Prior Authorization in Medicare Advantage Plans: How Often Is It Used?

This year, during the annual Medicare Open Enrollment period, more than 60 million people on Medicare have the opportunity to choose between traditional Medicare and Medicare Advantage plans. In making this decision, they are encouraged to take into account a number of factors, including premiums, cost-sharing, extra benefits, drug coverage, quality of care, and provider networks. A potentially overlooked consideration is access to covered services; specifically, how prior authorization may affect beneficiaries’ access to covered services.

Medicare Advantage plans can require enrollees to get approval from the plan prior to receiving a service, and if approval is not granted, then the plan generally does not cover the cost of the service. Medicare Advantage enrollees can appeal the plan’s decision, but relatively few do so. Traditional Medicare, in contrast, does not require prior authorization for the vast majority of services, except under limited circumstances, although some think expanding use of prior authorization could help traditional Medicare reduce inappropriate service use and related costs. Optimally, prior authorization deters patients from getting care that is not truly medically necessary, reducing costs for both insurers and enrollees. Prior authorization requirements can also create hurdles and hassles for beneficiaries (and their physicians) and may limit access to both necessary and unnecessary care.

In this data note, we examine the share of Medicare Advantage enrollees in plans that impose prior authorization requirements for Medicare-covered services.

Findings

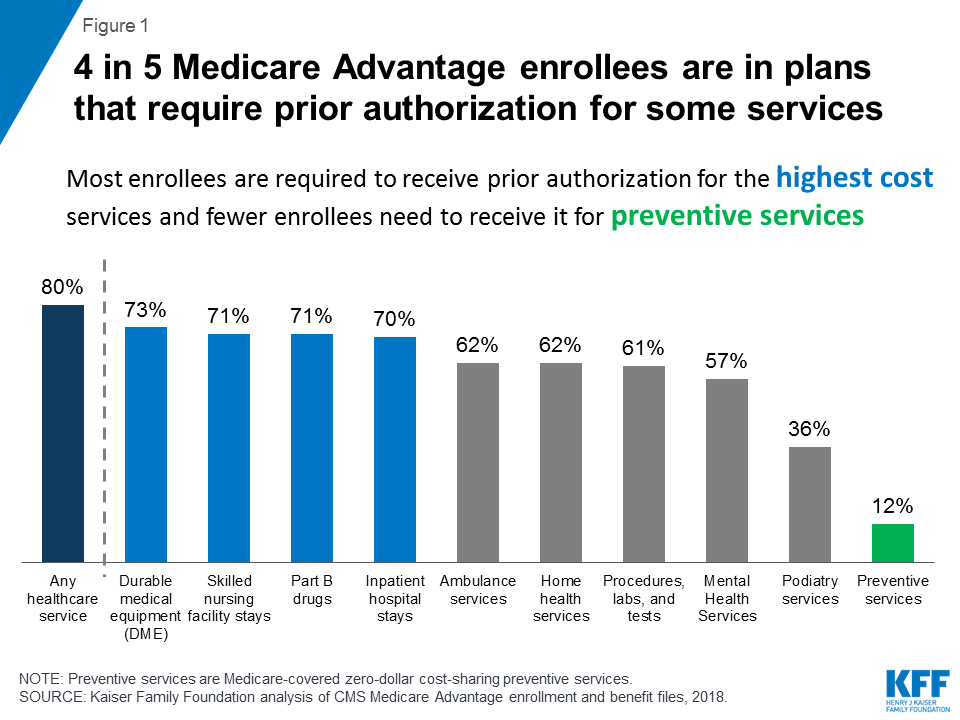

- 80 percent of Medicare Advantage enrollees are in plans that require prior authorization for at least one Medicare-covered service (Figure 1).

Figure 1: 4 in 5 Medicare Advantage enrollees are in plans that require prior authorization for some services - At least 70 percent of enrollees are in plans that require prior authorization for durable medical equipment, Part B drugs, skilled nursing facility stays, and inpatient hospital stays.

- 60 percent of enrollees are in plans that require prior authorization for ambulance, home health, procedures, and laboratory tests.

- More than half of enrollees are in plans that require prior authorization for mental health services.

In general, Medicare Advantage plans typically use prior authorization for relatively high cost services used by enrollees with significant medical needs, such as inpatient care and drugs covered under Medicare Part B. Prior authorization is also being used to limit access to services for which there has been evidence of fraud, such as durable medical equipment, and for services, such as home health, that have experienced disproportionately rapid growth in Medicare spending, at least in certain parts of the country. Beginning in 2019, Medicare Advantage plans will also be allowed to use prior authorization in conjunction with step therapy for Part B (physician-administered) drugs, which could result in some enrollees being required to try a less expensive drug before a more expensive one is covered.

Whether prior authorization serves as an appropriate tool for limiting use of unnecessary care or a worrisome barrier to medically necessary care is an important question for both lawmakers and beneficiaries. Recently, more than 100 Members of Congress sent a letter to the Centers for Medicare and Medicaid Services (CMS) Administrator, Seema Verma, expressing concern about Medicare Advantage plans’ use of prior authorization, and asked CMS to collect data on the scope of prior authorization practices to enable better oversight. The HHS Office of the Inspector General (OIG) recently found that Medicare Advantage plans deny care – inappropriately – at relatively high rates. To the extent that the OIG findings are more the norm than the exception, they raise concerns for enrollees and questions as to whether prior authorization rules contribute to the relatively high rates of disenrollment among sicker Medicare Advantage enrollees.

Currently, CMS does not collect or disseminate plan-specific denial rates, as it is required to do for plans offered in the ACA marketplaces, nor assess the extent to which prior authorization rules affect enrollees’ access to various types of services. Greater transparency with respect to prior authorization could help explain how Medicare Advantage plans are managing care and costs, help beneficiaries choose among the many Medicare coverage options offered in their area, and help CMS carry out its important oversight responsibilities on behalf of the rapidly growing Medicare Advantage population.

Methods

This analysis uses data from the CMS Medicare Advantage Plan Benefits Package Files for 2018. The data indicate the services for which prior authorization is ever required, but do not convey the specific conditions under which prior authorization is required for a given service. Plan data are weighted by March 2018 enrollment.