The Uninsured at the Starting Line in Missouri: Missouri findings from the 2013 Kaiser Survey of Low-Income Americans and the ACA

I. Patterns of Coverage and the Need for Assistance

Coverage Dynamics among the Insured and Uninsured

Health insurance coverage is dynamic, and every year thousands of Missourians gain, lose, or change their health coverage. However, for most uninsured adults in Missouri, lack of coverage is a long-term issue that spans many years. Many uninsured adults in Missouri reported trying to obtain coverage in the past but were unsuccessful due to barriers such as ineligibility for public coverage or high costs of private coverage. Under the ACA, some uninsured are projected to gain coverage as those barriers are removed, but some may continue to experience gaps or changes in coverage.

For most currently uninsured adults in Missouri, lack of coverage is a long-term issue.

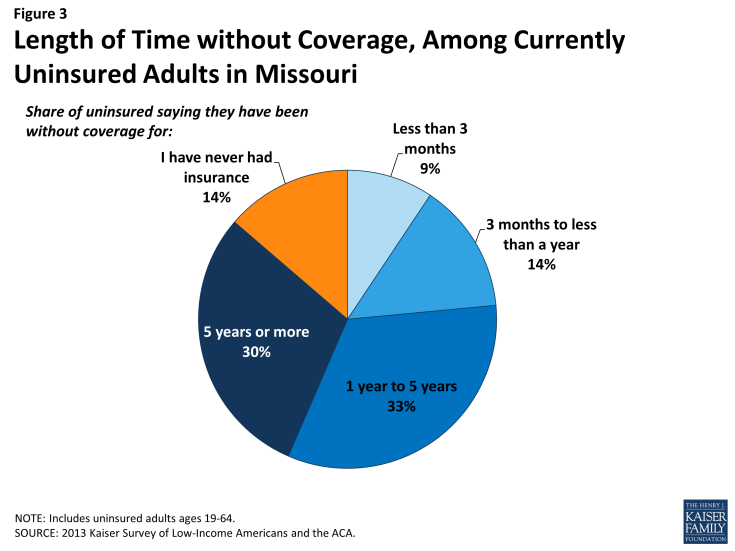

While some people lack health insurance coverage during short periods of unemployment or job transitions, for many uninsured adults in Missouri, lack of coverage is a chronic problem. The survey shows that a large share of uninsured adults in Missouri have been without insurance for a very long period of time: 43% reported being uninsured for 5 years or more, including 14% of the uninsured who reported that they have never had coverage in their lifetime (Figure 3). Of note, almost one in five (18%) poor uninsured adults (<100% FPL) reported never having coverage in their lifetime, and these adults will likely remain uninsured without a Medicaid expansion (see Appendix Table A2). The length of time adults have been uninsured does not differ significantly by income in Missouri.

It is important for policymakers in Missouri implementing coverage expansions on the Marketplace and considering a Medicaid expansion to be aware that people targeted by the ACA have varying levels of experience with the insurance system. While some previously had coverage, a substantial share of uninsured adults in Missouri has been outside the insurance system for quite some time. The long-term uninsured may require targeted outreach and education efforts to link them to the health care system and help them navigate their new health insurance.

Many uninsured adults in Missouri report trying to obtain insurance coverage in the past, but most did not have access to affordable coverage.

The uninsured report a desire to obtain coverage, but prior to implementation of the ACA in Missouri, options for coverage—particularly for the poor or moderate-income—were limited. The vast majority of uninsured adults in Missouri do not have access to employer coverage. More than eight in ten (83%) uninsured adults in Missouri report no access to employer coverage, either because no one in their family is working for an employer, their or their spouse’s employer does not offer coverage, or they are ineligible for that coverage (Table 1). For example, 47% of uninsured adults in Missouri are in a family without an employer, meaning both they and their spouse (if married) are either not working or are working but are self-employed. Over a quarter (26%) of uninsured adults are in a family that has an employer who does not offer coverage to any workers, and one in ten (10%) are in a family that works for an employer who offers coverage but they are ineligible for that coverage. Most are ineligible because they work part-time or are in a waiting period. About one in six (17%) uninsured adults in Missouri does have access to coverage through an employer, but the majority report that the coverage offered to them is not affordable. Notably, lack of access to employer coverage is particularly high among poor uninsured adults (91%), a group that generally will not be eligible for financial assistance in gaining coverage under the ACA.

