How the Loss of Cost-Sharing Subsidy Payments is Affecting 2018 Premiums

Issue Brief

How the Loss of Cost-Sharing Subsidy Payments is Affecting 2018 Premiums

Issue Brief

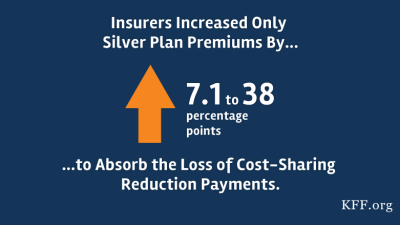

This analysis of 32 states and Washington, D.C., tracks data on 2018 Affordable Care Act (ACA) marketplace premium increases that insurers directly attributed to the end of cost-sharing reduction payments, which reimburse insurers for providing marketplace health plans with reduced out-of-pocket costs for lower-income people. Following months of uncertainty, the Trump administration announced on Oct. 12 that the payments would be discontinued immediately, although insurers must still offer the subsidized coverage.