Medicaid Reforms to Expand Coverage, Control Costs and Improve Care: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2015 and 2016

Managed Care Reforms

| Key Section Findings |

Tables 5 through 10 include more detail on the populations covered under managed care (Table 5), expansions to new groups (Table 6), selected benefits included in managed care contracts (Table 7), managed care quality initiatives (Table 8), and MLR (Table 9) and auto-enrollment policies (Table 10). These tables are also available in a downloadable PDF. |

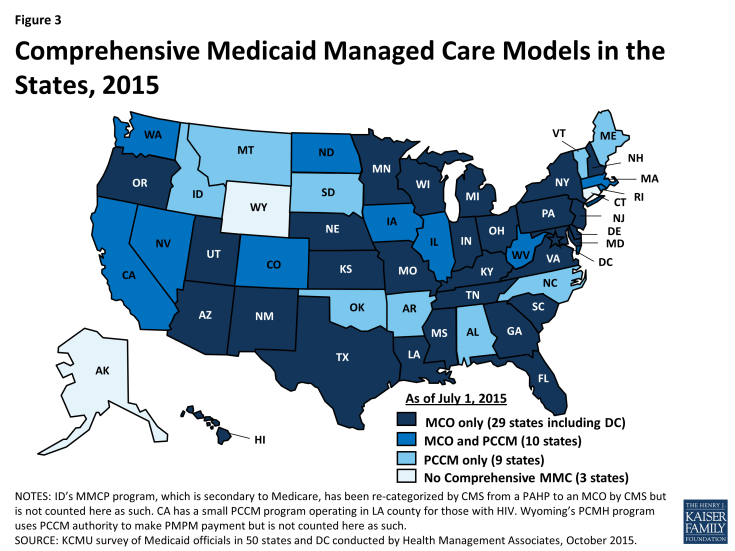

Managed care is now the predominant delivery system for Medicaid in most states, as Medicaid programs increasingly have turned to managed care as a means to help ensure access, improve quality and achieve budget certainty. As of July 2015, all states (including DC) except three – Alaska, Connecticut and Wyoming– had in place some form of managed care. Across the 48 states with some form of managed care, a total of 39 states (including DC) had contracts with comprehensive risk-based managed care organizations (MCOs); 19 states administered a Primary Care Case Management (PCCM) program, a managed fee-for-service based system in which beneficiaries are enrolled with a primary care provider who are paid a small fee to provide case management services in addition to primary care. Of the 48 states that operate some form of managed care, a total of 10 states operate both MCOs and a PCCM program while 29 states (including DC) operate MCOs only and nine states operate PCCM programs only.1 (Figure 3) Wyoming, one of the three states without managed care (i.e., without an MCO or PCCM model), does operate a limited-benefit risk-based prepaid health plan (PHP). In total, 18 states (including Wyoming) contracted with one or more PHPs to provide behavioral health, dental care, maternity care, non-emergency medical transportation, or other benefits.

Populations Covered by Managed Care

The share of Medicaid beneficiaries enrolled in MCOs, PCCM programs or remaining in fee-for-service varies widely by state. However, the share of Medicaid beneficiaries enrolled in MCOs has steadily increased as states have expanded their managed care programs to new regions and new populations and made MCO enrollment mandatory for additional eligibility groups. In this year’s survey, states were asked to indicate the approximate share of specific Medicaid populations that were served by MCOs, PCCM programs and fee-for-service (FFS) for their acute care services. As shown in Table 5, among the 39 states (including DC) with MCOs, 21 states reported that 75 percent or more of their Medicaid beneficiaries were enrolled in MCOs as of July 1, 2015, including four of the five states with the largest total Medicaid enrollment, accounting for 4 out of every 10 Medicaid beneficiaries across the country (California, New York, Texas and Florida). (Figure 4 and Table 5)

Figure 4: MCO Managed Care Penetration Rates for Select Groups of Medicaid Beneficiaries as of July 1, 2015

Children and adults (particularly those enrolled through the ACA Medicaid expansion) are much more likely to be enrolled in an MCO than elderly Medicaid beneficiaries or those with disabilities. Thirty-two (32) of the 39 MCO states covered 75 percent or more of children through MCOs. Twenty-one (21) of the 39 MCO states covered 75 percent or more of low-income adults (e.g., parents, pregnant women) through MCOs. The elderly and people with disabilities were the group least likely to be covered through managed care contracts, with only 15 of the 39 MCO states covering 75 percent or more such enrollees through MCOs. (Figure 4) With the exception of some states participating in the CMS Financial Alignment Demonstrations, most states were even less likely to include those dually eligible for Medicare and Medicaid through managed care contracts.

Of the 29 states that were implementing the ACA Medicaid expansion on July 1, 2015, 26 were using MCOs to cover newly eligible adults. (The three expansion states without risk-based managed care were Arkansas, Connecticut and Vermont.) The large majority (23) of these 26 states covered more the 75 percent of beneficiaries in this group through managed care. The three states with less than 75 percent MCO penetration for this group were Colorado, Illinois and Iowa (which each operate PCCM programs as well as MCOs.)

Ten (10) of the 19 states with PCCM programs also contract with MCOs. In most of these states, MCOs cover a larger share of beneficiaries than PCCM programs. However, Colorado, Iowa and North Dakota are exceptions: a majority of Colorado’s enrollees were in the PCCM program, which is the foundation of the state’s Accountable Care Collaboratives, and approximately four in ten enrollees in both Iowa and North Dakota were enrolled in those states’ PCCM programs as of July 1, 2015.

Managed Care Population Changes

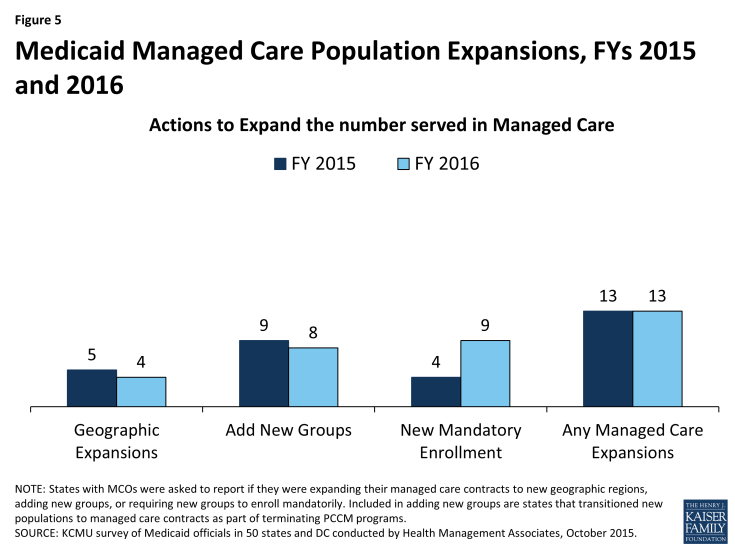

In both FY 2015 and in FY 2016, states continued to take actions to increase enrollment in managed care, although fewer states reported doing so than in last year’s survey – likely reflecting full or nearly full MCO saturation in a growing number of states. Of the 39 states (including DC) with MCOs, a total of 20 states indicated that they made specific policy changes in either FY 2015 (13 states) or FY 2016 (13 states) to increase the number of enrollees in MCOs, compared to 34 in last year’s survey; no states with MCOs took any action to restrict MCO enrollment.

