Medicaid Per Enrollee Spending: Variation Across States

Medicaid, the nation’s public health insurance program for low-income people, provided health and long-term care services for over 68 million Americans in FY 2011 including many children, working families, low-income elderly, and individuals with disabilities. Historically, states have had significant flexibility to expand Medicaid beyond federal minimums for benefits and coverage and to determine how care is delivered and how much providers are paid. These policy choices— as well as other factors such as a state’s ability to raise revenue, the need for public services, the health care markets in which Medicaid operates, and each state’s policy process— all lead to state variation in Medicaid. This brief examines variation in Medicaid spending per enrollee across eligibility groups, across states, and over time, and discusses implications for program policy and financing. We use the most recent available administrative data (FY 2011). Key findings include the following:

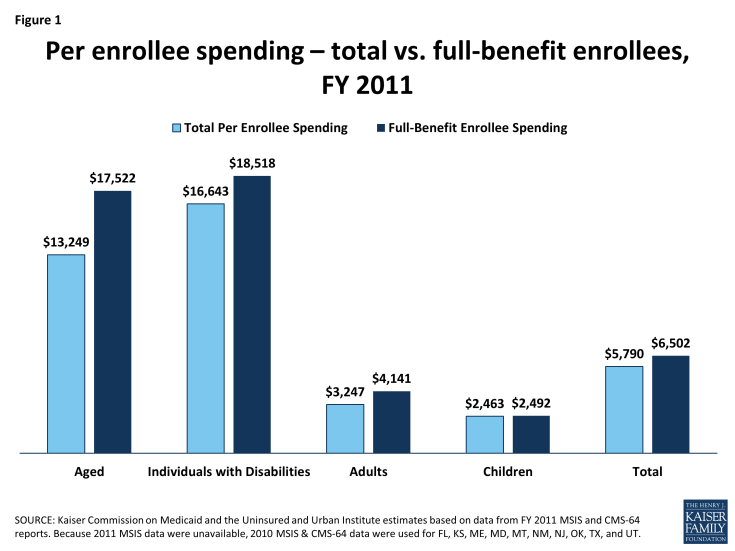

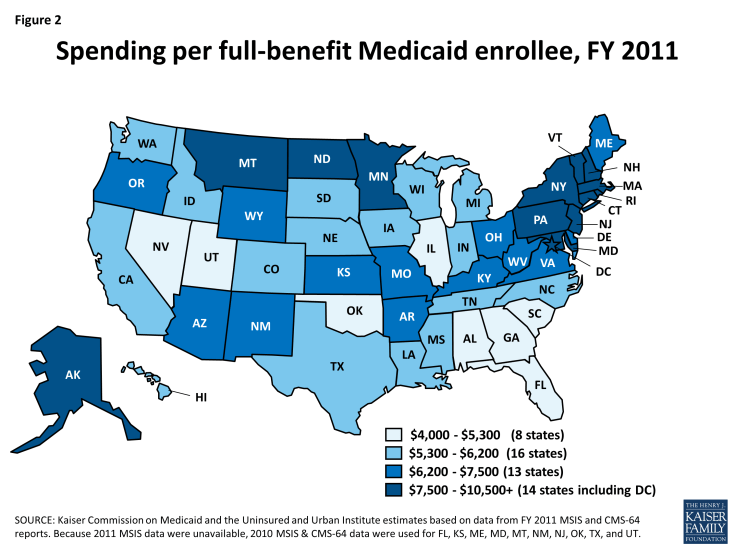

- In FY 2011, total national Medicaid spending per enrollee was $5,790. When excluding “partial-benefit enrollees,” national spending per enrollee was $6,502. In general, states in the south tend to have lower spending per enrollee, while states in the northeast have higher spending per enrollee.

