How Are Hospitals Faring Under the Affordable Care Act? Early Experiences from Ascension Health

INTRODUCTION

The expansions in Medicaid and private health insurance through the Affordable Care Act (ACA) will likely have a substantial impact on the nation’s hospitals. Increases in the number of people with health insurance coverage are expected to increase the demand for care at hospitals as well as patient revenue from insured patients and reduce the amount of uncompensated care that hospitals provide.1 Based on this assumption, the ACA will reduce Medicaid Disproportionate Share Hospital (DSH) payments to hospitals that serve a large number of Medicaid and uninsured patients to help cover the costs of uncompensated care. These reductions will amount to $43 billion between 2018 and 2025.2

While many are focusing on the effect of these changes on public hospitals and other large urban safety net systems, many private, not-for-profit hospitals that have a strong tradition and mission of caring for underserved populations also will likely be affected. Many of these hospitals are eligible to receive Medicaid DSH payments, provide substantial amounts of uncompensated care, and serve as a major safety net provider in their community.

The impact on specific hospitals will depend on many factors, but a crucial factor will be whether or not the hospital is located in a state that expanded Medicaid eligibility to adults with family incomes at 138% of poverty or less. As of April 2015, 21 states had chosen not to expand Medicaid through the ACA; although residents of these states with incomes between 100-400% of poverty can still purchase subsidized coverage through the health insurance marketplaces, many poor adults in non-expansion states will fall into a “coverage gap” and not have access to ACA coverage. Early research shows that the number of uninsured decreased by 36 percent in states that expanded Medicaid, compared to 24 percent in states that did not expand Medicaid.3

The objective of this report is to examine experiences with the Affordable Care Act through September 2014 among acute-care hospitals in Ascension Health, the nation’s largest not-for-profit hospital system with 131 hospitals and more than 30 senior care facilities in 23 states and the District of Columbia. Ascension Health is a Catholic healthcare system with service to the poor as an explicit part of their mission statement.4 In previous years, the system has undertaken a number of initiatives to improve access to care for uninsured persons in communities where they are located.5

Ascension Health Hospitals and Health Reform

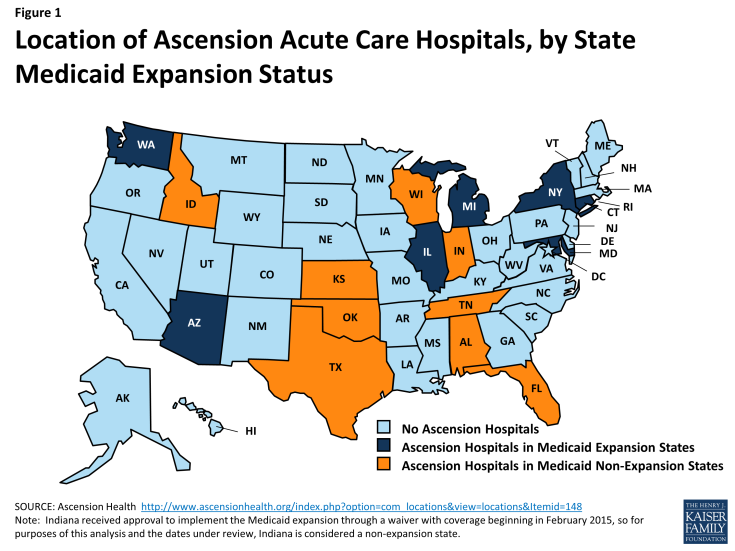

Ascension Health acute care hospitals are located in 16 states and the District of Columbia. These include 7 states and D.C. that expanded Medicaid (Arizona, Connecticut, Illinois, Maryland, Michigan, New York, and Washington), and 9 states that did not expand Medicaid (Alabama, Florida, Idaho, Indiana, Kansas, Oklahoma, Tennessee, Texas, and Wisconsin) (see Figure 1). Indiana received approval to implement the Medicaid expansion through a waiver with coverage beginning in February 2015, so for purposes of this analysis and the dates under review, Indiana is considered a non-expansion state. Most hospitals are located in large urban areas (e.g. Washington, DC, Detroit, MI, Milwaukee WI, Jacksonville, FL, Chicago, IL, Indianapolis, IN, Nashville, TN), although some hospitals are located in small communities and rural areas (e.g. Pasco, WA, Lewiston, ID, Tawas City, MI). Overall, the system includes 131 hospitals, has almost 22,000 beds, had total operating revenue in 2014 of $20 billion, and paid $1.8 billion in community benefit, a third of which was charity care for uninsured and underinsured patients.6

