California’s Uninsured on the Eve of ACA Open Enrollment

This report presents the findings of a baseline survey of California’s uninsured adult population just before the start of the first open enrollment period under the Affordable Care Act (ACA). It will be followed by three other surveys over the course of the next two years that will capture the changing experiences and attitudes of this same group of 2,000 people over time, whether they obtain coverage or remain uninsured.

The report analyzes the uninsured population in terms of four basic groups: those whose incomes would put them in the ‘Medi-Cal target group’ (138 percent of the federal poverty level (FPL) or less), possibly qualifying them to be covered by California’s Medicaid program; those whose incomes would put them in the ‘exchange subsidy target group’ (greater than 138 percent and up to 400 percent FPL), giving them access to subsidies to purchase insurance through the state’s new health insurance marketplace, Covered California; those who will be able to shop on the exchange but will not be eligible for tax credits based on their relatively higher incomes (greater than 400 percent FPL); and finally those uninsured who will not be able to access health insurance via either option due to their immigration status. The first three groups together comprise a population we are terming the ‘eligible uninsured’.

This report presents the findings of a baseline survey of California’s uninsured adult population just before the start of the first open enrollment period under the Affordable Care Act (ACA). It will be followed by three other surveys over the course of the next two years that will capture the changing experiences and attitudes of this same group of 2,000 people over time, whether they obtain coverage or remain uninsured.

The report analyzes the uninsured population in terms of four basic groups: those whose incomes would put them in the ‘Medi-Cal target group’ (138 percent of the federal poverty level (FPL) or less), possibly qualifying them to be covered by California’s Medicaid program; those whose incomes would put them in the ‘exchange subsidy target group’ (greater than 138 percent and up to 400 percent FPL), giving them access to subsidies to purchase insurance through the state’s new health insurance marketplace, Covered California; those who will be able to shop on the exchange but will not be eligible for tax credits based on their relatively higher incomes (greater than 400 percent FPL); and finally those uninsured who will not be able to access health insurance via either option due to their immigration status. The first three groups together comprise a population we are terming the ‘eligible uninsured’.

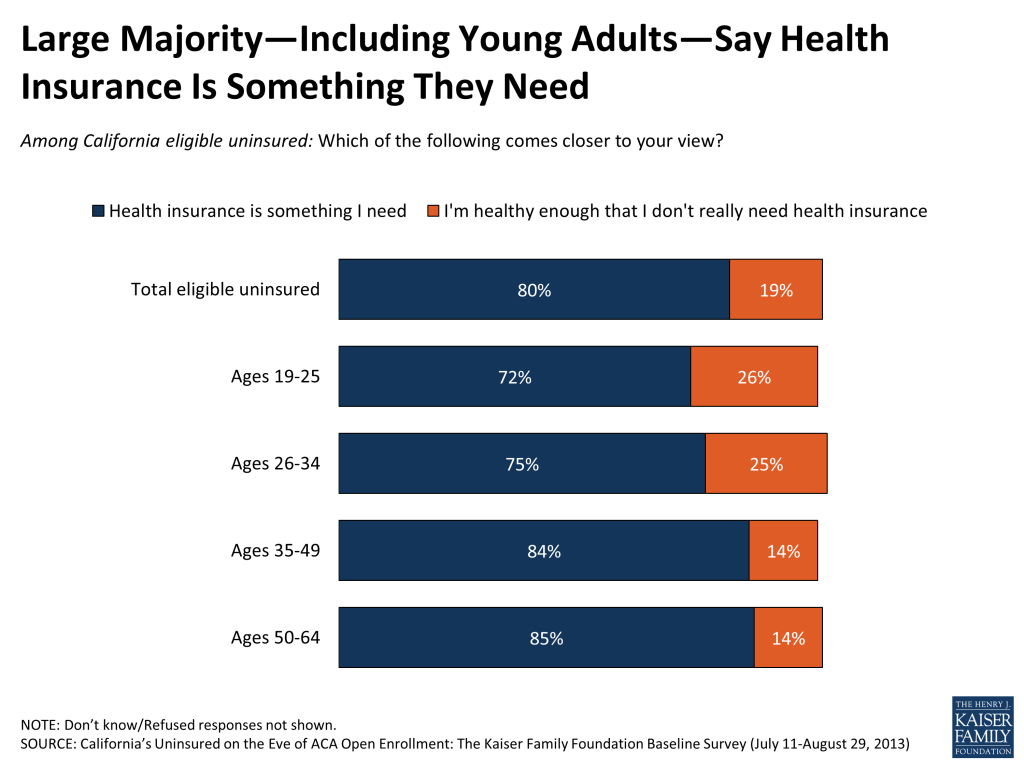

Eight in ten uninsured Californians feel the need for health insurance

- According to the survey, a large majority of California’s eligible uninsured1 – eight in ten – do feel they need health insurance coverage. Even seven in ten (72 percent) of the youngest uninsured Californians – those ages 19 to 25 – say they need health insurance.

- Many have not had coverage for some time, though. About two-thirds have been without health insurance for at least two years. One in five say they’ve never had health insurance. Cost remains the primary reason for not having health insurance, followed by job loss.

- A majority of the uninsured (57 percent) do believe that health insurance is worth the money it costs, while just over a third disagree. These views are obviously based on perceptions of the cost of coverage before the opening of exchange enrollment in October.

California’s uninsured and the ACA: A steep learning curve ahead, but cautious optimism

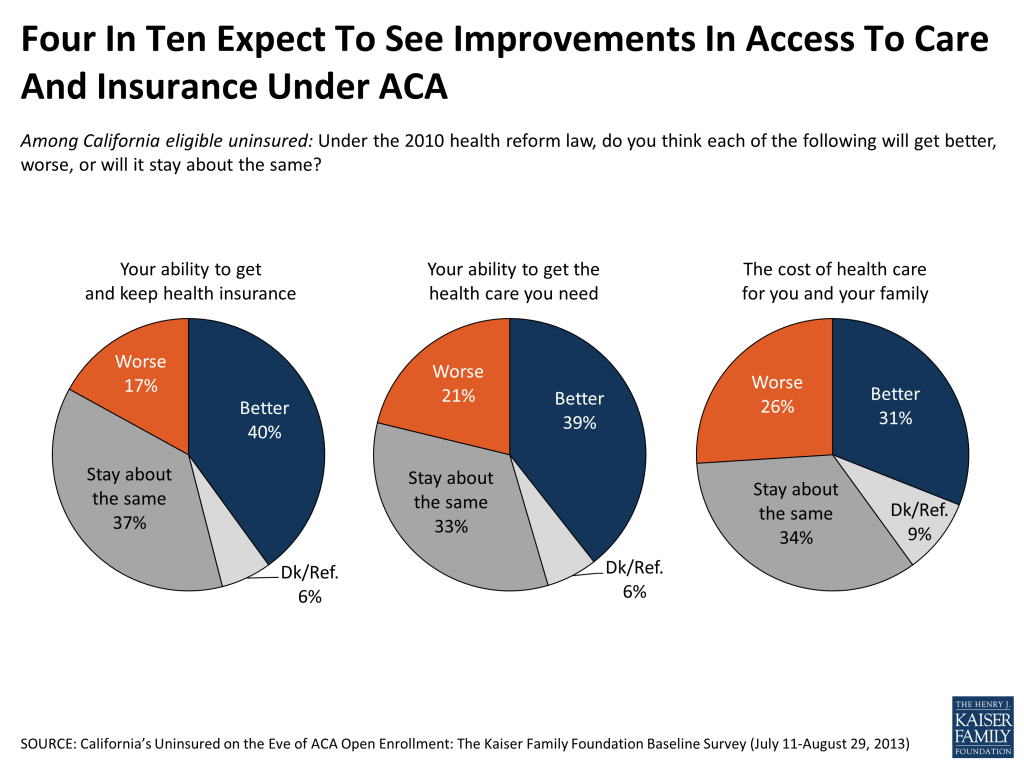

- California’s eligible uninsured tilt more optimistic than pessimistic on the ACA’s expected impact in their own lives: Four in ten believe the law will enhance their ability to get health care and health insurance, compared to about two in ten who expect the law to make this more difficult. About a third don’t expect it to make any difference.

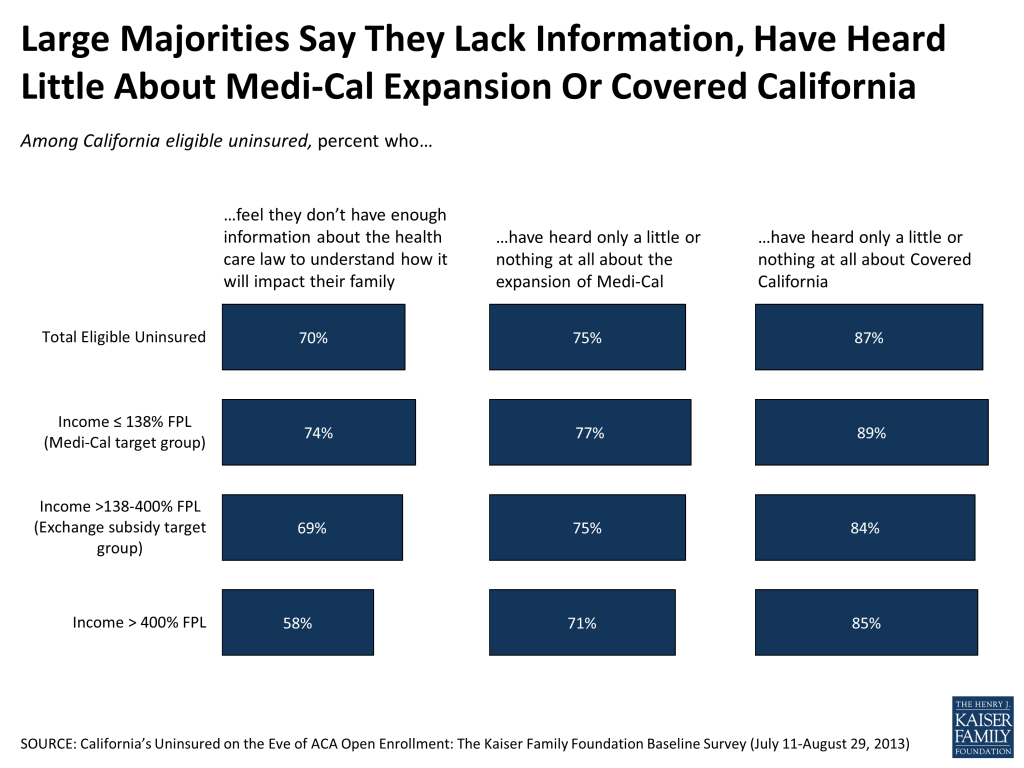

- Yet at the same time, the large majority of California’s eligible uninsured –seven in ten (70 percent) –say that as of late August, before the start of the most intensive phase of outreach, they don’t yet have enough information about the ACA to understand how it will impact them in concrete terms.

- At this early stage, then, among those whose incomes put them in the Medi-Cal target group, three-quarters (77 percent) say they have heard little or nothing about the program’s upcoming expansion. And among those in the exchange subsidy target group, more than eight in ten say they have heard little or nothing about the state’s newly minted health insurance marketplace.

