Medicare Advantage 2024 Spotlight: First Look

Issue Brief

Medicare Advantage 2024 Spotlight: First Look

Issue Brief

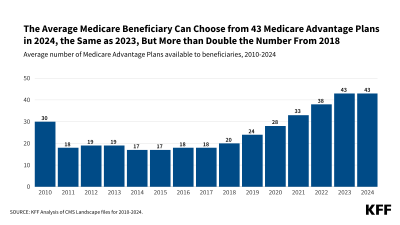

For 2024, the average Medicare beneficiary has access to 43 Medicare Advantage plans and can choose from plans offered by 8 firms. Among the majority of Medicare Advantage plans that cover prescription drugs, 66 percent will charge no premium in addition to the monthly Medicare Part B premium. As in previous years, the vast majority of Medicare Advantage plans will offer supplemental benefits, including fitness, dental, vision, and hearing benefits.