2015 Survey of Health Insurance Marketplace Assister Programs and Brokers

Section 3: Why Did Consumers Seek Help?

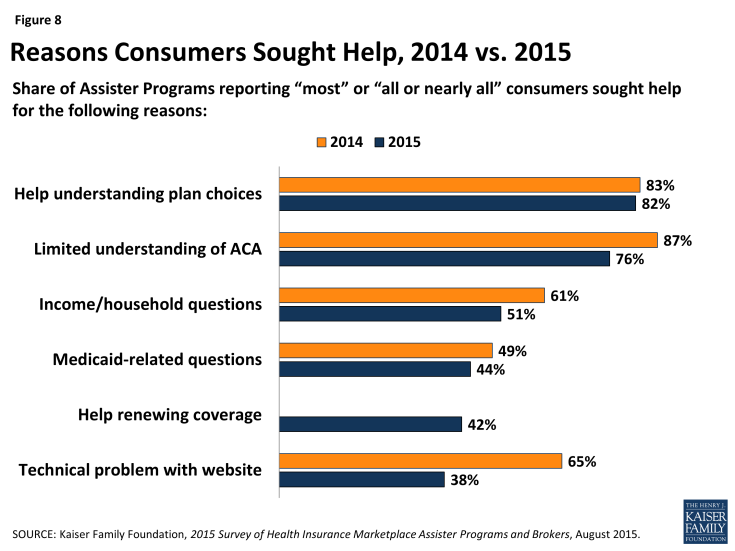

Lack of understanding of the ACA and health insurance motivated many consumers to seek assistance. Like last year, three-quarters of Assister Programs reported consumers sought help because they didn’t understand the ACA, didn’t understand health insurance, or lacked confidence to apply for coverage and financial assistance on their own. Overwhelmingly these were the top three reasons cited by Assister Programs last year and this year.

With millions of consumers returning to the Marketplace in year two to renew or change coverage, Assister Programs were less likely this year than last year to cite Marketplace website glitches as a major factor leading consumers to seek help. But in similar numbers to last year, Programs reported that consumers needed help answering Marketplace questions about their households and income, about their eligibility for Medicaid, and about other tax related questions. Also this year, for the first time, more than 40% of Programs said most consumers they served needed help renewing their coverage or updating their application for financial assistance for year two. (Figure 8)

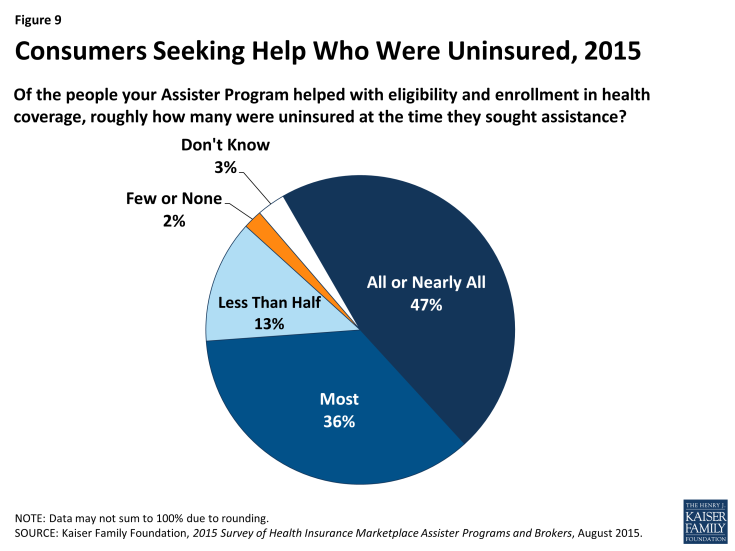

Most who sought help were uninsured. This year, 83% of Assister Programs reported that most to nearly all of the consumers they helped were uninsured at the time they sought assistance, slightly lower than the 89% of Programs last year reporting most to nearly all of the consumers they helped were uninsured. (Figure 9 and Appendix Table A1) This year for the first time some consumers sought help renewing coverage. Even so, most Assister Programs may remain focused primarily on outreach and assistance to uninsured individuals in year two. This may change in future years as more uninsured people get and keep health coverage.