Out of almost 600,000 inpatient discharges that occurred during the first nine months of 2014, almost two-thirds (64 percent) occurred in states that did not expand Medicaid, while one-third occurred in states that expanded Medicaid (see Supplementary Table 1). Among the states that did not expand Medicaid, discharges were fairly evenly distributed, with the highest numbers in Texas (16.9 percent of discharges), Indiana (15.8 percent), Florida (14.4 percent), and Wisconsin (13.1 percent). Among hospitals in states that expanded Medicaid, more than half (52.4 percent) occurred in the state of Michigan, which includes a number of large systems that are part of Ascension Health (St. John Providence Health System, Genesys Health System, St. Mary’s & St. Joseph Health System, and Borgess Health). Fourteen percent of discharges occurred among hospitals in Illinois (Alexian Brothers Health System), while 10.2 percent were in Arizona (Carondelet Health Network).

In general, Medicaid expansion states with Ascension hospitals had lower uninsured rates prior to ACA implementation compared to non-expansion states, due in part to relatively higher Medicaid eligibility levels in states such as Arizona, Connecticut, DC, and New York (see Supplementary Table 2). More substantial expansions – especially for childless adults – occurred in Michigan, Illinois, Maryland, and Washington states. Michigan’s Medicaid expansion was not implemented until April 1, 2014. Childless adults are not eligible for Medicaid in all of the non-expansion states except Wisconsin. For parents of dependent children, current income eligibility in non-expansion states range from 16 and 19 percent of the federal poverty level in Alabama and Texas, respectively, to 100 and 110 percent of poverty in Wisconsin and Tennessee.

OVERVIEW OF ANALYTIC APPROACH

Data on inpatient discharges and hospital finances (including charity care expenses, patient revenue and costs) for the last three quarters of 2013 (April through December) and the first three quarters of 2014 (January through September) was compiled by state and provided to the authors by Ascension Health. While not representative of all not-for-profit hospitals, the advantage of focusing on a single hospital system is that potential biases due to differences in accounting and reporting practices between hospitals in different states, as well as differences in policies regarding provision of care to low income and uninsured patients, are minimized. However, state variation in Medicaid policy or other factors may still affect results.

The analysis compares Ascension Health hospitals in Medicaid expansion states with those in non-expansion states on changes in hospital inpatient volume, payer mix of patients, uncompensated care, revenues and costs, and operating margins. To understand changes since the implementation of most of the ACA coverage expansions on January 1, 2014, the analysis examines changes between the last three quarters of 2013 and the first three quarters of 2014. Hospitals in Arizona that are part of the Ascension system are excluded from the estimates due to incomplete data on hospital finances. Arizona hospitals accounted for 3 percent of all patient revenue system-wide in 2014 and about 8 percent among hospitals in Medicaid expansion states.

Since open enrollment in the health insurance marketplaces was not completely closed until the end of April, 2014, it is possible that changes in utilization due to the coverage expansion accelerated over the course of 2014. Therefore, sensitivity analysis also examined changes in utilization between the first and third quarters of 2014.