As of late August, many doubt they are eligible, but large shares say if they qualified for Medi-Cal they would join

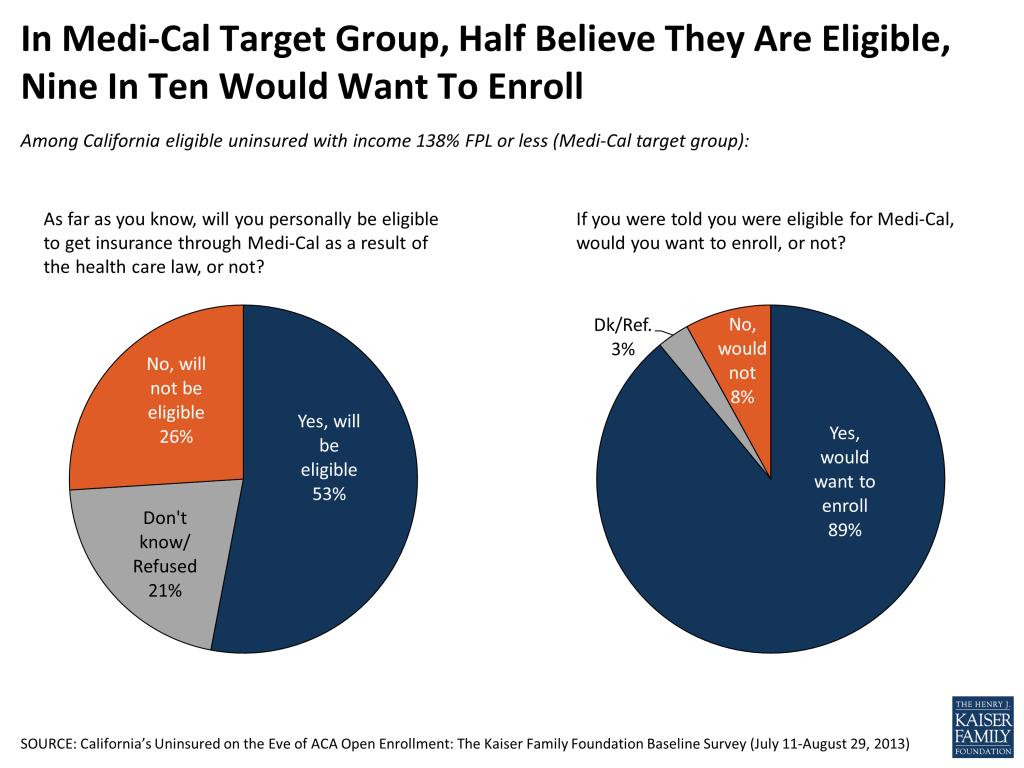

- As of late August, there is widespread confusion among the state’s uninsured as to whether they are eligible for any of the newly expanded benefits: three-quarters in the income group targeted to get subsidies in the marketplace are either not sure or presume they will not be eligible for such financial assistance. Only half of those in the Medi-Cal income group presume they will be qualified for the program.

- But there is a good deal of interest in signing up for Medi-Cal if those eligibility uncertainties could be put to rest. Nine in ten (89 percent) in the Medi-Cal eligible income group say that if told they qualified for the state health insurance program, they would want to enroll.

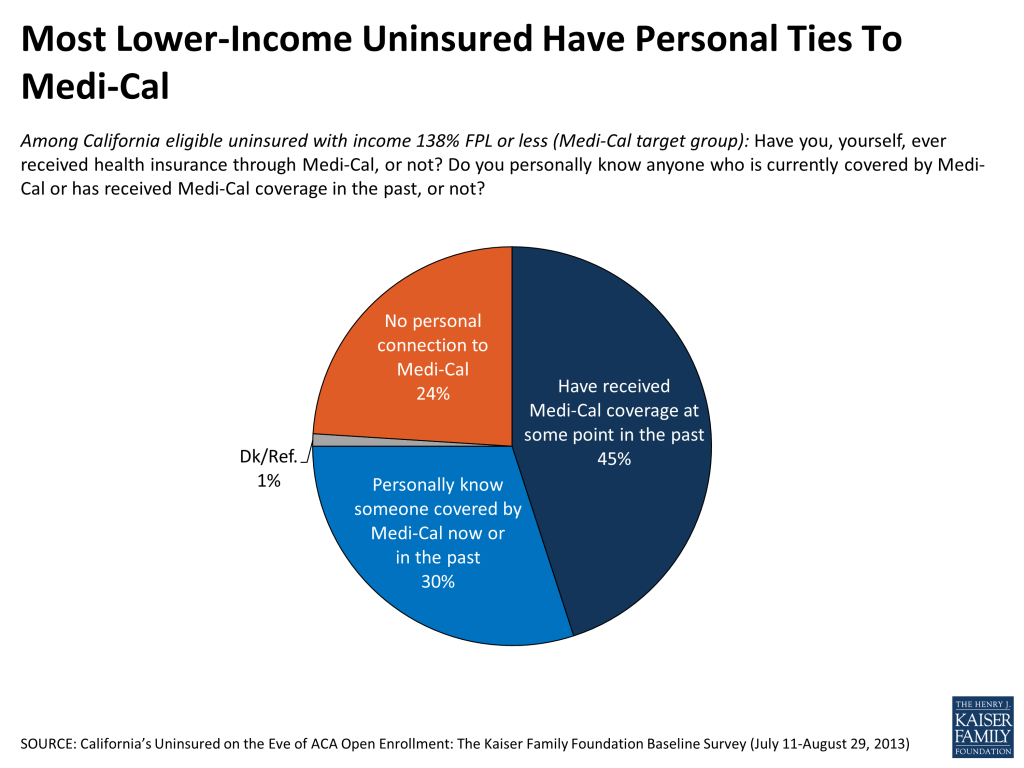

- Medi-Cal is viewed quite positively by the uninsured (62 percent favorable), a group that has widespread ties to the program: over four in ten of those with incomes 138 percent of the poverty level or less say they have been on Medi-Cal at some point, and another three in ten know someone who has participated in the program.

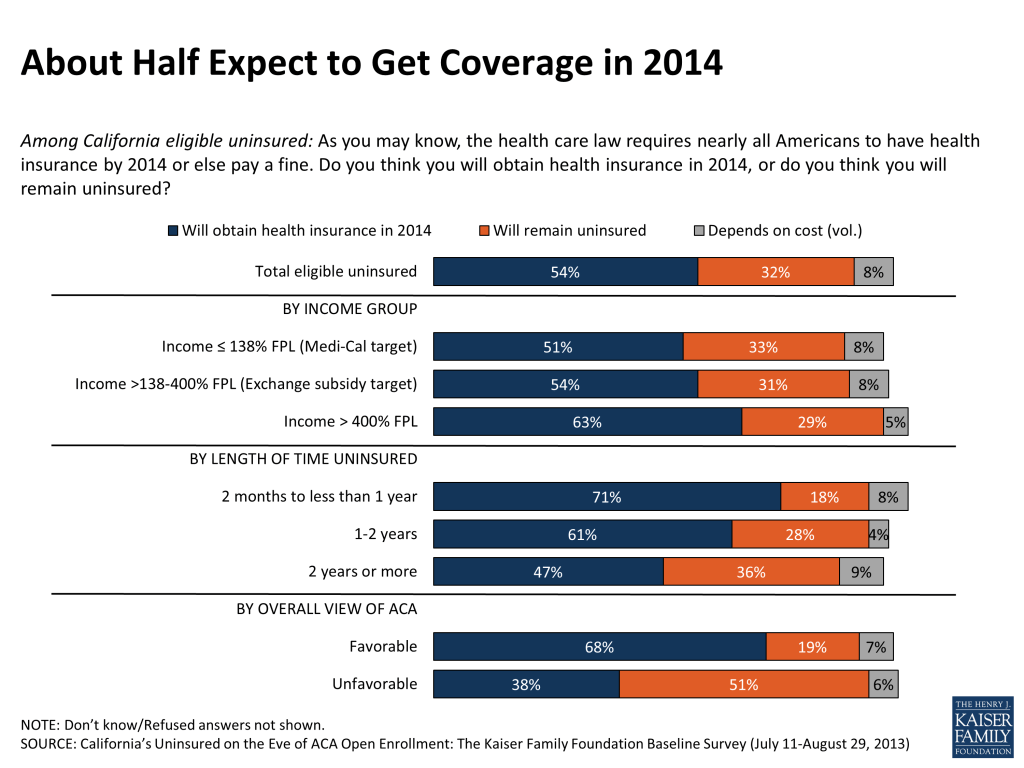

- The survey suggests that, as of late August, when told of the existence of the individual mandate, the preliminary impression of about half the population is that they would plan to get health coverage, with the other half either thinking they won’t get coverage (32 percent) or not sure what they will do (15 percent).

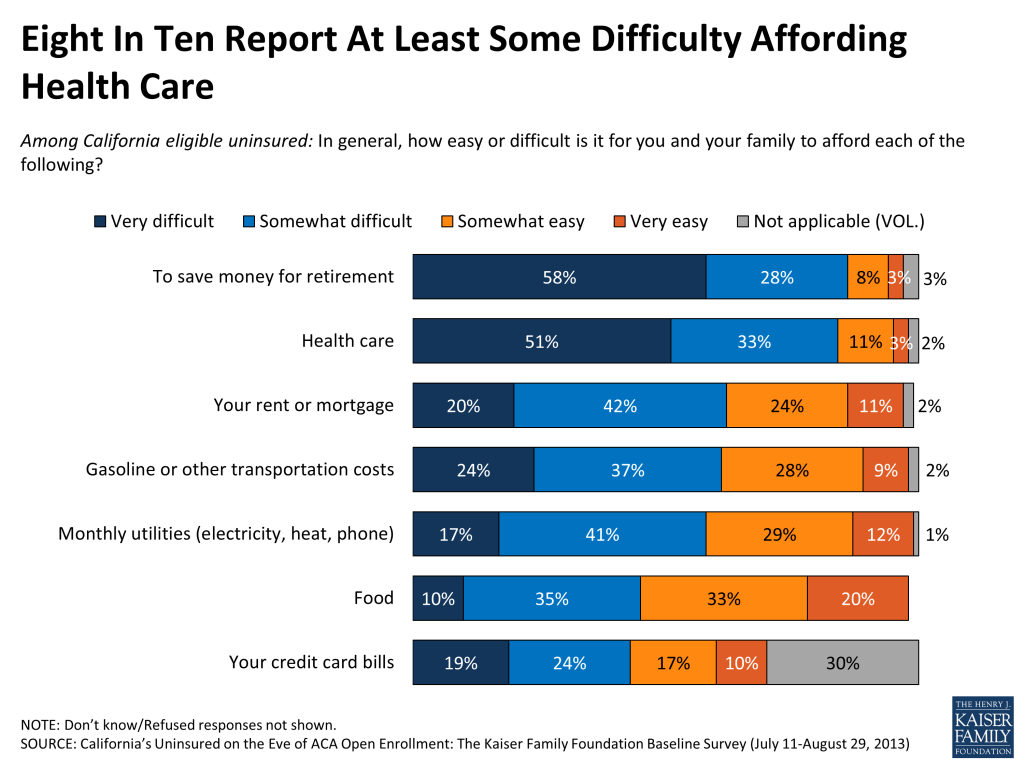

California’s uninsured: financially stressed, medically underserved

- The survey suggests that the new coverage options will be presented to a population that is in real need of help on this front, with many skipping care they need because of cost and most feeling anxiety over their inability to pay for a major health crisis. At the same time, the rollout will meet a population already quite financially overstretched, both leery of new costs and anxious for financial relief.

- A majority of California’s eligible uninsured population (57 percent) describe themselves as financially insecure, with over eight in ten (84 percent) reporting their family finds it difficult to pay for health care.

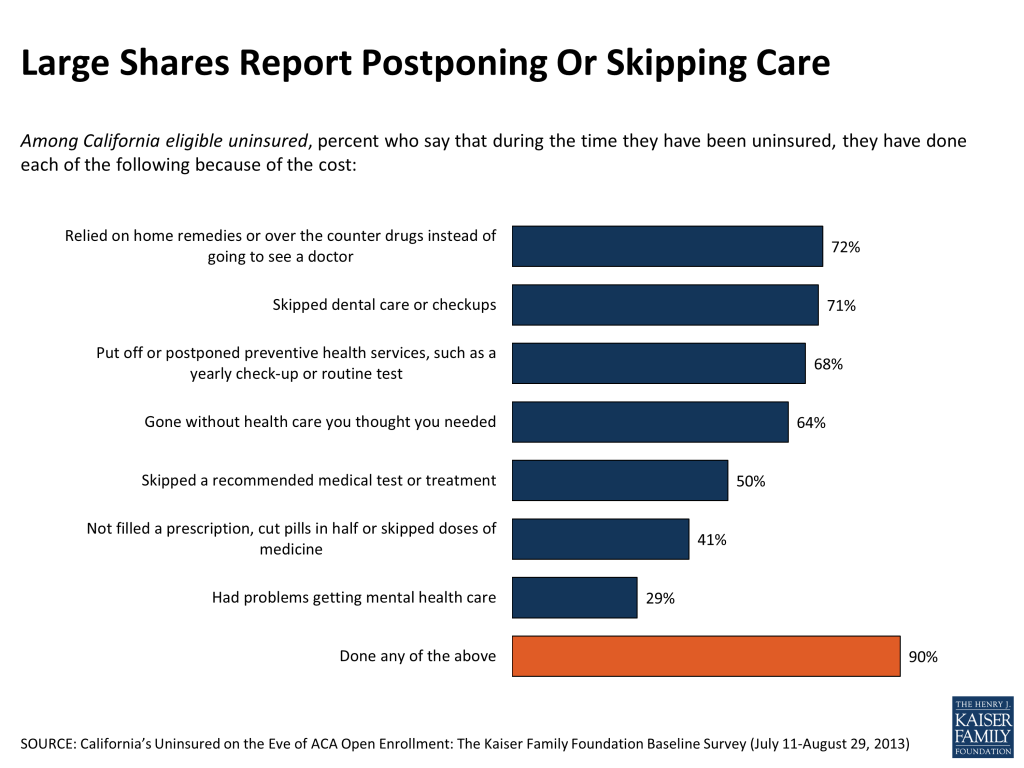

- As a result, more than six in ten (64 percent) say that they’ve gone without needed health care because of the cost during the time they’ve been uninsured. Four in ten say they have had trouble paying the medical bills they did incur.