The most common strategy was to expand voluntary or mandatory enrollment to additional eligibility groups (9 states in FY 2015 and 8 states in FY 2016). The eligibility group most commonly added to MCOs was persons eligible for LTSS (New Jersey, New Mexico, New York, Texas, Virginia and Washington), followed by the newly eligible adult group in states adopting the ACA Medicaid expansion (Illinois, Indiana, Pennsylvania and West Virginia). In addition, five states (Florida, Indiana, Iowa, Louisiana and Rhode Island) are terminating their PCCM programs in either FY 2015 or FY 2016 and shifting those populations into risk-based managed care (discussed below). Four states (Florida, Illinois, Louisiana and New York) made enrollment mandatory for specific eligibility groups in FY 2015, and nine states (Illinois, Iowa, Louisiana, New Hampshire, New York, Rhode Island, Utah, Virginia and Washington) are doing so in FY 2016. Expansions of MCO geographic service areas were reported in five states in FY 2015, and in four states for FY 2016. (Figure 5) In addition, California reported plans to enroll undocumented children into MCOs in FY 2015. This is predominantly a state-funded program and is therefore not counted as a Medicaid policy change in this report.

| Notable MCO Expansions Implemented or Planned |

| Florida transitioned nearly all Medicaid enrollees into MCOs on a phased-in schedule that was completed in August 2014. At that time, Florida’s PCCM, dental PHP and behavioral health PHP programs ended.

Indiana began enrolling aged, blind and disabled enrollees into the Hoosier Care Connect MCO program in April 2015 and ended the Care Select PCCM program on June 30, 2015. Iowa plans to implement statewide MCO coverage for almost all Medicaid enrollees on January 1, 2016 (pending federal waiver approval) and end its PCCM and behavioral health PHP programs. Louisiana discontinued its Bayou Health Shared Savings (enhanced PCCM) model on January 31, 2015 and transitioned enrollees to MCOs. Rhode Island reported plans to eliminate its PCCM program for adults with disabilities (Connect Care Choice) in FY 2016 and transition enrollees to MCOs. |

Primary Care Case Management (PCCM) Programs Changes

Of the 19 states with PCCM programs, six indicated they enacted policies to increase PCCM enrollment in FY 2015 or FY 2016. Four (Iowa, Massachusetts, Montana and Nevada) indicated that they would enroll new Medicaid expansion adults in their PCCM programs; Alabama expanded its Health Home program statewide in FY 2015; and Colorado reported increased PCCM enrollment of persons dually eligible for Medicare and Medicaid as part of its Financial Alignment Demonstration.

In contrast, seven states (Florida, Illinois, Indiana, Iowa, Louisiana, Oklahoma, and Rhode Island) have taken actions to decrease enrollment in their PCCM programs. Five of these states (Florida, Indiana, Iowa, Louisiana and Rhode Island) have ended or plan to end their PCCM programs and will transition PCCM enrollees to risk-based managed care. In June 2014, Illinois began transitioning 1.5 million PCCM enrollees to new care coordination models (including both risk-based managed care and PCCM models) in five mandatory enrollment regions. In Oklahoma, effective July 2014, individuals with creditable primary coverage are no longer eligible for the SoonerCare Choice PCCM program.

Limited-Benefit Prepaid Health Plans (PHP) Changes

Of the 18 states with one or more limited-benefit prepaid health plans (PHPs), six indicated they enacted policies to increase PHP enrollment in FY 2015 or FY 2016. California is planning to move coverage of substance abuse services from FFS to a PHP arrangement in FY 2016.2 Iowa reported that the benefit for its Medicaid expansion population includes a dental PHP program, and Pennsylvania reported that the Medicaid expansion would increase enrollment in its behavioral health PHP program. Michigan indicated that its dental PHP program was expanding to additional counties; Wisconsin noted that its LTSS PHP was expanding to additional counties; and Wyoming expanded a behavioral health PHP program for children statewide.

Four states reported actions that decreased enrollment in their PHP programs. Iowa and Florida folded, or will fold, PHP arrangements into their MCO programs (dental and behavioral health PHPs in Florida and a behavioral health PHP program in Iowa). Colorado ended a physical health PHP and replaced it with an MCO arrangement, and Washington is allowing “Early Adopter” counties to convert behavioral health PHPs to fully integrated MCO contracts.

Benefits Covered Under Managed Care Contracts

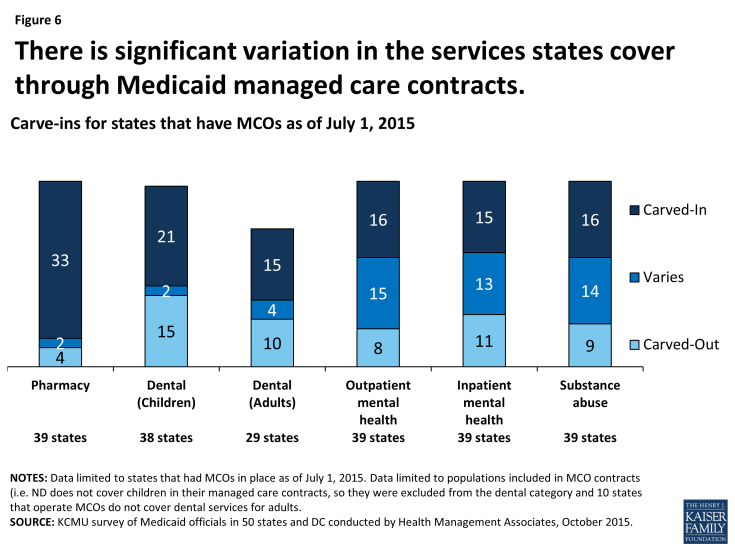

Although MCOs are at-risk financially for providing a comprehensive set of acute-care services, nearly all states elect to exclude or “carve-out” certain services from MCO contracts. These services may be delivered and financed through another contractual arrangement (e.g., through a limited benefit risk-based PHP) or in the FFS delivery system. In this year’s survey, states were asked to indicate the delivery system(s) used to provide the following benefits: prescription drugs, children’s dental services, adult dental services, outpatient and inpatient mental health services and substance abuse services.

