Medicare’s Income-Related Premiums Under Current Law and Changes for 2019

For several years, Medicare beneficiaries with relatively high incomes have been required to pay income-related monthly premiums for Part B, which covers physician and other outpatient services, and for Part D, which covers outpatient prescription drugs. Most Medicare beneficiaries pay the standard monthly premium, which is set to cover 25 percent of Part B and Part D program costs, but higher-income beneficiaries are required to pay a larger share of program costs. According to the Medicare trustees, in 2017, 3.5 million Medicare beneficiaries paid Part B income-related premiums (6.6 percent of beneficiaries in Part B) and 2.5 million beneficiaries paid Part D income-related premiums (5.6 percent of Part D enrollees). This issue brief describes current requirements with respect to Medicare’s Part B and Part D income-related premiums and changes to these premiums that will take effect in 2019, based on a provision in the Bipartisan Budget Act of 2018.

How much are Medicare’s income-related premiums in 2019? Part B premiums for higher-income beneficiaries will range from $189.60/mo for individuals with incomes of $85,001 to $107,000, to $460.50/mo for those individuals with incomes above $500,000

Part B and Part D Standard Premiums

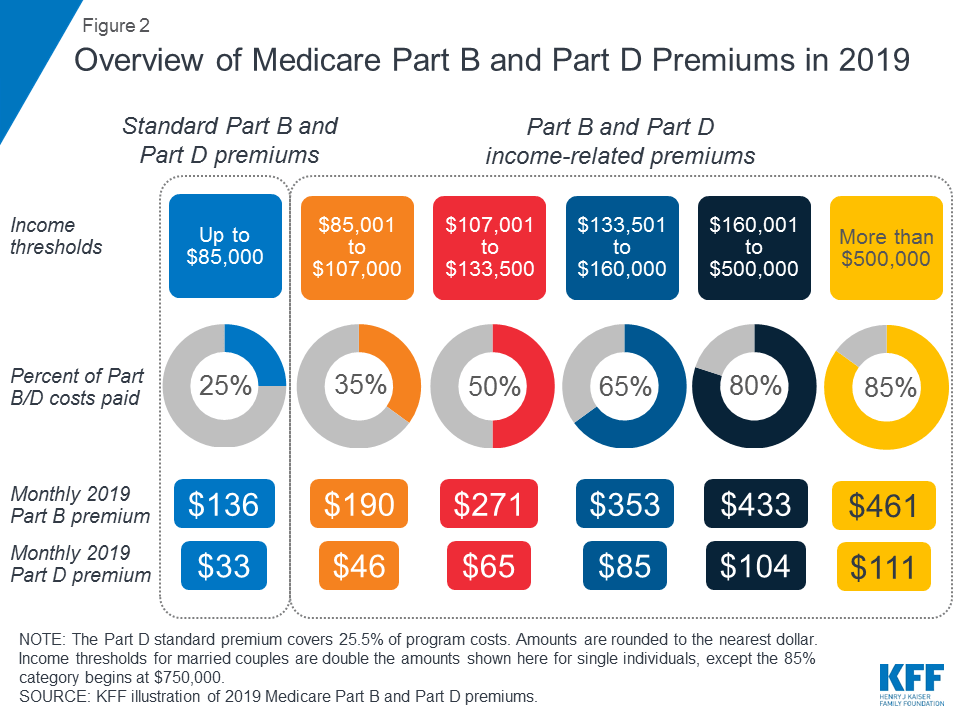

Monthly premiums for most people on Medicare equal 25 percent of average per capita Part B expenditures for Part B enrollees and 25.5 percent of average per capita Part D expenditures for drug plan enrollees. In 2019, the Part B standard monthly premium is $135.50, up from $134 in 2018; for Part D, the national average monthly premium for 2019 is $33.19, but actual monthly premiums for stand-alone Part D drug plans vary across plans and regions from a low of $10.40 to a high of $156.