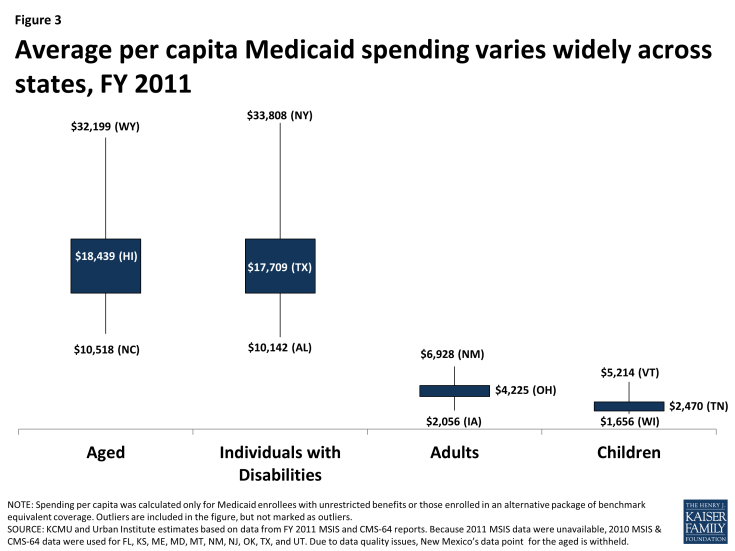

- Per enrollee spending is higher among the aged and individuals with disabilities due to the higher use of complex acute services and long-term care ($17,522 and $18,518 respectively for FY 2011). Average spending per Medicaid enrollee was less for adults and children ($4,141 and $2,492 respectively). For each eligibility group, there is considerable variation across states in per enrollee spending.

- In addition to variation across states, there was also considerable variation within states for each eligibility group, particularly for individuals with disabilities. For example, in Kansas average spending for individuals with disabilities was $17,153 (close to the national average) but ranged from $765 for those in the first quartile to $126,727 for those in the top 5th percentile.

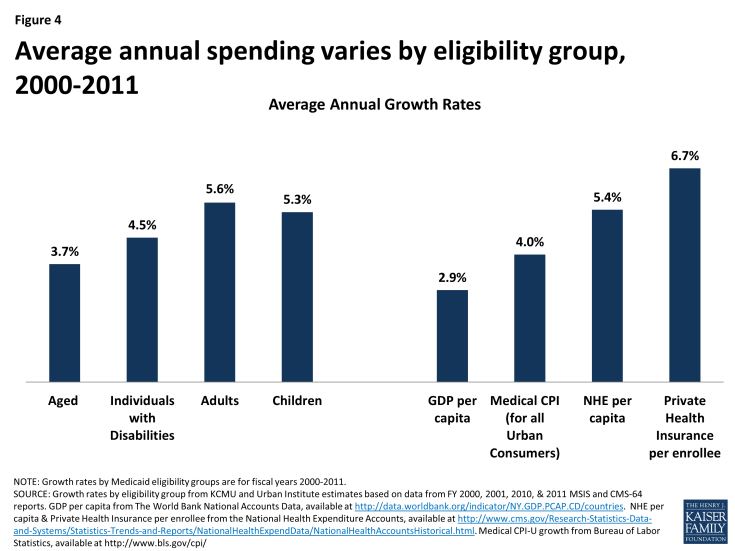

- Per enrollee spending growth between FY 2000 and FY 2011 also varies across eligibility groups. Spending growth for the aged excluding prescription drug spending grew more slowly than spending for adults, children, and individuals with disabilities. States with relatively low spending per enrollee in FY 2000 had higher rates of spending growth than states with high spending per enrollee.

- From FY 2000 to FY 2011, growth in Medicaid spending per enrollee was greater than growth in GDP or Medical CPI in most states but lower than the growth of national health expenditures per capita and private health insurance per enrollee in the same time period.