The data presented shows this information only for populations enrolled under an MCO contract. Nearly all states exclude some populations from MCOs. For example, North Dakota does not cover children through its managed care contracts so North Dakota is not included in the “Dental (Children)” data. Ten states that operate MCOs do not cover dental services for adults (or only cover emergency dental), so these states are excluded from the “Dental (Adults)” counts.

“Carved-in” refers to the inclusion in MCO contracts of virtually all services in a given category (exceptions may exist, such as limited carve-outs for selected drugs). “Varies” refers to cases where the inclusion of benefits in MCO contracts may vary by population or region or the contract may cover some but not all services (e.g., states that carve-in some behavioral health services but carve-out specialized services for persons with serious mental illness). “Carved-out” means that the services are largely excluded from MCO contracts and are instead covered under either a FFS or PHP model. (Figure 6) States were also asked to describe any carve-in or carve-out changes for specific benefits in FY 2015 or planned for FY 2016. The most commonly reported benefit change was to carve-in behavioral health services and LTSS.

Figure 6: There is significant variation in the services states cover through Medicaid managed care contracts.

Pharmacy

Most MCO states (33 of 39 states) carve-in their pharmacy services for the populations covered by their MCO contracts. Some of these states have small carve-outs for certain drugs or drug classes (e.g., HIV/AIDS drugs, medications for hepatitis C, mental health drugs, etc.). Three states (Iowa, Missouri and Nebraska) carve-out pharmacy benefits entirely, delivering these benefits on a FFS basis. Additionally, Tennessee reported that all drugs – except for certain physician-administered drugs – are carved-out and delivered FFS through a contracted pharmacy benefit manager. Two states (Indiana and Wisconsin) reported that pharmacy benefits are carved-in under certain MCO programs but carved-out of others.

A number of states have carved pharmacy benefits into their managed care contracts in recent years. In this year’s survey, four states added or reported plans to add pharmacy benefits to their managed care contracts (Delaware, Iowa, Indiana and New York). Delaware reported carving pharmacy benefits into their MCO contracts in FY 2015. Iowa plans to carve the pharmacy benefit into its MCO contracts as it terminates its PCCM program and shifts this population to MCOs in FY 2016. Indiana implemented a new MCO program for the aged, blind and disabled population in FY 2015 that included pharmacy benefits; it also carved-in pharmacy benefits for the Healthy Indiana Plan (the state’s expansion group). New York, which had already carved most pharmacy benefits into managed care contracts, plans to carve-in hemophilia factor products and injectable antipsychotic drugs in FY 2016. In contrast, only one state (Maryland) reported carving some pharmacy benefits out of managed care contracts in FY 2016 (substance use disorder drugs).

Dental

Children’s Dental. More than half of MCO states that cover children under their managed care contracts3 generally carve-in children’s dental services (21 of 38 states). Fifteen (15) MCO states carve-out children’s dental services. The majority of these states cover children’s dental on a FFS basis, but two states (Louisiana and Rhode Island) carve-out these services to a PHP and two states (Michigan and Utah) use both PHP and FFS models, depending on geographic area. Two states (Indiana and Wisconsin) reported that children’s dental services are sometimes carved-in: Indiana’s coverage varies by MCO program and Wisconsin’s coverage varies by geographic region.

Adult Dental. Twenty-nine (29) of the 39 MCO states reported that they cover adult dental benefits; the other ten do not cover adult dental or only provide coverage for emergency dental services.4 Just over half of the MCO states that cover adult dental generally carve-in this benefit (15 of 29 states). Another four (Indiana, Massachusetts, Michigan and Wisconsin) sometimes carve-in adult dental services; in Indiana, Massachusetts and Michigan, the dental carve-in varies by MCO program while the dental carve-in in Wisconsin varies by geographic region. Eight of the remaining ten MCO states with adult dental benefits carve these services out5 to FFS, while two states (Iowa for expansion adults and Louisiana) carve-out adult dental services to PHPs.

Indiana reported carving dental services into managed care contracts for selected populations (children and adults) in FY 2015.

Behavioral Health

States cover behavioral health services (mental health and substance abuse services) through a wide array of delivery arrangements. Sixteen (16) MCO states generally cover outpatient mental health services through their MCO contracts; a similar number cover inpatient mental health services (15 states) and substance abuse services (16 states) through their MCO contracts. Of the remaining states, a number contract with PHPs to provide carved-out specialty behavioral health services.

Eight states reported planned changes for FY 2016: six states (Arizona, Iowa, Louisiana, New York, Washington and West Virginia) plan to carve inpatient and outpatient mental health services as well as substance abuse services into at least some of their MCO contracts. Arizona plans to carve-in these services for their dual-eligible beneficiaries under their acute care contracts; New York continues to phase in coverage of these services under managed care plans. Iowa and Louisiana plan to transition coverage from PHPs to their managed care contracts. Washington also reported plans to carve these services into managed care contracts in regions that elect to be “Early Adopters” as part of their effort to establish common purchasing regions for managed behavioral health and physical health. (Those that do not will contract separately for physical and behavioral health.) In addition, Mississippi plans to carve inpatient mental health services into its managed care contracts as part of its larger effort to carve-in inpatient services generally. Maryland reported carving substance abuse services out of managed care contracts in FY 2015.

Long-Term Care Services and Supports (LTSS)

In this survey, about half of the MCO states reported that institutional LTSS (17 states) and home and community-based services (HCBS) (18 states) were provided only under the FFS delivery system. However, the survey did not capture whether LTSS was carved out of the states’ MCO arrangements or whether, instead, persons receiving LTSS were entirely excluded from MCO arrangements for all of their care (primary, acute, and behavioral health services). Only a small number of states reported that most LTSS is provided by MCOs – five states for institutional LTSS (Arizona, Hawaii, Kansas, New Mexico and Tennessee) and four states for HCBS (Arizona, Kansas, New Jersey and Tennessee). In some of these states, however, persons with intellectual and developmental disabilities (IDD) are excluded from enrollment or IDD waiver services are carved-out. In addition, 17 other MCO states reported providing some HCBS and institutional LTSS through MCOs, often based on specific population characteristics and/or geographic region (for example, under a Financial Alignment Demonstration for dual eligible beneficiaries). A number of states also mentioned PACE programs,6 but this site-based form of managed care was not counted for purposes of this analysis.