FINDINGS

Inpatient Discharge Volume and Distribution

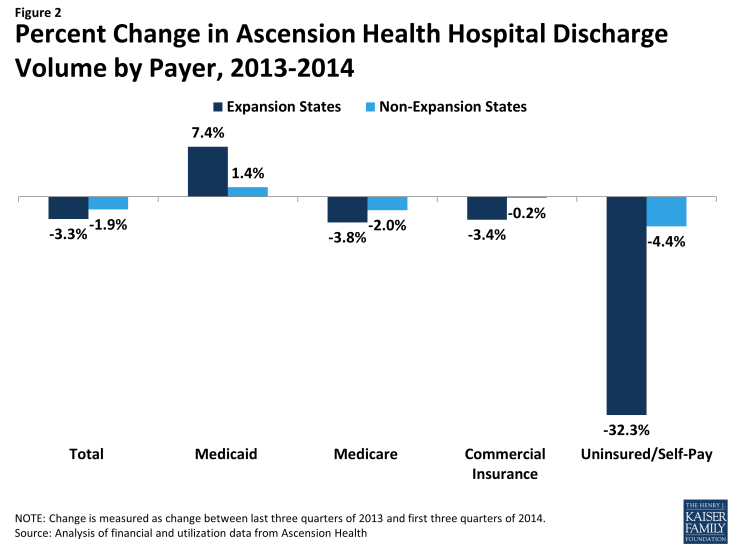

There were a total of 564,193 inpatient discharges in Ascension Health hospitals during the first three quarters of 2014 (excluding hospitals in Arizona), representing a slight decrease (-2.4 percent) from the last three quarters of 2013 (Table 1). However, trends in discharge volumes varied substantially by payer and whether the hospital was in a Medicaid expansion state (Figure 2). Medicaid discharges increased 7.4% among hospitals in expansion states during the first three quarters of 2014 but increased only 1.4 percent among hospitals in non-expansion states (Figure 2). Uninsured and self-pay discharges decreased 32.3 percent in expansion states but only 4.4 percent in non-expansion states. Medicare discharges decreased slightly across all states, as did discharges from commercial insurance (although somewhat less so in non-expansion states).

Changes in discharge volumes for Medicaid and uninsured patients accelerated throughout the first three quarters of 2014, likely reflecting changes as the ACA was implemented throughout the year. However, virtually all of the increase in Medicaid volume in expansion states between the first and third quarters of 2014 was driven by hospitals in Michigan. This likely reflects the April 1 implementation of Medicaid expansion in Michigan instead of January 1 for the other states, and the fact that the increase in adult eligibility levels for Medicaid in Michigan was substantial.

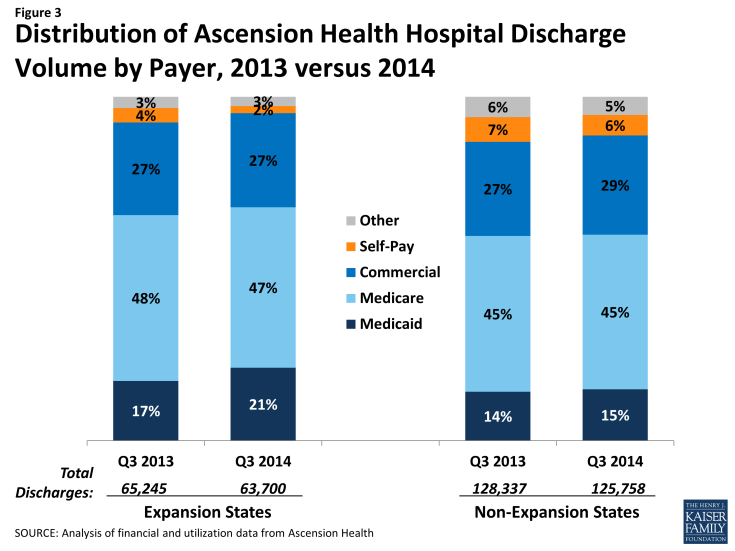

The changes in discharges by payer led to changes in payer mix for hospital discharges in expansion states. Among hospitals in expansion states, the share of inpatient discharges that were uninsured/self-pay declined from 4.0 percent in the third quarter of 2013 to 2.1 percent during a similar period in 2014 (Table 2 and Figure 3). Almost all of this decrease is attributed to increases in Medicaid discharges, which increased from 17.4 percent of all discharges to 21.2 percent of discharges. The share of Medicare discharges decreased slightly during this period (from 48.3 percent to 46.7 percent), while the share of discharges from commercial insurance was virtually unchanged (about 27 percent).

