The Uninsured at the Starting Line: Findings from the 2013 Kaiser Survey of Low-Income Americans and the ACA

IV. Health Coverage and Financial Security

How the ACA Might Affect Low and Moderate Income People’s Financial Situation

Low-income families face multiple financial challenges on a daily basis, but a major challenge is the cost of health care. Insurance provides some financial protection for many low-income adults, but many still struggle to pay their share of premiums or other costs associated with care. Low-income adults without coverage are particularly vulnerable, facing even more financial strain than their insured counterparts. Both insured and uninsured low-income adults struggle with medical bills and debt, and coverage expansions, assistance with premium costs, and limits on out-of-pocket costs under the ACA have the potential to ameliorate the financial issues associated with the cost of health care.

Health care costs pose a challenge for low- and moderate-income families, even if they have insurance coverage.

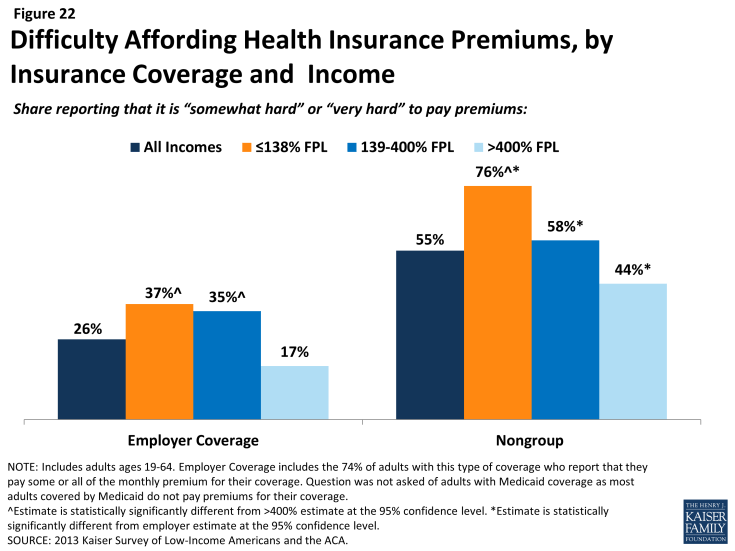

Health care accounts for a major budget item for low-income families, and affordability is a concern for many. Even among those with insurance, costs can be a burden. One source of cost burden is the cost of insurance itself. Nearly three-quarters of adults with employer coverage (74%) say they pay at least some part of their premium (data not shown), and adults with non-group coverage pay premiums directly to insurers themselves. Of adults who pay at least some portion of their premium, those with low incomes are most likely to report difficulty paying these costs (Figure 22). Thirty-seven percent of low-income (< 138% FPL) adults and 35% of moderate-income adults (139%-400% FPL) who pay a share of the premium for employer coverage report that their share is somewhat hard or very hard for them to afford, compared to 17% of higher-income (>400% FPL) adults with this coverage. For adults with non-group coverage, the rates are higher, with 76% of the low-income, 58% of the moderate income, and 44% of the higher income reporting difficulty paying their premiums. Since most adults with employer coverage share the cost of the premium with their employer, it is not surprising that rates of difficulty are higher among those with non-group coverage, who all pay the entire cost themselves.

Health care costs translate to medical debt for many l0w-income adults. While uninsured adults of all incomes are most likely to have outstanding medical bills, many low- and moderate-income insured adults also report high rates of medical bills that are unpaid or being paid off over time (Table 5). For example, 26% of low-income (<138% FPL) adults with employer coverage and 28% of low-income adults with Medicaid coverage report having medical debt. Some of these bills may reflect people’s coverage not covering all of their medical expenses, and some have been incurred during periods of uninsurance: 34% of insured adults with a gap in coverage have outstanding medical bills, compared to 23% with no gaps in coverage (data not shown). Some adults with Medicaid may have become eligible for their coverage as a result of having high medical bills, qualifying through a “medically needy” pathway for people who have high medical expenses.1 Once uninsured adults gain coverage, they may still have lingering medical bills from the past.