| Table 1: Access to Employer Health Coverage Among Uninsured Adults in Missouri | ||||

| All | By Income | |||

| <100% FPL | 100-400% FPL | |||

| % | % | % | ||

| No Access to ESI | 83% | 91% | 76% | |

| No one in family has an employer* | 47% | 58% | 37%* | |

| Firm doesn’t offer coverage | 26% | 25% | 27% | |

| Not eligible for coverage | 10% | — | 12% | |

| Access to ESI | 17% | 9% | 24%^ | |

| Cannot afford premium | 13% | — | 17% | |

| Don’t think need coverage | — | — | — | |

| Some other reason | — | — | — | |

| Notes: Don’t Know and Refused responses not shown, they account for less than 4% of the uninsured population.*Individuals who are self-employed without other employment are treated as not having an employer. “–“: Estimates with relative standard errors greater than 30% are not provided. ^ Estimate statistically significantly different from <100% FPL at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

||||

Similarly, poor and moderate-income adults reported limited access to coverage through Medicaid. While the state had expanded eligibility to children through Medicaid and the Children’s Health Insurance Program, Medicaid eligibility for adults remains very limited (see Background for more detail). In addition, some individuals who were eligible for Medicaid remained uninsured because they were not aware that they were eligible for coverage or they faced application or enrollment barriers.

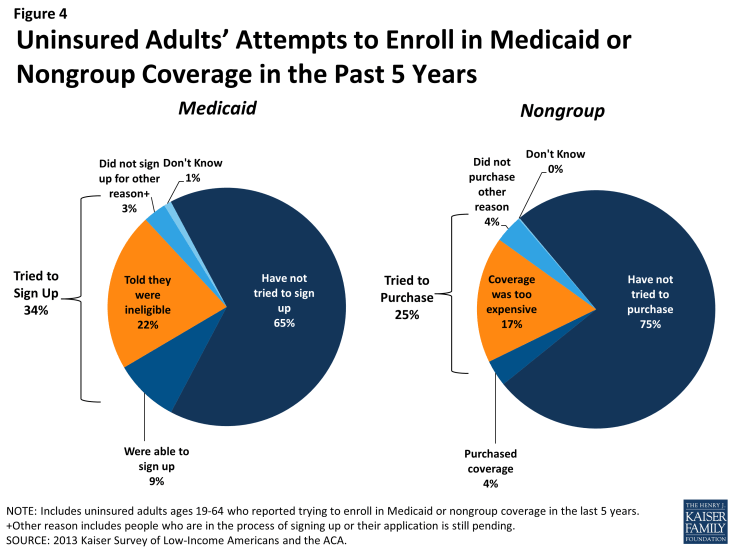

The gaps in Medicaid eligibility for adults and difficulties with the enrollment process posed barriers for many low-income adults seeking coverage. One-third of uninsured adults in Missouri (34%) reported trying to sign up for Medicaid in the past five years (Figure 4 and Appendix Table A2). The majority of adults in Missouri who tried to sign up for Medicaid were unsuccessful, and among those, most (22% of the uninsured) were unable to sign up because they were told they were ineligible (Figure 4). Notably, results are similar when looking at just poor uninsured Missourian adults. Most of the adults who were told they were ineligible will likely remain ineligible for public coverage, barring a change in their income, as Missouri has not yet expanded Medicaid under the ACA.

