Medicaid and CHIP Eligibility, Enrollment, Renewal, and Cost-Sharing Policies as of January 2016: Findings from a 50-State Survey

Premiums and Cost-Sharing

Given that additional expenses can strain the budgets of low-income individuals and families, federal rules in Medicaid and CHIP set limits on the amounts that states can charge for premiums and cost-sharing, including copayments, coinsurance, and deductibles (see Box 1). In light of this, premiums and cost-sharing generally remain low in Medicaid and CHIP as of January 1, 2016, with few changes in 2015. However, under Section 1115 waiver authority, several states have implemented monthly contributions or premiums for adults that would not otherwise be allowed under federal rules.

| Box 1: Premium and Cost-sharing Rules for Medicaid and CHIP |

| States have flexibility to impose premiums and cost-sharing in Medicaid. The maximum allowable charges vary by income and coverage group within federal rules:

Premiums in Medicaid. Medicaid enrollees, including children, pregnant women, parents and the adult expansion group, with incomes below 150% FPL may not be charged premiums. Premiums are allowed for Medicaid enrollees (both children and adults) with incomes above 150% FPL. Cost-sharing in Medicaid. Children with incomes below 133% FPL generally cannot be charged cost-sharing. Cost-sharing is allowed for adults enrolled in Medicaid, but charges for those with incomes below 100% FPL are limited to nominal amounts. Cost-sharing cannot be charged for preventive services for children or emergency, family planning, or pregnancy-related services in Medicaid. Under the ACA, preventive services defined as essential health benefits in Alternative Benefit Plans (ABP) in Medicaid also are exempt from cost-sharing for any individual enrolled in an ABP. Out-of-pocket limit in Medicaid. Overall premium and cost-sharing amounts for family members enrolled in Medicaid may not exceed five percent of household income. Premiums and Cost-sharing in CHIP. States have somewhat greater flexibility to charge premiums and cost-sharing for children covered by CHIP, although there remain federal limits on the amounts that can be charged, including an overall cap of five percent of household income. See: Premiums, Copayments, and other Cost-Sharing at http://www.medicaid.gov/medicaid-chip-program-information/by-topics/cost-sharing/cost-sharing.html |