Ten states reported changes for FY 2015 or planned for FY 2016. In FY 2015, six states (California, Michigan, New Jersey, New York, South Carolina and Texas) implemented MCO arrangements for institutional LTSS and HCBS for at least some populations; many of these states noted this change was in reference to the launch of dual eligible demonstrations (Michigan, New York, South Carolina and Texas). California implemented MCO contracts including both HCBS and institutional care services in some counties in FY 2015. New Jersey carved HCBS (services and beneficiaries) into managed care contracts as well as institutional services for new nursing facility entrants (those already in nursing facilities will remain in FFS). Texas also carved institutional LTSS into its non-dual managed LTSS program. Additionally, Idaho added institutional as well as HCBS to its Medicare-Medicaid Coordinated Plan (MMCP) in FY 2015.7

In FY 2016, five states will implement new LTSS MCO arrangements. Rhode Island will implement its dual eligible demonstration; Iowa will include both HCBS and institutional LTSS into new MCO contracts (pending federal waiver approval), and New Hampshire will add HCBS to its MCO contracts. New York and New Mexico will add additional LTSS (services and beneficiaries) to their MCO contracts (assisted living services in New York, waiver services for the medically frail in New Mexico).

Managed Care Quality Initiatives

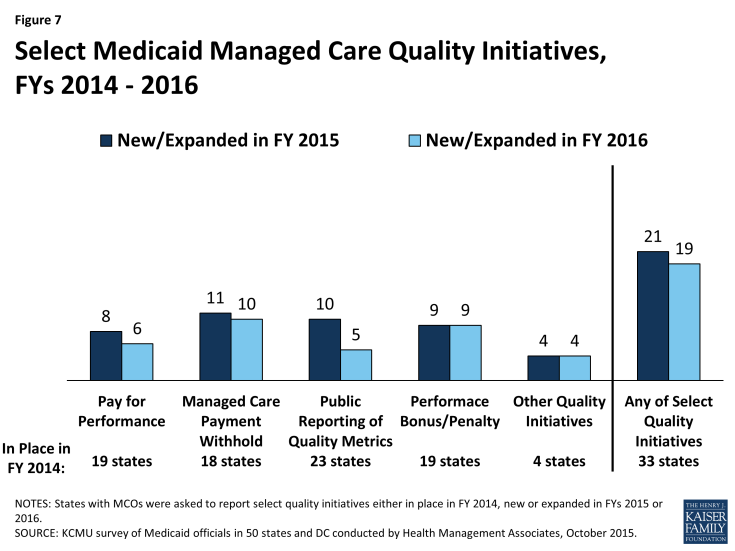

All states with MCO programs track one or more quality measures and require other health plan quality activities to improve health care outcomes and plan performance. In this year’s survey, states were asked whether certain quality strategies were in place in FY 2014, or newly added or expanded in FY 2015 or FY 2016. Thirty-three (33) of the 39 MCO states (including DC) had one or more of these quality strategies in place in FY 2014. A majority (23 states) publicly reported or required MCOs to publicly report quality metrics (e.g., a “report card”), and over one-third had pay-for-performance provisions, capitation withholds, and performance bonuses or penalties in place in FY 2014 as well. (Figure 7) Four states mentioned other types of quality initiatives in place in 2014 including a requirement for some or all plans to be NCQA-accredited (Massachusetts and Tennessee), a requirement for MCOs to implement provider and member incentive plans (Missouri) and other reviews of performance, quality and network adequacy (Nevada).

In FY 2015, a total of 21 states implemented new or expanded quality initiatives and 19 states planned to do so in FY 2016. The most common initiative that was new or expanded in FY 2015 and 2016 was managed care payment withholds tied to quality performance. (Figure 7) Three of these states in FY 2015 (California, Texas and West Virginia) and two of these states in FY 2016 (DC and Iowa) added new withhold requirements. Withhold amounts ranged from 0.15 percent (Virginia) to five percent (West Virginia and Minnesota). Several states also reported expanding or adding new pay-for- performance requirements as well as performance bonus or penalties and initiatives to publicly report quality metrics.

A few states mentioned additional types of quality initiatives. Minnesota will require MCOs to participate in its ACO and value-based contracting initiatives in FY 2016, and Pennsylvania will require MCOs to participate in community-based care management programs in FY 2015 and plans to require MCOs to participate in physical health/behavioral health integration efforts in FY 2016.

Medicaid Managed Care Administrative Policies

Minimum Medical Loss Ratios

For an MCO, the proportion of total per member per month capitation payments that is spent on clinical services and for quality improvement is known as the Medical Loss Ratio (MLR). Thus, the MLR represents the share of dollars that MCOs spend on providing and improving patient care, rather than on administrative costs, which include executive salaries, overhead, and marketing and profits. State insurance regulators commonly set a minimum MLR for commercial health plans, and the ACA mandates a minimum MLR for Medicare Advantage plans and for qualified health plans (QHPs) participating in the health insurance Marketplaces. There is currently no federal minimum MLR for Medicaid MCOs, nor are state Medicaid programs currently required to set minimum MLRs, but states are allowed to establish minimum MLR requirements for Medicaid health plans.

As of July 1, 2015, 19 of the 39 states that contracted with comprehensive risk-based MCOs specified a minimum MLR for all or some plans, and 20 states did not have an MLR requirement. Seventeen (17) of the 19 states with a MLR requirement always applied it and two states applied it on a limited basis (e.g., for the new ACA Medicaid expansion population). State Medicaid MLRs vary, but are most commonly set at 85 percent. A few states noted that their minimum MLRs varied by type of plan or population.

Other states that do not require a minimum MLR did note other mechanisms to monitor administrative costs and profits among Medicaid MCOs. Four states without minimum MLRs (Massachusetts, New York, Pennsylvania and Virginia) reported having a cap on profits and/or administrative costs. Two states (California and Utah) reported using a target MLR in their rate-setting process. One state (Texas) reported requiring “experience rebates” from plans with profits above a specified level, and one state (Kansas) reported not requiring a minimum MLR but does track MLRs of its plans.

Auto-enrollment

Beneficiaries who are required to enroll in MCOs must be offered a choice of at least two plans. Those who do not select a plan are auto-enrolled in a plan by the state. Of the 39 states with comprehensive risk-based MCOs, all except one required some or all beneficiaries to enroll in an MCO. (The exception is North Dakota, which has only one health plan.) The proportion of beneficiaries who are auto-enrolled varies widely across states. Two states had auto-enrollment rates of 10 percent or less, while six states auto-enrolled over 75 percent of new MCO enrollees.8 States’ auto-enrollment algorithms also vary, but are usually designed to take into consideration previous plan or provider relationships, geographic location of the beneficiary, and/or plan enrollments of other family members. In addition, over half (23) of MCO states reported that their auto-enrollment algorithms were designed to balance enrollments among plans; 15 states considered plan capacity, and eight states took plan quality rankings into consideration. Other states noted plans to move toward including quality rankings in their auto-assignment algorithms in the future.

| Selected State Auto-Enrollment Quality Criteria |

| Minnesota: Enrollees who do not select a plan are defaulted (i.e., auto-enrolled) into plans in their area with the highest overall quality score.