Regardless of coverage, medical bills can cause serious financial strain. People may report medical debt but not have a problem paying that debt. However, when asked directly whether they had problems paying medical bills in the past year, notable shares of low- and moderate-income adults reported that they did (Table 5). In many cases, the problems people had paying medical bills were severe. Adults in every coverage and income category reported that medical bills caused them to use up all or most of their savings, have difficulty paying for necessities, borrow money, or be contacted by a collection agency (Table 5).

| Table 5: Medical Debt and Problems with Medical Bills among Adults, by Income and Coverage | |||||

| Uninsured | Insured | ||||

| Employer | Nongroup | Medicaid | |||

| Has Outstanding Medical Bills or Paying Off Bills Over Time | |||||

| All | 39% | 21%* | 28%* | 30%* | |

| By Income | |||||

| <138% FPL | 40% | 26%* | — | 28%* | |

| 139-400% FPL | 38% | 28%* | 31% | — | |

| >400% FPL | — | 15% | — | — | |

| Had Problem Paying Medical Bills in Past Year^ | |||||

| All | 22% | 9%* | 12%* | 15%* | |

| By Income | |||||

| <138% FPL | 25% | 18% | — | 17%* | |

| 139-400% FPL | 17% | 13% | — | — | |

| >400% FPL | — | 4% | — | — | |

| Medical Bills Led to Serious Financial Strain^,^^ | |||||

| All | 20% | 7%* | 11%* | 12%* | |

| By Income | |||||

| <138% FPL | 23% | 13%* | — | 14%* | |

| 139-400% FPL | 15% | 11% | — | — | |

| >400% FPL | — | — | — | — | |

| Notes: Excludes people covered by other sources, such as Medicare, VA/CHAMPUS, or other state programs. “–“: Estimates with relative standard errors greater than 30% or cell sizes below 50 are not provided. ^ Excludes people who reported a problem with medical bills that were not their own. ^^ Defined as reporting that medical bills caused them to use up all or most savings; have difficulty paying for necessities; borrow money; or be contacted by a collection agency. * Estimate statistically significantly different from uninsured estimate at the 95% confidence level.SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