Premiums and Cost-Sharing For Children

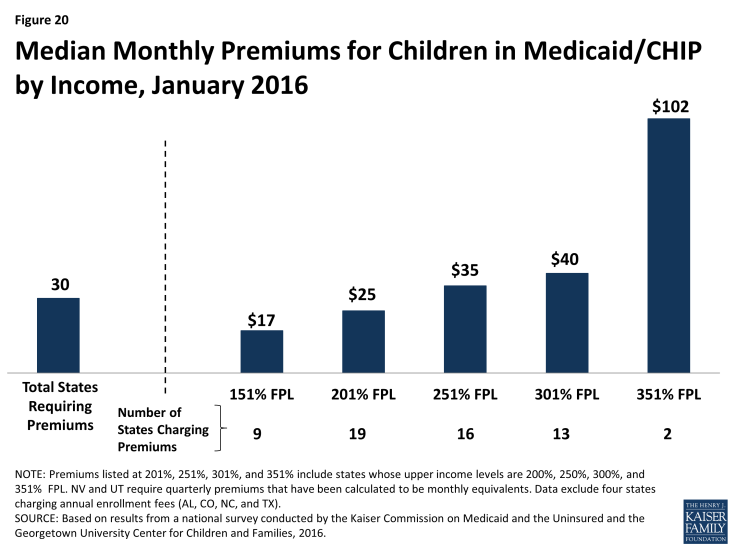

As of January 2016, 30 states charge premiums or enrollment fees for children in Medicaid or CHIP. Reflecting the ACA eligibility protections for children that extend through 2019, this count remained steady during 2015 as did most premium amounts. Under the ACA protections, states generally cannot increase premium amounts. One exception to this protection is if a state had a routine premium adjustment approved in its state Medicaid or CHIP plan prior to the enactment of the ACA on March 23, 2010. During 2015, two states (Maryland and Pennsylvania) increased premiums under such routine annual adjustments. Other changes included Michigan joining the three other states (California, Maryland and Vermont) that charge monthly premiums to children in Medicaid when it shifted all children from its separate CHIP program to Medicaid. Premiums and enrollment fees are more prevalent in CHIP than Medicaid due to the relatively higher incomes of families with children covered under CHIP and the program’s more flexible premium rules. 1 Overall, 26 states charge monthly or quarterly premiums and 4 charge annual enrollment fees for children in Medicaid or CHIP. In the 26 states charging monthly or quarterly premiums, charges begin for families above 150% FPL in 19 states, including 8 states in which charges begin above 200% FPL. Median monthly premium amounts range from $17 at 151% FPL to $102 at 351% FPL, although only two states extend eligibility up to this level (Figure 20).

States vary in their policies for nonpayment of premiums. States must provide a minimum 60-day grace period in Medicaid before cancelling coverage for nonpayment of premiums and cannot require enrollees to repay outstanding premiums as a condition of reenrollment, nor can they delay reenrollment. In contrast, CHIP programs are required to provide only a minimum 30-day grace period and may impose up to a 90-day lockout period during which time a child is not allowed to reenroll. Among the 22 states that charge monthly or quarterly premiums or enrollment fees in CHIP, only 4 states limit the grace period to the minimum 30 days, while 17 states provide a 60-day or longer grace period. With the addition of New Jersey in 2015, 14 CHIP programs have a lock-out period after a child is disenrolled for nonpayment of premiums, which range from 1 month to the maximum 90 days. Sixteen states that charge monthly or quarterly payments in Medicaid or CHIP require children who have been disenrolled due to nonpayment of premiums to reapply for coverage. However, seven states reinstate coverage retroactively if outstanding premiums are repaid.

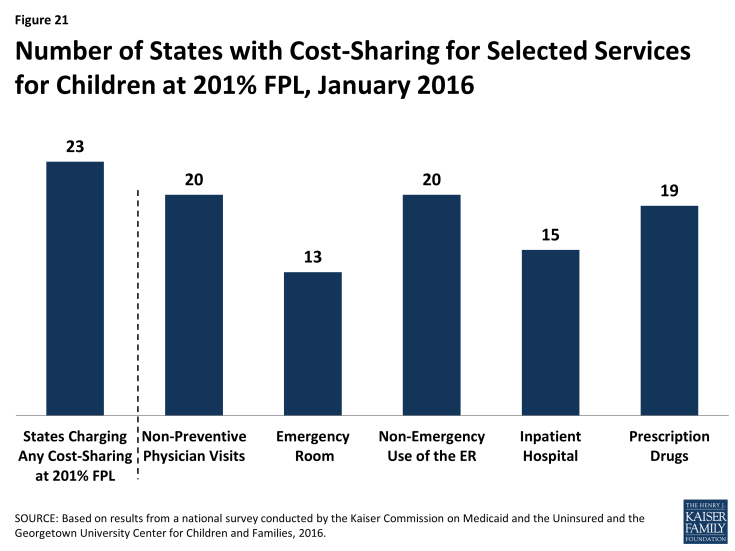

The number of states (26 states) charging cost-sharing for children in Medicaid or CHIP, as well as the amounts of copayments remained largely constant in 2015. As of January 2016, only three states charge cost-sharing for children in Medicaid, while 25 of the 36 states with separate CHIP programs charge cost-sharing. The number of states charging cost-sharing for children did not change in 2015; however, the data reflect Arkansas’ transition of children who were subject to cost-sharing in Medicaid to its new separate CHIP program. Only Tennessee charges cost-sharing for children in families with incomes below 133% FPL; under Section 1115 waiver authority, cost-sharing for children starts at the poverty level in the state. Copayments vary by service type. For example, for a child with family income at 201% FPL, 20 states charge cost-sharing for a physician visit, 13 charge for an emergency room visit, 20 charge for non-emergency use of the emergency room, 15 charge for an inpatient hospital visit, and 19 have charges for prescription drugs, although, in some cases, charges only apply to brand name or non-preferred brand name drugs (Figure 21).