- There is widespread worry about what would happen if a family member was struck by a serious illness or involved in an accident. Three in four say they are “very worried” about not being able to pay the resulting medical bills.

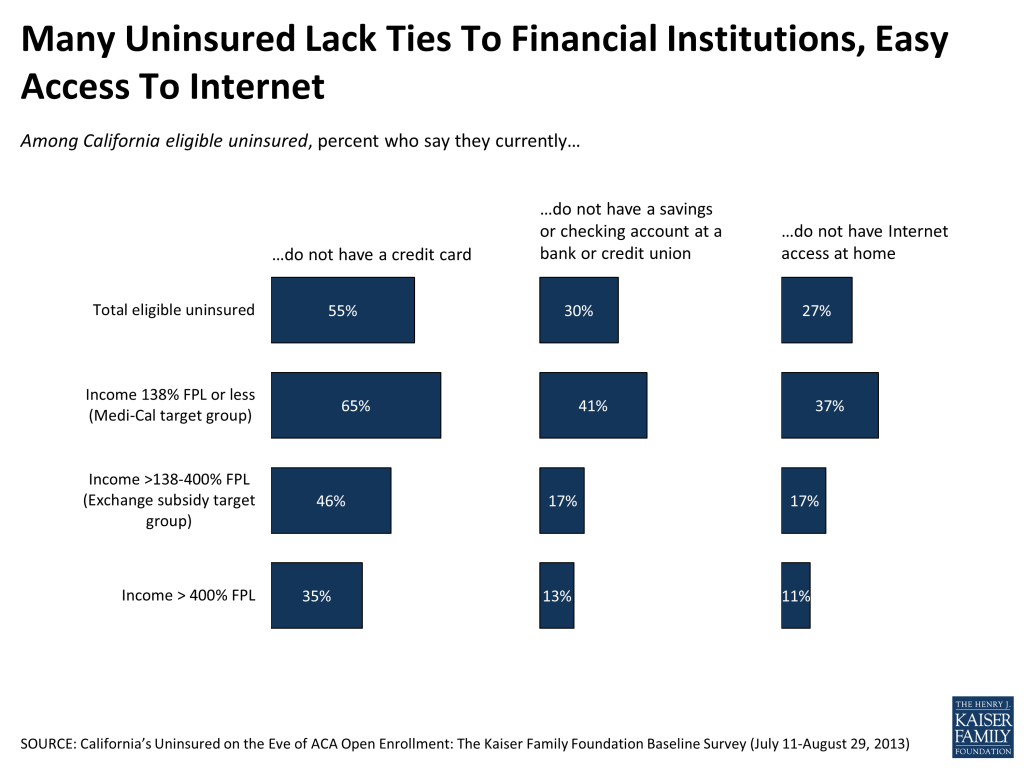

- This group also stands out for more attenuated links to the financial system. More than half report they do not have a credit card, three in ten do not have a bank savings or checking account, and one in four does not have Internet access at home. Over half say they ‘rarely’ or ‘never’ shop online.

Uninsured and undocumented

- The survey suggests that about a fifth of the state’s uninsured are undocumented immigrants2 , a group that is not eligible to buy coverage through Covered California or to join Medi-Cal.

- This group may have misplaced expectations of getting help that in actuality will not be forthcoming: about half (49 percent) say they think they may be eligible to get insurance through Medi-Cal as a result of the ACA. Forty-three percent expect they will be eligible to shop for health insurance on the exchange.

- As is true for the rest of the state’s uninsured population, currently eight in ten undocumented uninsured report finding it difficult to pay for health care, and 46 percent say they have gone without needed health care because they couldn’t afford it.

- This group stands out as particularly concerned about being able to find a doctor that would treat them if they needed one: 68 percent say they are “very worried”, nearly 30 percentage points higher than among other uninsured Californians.

Report: Introduction

The nearly six million people that make up California’s adult uninsured population are, as a group, financially stressed, medically underserved, and on the brink of what could well be a once-in-a-lifetime policy shift that will put health insurance within many of their grasps. The large majority report they do feel the need for health insurance, but based on past experience in an increasingly high-priced insurance market, some wonder whether coverage is worth the cost. They also, as a group, feel woefully under-informed about the practical mechanics of this upcoming change, and as of late August most report having heard little about the coverage expansion opportunities ahead. Though many are cautiously optimistic, they remain divided in their expectations of whether the Affordable Care Act (ACA) will, in their own lives, represent a change for the good, the bad, or no change at all. The survey suggests this may in part be due to confusion, and perhaps even misplaced pessimism, about their potential eligibility for the widespread benefits.

These are the results of a baseline survey of California’s uninsured population by the Kaiser Family Foundation (KFF), the first in what is expected to be a series of four surveys that will track the views and experiences of the same group of people over the next two years and will be complemented by a series of profiles and stories intended to put a face on these numbers. The project hopes to provide a unique contribution by beginning with a representative, random sample survey of 2,000 uninsured Californians that mirror and represent the state’s large uninsured population, and then returning to those same 2,000 residents at three future points in time – including at the end of the first enrollment period next spring – to learn how they are, or are not, interacting with the nascent coverage expansion.

With its ‘largest in the nation’ status that includes having the largest number of uninsured, its racial and ethnic diversity, and the state government’s full and early commitment to a smooth rollout of the ACA, California stands out as a laboratory of how the three year old law – up until now a remote political football for many Americans – will translate into real world, person-to-person changes. In all, 15 percent of the nation’s uninsured reside there, and will see the ACA through the window of the Golden State.3

This first report seeks to sum up the opinions, concerns and experiences of the state’s uninsured population as they are poised on the brink of this change. The first section assesses what California’s uninsured population knows and thinks about the ACA changes that are on the horizon, and examines their past experiences and current attitudes about health insurance in general. The second section presents a snapshot of the primary characteristics of this group of residents, along with the numerous challenges they currently face in getting, and paying for, the health care they need. And the third section examines the group of uninsured that will not be eligible to participate in the expansion of coverage: the undocumented uninsured.

The report analyzes the uninsured population in terms of four basic groups: those whose incomes would put them in the ‘Medi-Cal target group’ (138 percent of the federal poverty level (FPL) or less), possibly qualifying them to be covered by California’s Medicaid program; those whose incomes would put them in the ‘exchange subsidy target group’ (greater than 138 percent and up to 400 percent FPL), giving them access to subsidies to purchase insurance through the state’s new health insurance exchange marketplace, Covered California; those who will be able to shop on the exchange but will not be eligible for tax credits based on their relatively higher incomes (greater than 400 percent FPL); and finally those uninsured who will not be able to access health insurance via either option due to their immigration status. The first three groups together comprise a group we are terming the ‘eligible uninsured’. This survey of the adult population ages 19-64 somewhat underrepresents the full “eligible insured” group that also includes children.

Putting survey results in context: Numbers of uninsured in California

Nearly 7 million people in California were without health insurance in 2012, including just under 6 million adults ages 19-64.4 Estimates of the exact number who will be eligible for new coverage under the ACA vary, but according to data from the Centers for Medicare & Medicaid Services (CMS), roughly 5.5 million uninsured Californians (including roughly 4.8 million adults ages 19-64) may be eligible to participate in some way based on their income and immigration status. This includes about 3 million in the Medi-Cal eligible income range (138 percent FPL or less), about 2 million who may be eligible for subsidies to purchase insurance through Covered California (incomes greater than 138 percent and up to 400 percent FPL), and just under 500,000 who will be eligible to purchase unsubsidized coverage through the new marketplace (incomes greater than 400 percent FPL).5 According to estimates by researchers at the University of California, roughly one million uninsured Californians will be ineligible for new coverage under the ACA due to their immigration status.6

Report: Section 1: California's Uninsured And The Aca

| A NOTE ON TERMINOLOGY:The ‘Eligible Uninsured’: For purposes of this report, the eligible uninsured are defined as those Californians ages 19-64 who have been without coverage for at least two months. Because the coverage expansions under the ACA do not extend to undocumented immigrants, most analysis is based on the 78 percent of the uninsured group who report being U.S. citizens or permanent residents, described for the purposes of easy understanding as the ‘eligible uninsured’. Income categories: Because eligibility for two of the law’s main components – the Medi-Cal expansion and the tax credits to help purchase insurance on the new exchanges – is based on an individual’s family income relative to the federal poverty level (FPL), in many cases we report survey results among the eligible uninsured by FPL categories. Those with incomes 138% FPL or less (roughly $32,000 a year for a family of 4) will be eligible for Medi-Cal coverage, while those with incomes greater than 138% and up to 400% FPL (roughly $32,000-$94,000 for a family of 4), will be eligible for subsidies to purchase insurance through Covered California, the state’s new marketplace. Those with incomes above 400% FPL will be allowed to buy insurance through Covered California, but will not be eligible for subsidy assistance. For convenience, we will sometimes refer to the group with incomes 138% FPL or less as the “Medi-Cal target group”, and those greater than 138% and up to 400% FPL as the “exchange subsidy target group”. These obviously are approximations that do not allow for every real world exception to be taken into account. For example, lawfully present immigrants may remain subject to a five year wait before they may enroll in Medi-Cal, but for the purposes of this analysis they are included in the Medi-Cal target group if they meet the income criteria. Similarly, some of those in the exchange subsidy target group may not be eligible for marketplace subsidies if they have access to affordable employer coverage, a situation difficult to ascertain in a phone survey. |

Limited familiarity, cautious optimism

SUMMARY: Positive views of the ACA outnumber negative among California’s eligible uninsured, even as the large majority say they don’t yet understand how the law will impact their own families and few have heard much about either the expansion of the Medi-Cal program or the creation of the state’s Covered California insurance marketplace.

California’s uninsured tilt positive on ACA

California’s eligible uninsured tilt more positive than negative on the 2010 health care law, particularly in comparison to the nation as a whole, but no one view is shared by a majority.

Overall, 48 percent of California’s eligible uninsured view the ACA favorably, while 30 percent view it unfavorably and one in five (22 percent) were not able to provide an opinion. Nationally, Americans in the same age range are more divided, 38 percent favorable versus 42 percent unfavorable in KFF’s August Health Tracking Poll, and the uninsured nationally are evenly divided at 36 percent favorable versus 38 percent unfavorable.

But large majority say they don’t have enough information yet to understand how ACA will impact them personally

As of late August, the large majority of California’s eligible uninsured – seven in ten (70 percent) – say they don’t feel they have enough information about the law to understand how it will impact them. In no demographic subgroup we examined does a majority say they know enough about the law at this point to understand its personal ramifications.

As the summer of 2013 comes to a close, and the season of intensive outreach begins, three-quarters say that they have heard “only a little” or “nothing” (32 percent and 43 percent respectively) about the expansion of Medi-Cal, including 77 percent of those in the Medi-Cal target group.

And more than eight in ten (84 percent) of those in the exchange subsidy target group say they have heard little or nothing about the state’s new marketplace, Covered California.