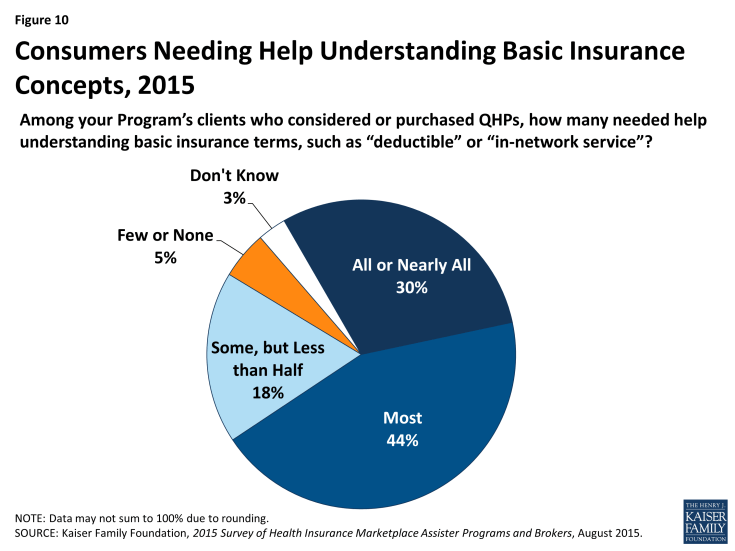

Most who sought help also had limited health insurance literacy. Unchanged from last year, 74% of Assister Programs said most to nearly all of their clients who shopped for or purchased private health plans needed help understanding basic insurance terms and concepts such as “deductible” and “in-network service.” (Figure 10 and Appendix Table A1)

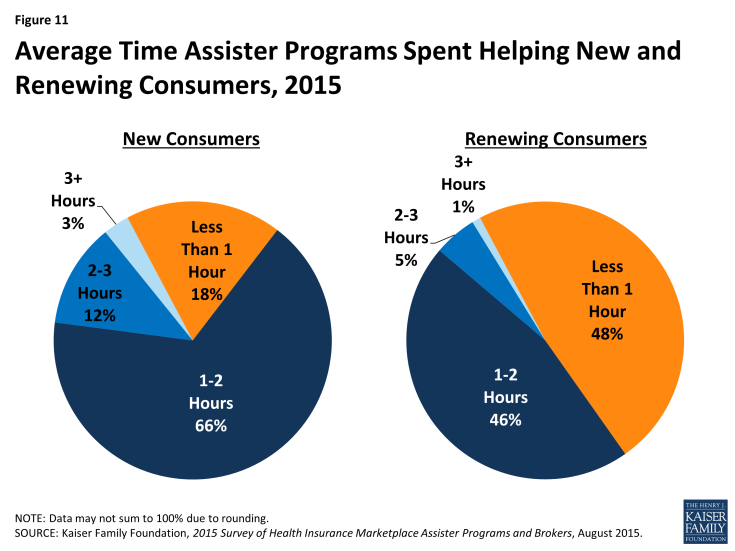

Helping consumers renew coverage took less time. When helping consumers who were returning to the Marketplace this year to renew or change coverage they had selected last year, the process was faster. Nearly half of Assister Programs said it took less than one hour, on average, to help consumers who were returning to the Marketplace. (Figure 11)

Eligibility and enrollment assistance is time-intensive. Similar to last year, about two-thirds of Assister Programs said it took one to two hours, on average, to help each consumer who was applying to the Marketplace for the first time. (Figure 11) However, there was a small increase in the number of Programs who said the average application took less than one hour, and a small decrease in the number reporting the average application took more than 2 hours. (Appendix Table A2) This uptick in appointments lasting less than an hour may reflect better functioning websites and more Assister experience using the application.