Understanding the complexity of variation in per enrollee spending and spending growth is critical in assessing the implications of federal policy changes, particularly those that would alter the underlying financing structure of Medicaid. This analysis shows that changes in Medicaid financing would have dramatically different effects across states. Specifically, if federal spending limits for each state were based on past spending levels, variation in total or per enrollee spending would be “locked-in”; if federal spending limits for each state were based on national averages there would be large redistributions in funds across states. Proposals that limit federal Medicaid financing based on national growth targets such as GDP plus a percentage or CPI plus population growth would not account for the fact that spending growth varies significantly across states and eligibility groups. Another important factor for consideration is that changes in Medicaid enrollment and state choices since the implementation of the ACA have likely led to even greater variation than that highlighted in this report.

How Does Medicaid Per Enrollee Spending Vary Across Eligibility Groups and States?

The simplest calculation for per enrollee spending is total spending for services divided by total Medicaid enrollment (the number of Medicaid enrollees ever enrolled over the course of a year). For FY 2011, national per enrollee spending was $5,790. This same calculation can be applied for each eligibility group. This simple calculation does not account for the fact that some Medicaid enrollees are only eligible for “partial benefits.” For example, “partial-benefit enrollees” include those eligible for family planning services only or dual eligibles for whom Medicaid covers only Medicare premiums and cost sharing but not other Medicaid services (so-called “partial duals”). Eliminating partial-benefit enrollees provides a better understanding of what Medicaid spends for people eligible for the full scope of benefits. Eliminating partial-benefit enrollees from the computation of per enrollee spending generally increases the calculations of per enrollee spending (because partial-benefit enrollees tend to be less expensive than full-benefit enrollees). This is particularly true for aged beneficiaries, as a large share of enrollees in this category are partial duals who have Medicare as their primary payer (Figure 1).

Elimination of the partial-benefit enrollees also has different implications across states. In general, the exclusion of partial-benefit enrollees increases calculations of per enrollee spending by about 12 percent. However, in a few states, there is a large differential between per enrollee spending for all enrollees and per enrollee spending for only full-benefit enrollees, including California (37%), Massachusetts (27%), Vermont (26%) and Alabama (21%).

The rest of the analysis in this brief uses spending per full-benefit enrollee. Across all states, per full-benefit enrollee spending averaged $6,502 in FY 2011 and ranged from $4,010 in Nevada to $11,091 in Massachusetts. In general, states in the south tend to have lower per enrollee spending, while states in the northeast tend to have higher per enrollee spending (Figure 2).

Average per enrollee spending across states also varies across eligibility groups. Per enrollee spending is higher for the aged and individuals with disabilities and lower for adults and children eligibility groups. The aged and individuals with disabilities use more complex acute care services as well as long-term care services. Spending per aged enrollee ranges from a low of $10,518 in North Carolina to a high of $32,199 in Wyoming; from $10,142 in Alabama to $33,808 in the New York for disabled enrollees; from $2,056 in Iowa to $6,928 in New Mexico for adult enrollees and from $1,656 in Wisconsin to $5,214 in Vermont for children (Figure 3).

Even in states that have average spending close to the national average, spending varies widely within the eligibility group within the state. For example, average spending per disabled enrollee in Kansas is $17,153, but spending ranges from $765 for those in the first quartile to $126,727 for those in the top 5th percentile of spending. Most Medicaid enrollees with disabilities in Kansas are not enrolled in comprehensive managed care, but even in states with high managed care enrollment, there is wide variation in per enrollee spending. In these states, there may be limited variation in monthly premiums for the majority of enrollees in managed care, but there may be considerable variation among the remaining enrollees not enrolled in comprehensive managed care. Variation in states with managed care may also stem from the effect of partial year enrollment on yearly premium totals and fee-for-service spending for services not included in managed care contracts. In Hawaii, where 90 percent of aged enrollees receive care through comprehensive managed care spending ranges from an average of $5,439 for those in the first quartile to $57,130 for those in the top 5th percentile of spending. Despite the general lower cost for non-disabled adult and child enrollees, the variation in spending per child was wide in both Ohio and Tennessee as well.

