How Many Employers Could be Affected by the Cadillac Plan Tax?

Issue Brief

How Many Employers Could be Affected by the Cadillac Plan Tax?

Issue Brief

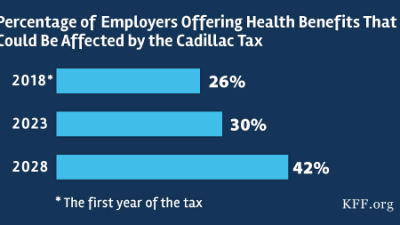

As fall approaches, we can expect to hear more about how employers are adapting their health plans for 2016 open enrollments. One topic likely to garner a good deal of attention is how the Affordable Care Act’s high cost plan tax (HCPT), sometimes called the “Cadillac plan” tax or “Cadillac tax,” is affecting employer decisions about their health benefits. The tax takes effect in 2018.

The potential of facing an HCPT assessment as soon as 2018 is encouraging employers to assess their current health benefits and consider cost reductions to avoid triggering the tax. Some employers announced that they made changes in 2014 in anticipation of the HCPT, and more are likely to do so as the implementation date gets closer.