of the drug on their own (which is unlikely in the case of expensive specialty tier medications), switch to an alternative medication that is covered by their plan, or appeal to their plan to cover their drug that is not on the formulary.

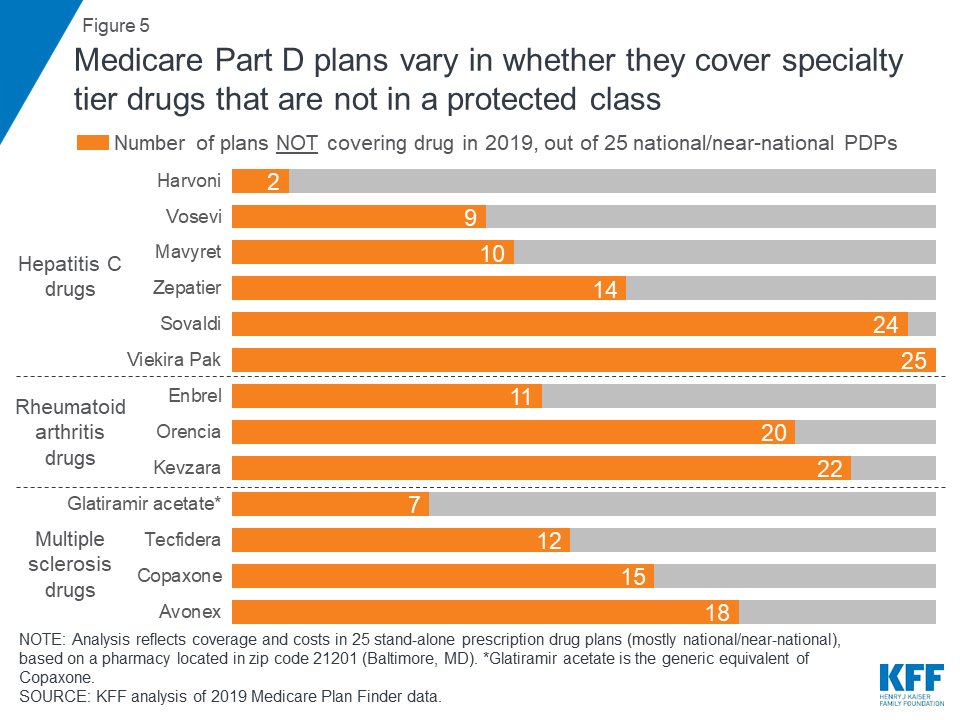

Sixteen of the 30 studied specialty drugs are covered by all plans in our analysis in 2019, 14 of which are for cancer, which is one of the six protected classes. In contrast, 12 of the studied specialty drugs are not covered by some plans and two drugs are not covered by any plan in our analysis (Figure 5).

Some plans cover a larger number of specialty drugs to treat each condition than other plans (outside of the protected-class cancer drugs). None of the 25 plans in this analysis covers all of the specialty tier drugs for hepatitis C, multiple sclerosis, or rheumatoid arthritis, and there is wide variation across plans in how many drugs they cover for each condition. For example, of the four MS drugs in our analysis, nine of the 25 plans cover just one of the four drugs, another nine plans cover two, and four plans cover three.