Income-Related Premiums for Part B and Part D

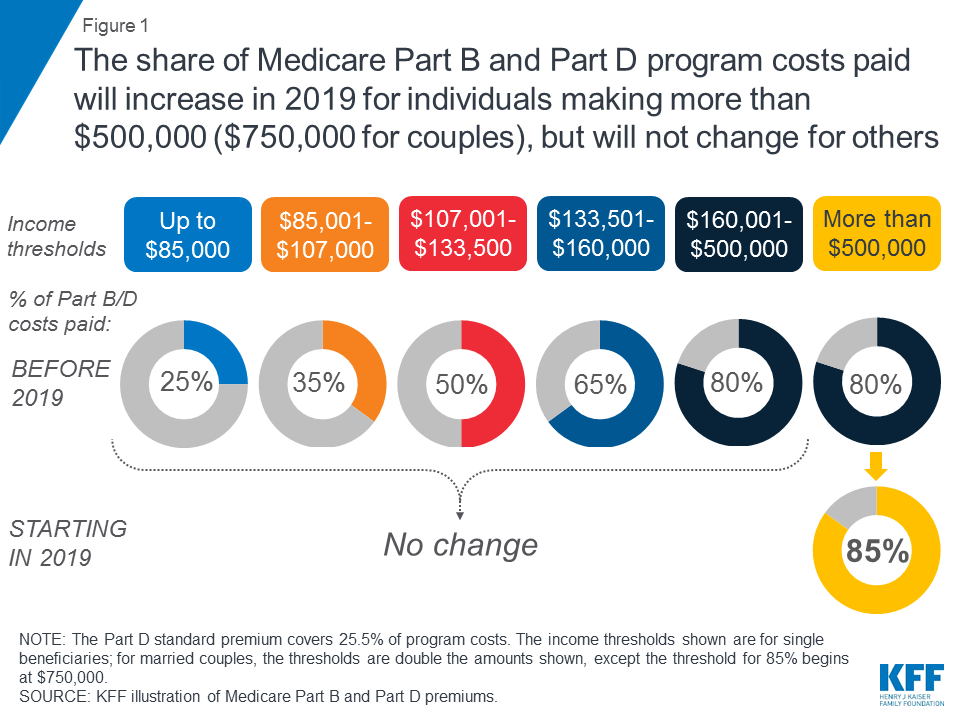

People on Medicare with incomes above $85,000 for individuals and $170,000 for couples are currently required to pay higher premiums for Medicare Part B and Part D. These premiums were first required for Part B in 2007 and for Part D in 2011, and have been modified over time, with the latest change taking effect in 2019 (Figure 1).

- The Part B income-related premium was established by the Medicare Modernization Act of 2003 (MMA) and took effect in 2007. For the first time in the program’s history, the MMA required beneficiaries with higher incomes (defined in the MMA as single beneficiaries with incomes above $80,000 and married couples with incomes above $160,000) to pay a larger share of Part B per capita costs than the standard 25 percent, ranging from 35 percent to 80 percent, depending on their income.

- The Part D income-related premium was established by the Affordable Care Act (ACA) in 2010 and took effect in 2011. Under this provision, Part D enrollees with higher incomes were required to pay an income-related premium surcharge in addition to the monthly premium for their chosen Part D plan. The Part D income-related surcharge is calculated as a percent of the national average cost of the standard drug benefit, using the same percentages (35 percent to 80 percent) and income thresholds as for Part B.

- The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) made changes to Medicare’s income-related premiums by requiring beneficiaries with incomes above $133,500 ($267,000 for married couples) to pay a larger share of Part B and Part D program costs than under the original MMA and ACA provisions. Under MACRA, beginning in 2018, beneficiaries with incomes above $133,500 and up to $160,000 ($267,000-$320,000 for married couples) were required to pay 65 percent of Part B and Part D program costs, up from 50 percent prior to 2018, while beneficiaries with incomes above $160,000 and up to $214,000 ($320,000-$428,000 for married couples) were required to pay 80 percent of Part B and Part D program costs, up from 65 percent.

- The most recent change to Medicare’s income-related premiums was incorporated in the Bipartisan Budget Act of 2018 (BBA). This change will affect beneficiaries with incomes above $500,000 ($750,000 for married couples) by requiring them to pay 85 percent of program costs beginning in 2019, up from 80 percent prior to 2019.

How Much Are Medicare’s Income-Related Premiums in 2019?