|||||

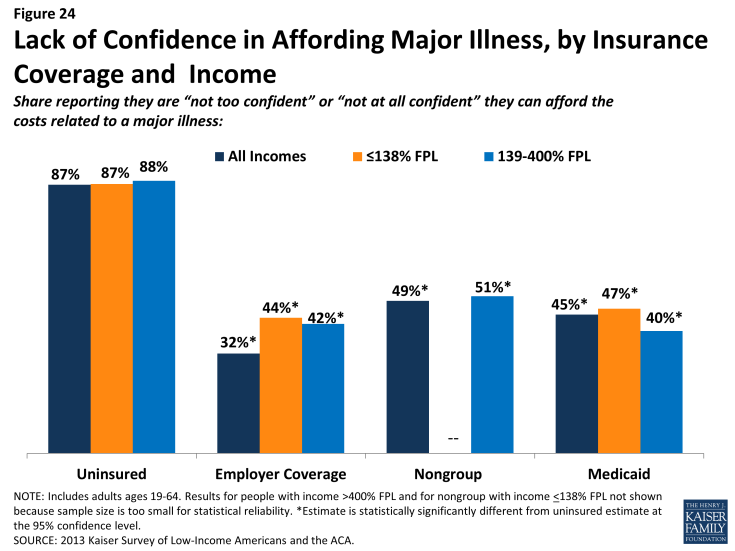

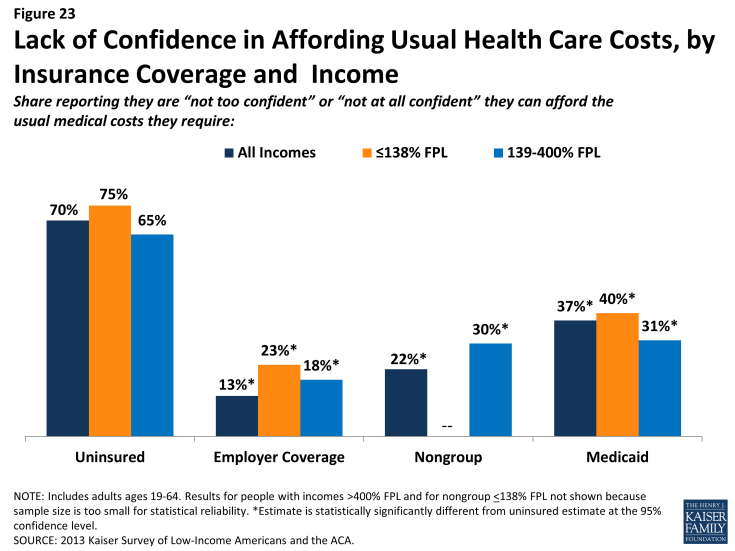

In addition to many low-income adults reporting that they have experienced financial strain or difficulty with health care costs, many live with worry about their ability to afford costs in the future. The vast majority of low- and moderate-income uninsured adults report that they lack confidence that they could afford either the cost of care for services they typically require (Figure 23) or the cost of care should they face a major illness (Figure 24). While not surprising, this finding indicates that uninsured adults are aware of the high cost of health care services, as even those with moderate or high incomes do not believe they can afford these costs. One role of insurance coverage is to protect people against these costs, particularly unexpected costs related to major illnesses or accidents. However, notable shares of low-income insured adults report that they lack confidence in their ability to afford health care, given their current finances and health insurance situation. Over a third of adults on Medicaid report lack of confidence in affording usual costs, a finding that appears to be driven by higher need among Medicaid beneficiaries (as those with disabilities report particularly high rates) or worry about keeping coverage (as those who had problems with renewal also report high rates) (data not shown). Of particular note is the finding that about half of adults with nongroup coverage do not feel confident that they could afford costs related to a major illness given their coverage and financial situation. This lack of confidence may reflect worry about affording out-of-pocket costs or concerns over limits on coverage.

Figure 23: Lack of Confidence in Affording Usual Health Care Costs, by Insurance Coverage and Income

Affordability provisions in the ACA may ameliorate some of the challenges that low-income insured individuals face in affording care. Under the law, qualified health plans must cover preventive services with no cost sharing and are prohibited from placing annual or lifetime caps on the dollar value of insurance coverage. In addition, plans may not exclude coverage for pre-existing conditions, which often was excluded from nongroup plans in the past and may have led to high out-of-pocket costs for insured individuals. Last, people who purchase coverage through the Marketplaces and have incomes up to 400% FPL receive tax credits to help them afford their premiums, and those with incomes up to 250% FPL also receive subsidies to help with cost sharing under their plans. As was the case in the past, people covered by Medicaid do not pay premiums and face only nominal cost sharing for services. However, given survey findings that many low-income insured people continue to face financial challenges related to health care, it will be important to track whether there are ongoing financial barriers as people enroll in coverage and seek care.

Low-income families face fragile financial circumstances.

“We went from basically not having any debt to $25,000 I think so far just in medical debt by itself. It’s very challenging- very rough.”

Jeff (MO), on medical costs while uninsured

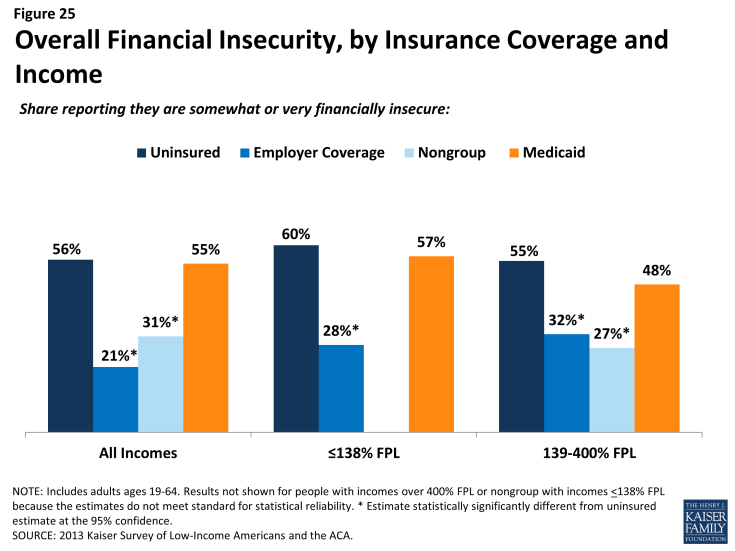

As discussed above, low- and moderate-income adults across coverage groups experience difficulty or worry paying for health care. These challenges translate to expenses in other areas as well, and low- and moderate-income adults across coverage groups report not being financially secure. However, adults who are low-income and uninsured or covered by Medicaid are particularly vulnerable to financial insecurity even outside of health care. Among the low-income, uninsured adults are more likely than adults with employer coverage to report that they feel generally financially insecure (Figure 25). Notably, adults with Medicaid coverage reported rates of financial insecurity closer to those of their uninsured counterparts. This pattern may reflect historical Medicaid eligibility rules, which were targeted very vulnerable adults: in most states, adults were only eligible if their incomes were below half the federal poverty level, and some adults had to deplete their income or resources before they could be eligible for assistance.

