Medicare Advantage Plans in 2017: Short-term Outlook is Stable

| Box 1: Availability of Special Needs Plans in 2017 |

| Special Needs Plans (SNPs) are a type of Medicare Advantage plan that was authorized in 2003 as part of the Medicare Prescription Drug, Improvement and Modernization Act (MMA) to provide a managed care option for beneficiaries with significant or relatively specialized health care needs. Medicare beneficiaries can enroll in a SNP if they are dually eligible for Medicare and Medicaid (D-SNPs), require an institutional-level of care (I-SNPs), or have a severe or chronic condition (C-SNP). Most SNPs are HMOs, but they can also be PPOs.

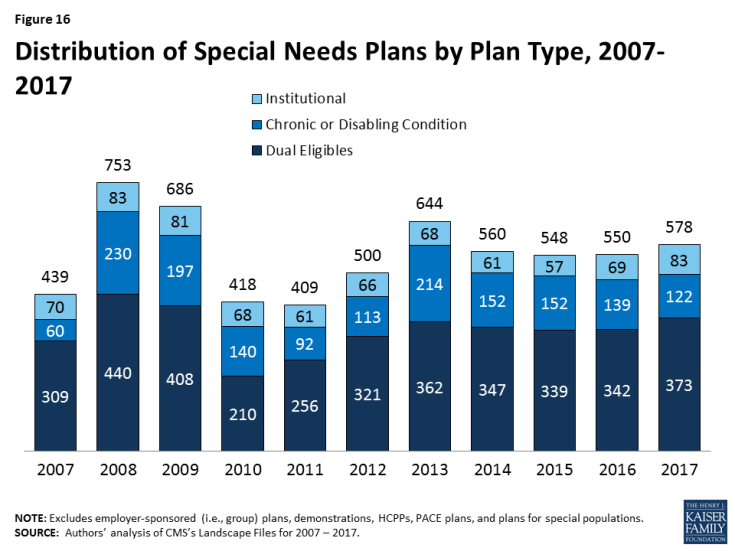

When SNPs were authorized, there were few requirements beyond those required of other Medicare Advantage plans. The Medicare Improvements for Patients and Providers Act (MIPPA) of 2008 established additional requirements for SNPs, including requiring all SNPs to provide a care management plan to document how care would be provided for enrollees and requiring C-SNPs to limit enrollment to beneficiaries with specific diagnoses or conditions. As a result of the MIPPA requirements, the number of SNPs declined in 2010. The ACA required D-SNPs to have a contract with the Medicaid agency for every state in which the plan operates, beginning in 2013. In 2017, 578 SNPs will be available, similar years since 2013 (Figure 16; Table A6). The availability of SNPs will continue to vary across states. In 2017, at least one SNP of any type will be available in all states but six (AK, IA, ND, SD, VT, and WY). SNPs were not available in Nebraska and Rhode Island in 2016 but will be available in 2017; Nebraska will have one D-SNP and Rhode Island will have one D-SNP and two I-SNPs. As in past years, SNPs will be most numerous in selected high population states, notably Florida (97 plans), California (70 plans), and New York (45 plans). The total number of D-SNPs will increase from 342 plans to 373 plans between 2016 and 2017, and the number of C-SNPs will decline from 139 plans in 2016 to 122 plans in 2017. Similar to prior years, most C-SNPs (72%) will focus on diabetes, chronic heart failure, or cardiovascular disorders. The total number of I-SNPs will increase from 69 plans in 2016 to 83 plans in 2017, and six new companies will offer I-SNPs for the first time in 2017 (accounting for 8% of plans). |

| Table A1. Medicare Advantage Plan Market Entries and Exits, Average Monthly Premiums and Average Out-of-Pocket Spending Limits for Medicare Advantage Prescription Drug plans (MA-PDs), Weighted by 2016 Enrollment, 2016-2017 | |||||||

| All Medicare Advantage Plans (MA-PD and MA-only plans) | All plans | HMO | Local PPO | PFFS | Regional PPO | Cost | MSA |

| 2016 Plan Total | 2,001 | 1,351 | 461 | 57 | 47 | 81 | 4 |

| Total number of staying plans | 1,763 | 1,193 | 400 | 47 | 47 | 72 | 4 |

| Number of staying plans with no service area reductions | 1,519 | 1,048 | 324 | 24 | 47 | 72 | 4 |

| Number of staying plans with reduced service areas | 185 | 99 | 63 | 23 | – | – | – |

| Number of consolidating plans, post consolidation | 59 | 46 | 13 | – | – | – | – |