expected Annual Costs for SELECTED Specialty tier drugs When noT covered

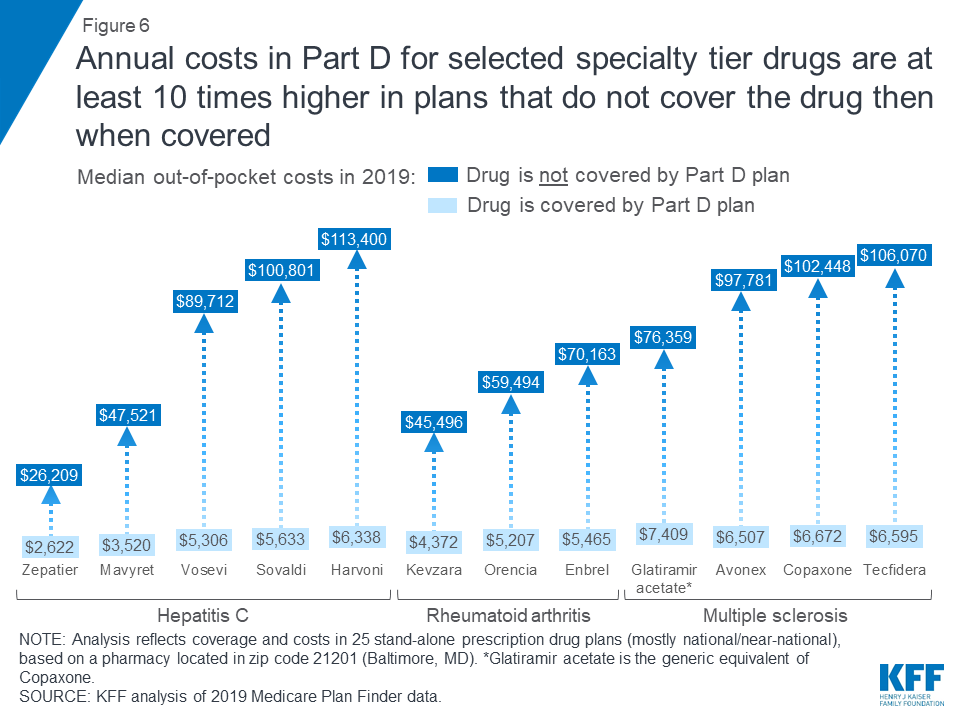

The annual cost for a specialty tier drug that is not covered on a plan’s formulary is substantially greater than the cost of that drug when it is covered. For the 14 specialty drugs in our analysis that are not covered by some or all plans, the median total annual cost when off formulary ranges from $26,209 for Zepatier to $145,769 for Gleevec—amounts that exceed the limits of affordability for the vast majority of Part D enrollees.

For the 12 specialty tier drugs in our analysis covered by some but not all plans, the median annual cost among plans that do not cover the drug is at least 10 times higher than the median out-of-pocket cost when it is covered (Figure 6). For example, the total median annual off-formulary cost for the hepatitis C drug Mavyret, is $47,521 compared to $3,520 in median annual out-of-pocket costs when covered; the total median annual off-formulary cost for the MS drug Tecfidera is $106,070, compared to $6,595 in median out-of-pocket costs when covered.

Between 2016 and 2019, the median annual out-of-pocket cost for several specialty tier drugs in our analysis increased by 12 percent, on average, even as the coverage gap for brands was closing.