| Average Spending Per Enrollee by Percentile in Select States, FY 2011 | ||||

| Percentile | Aged in Hawaii | Individuals with Disabilities in Kansas | Adults in Ohio | Children in Tennessee |

| 0-25% | $5,439 | $765 | $880 | $876 |

| >25-50% | $10,351 | $3,333 | $3,023 | $1,705 |

| >50-75% | $17,571 | $12,787 | $4,261 | $2,256 |

| >75-90% | $32,946 | $34,619 | $6,375 | $3,728 |

| >90-95% | $46,024 | $64,732 | $9,132 | $5,424 |

| >95% | $57,130 | $126,727 | $15,417 | $8,598 |

| Note: We selected states with spending per enrollee for the given eligibility group that was at or close to the national median.Source: Kaiser Commission on Medicaid and the Uninsured and Urban Institute estimates based on data from FY 2011 MSIS and CMS-64 reports. | ||||

How Has Growth In Medicaid Per Enrollee Spending Varied Across Eligibility Groups and States?

As described above, the levels of per enrollee spending vary considerably across eligibility groups. While not as dramatic, per enrollee spending growth rates also vary across groups. Looking at average annual spending growth for per enrollee spending by eligibility group between FY 2000 and FY 2011, spending for the aged excluding prescription drug spending grew more slowly than other groups over the period.1 Spending for children and adults grew faster than other groups; however, these groups are typically lower cost groups than the aged and individuals with disabilities. Growth in Medicaid spending per enrollee from FY 2000 to FY 2011 was greater than GDP and Medical CPI in most states but lower than national health expenditures per capita and private health insurance spending per enrollee (Figure 4).2

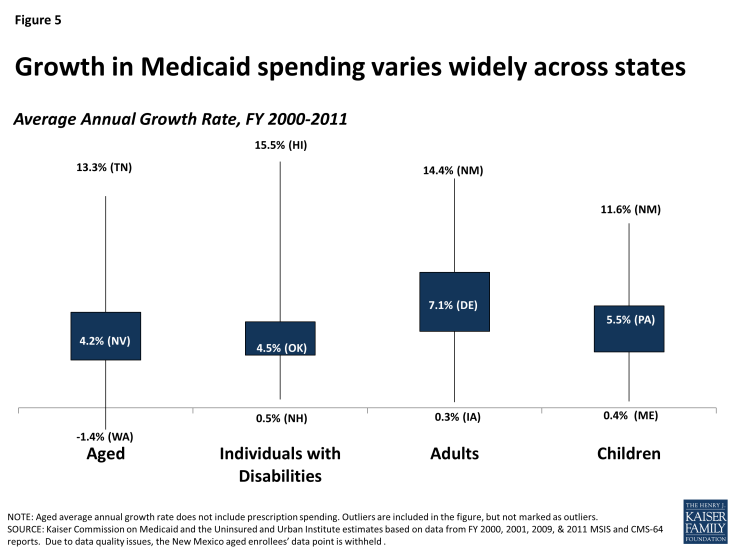

Just as there is wide variation across eligibility groups in per enrollee spending, there is also wide variation across the states in growth rates within each eligibility group (Figure 5).

