Women's Coverage, Access, and Affordability: Key Findings from the 2017 Kaiser Women’s Health Survey

Introduction

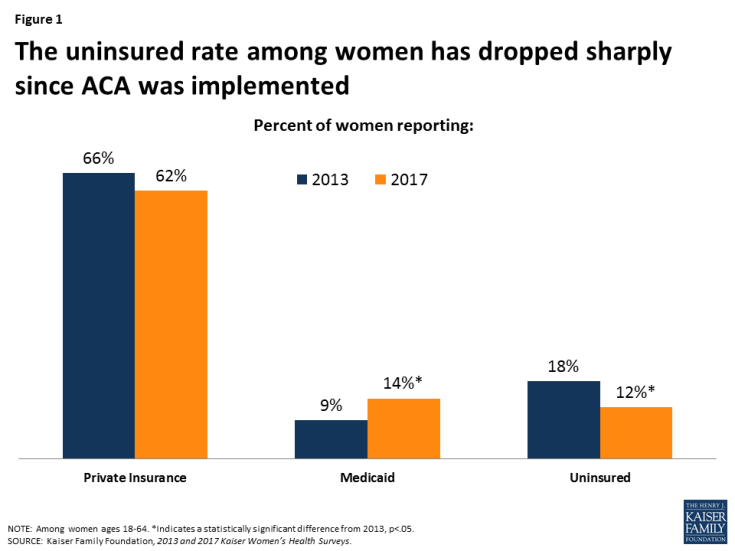

Since the Affordable Care Act (ACA) went into effect, there has been a sharp drop in the uninsured rate among women, along with major increases in Medicaid and private insurance coverage. In 2013, the Kaiser women’s health survey found nearly one in five non-elderly women were uninsured. By 2017, this had dropped to one in ten. Just as before the ACA, uninsured rates are higher among subgroups of women, particularly those who are low-income and Latina.

While coverage is a major factor for women’s access to care, many other factors play a role as well, including insurer practices, out of pocket costs, and provider availability. This brief presents findings from the 2017 Kaiser Women’s Health Survey, a nationally representative survey of women ages 18 to 64 on their coverage, use, and access to health care services. The Kaiser Family Foundation has conducted surveys on women’s health care in 2001, 2004, 2008, and 2013. This brief focuses on findings from the newest 2017 survey and also presents some findings compared to earlier years.

Coverage

The share of women with health coverage has increased since the ACA was implemented; however, approximately one in ten women remain uninsured in 2017.

The Kaiser Women’s Health Survey finds that approximately one in ten (12%) non-elderly adult women report being uninsured in 2017, down from 18% in 2013, and consistent with estimates from other large national surveys (Figure 1). Most women (62%) are covered by a private insurance policy, either through an employer-sponsored plan or one that they purchase on their own. The ACA’s coverage expansion also included a large expansion in eligibility for Medicaid, which now covers 14% of women ages 18 to 64.

Approximately one in five women are either currently uninsured or were without coverage at some point in the prior year.

In addition to the one in ten (12%) women who remain uninsured in 2017, another 8% are currently insured but report that there was some period in the prior year when they were without any coverage (Table 1). Women can be uninsured for periods as a result of job loss or change, premium prices becoming unaffordable, or in the case of dependent coverage, a spouse’s job loss, divorce, or widowhood. Spells without insurance are more common among low-income women who have lower coverage rates to begin with. Low-income women are more likely to work part-time or part-year, work in a low wage job that lacks health benefits, or live in a household without an attachment to the workplace, all of which can affect coverage stability. Women with poorer self-reported health status are almost twice as likely as those in better health to have gone without insurance at some point in the prior year.