| Total number of departing plans | 238 | 158 | 61 | 10 | – | 9 | – |

| Number of plans departing due to consolidation | 67 | 50 | 13 | – | – | 4 | – |

| Number of terminating plans | 171 | 108 | 48 | 10 | – | 5 | – |

| Number of new plans | 271 | 194 | 69 | 1 | 2 | 5 | – |

| 2017 Plan Total | 2,034 | 1,387 | 469 | 48 | 49 | 77 | 4 |

| Total Medicare Advantage enrollees, as of September 2016 | 12,282,452 | 8,496,896 | 2,065,184 | 225,353 | 1,065,036 | 427,283 | 2,700 |

| Number of staying plans’ enrollees | 11,867,742 | 8,223,231 | 1,951,216 | 198,751 | 1,065,036 | 426,808 | 2,700 |

| Number of enrollees losing access to their plan | 414,710 | 273,665 | 113,968 | 26,602 | – | 475 | – |

| Average premiums of MA-PDs, weighted by 2016 enrollment | |||||||

| Premiums for all plans, 2016 | $37.24 | $27.61 | $61.59 | $55.82 | $32.89 | $112.38 | $0.00 |

| Terminating plans, 2016 | $41.83 | $25.41 | $78.57 | $52.76 | N/A | $71.02 | N/A |

| Staying plans, 2016 | $37.08 | $27.69 | $60.60 | $56.23 | $32.89 | $112.42 | $0.00 |

| 2017 Premiums for remaining 2016 plans | $38.61 | $29.12 | $62.41 | $60.96 | $34.53 | $112.68 | $0.00 |

| Change in premiums for plans available in both 2016 and 2017 | $1.53 | $1.44 | $1.82 | $4.73 | $1.64 | $0.26 | $0.00 |

| Share of enrollees in MA-PDs with no premiums, among plans available in both 2016 and 2017 | |||||||

| 2016 | 49% | 59% | 24% | 8% | 45% | 1% | 100% |

| 2017 | 48% | 58% | 24% | 8% | 45% | 1% | 100% |

| Change in share of plans with no premiums | -1% | -1% | 0% | 0% | 0% | 0% | 0% |

| Average premiums paid per enrollee, among MA-PDs with premiums (excluding zero premium plans) and available in both 2016 and 2017 | |||||||

| 2016 | $73.11 | $67.99 | $79.98 | $60.91 | $59.60 | $113.90 | N/A |

| 2017 | $74.84 | $69.39 | $82.29 | $66.03 | $62.58 | $114.16 | N/A |

| Average out-of-pocket spending limits per year among MA-PDs, weighted by 2016 enrollment, among plans available in both 2016 and 2017 | |||||||

| 2016 | $5,204 | $4,974 | $5,661 | N/A | $6,595 | $3,538 | N/A |

| 2017 | $5,235 | $4,974 | $5,817 | N/A | $6,605 | $3,698 | N/A |

| Change in average out-of-pocket spending limits | $32 | $1 | $156 | N/A | $10 | $160 | N/A |

| Total MA-PD enrollees, as of September 2016 | 11,668,604 | 8,343,955 | 2,032,438 | 132,299 | 951,002 | 208,910 | – |

| Number of staying MA-PDs’ enrollees | 11,284,612 | 8,072,317 | 1,920,084 | 132,299 | 951,002 | 208,910 | – |

| Number of enrollees losing access to their MA-PD | 383,992 | 271,638 | 112,354 | – | – | – | – |

|

NOTE: Excludes Special Needs Plans (SNPs), demonstrations, Health Care Prepayment Plans (HCPPs), Program of All Inclusive Care for the Elderly (PACE) plans, employer-sponsored (i.e., group) plans, and plans for special populations.

SOURCE: Authors’ analysis of CMS’s Landscape Files for 2016 and 2017 and CMS’s 2016 and 2017 Part C and D Crosswalk file and September 2016 enrollment.

|

|||||||

| Table A2. Average Number of Plans Available to Beneficiaries by County of Residence, 2009-2017 | |||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| National Average | 48 | 33 | 24 | 20 | 20 | 18 | 18 | 19 | 19 |

| Metro counties | 51 | 35 | 26 | 22 | 22 | 20 | 20 | 21 | 21 |

| Non-metro counties | 36 | 24 | 16 | 13 | 13 | 11 | 10 | 11 | 11 |

| Fee-for-Service Costs, by Quartile | |||||||||

| Lowest cost quartile | 45 | 28 | 18 | 17 | 17 | 17 | 15 | 15 | 15 |

| Second quartile | 46 | 31 | 20 | 17 | 16 | 15 | 14 | 15 | 15 |

| Third quartile | 44 | 30 | 20 | 17 | 18 | 16 | 16 | 17 | 17 |

| Highest cost counties | 53 | 37 | 30 | 24 | 24 | 21 | 22 | 23 | 23 |

|

NOTE: Excludes SNPs, employer-sponsored (i.e., group) plans, demonstrations, HCPPs, PACE plans, and plans for special populations.