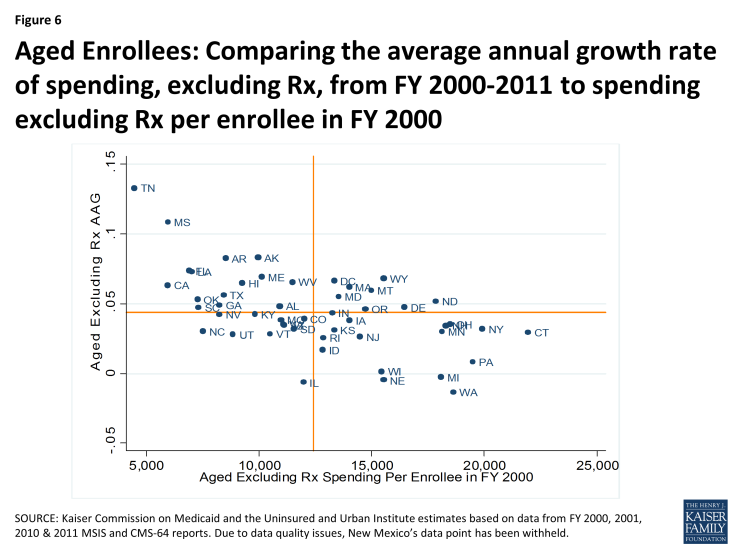

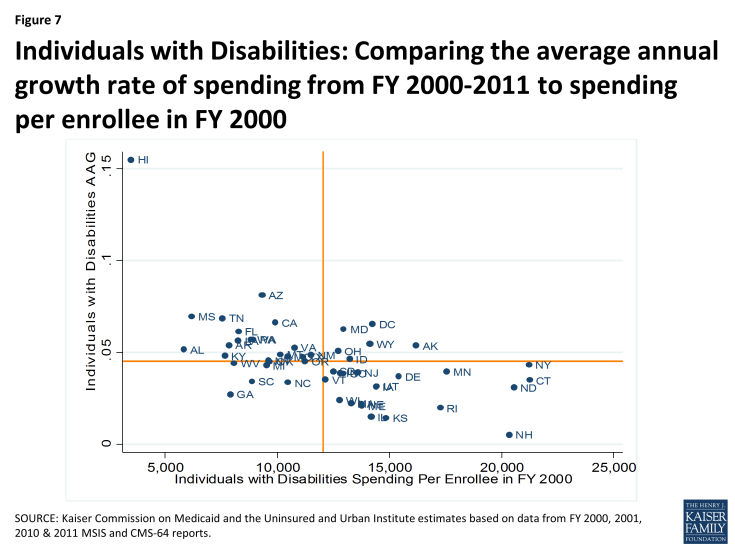

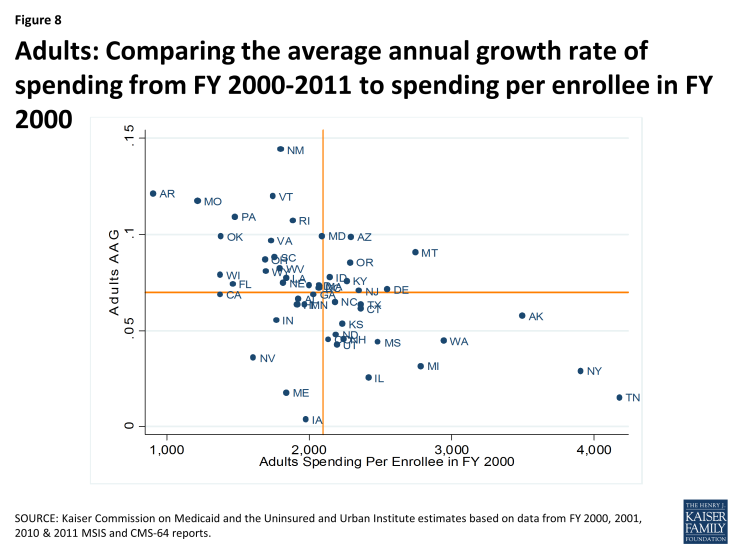

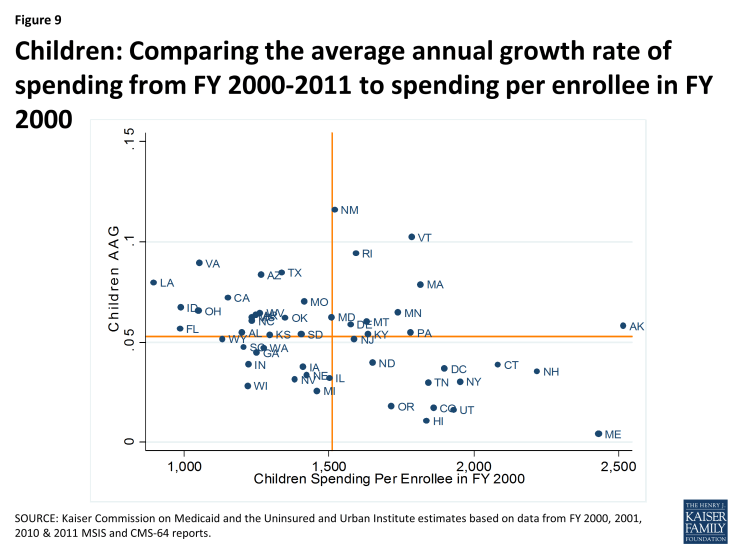

However, there is some indication of convergence of per enrollee spending across states over time. Within each eligibility group, states with low spending per enrollee tend to grow faster than states with higher spending per enrollee. This is shown in Figures 6 through 9, where for each eligibility group, we plot the spending per enrollee in FY 2000 against the average annual growth rate from FY 2000 through FY 2011. We divide these plots into four quadrants by drawing the unweighted national average annual growth rate, and the unweighted national average spending per enrollee (the orange lines). We can see that states with FY 2000 spending per enrollee above the unweighted national average— that is to say, states to the right of the vertical orange line in Figures 6 through 9— tend to have grown more slowly over the following decade. These states are in the bottom right quadrant. On the other hand, states in the top left quadrants represent the states with FY 2000 spending per enrollee that was below the national average but that grew faster than the national average annual growth rate.

Figures 6 through 9 show that the level of per enrollee spending in FY 2000 is inversely correlated with the average annual growth rate over the FY 2000 – 2011 period. By calculating the correlation coefficients between the spending per enrollee and average annual growth rates, we can see numerically what Figures 6 through 9 show us visually. The correlation coefficient is a statistical tool that tells us how close our plots in Figures 6 through 9 are to straight lines. In other words, it tells us how well we can predict the average annual growth rate knowing just the spending per enrollee in FY 2000. The negative number confirms that there is an inverse correlation between the two. With correlation coefficients ranging from -.38 to -.6 for all four groups, we classify the relationship between spending per enrollee in FY 2000 and the average annual growth rate from FY 2000 – 2011 as moderately strong overall. Comparing between the eligibility groups, we see that with correlation coefficients of -.570 and -.568, spending per enrollee and average annual growth rates are more strongly linearly correlated for the aged (excluding prescription spending) and individuals with disabilities, than for adults and for children.3

