Behavioral Health Parity and Medicaid

Introduction

Behavioral health parity refers to requirements for health insurers to cover mental health and substance use disorder services on terms that are equal to those offered for medical and surgical services.1 Historically, insurers could impose more restrictive financial requirements, such as higher co-payments, on behavioral health services than for medical/surgical services, and they could apply more stringent treatment limitations, such as the number of visits covered, for behavioral health services than for medical/surgical services. The federal behavioral health parity law is intended to achieve equitable coverage when health plans cover both medical/surgical and behavioral health services. This issue brief explains how the behavioral health parity law applies in the Medicaid program, including the major provisions of the Centers for Medicare and Medicaid Services’ (CMS) April 10, 2015 proposed regulations, and identifies key policy issues at the intersection of behavioral health parity and Medicaid.

Background

Federal Behavioral Health Parity Law for Group Health Plans

The federal behavioral health parity law originally was enacted to apply to group health plans that offer both behavioral health services and medical/surgical services. The 1996 Mental Health Parity Act requires parity in aggregate lifetime and annual dollar coverage limits between mental health and medical/surgical services for group health plans. The 2008 Mental Health Parity Addiction Equity Act (MHPAEA) builds on the group health plan parity requirements by mandating parity in financial requirements and quantitative and non-quantitative treatment limitations. MHPAEA also applies federal parity rules for group health plans to substance use disorder services.2

Medicaid Coverage of Behavioral Health Services

States have flexibility to determine which services to offer in their Medicaid programs, within the parameters of federal minimum requirements.3 Some behavioral health services may be covered in mandatory state plan categories, such as physician services or outpatient hospital services. Many behavioral health services are covered under optional state plan categories, such as rehabilitative services, case management, and prescription drugs. Federal Medicaid law does not require states to cover any particular behavioral health services in their state plan benefit package.

Instead of the traditional state plan benefit package, states may choose to offer an alternative benefit plan (ABP) to most Medicaid beneficiaries, and states must offer an ABP to adults who are newly eligible for Medicaid under the Affordable Care Act’s (ACA) expansion.4 Unlike the Medicaid state plan benefit package, which comprises services in the mandatory and optional categories in federal law, an ABP is based on the contents of a private health insurance plan that is used as a benchmark to define benefits.5 ABPs must cover the ACA’s 10 essential health benefits, including mental health and substance use disorder services.6

Another provision of federal Medicaid law relevant to parity is the long-standing prohibition against Medicaid payments for services provided in an “institution for mental disease” for beneficiaries between the ages of 21 and 65.7

Medicaid Behavioral Health Delivery Systems

States have flexibility to design the delivery system through which Medicaid behavioral health services are provided. Delivery systems range from the traditional fee-for-service (FFS) system to capitated managed care models. In recent years, an increasing number of states are using managed care to deliver Medicaid services.8 Federal law defines the different types of managed care entities (MCEs) that states can use, including managed care organizations (MCOs), prepaid inpatient health plans (PIHPs), and prepaid ambulatory health plans (PAHPs). All three types of MCEs receive risk-based capitated payments. MCOs deliver a comprehensive set of services to beneficiaries, while PIHPs and PAHPs are responsible for a more limited set of specific services.9

Behavioral Health Parity and Medicaid

Medicaid behavioral health parity rules are based on the underlying federal parity law that applies to group health plans, with some changes to account for differences between the different types of coverage. Federal parity law applies to Medicaid through two statutes: the 1997 Balanced Budget Act applies federal parity rules to Medicaid MCOs,10 and the ACA applies the financial requirement and treatment limitation provisions of federal parity law to Medicaid ABPs.11

On April 10, 2015, CMS proposed regulations to further define the rules for behavioral health parity in the Medicaid program.12 Public comments on the proposed regulations are due on June 9, 2015, and CMS proposes that the final regulations take effect 18 months after publication of the final regulations.13 The rest of this brief discusses the major provisions of the proposed Medicaid parity rules.

