Analysis of UnitedHealth Group’s Premiums and Participation in ACA Marketplaces

In late 2015, amid a series of closures of relatively small co-op health plans, the nation’s largest private insurer, UnitedHealth Group, announced that it too expected losses in its Affordable Care Act (ACA) marketplace business and would reconsider its participation in the Marketplaces in the first half of 2016. Most recently, there have been media reports that UnitedHealthcare (a subsidiary of UnitedHealth Group) would no longer participate in the Arkansas, Georgia, and Michigan exchange markets starting in 2017. Though United is a large, established insurer in the employer-based insurance market, it has been cautious about entering the ACA marketplaces, only participating in a handful of states in 2014 before expanding its reach in 2015 and 2016.

This analysis provides a state by state look at where United is participating in the Marketplaces this year and the extent to which it is offering one of the lower premium plans. It provides context for what the effect would be if United withdraws from some or all remaining markets where the company participates in 2016 (both in states using Healthcare.gov and those running their own exchanges). We examine the effect a further withdrawal would have on insurer participation on the exchanges, with a particular focus on areas with limited competition (counties with just 1 or 2 insurers). We also analyze premium data to identify where United currently offers one of the two lowest-cost silver plans. As the low-cost silver plans are generally the most popular plans on the market, and these plans are the basis for subsidy calculation, a United exit would likely have a more significant effect on people living in these counties.

If United were to exit from all areas where it currently participates and not be replaced by a new entrant, the effect on insurer competition could be significant in some markets – particularly in rural areas and southern states. United current participates in 1855 counties, representing 59% of all counties nationwide (and an estimated 71% of marketplace enrollees). We find that in 29% of counties (536 out of 1855 counties) where United participates, its exit would result in a drop from two insurers to one. In another 29% of counties (532) where United currently participates, there would be two exchange insurers as a result of a withdrawal. If United were to leave the exchange market overall, 1.8 million Marketplace enrollees would be left with two insurers, and another 1.1 million would be left with one insurer as a result of the withdrawal.

United does not generally offer low premium plans in the Marketplaces. It has the lowest or second-lowest silver plan in 35% of counties (647) where it participates in 2016, representing an estimated 16% of marketplace enrollees overall. Even when it did price relatively low, it was often not significantly lower than its nearest competitors. As a result, the effect of a United withdrawal nationally would be modest. The national weighted average benchmark silver plan would have been roughly 1% higher in 2016 had United not participated (less than $4 per month for an unsubsidized 40-year-old).

United’s Participation in ACA Marketplaces

When the new health insurance exchanges launched in 2014, United was noticeably absent from most state marketplaces. Taking a relatively cautious approach early on, the company offered plans in just 4 states in 2014, but quickly expanded to 23 states in 2015 and again expanded to a total of 34 states in 2016.

The parent company UnitedHealth Group owns a number of subsidiaries, including UnitedHealthcare and Harken Health. In cases where two or more issuers in a given area are owned or operated by a single parent company, we group issuers by parent company (using HHS Medical Loss Ratio public use files, and refer to these groupings of affiliated issuers as single “insurers” throughout the analysis. At the time of this report, one United subsidiary, UnitedHealthcare, will leave the market in Arkansas, Georgia, and Michigan in 2017, while Harken Health, another United subsidiary, will continue to participate in Georgia. (We therefore consider United as remaining in the market in Georgia counties where the Harken Health subsidiary currently operates.)

An outstanding question is whether the withdrawals from these three states will be followed by similar exits elsewhere. It is possible that United may continue to participate in some states but exit from certain counties within the state. In Virginia, for example, the insurer’s preliminary rate filing indicates that it may not participate in some counties in 2017 where it had in 2016. The rest of this analysis examines the effects of a full exit by UnitedHealth Group from the remaining states, taking into account the insurer’s planned withdrawal from Arkansas and Michigan and partial withdrawal from Georgia.

Effects of a United Withdrawal on Insurer Participation

If United were to withdraw from additional state Marketplaces, the effects on competition would vary from state-to-state and even county-to-county depending on how significant of a player United had been. Our ability to analyze market share and market concentration at the state or county level, however, is limited by the lack of publicly-available insurer enrollment data in the majority of states (the following section discusses this in more detail).

