What Do Medicaid Unwinding Data by Race and Ethnicity Show?

Blog

What Do Medicaid Unwinding Data by Race and Ethnicity Show?

Blog

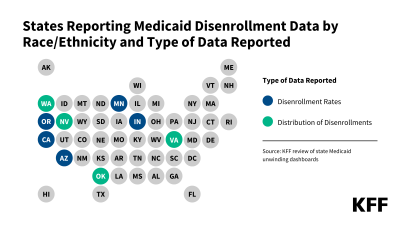

As of September 2023, nine states are reporting data that allow for analysis of disenrollment patterns by race and ethnicity. Five states (Arizona, California, Indiana, Minnesota, and Oregon) provide data on disenrollment rates by race and ethnicity. Four states (Nevada, Oklahoma, Virginia, and Washington) report the distribution of disenrollments by race and ethnicity that can be compared to the distribution of overall Medicaid enrollment in each state by race and ethnicity.