SOURCE: Authors’ analysis of CMS’s Landscape and Penetration Files for 2009 – 2017. |

|||||||||

| Table A3. Unweighted Average Monthly Premiums for Medicare Advantage Prescription Drug Plans, by Plan Type, 2009-2017 | ||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Change, 2016-2017 | |

| All Plans | $51.81 | $55.86 | $50.61 | $49.80 | $51.43 | $51.47 | $53.42 | $52.57 | $50.97 | -$1.60 |

| HMOs | $34.52 | $40.11 | $36.24 | $33.20 | $34.11 | $35.37 | $38.28 | $39.14 | $38.81 | -$0.33 |

| Local PPOs | $65.12 | $70.17 | $65.72 | $69.14 | $72.57 | $74.92 | $81.02 | $78.61 | $72.91 | -$5.70 |

| PFFS plans | $74.46 | $75.09 | $65.79 | $70.96 | $83.29 | $90.93 | $87.86 | $91.40 | $92.43 | $1.03 |

| Regional PPOs | $55.68 | $59.29 | $53.38 | $55.64 | $56.89 | $59.30 | $67.85 | $74.93 | $80.84 | $5.91 |

|

NOTE: Excludes SNPs, demonstrations, HCPPs, PACE plans, employer-sponsored (i.e., group) plans, and plans for special populations. Premiums include plans with premiums as well as plans with no premiums. Cost plans are included in the total but are not shown separately.

SOURCE: Authors’ analysis of CMS’s Landscape Files for 2009 – 2017.

|

||||||||||

| Table A4. Number of Medicare Advantage Plans Available, by Plan Type and Firm, 2015-2017 | ||||||||||||||||||

| All | HMOs | Local PPOs | PFFS Plans | Regional PPOs | Cost Plans | |||||||||||||

| 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | |

| Number of Plans – Total | 1945 | 2001 | 2034 | 1275 | 1351 | 1387 | 465 | 461 | 469 | 69 | 57 | 48 | 43 | 47 | 49 | 86 | 81 | 77 |

| UnitedHealthCare | 164 | 223 | 272 | 132 | 187 | 234 | 22 | 24 | 25 | 2 | 2 | 2 | 8 | 10 | 11 | 0 | 0 | 0 |

| Humana | 395 | 362 | 337 | 195 | 184 | 164 | 116 | 106 | 105 | 53 | 41 | 37 | 31 | 31 | 31 | 0 | 0 | 0 |

| BCBS – Total | 291 | 311 | 316 | 163 | 189 | 194 | 110 | 110 | 109 | 4 | 2 | 3 | 4 | 4 | 4 | 6 | 6 | 6 |

| Anthem BCBS | 54 | 62 | 65 | 35 | 45 | 48 | 16 | 14 | 14 | 0 | 0 | 0 | 3 | 3 | 3 | 0 | 0 | 0 |

| Other BCBS plans | 237 | 249 | 251 | 128 | 144 | 146 | 94 | 96 | 95 | 4 | 2 | 3 | 1 | 1 | 1 | 6 | 6 | 6 |

| Kaiser Permanente | 39 | 41 | 41 | 34 | 34 | 34 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5 | 6 | 6 |

| Aetna | 195 | 203 | 233 | 121 | 119 | 113 | 74 | 82 | 117 | 0 | 0 | 0 | 0 | 2 | 3 | 0 | 0 | 0 |

| WellCare | 40 | 49 | 50 | 40 | 49 | 50 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cigna | 43 | 46 | 43 | 40 | 43 | 41 | 3 | 3 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 778 | 766 | 742 | 550 | 546 | 557 | 140 | 136 | 111 | 10 | 12 | 6 | 0 | 0 | 0 | 75 | 69 | 65 |

|

NOTE: Excludes SNPs, demonstrations, HCPPs, PACE plans, employer-sponsored (i.e., group) plans, and plans for special populations. BCBS are BlueCross BlueShield affiliates, which includes Anthem BCBS plans. Total includes MSAs, which are not shown separately. For earlier years of data, see See Jacobson G, Gold M, Damico A, Neuman T, and Casillas, G. “Medicare Advantage 2016 Data Spotlight: Overview of Plan Changes.” December 2015. https://www.kff.org/medicare/issue-brief/medicare-advantage-2016-data-spotlight-overview-of-plan-changes/