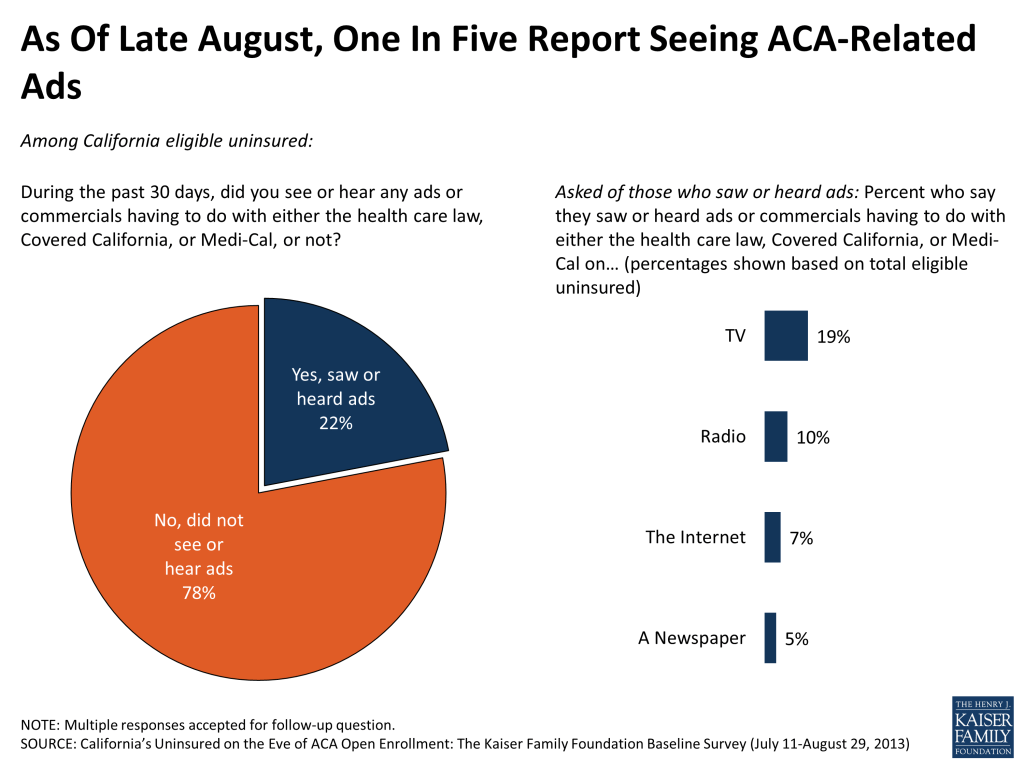

One in five uninsured report seeing an ACA-related ad

The state’s marketplace and other interested parties began an ongoing process of outreach toward the uninsured population earlier this summer, one that is still in the process of ramping up (for example, Covered California itself unveiled its first television ad in late August.) At this early point in the ad campaign, about one in five of California’s eligible uninsured report having seen or heard an ad having to do with the health care law, Covered California or Medi-Cal. Most of these reported having seen multiple ads on the topic, with TV by far the most frequently named delivery vehicle, followed by radio.

Nearly half in the group that have seen an ad report that at least one of the commercials they saw provided information about how to get health insurance coverage, while the other half do not remember being provided any instruction. Overall, so far six percent of California’s eligible uninsured report that the advertising has driven them to seek out further information about the law.

About half aware of Medi-Cal expansion, creation of marketplaces and availability of subsidies

About half the eligible insured are aware, however, of the two key coverage expansions being a part of the 2010 health law, even if they have not heard much about them recently. For example, half of the state’s eligible uninsured are aware that the ACA does provide for expansion of Medi-Cal, including similar shares of those in the eligible income group. And half report knowing that the law creates health insurance exchanges or marketplaces, with knowledge somewhat higher in the exchange subsidy target group (57 percent) than in the Medi-Cal target group (45 percent). Roughly the same share are aware that the federal government will subsidize the purchase of health insurance on Covered California for many in these income groups.

In each case, however, this does leave roughly half the target populations unaware that these provisions even exist as part of the ACA.

| Figure 4: About Half of Eligible Uninsured Aware Health Reform Law Includes Medi-Cal Expansion, Provision of Tax Credits on Exchanges | ||||

| Among California eligible uninsured: Percent who say yes, the health care law does each of the following | Total eligible uninsured | ≤138% FPL (Medi-Cal target) | >138%-400% FPL (exchange subsidy target) | >400% FPL |

| Require nearly all Americans to have health insurance by 2014 or else pay a fine | 57% | 52% | 63% | 56% |

| Expand the Medi-Cal program to cover more low-income Californians | 53 | 52 | 53 | 58 |

| Provide financial help to low and moderate income Americans who don’t get insurance through their jobs to help them purchase health insurance coverage beginning in 2014 | 52 | 52 | 54 | 48 |

| Create health insurance exchanges or marketplaces where people who don’t get coverage through their employers can shop for insurance and compare prices and benefits | 50 | 45 | 57 | 51 |

| Prohibit insurance companies from denying coverage because of a person’s medical history | 45 | 39 | 52 | 48 |

Meanwhile, more than half the uninsured (57 percent) are aware of the existence of the individual mandate, a provision that will apply to many of them. Finally, over four in ten (45 percent) are aware of the guaranteed issue provision that mean that many of the eligible uninsured – including those who say someone in their household has a pre-existing condition – will be able to qualify for health insurance that may previously have been denied them.

In the big picture, more expect the ACA to make their situations better than worse, with a third expecting no change either way

California’s eligible uninsured have mixed expectations as to whether the ACA will be of benefit to them, but overall roughly two times as many expect to be better off as to be worse off. Four in ten believe the law will enhance their ability to get the health care (39 percent) and health insurance (40 percent) they need, compared to about two in ten who expect the law to make life more difficult on these fronts. About a third don’t expect it to make any difference.

Views are more closely divided, however, when it comes to the thorny issue of health care costs: About one in four (26 percent) think the law will raise health care costs for their own family, while a slightly larger share think it will bring costs down (31 percent).

California’s open enrollment period: First reactions

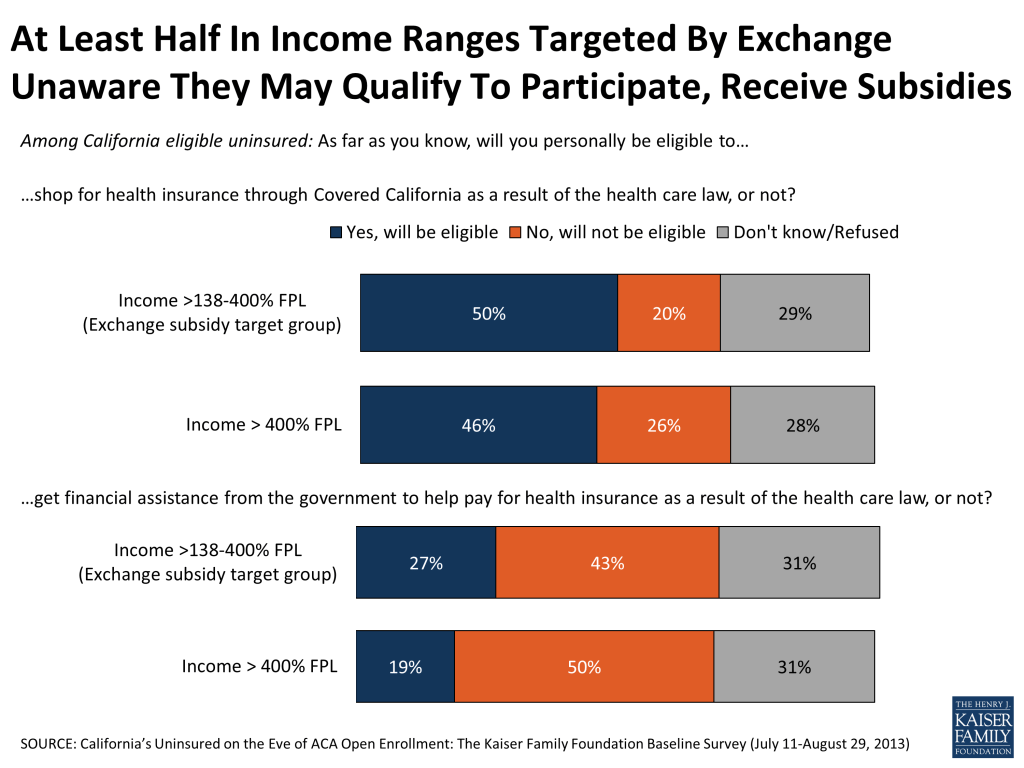

SUMMARY: On the eve of the start of the six-month open enrollment period, there is widespread confusion among the state’s uninsured as to whether they are eligible for any of the new and expanded benefits, with three-quarters in the exchange subsidy target group either not sure or presuming they will not be eligible for such financial assistance, and only half of those in the Medi-Cal target income group presuming they will be qualified.

But there is a good deal of interest in potentially signing up for the Medi-Cal program if those eligibility uncertainties could be put to rest. Nine in ten in the Medi-Cal target group say that, if told they qualified for the state health insurance program, they would enroll. Medi-Cal is viewed quite positively as a program by the uninsured, a group that has widespread ties to the program: over four in ten of those in the Medi-Cal target income range say they have been on Medi-Cal at some point, and another three in ten know someone who has participated in the program.

The survey suggests that, as of late August, when told of the existence of the individual mandate, the preliminary impression of about half the population is that they would plan to get health coverage, with the other half either thinking they won’t get coverage or not sure what they will do. These impressions obviously will shift as the uninsured learn more about the specific ways the law will apply to their own family situation.

Focus on Covered California: Good deal of uncertainty about eligibility to shop in marketplace, get tax credits; Group with limited experience of online shopping

Overall, roughly 2.5 million uninsured state residents may eventually be eligible to shop for coverage using the Covered California marketplace.7 But as we saw in the previous section, familiarity with the statewide marketplace and its benefits is still relatively limited at this point. In this section we examine the uninsured’s current thinking about their own potential eligibility and find that three in four in the subsidy target income group have doubts about whether they would indeed qualify for subsidy assistance. Half are not sure whether they are eligible to shop on the exchanges at all or believe they will not have this option.

Do you think you will be eligible to buy through the state marketplace? For financial assistance from the government?

At summer’s end, half of those with household incomes that fall in the subsidy-eligible range for Covered California say they believe they will be eligible to shop for insurance on the exchange, while three in ten are unsure about whether they could participate. About one in five say they do not believe they will meet the requirements for the exchange. Views among those uninsured making over 400 percent of the FPL – a group eligible to shop in the marketplace but not to receive financial assistance – are similar.

Even fewer in the subsidy target group – just over a quarter – say they think they will be eligible to get financial help from the federal government to help pay for health insurance. The plurality – 43 percent – say they think they will NOT be eligible, and a third aren’t sure. At the same time, roughly one in five (19 percent) of those with incomes above 400 percent of poverty believe they will be eligible for such help, when in reality they are likely to be out of the eligible income range.

Will Covered California help you?

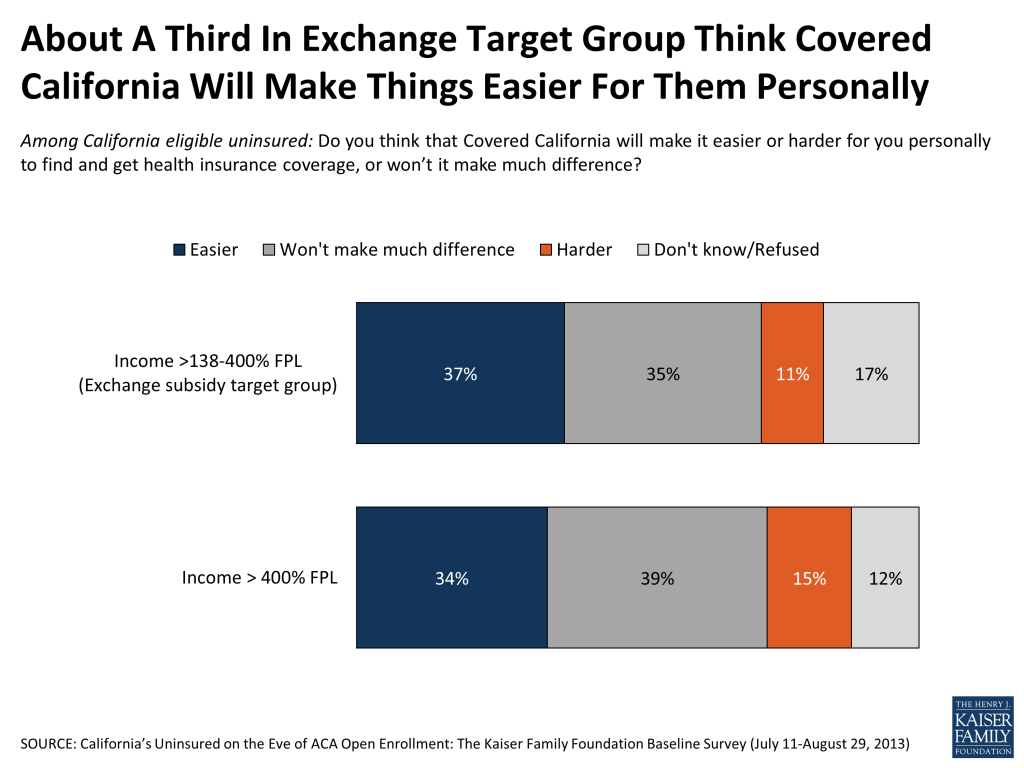

By better than three to one, those in the exchange subsidy target group think that the state marketplace will make it easier rather than harder for them to find and get insurance coverage (37 percent versus 11 percent). But half either say they don’t expect to see any change at all in their ability to get health insurance (35 percent) or they don’t know what to expect (17 percent).