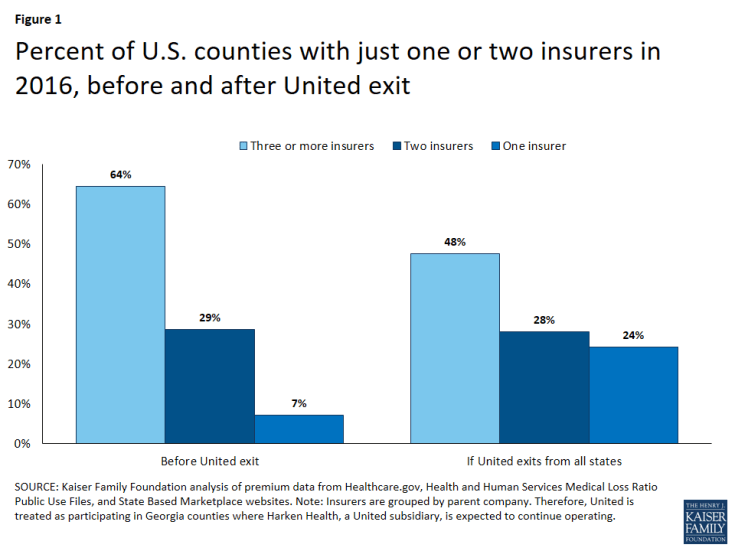

Another way to quantify the effect of United’s potential departure is to focus on those areas that would be left with just one or two insurers. Our previous analysis of insurer participation on the Marketplaces in states that use Healthcare.gov found that 40% of counties in those states had one or two insurers in 2016, up from 35% the previous year. This analysis includes all 50 states and DC, and finds that 36% of counties nationally had one or two exchange insurers in 2016.

If United were to withdraw from all states, 532 counties would go from having three insurers to two, while another 536 counties would go from having two insurers to just one. The net effect of a United exit would be that 532 more counties in the U.S. would have just one or two insurers on the exchange. Combining these counties with the 1,121 counties that already had one or two insurers would mean that just over half (53%) of U.S. counties would have one or two exchanges insurers.

Figure 1: Percent of U.S. counties with just one or two insurers in 2016, before and after United exit

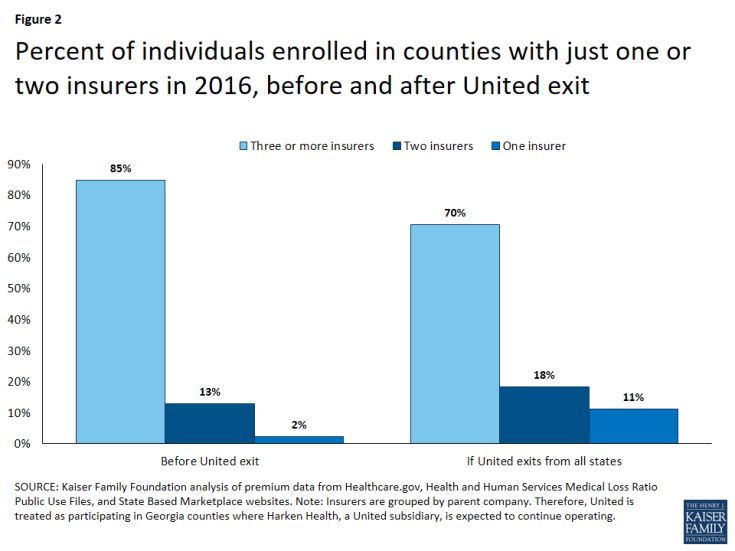

As discussed in more detail below, counties with limited competition tend to be more rural and sparsely populated, and therefore do not represent the bulk of enrollment. If United exits everywhere (again, with the exception of Harken Health in Georgia), the number of Marketplace enrollees with access to only one or two exchange insurers would increase (from 1.9 million to 3.8 million or from 15% to 30% of all enrollees), and the number of enrollees with only one insurer would also increase (from 303 thousand to 1.4 million or from 2% to 11% of all enrollees). Still, the vast majority of Marketplace enrollees (8.9 million or 70% of enrollees nationally) would continue to have a choice of three or more insurers, even in the absence of United.