Prior to the ACA, there were also barriers to obtaining coverage on the nongroup, or individual, market. This type of coverage was not guaranteed in Missouri, and insurance companies could charge higher premiums for sicker or older individuals, making coverage unaffordable for many uninsured adults.1 Uninsured Missourians also report trying to obtain nongroup coverage. One in four uninsured adults in Missouri (25%) reported trying to obtain nongroup coverage in the past five years. Most of these Missourians (17% of the uninsured) did not purchase a plan because the policy they were offered was too expensive (Figure 4). Overall, almost half of uninsured adults reported trying to sign up for either Medicaid or nongroup coverage in the past five years (data not shown).

Some of the barriers to coverage that the uninsured have reported facing in the past are addressed by the ACA. Large employers (>50 workers) face penalties if they do not offer affordable coverage to their workers,2 and thousands of uninsured families are now able to purchase coverage in the Marketplace and receive premium tax credits to reduce the cost. Insurers are no longer able to deny coverage based on health status and are limited in what they charge people based on age, location, and tobacco use status. However, some uninsured adults may continue to face barriers to coverage. Missouri chose not expand Medicaid in January 2014, leaving many of these barriers in place for poor uninsured adults. Further, as was the case before the ACA, undocumented immigrants remain ineligible to enroll in Medicaid or Marketplace coverage, and recent lawfully residing immigrants are subject to certain Medicaid eligibility restrictions. Less than 2 percent of the uninsured in Missouri are undocumented immigrants (data not shown).

For those who are eligible for assistance in the Marketplace, education efforts regarding new coverage options are important, as three in four uninsured adults (76%) in the income range for premium tax credits reported knowing only a little or nothing at all about the Marketplace.3 People who have attempted to obtain coverage in the past may be unaware that rules and costs have changed under the ACA. Outreach and education will be needed to inform people that eligibility rules have changed and that financial assistance is available to offset the cost of coverage.

Health coverage is not always stable.

For most insured adults in Missouri, coverage is continuous throughout the year and over time. However, when accounting for both insured people with a gap in their coverage and uninsured people who recently lost coverage, the survey indicates that sizeable shares of adults in Missouri lose or gain coverage over the course of a year.

Among Missouri adults who were insured at the time of the survey, 8% reported being uninsured at some point in the past year (see Table 2), and those who had a gap in coverage were uninsured for over half the year (6.9 months) on average (data not shown). Further, some currently uninsured adults had coverage at some point within the past year. Among uninsured adults in Missouri, nearly one in four (23%) reported having lost coverage within the last year. Among both those with a gap in coverage or who recently lost coverage, the majority reported that they most recently had employer coverage (data not shown).

In addition to those who lose or gain coverage over the course of a year, many adults in Missouri who have coverage throughout the entire year have a change in their health insurance plan. Among adults with insurance coverage, 11% had coverage for the entire year but reported that they had a change in their coverage (Table 2). Coverage changes may be due to a number of different factors including changes in employment, changes in eligibility for public programs, or simply a change in plan or insurance carrier. The most common reasons for a change in coverage appear to be related to changes in employment or changes in plans during open enrollment, as most Missourians with a coverage change reported changing from an employer plan to another employer plan.

| Table 2: Coverage Dynamics Among Insured and Uninsured Adults In Missouri, by Income and Current Coverage | |||||||||

| All | By Income | By Current Coverage | |||||||

| <100% FPL | 100-400% FPL | >400% FPL | Employer | Nongroup | Medicaid | ||||

| % | % | % | % | % | % | % | |||

| Insured Adults | 100% | 100% | 100% | 100% | 100% | 100% | 100% | ||

| Gap in Coverage in Past Year | 8% | 21% | 8%^ | — | 5% | — | 23%* | ||

| Changed Coverage During Year | 11% | 8% | 13% | 10% | 13% | — | 6%* | ||

| Same Coverage for Full Year | 81% | 71% | 79% | 85%^ | 82% | 75% | 72%* | ||

| Uninsured Adults | 100% | 100% | 100% | 100% | 100% | 100% | 100% | ||

| Uninsured Full Year | 76% | 79% | 73% | — | NA | NA | NA | ||

| Lost Coverage Within Past Year | 23% | 20% | 27% | — | NA | NA | NA | ||

| NOTES: Don’t Know and Refused responses not shown. Excludes people covered by other sources, such as Medicare, VA/CHAMPUS, or other state programs. * Estimate statistically significantly different from employer estimate at the 95% confidence level. ^ Estimate statistically significantly different from <100% estimate at the 95% confidence level. “–“: Estimates with relative standard errors greater than 30% are not provided. ^ Estimate is statistically significantly different from <138% FPL estimate at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