SOURCE: Authors’ analysis of CMS’s Landscape Files for 2015 – 2017.

|

||||||||||||||||||

| Table A5. Share of Medicare Beneficiaries with Access to Firms’ Medicare Advantage Plan Offerings, by Plan Type and Firm, 2015-2017 | ||||||||||||||||||

| Any Plan | HMOs | Local PPOs | PFFS Plans | Regional PPOs | Cost Plans | |||||||||||||

| Firm | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | 2015 | 2016 | 2017 |

| UnitedHealthcare | 69% | 70% | 74% | 49% | 55% | 61% | 18% | 13% | 10% | 2% | 2% | 2% | 32% | 32% | 33% | 0% | 0% | 0% |

| Humana | 86% | 85% | 83% | 56% | 58% | 56% | 54% | 53% | 58% | 44% | 43% | 39% | 61% | 61% | 61% | 0% | 0% | 0% |

| BCBS – Total | 71% | 72% | 72% | 54% | 58% | 58% | 46% | 45% | 41% | 1% | 1% | 3% | 15% | 15% | 15% | 2% | 2% | 2% |

| Anthem BCBS plans | 21% | 24% | 24% | 15% | 20% | 22% | 9% | 9% | 8% | 0% | 0% | 0% | 8% | 8% | 8% | 0% | 0% | 0% |

| Other BCBS plans | 58% | 55% | 55% | 46% | 44% | 43% | 37% | 36% | 33% | 1% | 1% | 3% | 7% | 7% | 7% | 2% | 2% | 2% |

| Kaiser Permanente | 15% | 17% | 17% | 13% | 13% | 13% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 2% | 2% | 2% |

| Aetna | 45% | 49% | 56% | 42% | 43% | 45% | 33% | 40% | 52% | 0% | 0% | 0% | 0% | 7% | 7% | 0% | 0% | 0% |

| Wellcare | 25% | 32% | 29% | 25% | 32% | 29% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Cigna | 19% | 20% | 20% | 19% | 20% | 20% | 2% | 2% | 1% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Others | 79% | 79% | 79% | 73% | 73% | 73% | 30% | 34% | 28% | 4% | 4% | 3% | 0% | 0% | 0% | 6% | 6% | 5% |

|

NOTE: Excludes SNPs, demonstrations, HCPPs, PACE plans, employer-sponsored (i.e., group) plans, and plans for special populations. BCBS are BlueCross BlueShield affiliates, which includes Anthem BCBS plans. Any plan includes beneficiaries with access to an MSA (not shown separately). For earlier years of data, see See Jacobson G, Gold M, Damico A, Neuman T, and Casillas, G. “Medicare Advantage 2016 Data Spotlight: Overview of Plan Changes.” December 2015. https://www.kff.org/medicare/issue-brief/medicare-advantage-2016-data-spotlight-overview-of-plan-changes/

SOURCE: Authors’ analysis of CMS’s Landscape Files for 2015 – 2017.

|

||||||||||||||||||

| Table A6. Number and Type of Special Needs Plans, by State, 2016 and 2017 | ||||||||||||||||||||

| 2016 | 2017 | |||||||||||||||||||

| State | Overall | Dual eligibles | Institutional | Chronic conditions | Overall | Dual eligibles | Institutional | Chronic conditions | ||||||||||||

| Alabama | 6 | 4 | 2 | 0 | 6 | 4 | 2 | 0 | ||||||||||||

| Alaska | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Arizona | 33 | 21 | 4 | 8 | 30 | 19 | 4 | 7 | ||||||||||||