The share of total discharges by uninsured/self-pay patients is higher in non-expansion states, which likely reflects the generally higher uninsured rates in states like Texas, Florida, Alabama, and Tennessee prior to the ACA. Nevertheless, the share of discharges by uninsured/self-pay patients decreased somewhat in those states, from 7.2 percent during the third quarter of 2013 to 6.0 percent during the third quarter of 2014, due largely to an increase in the share of discharges from commercial patients (from 27.4 percent to 28.8 percent). There was less than a one percentage point change in the share of Medicaid and Medicare discharges at hospitals in non-expansion states.

Financial Outcomes

Patient revenue, expenses, operating margins

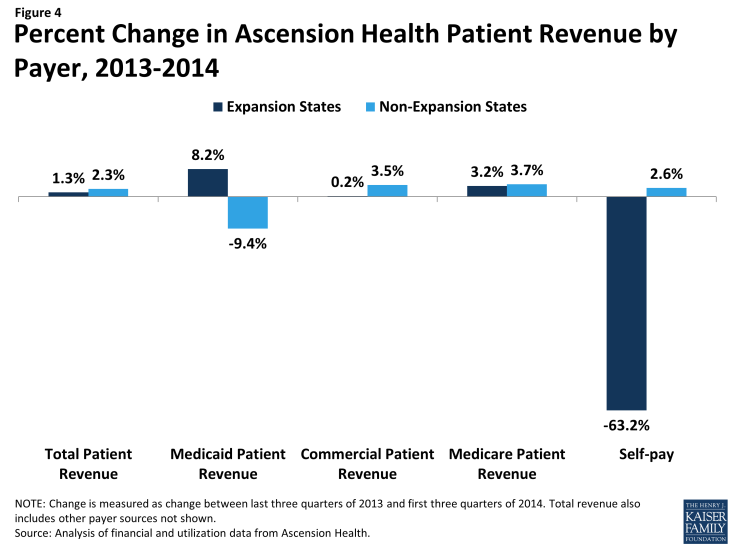

Total patient revenue (from inpatient and outpatient sources) increased 2.0 percent system-wide (excluding Arizona), from about $13.3 billion during the last three quarters of 2013 to $13.5 billion during the first three quarters of 2014 (Table 3 and Figure 4). Ascension Health hospitals in expansion states experienced somewhat slower growth in revenues (1.3 percent) compared to hospitals in non-expansion states (2.3 percent).

Increases in Medicaid and Medicare patient revenue accounted for much of the increase in patient revenue for hospitals in expansion states. Medicaid revenue increased by $46 million, (or 8.2 percent). There were also increases in patient revenue for Medicare. Revenue from self-pay patients declined 63.2 percent among hospitals in expansion states, consistent with the decrease in discharge volumes from self-pay patients.

Increases in revenue from commercial insurance accounted for much of the increase in patient revenue among hospitals in non-expansion states (an increase of $105 million, or 3.5 percent). There were also increases in revenue from Medicare and self-pay patients, while patient revenue from Medicaid declined.

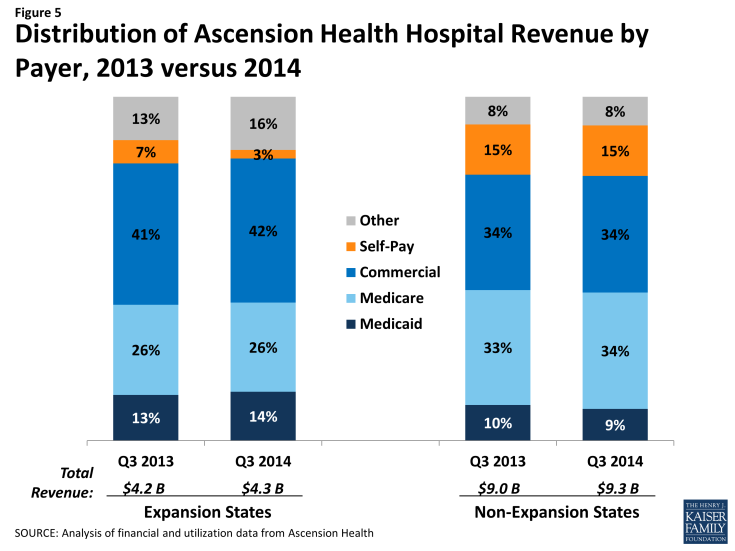

Corresponding to these changes in patient revenue by payer, hospitals in expansion states had a decrease in the share of their total revenue from self-pay and a slight increase in the share from Medicaid (Table 4 and Figure 5). For hospitals in non-expansion states, there was no change in the share of revenue from self-pay.