Figure 2: Percent of individuals enrolled in counties with just one or two insurers in 2016, before and after United exit

State-by-State Effects of a United Withdrawal on Insurer Participation

The table below shows the distributional effects of a potential exit by United in the states and counties where it currently participates. Consumer choice and plan participation in certain states, such as Alabama, Kansas, Mississippi, North Carolina, Oklahoma, and Tennessee, would be particularly affected by a United departure. All Kansas and Oklahoma exchange enrollees currently have two insurers from which to choose, but would be left with one insurer if United were to exit from the state and not be replaced by a new entrant. In Alabama, 67% of enrollees (living in 60 counties) would go from having a choice of two insurers to a single exchange insurer, and the remaining 33% of enrollees (living in 7 counties) would go from having a choice of three insurers to two.

| Table 1: Potential Effects of a United Withdrawl on Insurer Participation In the States and Counties where United Participates in 2016 |

||||||||

|

State |

Total # Counties in State | Total # Enrollees in State | Where United Participates | If exit, drop from 2 to 1 Insurer (% of state total) |

If exit, drop from 3 to 2 Insurers (% of state total) |

|||

| Counties | Enrollees | Counties | Enrollees* | Counties | Enrollees* | |||

| Alabama | 67 | 195,047 | 67 | 195,047 | 60 (90%) | 130,359 (67%) | 7 (10%) | 64,688 (33%) |

| Arizona | 15 | 203,064 | 15 | 203,064 | 8 (53%) | 30,761 (15%) | 5 (33%) | 14,825 (7%) |

| Arkansas | 75 | 73,643 | 75 | 73,643 | – | – | – | – |

| California** | 58 | 1,575,340 | 34 | 203,472 | – | – | 28 (48%) | 158,769 (10%) |

| Colorado | 64 | 150,769 | 42 | 125,276 | – | – | 26 (41%) | 7,318 (5%) |

| Connecticut*** | 8 | 116,019 | 8 | 116,019 | – | – | – | – |

| Florida | 67 | 1,742,806 | 67 | 1,742,806 | 44 (66%) | 268,068 (15%) | 13 (19%) | 367,156 (21%) |

| Georgia**** | 159 | 587,833 | 157 | 569,200 | 30 (19%) | 20,184 (3%) | 47 (30%) | 47,604 (8%) |

| Illinois | 102 | 388,176 | 27 | 304,434 | – | – | – | – |

| Indiana | 92 | 196,241 | 92 | 196,241 | – | – | 9 (10%) | 6,567 (3%) |

| Iowa | 99 | 55,088 | 76 | 48,311 | – | – | 73 (74%) | 47,161 (86%) |

| Kansas | 105 | 101,553 | 105 | 101,553 | 105 (100%) | 101,553 (100%) | – | – |

| Kentucky*** | 120 | 93,666 | 120 | 93,666 | 38 (32%) | 18,540 (20%) | 39 (33%) | 20,488 (22%) |

| Louisiana | 64 | 214,143 | 64 | 214,143 | – | – | 59 (92%) | 130,990 (61%) |

| Maryland** | 24 | 162,103 | 24 | 162,103 | – | – | – | – |

| Massachusetts*** | 14 | 213,883 | 14 | 213,883 | – | – | – | – |

| Michigan | 83 | 345,804 | 7 | 153,559 | – | – | 1 (1%) | 1,905 (1%) |

| Mississippi | 82 | 108,668 | 82 | 108,668 | 50 (61%) | 47,001 (43%) | 32 (39%) | 61,667 (57%) |

| Missouri | 115 | 290,197 | 115 | 290,197 | 2 (2%) | 3,723 (1%) | 96 (83%) | 97,380 (34%) |