When Parity Applies in Medicaid

Services Provided to Medicaid MCO Enrollees

CMS proposes that behavioral health parity rules apply to all services provided to Medicaid managed care enrollees, regardless of delivery system carve-outs.14 As described above, states may choose to deliver services through MCOs, PIHPs, or PAHPs, or on a FFS basis. Many states have a split delivery system in which MCOs are not responsible for the full scope of medical/surgical and behavioral health services available to beneficiaries under the Medicaid state plan; instead, some services are provided by an MCO and other services are provided to MCO enrollees through a PIHP or PAHP or FFS. Under the proposed rules, parity would apply to all MCOs, PIHPs, and PAHPs that provide benefits to MCO enrollees, without regard to whether all benefits are furnished by the same MCE, so long as both medical/surgical and behavioral health benefits are included in the Medicaid state plan benefit package.15 In split delivery systems, CMS proposes that the state Medicaid agency must review all services provided to MCO enrollees across all delivery systems to ensure parity.16 CMS’s proposal seeks to preserve state flexibility about delivery system choices while avoiding the result of nullifying parity for MCO enrollees if all behavioral health services were carved out from MCO contracts. CMS considered an alternative solution of requiring all behavioral health services to be included in MCO contracts.17

Services Provided in Medicaid ABPs

In general, behavioral health parity applies to services contained in Medicaid ABPs, regardless of whether those services are delivered FFS or through managed care.18 The parity rules regarding scope of benefits, financial requirements, treatment limits, and information disclosure apply to all ABPs, including those under which all benefits are delivered on a FFS basis (“all-FFS ABPs”). For all-FFS ABPs, the state Medicaid agency is responsible for ensuring parity.19 If an ABP contains benefits that are delivered to MCO enrollees, the parity rules for aggregate lifetime and annual dollar limits also apply.20

States are encouraged, but not required, to apply parity rules to FFS Medicaid state plan benefits that are provided to beneficiaries who are not MCO enrollees and that are not part of an ABP.21 The statutory authority for Medicaid behavioral health parity only reaches MCOs and ABPs; to date, Congress has not required parity for Medicaid FFS benefits outside an ABP. Parity rules also do not apply to Medicare benefits that are provided by Medicaid MCOs to dual eligible beneficiaries.22 The rules for when parity applies in Medicaid are summarized in Table 1 below.

| Table 1: When Does Behavioral Health Parity Apply in Medicaid? | ||

| Delivery System Type | Medicaid State Plan Services | Medicaid ABP Services |

| MCO | Parity applies to all state plan services provided to MCO enrollees | Parity applies to all ABP services provided to MCO enrollees; in addition, the scope of benefits, financial requirement, treatment limit, and information disclosure parity rules apply to all ABPs, regardless of delivery system |

| PIHP | Parity applies only to state plan services provided by PIHPs to MCO enrollees (carve-outs from MCO contract) | Parity applies to ABP services provided by PIHPs to MCO enrollees (carve-outs from MCO contract); in addition, the scope of benefits, financial requirement, treatment limit, and information disclosure parity rules apply to all ABPs, regardless of delivery system |

| PAHP | Parity applies only to state plan services provided by PAHPs to MCO enrollees (carve-outs from MCO contract) | Parity applies to ABP services provided by PAHPs to MCO enrollees (carve-outs from MCO contract); in addition, the scope of benefits, financial requirement, treatment limit, and information disclosure parity rules apply to all ABPs, regardless of delivery system |

| FFS | Parity applies only to state plan services provided on a FFS basis to MCO enrollees (carve-outs from MCO contract) | Parity applies to ABP services provided to MCO enrollees on a FFS basis (carve outs from MCO contract); in addition, the scope of benefits, financial requirement, treatment limit, and information disclosure parity rules apply to all ABPs, even those in which all services are provided FFS |

Definition and Classification of Benefits for Parity Analysis

The first preliminary step in applying the Medicaid parity rules is for the state to define medical/surgical, mental health, and substance use disorder benefits.23 CMS proposes that these definitions be based on generally recognized independent standards of current medical practice, such as the ICD, DSM or state guidelines.24 CMS also proposes that these definitions should exclude long-term care benefits, because those benefits are not typically provided by private insurers.25

The second preliminary step in applying the Medicaid parity rules is for all benefits to be assigned to one of four classifications: inpatient, outpatient, emergency care, and prescription drugs.26 The proposed rules allow for only one benefit sub-classification: office visits may be sub-classified separately from other outpatient services.27 No other sub-classifications are permitted, such as distinctions between generalists and specialists.28 In addition, prescription drugs may be assigned to different tiers.29 The MCO, PIHP, or PAHP is responsible for classifying the benefits that each provides to MCO enrollees, and the state is responsible for classifying benefits provided to ABP enrollees on a FFS basis.30 In classifying benefits, the same standards must be applied to medical/surgical and behavioral health benefits.31 Prescription drug tiers must be determined based on reasonable factors determined in accordance with the parity rules for non-quantitative treatment limits (described below), including cost, efficacy, generic vs. brand-name, and mail order vs. pharmacy pick-up, and without regard to whether a drug is generally prescribed for behavioral health or medical/surgical purposes.32 The preamble to the proposed rules states that CMS expects MCEs within a state to define benefit classifications similarly and apply terms uniformly.33 The preamble to the proposed rule also indicates that intermediate benefits, such as partial hospitalization or intensive outpatient treatment, may be assigned to any classification so long as the assignment is done consistently for medical/surgical and behavioral health services; however, CMS requests comments on this approach as well as alternatives.34 The benefit definition and classification rules are summarized in Table 2 below.