Figure 21: Number of States with Cost-Sharing for Selected Services for Children at 201% FPL, January 2016

Premiums and Cost-Sharing for Parents and Other Adults

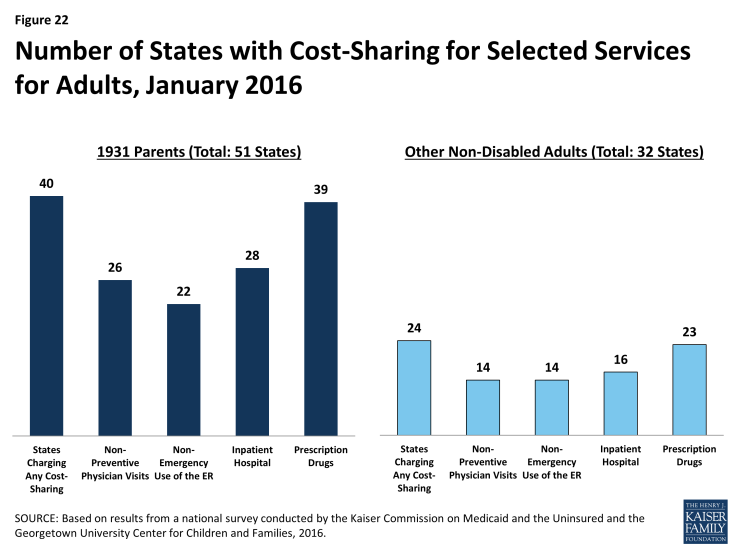

As of January 2016, states generally do not charge premiums for low-income parents in Medicaid, but many do have cost-sharing for these parents. Because most parents covered through the Section 1931 eligibility pathway that existed pre-ACA have incomes below poverty, states generally do not charge them monthly premiums. However, during 2015, Indiana implemented monthly contributions for Section 1931 parents under waiver authority, although enrollees cannot be disenrolled due to nonpayment. Forty states charge nominal cost-sharing for Section 1931 parents in Medicaid which varies by service. As of January 2016, 26 states charge parents cost-sharing for a physician visit, 22 charge for non-emergency use of the emergency room, 28 charge for an inpatient hospital visit, and 39 charge for prescription drugs, which may be limited to brand name drugs in some cases (Figure 22). Indiana is the only state to obtain Section 1916(f) waiver authority to charge parents higher cost-sharing than otherwise allowed, which applies to non-emergency use of the emergency room. Cost-sharing for parents remained stable in 2015 with a few exceptions: Florida and Oklahoma increased and Montana decreased cost-sharing for some services, and New York raised the income level at which cost-sharing begins from 0% to 100% FPL.

There are no premiums for expansion adults in 26 of the 31 states that have implemented the ACA Medicaid expansion, but 5 states charge premiums or monthly contributions under Section 1115 waiver authority as of January 2016. Specifically, Arkansas, Indiana, Iowa, Michigan, and Montana charge premiums and/or monthly contributions for adults with incomes above poverty. The consequences of nonpayment of these charges vary across these states. Indiana and Montana can disenroll adults above poverty due to unpaid amounts and impose a lock-out period for those disenrolled. Iowa can also disenroll adults with incomes above poverty; however, it must waive the charges for individuals who self-attest to financial hardship and individuals can reenroll at any time. In Arkansas, monthly contributions are in lieu of point-of-service copayments; adults who do not make monthly contributions are responsible for point-of-service cost-sharing charges. The waivers in Arkansas, Iowa, Indiana, and Montana also allow the states to collect monthly contributions from individuals with incomes below poverty, although Arkansas has not implemented monthly contributions at this income level as of January 2016. Individuals with incomes below poverty cannot be disenrolled due to nonpayment. (See Box 2 for more details).