| Table 1: Share of women 18-64 currently uninsured or uninsured for some period of time in the past 12 months | |||||||||||||

| All | Insurance Type | Race/Ethnicity | Poverty Level | Health Status | |||||||||

| ESI | Individual | Medicaid | White | Black | Latina | <200% FPL | >200% FPL | Excellent to good | Fair or poor | ||||

| Currently uninsured | 12% | — | — | — | 8% | 12% | 28%* | 19%* | 8% | 12% | 16% | ||

| Time in past 12 months without insurance | 8% | 6% | 10% | 15%* | 6% | 11%* | 13%* | 14%* | 5% | 7% | 13%* | ||

| NOTES: Among women ages 18-64 with insurance at time of survey. The Federal Poverty Level (FPL) was $20,420 for a family of three in 2017. *Indicates a statistically significant difference from Employer Sponsored Insurance (ESI), White, ≥200% FPL, Excellent to good, p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

|||||||||||||

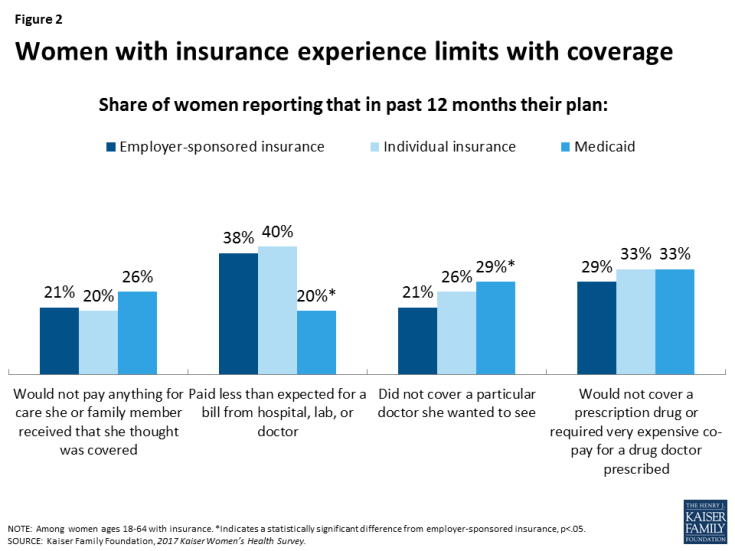

Many women with insurance report their plans would not pay for treatments or did not include doctors they wanted to see as part of their networks.

Insurance companies and employers have great discretion over what services they cover, the out of pocket costs they charge for covered benefits, and the network of clinicians their beneficiaries can see.

Among women covered by employer-sponsored insurance, approximately one in five (21%) reported that their plan would not pay anything for care she or a family member thought was covered (Figure 2). Similarly, one in five women reported their plan did not include a particular doctor she wanted to see in network. Rates were similar among women who purchased insurance on their own, but were higher among women covered by Medicaid. Approximately four in ten women with ESI (38%) and individual insurance (40%) reported their plan paid less than they expected for a medical bill. This was less common among women with Medicaid, but still a problem for 20%. While co-payments and co-insurance are routine charges in the private insurance market, they are less common in the Medicaid program.

Three in ten women with employer-sponsored insurance (29%) and one-third of women with individual policies or Medicaid reported their plan would not cover a particular prescription medicine or they had to pay a very expensive co-pay to obtain it.

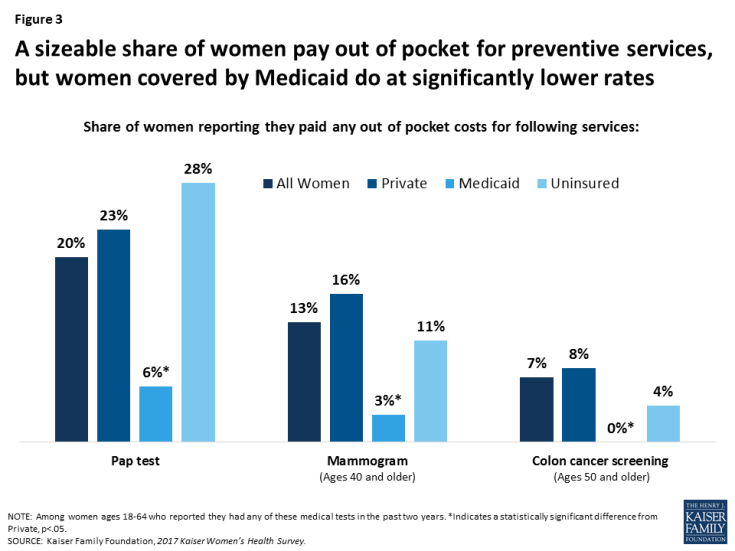

A sizeable share of women with insurance report paying out of pocket for screening tests, despite the ACA’s requirement for coverage of preventive services without cost sharing.