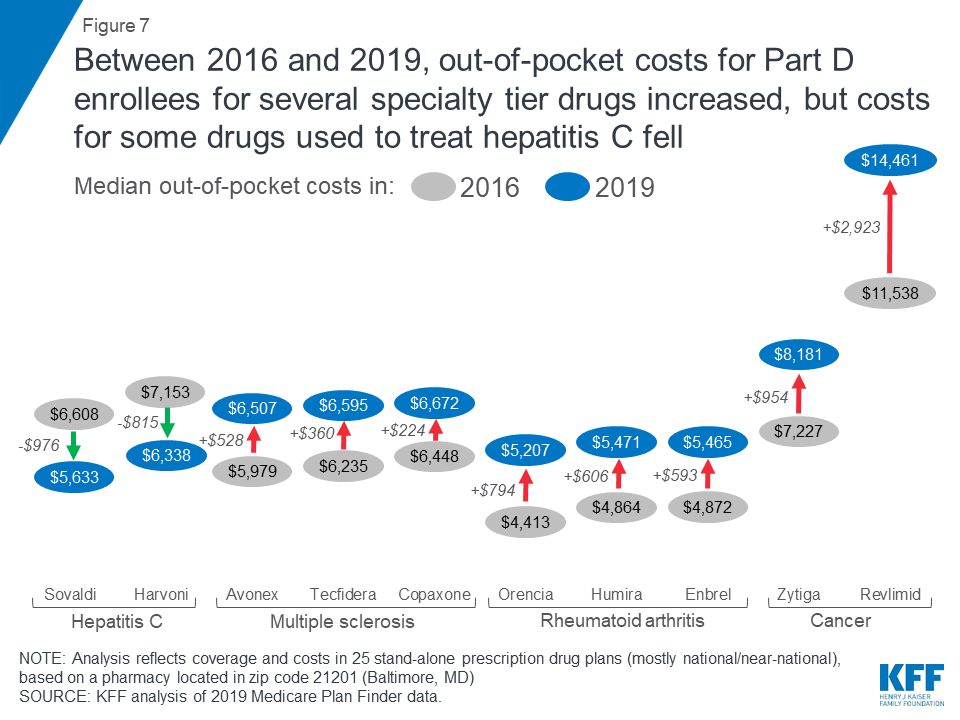

To examine the change in out-of-pocket costs for specialty tier drugs over time, we compared 2016 and 2019 costs for 10 of the 30 drugs in our current analysis that were included in our prior study and covered by at least one plan in 2019. In 2019, expected annual out-of-pocket costs for eight of the 10 specialty tier drugs are 12 percent higher than in 2016, on average (an increase of $873) (Figure 7, Table 3). For two of the 10 drugs, Harvoni and Sovaldi—both used to treat hepatitis C—median annual out-of-pocket costs in 2019 are 13 percent lower than in 2016, on average (a decrease of $896), possibly due to the entrance of competitor products since the end of 2015, and other factors related to changes in the benefit design (lower cost sharing in the gap, the manufacturer price discount, and a higher out-of-pocket threshold for catastrophic coverage), combined with the limited duration of treatment for hepatitis C drugs, that translate to a reduction in annual out-of-pocket costs for enrollees taking these two drugs in 2019. Of the 12 specialty tier drugs in our previous analysis, two drugs (Viekira Pak and Gleevec) are not covered by any plan in our analysis in 2019, so we could not calculate a change in the median out-of-pocket cost for these drugs.

For the eight specialty drugs in our analysis in both years where Part D enrollees can expect to pay more out-of-pocket in 2019 than in 2016, median annual cost increases range from $224 for the MS drug Copaxone to $2,923 for Revlimid, a drug for multiple myeloma. The expected annual out-of-pocket cost for Copaxone is $6,672 in 2019, up from $6,448 in 2016, while the expected annual cost for Revlimid increased from $11,538 to $14,461 over these years. Conversely, median annual out-of-pocket costs for two hepatitis C specialty drugs decreased between 2016 and 2019—by $976 for Sovaldi (from $6,608 to $5,633) and $815 for Harvoni (from $7,153 to $6,338).

With the now-complete closure of the Part D coverage gap for brand-name drugs, enrollees who take selected specialty tier drugs can expect to face lower out-of-pocket costs below the catastrophic threshold in 2019 than in 2016, but higher costs above. Under the current benefit design, beneficiaries pay 25 percent of total costs for brand-name drugs in the coverage gap in 2019, down from 45 percent in 2016, and the manufacturer discount on brand-name drugs in the coverage gap increased from 50 percent to 70 percent between 2018 and 2019, generating even greater savings for enrollees taking brand-name drugs with spending in the coverage gap.

As an example, for Humira, median out-of-pocket costs below the catastrophic coverage threshold decreased by $99 between 2016 and 2019 (from $3,155 to $3,057), while costs above the catastrophic threshold increased by $705 over these years (from $1,709 to $2,414)—and in total, expected annual out-of-pocket costs for Humira are $606 (12%) higher in 2019 than in 2016 (Figure 8).

Thus, while the closing of the coverage gap has reduced out-of-pocket costs for Part D enrollees who reach the gap but not the catastrophic phase of the benefit, enrollees can expect to see higher annual out-of-pocket costs for several specialty tier drugs in 2019 compared to 2016. This is because higher underlying prices for these drugs translate to higher out-of-pocket costs in the catastrophic phase of the benefit, where beneficiaries pay 5 percent of the price of the drug, which more than offsets any savings from lower costs in the gap.

Discussion

This analysis shows that Medicare Part D enrollees who do not receive low-income subsidies can expect to pay thousands of dollars in out-of-pocket costs for a single specialty tier drug in 2019, even though the Part D coverage gap for brands is now fully closed. Although Part D offers catastrophic coverage for high drug costs, beneficiaries can still face substantial out-of-pocket costs for expensive medications, including many drugs for cancer, hepatitis C, multiple sclerosis, and rheumatoid arthritis, because there is no hard cap on spending in the Part D benefit. Part D enrollees who need specialty tier drugs that are not covered by their plan could be exposed to substantial costs—which would likely mean not filling a prescription for the off-formulary drug and instead taking a therapeutic substitute.