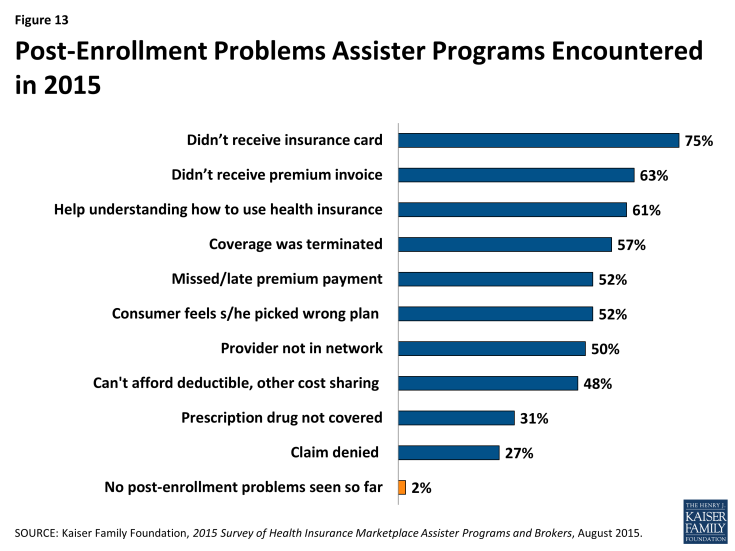

Appointment time efficiency gains appear to have been spent productively, with more Assisters able to complete the enrollment process with consumers this year, including selection of a health plan. Last year 61% of Assister Programs said they knew the plan choice outcome for most or nearly all consumers they helped. This year 71% said this was the case. (Figure 12)

Figure 12: Consumers Completing the Enrollment Process, Including Selecting a Health Plan, 2014 vs. 2015

Help Between Open Enrollment Periods

Assister Programs helped at least 630,000 consumers with special enrollment periods and at least 290,000 consumers report mid-year changes. This year we asked returning Assister Programs about help they provided consumers outside of Open Enrollment periods. Most Programs were available throughout the year to help consumers who became eligible for special enrollment periods (SEPs or who needed to report other mid-year income or family changes to the Marketplace in order to update their application for subsidies.

On average, returning Programs each helped 183 consumers apply for SEPs last year. Forty-seven percent helped fewer than 50, but 24% of Programs helped more than 100. Navigator Programs and FQHCs helped more consumers with SEPs on average, compared to CACs. (Table 4) Nationwide, we estimate Assister Programs helped more than 630,000 consumer apply for SEPs in 2014.

| Table 4: Help with Special Enrollment Periods and Mid-Year Changes | ||||

| All Assister Programs | by Program Type | |||

| Navigator and FEAP | FQHC | CAC | ||

| Number of People Helped with Special Enrollment Periods | ||||

| Up to 50 people | 47% | 27% | 33% | 60%*^ |

| 51-100 people | 15% | 19% | 19% | 12% |

| 101-500 people | 17% | 29% | 25% | 9%*^ |

| More than 500 people | 7% | 11% | 10% | 5%* |

| Don’t know/No answer | 13% | 13% | 12% | 14% |

| Number of People Helped with Mid-Year Changes | ||||

| Up to 50 people | 42% | 44% | 53% | 71%*^ |

| 51-100 people | 18% | 10% | 13% | 5%*^ |

| 101-500 people | 19% | 16% | 14% | 5%*^ |

| More than 500 people | 8% | 5% | 3% | 1% |

| Don’t know/No answer | 13% | 25% | 17% | 18% |

|

*Significantly different from Navigator and FEAP estimate at the 95% confidence level; ^Significantly different from FQHC at the 95% confidence level

NOTE: Columns may not sum to 100% due to rounding.

|

||||

Assister Programs also helped consumers report mid-year changes in their subsidy eligibility, though fewer consumers, overall, came in for this type of help. On average, each Program helped about 90 consumers report mid-year changes last year, although Navigator Programs and FQHCs helped more consumers report mid-year changes compared to CACs. (Table 4) Nationwide, we estimate Assister Programs helped more than 290,000 consumers report mid-year changes to the Marketplaces in 2014.