The ACA requires most plans to cover certain preventive services at no cost. These services include cancer screenings such as Pap tests, mammograms, and colonoscopies. However, one in five women reported paying out of pocket costs for a recent Pap test, 13% for a mammogram, and 7% for a colon cancer screening (Figure 3). Almost one in four (23%) women with private insurance paid out of pocket for a Pap test as did 16% for a mammogram. Some women are enrolled in grandfathered plans that are not subject to the preventive services coverage requirement. Furthermore, some women may be seeking care out of network or the primary reason for their visit may not be preventive, both of which are stipulations for no cost coverage. Very few women covered by Medicaid said they had to pay out of pocket for preventive services, but many uninsured women who likely have no coverage for these services report paying for Pap and mammogram screenings. Some uninsured women can get no-cost care for Pap smears or mammograms through the Breast and Cervical Cancer Screening program that is operated by the Centers for Disease Control and Prevention (CDC), but many go without care because of affordability concerns.

Figure 3: A sizeable share of women pay out of pocket for preventive services, but women covered by Medicaid do at significantly lower rates

Access Challenges

While coverage plays a large role in access to care, there are many other factors that affect whether or not a woman uses services. These include out of pocket costs, provider availability and capacity, as well as logistical issues such as transportation and finding time to make it to medical appointments. The ACA attempted to alleviate some of the financial barriers through a variety of requirements on insurers, including full cost coverage for preventive services, cost-sharing subsidies for lower income families, and prohibiting insurer lifetime caps on coverage. However, many women report barriers that are related to issues outside of the health care system, such as workplace benefits and flexibility, childcare, and transportation.

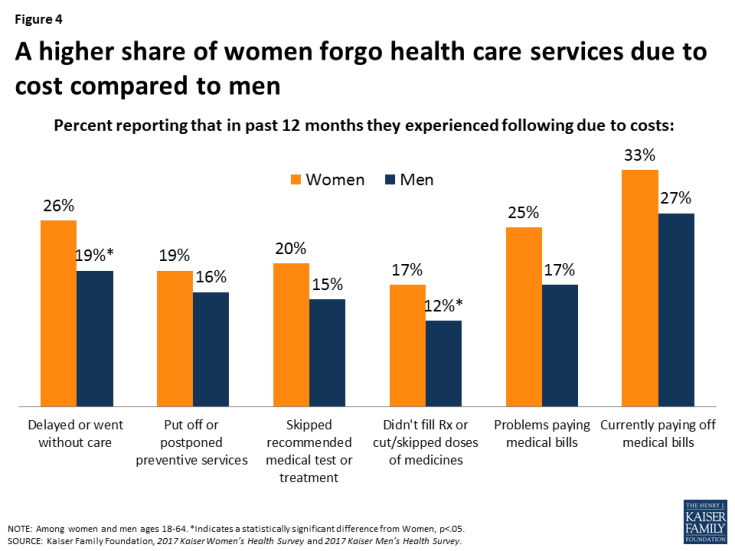

Out of pocket costs limit access to care for women and men, but more commonly among women.

While women and men both feel the impact of health costs, such as insurance premiums, co-payments, and deductibles, they can be particularly burdensome for women who on average earn lower wages, have fewer financial assets, accumulate less wealth, and have higher rates of poverty than men. Roughly one in four (26%) women and one in five (19%) men have had to delay or forego care in the past year due to cost (Figure 4). Because of costs, approximately one in five women have postponed preventive care (19%), skipped a recommended test or treatment (20%), or made medication tradeoffs such as not filling a prescription or cutting dosages (17%). One in four women report that they have had problems paying medical bills (25%) in the prior year and one in three are currently paying off medical bills (33%).