| Nebraska | 93 | 87,824 | 93 | 87,824 | – | – | 2 (2%) | 840 (1%) |

| Nevada | 17 | 88,142 | 3 | 79,278 | – | – | 3 (18%) | 79,278 (90%) |

| New Jersey | 21 | 288,571 | 21 | 288,571 | – | – | – | – |

| New York** | 62 | 271,964 | 15 | 204,536 | – | – | – | – |

| North Carolina | 100 | 613,477 | 77 | 563,819 | 38 (38%) | 155,008 (25%) | 39 (39%) | 408,811 (67%) |

| Ohio | 88 | 243,714 | 88 | 243,714 | – | – | – | – |

| Oklahoma | 77 | 145,328 | 77 | 145,328 | 77 (100%) | 145,328 (100%) | – | – |

| Pennsylvania | 67 | 439,235 | 23 | 289,131 | – | – | 5 (7%) | 172,724 (39%) |

| Rhode Island | 5 | 34,670 | 5 | 34,670 | – | – | 5 (100%) | 34,670 (100%) |

| South Carolina | 46 | 231,845 | 5 | 45,649 | 3 (7%) | 20,674 (9%) | 2 (4%) | 24,975 (11%) |

| Tennessee | 95 | 268,860 | 95 | 268,860 | 57 (60%) | 78,803 (29%) | 24 (25%) | 69,333 (26%) |

| Texas | 254 | 1,306,179 | 30 | 1,044,424 | 7 (3%) | 26,323 (2%) | 3 (1%) | 9,780 (1%) |

| Virginia | 134 | 421,892 | 37 | 245,465 | – | – | 7 (5%) | 8,579 (2%) |

| Washington** | 39 | 200,691 | 39 | 200,691 | 16 (41%) | 81,912 (41%) | – | – |

| Wisconsin | 72 | 239,031 | 56 | 193,895 | 1 (1%) | 37 (0%) | 7 (10%) | 5,856 (2%) |

| TOTAL (US) | 3,142 | 12,681,637 | 1,855 | 9,051,140 | 536 (17%) | 1,128,274 (9%) | 532 (17%) | 1,841,363 (15%) |

| Source: Kaiser Family Foundation, Analysis of UnitedHealth Group’s Premiums and Participation in ACA Marketplaces. 2016. Note: *“Enrollees” refers to the sum of all those signed up for a marketplace plan in the affected counties at the end of open enrollment in 2016. It does not refer to the number of enrollees in United plans – this information is not available at the county-level. **Marketplace enrollment-per-county data obtained from State for 2015 increased proportionate to 2016 sign-ups. ***Marketplace enrollment-per-county estimated as proportion of State enrollment. See methods for more details. ****Georgia results include Harken Health as a participating insurer. |

||||||||

The loss of United from Arkansas’ exchange will result in a drop from 4 insurers to 3 insurers (grouped by parent company) in every county in the state if the insurer is not replaced by a new entrant. Though more insurers participating in an area is generally seen as a sign of stronger competition, some market analysts have suggested that a minimum of 3 insurers is generally sufficient for effective competition to take place.Similarly, in Mississippi, 43% of enrollees (living in 50 counties) would go from having a choice of two insurers to having a single exchange insurer, and the remaining 57% of enrollees (living in 32 counties) would go from having a choice of three insurers to two.

In Georgia, the withdrawal of the subsidiary UnitedHealthcare will leave many counties with limited exchange market competition: 47 counties would go from having three insurers to two, and another 30 counties will be left with 1 exchange insurer. Though nearly half (48%) of Georgia counties will have just one or two insurers in the absence of UnitedHealthcare (up from 19% of counties in 2016), these counties are largely rural and do not represent the bulk of enrollment. In total, 67,788 Georgia Marketplace enrollees (representing 12% of enrollees overall in the state) will have a choice of one or two insurers in 2017 (up from 28,184 in 2016), unless another company enters the market.

Insurer Participation in Urban vs. Rural Areas

The areas where United currently participates are somewhat less rural than the areas where it does not participate. In the 1,855 counties where United offers exchange coverage in 2016, 18% of the population lives in rural areas, while across the 1,287 areas where United did not participate, 25% of the population lives in rural areas. Even so, because rural areas typically have fewer insurers, United’s withdrawal would have a more pronounced effect on insurer participation in rural regions.