As of January 2016, 23 of the 31 states that have expanded Medicaid charge expansion adults cost-sharing. In addition, Wisconsin charges the adults it covers up to 100% FPL cost-sharing. Most states have aligned cost-sharing policies for adults and Section 1931 parents, although there are differences in some states. Cost-sharing amounts are generally nominal reflecting the low incomes of adults. Overall, 14 states charge cost-sharing for a physician visit, 14 charge for non-emergency use of the emergency room, 16 charge for an inpatient hospital visit, and 23 charge for prescription drugs as of January 2016. There were few changes in cost-sharing in the past year. These changes included some increases in copayments in New Hampshire and New York raising the income at which cost-sharing begins from 0% to 100% FPL.

| Box 2: Premiums/Monthly Contributions for Adults Under Section 1115 Waiver Authority |

|

Arkansas received waiver approval to require certain enrollees to make monthly income-based contributions to health savings accounts (HSAs) to be used in lieu of paying point-of-service copayments and co-insurance. Medically-frail individuals, including those with disabilities or complex health conditions, are exempt from these payments. Monthly contributions are $10 for expansion adults with incomes between 101% – 115%, and $15 for individuals with incomes between 116% – 138%. Under the waiver, Arkansas can charge monthly HSA contributions for expansion adults with incomes down to 50% FPL, but the state is not currently charging those with incomes below poverty. Adults with incomes above poverty who fail to make monthly HSA contributions are responsible for copayments and co-insurance at the point of service, and providers can deny services for failure to pay cost-sharing. Cost-sharing charges are at amounts otherwise allowed under federal law. In Iowa, the waiver allows the state to impose monthly contributions of $5 per month for non-medically frail beneficiaries with incomes between 50% and 100% FPL and $10 per month for non-medically frail beneficiaries with incomes above poverty beginning as of the second year of enrollment. The state cannot disenroll individuals below poverty due to unpaid premiums. Individuals above poverty have a 90-day grace period to pay past-due premiums before they are disenrolled, and the state must waive premiums for enrollees who self-attest to financial hardship. Individuals who are disenrolled for nonpayment can reenroll at any time. The waiver in Indiana imposes monthly contributions at 2% of income for most newly eligible adults and Section 1931 parents. Those with incomes between 0% and 5% FPL must pay $1.00 per month. Individuals with incomes below poverty cannot be disenrolled due to nonpayment but receive a more limited benefit package and are subject to copayments at the point of service. (Medically frail individuals are not placed in the more limited benefit package.) Individuals above poverty are not enrolled in coverage until they make their first monthly payment. In addition, non-medically frail individuals above poverty can be disenrolled due to nonpayment after a 60-day grace period and are subject to a 6-month lock-out period. Michigan’s waiver provides for monthly premiums of 2% of income for enrollees with incomes above poverty, as well as monthly payments into HSAs based on their prior six months of copayments for services used. The copayments are at the same level as what would have been collected without the waiver. Enrollees cannot lose or be denied Medicaid eligibility, be denied health plan enrollment, or be denied access to services, and providers may not deny services for failure to pay copayments or premiums.2 In Montana, non-medically frail expansion adults with incomes above 50% FPL are subject to monthly premiums of 2% of income. Enrollees receive a credit in the amount of their premiums toward copayments incurred, so that they effectively only have to pay copayments that exceed 2% of income. Those with incomes above poverty can be disenrolled for nonpayment after notice and a 90-day grace period and can reenroll upon payment of arrears or after the debt is assessed against their state income taxes, no later than the end of the calendar quarter. Reenrollment does not require a new application, and the state must establish a process to exempt beneficiaries from disenrollment for good cause. Individuals below poverty cannot be disenrolled for nonpayment of premiums.

Source: M. Musumeci and R. Rudowitz, “The ACA and Medicaid Expansion Waivers,” The Kaiser Commission on Medicaid and the Uninsured, November 2015, available at https://www.kff.org/medicaid/issue-brief/the-aca-and-medicaid-expansion-waivers/ |