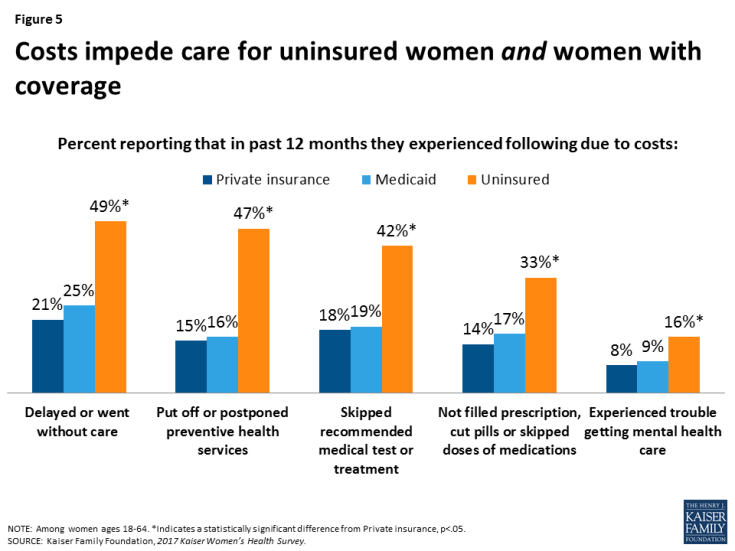

Costs are particularly burdensome for uninsured and low-income women and those in fair or poor health.

For uninsured women in particular, health costs are a sizeable barrier to care. Half (49%) of uninsured women went without or delayed care because of the costs (Figure 5). Almost as many postponed preventive services (47%) and 42% skipped a recommended medical test or treatment. One in three uninsured women did not fill a prescription and/or skipped or cut pills, and roughly one in six (16%) reported they experienced problems obtaining mental health care because of cost.

However, many women with coverage also experience affordability challenges that limit their access to care. For example, nearly one in five women with private insurance (18%) or Medicaid (19%) skipped a test or treatment because of the costs and many experienced other cost barriers as well. State Medicaid programs are permitted to charge nominal cost sharing amounts, which can be an obstacle since women on the program have very low incomes by definition, and even a few dollars can pose a barrier to receiving care. Low-income women and those in poorer health who generally have greater health needs experience some cost-related barriers at twice the rate of their counterparts with higher incomes and better health status. Rates of cost barriers are similar across racial/ethnic groups (Table 2).

| Table 2: Cost barriers to health care for women, by selected characteristics | ||||||||

| Health Status | Poverty Level | Race/Ethnicity | ||||||

| Share of women reporting that in past 12 months they experienced following due to costs: | Excellent to good | Fair or Poor | <200% FPL | >200% FPL | White | Black | Latina | |

| Delayed or went without care | 22% | 43%* | 39%* | 19% | 25% | 25% | 27% | |

| Postponed preventive services | 17% | 29%* | 28%* | 15% | 19% | 16% | 18% | |

| Skipped a recommended medical test or treatment | 18% | 34%* | 29%* | 16% | 22% | 22% | 19% | |

| Didn’t fill a prescription or skipped or cut pills | 13% | 35%* | 25%* | 14% | 17% | 18% | 16% | |

| Had problems getting mental health care | 8% | 17%* | 14%* | 8% | 10% | 9% | 7% | |

| NOTES: Among women ages 18-64. The Federal Poverty Level (FPL) was $20,420 for a family of three in 2017. *Indicates a statistically significant difference from Excellent to Good, >200% FPL, White, p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