The high cost of prescription drugs has contributed to growing public support for the government to take action to address drug costs. A majority (80%) of Americans say the cost of prescription drugs is unreasonable, and there is broad support among Democrats, Republicans, and Independents for several different options to lower drug costs. The Trump Administration has endorsed a number of proposals to address rising drug costs for Medicare and beneficiaries, including adding a hard cap on Part D out-of-pocket spending. The Administration has also proposed changes to reduce spending on drugs covered under Part B, including a proposal to benchmark U.S. prices against prices set internationally. Lawmakers in Congress are also moving forward with proposals to reduce drug costs, including allowing Medicare to negotiate drug costs, letting patients import prescription drugs from Canada, and expediting the introduction of generic and other prescription drugs. As more expensive drugs come to market in the future, the high cost of prescription drugs will continue to be a pressing issue for policymakers and a major pocketbook issue for patients.

Tables

| Table 1: Expected Annual Costs in Medicare Part D Plans for 30 Specialty Tier Drugs, 2019 | ||||||

| Health condition | Drug name | Full drug costs | Out-of-pocket drug costs | |||

| Off formulary | On formulary | On formulary | ||||

| Median annual total cost | Median annual total cost | Median annual out-of-pocket cost | Cost above catastrophic threshold | Percent of median cost above threshold | ||

| Cancer | Alunbrig | N/A | $187,893 | $11,014 | $8,628 | 78% |

| Calquence | N/A | $171,481 | $10,175 | $7,868 | 77% | |

| Erleada | N/A | $137,553 | $8,586 | $6,313 | 74% | |

| Gleevec | $145,787 | N/A | N/A | N/A | N/A | |

| Idhifa | N/A | $300,858 | $16,551 | $14,276 | 86% | |

| Imatinib mesylate | N/A | $91,844 | $8,983 | $3,883 | 43% | |

| Kisqali | N/A | $207,084 | $12,145 | $9,587 | 79% | |

| Nerlynx | N/A | $143,175 | $8,842 | $6,571 | 74% | |

| Revlimid | N/A | $259,051 | $14,461 | $12,186 | 84% | |

| Rubraca | N/A | $176,789 | $10,386 | $8,111 | 78% | |

| Rydapt | N/A | $206,423 | $11,830 | $9,554 | 81% | |

| Venclexta | N/A | $135,686 | $8,712 | $6,227 | 71% | |

| Verzenio | N/A | $150,126 | $9,164 | $6,889 | 75% | |

| Zejula | N/A | $202,330 | $11,625 | $9,350 | 80% | |

| Zytiga | N/A | $125,351 | $8,181 | $5,754 | 70% | |

| Hepatitis C | Epclusa | N/A | $75,538 | $5,283 | $3,010 | 57% |

| Harvoni | $113,400 | $96,732 | $6,338 | $4,063 | 64% | |

| Mavyret | $47,522 | $40,393 | $3,520 | $1,251 | 36% | |

| Sovaldi | $100,802 | $82,747 | $5,633 | $3,368 | 60% | |

| Viekira Pak | $99,985 | N/A | N/A | N/A | N/A | |

| Vosevi | $89,713 | $76,256 | $5,306 | $3,045 | 57% | |

| Zepatier | $26,210 | $22,377 | $2,622 | $351 | 13% | |

| Multiple sclerosis | Avonex | $97,799 | $85,532 | $6,507 | $3,660 | 56% |

| Copaxone | $102,456 | $89,614 | $6,672 | $3,849 | 58% | |

| Glatiramer acetate | $76,375 | $60,385 | $7,409 | $2,309 | 31% | |

| Tecfidera | $106,088 | $92,285 | $6,595 | $4,238 | 64% | |

| Rheumatoid arthritis | Enbrel | $70,171 | $60,621 | $5,465 | $2,398 | 44% |

| Humira | N/A | $59,078 | $5,471 | $2,414 | 44% | |

| Kevzara | $45,514 | $39,809 | $4,372 | $1,451 | 33% | |

| Orencia | $59,511 | $48,838 | $5,207 | $1,825 | 35% | |

| NOTE: Analysis reflects coverage and costs in 25 stand-alone prescription drug plans (mostly national/near-national), based on a pharmacy located in zip code 21201 (Baltimore, MD). ‘N/A’ is not applicable.SOURCE: KFF analysis of 2019 Medicare Plan Finder data. | ||||||

| Table 2: Formulary Tier Placement and Utilization Management Restrictions in Medicare Part D Plans for 30 Specialty Tier Drugs, 2019 | ||||||||