Missouri: Auto-enrollment algorithm includes various factors including plan capacity, balancing enrollment among plans, certain performance criteria and consideration of the number of FQHCs, RHCs, CMHCs, and safety net hospitals in the plan. Washington: The auto-enrollment algorithm is based on an average of plan performance on two HEDIS measures as well as initial health screening rates. In May 2015, Washington’s Health Benefit Exchange implemented health plan selection online, enabling Medicaid beneficiaries to select a health plan online at the time of eligibility and recertification or at any time (as state does not currently have a “lock-in” policy). The state anticipates this change will reduce the number of auto-enrolled individuals. |

Using HEDIS measures for Plan Selection. In this year’s survey, states were asked if they used, or planned to use, HEDIS scores as criteria for selecting MCOs to contract with. Of the 39 states with MCOs, 14 answered “yes,” 22 answered “no,” and three states did not respond.

| Proposed Managed Care Rule |

| On May 26, 2015, CMS released a long-awaited proposal to revise and modernize the Medicaid managed care regulations.9 The proposed rule addresses changes that have occurred in state Medicaid managed care and other programs since the regulations were last revised in 2002, including the emergence of managed long-term services and supports (MLTSS) and other innovative payment and delivery system models. Among other things, the sweeping changes proposed are intended to strengthen the quality of care provided to Medicaid beneficiaries, promote more effective use of data in overseeing managed care, strengthen actuarial soundness and other payment requirements, ensure beneficiary protections, promote beneficiary access to care and strengthen program integrity safeguards. The proposed rule is also intended to promote better alignment with other coverage including Marketplace Qualified Health Plans and Medicare Advantage plans.10 A variety of other stakeholders, including state Medicaid agencies, health plans, providers and beneficiary advocates, commented on the proposed rule, expressing support for select provisions and raising concerns over others.11

In its lengthy and detailed comment letter to CMS submitted on July 27, 2015, the National Association of Medicaid Directors (NAMD) identified both the specific concerns of its members as well as those provisions of the proposed rule viewed as positive policy approaches.12 Three overarching concerns were identified: the new administrative costs that states would incur to implement the new requirements; the ability of CMS to carry out the new proposed oversight activities without resulting in problematic delays for states (e.g., approvals of capitation rates and contracts); and the apparent shift in the balance of regulatory authority for Medicaid managed care from the states to the federal government. Of particular concern is a requirement for states to provide a minimum 14-day period of FFS coverage before enrolling beneficiaries into managed care arrangements and the proposed capitation rate review process. In this survey, states were asked to identify the key issues, concerns or opportunities related to the proposed rule. A number of states indicated that the proposed rule was still under review and other states touched on many of the issues raised in the NAMD comment letter. The most frequently cited concerns related to the capitation rate review process and the 14 day FFS enrollment requirement. |

Table 5: Share of the Medicaid Population Covered Under Different Delivery Systems, as of July 2015

| States | Type(s) of Managed Care In Place | Share of Medicaid Population in Different Managed Care Systems | ||