General financial insecurity translates to concrete financial difficulties in making ends meet. Uninsured adults and those on Medicaid are more likely than privately-insured adults to have difficulty paying for other necessities such as food, housing, or utilities, with 58% reporting such difficulty compared to 19% of those with employer coverage and a quarter of those with nongroup coverage (Table 6). While low-income adults across the coverage spectrum report high rates of difficulty paying for necessities, those with employer coverage report the lowest rates in this income group. These individuals may have the stronger or more stable ties to employment than their counterparts with other or no insurance coverage. A similar pattern holds for people’s ability to get ahead financially, either saving money or paying off debt.

While similarly high levels of adults across income and coverage groups report that they have taken on debt or taken money out of their savings to pay bills in the past year (Table 6), uninsured adults are more likely than adults with employer or nongroup coverage to report changing their living situation or postponing marriage or children for financial reasons.

| Table 6: Financial Difficulty among Adults, by Income and Coverage | |||||

| Uninsured | Insured | ||||

| Employer | Nongroup | Medicaid | |||

| Has difficulty paying for necessities | |||||

| All | 58% | 19%* | 25%* | 58% | |

| By Income | |||||

| <138% FPL | 68% | 40%* | — | 59%* | |

| 139-400% FPL | 54% | 26%* | 23%* | 55% | |

| >400% FPL | — | — | — | — | |

| Has difficulty saving money | |||||

| All | 82% | 50%* | 61%* | 80% | |

| By Income | |||||

| <138% FPL | 87% | 61%* | 73% | 82% | |

| 139-400% FPL | 78% | 60%* | 69% | 76% | |

| >400% FPL | 73% | 41%* | 48%* | — | |

| Has difficulty paying off debt | |||||

| All | 57% | 30%* | 37%* | 59% | |

| By Income | |||||

| <138% FPL | 61% | 41%* | — | 63% | |

| 139-400% FPL | 53% | 38%* | 43% | 49% | |

| >400% FPL | — | 22%* | — | — | |

| Taken on debt or took money out of savings to pay bills | |||||

| All | 46% | 42% | 53% | 45% | |

| By Income | |||||

| <138% FPL | 44% | 41% | — | 43% | |

| 139-400% FPL | 50% | 52% | 54% | 53% | |

| >400% FPL | — | 36% | 49% | — | |

| Changed living situation or postponed marriage/children for financial reasons | |||||

| All | 39% | 17%* | 11%* | 32% | |

| By Income | |||||

| <138% FPL | 46% | 35%* | — | 32%* | |

| 139-400% FPL | 35% | 20%* | — | — | |

| >400% FPL | — | 11% | — | — | |

| Notes: Excludes people covered by other sources, such as Medicare, VA/CHAMPUS, or other state programs. “–“: Estimates with relative standard errors greater than 30% or cell sizes below 50 are not provided. * Estimate statistically significantly different from uninsured estimate at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

|||||

“I don’t have enough for health insurance, rent, and bills.”

Celina (MO), on family finances and health insurance

While it is not surprising that many low-income families are in a precarious financial situation, it is notable that low-income adults who lack insurance coverage or who were covered by Medicaid before the ACA are more financially unstable than their privately-insured counterparts. Prior to the ACA, Medicaid coverage for adults was targeted to those with the greatest need, and this role is reflected in the fact that they face similar financial challenges as their uninsured counterparts. While insurance coverage can provide financial protection in the event of illness or injury, it is not curative of all of the financial burdens faced by low-income families. Given their overall situation, health insurance alone may not lift low-income people out of poverty, and many low-income adults may continue to face financial challenges even after gaining coverage. However, gains in coverage under the ACA may address some of the consequences of financial instability among low-income families, and linking low-income adults with other support systems may help address the broader financial challenges that they face.