In the 532 counties where a United exit would result in a drop from three to two insurers, a disproportionately large share (26%) of the population lives in rural areas. And in the 536 counties where the company’s withdrawal would leave just one insurer, an even larger share (35%) of the population lives in rural areas. For perspective, 20% of the total 2016 enrolled population lives in rural areas. In the 787 counties where a United exit would leave behind at least 3 insurers, just 13% of the population lives in rural areas.

Areas Where United Offers a Low-Cost Silver Plan

In addition to potentially leaving several areas with one or two participating insurers, a United withdrawal would be most disruptive where a large share of enrollees had been enrolled in one of the company’s plans. However, it is unclear how often that is the case due to a lack of publicly-available enrollment data for exchange plans. While insurer-level enrollment data are unavailable in most states, we do know from Health and Human Services (HHS) reports that a large share of enrollees tend to enroll in one of the two lowest cost silver plans.

Table 2 below illustrates the distributional effect United’s participation had on silver premiums in 2016 Marketplaces. Overall, United offered one of the two lowest cost silver plans in 647 counties in 2016; this represents 35% of the counties in which the company participated and 21% of counties across the U.S. This represents 22% of enrollees living in areas where United participates and 16% of enrollees nationally. If the general trend reported by HHS holds true in these counties, and enrollees were more likely to sign up for the low-cost silver plans, it is likely that United held a sizable share of the market in these areas.

| Table 2: Distribution of Counties where United participates in 2016, by the dollar-per-month increase in the benchmark premium for a 40-year-old if United had not participated |

||||||

| State | Total # Counties in State | Counties Where United Participates | Counties where United offers one of the two lowest cost silver plans (% of state total) | Counties where the benchmark would be higher if United had not participated (40 year old premium) |