The exchange eligible and the Internet

One of the primary methods – though not the only method – for accessing Covered California is through its website, www.CoveredCA.com, which allows for online comparison shopping and purchasing. Most of the uninsured in the income group eligible for the tax credits in the marketplace do have Internet access at home (83 percent), and another 9 percent have access somewhere other than home. But they are not intensive Internet shoppers: 25 percent say they very or somewhat often use the Internet to buy products online, 28 percent say they do so ‘just occasionally’, and nearly half say they ‘rarely’ (18 percent) or ‘never’ (29 percent) buy things online. And while 18 percent say they often use the Internet to access health information, 56 percent say they rarely or never do this.

Focus on Medi-Cal: Views of the program, personal connections, and expectations for eligibility in 2014

Eligible uninsured no strangers to Medi-Cal; Majority have positive views of program

Those uninsured whose incomes put them in the range of the Medi-Cal expansion are for the most part, no strangers to the program. About four in ten (45 percent) say they have already been on Medi-Cal at some point themselves. Another 30 percent know someone that receives or has received health coverage through the program. And all told 18 percent in this income group say they have unsuccessfully tried to sign up for the health insurance program at some point or another, with most of these reporting they could not enroll in Medi-Cal because they were told they were ineligible.

In large part, this group views the program quite positively. Overall, about two-thirds in the Medi-Cal target group have a favorable view of the program, while about a quarter have an unfavorable view. These positive views are driven by those who have themselves been on Medi-Cal or know someone who has: 67 percent and 73 percent, respectively, give the program positive reviews. Those with no connection to the program lean more positive than negative (47 percent versus 25 percent), but a quarter say they don’t know enough about Medi-Cal to offer an opinion. It’s worth noting that under the ACA, the process for Medicaid enrollment is being adjusted to remove perceived barriers to sign-up and to better coordinate with the state exchanges, a factor that could impact ratings of the program moving forward.

Only half believe themselves eligible for Medicaid under expansion; Nine in ten say they would sign up if told they qualified

Given their connections to the program and their positive evaluations, it follows that there would be a fair bit of interest in enrollment among this group, and the survey bears that out: Nine in ten (89 percent) in the relevant income bracket say that if they were told they were eligible for Medi-Cal, they would want to enroll. The catch at this point, at least, is eligibility confusion. While about half (53 percent) of those in the Medi-Cal target group believe they will be eligible for the program, another 21 percent are not sure and a quarter (26 percent) believe they will not be eligible. Some of this confusion may stem from the fact that eligibility standards are changing under the ACA, and public knowledge may not yet have caught up with these changes. For example, adults without dependent children were previously ineligible no matter what their household income, a standard that has changed under the law.

One pathway this population could use to find out about their possible Medi-Cal eligibility is the state’s new marketplace website. The survey suggests, however, that the Medi-Cal target group includes a relatively large group of people with limited Internet access and experience. More than a third (37 percent) do not have Internet access at home, and fully half have never purchased a product online.

Given knowledge of mandate, half say would likely get health insurance

When told or reminded that “nearly all Americans [will be required] to have health insurance by 2014 or else pay a fine,” just over half (54 percent) of the eligible uninsured report they expect to obtain health insurance next year, a third (32 percent) plan to remain uninsured, 8 percent say it would depend on the cost and 7 percent don’t have a sense of how they would react.

The groups most likely to say they expect to get coverage are those that became uninsured only sometime in the past year (71 percent of them are ready to sign back up) and those with favorable views of the ACA (68 percent).

In terms of who is most likely to say they plan to remain uninsured: those with dim views of the health law stand out here, with 51 percent saying they do not intend to seek health insurance. (Even here, however, four in ten do say they will likely seek coverage.) Those who feel their financial situation to be “very insecure” are also disproportionately more likely to say they expect to remain uninsured (43 percent).

Among those who expect to obtain coverage in 2014, most are unsure at this point where that coverage will come from.

| Figure 12: Most Who Expect to Obtain Insurance in 2014 Don’t Know Where They Will Get It | |

| Among California eligible uninsured: Do you think you will obtain health insurance in 2014, or do you think you will remain uninsured? (If expect to obtain coverage: Do you think you will get coverage from Medi-Cal, an employer, the marketplace known as Covered California, or are you not sure where you will get insurance?) | |

| Will obtain insurance (NET) | 54% |

| From an employer | 9 |

| From Medi-Cal | 5 |

| From Covered California | 4 |

| From Medicare (vol.) | 1 |

| Somewhere else (vol.) | 1 |

| Not sure where | 35 |

| Will remain uninsured | 32 |

| Depends on the cost (vol.) | 8 |

| Don’t know | 7 |

What’s driving the views of those that say they don’t plan to get coverage in 2014?

Most (62 percent) of those who say they don’t plan to get insurance explicitly point to cost as a reason, saying they don’t think they will be able to find an affordable plan or that they just don’t have the money to pay for insurance. Smaller shares say the reason they won’t seek coverage is that they don’t need it or don’t want it (21 percent), or that they don’t see how they will qualify for coverage (12 percent).

| Figure 13: Voices of the Uninsured | |

| Among California eligible uninsured who say they will remain uninsured in 2014: Why do you think you will remain uninsured? | |

| Cost related/Don’t think will be able to find an affordable plan – 62% | “[I’m the] sole caregiver [taking care of my] with Alzheimer’s and head of household, therefore it’s financially restrictive.” “I’d rather [pay] health and dental for my kids instead of myself.” “The company I’m working for might not be able to help me, and if there’s no money I won’t be able to afford insurance.” “If I get a job and remain employed and if they offer benefits [I will get insurance.] If not I will have to feed and take care of my family first before I can buy health insurance.” “The fine will be less than the health insurance and medical bills combined.” |

| Don’t want/need coverage – 21% | “I’m healthy, I pay cash when I go to the doctor.” “I don’t like being told what to do.” “Because I completely disagree. It is my choice whether or not I want insurance.” |

| Not available to me/won’t qualify – 12% | “[My] employer has less than 50 people and will not provide health insurance.” “[I’m] falling into a gray area and I don’t fit in any of the categories.” |

| Other | “Because there is too much of a fight right now, so I don’t think [the ACA] will be implemented.” “I don’t think I will receive good enough health insurance.” |

What do the uninsured have to say about health insurance?

To understand what will happen to California’s millions of uninsured in upcoming months, it’s helpful to understand not just what this population knows and understands about the changes ahead, but how this knowledge may interact with their existing views about health insurance: why they don’t have it, whether they actually want it and for what purpose, and whether they think that up to this point, the value of insurance has been worth its cost.

Most of California’s eligible uninsured have been without coverage for some time; Point to cost of coverage, job loss, and other factors

Two-thirds of those uninsured Californians who self-identify as either U.S. citizens or lawfully present immigrants say they have been uninsured for more than 2 years. About 17 percent have been uninsured for between one and two years, and another 17 percent are more newly uninsured than that. And about one in five say that they’ve never had insurance. The higher-income uninsured are somewhat more likely to report losing their coverage more recently: 48 percent have become uninsured in the past two years, compared to 31 percent in the lowest income bracket.

| Figure 14: Majority of Uninsured Have Been Without Coverage for Two Years or More | ||||

| Among California eligible uninsured: How long have you been uninsured? | Total eligible uninsured | ≤138% FPL (Medi-Cal target) | >138%-400% FPL (exchange subsidy target) | >400% FPL |

| 2 months to less than 1 year | 17% | 14% | 16% | 27% |

| 1 year to less than 2 years | 17 | 17 | 18 | 21 |

| 2 years or more | 66 | 69 | 66 | 53 |

The main reasons they are without health insurance? Cost tops the list, with 47 percent explicitly saying they are uninsured because health coverage is too expensive. One in five refer to job loss or unemployment, and about one in eight (12 percent) point to barriers that stop them from qualifying for coverage through their employer.

Only 3 percent volunteer they don’t have health insurance because they don’t think they need it.

| Figure 15: Voices of the Uninsured | |

| Among California eligible uninsured: What’s the main reason you do not have health insurance? | |

| Too expensive/have little or no money – 47% | “Because we cannot afford; if health insurance would be more affordable we would try to buy it.” “My job offers it but it is too expensive.” “Because I am self-employed and have insufficient finances to obtain insurance coverage at this time.” |

| Unemployed/lost job – 19% | “I’m unemployed, and have no money to purchase.”

“I had insurance through my job but not anymore.” |

| Employer doesn’t offer it/Not eligible for employer coverage – 12% | “My husband’s job doesn’t offer it.” “Just started new job, health insurance won’t be in effect for 30 days.” |

| Not eligible for Medi-Cal or other government insurance program – 5% | “I am a care giver and they don’t give medical insurance and I applied for Medi-Cal and got disqualified.” |

| Don’t need it – 3% | “I’m not too sickly in general for the most part, usually if anything just a cold.” |

| Can’t get it/refused due to poor health – 2% | “I tried to apply to private companies but am turned down every time.” “I became disabled and my job’s coverage did not cover me. They only covered me for 30 days because the company that bought us out won’t cover me because I have not been with the new company a year and because of my condition.” |

| Don’t know how to get it – 2% | “I don’t have the information needed to apply.” |

This group reports having had a range of types of coverage before becoming uninsured, including employer sponsored insurance (39 percent), Medi-Cal or Medicaid (18 percent) or coverage under a parent’s plan (13 percent). One in ten (9 percent) say that at some point they have been denied health insurance coverage due to someone in their family having a pre-existing condition.

Overall, about two-thirds (68 percent) of California’s eligible uninsured say they or their spouse are working. Why, if so many are employed, are more not insured? For the majority of those who are employed or have a working spouse it’s because they are either self-employed or their employer doesn’t offer coverage. Nearly three in ten (28 percent) of the eligible uninsured do, however, have ties to an employer that offers coverage to at least some of its employees. This group gives a variety of reasons for not participating in such coverage: the most frequently mentioned option is that the cost is too high, but others say they aren’t enrolled because they aren’t eligible, either because they don’t work enough hours or haven’t worked at the firm long enough. It’s worth noting that those that do have access to affordable employer coverage will not be eligible for exchange subsidies.

Eight in ten say health insurance is something they need, including large majority of ‘young invincibles’

Though some may presume the reason most of the state’s uninsured lack coverage is because they don’t feel they need it, the survey suggests this isn’t true. According to the survey, the large majority of California’s eligible uninsured – eight in ten – do feel they need health insurance coverage. Even seven in ten (72 percent) of the youngest uninsured Californians – those ages 19 to 25 – say they need health insurance. Overall, just under two in ten instead say they feel healthy enough that they don’t need coverage.

The desire for insurance is even more widespread among those with more health problems. Among those in ‘poor’ or ‘fair’ health, nine in ten feel they need coverage. But even among those who say they are in good health, a majority—three in four—feel they need health coverage.

