Annual Family Premiums for Employer Coverage Rise 6% in 2025, Nearing $27,000, with Workers Paying $6,850 Toward Premiums Out of Their Paychecks

More of the Largest Firms Cover GLP-1s for Weight Loss, and Use Is Higher Than Expected; Some May Be Limiting Coverage

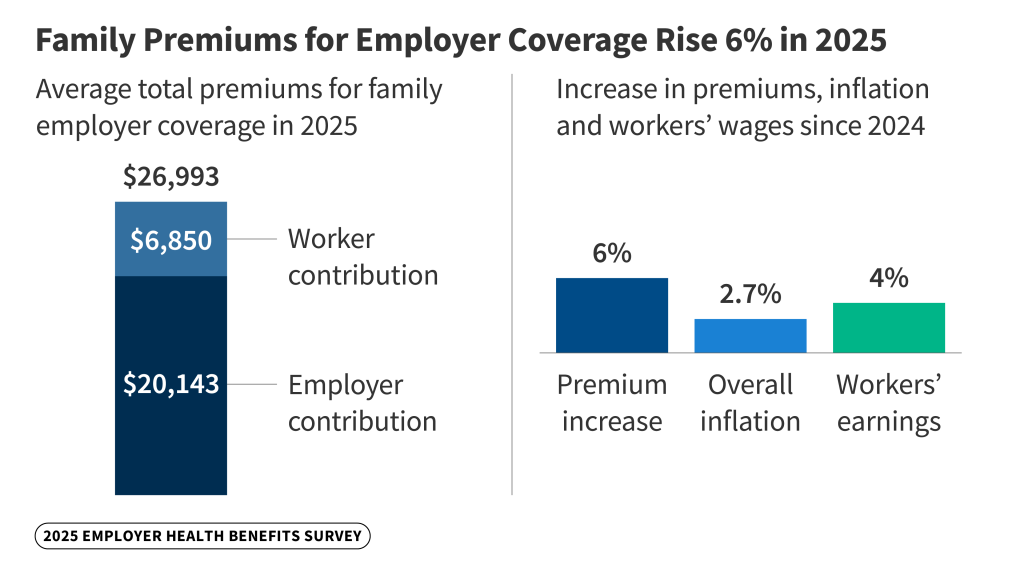

Family premiums for employer-sponsored health insurance reached an average of $26,993 this year, KFF’s annual benchmark health benefits survey of large and smaller employers finds. On average, workers contribute $6,850 annually to the cost of family coverage, with employers paying the rest.

Family premiums are up 6%, or $1,408, from last year, similar to the 7% increase recorded in each of the previous two years. This year’s increase compares to general inflation of 2.7% and wage growth of 4% over the same period.

Over the past five years, the cumulative increase in family premiums (26%) and in what workers pay toward family premiums (23%) is similar to inflation (23.5%) and wage growth (28.6%).

Many employers may be bracing for higher costs next year, with insurers requesting double-digit increases in the small-group and individual markets on average, possibly foreshadowing big increases in the large-group markets as well. Employers continue to single out drug prices as a factor contributing to higher premiums in recent years.

Among large firms (at least 200 workers), who are more likely to know details of their health insurance costs, more than a third (36%) say prescription drug prices contributed “a great deal” to higher premiums in recent years. Significant shares say the same about coverage for new prescription drugs (22%) as well as the prevalence of chronic disease (30%), higher utilization of services (26%), and hospital prices (22%).

“There is a quiet alarm bell going off. With GLP-1s, increases in hospital prices, tariffs and other factors, we expect employer premiums to rise more sharply next year,” KFF President and CEO Drew Altman said. “Employers have nothing new in their arsenal that can address most of the drivers of their cost increases, and that could well result in an increase in deductibles and other forms of employee cost sharing again, a strategy that neither employers nor employees like but companies resort to in a pinch to hold down premium increases.”

About 154 million Americans under age 65 rely on employer-sponsored coverage, and the 27th annual survey of more than 1,800 employers with at least 10 workers provides a detailed picture of the trends affecting it.