| Table 2: Benefit Definition and Classification for Purposes of Parity | ||

| Step: | Who Is Responsible? | What Standards Apply? |

|

Step 1: Benefit Definition

a. Medical/Surgical

b. Behavioral Health

|

State Medicaid agency is responsible for defining all benefits | Generally recognized independent standards of current medical practice, such as the ICD, DSM or state guidelines; long-term care benefits are excluded |

|

Step 2: Benefit Classification

a. Inpatient

b. Outpatient

i. Office visit*

ii. Other outpatient services

c. Emergency care

d. Prescription drug (tiers allowed)

|

For benefits provided to MCO enrollees, the MCO, PIHP, or PAHP is responsible for classifying medical/surgical and behavioral health benefits as defined by the state

.

For ABP benefits provided on a FFS basis, the state Medicaid agency is responsible for classifying benefits

|

The same standards must be applied when classifying medical/surgical and behavioral health benefits.

.

Prescription drug tiers must be based on reasonable factors** and without regard to whether a drug is generally prescribed for medical/surgical or behavioral health purposes

|

| NOTES: *Outpatient office visit sub-classification is optional. **Reasonable factors are determined in accordance with the non-quantitative treatment limit rules and include cost, efficacy, generic vs. brand name, and mail order vs. pharmacy pick-up. | ||

Benefit classifications are important because parity is determined by comparing financial requirements and treatment limitations for medical/surgical and behavioral health benefits within the same classification, as detailed below. The rest of this brief summarizes the proposed rules for determining parity in various respects after benefits are defined and classified. The proposed rules cover the scope of benefits, financial requirements and quantitative treatment limits, non-quantitative treatment limits, aggregate lifetime and annual dollar limits, and information disclosure required by parity. Major provisions of the proposed parity rules are summarized in Text Box 1 below.

Text Box 1:

Summary of Proposed Medicaid Behavioral Health Parity Rules

Scope of benefits: If behavioral health benefits are provided in any classification, they must be provided in every classification in which medical/surgical benefits are provided.

Financial requirements and quantitative treatment limits:

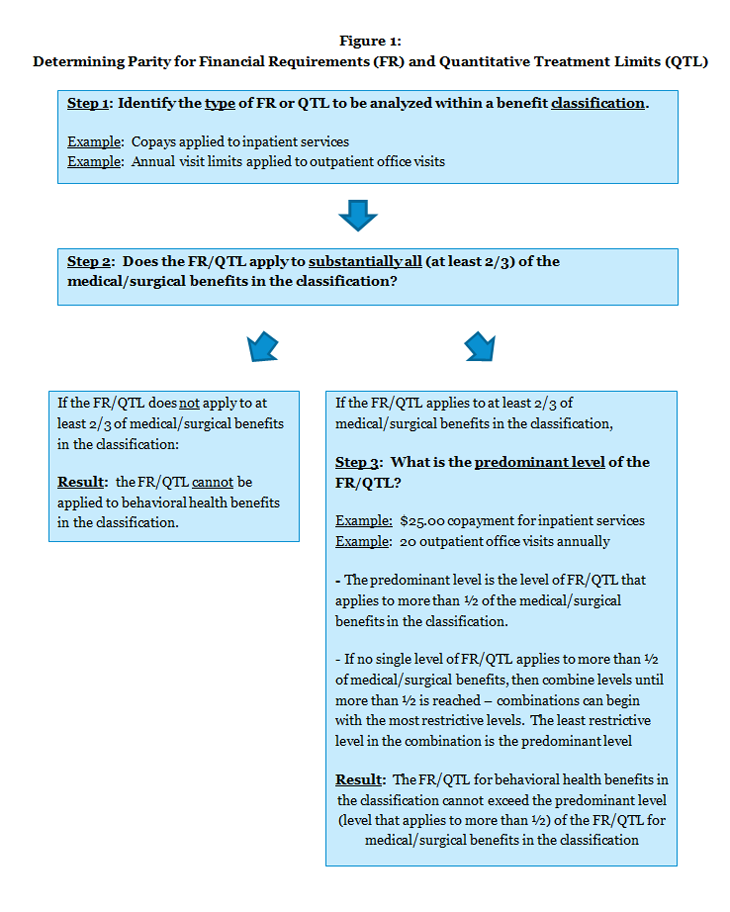

- Financial requirements and treatment limits on behavioral health benefits in any classification cannot be more restrictive than the predominant level of the financial requirement or treatment limit of that type that applies to substantially all medical/surgical benefits in the same classification (See Figure 1).

- Cumulative financial requirements for behavioral health benefits in a classification that accumulate separately from any such requirement for medical/surgical benefits in the same classification are prohibited.

Non-quantitative treatment limits (NQTLs): NQTLs on behavioral health benefits in any classification may not be imposed unless, under the policies and procedures as written and in operation, any processes, strategies, evidentiary standards, or other factors used to apply the NQTL to behavioral health benefits are comparable to and applied no more stringently than those used to apply the NQTL to medical/surgical benefits in that classification.

Aggregate lifetime and annual dollar limits:

- Aggregate lifetime and annual dollar limits may not be applied to behavioral health benefits if those limits apply to less than 1/3 of medical/surgical benefits.

- If aggregate lifetime or annual dollar limits apply to more than 1/3 but less than 2/3 of medical/surgical benefits, any such limits for behavioral health benefits must not exceed a weighted average of the limit for medical/surgical benefits.

- If aggregate lifetime or annual dollar limits apply to at least 2/3 of medical/surgical benefits, then any such limits for behavioral health benefits must be applied in a way that does not distinguish between the two types of benefits.

Information disclosure requirements: The criteria for behavioral health medical necessity determinations and the reason for any denial of reimbursement or payment for behavioral health services must be made available to beneficiaries, potential MCO enrollees, and providers.

Scope of Benefits Required by Parity

If behavioral health benefits are provided in any classification, they must be provided in every classification in which medical/surgical benefits are offered.35 Parity requirements do not affect the amount, duration, and scope of Medicaid behavioral health benefits except as specifically provided in the parity rules.36 The rules specify that MCEs are not required to provide any behavioral health benefits beyond those specified in their contracts with the state Medicaid agency.37 In addition, providing benefits for one or more behavioral health conditions does not require an MCE to provide benefits for any other behavioral health condition.38 MCEs also are not required to provide any additional behavioral health benefits in any classification if the only behavioral health benefit that they cover is tobacco cessation services for pregnant women.39 While the parity rules do not require a state Medicaid agency to provide any specific behavioral health benefits in an all-FFS APB, all ABPs must offer the ACA’s 10 essential health benefits, which include mental health and substance use disorder benefits.40

Scope of Benefits and Managed Care Payment Rates

CMS proposes that only the cost of Medicaid state plan services plus any additional services provided by MCEs outside the Medicaid state plan benefit package that are necessary to comply with parity may be included when determining actuarially sound payment rates.41 MCEs may cover additional services outside the Medicaid state plan benefit package that are necessary to comply with parity as well as any additional services that the managed care entity voluntarily agrees to provide; however, CMS proposes that only the costs of the former additional services can be used to calculate managed care payment rates. CMS seeks comment on the risk that this rule may be used to include in managed care rate determinations the costs of non-state plan services that are not strictly necessary for compliance with parity and how this risk may be mitigated through more prescriptive language or specific oversight activities.42

General Parity Rule

The proposed rules provide that financial requirements and treatment limits on behavioral health benefits in any classification cannot be more restrictive than the predominant financial requirement or treatment limit of that type that applies to substantially all medical/surgical benefits in the same classification.43 Each of the italicized terms has a specific meaning in the proposed regulations and is further explained below. Parity must be analyzed separately for each type of financial requirement or treatment limit.44 If office visits are sub-classified separately from other outpatient services, financial requirements and quantitative treatment limits on behavioral health benefits in one sub-classification may not be more restrictive than the predominant requirement or limit that applies to substantially all medical/surgical benefits in the same sub-classification.45 For prescription drugs, different levels of financial requirements can apply to different drug tiers.46