The main reason uninsured Californians want health coverage: to protect against the kind of financial catastrophe that can accompany a major, unexpected illness or a life-changing accident. Most (seven in ten, including majorities in all age groups), say this is their primary reason to want insurance. For one in four, however, the main point of insurance is to pay for more routine health care expenses. This rises to 40 percent among those who are already grappling with a disability or chronic health problem.

| Figure 18: Those With Chronic Health Conditions More Likely to Say Insurance Is Necessary to Pay for Everyday Health Care Expenses | |||

| Among California eligible uninsured: Which one of the following do you think is the MOST important reason to have health insurance? | Total eligible uninsured | Among those who say they have a disability or chronic condition that keeps them from participating in activities | Among those with no disability/chronic condition |

| To pay for everyday health care expenses, like check-ups and prescriptions | 27% | 40% | 25% |

| To protect against high medical bills in case of severe illness or accident | 71 | 58 | 73 |

Up to this point, a majority have believed that health insurance is worth the cost, though a third disagree

At this point, a majority of the uninsured – 57 percent – do believe that health insurance is worth the money it costs, while just over a third disagree. These views are obviously based on perceptions of the cost of coverage before the opening of the exchange in October.

Report: Section 2: The Uninsured Experience, Pre-aca

Who are the uninsured in California?

In this section of the report, we look at a snapshot of the uninsured population in the state, with the goal of better understanding their upcoming interactions with the ACA’s coverage expansion by better understanding who they are and what challenges they currently face in getting and paying for health care services.

Most lack financial security, half say “very difficult” to pay for health care

Perhaps the most striking element of California’s uninsured population is the extent to which they, even more than the average American living through an economic downturn, are struggling to stay financially afloat. Nearly all the eligible uninsured –roughly nine in ten – have family incomes under 400 percent of the FPL (about $94,000 a year for a family of four), and nearly half are at or below 138 percent of FPL, representing an annual income of roughly $32,000 for a family of four.

And they feel it. A majority (57 percent) describe themselves as financially insecure, including one in four (25 percent) who say they feel “very insecure.” More than eight in ten (84 percent) report at least some difficulty affording health care, including half who find it “very difficult”. Roughly six in ten find it difficult to pay for gas and other transportation costs, their monthly utilities, and their rent or mortgage. More than four in ten have at least some difficulty affording food.

Four in ten of California’s uninsured do not have a regular source of care; when they do, most common location is a health clinic rather than a doctor’s office

More than four in ten of the eligible uninsured (44 percent) say they do not have a regular place to go to when they are sick or need advice about their health. For those who do have a usual source of care, most common (30 percent overall) is to visit a clinic or health center. Smaller groups use a doctor’s office (11 percent) or even an emergency room (7 percent) or urgent care center (4 percent).

Many experience financial struggles despite fact that most uninsured are themselves employed

Overall, about two-thirds (68 percent) of California’s eligible uninsured say they or their spouse are working. The majority (58 percent) are employed themselves, with about one in ten overall (12 percent) working more than one job. Overall 20 percent say they are unemployed and looking for work, 7 percent call themselves homemakers, and 6 percent are students.

But most of the state’s uninsured don’t have a bulwark of educational resources to draw on in terms of upward employment mobility: half have no education past high school, and just 14 percent have completed a college degree.

Uninsured have tangential relationship to financial institutions: majority have no credit card, three in ten have no savings or checking account

Though the majority of the state’s uninsured are employed, incomes among this population are low and financial resources are limited. More than half of California’s eligible uninsured report they do not have a credit card, and three in ten do not have a bank savings or checking account. In this latter group, most say they pay their bills in cash, though some used money orders or prepaid cards. In late August, the Obama Administration issued rules requiring that the ACA’s health insurance exchanges accept prepaid debit cards for payment from those that do not have a relationship with a bank.8

Like the state as a whole, eligible uninsured a racial and ethnic mix

California’s eligible uninsured are a racial and ethnic melting pot, like the state in which they reside. The two largest groups: 45 percent identify as Hispanic, 32 percent are non-Hispanic White. A third say they were born outside of the United States. Among Hispanics in the eligible uninsured group, more than four in ten (44 percent) prefer to communicate in Spanish rather than English, a finding particularly relevant in light of the rollout of the coverage expansion effort.

The current picture: Many uninsured Californians missing out on needed health care

Many say health needs not being well met, have gone without needed care due to cost

In the summer of 2013, as the Covered California marketplace gears up for its October debut and the state Medi-Cal offices prepare for an influx of potential new customers, roughly half (49 percent) of the eligible uninsured in California say that their health needs are not being well met at the present moment. On the flip side, half say that despite their lack of coverage, they have found a way to meet their health needs at least “somewhat well”.

Many of the state’s uninsured react to their lack of coverage by not seeking out the health care they think they need. More than six in ten (64 percent) say that they’ve gone without needed health care because of the cost during the time they’ve been uninsured. Roughly seven in ten have report skipping dental care, and a similar share say they have put off preventive care they thought they needed. Half say they have skipped a recommended test or treatment. Four in ten report cutting corners on needed medication.

There is a consistent gender gap in these findings: Uninsured women are more likely to report putting off care due to cost across a variety of categories. For example, 74 percent of women say they have gone without health care they needed, compared to 56 percent of men.

Not surprisingly, those with more health needs – for example, those who say they are in fair or poor health – are more likely to say health needs have come up that they have not been able to fill because of the cost.

| Figure 22: Those With Health Problems More Likely to Report Problems Getting Care Due to Cost | ||||

| Among California eligible uninsured: Percent who say they have done each of the following because of the cost during the time they have been uninsured | ||||

| BY GENDER | BY HEALTH STATUS | |||

| Women | Men | Excellent/Very good/Good | Fair/Poor | |

| Relied on home remedies or over the counter drugs instead of going to see a doctor | 78% | 68% | 69% | 79% |

| Skipped dental care or check-ups | 80 | 63 | 68 | 76 |

| Put off or postponed preventive health services, such as a yearly check-up or routine test | 75 | 63 | 64 | 77 |

| Gone without health care you thought you needed | 74 | 56 | 58 | 76 |

| Skipped a recommended medical test or treatment | 57 | 44 | 46 | 57 |

| Not filled a prescription, cut pills in half or skipped doses of medicine | 47 | 36 | 33 | 56 |

| Had problems getting mental health care | 34 | 24 | 24 | 37 |

Four in ten ‘very worried’ about finding a doctor to treat them when needed

Overall, two in three among the eligible uninsured currently worry about being able to find a doctor to treat them, with 39 percent reporting they are “very worried”. Hispanics and Blacks are significantly more likely than whites to say they worry about finding a practitioner, those with lower incomes are more likely to worry than those in households making more money, and women are more likely to be concerned about this than men.

| Figure 23: Large Shares Worry About Finding a Doctor Who Will Treat Them | |

| Among California eligible uninsured: Percent who say they are “very” or “somewhat” worried about not being able to find a doctor or health professional who will treat them | |

| Total eligible uninsured | 66% |

| BY INCOME GROUP | |

| Income ≤138% FPL (Medi-Cal target) | 72 |

| Income >138%-400% FPL (exchange subsidy target) | 62 |

| Income >400% FPL | 49 |

| BY RACE/ETHNICITY | |

| Hispanic | 79 |

| Black (Non-Hispanic) | 71 |

| White (Non-Hispanic) | 53 |

| BY GENDER | |

| Women | 72 |

| Men | 61 |

Meanwhile, a third of the eligible uninsured say they are in less than good health, including higher shares of those in the lowest income groups. And just over four in ten (44 percent) overall say at least one person in their household would be considered to have a pre-existing condition of some sort.

| Figure 24: Self-Reported Health Status Among California Uninsured | ||||

| Among California eligible uninsured: In general, would you say your health is excellent, very good, good, fair, or poor? | ||||

| Total eligible uninsured | ≤138% FPL (Medi-Cal target) | >138%-400% FPL (exchange subsidy target) | >400% FPL | |

| Excellent, very good, or good | 65% | 55% | 73% | 79% |

| Fair or poor | 35 | 44 | 27 | 20 |

Medical bills, problems paying, worries about being able to pay

Four in ten had trouble paying medical bills in past year, many with severe consequences

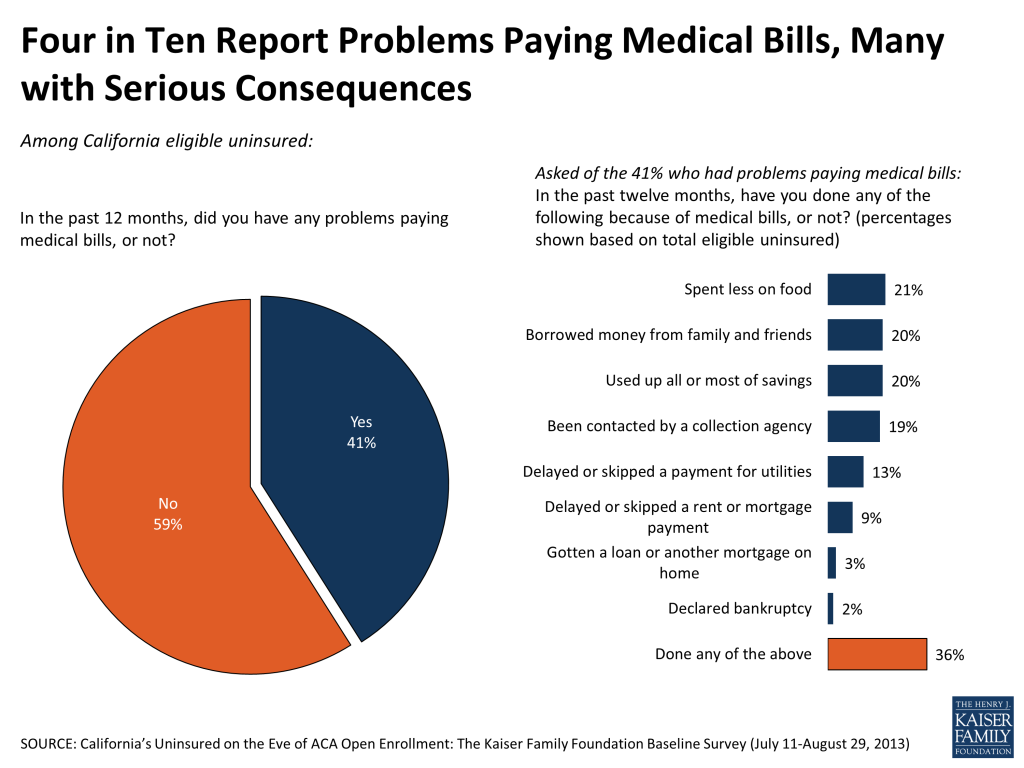

Over the course of the past year, four in ten (41 percent) uninsured Californians say they had trouble paying medical bills, with roughly half that group (or 23 percent of the eligible uninsured overall) reporting that these bills had a ‘major impact’ on their family.

| Figure 25: Four in Ten Uninsured Report Problems Paying Medical Bills | |

| Among California eligible uninsured: Percent who say they had problems paying medical bills in the past 12 months | |

| Total eligible uninsured | 41% |

| BY INCOME GROUP | |

| Income ≤138% FPL (Medi-Cal target) | 47 |

| Income >138%-400% FPL (exchange subsidy target) | 36 |

| Income >400% FPL | 27 |

| BY RACE/ETHNICITY | |

| Hispanic | 38 |

| Black (Non-Hispanic) | 59 |

| White (Non-Hispanic) | 41 |

| BY GENDER | |

| Women | 47 |

| Men | 35 |

| BY AGE | |

| 19-25 | 43 |

| 26-34 | 35 |

| 35-49 | 43 |

| 50-64 | 42 |

| BY HEALTH STATUS | |

| Excellent/very good/good | 33 |

| Fair/poor | 55 |

Blacks (59 percent) and those in fair or poor health (55 percent) are the most likely to report having trouble paying their medical bills, and there is a gender gap with women 12 percentage points more likely than men to report this kind of financial trouble. Perhaps surprisingly, there is little difference across age groups here, with younger people just as likely as older to say they’ve had trouble paying for care.

Among the negative impacts of incurring these high medical bills: 21 percent have spent less on food; 20 percent borrowed money from family and friends; 20 percent used up all or most of savings; 19 percent have been contacted by collection agency; 13 percent skipped a utility payment; and 9 percent skipped a rent or mortgage payment. Overall, about one in three of the state’s eligible uninsured (36 percent) have faced at least one of these serious consequences as a result of health care expenses.