||

| $1 – $25 | $25 -$100 | > $100 | ||||

| Alabama | 67 | 67 | 66 (99%) | 8 (12%) | 58 (87%) | |

| Arizona | 15 | 15 | 10 (67%) | 2 (13%) | 5 (33%) | 3 (20%) |

| Arkansas | 75 | 75 | (0%) | |||

| California* | 58 | 34 | 3 (5%) | 3 (5%) | ||

| Colorado* | 64 | 42 | 1 (2%) | 1 (2%) | ||

| Connecticut* | 8 | 8 | (0%) | |||

| Florida | 67 | 67 | 19 (28%) | 6 (9%) | 12 (18%) | 1 (1%) |

| Georgia** | 159 | 157 | 34 (21%) | 31 (19%) | 3 (2%) | |

| Illinois | 102 | 27 | 18 (18%) | 10 (10%) | 8 (8%) | |

| Indiana | 92 | 92 | (0%) | |||

| Iowa | 99 | 76 | 71 (72%) | 5 (5%) | 66 (67%) | |

| Kansas | 105 | 105 | 2 (2%) | 2 (2%) | ||

| Kentucky* | 120 | 120 | (0%) | |||

| Louisiana | 64 | 64 | 50 (78%) | 37 (58%) | 13 (20%) | |

| Maryland* | 24 | 24 | 10 (42%) | 10 (42%) | ||

| Massachusetts* | 14 | 14 | (0%) | |||

| Michigan | 83 | 7 | (0%) | |||

| Mississippi | 82 | 82 | 16 (20%) | 11 (13%) | 5 (6%) | |

| Missouri | 115 | 115 | 70 (61%) | 55 (48%) | 14 (12%) | |

| Nebraska | 93 | 93 | 65 (70%) | 14 (15%) | 50 (54%) | |

| Nevada | 17 | 3 | 2 (12%) | 2 (12%) | ||

| New Jersey | 21 | 21 | (0%) | |||

| New York* | 62 | 15 | (0%) | |||

| North Carolina | 100 | 77 | 74 (74%) | 29 (29%) | 36 (36%) | 9 (9%) |

| Ohio | 88 | 88 | 13 (15%) | 12 (14%) | 1 (1%) | |

| Oklahoma | 77 | 77 | (0%) | |||

| Pennsylvania | 67 | 23 | 14 (21%) | 12 (18%) | 2 (3%) | |

| Rhode Island* | 5 | 5 | 0% | |||

| South Carolina | 46 | 5 | (0%) | |||

| Tennessee | 95 | 95 | 73 (77%) | 43 (45%) | 30 (32%) | |

| Texas | 254 | 30 | 8 (3%) | 7 (3%) | 1 (0%) | |

| Virginia | 134 | 37 | 11 (8%) | 11 (8%) | ||

| Washington* | 39 | 39 | 16 (41%) | 16 (41%) | ||

| Wisconsin | 72 | 56 | 1 (1%) | |||

| TOTAL (US) | 3,142 | 1,855 | 647 (21%) | 327(18%) | 304 (10%) | 13 (0%) |

| Source: Kaiser Family Foundation, Analysis of UnitedHealth Group’s Premiums and Participation in ACA Marketplaces. 2016. *Premiums in state-based exchanges gathered by rating area from state plan finder tools. See methods for more details. **Georgia results include Harken Health as a participating insurer. |

||||||

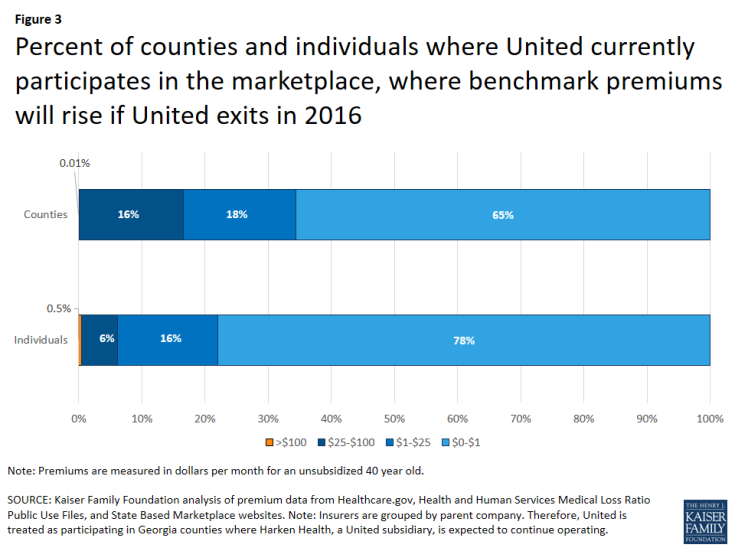

In addition to being one of the more popular plan options, the second-lowest cost silver (benchmark) plan is the basis for calculating subsidies on the exchange. Enrollees must pay the difference between the plan they choose and the benchmark plan, making them sensitive to large differences in premiums. In roughly half (330) of the counties where United offered one of the lowest-cost silver plans, the company’s presence in the Marketplace had a relatively minor effect on benchmark premiums. If the company had not participated in these counties, the benchmark plan would have been higher by $25 per month or less for a 40-year-old. In the remaining counties, where the benchmark premium would have been much higher ($25 to $100), it’s likely that United represents a larger portion of the market.

In states like Iowa, Alabama, Arizona, Nebraska, North Carolina, and Tennessee, where United priced significantly lower than some of its competitors, it is likely that more enrollees would have enrolled in a United plan and would therefore be most affected by the company’s withdrawal.

Overall, the national average benchmark premium would be 1% higher had United not participated in 2016, which is less than $4 per month for an unsubsidized 40-year-old on average. (Note that this does not take into account different pricing behavior by insurers due to fewer competitors.)

Figure 3: Percent of counties and individuals where United currently participates in the marketplace, where benchmark premiums will rise if United exits in 2016

Conclusion

On average nationally, based on our analysis of 2016 insurer premiums, United’s participation on the exchanges had a relatively small effect on premiums. The company was less likely to offer one of the lowest-cost silver plans, where the bulk of enrollees tend to sign up. When it did offer a low-cost option, its pricing was often not far from its competitors. As a result, the weighted average benchmark premium would have been roughly 1% higher had United not participated in 2016 (not accounting for the possible effect changes in insurer participation may have had on pricing behavior or the potential for new entrants to the market).