Assister Programs provided post-enrollment help to nearly 800,000 consumers between the first and second Open Enrollment period. During the 6-month period between Open Enrollments, nearly all returning Assister Programs also offered to help consumers with post-enrollment problems, though they are not required to do so. Those Programs that did provide post-enrollment assistance, on average, helped about 250 consumers. Again, Navigator Programs and FQHCs helped more consumers with post-enrollment problems compared to CACs. (Table 5)

| Table 5: Help with Post-Enrollment Problems | ||||

| All Assister Programs | by Program Type | |||

| Navigator and FEAP | FQHC | CAC | ||

| Number of People Helped with Post-Enrollment Problems | ||||

| Up to 50 people | 42% | 29% | 32% | 51%*^ |

| 51-100 people | 18% | 14% | 19% | 19% |

| 101-500 people | 19% | 28% | 26% | 13%*^ |

| More than 500 people | 8% | 13% | 14% | 3%*^ |

| Don’t know/No answer | 13% | 16% | 9% | 14% |

|

*Significantly different from Navigator and FEAP estimate at the 95% confidence level; ^Significantly different from FQHC at the 95% confidence level

NOTE: Columns may not sum to 100% due to rounding. |

||||

Consumers sought help with premium payment and invoicing problems, claims denials, and when their health providers were not in-network. Consumers also returned for help because they did not understand how to use their health coverage. (Figure 13) Most Assister Programs (69%) say they could help consumers successfully resolve post-enrollment problems most of the time; 27% said they succeeded just some of the time and 4% said not very often.

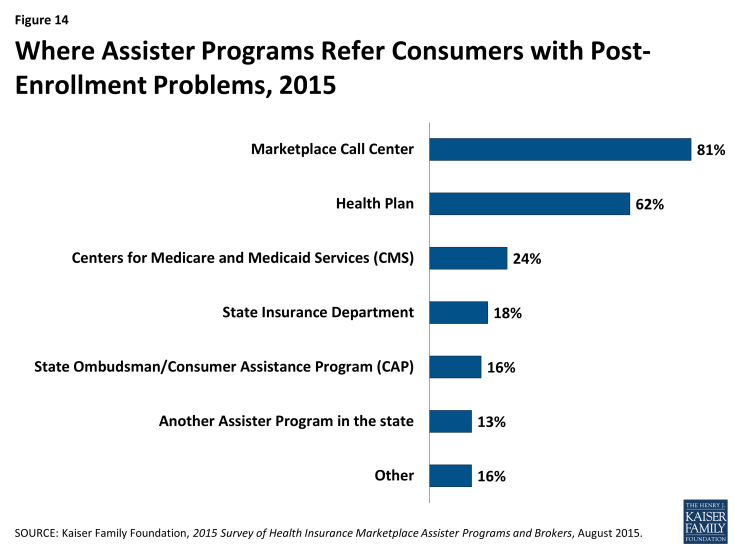

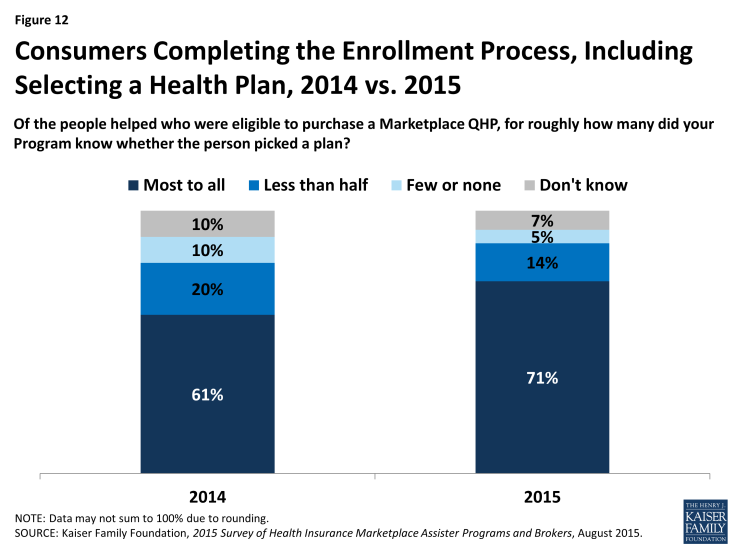

The ACA requires Navigators to refer consumers with post-enrollment problems to state Consumer Assistance Programs, or CAPs. However, federal funding for CAPs has not continued, and while many remain operational, Marketplace Assisters mostly refer consumers with post-enrollment problems elsewhere. When asked where they refer consumers with post-enrollment problems they cannot resolve, only 16% of Assister Programs mention CAPs. Instead, like last year, Assisters mostly refer consumers to the Marketplace Call Center (81%) or back to their health plan (62%). (Figure 14)