| MCO | PCCM | Other / FFS | ||

| Alabama | PCCM | — | 64.3% | 35.7% |

| Alaska | FFS | — | — | 100.0% |

| Arizona | MCO | 87.3% | — | 12.7% |

| Arkansas | PCCM* | — | 57.6% | 42.4%* |

| California | MCO and PCCM* | 77.0% | <1% | 23.0% |

| Colorado | MCO and PCCM* | 8.5% | 64.9% | 26.6% |

| Connecticut | FFS* | — | — | 100.0% |

| DC | MCO | 72.0% | — | 28.0% |

| Delaware | MCO | 90.0% | — | 10.0% |

| Florida | MCO | 79.0% | — | 21.0% |

| Georgia | MCO | 66.4% | — | 33.6% |

| Hawaii | MCO | 99.9% | — | 0.1% |

| Idaho | PCCM* | — | NR | NR |

| Illinois | MCO and PCCM | 52.7% | 26.6% | 20.7% |

| Indiana | MCO* | 77.9% | 0.6%* | 21.5% |

| Iowa | MCO and PCCM | 12.0% | 37.0% | 51.0% |

| Kansas | MCO | 95.0% | — | 5.0% |

| Kentucky | MCO | 91.0% | — | 9.0% |

| Louisiana | MCO | 71.0% | — | 29.0% |

| Maine | PCCM | — | NR | NR |

| Maryland | MCO | 82.0% | — | 18.0% |

| Massachusetts | MCO and PCCM | 51.5% | 20.6% | 27.9% |

| Michigan | MCO | 77.0% | — | 23.0% |

| Minnesota | MCO | 73.0% | — | 27.0% |

| Mississippi | MCO* | 67.0% | — | 33.0% |

| Missouri | MCO | 50.5% | — | 49.5% |

| Montana | PCCM | — | 73.7% | 26.3% |

| Nebraska | MCO | 74.0% | — | 26.0% |

| Nevada | MCO and PCCM | 68.0% | 6.0% | 26.0% |

| New Hampshire | MCO | 89.8% | — | 10.2% |

| New Jersey | MCO | 93.0% | — | 7.0% |

| New Mexico | MCO | 87.5% | — | 12.5% |

| New York | MCO | 77.8% | — | 22.2% |

| North Carolina | PCCM | — | NR | NR |

| North Dakota | MCO and PCCM | 21.0% | 41.0% | 37.0% |

| Ohio | MCO | 78.3% | — | 21.7% |

| Oklahoma | PCCM | — | 69.9% | 30.1% |

| Oregon | MCO* | 93.0% | — | 7.0% |

| Pennsylvania | MCO | 70.0% | — | 30.0% |

| Rhode Island | MCO and PCCM | 87.7% | 1.6% | 10.7% |

| South Carolina | MCO | 75.0% | — | 25.0% |

| South Dakota | PCCM | — | 86.0% | 14.0% |

| Tennessee | MCO | 100.0% | — | — |

| Texas | MCO | 88.0% | — | 12.0% |

| Utah | MCO* | 62.8% | — | 37.2% |

| Vermont | PCCM | — | NR | NR |

| Virginia | MCO | 66.0% | — | 34.0% |

| Washington | MCO and PCCM | 79.0% | 1.0% | 20.0% |

| West Virginia | MCO and PCCM | 65.0% | 2.0% | 33.0% |

| Wisconsin | MCO | 67.0% | — | 33.0% |

| Wyoming | FFS* | — | — | 100.0% |

| NOTES: Share of Medicaid Population that is covered by different managed care systems. MCO refers to risk-based managed care; PCCM refers to Primary Care Case Management. Other/FFS refers to Medicaid beneficiaries that are not in MCOs or PCCM programs. *AR – included in “Other/FFS” include those receiving premium assistance through the Private Option (Medicaid Expansion). *CA – PCCM program operates in LA county for those with HIV. *CO – PCCM enrollees are part of the state’s Accountable Care Collaboratives (ACO). *CT – terminated its MCO contracts in 2012 and now operates its program on a fee-for-service basis using four administrative services only entities. *ID – The Medicaid-Medicare Coordinated Plan (MMCP) has been recategorized by CMS as an MCO but is not counted here as such since it is secondary to Medicare. *IN – state ended its PCCM program as of July 1, 2015. *MS – risk-based managed care program does not cover inpatient hospital services. *OR – MCO enrollees include those enrolled in the state’s Coordinated Care Organizations. *UT – MCO enrollees include those enrolled in the state’s Accountable Care Organizations. *WY – the state does not operate a traditional PCCM or MCO program, but does use PCCM authority to make PCMH payments.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||||

Table 6: Medicaid Managed Care Expansions to New Groups in all 50 States and DC, FY 2015 and 2016

| States | Geographic Expansions | Add New Groups | New Mandatory Enrollment | Any Managed Care Expansions | |||||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | Either Year | |

| Alabama | |||||||||

| Alaska | |||||||||

| Arizona | |||||||||

| Arkansas | |||||||||

| California | |||||||||

| Colorado | X | X | X | ||||||

| Connecticut | |||||||||

| Delaware | |||||||||

| DC | |||||||||

| Florida | X | X | X | ||||||

| Georgia | |||||||||

| Hawaii | |||||||||

| Idaho | |||||||||

| Illinois | X | X | X | X | X | X | X | X | X |

| Indiana | X | X | X | ||||||

| Iowa | X | X | X | X | X | ||||

| Kansas | |||||||||

| Kentucky | |||||||||

| Louisiana | X | X | X | X | X | ||||

| Maine | |||||||||

| Maryland | |||||||||

| Massachusetts | |||||||||

| Michigan | |||||||||

| Minnesota | |||||||||

| Mississippi | X | X | X | X | X | ||||

| Missouri | |||||||||

| Montana | |||||||||

| Nebraska | X | X | X | ||||||

| Nevada | |||||||||

| New Hampshire | X | X | X | ||||||

| New Jersey | X | X | X | ||||||

| New Mexico | X | X | X | ||||||

| New York | X | X | X | X | X | X | X | X | |

| North Carolina | |||||||||

| North Dakota | |||||||||

| Ohio | |||||||||

| Oklahoma | |||||||||

| Oregon | |||||||||

| Pennsylvania | X | X | X | ||||||

| Rhode Island | X | X | X | X | |||||

| South Carolina | |||||||||

| South Dakota | |||||||||

| Tennessee | |||||||||

| Texas | X | X | X | X | |||||

| Utah | X | X | X | X | |||||

| Vermont | |||||||||

| Virginia | X | X | X | X | X | ||||

| Washington | X | X | X | X | |||||

| West Virginia | X | X | X | ||||||

| Wisconsin | X | X | X | X | X | ||||

| Wyoming | |||||||||

| Totals | 5 | 4 | 9 | 8 | 4 | 9 | 13 | 13 | 20 |

| NOTES: States were asked if they expanded managed care (comprehensive risk-based managed care) to new regions, new populations, or increased the use of mandatory enrollment.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

|||||||||

Table 7: Coverage of Select Benefits Under Medicaid Managed Care Contracts, as of July 2015

| State | Coverage of Select Benefits under MCO contracts | |||||

| Pharmacy | Dental | Behavioral Health | ||||

| Children | Adults | Outpatient Mental Health | Inpatient Mental Health | Substance Abuse | ||

| Alabama | — | — | — | — | — | — |

| Alaska | — | — | — | — | — | — |

| Arizona | carved-in | carved-in | carved-in | varies (region) | varies (region) | varies (region) |

| Arkansas | — | — | — | — | — | — |

| California | carved-in | carved-out | carved-out | varies (services) | carved-out | carved-out |

| Colorado | carved-in | carved-in | carved-in | carved-out | carved-out | carved-out |

| Connecticut | — | — | — | — | — | — |

| DC | carved-in | carved-in | carved-in | varies (services) | varies (services) | varies (services) |

| Delaware | carved-in | carved-out | not covered | varies (services) | varies (services) | varies (services) |

| Florida | carved-in | carved-in | carved-in | carved-in | carved-in | carved-in |

| Georgia | carved-in | carved-in | not covered | carved-in | carved-in | carved-in |

| Hawaii | carved-in | carved-out | not covered | varies (services) | varies (services) | varies (services) |

| Idaho | — | — | — | — | — | — |

| Illinois | carved-in | carved-in | carved-in | carved-in | carved-in | carved-in |

| Indiana | varies | varies | varies | carved-out | varies (services) | varies (services) |

| Iowa | carved-out | carved-out | carved-out | carved-out | carved-out | carved-out |

| Kansas | carved-in | carved-in | carved-out | carved-in | carved-in | carved-in |

| Kentucky | carved-in | carved-in | carved-in | carved-in | carved-in | carved-in |

| Louisiana | carved-in | carved-out | carved-out | carved-out | carved-out | carved-out |

| Maine | — | — | — | — | — | — |

| Maryland | carved-in | carved-out | carved-out | carved-out | carved-out | carved-out |

| Massachusetts | carved-in | carved-out | varies | carved-in | carved-in | carved-in |

| Michigan | carved-in | carved-out | varies | varies (services) | varies (services) | carved-out |

| Minnesota | carved-in | carved-in | carved-in | carved-in | carved-in | carved-in |

| Mississippi | carved-in | carved-in | carved-in | carved-in | carved-out | carved-in |

| Missouri | carved-out | carved-in | carved-in | varies (services) | carved-out | varies (services) |

| Montana | — | — | — | — | — | — |

| Nebraska | carved-out | carved-out | carved-out | carved-out | carved-out | carved-out |

| Nevada | carved-in | carved-in | not covered | carved-in | carved-in | carved-in |

| New Hampshire | carved-in | carved-out | not covered | carved-in | carved-in | carved-in |