Financial Requirements and Quantitative Treatment Limits

The parity analysis for financial requirements and quantitative treatment limitations is described below and summarized in Figure 1. These rules apply to both MCEs providing services to MCO enrollees and to states for purposes of all-FFS ABPs. In addition, other Medicaid cost-sharing rules continue to apply.47

Step 1: Identify Type of Requirement or Limitation to Be Analyzed within a Benefit Classification

When analyzing parity, a financial requirement or treatment limit must be compared only to a financial requirement or treatment limit of the same type within a benefit classification. Therefore, the first step in a parity determination is to identify the type of requirement or limitation at issue within a benefit classification. Types of financial requirements include deductibles, copays, coinsurance, and out-of-pocket maximums.48 Types of quantitative treatment limits include annual, episode, and lifetime day and visit limits.49 A permanent exclusion of all benefits for a particular condition or disorder is not a treatment limit for purposes of the parity rules.50

Step 2: Determine Whether the Requirement or Limitation Applies to Substantially All Medical/Surgical Benefits in the Classification

A financial requirement or quantitative treatment limit applies to substantially all medical/surgical benefits in a classification if it applies to at least 2/3 of the medical/surgical benefits in the classification.51 The second step in analyzing parity is to determine whether a particular requirement or limitation applies to substantially all medical/surgical benefits in the classification. The portion of medical/surgical benefits in a classification subject to a financial requirement or quantitative treatment limit is based on the total dollar amount of all payments for medical/surgical benefits in the classification expected for that year. For services provided to MCO enrollees, the total dollar amount includes the combined MCO/PIHP/PAHP payments expected for a contract year, determined by any reasonable method.52 (The preamble, but not the proposed rule, provides that this total amount also would include payments for FFS benefits provided to MCO enrollees in states with split delivery systems.53) For all-FFS ABPs, the total dollar amount includes all payments expected for the plan year, based on any reasonable method.54 (The preamble, but not the proposed rule, instead refers to the year starting with the effective date of the approved ABP SPA.55)

Parity Rule if Requirement/Limitation does not apply to at least 2/3 of Medical/Surgical Benefits in the Classification:

If a financial requirement or quantitative treatment limit does not apply to at least 2/3 of all medical/surgical benefits in a classification, then that type of financial requirement or quantitative treatment limit cannot be applied to behavioral health benefits in that classification.56 If the requirement or limitation does apply to at least 2/3 of the medical/surgical benefits in the classification, then the analysis continues to the next step.

Step 3: Determine the Predominant Level of that Type of Requirement or Limitation that Applies to Medical/surgical Benefits in the Classification

The predominant level of that type of financial requirement or quantitative treatment limit is the level that applies to more than ½ of medical/surgical benefits in the classification subject to the financial requirement or quantitative treatment limit.57 If a financial requirement or quantitative treatment limit applies to substantially all (at least 2/3) medical/surgical benefits in a classification, the next step in the parity analysis is to determine the predominant level for the type of requirement or limitation at issue for medical/surgical benefits in the classification. Examples of levels of financial requirements or quantitative treatment limits include dollar, percentage, day or visit amounts.58 The preamble, but not the proposed rule, provides that, in states with split delivery systems, all payments for services provided to MCO enrollees (MCO, PIHP, PAHP, and FFS) need to be considered when determining if a financial requirement or quantitative treatment limit is the predominant level.59

If there is no single level that applies to more than ½ of medical/surgical benefits in a classification subject to the financial requirement or quantitative treatment limit, then levels may be combined until the greater than ½ threshold is reached.60 In these cases, the least restrictive level within the combination is the predominant level. The most restrictive levels can be combined first to reach the more than ½ threshold.

Parity Rule if Requirement/Limitation Applies to at Least 2/3 of Medical/Surgical Benefits in the Classification:

If a type of financial requirement or quantitative treatment limitation applies to at least 2/3 of all medical/surgical benefits in a classification, then that type of financial requirement or quantitative treatment limitation for behavioral health benefits in that classification cannot be more restrictive than the predominant level of the requirement or limitation applied to medical/surgical benefits in the classification.61

Cumulative requirements

The proposed parity rules prohibit cumulative financial requirements for behavioral health benefits in a classification that accumulate separately from any such requirement for medical/surgical benefits in the same classification.62 Cumulative financial requirements include deductibles and out-of-pocket maximums.63

The preamble, but not the proposed rule, provides that quantitative treatment limits may accumulate separately for medical/surgical and behavioral health benefits for purposes of determining parity in Medicaid, so long as the general parity rule (described above) is met. CMS explains that it arrived at this policy due to the difficulties in administering unified treatment limits in split delivery systems.64