| Formulary tier placement | Utilization management restrictions | |||||||

| Number of plans placing drug on: | Off formulary | Number of plans requiring: | ||||||

| Health Condition | Drug Name | Preferred brand tier | Non-preferred drug tier | Specialty tier | Prior authorization | Quantity limits | Step therapy | |

| Cancer | Alunbrig | 0 | 4 | 21 | 0 | 25 | 16 | 0 |

| Calquence | 0 | 4 | 21 | 0 | 25 | 16 | 0 | |

| Erleada | 0 | 0 | 25 | 0 | 25 | 10 | 0 | |

| Gleevec | 0 | 0 | 0 | 25 | 0 | 0 | 0 | |

| Idhifa | 0 | 0 | 25 | 0 | 25 | 16 | 0 | |

| Imatinib mesylate | 0 | 0 | 25 | 0 | 25 | 24 | 0 | |

| Kisqali | 0 | 4 | 21 | 0 | 25 | 15 | 0 | |

| Nerlynx | 0 | 0 | 25 | 0 | 25 | 11 | 0 | |

| Revlimid | 0 | 4 | 21 | 0 | 25 | 24 | 0 | |

| Rubraca | 0 | 0 | 25 | 0 | 25 | 15 | 0 | |

| Rydapt | 0 | 0 | 25 | 0 | 25 | 16 | 0 | |

| Venclexta | 0 | 7 | 18 | 0 | 25 | 14 | 0 | |

| Verzenio | 0 | 4 | 21 | 0 | 25 | 16 | 0 | |

| Zejula | 0 | 0 | 25 | 0 | 25 | 16 | 0 | |

| Zytiga | 0 | 6 | 19 | 0 | 25 | 15 | 0 | |

| Hepatitis C | Epclusa | 1 | 0 | 24 | 0 | 25 | 15 | 0 |

| Harvoni | 1 | 0 | 22 | 2 | 23 | 13 | 0 | |

| Mavyret | 0 | 0 | 15 | 10 | 15 | 6 | 0 | |

| Sovaldi | 0 | 0 | 1 | 24 | 1 | 1 | 0 | |

| Viekira Pak | 0 | 0 | 0 | 25 | 0 | 0 | 0 | |

| Vosevi | 0 | 0 | 16 | 9 | 16 | 6 | 0 | |

| Zepatier | 0 | 0 | 11 | 14 | 11 | 2 | 0 | |

| Multiple sclerosis | Avonex | 0 | 0 | 7 | 18 | 6 | 6 | 0 |

| Copaxone | 0 | 0 | 10 | 15 | 10 | 10 | 0 | |

| Glatiramer acetate | 0 | 0 | 18 | 7 | 15 | 15 | 0 | |

| Tecfidera | 0 | 0 | 13 | 12 | 11 | 8 | 0 | |

| Rheumatoid arthritis | Enbrel | 1 | 0 | 13 | 11 | 14 | 12 | 0 |

| Humira | 1 | 0 | 24 | 0 | 25 | 21 | 0 | |

| Kevzara | 0 | 0 | 3 | 22 | 3 | 3 | 0 | |

| Orencia | 0 | 0 | 5 | 20 | 5 | 0 | 0 | |

| NOTE: Analysis reflects coverage and costs in 25 stand-alone prescription drug plans (mostly national/near-national), based on a pharmacy located in zip code 21201 (Baltimore, MD).SOURCE: KFF analysis of 2019 Medicare Plan Finder data. | ||||||||

| Table 3: Expected Annual Costs in Medicare Part D Plans for 12 Specialty Tier Drugs, 2016 and 2019 | ||||||

| Health condition | Drug name | Full cost(when covered) | Median out-of-pocket cost up to catastrophic phase | Median out-of-pocket cost in catastrophic phase | Total median out-of-pocket cost | |