In addition to the full report and summary of findings released today, Health Affairs is publishing an article with select findings online. The article will also appear in its November issue. And a new column from KFF’s Drew Altman discusses the limitations employers face trying to control health care costs and why more sharply rising premiums expected next year could lead to a new wave of rising deductibles.

Biggest Employers Add GLP-1 Coverage for Weight Loss, But Fret about Their Costs

About one in five (19%) of large firms offering health benefits say they cover costly GLP-1 drugs such as Wegovy for weight loss in 2025. A majority (57%) say they do not cover such drugs for weight loss, while about a quarter (24%) are unsure if their largest plan cover them.

Among the biggest firms (those with at least 5,000 workers), 43% now say they cover GLP-1 drugs for weight loss in their largest plan, up from 28% in 2024.

Many employers condition their coverage of these medications, and some require that enrollees take additional steps to address their weight. For example, about a third (34%) of large firms offering these drugs for weight loss require that enrollees meet with a dietician, therapist or other professional, or participate in a lifestyle program, for the drugs to be covered.

Even with such restrictions, the high cost of these drugs worries many employers. Most (59%) of the biggest employers (at least 5,000 workers) offering the drugs for weight loss say their cost has exceeded expectations, and two-thirds (66%) say that they had a “significant” impact on their health plan’s prescription drug spending.

Such factors could lead some employers to reduce or eliminate coverage or add additional restrictions. And while most large employers (44%) say covering GLP-1 drugs is either important or very important to their employees, just 1% of those not already offering coverage say they are “very likely” to do so next year.

A companion report for the Peterson-KFF Health System Tracker based on focus-group conversations highlights how the high costs of covering GLP-1 drugs is leading some employers to change how they cover the drugs, such as tightening utilization controls. Some employers report restricting coverage for enrollees with diabetes.

“Large employers know these new high-priced weight-loss drugs are an important benefit for their workers, but their costs often exceed their expectations,” KFF Senior Vice President and study author Gary Claxton said. “It’s not a surprise that some are rethinking access to the drugs for weight loss.”

More Workers Are in HSA-Qualified Plans as Average Deductible Reaches $1,886

The survey finds nearly three in 10 covered workers (29%) are now enrolled in high-deductible health plans that could be used with a tax-preferred Health Savings Account.

Among workers who face an annual deductible for single coverage, the average this year stands at $1,886, which compares to $1,773 last year. Deductibles are up 17% since 2020 when the average was $1,617.

On average, workers with a deductible at small firms (under 200 workers) face much larger deductibles than workers at larger firms ($2,631 vs. $1,670). More than half (53%) of covered workers at small firms now face a deductible of at least $2,000, and more than a third (36%) face an average single deductible of at least $3,000.

In 2025, nearly three-quarters (72%) face an out-of-pocket maximum of more than $3,000 for single coverage, including one in five (21%) who face an out-of-pocket maximum of more than $6,000.

Coverage for Part-Time and Low-Wage Workers Lags; Medicaid Can Fill Gaps

The survey also highlights some challenges facing part-time and low-wage workers in obtaining health coverage.

Part-time workers generally are not eligible for their employer’s health benefits, with only 27% of large firms and 18% of small firms offering coverage to part-time workers.

A much smaller share of workers is covered by their employer’s health benefits at firms with many low-wage workers (43%) than at firms with few low-wage workers (64%). One third (34%) of small employers that do not offer health benefits say that Medicaid is a “very important” source of coverage for their workers, and another one in five (22%) say Medicaid is “somewhat important.”

The survey also finds that Individual Coverage Health Reimbursement Arrangements (ICHRAs) — a much-hyped option to help workers purchase coverage through the Affordable Care Act (ACA) Marketplaces or elsewhere on the individual market —have not taken off.

Among small firms that don’t offer health benefits, 9% report offering funds to at least one worker to purchase their own coverage, similar to the share who said so last year (11%). Among the rest of non-offering small firms, just 2% say they were “very likely” to offer such assistance to any workers in the next two years. A companion report for the Peterson-KFF Health System Tracker highlights employers’ experience with ICHRA and how this nascent market is taking shape.