Changes in total revenue include both changes in payer mix for inpatient discharges, as described above, and changes in payer mix for other service lines and changes in patterns of care. Inpatient and outpatient service lines had different rates of increases in revenue by payer. In Medicaid expansion states, Medicaid outpatient revenue increased 13.0 percent between the last three quarters of 2013 and first three quarters of 2014, while Medicaid inpatient revenue increased by 4.9 percent (data not shown). As a result, the share of total Medicaid revenue received from outpatient versus inpatient care increased from 40.6 percent to 42.4 percent among Ascension Health hospitals in Medicaid expansion states. There was a decline in both inpatient and outpatient self-pay revenue.

In hospitals in non-expansion states, Medicaid inpatient revenue also dropped, and Medicaid outpatient revenue increased at a much lower rate (2.9 percent) compared to hospitals in expansion states. Outpatient revenue as a share of total Medicaid revenue increased from 38.7 percent during the last three quarters of 2013 to 44.0 percent during the first three quarters of 2014, perhaps indicating that the shift from inpatient to outpatient care is part of a broader trend rather than related to the ACA coverage expansions.

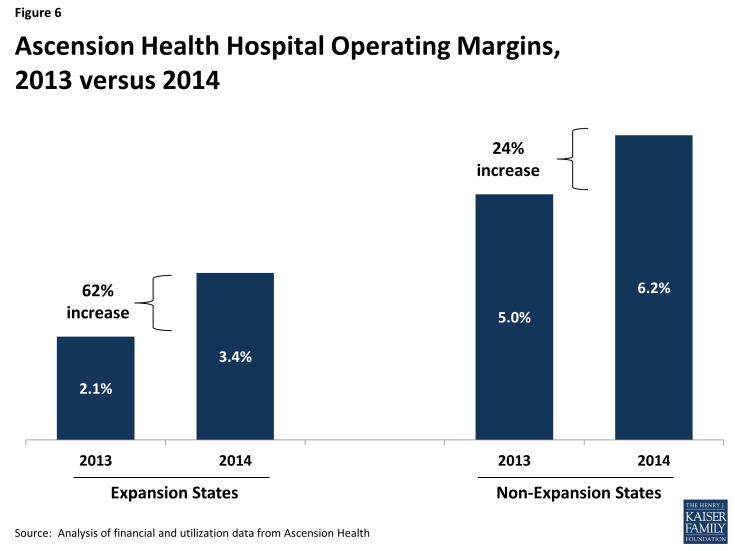

There was no change in the cost of providing health services among hospitals in expansion states, while costs increased 1.3 percent among hospitals in non-expansion states. As a result, operating margins for hospitals in expansion states increased from 2.1 percent during the last three quarters of 2013 to 3.4 percent during the first three quarters of 2014, a 62 percent increase (Figure 6). Operating margins were considerably higher among hospitals in non-expansion states prior to the coverage expansions (5.0 percent) and they increased somewhat more modestly after the expansions, from 5.0 percent to 6.2 percent.

Other Financial Outcomes

Ascension hospitals have financial assistance programs for uninsured patients who have no access to public or private health insurance coverage. Uninsured patients with family incomes less than or equal to 200% of the federal poverty level are eligible for 100% charity care write-off of the charges, while uninsured patients between 200% and 300% of poverty are eligible for discounts based on a sliding scale. Uninsured people with family incomes greater than 300% are eligible for discounted charges based on their assessed ability to pay.

During the first three quarters of 2014, charity care costs for Ascension Health hospitals amounted to $395 million, a $58 million decrease (12.8 percent) from the last three quarters of 2013 (Table 5). Consistent with the decrease in uninsured/self-pay discharges, hospitals in Medicaid expansion states saw a decrease of almost 40 percent in charity care costs (down $35 million, from $85 million to $50 million). Hospitals in non-expansion states saw a smaller decrease in charity care costs during this period (6.2 percent), down $23 million from $368 million in the last three quarters of 2013 to $345 million during the first three quarters of 2014.