||||||||

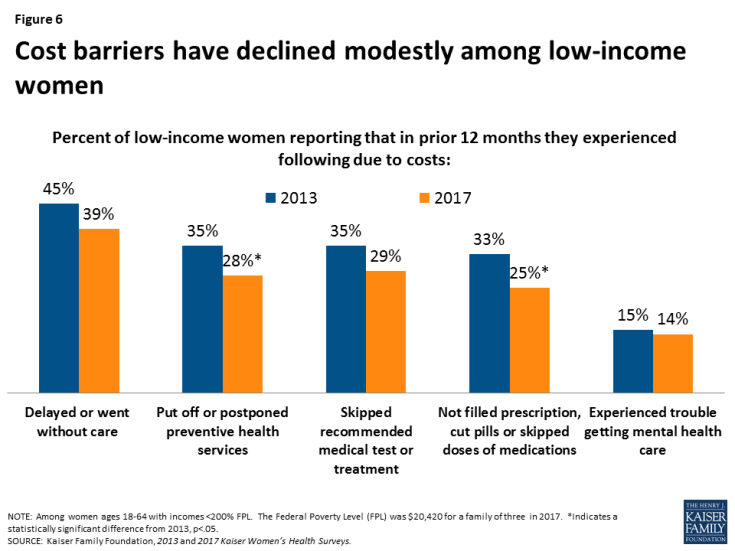

Fewer low-income women report cost to be a barrier to care, but it is still a challenge for many. In 2017, approximately a quarter of low-income women reported that costs was a reason that they postponed preventive services (28%) or skipped medication doses (25%), but this is a drop from 2013 when approximately one-third of women reported these barriers (Figure 6). Since 2013, millions of low-income women have gained coverage, both through Medicaid expansion as well as private plans in ACA Marketplaces, which may explain part of this decline.

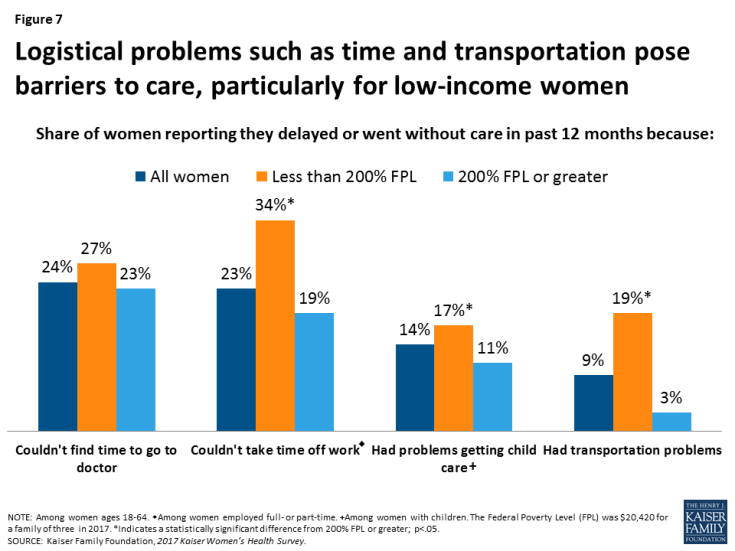

Women face logistical barriers to obtaining health care related to their roles as mothers and employees.

Costs and affordability are not the only barriers to health care for women. Lack of time and flexibility with work can pose a challenge in getting care for a sizeable fraction of women. Nearly one in four women report that they did not obtain care they needed because they did not have time (24%) and because they could not take time off work (23%) (Figure 7). Transportation and childcare also present as barriers to care but to a lesser degree. These barriers affect women of all income levels, but low-income women more commonly experience childcare and transportation problems. One-third of low-income women (34%) also reported they missed or delayed care because they could not take time off work, compared to one in five higher income women (19%). Consistent with the disparities by poverty level, some barriers are reported more frequently among women of color, and those in fair or poor health (Table 3).

Figure 7: Logistical problems such as time and transportation pose barriers to care, particularly for low-income women

| Table 3: Logistical barriers to care for women, by race/ethnicity and health status | |||||

| Race/Ethnicity | Health Status | ||||

| Share of women reporting they delayed or went without care in past 12 months because they: |

White | Black | Latina | Fair or Poor | Excellent to Good |

| Couldn’t find time to go to doctor | 24% | 23% | 21% | 23% | 25% |

| Couldn’t take time off work | 21% | 25% | 25% | 34%* | 21% |

| Had problems getting child care | 14% | 10% | 20% | 11% | 14% |

| Had transportation problems | 6% | 15%* | 12%* | 21%* | 6% |

| NOTES: Among women ages 18-64. *Indicates a statistically significant difference from White, Excellent to good, p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

|||||

Impact of Medical Bills

Women and their family members can face problems paying medical bills for a variety of reasons. Some women incur significant medical expenses because of an unexpected health event such as cancer, or an illness or injury that limits a woman’s ability to work and earn income to pay off bills. Women who are uninsured do not have coverage to offset the charges and may even be charged higher rates than insured women are. However, women with Medicaid and with private insurance may also have difficulties paying medical bills, which can include charges for out of network care and coverage limits or exclusions.

One in three women reported that they have unpaid medical bills.

