The independent source for health policy research, polling, and news.

Hospitals with More Private Insurance Revenue, Larger Operating Margins and Less Uncompensated Care Received More Federal Coronavirus Relief Funding Than Others

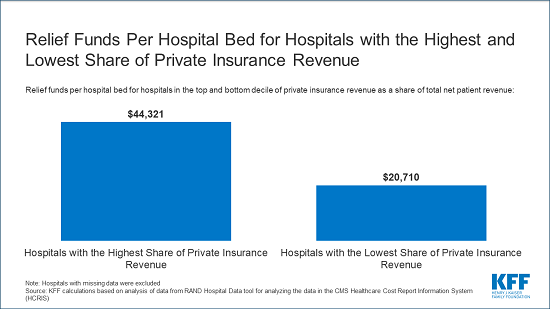

Hospitals that in normal times derive most of their revenue from patients with private insurance received more than twice as much federal coronavirus relief funding per bed than the hospitals that get the smallest share of private insurance money, finds a new KFF analysis of the first $50 billion in relief grants.

Institutions representing the top 10 percent of hospitals based on share of private insurance revenue received $44,321 in coronavirus relief per hospital bed, the analysis finds. That was more than double the $20,710 per hospital bed for the hospitals in the bottom 10 percent based on private insurance revenue.

The lopsided awards are the outgrowth of a distribution formula – determined by the Department of Health and Human Services in an attempt to get relief money out quickly – that favored hospitals with the highest share of revenue from patients with private insurance. These grants were provided using funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program and Health Care Enhancement Act, which both deferred to the HHS on how the money should be distributed.

Previous KFF analysis documented that private insurance typically reimburses at twice the rate of Medicare, with some hospitals commanding even higher reimbursement. This new study shows that the hospitals that are benefiting the most from that higher reimbursement are now getting the most taxpayer money in the form of coronavirus relief funds. Meanwhile hospitals that make most of their money treating people who are on Medicare and Medicaid, and therefore are typically paid at much lower rates, are getting relatively less help.

The analysis finds that the hospitals receiving more money are less likely to be teaching hospitals (10% vs 38%) and more likely to be for-profit (33% vs 23%). They had higher average operating margins (4.2% vs -9.0%) and provided less uncompensated care as a share of operating expenses (7.0% vs. 9.1%).

With additional relief money expected, our analysis of more than 4,500 hospitals focused on those with the highest and lowest shares of revenue from private payers to inform policy decisions regarding how to allocate any remaining grants to providers as well as any potential new funding from Congress. In its latest proposed coronavirus relief bill, the House has added details that would take steps to minimize the advantages for providers with more revenue from privately insured patients.

For the full analysis, as well as other data and analyses related to the COVID-19 pandemic, visit kff.org.