The independent source for health policy research, polling, and news.

Medicare Advantage Insurers Report Much Higher Gross Margins Per Enrollee Than Insurers in Other Markets

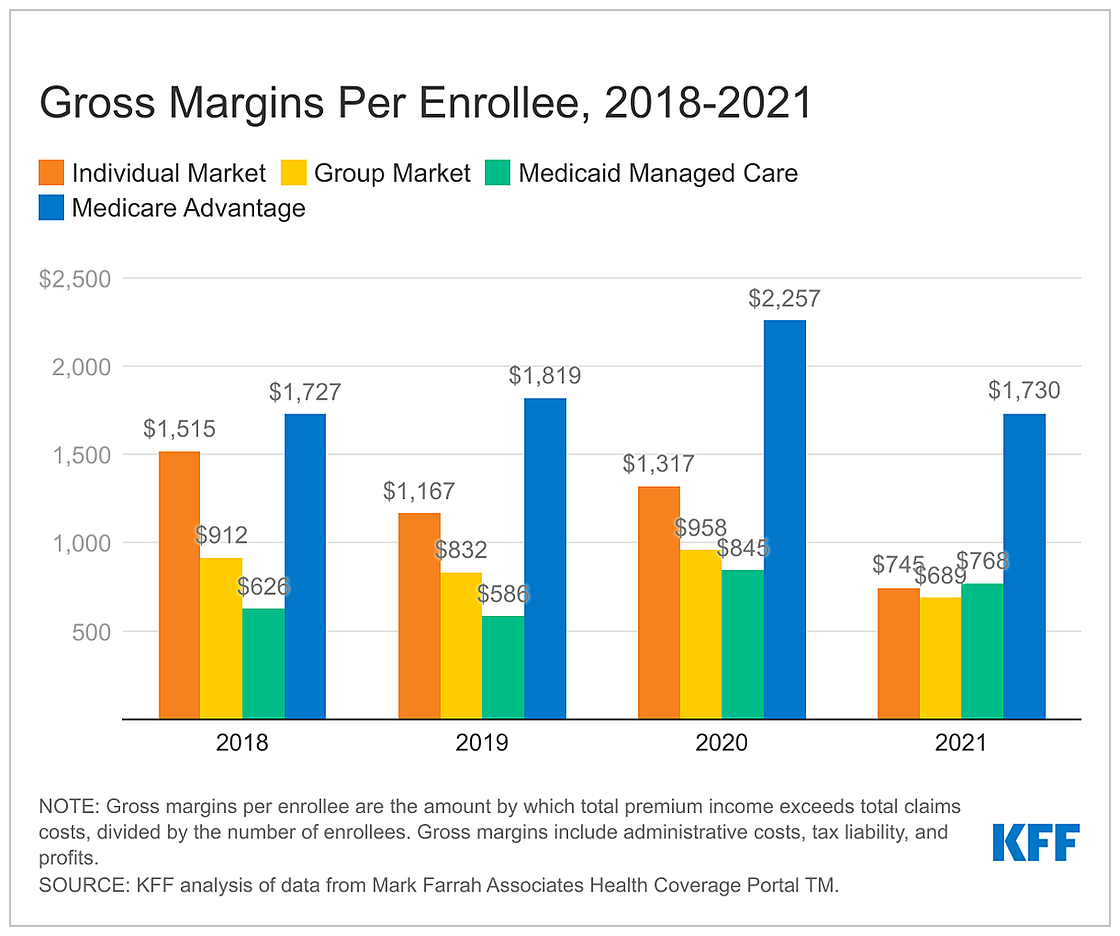

A new analysis of health insurers’ 2021 financial data shows that insurers continue to report much higher gross margins per enrollee in the Medicare Advantage market than in other health insurance markets.

The analysis examines insurers’ financial data in the Medicare Advantage, Medicaid managed care, individual (non-group), and fully insured group (employer) markets.

In 2021, Medicare Advantage insurers reported gross margins averaging $1,730 per enrollee, at least double the margins reported by insurers in the individual/non-group market ($745), the fully insured group/employer market ($689), and the Medicaid managed care market ($768).

For Medicare Advantage insurers, the gross margins per enrollee in 2021 were similar to the period before the COVID-19 pandemic. Margins per enrollee for the individual and group markets in 2021 were below pre-pandemic levels, while the margins per enrollee for Medicaid managed care insurers are higher.

The high margins per member for Medicare Advantage insurers occur following years of rapid growth in the market, with more than half of eligible beneficiaries expected to enroll in Medicare Advantage plans this year.

The analysis also examines the percentage of premium income that insurers pay out in claims, also called the medical-loss ratio, and finds insurers across the four markets reported similar medical-loss ratios in 2021.

“Health Insurer Financial Performance in 2021” is available online.