Another cost of caring for the poor is the difference between what Medicaid pays and the cost of care for Medicaid patients. System-wide, this differential increased by $122 million between 2013 and 2014, although the differential between costs and payments increased to a greater extent among hospitals in non-expansion states ($99 million, or a 35.5. percent increase) compared to expansion states ($23 million, or a 21.7 percent increase).

Combining the decrease in charity care costs with the increase in Medicaid shortfalls indicates the net change in the cost to hospitals of caring for low income patients. For hospitals in Medicaid expansion states, the decrease in charity care costs ($35 million) was greater than the increase in Medicaid shortfalls ($23 million), indicating a net decrease in costs of care to the poor. For hospitals in non-expansion states, the amount of the increase in Medicaid shortfalls ($99 million) exceeded the decrease in charity care ($23 million) by a considerable amount, resulting in a large increase in the cost of care to low income patients.

DISCUSSION

Consistent with expectations, Ascension Health hospitals in states that expanded Medicaid experienced greater increases in Medicaid inpatient discharge volumes and Medicaid total patient revenue, as well as greater decreases in uninsured volumes and charity care costs compared to hospitals in states that did not expand Medicaid. Hospitals in expansion states also experienced a greater improvement in overall financial performance (operating margins) between the last three quarters of 2013 and the first three quarters of 2014 relative to the financial performance of hospitals in non-expansion states, although this reflects almost no increases in the costs of providing services among hospitals in expansion states rather than greater increases in revenue. Still, these hospitals saw a shift in both discharges and revenue from self-pay/uninsured to Medicaid and, as a result, a decrease in their cost of care for the poor.

Ascension Health hospitals in states that did not expand Medicaid also experienced decreases in uninsured volumes and charity care costs, although these changes were not as large as those experienced by hospitals in states that expanded Medicaid. These hospitals also had an increase in revenue from commercial as well as Medicare patients that offset a decrease in revenue from Medicaid, and as a result hospitals in non-expansion states experienced overall increases in patient revenue that were somewhat larger than hospitals in expansion states.

Looking ahead, potential areas of concern for hospitals are Medicaid payment rates and Medicaid DSH cuts. Examination of other outcomes shows that there are potential areas of concern for hospitals under the ACA. One is the increase in costs due to Medicaid payments falling below costs (the so-called “shortfall”). For hospitals in Medicaid expansion states, this increase was mostly due to increased utilization from Medicaid beneficiaries, many of whom were likely newly insured through the Medicaid expansions. However, these hospitals also benefitted from increased patient revenue from Medicaid, which offset the shortfall, as well as reduced charity care costs, which led to an overall decrease in the cost of care to the poor.

Medicaid shortfalls increased for different reasons among hospitals in non-expansion states, which experienced a much smaller increase in utilization from Medicaid beneficiaries and a decrease in patient revenue from Medicaid. It is unclear what explains the increase in Medicaid shortfalls among these hospitals, but it is possible that they were affected by provider rate cuts or freezes for Medicaid inpatient and outpatient services paid by states. For example, most of the states with Ascension Health hospitals implemented rate cuts or freezes for inpatient care for FY2014 (which started in October, 2013).7 This may have had a greater effect on hospitals in non-expansion states, where average Medicaid revenue per inpatient day decreased from $1,297 in 2013 to $1,045 in 2014 (findings not shown). Medicaid inpatient revenue per inpatient day was unchanged for hospitals in expansion states.

Also, since charity care costs did not decrease as much among hospitals in non-expansion states as they did among hospitals in expansion states, the increase in Medicaid shortfalls among hospitals in non-expansion states resulted in a net increase in the costs of caring for low income patients, while hospitals in expansion states experienced a net decrease in these costs. Hospitals in non-expansion states were able to overcome these higher costs by increasing revenue from other patients, especially commercially insured and Medicare patients.