| New Jersey | carved-in | carved-in | carved-in | varies (program, population) | varies (program, population) | varies (program, population) |

| New Mexico | carved-in | carved-in | carved-in | carved-in | carved-in | carved-in |

| New York | carved-in | carved-in | carved-in | varies (population, services) | varies (population, services) | varies (services) |

| North Carolina | — | — | — | — | — | — |

| North Dakota | carved-in | excluded | not covered | carved-in | carved-in | carved-in |

| Ohio | carved-in | carved-in | carved-in | varies (population) | carved-in | varies (population) |

| Oklahoma | — | — | — | — | — | — |

| Oregon | carved-in | carved-in | carved-in | carved-in | carved-out | carved-in |

| Pennsylvania | carved-in | carved-in | carved-in | carved-out | carved-out | carved-out |

| Rhode Island | carved-in | carved-out | carved-out | varies (services) | varies (services) | varies (services) |

| South Carolina | carved-in | carved-out | carved-out | varies (services) | varies (services) | varies (services) |

| South Dakota | — | — | — | — | — | — |

| Tennessee | carved-out | carved-in | not covered | carved-in | carved-in | carved-in |

| Texas | carved-in | carved-in | not covered | carved-in | carved-in | carved-in |

| Utah | carved-in | carved-out | carved-out | varies (services) | varies (services) | varies (services) |

| Vermont | — | — | — | — | — | — |

| Virginia | carved-in | carved-out | not covered | varies (services) | varies (services) | varies (services) |

| Washington | carved-in | carved-out | carved-out | carved-out | carved-out | carved-out |

| West Virginia | carved-in | carved-in | not covered | carved-in | carved-in | carved-in |

| Wisconsin | varies | varies | varies | varies (services) | varies (services) | varies (services) |

| Wyoming | — | — | — | — | — | — |

| Carved-in | 33 | 21 | 15 | 16 | 15 | 16 |

| Varies | 2 | 2 | 4 | 15 | 13 | 14 |

| Carved-out | 4 | 15 | 10 | 8 | 11 | 9 |

| NOTES: *– indicates there were no MCOs operating in that state’s Medicaid program in July 2015. Data limited to populations included in MCO contracts (e.g., ND does not cover children in their managed care contracts, so they were excluded from the dental (children) category and 10 states that operate MCOs do not cover dental services for adults, these states were excluded from dental (adults)). Carved-in refers to states that carve-in virtually all services (exceptions might relate to small carve-outs for select drugs for example). Varies refers to instances where services are carved in for some populations covered under MCOs but not for other MCO populations or some services are carved-in while others are not (e.g. more intensive mental health or behavioral health services are carved-out.) Carved-out means that the service is largely carved out of managed care and covered by either FFS or PHPs.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||||||

TABLE 8: MEDICAID MANAGED CARE QUALITY INITIATIES IN ALL 50 STATES AND DC, FY 2014 – 2016

|

States |

Pay for Performance |

Managed Care Payment Withhold |

Public Reporting of Quality Metrics |

Performance Bonus or Penalties |

Other Quality Initiatives |

Any Quality Initiatives |

||||||||||||

|

In Place |

New/ Expanded |

In Place |

New/ Expanded |

In Place |

New/ Expanded |

In Place |

New/ Expanded |

In Place |

New/ Expanded |

In Place |

New/ Expanded |

|||||||

|

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

|

|

Alabama |

||||||||||||||||||

|

Alaska |

||||||||||||||||||

|

Arizona |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||

|

Arkansas |

||||||||||||||||||

|

California |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||||||||

|

Colorado |

X |

X |

X |

X |

||||||||||||||

|

Connecticut |

||||||||||||||||||

|

DC |

X |

X |

X |

X |

X |

X |

||||||||||||

|

Delaware |

X |

X |

X |

|||||||||||||||

|

Florida |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||||||||

|

Georgia |

X |

X |

X |

X |

X |

X |

||||||||||||

|

Hawaii |

X |

X |

X |

X |

||||||||||||||

|

Idaho |

||||||||||||||||||

|

Illinois |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||

|

Indiana |

X |

X |

X |

X |

||||||||||||||

|

Iowa |

X |

X |

X |

|||||||||||||||

|

Kansas |

X |

X |

X |

X |

||||||||||||||

|

Kentucky |

X |

X |

X |

X |

||||||||||||||

|

Louisiana |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||||

|

Maine |

||||||||||||||||||

|

Maryland |

X |

X |

X |

|||||||||||||||

|

Massachusetts |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||||

|

Michigan |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||||

|

Minnesota |

X |

X |

X |

X |

X |

X |

||||||||||||

|

Mississippi |

X |

X |

X |

X |

||||||||||||||

|

Missouri |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||

|

Montana |

||||||||||||||||||

|

Nebraska |

||||||||||||||||||

|

Nevada |

X |

X |

X |

X |

X |

X |

||||||||||||

|

New Hampshire |

X |

X |

X |

X |

||||||||||||||

|

New Jersey |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||||||||

|

New Mexico |

X |

X |

X |

X |

X |

|||||||||||||

|

New York |

X |

X |

X |

X |

||||||||||||||

|

North Carolina |

||||||||||||||||||

|

North Dakota |

||||||||||||||||||

|

Ohio |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||||||

|

Oklahoma |

||||||||||||||||||

|

Oregon |

X |

X |

X |

X |

X |

|||||||||||||

|

Pennsylvania |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||

|

Rhode Island |

X |

X |

X |

|||||||||||||||

|

South Carolina |

X |

X |

X |

X |

X |

|||||||||||||

|

South Dakota |

||||||||||||||||||

|

Tennessee |

X |

X |

X |

|||||||||||||||

|

Texas |

X |

X |

X |

X |

X |

X |

X |

|||||||||||

|

Utah |

X |

X |

||||||||||||||||

|

Vermont |

||||||||||||||||||

|

Virginia |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||

|

Washington |

X |

X |

X |

|||||||||||||||

|

West Virginia |

X |

X |

X |

X |

X |

X |

X |

|||||||||||

|

Wisconsin |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||||||||

|

Wyoming |

||||||||||||||||||

|

Totals |

19 |

8 |

6 |

18 |

11 |

10 |

23 |

10 |

5 |

19 |

9 |

9 |

4 |

4 |

4 |

33 |

21 |

19 |

|

NOTES: States with MCO contracts were asked to report if select quality initiatives were included in contracts in FY 2014, new or expanded in FY 2015 or in FY 2016. The table above does not reflect all quality initiatives states have included as part of MCO contracts. SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||||||||||||||||||