In 2019, Part B premiums for higher-income beneficiaries range from $189.60 per month for individuals with annual incomes above $85,000 up to $107,000 who are required to pay 35 percent of program costs, to $460.50 per month for individuals with incomes above $500,000 who are required to pay 85 percent of program costs (Figure 2). For Part D, the 2019 monthly premium surcharge ranges from $12.40 for individuals with annual income above $85,000 up to $107,000, to an additional $77.40 for individuals with incomes above $500,000. When combined with the national average premium amount, higher-income Part D enrollees will pay between $46 and $111 per month in 2019.

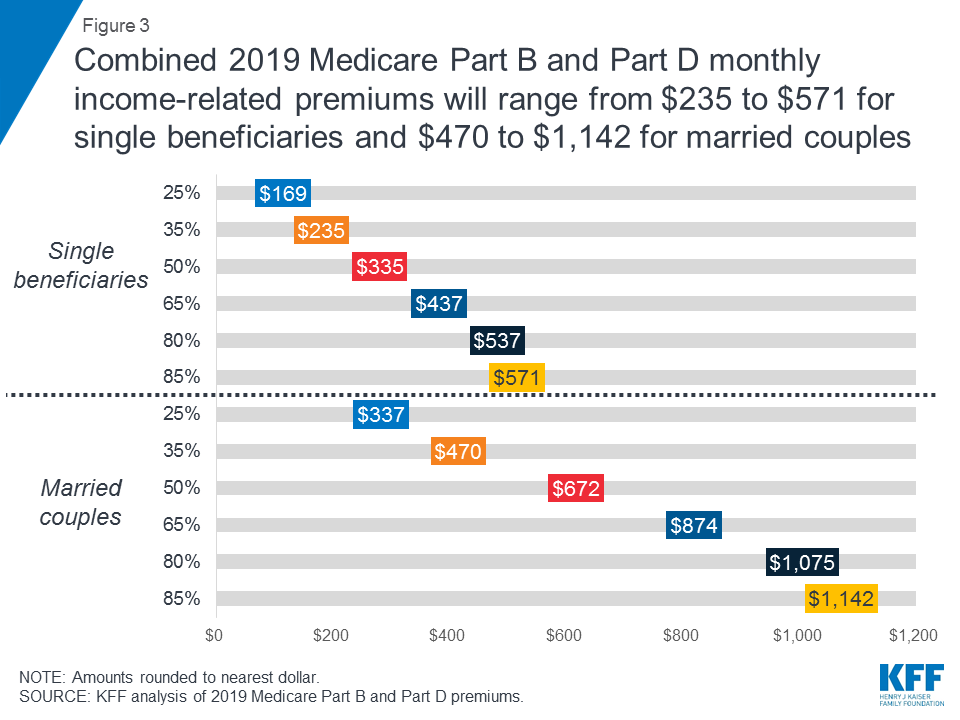

For beneficiaries enrolled in both Part B and Part D, the combined income-related monthly premiums for 2019 range from around $235 for single beneficiaries with incomes above $85,000 up to $107,000, to $571 for beneficiaries with incomes above $500,000 (Figure 3). Monthly income-related premiums for married couples who are both enrolled in Part B and Part D are twice these amounts, ranging from $470 to $1,142.

How Do the Income Thresholds Change Over Time?

For the first few years that the Medicare Part B income-related premium was in effect (between 2007 and 2010), the income thresholds that determined who paid the higher amounts were set to increase annually with the rate of price inflation so that about 5 percent of Part B enrollees would pay the income-related premium each year. In 2007, the initial threshold was set at $80,000 for single beneficiaries and $160,000 for married beneficiaries, increasing to $82,000/$164,000 for 2008 and $85,000/$170,000 for both 2009 and 2010; there was no increase for 2010 because there was no price inflation.

Since 2011, the income thresholds that determine who pays the higher Part B premiums have been fixed at their current levels through 2019 (a provision of the ACA); this provision also applies to Part D. As a result, a growing share of beneficiaries have been subject to the income-related premiums over this time period.

In 2020 and subsequent years, the income thresholds will once again be indexed to general price inflation, based on their levels in 2019 (a provision in MACRA), except that the top-level income thresholds of $500,000/$750,000 that determine who pays 85 percent of Part B and Part D costs will be frozen through 2027 and adjusted annually for inflation starting in 2028 (a provision of the BBA of 2018). As a result, the number and share of beneficiaries paying the top 85 percent level of income-related premiums will increase as the number of people on Medicare continues to grow in future years and as their incomes rise.