Hospitals are also concerned about pending reductions in Medicaid DSH payments. The logic of the Medicaid DSH payment reductions is that the decrease in hospitals’ charity care costs for the uninsured and increase in direct reimbursement for patient services will offset the loss of Medicaid DSH subsidies, which are also currently used in part to cover lower Medicaid reimbursement rates. Although the analysis did not examine the potential impact of the loss of Medicaid DSH subsidies on Ascension Health hospitals, and overall patient revenues increased despite the shortfall, these results exemplify the potential areas of concern that Ascension Health and other hospitals face through the loss of such subsidies as well as cuts in direct reimbursement for patient services from state Medicaid programs. When Massachusetts reduced the state’s hospital uncompensated care pool in order to fund the coverage expansions in the 2006 Massachusetts Health Reform, some hospitals were negatively impacted because the loss of subsidies for care for the uninsured was larger than the reduction in uncompensated care they provided.8 Financially weak hospitals are at even greater risk of being unable to absorb the Medicaid DSH reductions.9

Numerous factors influence changes in revenues and the financial performance of hospitals and health systems. While state Medicaid expansion decisions and corresponding changes in revenue mix by volume play a role, other factors such as changes in patient care patterns, changes in acuity of patients seeking inpatient care, the local health care and economic environment, state and local policies, and the extent of competition with other hospitals can affect hospitals’ financial performance. While it is beyond the scope of this analysis to examine all of these factors, analysis of financial information from Ascension hospitals in expansion and non-expansion states points to several forces driving overall financial performance. For example, changes to Medicaid payment rates, particularly in non-expansion states, may have contributed to hospitals in these states seeing drops in Medicaid revenue and rising Medicaid shortfalls.

Ascension Health hospitals are somewhat under-represented in states with Medicaid expansions, although the experiences with health reform of other not-for-profit systems in Medicaid expansion states appear to be similar. For example, Dignity Health — the nation’s fifth largest nonprofit health system and located primarily in California, Nevada, and Arizona (all Medicaid expansion states) — observed a 50 percent decrease in uncompensated care and an 11.5 percent increase in patient revenue between the third quarters of 2013 and 2014, which they attributed to shifts from self-pay and uninsured patients to insured patients.10 Providence Health System based in Seattle Washington – the 10th largest nonprofit system with most hospitals based in Washington, California, and Oregon (but also some in Alaska and Montana) – saw self-pay volumes decrease by 44 percent and Medicaid revenues increase 25 percent through September, 2014 compared to 2013.11 Unity-Point Health, the 13th largest nonprofit system and based in Iowa, observed a 33 percent increase in patient revenue from Medicaid between the first quarters of 2013 and 2014, a 25 percent increase in patient revenue from commercial insurance, and a 27 percent decrease in charity care.12

Nevertheless, it is important to note that the results of this analysis are not necessarily representative of all hospitals in the U.S. Analyses of the full impact of the ACA on hospitals won’t be possible until nationally representative data for 2014 and later years become available from sources such as the American Hospital Association, the Health Care Cost and Utilization Project, and Medicare Hospital Cost Reports. Until then, information on individual hospitals and hospital systems will be the best available evidence of the impact of the ACA on hospitals. As this analysis shows, overall, Ascension hospitals in Medicaid expansion states saw increased Medicaid discharges, increased Medicaid revenue, and decreased cost of care for the poor, while hospitals in non-expansion states saw a very small increase in Medicaid discharges, a decline in Medicaid revenue, and growth in cost of care to the poor. These data suggest that Medicaid expansion can offset the cost of care to the poor and serve as a growing source of revenue as hospitals face cuts in payment and DSH funds.

This Kaiser Commission on Medicaid and the Uninsured brief was prepared by Peter Cunningham, Professor, Department of Healthcare Policy and Research, Virginia Commonwealth University School of Medicine, and Rachel Garfield and Robin Rudowitz from the Kaiser Family Foundation. The authors thank Rhonda Anderson, Senior Vice President and Chief Financial Officer; Joseph Lubiewski, Manager, Financial Planning; Brian J. Wuelling, Senior Financial Planning Analyst; and Mary Ella Payne, Senior Vice President for Policy and System Legislative Leadership, Ascension Health, for their assistance in this project. Ali Bonakdar of the Department of Health Care Policy and Research, VCU School of Medicine assisted with the data analysis.