Intense worry about paying medical bills in the face of a serious illness or accident touches nearly all the state’s uninsured

There is a widespread concern among the uninsured about being able to pay medical bills in the event of a serious illness. Three in four are “very” worried about this, overall more than nine in ten worry at least a little about it. This concern ranks at the top of a list of six common financial worries.

About half say they are “very worried” about being able to pay for their routine health care expenses, including a higher share of women (57 percent) than men (44 percent).

Report: Section 3: California's Undocumented Uninsured

| A NOTE ON TERMINOLOGY:The Undocumented Uninsured: For the purposes of this report, undocumented immigrants are defined as those that reported a) they were not born in the United States, and b) they came to this country without a green card, and c) they have not received a green card or become permanent residents since arriving. See Section 5: “About the terms used in this report” for more details. |

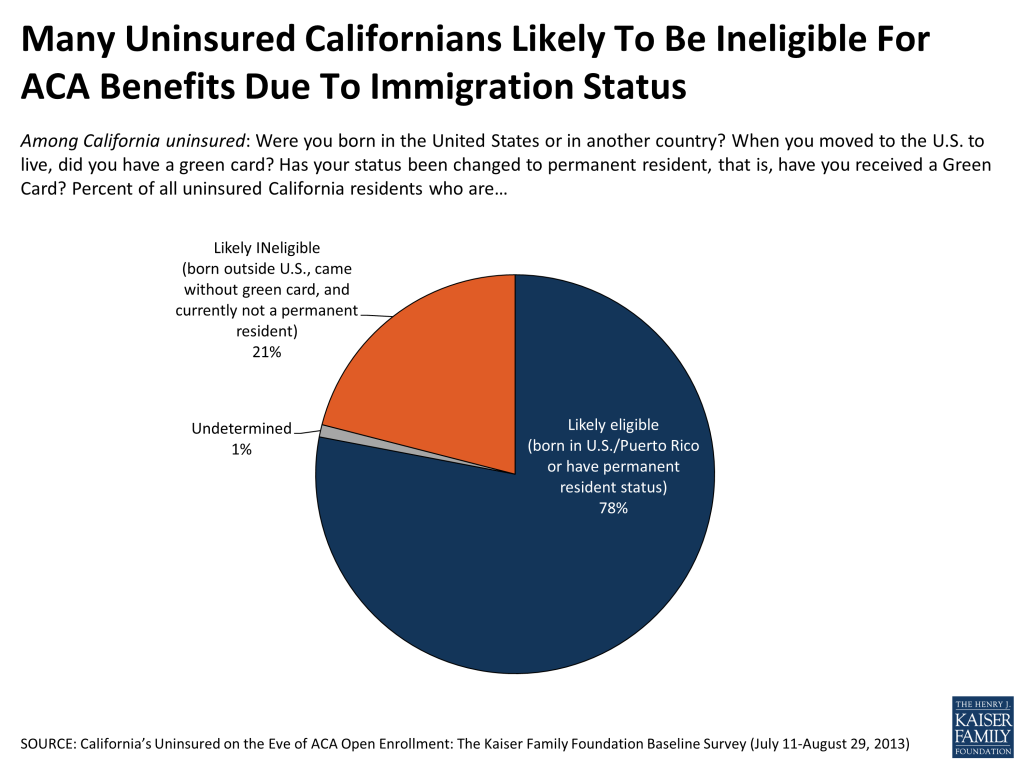

The fourth group of California’s uninsured – a group that we have not considered at any length in the report thus far – is the group that, because of their immigration status, will not be eligible for Medi-Cal or exchange coverage in 2014. Looking at California’s uninsured population as a whole—that is, including those who will be eligible for the ACA’s coverage benefits and those who will not – the survey suggests that about a fifth of the uninsured are undocumented immigrants and would be in this category. Under current law, undocumented immigrants will not be eligible to buy coverage through Covered California or to be covered by the Medi-Cal program.9

As a brief portrait: Nine in ten among the group currently ineligible due to immigration status describe themselves as Hispanic, six in ten (59 percent) are employed and a little over four in ten are married. Over half say they have been in the U.S. for more than ten years. They are more likely than the rest of the uninsured population to be parents of a dependent child and to have lower levels of education.

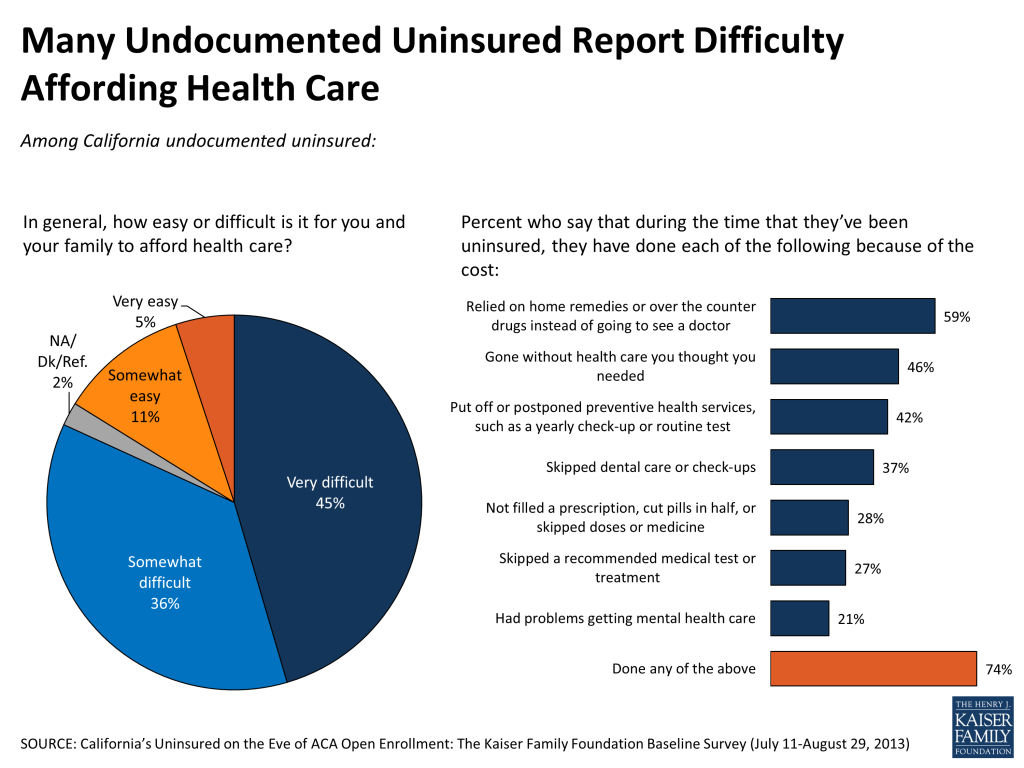

In their health care needs, however, they look much like the rest of the state’s uninsured population. Overall, the large majority of the undocumented uninsured – roughly eight in ten – report finding it difficult to pay for health care. And eight in ten say they feel the need for health insurance, most to cover the risk of an unforeseen illness or accident.

| Figure 29: Undocumented Uninsured Feel Need for Insurance | |

| Among California undocumented uninsured: | |

| Which of the following comes closer to your view? | |

| Health insurance is something I need | 82% |

| I’m healthy enough that I don’t really need health insurance | 18 |

| Which of the following do you think is the MOST important reason to have health insurance? | |

| To pay for everyday health care expenses, like check-ups and prescriptions | 19 |

| To protect against high medical bills in case of severe illness or accident | 79 |

Without the benefit of insurance, many are skipping care they need because they can’t afford it. Overall, 46 percent of uninsured undocumented immigrants say they have gone without needed health care, a significant share, though a smaller proportion than among the rest of the uninsured population (where 64 percent report having skipped needed care).

But worry about the ability to pay bills in the case of a severe and unexpected illness is high in this group, with 86 percent saying they are “very worried”. And they stand out as particularly concerned about being able to find a doctor that would treat them if they needed one: 68 percent are “very worried”, nearly 30 percentage points higher than among other uninsured Californians.

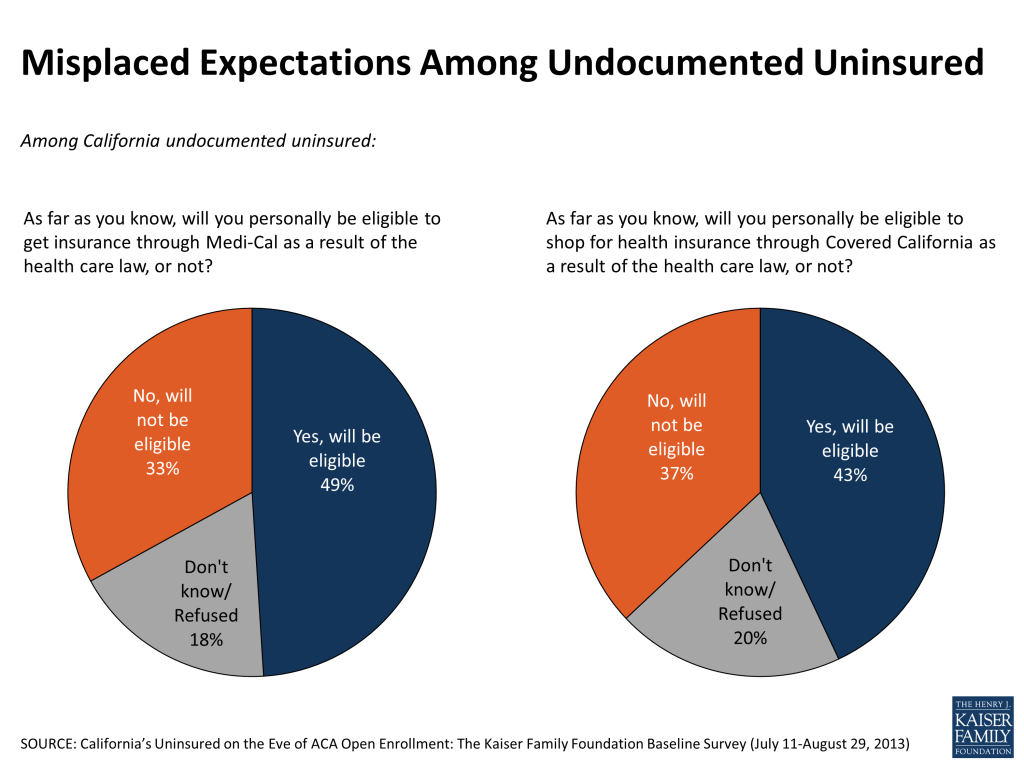

The undocumented uninsured also stand out as a group with very positive views of the ACA, despite the fact that they are not covered by the law, and many have what would seem to be misplaced expectations of receiving help under the law. Among this group, 63 percent have a favorable view of the ACA, and four in ten say that they expect to see improved access to care and insurance under the law. On the other hand, between four and five in ten expect things will stay the same for them.

| Figure 32: Expectations for Law’s Impact Are Similar Among Eligible Uninsured and Undocumented, Though Latter Group Not Eligible for Coverage Expansions | ||

| Among California uninsured: Under the 2010 health care law, do you think each of the following will get better, worse, or will it say about the same? | ||

| Eligible uninsured | Undocumented uninsured | |

| Your ability to get the health care you need | ||

| Better | 39% | 44% |

| Worse | 21 | 6 |

| Stay about the same | 33 | 42 |

| Your ability to get and keep health insurance | ||

| Better | 40 | 40 |

| Worse | 17 | 7 |

| Stay about the same | 37 | 50 |

| The cost of health care for you and your family | ||

| Better | 31 | 35 |

| Worse | 26 | 12 |

| Stay about the same | 34 | 46 |

More specifically in terms of perceived benefits, about half (49 percent) of the undocumented uninsured think they may be eligible to get insurance through Medi-Cal as a result of the ACA, and 43 percent expect they will be eligible to shop for health insurance through Covered California. These findings suggest there is a group in this population that could be left feeling disappointed and potentially frustrated come 2014.

Report: Section 4: What Comes Next

Over the course of the next six months, millions of uninsured Californians will likely come into contact with the enrollment expansion options being made available to them under the Affordable Care Act. As opposed to being an ideological debate, this contact will involve real life choices, possibly real life compromises. It will involve real, tangible benefits. For some, it will require a tangible financial investment.