There are several reasons women might report they have outstanding bills including they have not yet received the bill, their insurer has yet to approve the claim, or they cannot afford to pay what they owe. Outstanding medical bills are more common among those with greater health needs as well as those with lower incomes to pay the bills. This includes roughly four in ten Black women (44%), those in poorer health (45%), those who live in rural areas (39%), and four in ten low-income women (40%) (Table 4).

| Table 4: Rates of unpaid medical bills, by selected characteristics | ||||||||||

| All Women | Race/Ethnicity | Location | Poverty Level | Health Status | ||||||

| Share of women reporting: | White | Black | Latina | Urban | Rural | <200% FPL | >200% FPL | Excellent to good | Fair or Poor | |

| Currently have unpaid medical bills or bills being paid off | 33% | 32% | 44%* | 26% | 29% | 39%* | 40%* | 31% | 30% | 45%* |

| NOTE: Among women ages 18-64. The Federal Poverty Level (FPL) was $20,420 for a family of three in 2017. *Indicates a statistically significant difference from White, Urban, >200% FPL, Excellent to good, p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

||||||||||

One in four women say they or a family member had problems paying medical bills in the past year.

One in four women stated that they or a member of their family had trouble paying medical bills in the past year (Table 5). This share rises to 28% of women ages 26 to 34 and nearly a third (32%) of women ages 45 to 54. It is not surprising that more uninsured (37%) and low-income (34%) women report problems paying bills, given that they do not have coverage or as many financial resources to cover their bills.

| Table 5: Share of women who have had trouble paying medical bills in past year, by selected characteristics | |||||||||||

| All Women | Age Group | Insurance Type | Poverty Level | ||||||||

| Share of women reporting: | 18-25 | 26-34 | 35-44 | 45-54 | 55-64 | Private | Medicaid | Uninsured | <200% FPL | >200% FPL | |

| They or family member had trouble paying medical bills in past 12 months | 25% | 18% | 28%* | 23% | 32%* | 24% | 24% | 21% | 37%* | 34%* | 22% |

| NOTES: Among women ages 18-64. The Federal Poverty Level (FPL) was $20,420 for a family of three in 2017. *Indicates a statistically significant difference from Ages 18-25, Private, ≥200% FPL; p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

|||||||||||

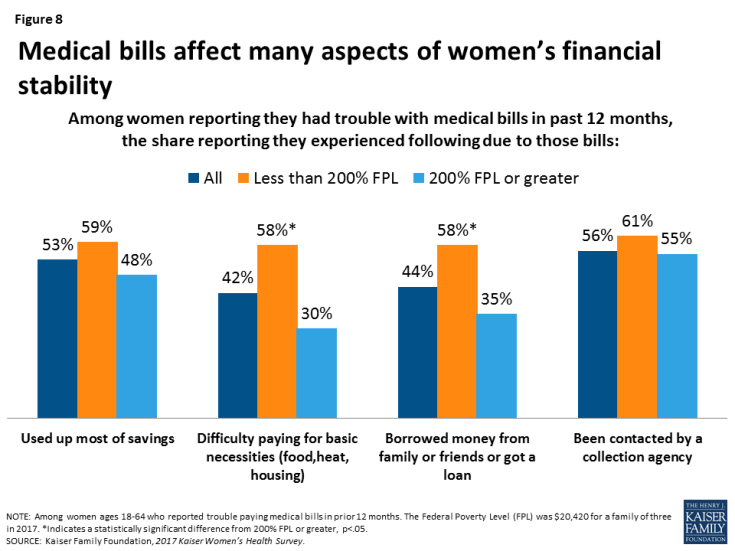

Medical bills can force women to make tradeoffs in paying for other basic necessities such as food or financial ones such as borrowing money and lowering credit standing.

Medical bills can have tangible consequences on other aspects of women’s lives. Among those who reported trouble paying bills, more than half said they used up most of their savings or had been contacted by a collection agency as a result (Figure 8). A little over four in ten reported they had difficulty paying for other necessities such as food (42%) or that they borrowed money to pay off bills (44%). Most of these consequences were more common among low-income women, who have fewer resources to pay off bills.

Use of Prescription Medicines

Over half (55%) of women take at least one prescription medicine on a regular basis. Fewer women of color rely on prescription medications to manage a medical condition.