Figure 6: Aged Enrollees: Comparing the average annual growth rate of spending, excluding Rx, from FY 2000-2011 to spending excluding Rx per enrollee in FY 2000

Figure 7: Individuals with Disabilities: Comparing the average annual growth rate of spending from FY 2000-2011 to spending per enrollee in FY 2000

Figure 8: Adults: Comparing the average annual growth rate of spending from FY 2000-2011 to spending per enrollee in FY 2000

Figure 9: Children: Comparing the average annual growth rate of spending from FY 2000-2011 to spending per enrollee in FY 2000

| Correlation Coefficients Between Spending Per Enrollee in FY 2000 and Average Annual Growth Rates from FY 2000 – 2011 | ||

| Basis of Eligibility Group | Correlation Coefficient | |

| Aged Enrollees, Excluding Prescriptions | -0.570 | |

| Individuals with Disabilities | -0.568 | |

| Adults | -0.531 | |

| Children | -0.382 | |

| Source: Kaiser Commission on Medicaid and the Uninsured and Urban Institute estimates based on data from FY 2000, 2001, 2010, & 2011 MSIS and CMS-64 reports. | ||

The correlation between spending per enrollee and average annual growth is partially due to the fact that the same change in spending will comprise a larger share of a small per enrollee spending level in a base year than it would of a large per enrollee spending level. However, it may also be attributable to state policy changes in covered benefits. Regardless, the correlation coefficients show us that states with lower spending per enrollee in a base year have experienced higher average annual growth rates, especially amongst the aged and individuals with disabilities eligibility groups. Thus we see that not only does spending per enrollee grow differently based upon the eligibility group, but within each eligibility group spending per enrollee grows differently across states, the level of spending in the base year is correlated with the rate of growth in the subsequent years, and the strength of this correlation varies across eligibility groups.