|||||||||

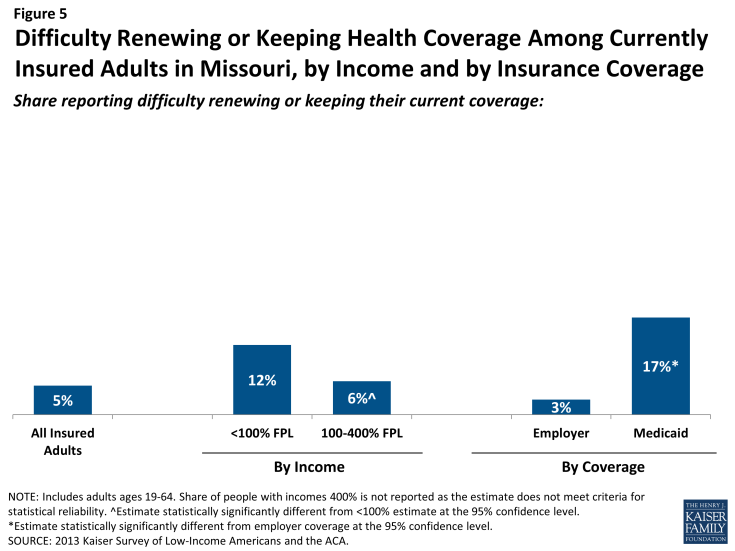

Last, a small number of insured adults in Missouri reported challenges in either renewing or keeping their coverage, another indication of instability in coverage throughout the year. Reflecting eligibility rules, adults with Medicaid are the most likely to report a challenge (17%) compared to adults with other insurance types (Figure 5). Medicaid eligibility is closely tied to income, and adults’ income may fluctuate throughout the year; adults must report changes in income that may affect their eligibility throughout the year, and poor and moderate-income people are very likely to have part-time or seasonal work that leads to income fluctuations over the course of a year. In addition, adults must renew their Medicaid coverage either in person, by phone, or online annually.

Figure 5: Difficulty Renewing or Keeping Health Coverage Among Currently Insured Adults in Missouri, by Income and by Insurance Coverage

The survey findings on changes in insurance coverage during the year have implications for implementation of health reform in Missouri. While there has been much focus on enrolling currently uninsured people into Marketplace coverage, survey findings demonstrate that people will continue to move around within the insurance system throughout the year. Many people lose or gain employer coverage over the course of a year due to changing economic conditions and the delicate relationship between employment and health insurance. Further, there is some churning in insurance coverage resulting from Medicaid income eligibility limits: as adults’ income fluctuates, they may gain or lose Medicaid eligibility. Adults may also experience gaps in Medicaid coverage due to renewal requirements.

Gaps in coverage can cause people to postpone or forgo health care or accumulate medical bills,4 and changes in insurance plans may disrupt continuity of treatment. The ACA envisioned having insurance options available across the income spectrum to help people have coverage continuously throughout the year. However, poor adults in the state are likely to continue to experience gaps in coverage as they fall in and out of the coverage gap. Renewal simplifications for Medicaid coverage enacted as part of the ACA may address issues in coverage disruptions: whereas previously all adults in Missouri had to submit a paper form and documentation of income for Medicaid renewal, provisions under the ACA provide new options for them to renew on-line or by phone and use pre-populated forms when possible to reduce the need for paper documentation.5 However, even after implementation, adults are likely to experience coverage changes due to job changes or income fluctuation.