Prescription drugs help many women treat and manage chronic conditions and acute illnesses. Prescription medicines can also play an important role in prevention for women, particularly contraception. More than half (55%) of women report they take at least one prescription medicine on an ongoing basis (Table 6). This includes women who take oral contraceptives. However, 45% of women report that they do not take any prescription medicines. Over half of Black, Latina, and urban women report that they do not take any prescription medications on a regular basis.

Almost three in ten women (28%) report taking one or two prescription medications, 15% report taking three to five medications, and one in ten women (11%) report they take at least six medications on an ongoing basis. Almost four in ten (38%) women who rate their health status as fair or poor take at least six medications. Women covered by Medicaid (18%), low-income women (17%), and those who live in rural areas (15%) are also more likely than their counterparts to take at least six medications on a routine basis.

| Table 6: Prescription medication use among women, by selected characteristics | |||||||||||||

| All Women | Race/Ethnicity | Poverty Level | Location | Insurance Type | Health Status | ||||||||

| Share of women 18-64 reporting that on a regular basis they take: | White | Black | Latina | <200%FPL | ≥200% FPL | Urban | Rural | Private | Medicaid | Uninsured | Fair to Poor | Excellent to Good | |

| No prescription medication | 45% | 40% | 53%* | 57%* | 47% | 43% | 53% | 37%* | 43% | 46% | 62%* | 24% | 50%* |

| 1 or 2 prescription medications | 28% | 30% | 19%* | 26% | 19%* | 33% | 27% | 24% | 34% | 20%* | 17%* | 15% | 31%* |

| 3 to 5 prescription medications | 15% | 17% | 14% | 11%* | 16% | 16% | 11% | 22%* | 15% | 15% | 11% | 14% | 16% |

| 6 or more prescription medications | 11% | 12% | 14% | 5%* | 17%* | 8% | 8% | 15%* | 6% | 18%* | 10% | 38% | 5%* |

| NOTES: Among women ages 18-64. Totals may not add to 100% due to rounding. The Federal Poverty Level (FPL) was $20,420 for a family of three in 2017. *Indicates a statistically significant difference from White, ≥200% FPL, Urban, Private, Excellent to good p<.05. SOURCE: Kaiser Family Foundation, 2017 Kaiser Women’s Health Survey. |

|||||||||||||

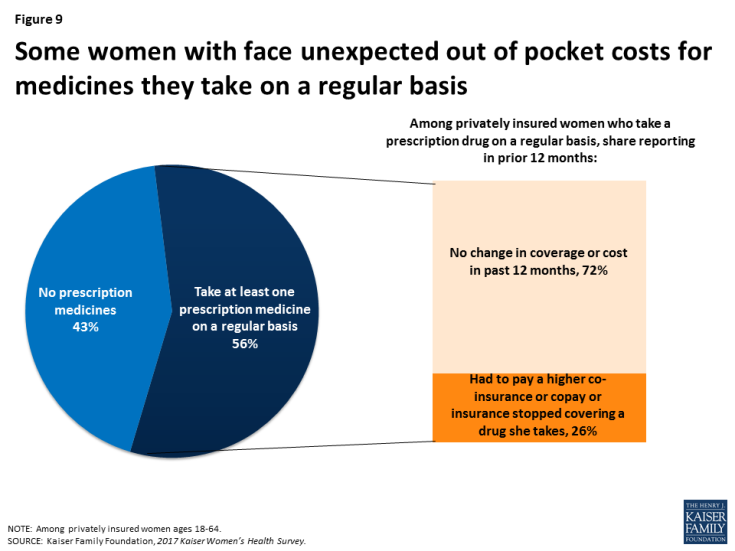

One in four women report they had to pay higher cost sharing than they expected or that insurance stopped covering a drug they take.

The cost of prescription drugs is one of the top health care concerns among the American public. Insurance companies have great leverage over the drug benefits they include in their policies. They can raise out of pocket costs, change the drugs they cover, and drop drugs from policies at any time and without notifying beneficiaries. Among privately insured women who say they take a prescription drug on a regular basis, about one in four (26%) reported that in the prior year their cost for the prescriptions rose or that their insurer dropped coverage for a drug they were taking (Figure 9). This was more commonly experienced by women ages 45-54 (31%) and 55-64 (32%) than women ages 18-44 (23%). It is also more common among White (30%) and Black (29%) women than Latinas (13%).

