Medicare Beneficiaries Are Not Insulated from Affordability Challenges As Part B Premiums Rise in 2026

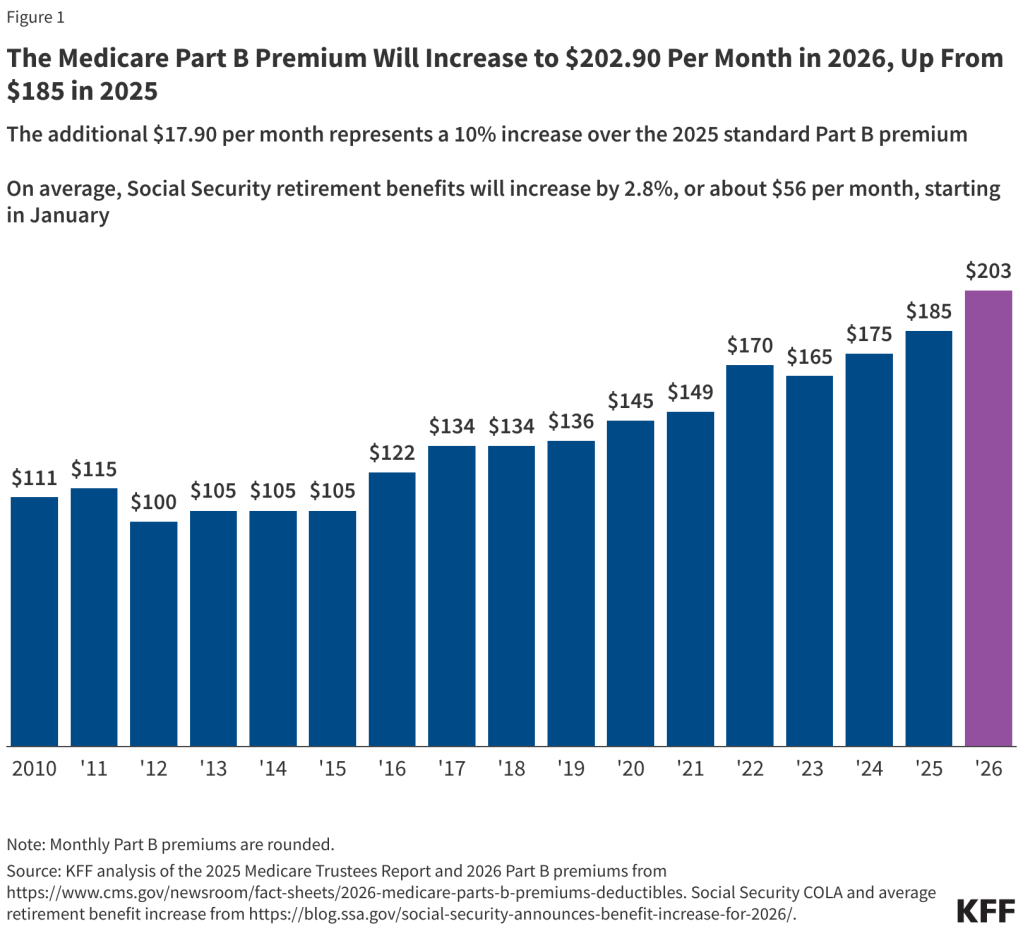

Published: November 17, 2025Last week, the Centers for Medicare & Medicaid Services (CMS) announced that Medicare Part B premiums will increase from $185.00 per month to $202.90 per month, a 10% increase (Figure 1). This means the standard Medicare Part B premium will exceed $2,400 annually next year. Medicare beneficiaries with incomes above $109,000 will pay an income-related premium that phases up to $689.90 per month, or more than $8,200 per year for those with incomes of $500,000 or more. Beneficiaries typically pay the Medicare Part B premium whether in traditional Medicare or a Medicare Advantage plan.

Because Medicare premiums are typically deducted from Social Security payments, the nearly $18 increase in monthly premiums will essentially reduce the annual increase (the COLA) for most beneficiaries. Social Security retirement benefits will increase by 2.8% in 2026, an increase of $56 per month, on average, but that amount will drop by about $18 due to the scheduled increase in the Part B premium.

Medicare Part B premiums have generally increased over time along with increases in Medicare Part B spending because Part B premiums are set to cover 25% of Part B spending. Medicare Part B covers outpatient services, such as physician visits, hospital outpatient services, diagnostic tests and physician-administered drugs.

The CMS announcement explains that the increase in the Medicare Part B premium for 2026 would have been larger if the Trump Administration had not taken action to reduce what Medicare pays for skin substitutes in the 2026 physician payment rule. Medicare spending for skin substitutes has increased dramatically in recent years.

The increase in Medicare premiums, deductibles and other expenses could be especially burdensome on low- and middle-income Medicare beneficiaries, particularly people who do not qualify for financial help from the Medicare Savings Programs. Under the Medicare Savings Programs, state Medicaid programs help cover Medicare premiums (and often deductibles and coinsurance) for Medicare beneficiaries with low incomes and modest assets, which means the increase in Medicare premiums will also affect state budgets.

Last year, KFF released an analysis showing more than 7 million people on Medicare spend at least 10% of their annual income on Medicare Part B premiums alone. This estimate does not account for other out-of-pocket costs incurred by Medicare beneficiaries for Medicare-covered services or for health expenses not covered by Medicare, like dental or long-term care.

Several proposals have been put on the table that could limit the growth in Medicare Part B spending, and help limit the growth in Medicare premiums. For example, lawmakers have considered various proposals to broaden site neutral payment reforms and tighten payments for Medicare Advantage. Others have proposed ways to limit the growth in spending for Medicare Part B physician-administered drugs.

Another approach could be to expand eligibility for the Medicare Savings Programs by increasing income and assets thresholds. This approach would help address affordability concerns for more people with Medicare but wouldn’t address underlying cost growth, and seems unlikely to move forward in the near term, given fiscal pressure on states in the wake of Medicaid spending reductions included in the 2025 Federal Budget Reconciliation Law.

The issue of health care affordability crosses generations. Recently, the press has focused attention on health care affordability challenges for people with employer and marketplace coverage. The rise in Medicare Part B premiums shows how increases in health care costs affect people with Medicare, too.