| Cancer | Gleevec* | 2016 | $123,158 | $2,780 | $5,723 | $8,503 |

| 2019 | n/a | n/a | n/a | n/a | ||

| change | n/a | n/a | n/a | n/a | ||

| Revlimid | 2016 | $183,517 | $2,780 | $8,758 | $11,538 | |

| 2019 | $259,051 | $2,275 | $12,186 | $14,461 | ||

| change | $75,534 | -$505 | $3,428 | $2,923 | ||

| Zytiga | 2016 | $97,314 | $2,780 | $4,447 | $7,227 | |

| 2019 | $125,351 | $2,428 | $5,754 | $8,181 | ||

| change | $28,037 | -$352 | $1,307 | $954 | ||

| Hepatitis C | Harvoni | 2016 | $95,824 | $2,780 | $4,373 | $7,153 |

| 2019 | $96,732 | $2,275 | $4,063 | $6,338 | ||

| change | $908 | -$505 | -$310 | -$815 | ||

| Sovaldi | 2016 | $85,177 | $2,780 | $3,828 | $6,608 | |

| 2019 | $82,747 | $2,265 | $3,368 | $5,633 | ||

| change | -$2,430 | -$515 | -$460 | -$976 | ||

| Viekira Pak* | 2016 | $82,936 | $2,786 | $3,730 | $6,516 | |

| 2019 | n/a | n/a | n/a | n/a | ||

| change | n/a | n/a | n/a | n/a | ||

| Multiple sclerosis | Avonex | 2016 | $64,173 | $3,141 | $2,838 | $5,979 |

| 2019 | $85,532 | $2,847 | $3,660 | $6,507 | ||

| change | $21,359 | -$294 | $822 | $528 | ||

| Copaxone | 2016 | $73,922 | $3,143 | $3,305 | $6,448 | |

| 2019 | $89,614 | $2,823 | $3,849 | $6,672 | ||

| change | $15,692 | -$320 | $544 | $224 | ||

| Tecfidera | 2016 | $69,393 | $3,167 | $3,068 | $6,235 | |

| 2019 | $92,285 | $2,357 | $4,238 | $6,595 | ||

| change | $22,892 | -$811 | $1,170 | $360 | ||

| Rheumatoid arthritis | Enbrel | 2016 | $41,564 | $3,196 | $1,676 | $4,872 |

| 2019 | $60,621 | $3,068 | $2,398 | $5,465 | ||

| change | $19,057 | -$128 | $721 | $593 | ||

| Humira | 2016 | $42,059 | $3,155 | $1,709 | $4,864 | |

| 2019 | $59,078 | $3,057 | $2,414 | $5,471 | ||

| change | $17,019 | -$99 | $705 | $606 | ||

| Orencia | 2016 | $38,407 | $2,856 | $1,557 | $4,413 | |

| 2019 | $48,838 | $3,382 | $1,825 | $5,207 | ||

change | $10,432 | $527 | $268 | $794 | ||

| NOTE: Analysis reflects coverage in 20 stand-alone prescription drug plans in 2016 and 25 stand-alone prescription drug plans (mostly national/near-national), based on a pharmacy located in zip code 21201 (Baltimore, MD). *Viekira Pak and Gleevec are not covered by any plan in our analysis in 2019.SOURCE: KFF analysis of 2016 and 2019 Medicare Plan Finder data. | ||||||

Methods

Data collection, plans, and pharmacies

All data were collected from the Medicare Plan Finder website in November-December 2018, using zip code 21201 in Baltimore, MD, which corresponds to prescription drug plan (PDP) region 5, covering Washington, D.C., Delaware, and Maryland—the same zip code used in our previous analysis. Data were collected for the 25 stand-alone PDPs in Region 5, 24 of which are offered by nine firms that sponsor plans on a national or near-national basis (at least 33 of the 34 PDP regions, excluding the territories). Medicare Advantage drug plans were excluded from the analysis because plan participation varies geographically and few plans are offered on a national or near-national basis.

We use one zip code to represent PDP costs nationally because most PDPs (including 24 of the 25 PDPs in Region 5) are offered on a national or near-national basis; 20 of the 25 PDPs in Region 5 are offered in all 34 PDP regions and 4 are offered in 33 regions; one PDP is offered in only four PDP regions. Based on our analysis of January 2019 enrollment data from the Centers for Medicare & Medicaid Services, the 25 PDPs in this analysis have a total of 19.4 million enrollees across all regions where they are offered, which is 76.5 percent of total PDP enrollment nationwide. As such, the analysis is broadly applicable to a majority of PDP enrollees nationwide.

Moreover, it is common for PDPs to use the same formulary and the same formulary tier structure in all regions. Some of the national and near-national PDPs have modest regional variation in cost-sharing amounts for generic and brand-name drugs, and there may be modest variation in the full price of drugs across pharmacies and regions, but there is no variation in the specialty tier coinsurance rate, which is the cost-sharing tier relevant to the drugs in our analysis in the vast majority of cases.