Table 9: Minimum Medical Loss Ratio Policies for Medicaid MCOs in all 50 States and DC, as of July 2015

| Minimum Medical Loss Ratio (MLR) | ||

| States | Require minimum MLR | % if required |

| Alabama | — | |

| Alaska | — | |

| Arizona | Yes — always | 85% |

| Arkansas | — | |

| California | Yes — sometimes* | 85%* (Expansion) |

| Colorado | Yes — always | 85% |

| Connecticut | — | |

| Delaware | No | |

| DC | Yes — always | 85% |

| Florida | Yes — always | 85% |

| Georgia | No | |

| Hawaii | Yes — always | ~90% |

| Idaho | — | |

| Illinois | Yes — always | 85% (aged, blind and disabled) 88% (MAGI-related populations) |

| Indiana | Yes — always | 85% (Hoosier Healthwise program) 87% (HIP 2.0 and Hoosier Care Connect) |

| Iowa | Yes — always | 85% |

| Kansas | No | |

| Kentucky | Yes — always | 85% |

| Louisiana | Yes — always | 85% |

| Maine | — | |

| Maryland | Yes — always | NR |

| Massachusetts | No* | |

| Michigan | No | |

| Minnesota | No | |

| Mississippi | Yes — always | 85% |

| Missouri | No | |

| Montana | — | |

| Nebraska | No | |

| Nevada | No | |

| New Hampshire | No | |

| New Jersey | Yes — always | 80% |

| New Mexico | Yes — always | 85% |

| New York | No* | |

| North Carolina | — | |

| North Dakota | No | |

| Ohio | Yes — always | 85% |

| Oklahoma | — | |

| Oregon | Yes — sometimes | 80% (Expansion) |

| Pennsylvania | No* | |

| Rhode Island | No | |

| South Carolina | No | |

| South Dakota | — | |

| Tennessee | No | |

| Texas | No* | |

| Utah | No* | |

| Vermont | — | |

| Virginia | No* | |

| Washington | Yes — always | 85-87%* |

| West Virginia | Yes — always | 85% |

| Wisconsin | No | |

| Wyoming | — | |

| Yes — always | 17 | |

| Yes — sometimes | 2 | |

| No | 20 | |

| N/A – No MCOs | 12 | |

| NOTES: MLR refers to the proportion of total per member per month capitation payments that is spent on clinical services and for quality improvement. “–” indicates states that do not have Medicaid MCOs. NR – not reported. CA (outside of their expansion population) and UT reported not requiring a minimum MLR but using a target MLR as part of their rate setting process. MA, NY, PA, VA reported no minimum MLR but do have administrative and/or profit caps. TX has experience rebates on plans above a certain profit level. VA – FY16 contract also requires MCOs to report MLRs to the state, but there is no minimum MLR. WA indicated that the minimum MLR varied by population.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||

Table 10: Auto-Enrollment Policies for Medicaid MCOs in all 50 States and DC, as of July 2015

|

Auto-Enrollment Practices |

Select Factors Used in State Auto-Enrollment Algorithms |

||||||

|

States |

Auto-Enrollment Process |

Share of Beneficiaries Auto-Enrolled |

Plan Capacity |

Plan Cost |

Balancing Enrollment |

Encouraging New Plan Entrants |

Plan Quality Rating |

|

Alabama |

|||||||

|

Alaska |

|||||||

|

Arizona |

Yes |

17% (Acute Care)* |

X |

||||

|

Arkansas |

|||||||

|

California |

Yes |

35-40% |

X |

X |

X |

X |

|

|

Colorado |

Yes |

94%* |

|||||

|

Connecticut |

|||||||

|

Delaware |

Yes |

45% |

X |

||||

|

DC |

Yes |

20% |

X |

X |

|||

|

Florida |

Yes |

52% – Acute Care (MMA) |

|||||

|

Georgia |

Yes |

NR |

X |

X |

|||

|

Hawaii |

Yes |

100%* |

X |

X |

X |

||

|

Idaho |

|||||||

|

Illinois |

Yes |

53% |

X |

X |

|||

|

Indiana |

Yes |

68% |

X |

||||

|

Iowa |

Yes |

80% |

|||||

|

Kansas |

Yes |

65% |

X |

||||

|

Kentucky |

Yes |

54% |

X |

X |

|||

|

Louisiana |

Yes |

50% |

X |

X |

|||

|

Maine |

|||||||

|

Maryland |

Yes |

32% |

X |

X |

|||

|

Massachusetts |

Yes |

30% |

X |

X |

|||

|

Michigan |

Yes |

24% |

X |

X |

X |

||

|

Minnesota |

Yes |

25% |

X |

||||

|

Mississippi |

Yes |

80% |

|||||

|

Missouri |

Yes |

13% |

X |

X |

|||

|

Montana |

|||||||

|

Nebraska |

Yes |

52% |

X |

||||

|

Nevada |

Yes |

30% |

X |

||||

|

New Hampshire |

Yes |

30% |

|||||

|

New Jersey |

Yes |

15% |

|||||

|

New Mexico |

Yes |

22% |

X |

||||

|

New York |

Yes |

4% (statewide) |

X |

X |

X |

||

|

North Carolina |

|||||||

|

North Dakota |

No |

||||||

|

Ohio |

Yes |

39% (CFC & ABD) |

|||||

|

Oklahoma |

|||||||

|

Oregon |

Yes |

5% |

X |

X |

|||

|

Pennsylvania |

Yes |

40% |

X |

||||

|

Rhode Island |

Yes |

20% |

|||||

|

South Carolina |

Yes |

60% |

X |

X |

|||

|

South Dakota |

|||||||

|

Tennessee |

Yes |

100%* |

X |

||||

|

Texas |

Yes |

30% |

X |

X |

|||

|

Utah |

Yes |

20% |

X |

||||

|

Vermont |

|||||||

|

Virginia |

Yes |

80% |

X |

||||

|

Washington |

Yes |

50% |

X |

||||

|

West Virginia |

Yes |

50% |

X |

||||

|

Wisconsin |

Yes |

60%* |

X |

X |

|||

|

Wyoming |

|||||||

|

Total |

38 |

15 |

2 |

23 |

3 |

8 |

|

|

NOTES: States with Medicaid MCOs were asked if they have an auto-enrollment process and to estimate the share of their population that is typically auto-enrolled (average monthly basis for FY 2015). NR – not reported. AZ – rate reported refers to acute care only. CO – the state only has one MCO plan; it uses a passive enrollment process since there isn’t a choice of plans. HI and TN both auto-enroll beneficiaries and then offer beneficiaries a period to change plans. WI – Long-term care does not have an auto-enrollment process; auto enrollment used only for HMOs. SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

|||||||