However, the significance of United leaving the exchange market would vary substantially by state and could have a significant effect in some markets. In more than half of the counties where it participates – and 34% of counties overall – a United withdrawal would have an appreciable effect on the number of insurers competing on the exchange. More than one in four counties where United participates would see a drop from two insurers to one if the company were to exit and not be replaced by a new entrant, and a similar number would go from having three insurers to two. In total, 1.8 million enrollees would go from having a choice of three insurers to two, and another 1.1 million would go from having a choice of two insurers to one.

Two of the states where United has announced its withdrawal, Georgia and Arkansas, offer an illustration of this variation. On the one hand, even after United’s withdrawal, every enrollee in Arkansas will continue to have 3 insurers from which to choose, a number that is sometimes seen as an important threshold for effective market competition to take place. United had not offered one of the two lowest silver plans in any county in Arkansas, which may also be an indication that the company did not have sizable market share in the state.

In Georgia, on the other hand, nearly fifty thousand Marketplace enrollees (8%) will go from having a choice of three insurers to two as a result of one United subsidiary withdrawing. Another twenty thousand enrollees (3%) will be left with just one insurer if no new entrants replace United. Additionally, United offered one of the lowest cost silver plans in about 1 in 5 Georgia counties, suggesting that it may have held a relatively sizable share of the market in these areas.

In a similar situation as Georgia, certain other states – such as Alabama, North Carolina, and Tennessee – would be particularly affected by a potential United withdrawal as these states would see appreciable drops in insurer participation and sizable changes in benchmark premiums in a number of counties if United were not participating.

The longer-term effects of a United withdrawal are more difficult to quantify. Other participating plans may independently plan to raise or lower premiums and enter or exit markets. In areas with limited insurer participation, the remaining plans after a United exit may have more market power relative to providers, but in the absence of insurer competition, those savings may not be passed along to consumers. The ACA’s rate review and medical loss ratio provisions may counter some of this effect by requiring insurers to undergo state or federal review of large rate increases and requiring that plans issue rebates if they set premiums too high relative to the cost of providing care.

The ACA marketplaces are still relatively new and insurers have only recently had sufficient information on who is enrolling and how much health care they are using in order to set accurate premiums. Premium changes and the exit of insurers that are not able to offer competitive and profitable plans is to be expected.

Methods

This analysis utilizes publicly available plan participation and premium data for states using the Healthcare.gov interface (including state-based exchanges that utilize Healthcare.gov: NV, NM, HI, and OR). We obtained plan participation and premium data for state-based exchanges that do not utilize Healthcare.gov by searching the most populous counties and/or zip codes by rating area on each state’s plan finder tools.

One limitation of this approach for state-based exchanges is that, while plans must set uniform premiums across a rating area, they may opt to selectively participate in certain counties within a rating area. Therefore, it is possible that some insurers do not participate in some counties within a given rating area in state-based exchanges that do not use Healthcare.gov, so the total insurer count may vary within those counties.

Enrollment data at the county level in states that use Healthcare.gov are published by the U.S. Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation (ASPE). These data represent plan sign-ups, not effectuated enrollment. Some state-based exchanges make similar data available. Where this data were available for state-based exchanges but only from 2015, county-level enrollment was increased based on the change in state enrollment from 2015 to 2016. Where county-level enrollment data were not available in state-based exchanges, we proportionately assigned state-level sign-ups by county population. The percent of county population residing in rural areas was obtained from the Missouri Census Data Center.

We grouped insurers by parent company or group affiliation, which we obtained from HHS Medical Loss Ratio public use files. In some cases, parent company information was not available from the HHS file, and corrections were made. Harken Health is a subsidiary of UnitedHealth Group; in Georgia this plan is treated as remaining in the market, while in Chicago, Illinois it is treated as potentially exiting the market.

Changes in the benchmark premium are weighted by county enrollment using the method described above. As we are unable to confirm the percentage of the premium that is due to essential health benefits in state-based exchanges, we did not apply this percentage in states that use the Healthcare.gov interface when calculating changes in the benchmark premium.