| Arkansas | 7 | 4 | 0 | 3 | 7 | 5 | 0 | 2 | ||||||||||||

| California | 72 | 31 | 4 | 37 | 70 | 28 | 4 | 38 | ||||||||||||

| Colorado | 9 | 4 | 3 | 2 | 9 | 4 | 3 | 2 | ||||||||||||

| Connecticut | 4 | 2 | 2 | 0 | 4 | 2 | 2 | 0 | ||||||||||||

| Delaware | 3 | 1 | 1 | 1 | 6 | 2 | 3 | 1 | ||||||||||||

| District of Columbia | 5 | 2 | 1 | 2 | 9 | 4 | 3 | 2 | ||||||||||||

| Florida | 94 | 58 | 6 | 30 | 97 | 64 | 8 | 25 | ||||||||||||

| Georgia | 14 | 8 | 2 | 4 | 20 | 12 | 3 | 5 | ||||||||||||

| Hawaii | 5 | 5 | 0 | 0 | 6 | 6 | 0 | 0 | ||||||||||||

| Idaho | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | ||||||||||||

| Illinois | 10 | 5 | 2 | 3 | 8 | 3 | 2 | 3 | ||||||||||||

| Indiana | 8 | 4 | 2 | 2 | 6 | 3 | 2 | 1 | ||||||||||||

| Iowa | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Kansas | 2 | 0 | 1 | 1 | 3 | 1 | 1 | 1 | ||||||||||||

| Kentucky | 13 | 8 | 1 | 4 | 13 | 9 | 1 | 3 | ||||||||||||

| Louisiana | 13 | 9 | 0 | 4 | 11 | 10 | 0 | 1 | ||||||||||||

| Maine | 4 | 2 | 1 | 1 | 4 | 2 | 1 | 1 | ||||||||||||

| Maryland | 10 | 3 | 3 | 4 | 12 | 3 | 5 | 4 | ||||||||||||

| Massachusetts | 9 | 7 | 1 | 1 | 10 | 7 | 2 | 1 | ||||||||||||

| Michigan | 6 | 4 | 1 | 1 | 6 | 4 | 1 | 1 | ||||||||||||

| Minnesota | 9 | 9 | 0 | 0 | 10 | 10 | 0 | 0 | ||||||||||||

| Mississippi | 6 | 4 | 0 | 2 | 6 | 6 | 0 | 0 | ||||||||||||

| Missouri | 12 | 3 | 5 | 4 | 8 | 3 | 3 | 2 | ||||||||||||

| Montana | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | ||||||||||||

| Nebraska | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | ||||||||||||

| Nevada | 7 | 0 | 1 | 6 | 7 | 0 | 1 | 6 | ||||||||||||

| New Hampshire | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | ||||||||||||

| New Jersey | 9 | 4 | 3 | 2 | 11 | 5 | 4 | 2 | ||||||||||||

| New Mexico | 3 | 2 | 1 | 0 | 6 | 6 | 0 | 0 | ||||||||||||

| New York | 53 | 37 | 11 | 5 | 45 | 31 | 11 | 3 | ||||||||||||

| North Carolina | 14 | 7 | 2 | 5 | 9 | 6 | 2 | 1 | ||||||||||||

| North Dakota | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Ohio | 18 | 11 | 4 | 3 | 18 | 12 | 5 | 1 | ||||||||||||

| Oklahoma | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | ||||||||||||

| Oregon | 11 | 7 | 3 | 1 | 15 | 8 | 6 | 1 | ||||||||||||

| Pennsylvania | 21 | 11 | 6 | 4 | 22 | 13 | 7 | 2 | ||||||||||||

| Puerto Rico | 15 | 13 | 0 | 2 | 16 | 14 | 0 | 2 | ||||||||||||

| Rhode Island | 0 | 0 | 0 | 0 | 3 | 1 | 2 | 0 | ||||||||||||

| South Carolina | 8 | 3 | 1 | 4 | 13 | 5 | 1 | 7 | ||||||||||||

| South Dakota | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Tennessee | 8 | 7 | 1 | 0 | 8 | 7 | 1 | 0 | ||||||||||||

| Texas | 31 | 22 | 2 | 7 | 36 | 26 | 2 | 8 | ||||||||||||

| Utah | 2 | 2 | 0 | 0 | 2 | 2 | 0 | 0 | ||||||||||||

| Vermont | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Virginia | 9 | 2 | 3 | 4 | 18 | 9 | 5 | 4 | ||||||||||||

| Washington | 8 | 6 | 2 | 0 | 9 | 6 | 3 | 0 | ||||||||||||

| West Virginia | 1 | 1 | 0 | 0 | 2 | 1 | 1 | 0 | ||||||||||||

| Wisconsin | 18 | 13 | 4 | 1 | 18 | 14 | 3 | 1 | ||||||||||||

| Wyoming | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Total, U.S. | 550 | 342 | 69 | 139 | 578 | 373 | 83 | 122 | ||||||||||||

|

NOTE: Columns do not sum to U.S. total because some SNPs overlap state boundaries.

SOURCE: Authors’ analysis of CMS’s Landscape Files for 2016-2017.

|

||||||||||||||||||||