Tax Subsidies for Private Health Insurance

III. Special Tax Deduction for Health Insurance Premiums for the Self-Employed

People who are self-employed often look to the non-group market for health insurance. The Bureau of Labor Statistics estimates that one-in-nine workers, or 15.3 million people, were self-employed in 2009.1 Starting in 2014, these households are able to access health care coverage and premium tax credits through the health insurance exchanges. In addition to premium tax credits, self-employed households can deduct the full cost of qualifying medical expenses.

Self-employed individuals are subject to federal income tax as well as self-employment tax, which is the equivalent to the FICA payroll taxes.2 A special tax provision permits the self-employed to take a deduction when calculating their income tax for the amount paid for health insurance for themselves and their spouse or dependents.3 To qualify for the deduction, health insurance must be established under the self-employed person’s business. This deduction, however, has several limitations. First, the deduction may not be taken if the self-employed individual, or his/her spouse, was eligible for subsidized coverage offered by an employer. For example, if a self-employed individual was eligible for health benefits offered by the spouse’s company from January through March but the self-employed individual was paying premiums for an individual plan, those premiums would not be eligible for the deduction. A second limitation is that the amount deducted cannot exceed the net profit and other earned income from the business under which the health insurance plan is established. For example, a person with a small amount of self-employment income and additional income from other sources cannot deduct the full amount of his or her health insurance premiums if the premiums exceed the net profit of the business. A third limitation is that self-employment health insurance deductions reduce income for income tax purposes only, and may not be deducted when calculating the net earnings subject to the self-employment tax.

Self-employed households have the same income eligibility requirements for premium tax credits as households with wage income. Unlike individuals in the non-group market, self-employed households are able to deduct the full value of their qualified medical spending pending that their business generates sufficient net profit.

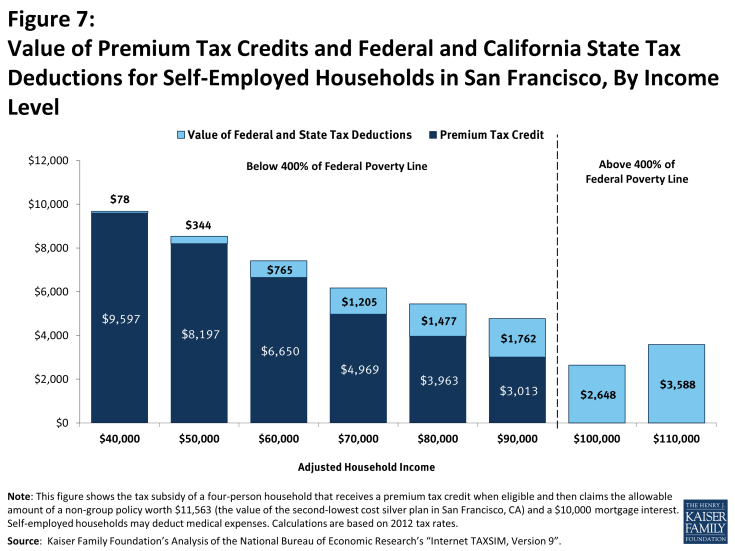

Figures 7 shows examples of the tax reductions for self-employed households enrolled in the second lowest-cost plan in San Francisco. The scenarios are the same as those assumed under Figure 4, except that the families deduct the full amount of their health insurance premium.4 The reduction amounts shown are calculated by computing each family’s taxes with and without a deduction for health insurance. The example households below $100,000 benefit from both the premium tax credit and the self-employed health insurance deduction. Similar to the dynamics for individuals in the non-group market, the tax deduction is regressive as it rewards wealthier families more; and the premium tax credit is progressive as it provides a higher subsidy for lower income households. The example households at or above $100,000 earn more than 400% of the federal poverty line and therefore pay the full premium cost ($11,563). Self-employed households at all income levels receive a higher tax subsidy than households with wage income, reflecting the fact that those that are self-employed can deduct the full amount of health insurance premiums, while people taking the medical expense deduction can only deduct expenses exceeding 10% of their adjusted gross income. Another interesting component of the tax burden faced by self-employed households is that they are unable to deduct health insurance spending from their self-employed tax liability. Because workers who receive an employer sponsored plan are not assessed FICA taxes on the value of their plan, employed-workers pay a smaller tax burden than similarly situated self-employed workers.