Figure 1: Determining Parity for Financial Requirements (FR) and Quantitative Treatment Limits (QTL)

Non-Quantitative Treatment Limits

Non-quantitative treatment limits (NQTLs) on behavioral health benefits in any classification may not be imposed unless, under policies and procedures as written and in operation, any processes, strategies, evidentiary standards or other factors used to apply the NQTL to behavioral health benefits are comparable to and applied no more stringently than those used to apply the NQTL to medical/surgical benefits in that classification.65 The parity rules for NQTLs apply both to MCEs that provide services to MCO enrollees and to states for purposes of ABPs. The proposed rule contains a non-exhaustive list of NQTLs, including:66

- Medical management standards limiting or excluding benefits based on medical necessity or appropriateness or based on whether the treatment is experimental or investigative;67

- Prescription drug formulary design;

- Provider network admission standards, including reimbursement rates;

- Methods for determining usual, customary, and reasonable charges;

- Step therapy/fail first policies;

- Exclusions based on failure to complete a course of treatment;

- Restrictions based on geographic location, facility type, provider specialty, and other criteria that limit the scope or duration of benefits;

- Network tier design, such as preferred or participating providers (not applicable to all-FFS ABPs); and

- Standards for access to out-of-network providers (not applicable to all-FFS ABPs).68

Aggregate Lifetime and Annual Dollar Limits

CMS also proposes parity rules for aggregate lifetime and annual dollar limits. These rules apply only to MCEs that provide services to MCO enrollees; they do not apply to all-FSS ABPs. The proposed rules about aggregate lifetime and annual dollar limits are as follows:

- MCEs that have no aggregate lifetime or annual dollar limits, or that apply these limits to less than 1/3 of all medical/surgical benefits, may not impose any such limits on behavioral health benefits.69

- MCEs that have aggregate lifetime or annual dollar limits on more than 1/3 but less than 2/3 of all medical/surgical benefits must either:

- Impose no aggregate lifetime or annual dollar limits on behavioral health benefits; or

- Impose limits on behavioral health benefits that are no more restrictive than a weighted average of the limits that apply to medical/surgical benefits.70

- MCEs that have aggregate lifetime or annual dollar limits on at least 2/3 of all medical/surgical benefits must either:

- Apply the limit to both medical/surgical and behavioral health benefits in a manner that does not distinguish between the two types of benefits; or

- Not include a limit on behavioral health benefits that is more restrictive than the limit for medical-surgical benefits.71

The 1/3 and 2/3 thresholds are based on the total dollar amount of all combinations of managed care payments (MCO, PIHP, PAHP) for medical/surgical services expected to be paid in a contract year, determined by any reasonable method.72

Availability of Information

The proposed parity rules require certain types of information to be disclosed to beneficiaries, potential MCO enrollees, and providers. Specifically, the criteria for behavioral health medical necessity determinations73 and the reason for any denial of reimbursement or payment for behavioral health services must be made available. The information disclosure requirements in the parity rules apply both to MCEs that provide services to MCO enrollees and to states for the purposes of all-FFS ABPs.74

Looking Ahead

CMS proposes that the parity rules take effect 18 months after publication of the final regulations. After the final rules are published, states will have 18 months to provide publicly available documentation of their compliance with the parity rules. States providing services to beneficiaries through MCOs also must provide documentation of how parity is met when they submit their MCO contracts to CMS, and all MCO, PIHP, and PAHP contracts must ensure that behavioral health services are provided to MCO enrollees in parity with medical/surgical services. These measures can provide important information to stakeholders about how the parity rules are implemented as their impact is assessed going forward.

The proposed parity rules identify a number of policy issues to be resolved, including:

- CMS’s proposal that, in the case of split delivery systems, state Medicaid agencies review all services provided to MCO enrollees across all delivery systems to ensure parity;

- whether states will choose to apply parity rules to Medicaid services that are provided to beneficiaries who are not MCO enrollees and that are not part of an ABP so that services will be provided in parity to all beneficiaries, regardless of benefit package or delivery system;

- the specific standards that will be used to classify benefits for purposes of parity determinations and how different MCEs and the state will coordinate those standards in states with split delivery systems;

- the extent to which the final parity rules will result in changes in benefits offered and any effects on the determination of managed care payment rates; and

- the extent to which the final parity rules will result in changes to any financial requirements or treatment limitations applied to behavioral health benefits.