The independent source for health policy research, polling, and news.

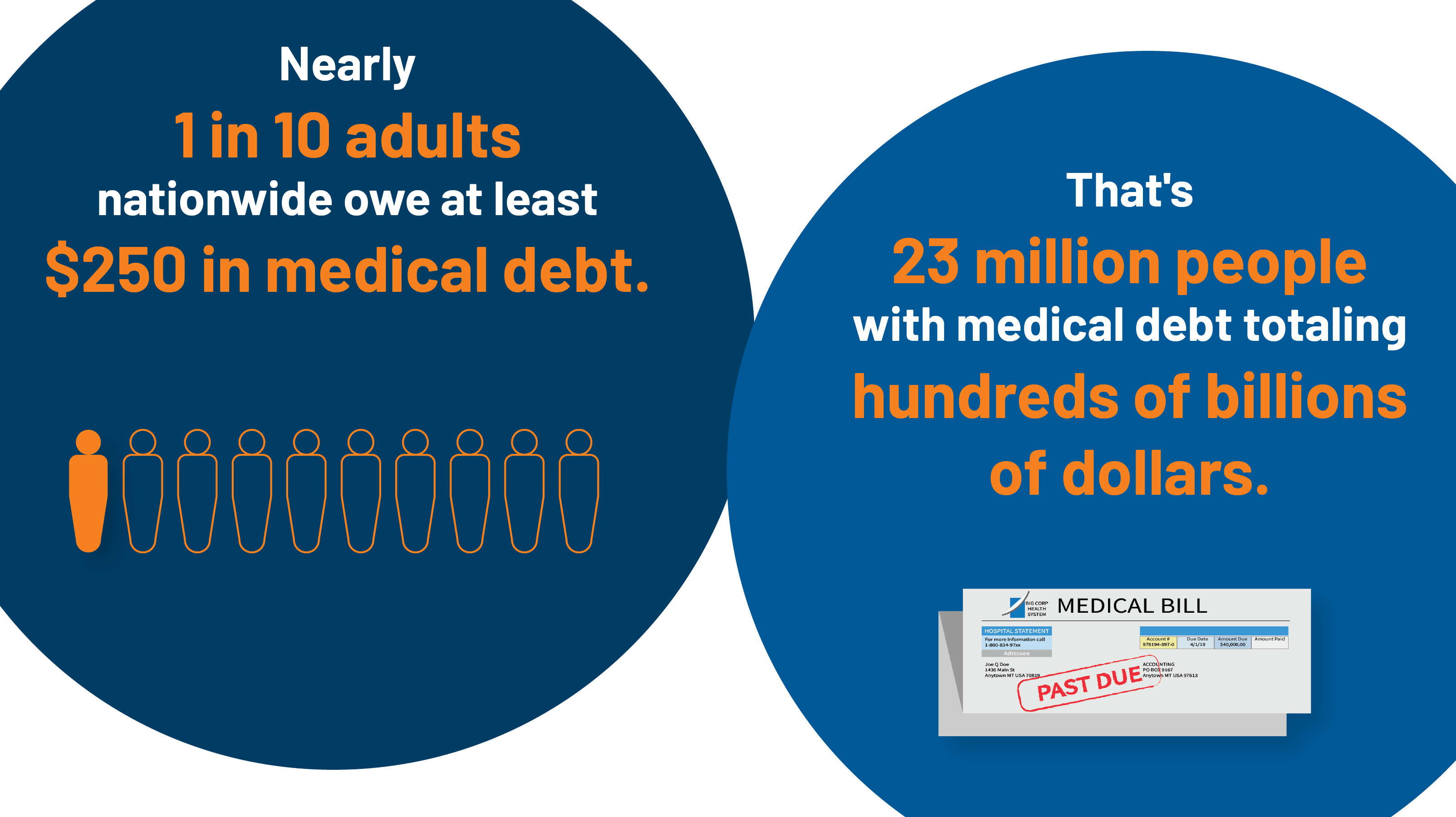

1 in 10 Adults Owe Medical Debt, With Millions Owing More Than $10,000

Black Adults, Those in Poor Health, and People Living with Disabilities are Most Likely to Carry Significant Medical Debt

Americans Likely Owe Hundreds of Billions of Dollars in Total Medical Debt

A new KFF analysis of government data estimates that nearly 1 in 10 adults (9%) – or roughly 23 million people – owe medical debt. This includes 11 million who owe more than $2,000 and 3 million people who owe more than $10,000.

The analysis is based on data from the 2020 Survey of Income and Program Participation, a nationally representative survey that asks every adult in a household whether they owed money for medical bills in 2019 and how much they owe. It looks at people with medical debt of more than $250.

The 2020 survey suggests Americans’ collective medical debt totaled at least $195 billion in 2019, though with quite a bit of uncertainty. A small share of adults account for a huge share of the total, with considerable variation from year to year. The estimate is significantly higher than other commonly cited estimates, which generally rely on data from credit reports that may not capture medical debts charged to credit cards or included in other debts rather than being directly owed to a provider.

Other findings include:

- People ages 35-49 (11%) and 50-64 (12%) are more likely than other adults to report medical debt. They have greater health needs than younger people on average and aren’t yet old enough to qualify for Medicare coverage, which may protect them from high costs.

- Larger shares of people in poor health (21%) and living with a disability (15%) report medical debt. People in these groups are more likely to need and receive care than people in better health and without disabilities.

- Among racial and ethnic groups, a larger share of Black adults (16%) report having medical debt compared to White (9%), Hispanic (9%), and Asian American (4%) adults.

- Adults who were uninsured for more than half of the year are more likely to report medical debt (13%) than those who were insured for all or most of the year (9%).

It’s not yet clear how the pandemic and resulting recession affected medical debt. Many people lost jobs and income early in the pandemic, which could have led to more difficulty affording medical care. At the same time, many people delayed or went without care, so fewer people may have been exposed to costly medical care. Shifts in insurance coverage and COVID-related cost-sharing waivers could also affect what people had to pay out-of-pocket.

Two related KFF analyses look at other challenges related to health costs:

The first finds that many households do not have enough money available to cover the cost of a typical deductible in a private health plan. For example, about a third (32%) of single-person households with private insurance in 2019 could not pay a $2,000 bill, and half (51%) could not pay a $6,000 bill.

The second finds that lower-income families (less than twice the federal poverty level) who have employer health coverage spend a tenth of their income on health care on average, including both their share of the premium and their out-of-pocket costs.

The new analyses are available through the KFF-Peterson Health System Tracker, an online information hub that monitors and assesses the performance of the U.S. health system.