Figure 9: Some women with face unexpected out of pocket costs for medicines they take on a regular basis

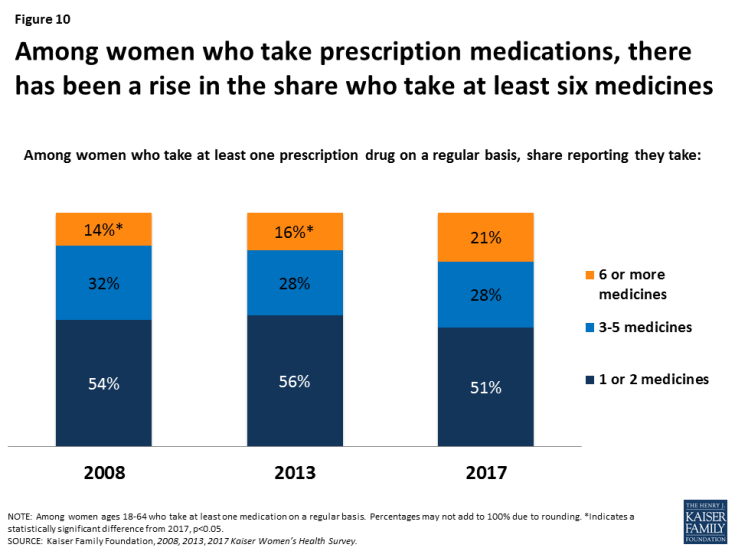

The share of women who take six or more prescription medications has increased over the past decade.

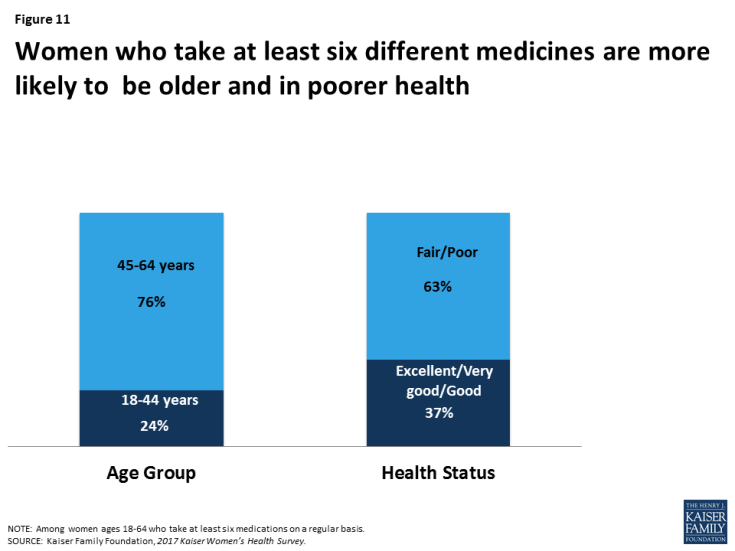

The proportion of women who report taking any prescription medicines has remained relatively steady from 51% in 2008 to 55% in 2017 (data not shown). Among that group, the share who take at least six medicines has risen from 14% in 2008 to 21% in 2017 (Figure 10). Almost two-thirds (63%) of this group rate their health as fair or poor, but over one-third (37%) rate their health positively (Figure 11).

Figure 10: Among women who take prescription medications, there has been a rise in the share who take at least six medicines

Figure 11: Women who take at least six different medicines are more likely to be older and in poorer health

Conclusion

Seven years after the passage of the ACA, nine in ten women have health coverage, more than ever before. On many measures, women with insurance have better access to care, but some still face barriers such as services that are not covered, expensive cost sharing, and providers that do not accept their coverage. Affordability continues to be a challenge, with many women reporting they could not afford to obtain preventive care, treatments, or prescription medicines because of the out of pocket costs. In addition, some barriers are outside the health care system and result because women do not have time to seek care or do not have workplaces that support them taking time off to go for appointments.

This brief was prepared by Usha Ranji, Caroline Rosenzweig, and Alina Salganicoff of the Kaiser Family Foundation.

The authors would like to thank Anthony Damico, an independent consultant, for his assistance with survey analysis.