For all drugs and plans in our analysis, cost and coverage data were collected from a Rite Aid pharmacy on Martin Luther King Jr. Boulevard in Baltimore, which was a standard cost-sharing pharmacy for 14 PDPs in Region 5 and a preferred cost-sharing pharmacy for 10 PDPs in this region. For one of the 25 PDPs (Aetna Medicare Rx Select), the Rite Aid pharmacy was out of network; therefore, for this plan, we obtained cost and coverage information from a CVS pharmacy on Charles Street in Baltimore. It is important to note that the standard versus preferred cost-sharing pharmacy distinction is generally not relevant for our analysis, because none of the 25 PDPs in Region 5 vary their specialty tier coinsurance rate by pharmacy type.

Drug selection

Our analysis focused on 30 specialty tier drugs across four health conditions that are commonly treated by specialty drugs: cancer, hepatitis C, multiple sclerosis, and rheumatoid arthritis. The list of 30 drugs includes 12 from our original 2016 analysis, which were available at the end of 2015, and an additional 18 drugs that were approved by the FDA in the intervening years (2016, 2017, and 2018, through November) for the four health conditions in our analysis and which are covered by Medicare Part D (as opposed to Part B) (as verified by the 09/14/18 version of the 2019 Medicare Part D formulary reference file).

For 19 of the 30 specialty tier drugs in our analysis, the dosage, form, and quantity of the medication used per month were taken from the defaults offered by the Medicare Plan Finder. For 11 drugs, the Plan Finder dosage, form, and/or quantity did not match the dosage and administration recommendations in the prescribing information for each drug available from the FDA, so we modified the Plan Finder dosages, forms, and/or quantities accordingly.

Drug cost and coverage information

For each drug, we collected information on the full cost (price), cost-sharing amounts paid by enrollees not receiving low-income subsidies (LIS), tier placement, and utilization management restrictions.

We calculated a drug’s expected full cost in 2019 when covered by calculating the median of the annual total cost for each drug among plans that include that drug on formulary, based on a full year of utilization (or in the case of the hepatitis C drugs, for the recommended treatment duration, which is typically 12 weeks); the full cost of non-covered drugs is the median of the annual total cost for each drug among plans that do not include the drug on formulary. We calculated expected annual out-of-pocket costs for each drug by calculating the median of the total annual out-of-pocket cost that a non-LIS enrollee in each plan would pay for the given drug in 2019, based on a full year of utilization (or in the case of the hepatitis C drugs, for the full treatment duration, which is typically 12 weeks), among plans that include that drug on formulary, excluding the monthly plan premium.

Cost information is presented on an annual basis because the 30 studied drugs are priced high enough that out-of-pocket costs are determined based on all benefit phases (deductible, initial coverage level, coverage gap, and catastrophic coverage).

The full cost of the drug is shown on the Medicare Plan Finder. The amount shown if the drug is on formulary is based on the drug’s unit price and dispensing fee as submitted by the plan. For off-formulary drugs, prices are inserted by CMS using a standard formula to approximate cash pricing: the wholesale acquisition cost (WAC) plus 15 percent for brands and WAC plus 20 percent for generics. The WAC is a publicly available list price that approximates what retail pharmacies pay wholesalers for single source drugs and is taken by CMS from the Medispan database, with First Data Bank as a backup. For the drugs in this analysis, the CMS-supplied price tends to be about 10 percent to 20 percent higher than the median price for plans with the drug on formulary.

Cost sharing is shown on the Medicare Plan Finder for four phases of the Part D drug benefit. Cost sharing in the deductible phase (where applicable) is equal to the full cost of the drug. Cost sharing in the initial coverage phase is determined based on the tier placement and cost-sharing structure for the particular plan; the specialty tier coinsurance rate ranges from 25 percent to 33 percent. Cost sharing in the coverage gap phase is based on a statutory formula that takes into account the statutory manufacturer’s discount for most brand drugs (70 percent in 2019) and a required coinsurance amount (25 percent in 2019). Cost sharing in the catastrophic phase is based on a statutory rule: the greater of 5 percent of the full cost of the drug or a nominal copayment amount.

Tier placement is also shown on the Medicare Plan Finder for each drug, as is the use of utilization management restrictions, including prior authorization, step therapy, and quantity limits.