By using the current survey as a baseline, and returning to the field to talk to this very same group of Californians after the six month open-enrollment period ends – whether they have signed up for health insurance or remain uninsured – we hope to shed light on what they make of all these changes. What choices did they make? Who enrolled in Medi-Cal and why, or why not? Who shopped on the state’s new exchange, and how do they evaluate that experience and the coverage they got there? Has expanded access to health insurance made a dent in the level of worry people without coverage currently experience in viewing an uncertain future? We will follow up over the longer term with a third and fourth wave of interviews to fully capture the views and experiences of the state’s uninsured throughout the first two years of the ACA insurance expansion.

In the interim, we plan to release additional analyses taking a closer look at key subgroups among the state’s uninsured population – such as young adults, Hispanics, and the undocumented uninsured – as well as a series of in-depth, follow-up profiles of individual uninsured Californians reflecting, illustrating and further exploring the results of the baseline survey.

Report: Section 5: About The Terms Used In This Report

The Eligible Uninsured: For purposes of this report, the uninsured are defined as those Californians ages 19-64 who have been without coverage for at least two months. Those who had been uninsured for less than two months were excluded from the survey since they may be experiencing a short period of uninsurance (i.e. someone who is between jobs), and the goal of the survey was to capture the experiences and views of those who have been without insurance for a longer period of time and are poised to experience the new coverage provisions of the ACA. Because the coverage expansions under the ACA do not extend to undocumented immigrants, most analysis is based on the 78 percent of this group who report being U.S. citizens or permanent residents, described in shorthand as the ‘eligible uninsured’. Those who volunteered they were here on student visas are also included in this category.

The Undocumented Uninsured: For the purposes of this report, undocumented immigrants are defined as those who reported a) they were not born in the United States or Puerto Rico, b) they came to this country without a green card, and c) they have not received a green card or become a permanent resident since arriving. There are several ways that this definition, while workable for the purposes of a broad analysis of this sort, falls short of the complexity of real life. First, it relies on self-reporting, and since respondents have an incentive not to reveal unlawful immigration status, it is undoubtedly a somewhat imperfect measure. Second, those that did not answer all three in the series of immigration status items (24 respondents) were not able to be categorized. Third, by necessity of time and efficiency, the survey did not allow for a full exploration of the many nuances inherent in the U.S. immigration system. For example, this category may actually include a small number of individuals in California as refugees, asylees or other humanitarian immigrants who might better be placed among the ‘eligible uninsured’. The survey, unfortunately, does not allow this level of detailed sorting.

Income categories: Because eligibility for two of the law’s main components – the Medi-Cal expansion and the tax credits being made available to purchase insurance on the new exchanges – is based on an individual’s family income relative to the federal poverty level (FPL), in many cases we report survey results among the eligible uninsured by FPL categories. Those with incomes 138% FPL or less (roughly $32,000 a year for a family of 4) will be eligible for Medi-Cal coverage, while those with incomes greater than 138% and up to 400% FPL (roughly $32,000-$94,000 for a family of 4), will be eligible for subsidies to purchase insurance through Covered California, the state’s new marketplace. Those with incomes above 400% FPL will be allowed to buy insurance through Covered California, but will not be eligible for subsidy assistance. For convenience, we will sometimes refer to the group with incomes 138% FPL or less as the “Medi-Cal target group”, and those greater than 138% and up to 400% FPL as the “exchange subsidy target group”. These obviously are approximations that do not allow for every real world exception to be taken into account. For example, lawfully present immigrants may remain subject to a five year wait before they may enroll in Medi-Cal, but for the purposes of this analysis they are included in the Medi-Cal target group if they meet the income criteria. Similarly, some of those in the exchange subsidy target group may not be eligible for marketplace subsidies if they have access to affordable employer coverage, a situation difficult to ascertain in a phone survey.

This report is based on findings from the first of what is expected to be a four-wave panel survey by the Kaiser Family Foundation (KFF). KFF plans to conduct the subsequent waves in early 2014, late 2014, and early 2015, with those surveys focusing on the coverage choices people make; experiences with enrollment and access to care; as well as tracking any changes in knowledge, attitudes, health expenses, and sense of financial security. All surveys will be conducted with the original random probability sample panel of respondents, whether they obtain coverage or remain uninsured.

The current survey was designed and analyzed by public opinion researchers at KFF, led by Mollyann Brodie, Ph.D., including Claudia Deane, Liz Hamel, and Sarah Cho, with input from Larry Levitt, Gary Claxton, and Rachel Garfield. Social Science Research Solutions (SSRS) collaborated with KFF researchers on sample design and weighting, and supervised the fieldwork.

The survey was conducted by telephone from July 11 through August 29, 2013, among a representative random sample of 2,001 adults ages 19-64 living in California, who reported having been without health insurance coverage for at least two months at the time of interview10 (note: persons without a telephone could not be included in the random selection process). Computer-assisted telephone interviews conducted by landline (990) and cell phone (1,011, including 660 who had no landline telephone) were carried out in English and Spanish11 by SSRS. Both the random digit dial landline and cell phone samples were generated through Marketing Systems Group’s GENESYS sampling system.

Because the study targeted a low-incidence population, the sample was designed to increase efficiency in reaching this group. To do so, both the landline and cell phone sampling frames oversampled areas with a lower-income population (since being uninsured is negatively correlated with income). The landline sample frame also oversampled households whose phone numbers were matched with directory listings indicating the presence of at least one person age 19-64 and a household income of less than $25,000. Additionally, 230 interviews (130 landline, 100 cell phone) were conducted with respondents who previously completed recent national SSRS omnibus surveys of the general public and indicated they were ages 19-64 and uninsured. These previous surveys were conducted with nationally representative, random-digit-dial landline and cell phone samples.

Screening for the survey involved verifying that the respondent (or another member of the household for the landline sample) met the criteria of: 1) residing in California; 2) being 19-64 years old; and 3) being currently uninsured. For the landline sample, if two or more household members met the criteria, a respondent was randomly selected by asking for the qualified person who had the most recent birthday. Selected respondents were further screened to confirm that they had been uninsured for at least two months.

A multi-stage weighting design was applied to ensure an accurate representation of the California uninsured population ages 19-64. The weighting process involved corrections for sample design, as well as sample weighting to match known demographics of the target population. The base weight accounted for the oversamples used in the sample design, as well as the likelihood of non-response for the re-contact sample, number of eligible household members for the landline sample, and a correction to account for the fact that respondents with both a landline and cell phone have a higher probability of selection. Demographic weighting parameters were based on the 19-64 year old uninsured California population using the Census Bureau’s 2011 American Community Survey (ACS) for age, education, race/ethnicity, nativity (for Hispanics only), Hispanics by gender, presence of own child in the household, marital status, California region, and poverty level.12 The sample was also weighted to match current patterns of telephone use among the uninsured in California using an estimate based on data from the July-December 2012 National Health Interview Survey combined with the weighted distribution of phone status among 996 uninsured California residents who completed interviews on SSRS omnibus surveys over the past year. All statistical tests of significance account for the effect of weighting.

The margin of sampling error including the design effect for the sample of eligible uninsured, on which most findings in the report are based, is plus or minus 4 percentage points. Numbers of respondents and margin of sampling error for key subgroups are shown in the table below.

| Group | N | MOSE |

| Total CA uninsured | 2,001 | + 3 percentage points |

| Eligible uninsured (citizens/permanent residents)13 | 1,585 | + 4 percentage points |

| Eligible uninsured by income group14 | ||

| Eligible uninsured, < 138% FPL (Medi-Cal target group) | 880 | + 5 percentage points |

| Eligible uninsured, >138%-400% FPL (exchange subsidy target group) | 531 | + 6 percentage points |

| Eligible uninsured, >400% FPL | 100 | + 13 percentage points |

| Undocumented immigrants | 392 | + 7 percentage points |

For results based on other subgroups, the margin of sampling error may be higher. Sample sizes and margin of sampling errors for other subgroups are available by request. Note that sampling error is only one of many potential sources of error in this or any other public opinion poll.

Endnotes

- For the purposes of this report, the ‘eligible uninsured’ are California residents ages 19-64 who have been uninsured for at least two months, and would be eligible for participation in the ACA coverage expansion based on their self-reported status as a citizen, permanent resident, or lawfully present immigrant. See Section 5: “About the terms used in this report” for more details. ↩︎

- For the purposes of this report, ‘undocumented immigrants’ are defined as those who reported they were born outside the United States, came to the U.S. without a green card, and have not received a green card or become a permanent resident since arriving. See Section 5: “About the terms used in this report” for more details. ↩︎

- For more on California, see “California’s Health Care Environment and Health Reform Efforts”, KFF, June 2013, https://modern.kff.org/wp-content/uploads/2013/06/8454-california_s-health-care-environment.pdf. ↩︎

- Kaiser Family Foundation analysis of 2013 ASEC Supplement to the Current Population Survey. ↩︎

- Kaiser Family Foundation analysis of CMS data, downloaded at: https://data.cms.gov/dataset/The-Number-of-Estimated-Eligible-Uninsured-People-/pc88-ec56. Note that these numbers exclude those who are ineligible due to immigration status. These numbers likely overestimate the number of eligible adults in each category for two reasons: 1) Breakouts by poverty level include children, as it was not possible to break out data by poverty level and age; and 2) Some of those in the middle income range (greater than 138 percent and up to 400 percent FPL) may be ineligible for subsidies if they have access to affordable employer coverage, a condition that could not be determined from these data. ↩︎

- UCLA Center for Health Policy Research and UC Berkeley Center for Labor Research and Education, California Simulation of Insurance Markets (CalSIM): http://healthpolicy.ucla.edu/programs/health-economics/projects/CalSIM/Documents/CalSIM_Statewide.pdf ↩︎

- Kaiser Family Foundation analysis of CMS data, downloaded at: https://data.cms.gov/dataset/The-Number-of-Estimated-Eligible-Uninsured-People-/pc88-ec56. ↩︎

- Kaiser Health News, HHS Will Allow ‘Unbanked’ People To Use Prepaid Debit Cards On Exchanges, August 29, 2013, available at http://capsules.kffhealthnews.org/index.php/2013/08/hhs-will-allow-unbanked-people-to-use-prepaid-debit-cards-on-exchanges/ ↩︎

- For more information on the current shape of immigration policy and the ACA, see KFF Issue Brief, Immigration Reform and Access to Health Coverage: Key Issues to Consider, available at http://modern.kff.org/uninsured/issue-brief/immigration-reform-and-access-to-health-coverage-key-issues-to-consider/ ↩︎

- Those who had been uninsured for less than two months were excluded from the survey since they may be experiencing a short period of uninsurance (i.e. someone who is between jobs), and the goal of the survey was to capture the experiences and views of those who have been without insurance for a longer period of time and are poised to experience the new coverage provisions of the ACA. ↩︎

- With over half of California’s total uninsured population being of Hispanic descent, it is essential to include Spanish interviewing as an option when surveying this population. Due to the diversity of languages spoken by California’s Asian population, we were not able to translate the questionnaire and conduct interviews in the many various Asian languages spoken by some of California’s uninsured. Roughly one in ten uninsured Californians are of Asian descent, and according to the Census, about half of this group says they speak English less than “very well.” Further, survey participation among Asians as a whole tends to be lower than among whites. As a result, we did not obtain enough interviews with Asians to report their results separately when breaking out results by race/ethnicity. Responses for Asians are included in the total, and are weighted so that they represent the appropriate share of the uninsured population. The views of non-English-speaking Asians may be underrepresented in this report, but given the small share this represents of the overall uninsured population, it is not likely to have a material impact on the overall findings. ↩︎

- For purposes of income grouping and weighting, income (categorized as a percent of the federal poverty level) is aggregated by “health insurance units.” This unit includes members of a family who can be covered under one insurance policy: the policy holder, spouse, children under age 19 and some full-time students under age 23. Other family members (e.g., grandparents) who may be living in the same household might not be included based on program eligibility; therefore, their incomes are not part of the income used to calculate poverty levels. The health insurance unit more accurately reflects the income that would be counted when people apply to Medi-Cal or purchase health insurance through Covered California. The U.S. Census Bureau produces simplified – but very similar – versions of federal poverty guidelines called family poverty thresholds. ↩︎

- 24 respondents declined to answer questions about immigration status, and so were not classified as either eligible uninsured or undocumented immigrants. ↩︎

- 74 respondents declined to answer questions about family size and income, and so were not classified into one of the 3 income groupings, though their responses are included in the analysis of all eligible uninsured. ↩︎