Policy Implications

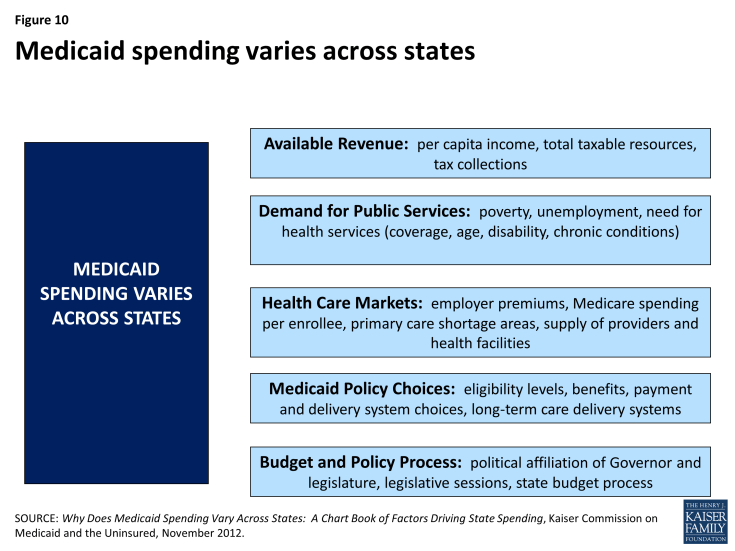

This analysis shows that there is considerable variation in Medicaid per enrollee spending across states, across groups of enrollees and even within groups of enrollees within a state. The analysis also shows wide variation in average annual growth rates for per enrollee spending across states. This variation is multi-faceted and complex. The reasons for this variation are not uniform or easy to explain. Variation is the result of a complex set of factors that include state policy choices (who is eligible, what benefits are covered, how services are paid for and delivered) as well as the availability of revenues, demand for service, health care markets and state budget and policy processes.4 Variation in Medicaid spending and growth patterns reflects the inherent flexibility built into the program for states to make policy choices to administer their programs within broad federal rules as well as other factors such as a state’s ability to raise revenue, the need for public services, the health care markets in which Medicaid operates as well as the policy process all lead to variation in Medicaid programs and spending (Figure 10).

Over the last several years, several proposals have been introduced that would alter the underlying financing structure of Medicaid. Currently Medicaid provides an entitlement to coverage to eligible individuals as well as an entitlement to states to federal matching funds without a pre-set limit. Some proposals would place an overall cap on federal Medicaid spending or a limit on federal Medicaid spending per enrollee. These policy changes would have dramatically different results across states because of the current variation in the program.

Federal spending limits for each state based in part on past spending levels would “lock-in” variation in total or per enrollee spending based on state historical decisions about how to administer Medicaid. Alternatives to try to set federal spending limits for each state based on national averages would result in large redistributions in funds that would have a limited relationship to past state Medicaid spending patterns. Proposals that limit federal Medicaid financing based on national growth targets such as GDP plus a percentage or CPI plus population growth would not account for the fact that spending growth varies significantly across states and eligibility groups. This analysis suggests that there is some convergence in state variation in spending per enrollee over time. States with relatively low spending per enrollee in FY 2000 had higher rates of spending growth than states with high spending per enrollee in 2000. Imposing one national growth rate across states would maintain baseline differences between states.

Looking ahead, in addition to historic variation, it is unclear how the Affordable Care Act (ACA) will affect per enrollee spending and growth across states. This analysis is based on administrative data from FY 2011, so it does not capture the implementation of the major coverage provisions in the ACA. Given that some states implemented the Medicaid expansion and others did not, as well the fact that expansion states face different scale of expansion relative to their existing programs, it is quite likely that variation will be even greater in the post-ACA world.

Understanding the complexity of variation in per enrollee spending and spending growth is critical in assessing the implications of federal policy changes, particularly those that would alter the underlying financing structure of the program.